North America Frozen Finger Chips Market Size, Share, Trends and Forecast by End Use and Country, 2025-2033

North America Frozen Finger Chips Market Size and Share:

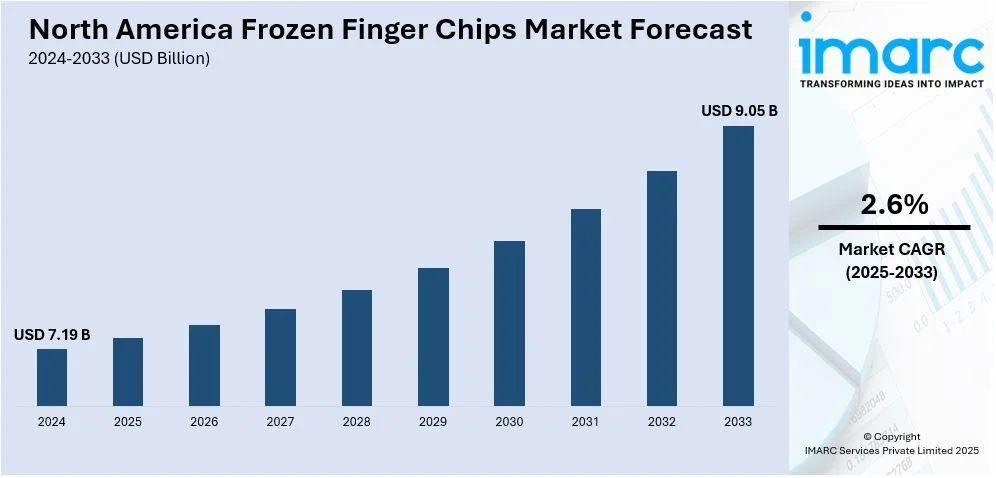

The North America frozen finger chips market size was valued at USD 7.19 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 9.05 Billion by 2033, exhibiting a CAGR of 2.6% from 2025-2033. The rising demand for convenience foods, expanding quick-service restaurants (QSRs), increasing retail availability, heightened longer shelf-life benefits, escalating air fryer adoption, rapid product innovation, and sustainability trends are bolstering the North America frozen finger chips market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7.19 Billion |

|

Market Forecast in 2033

|

USD 9.05 Billion |

| Market Growth Rate (2025-2033) | 2.6% |

According to North America frozen finger chips market overview, increasing people's busy schedules between work life and family have driven high product demand for goods like frozen finger chips, particularly those convenient convenience foods in quick and short busy meals preparation processes. These fries are very easy to prepare as consumers just have to pop them in the oven, air fryer, or deep fryer. This is particularly appealing to working professionals, students, and parents who need quick meal solutions. With 73% of large organizations favoring structured hybrid models and requiring specific office attendance, it is contributing to longer in-office working hours. This made way for fast preparation of meals suitable for such a busy worker lifestyle. Growing dual-income families is also adding up to this. When two parents work, time for preparing the meal will reduce. And who would be able to spend an hour peeling, chopping, and frying potatoes when it could be consumed equally tasty, already frozen, as finger chips.

The North America frozen finger chips market forecast indicates that fast-food chains, diners, and restaurants rely heavily on frozen finger chips due to their consistency, longer shelf life, and ease of preparation. Industry estimates predict a 4.7% increase in QSR franchise industry output, growing from $287 billion in 2023 to $301 billion in 2024. This expansion of quick-service restaurants (QSRs) requires millions of fries daily, and frozen options to help them meet high demand without compromising quality. They need fries that cook quickly, have a uniform texture, and remain crispy longer. Casual dining and cloud kitchens have also contributed to market growth. Many restaurants and food delivery services rely on frozen fries because they cut down on preparation time and reduce labor costs. Instead of peeling and cutting potatoes daily, kitchen staff can simply fry pre-cut frozen fries, ensuring a faster turnaround.

North America Frozen Finger Chips Market Trends:

Growth of Retail and Supermarket Chains

As per the North America frozen finger chips market trends, supermarkets and hypermarkets are expanding their frozen food sections, dedicating more space to products like frozen fries. Retail giants like Walmart, Costco, and Kroger stock a wide variety of frozen finger chips, making them accessible to a larger consumer base. Private-label brands have also intensified competition. Many retailers have introduced their own frozen fry brands, often at lower prices, attracting budget-conscious shoppers. This increased product availability and affordability have driven market growth. E-commerce has further boosted sales. With the rise of grocery delivery services like Amazon Fresh and Instacart, consumers can order frozen fries online and have them delivered to their doorstep. The month of December 2024 saw the fifth straight month in which the U.S. consumers spent at least $9.5 billion buying groceries online. The convenience of online shopping has widened the reach of frozen finger chips beