North America Fruit Juice Market Size, Share, Trends and Forecast by Type, Flavor, Distribution Channel, and Country, 2025-2033

North America Fruit Juice Market Size and Share:

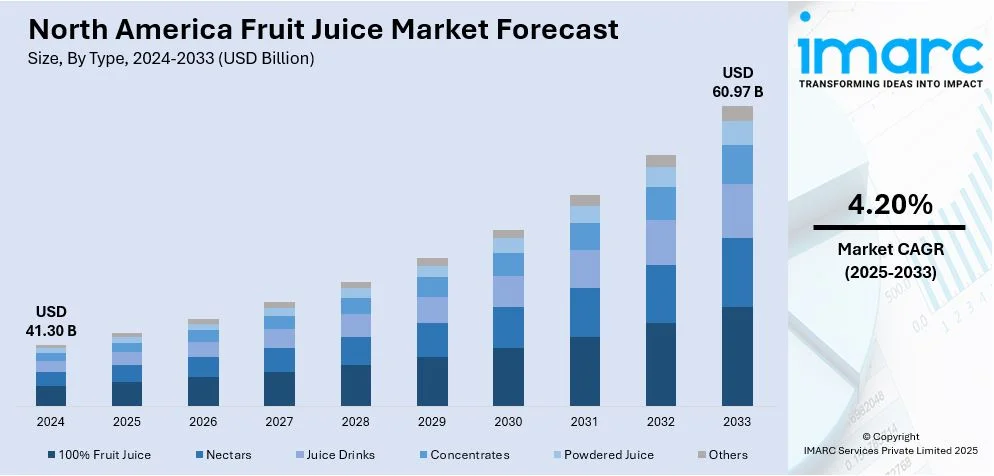

The North America fruit juice market size was valued at USD 41.30 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 60.97 Billion by 2033, exhibiting a CAGR of 4.20% during 2025-2033. The United States currently dominates the market, holding a significant market share in 2024. The growing health awareness, demand for natural and functional beverages, convenience of ready-to-drink options, flavor and packaging innovation, and strong retail infrastructure that enhances consumer access and product visibility are some of the major factors fueling the North America fruit juice market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 41.30 Billion |

|

Market Forecast in 2033

|

USD 60.97 Billion |

| Market Growth Rate 2025-2033 | 4.20% |

A significant shift toward healthier lifestyles has led consumers to prefer natural and nutritious beverages over sugary sodas, which is driving the market growth. Fruit juices, rich in minerals, vitamins, and antioxidants, are perceived as beneficial for boosting immunity and overall health. This trend is further amplified by the growing interest in functional juices fortified with probiotics, adaptogens, and other health-enhancing ingredients. For instance, in January 2025, Strawberry Vanilla, Tropical Mango, Orange Squeeze, and Lemon Lime are the four Real Fruit Soda varieties that Evolution Fresh, a top manufacturer of organic, cold-pressed, premium juice products, revealed will now be available nationwide at a few Whole Foods Market locations. Fresh, organic fruit juice, never concentrated, is used to make each Evolution Fresh Real Fruit Soda.

The modern, fast-paced lifestyle of North American consumers has increased the demand for convenient, ready-to-drink beverages. Fruit juices, available in various packaging formats like bottles, cartons, and pouches, cater to this need by offering portable and easy-to-consume options. For instance, in December 2023, the nation's largest youth sports organization, US Youth Soccer, partnered with Tree Top, a farmer-owned, farmer-grown cooperative and top manufacturer of premium fruit-based products, such as apple juices and sauces, as an official snack and juice partner and sponsor. Manufacturers are continually innovating to meet diverse consumer tastes, introducing a wide range of flavors, blends, and formulations. The development of exotic fruit blends, reduced-sugar options, and organic variants has broadened the market appeal and attracted health-conscious consumers.

North America Fruit Juice Market Trends:

Health and Wellness Trends

The growing awareness around health and wellness among consumers has significantly boosted demand for fruit juices in North America. Consumers are increasingly seeking natural, nutrient-rich beverages as alternatives to sugary soft drinks. Juices high in vitamins, antioxidants, and functional ingredients like probiotics or immunity-boosting compounds appeal to health-conscious individuals. This trend is especially strong among millennials and Gen Z, who are more inclined toward clean-label, organic, and cold-pressed juice products. According to the NCBI, over 80% of occupations are sedentary, with only 20% offering physically active jobs. According to a U.S. study, daily energy expenditure connected to profession has dropped by more than 100 calories over the past 50 years, which has led to weight increase and obesity. Manufacturers are innovating with low-sugar, preservative-free formulations to meet this demand, reinforcing fruit juice’s image as a healthy beverage choice in a wellness-oriented marketplace.

Product Innovation and Diversification

The growing innovations are creating a positive impact on the North America fruit juice market outlook. Brands are expanding beyond traditional flavors to include exotic fruits, vegetable blends, and functional additives such as fiber, protein, or adaptogens. New formats like cold-pressed, HPP-treated, or juice shots cater to evolving preferences. Functional juices offering benefits like energy, detox, or immune support are gaining traction. Additionally, sustainable packaging and ready-to-drink options enhance appeal. These innovations meet changing consumer expectations and create differentiation in a competitive market. The focus on continuous product development ensures that fruit juice remains relevant and appealing across diverse consumer segments in North America. For instance, in September 2024, a malt-based "Hard Nectar" called Jumex Hard was introduced by Grupo Jumex in response to market demand for fruit nectars that are combined with alcohol. In collaboration with AriZona Beverages Company, that was the company's first foray into the alcoholic beverage industry.

Rising Demand for Convenience

Busy lifestyles and on-the-go consumption patterns have driven demand for convenient, ready-to-drink beverages, including fruit juices. Consumers increasingly favor single-serve juice bottles and portable packaging that fit into fast-paced routines, particularly among working adults, students, and parents. According to the North America fruit juice market forecast, this convenience factor supports consumption in various settings, workplaces, schools, gyms, or travel. Supermarkets, hypermarkets, and vending machines have expanded their offerings of chilled, pre-packaged juices, making them easily accessible. The availability of fresh and shelf-stable options across retail formats supports this trend. As people prioritize both health and convenience, fruit juice serves as a functional and time-saving beverage solution. For instance, in January 2024, in the United States, Better Juice's sugar reduction solution was made available through a partnership with Ingredion, Inc. Better Juice's expansion was accelerated by a Series A capital round led by Ingredion Ventures, the company's venture investing arm.

North America Fruit Juice Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the North America fruit juice market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on type, flavor, and distribution channel.

Analysis by Type:

- 100% Fruit Juice

- Nectars

- Juice Drinks

- Concentrates

- Powdered Juice

- Others

Juice drinks stand as the largest component in 2024 due to their affordability, extended shelf life, and wide consumer appeal. These beverages typically contain a lower percentage of real juice blended with water, sweeteners, and flavorings, making them more cost-effective for both producers and consumers. Their milder taste, variety of flavors, and lower calorie content compared to 100% juices attract health-conscious consumers and younger demographics. Additionally, juice drinks are heavily marketed and widely available across retail and foodservice channels, further driving their dominance in the North America fruit juice market growth.

Analysis by Flavor:

- Orange

- Apple

- Mango

- Mixed Fruit

- Others

Orange leads the market due to its long-standing popularity, high vitamin C content, and strong consumer perception as a healthy and refreshing beverage. Widely consumed at breakfast and throughout the day, orange juice is considered a household staple. Its well-established supply chain, consistent availability, and affordability further support its dominance. Additionally, extensive marketing and brand recognition by major juice manufacturers have reinforced orange juice’s position in the market. The combination of health benefits, taste preference, and cultural familiarity makes orange the most favored fruit juice in the North America fruit juice market.

Analysis by Distribution Channel:

.webp)

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Food Stores

- Online Stores

- Others

Supermarkets and hypermarkets lead the market due to their widespread accessibility, broad product variety, and competitive pricing. These retail formats offer consumers the convenience of one-stop shopping, where they can compare multiple juice brands, flavors, and packaging options in a single visit. Their strong distribution networks and frequent promotions attract regular foot traffic, enhancing product visibility and impulse buying. Additionally, supermarkets and hypermarkets often feature private-label juices, which appeal to cost-conscious shoppers. This combination of convenience, assortment, and affordability positions them as the primary channel in the North America fruit juice market.

Analysis by Country:

- United States

- Canada

- Mexico

In 2024, the United States accounted for the largest market due to the increasing health consciousness among consumers has led to a greater demand for natural and nutritious beverages, with fruit juice perceived as a convenient source of vitamins and antioxidants, particularly vitamin C. The popularity of on-the-go lifestyles also supports ready-to-drink juice consumption, especially among younger demographics is fueling the North America fruit juice market demand. Innovation in flavors, packaging, and reduced-sugar or organic options has broadened appeal across health-conscious and premium segments. Additionally, strong retail infrastructure, including supermarkets, convenience stores, and online platforms, enhances product accessibility. Marketing efforts that emphasize wellness, immunity, and sustainability further reinforce consumer interest, contributing to consistent growth in the U.S. fruit juice market.

Competitive Landscape:

The North America fruit juice market is characterized by intense competition among established beverage giants and emerging health-focused brands. These companies are increasingly focusing on health-conscious products, including functional beverages and reduced-sugar options. Innovations like prebiotic sodas and expanded product offerings are central to maintaining market relevance. However, challenges like supply chain disruptions, tariff impacts, and changing consumer preferences, particularly towards low-sugar alternatives, are reshaping the competitive dynamics in the sector.

The report provides a comprehensive analysis of the competitive landscape in the North America fruit juice market with detailed profiles of all major companies, including:

- The Coca-Cola Company

- PepsiCo, Inc.

- Keurig Dr Pepper, Inc.

- The Kraft Heinz Company

- Campbell Soup Company

- Ocean Spray Cranberries, Inc.

- Tropicana Brands Group

Latest News and Developments:

- April 2025: Minute Maid became WWE’s Official Juice Partner, launching its "Bring the Juice" platform. The partnership includes activations at WWE events, custom packaging, and social content with WWE stars.

- March 2025: Califia Farms launched its new Creamy Refreshers line, introducing four tropical fruit juice beverages: Key Lime Colada, Strawberry Creme, Orange Crème, and Piña Colada. These dairy-free drinks contain blended coconut cream with real fruit juice, offering a rich and refreshing taste.

- January 2025: Odwalla launched a new line of juices and smoothies. The offerings include mango, strawberry-banana, and berries smoothies, as well as 100% juices like orange, guava, and ginger.

- October 2024: Coca-Cola relaunched its Mexican soft drink brand Barrilitos in California and Texas, with plans for expansion into Nevada and Oklahoma. The fruity beverages, originally launched in 1938, featured a new formula targeting Gen Z and multicultural consumers, with flavors like mandarin, pineapple, and fruit punch.

- August 2024: Welch’s introduced a new line of zero-sugar fruit juices, aiming to provide fruit-forward flavors without added sugars. The product line-up includes passion fruit and grape flavors in 59 oz cartons, and Tropical Punch, Strawberry, and Concord Grape in 64 oz and 10 oz sizes.

North America Fruit Juice Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | 100% Fruit Juice, Nectars, Juice Drinks, Concentrates, Powdered Juice, Others |

| Flavors Covered | Orange, Apple, Mango, Mixed Fruit, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Food Stores, Online Stores, Others |

| Countries Covered | United States, Canada, Mexico |

| Companies Covered | The Coca-Cola Company, PepsiCo, Inc., Keurig Dr Pepper, Inc., The Kraft Heinz Company, Campbell Soup Company, Ocean Spray Cranberries, Inc., Tropicana Brands Group, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America fruit juice market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America fruit juice market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America fruit juice industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The North America fruit juice market was valued at USD 41.30 Billion in 2024.

The North America fruit juice market is projected to exhibit a CAGR of 4.20% during 2025-2033, reaching a value of USD 60.97 Billion by 2033.

Key factors driving the North America fruit juice market include rising health awareness, demand for natural and functional beverages, innovation in flavors and packaging, and the convenience of ready-to-drink formats. Additionally, strong retail infrastructure and marketing campaigns promoting nutritional benefits are encouraging greater fruit juice consumption across diverse consumer segments.

The United States currently dominates the North America fruit juice market due to health awareness, demand for natural drinks, convenience, flavor innovation, and strong retail presence.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)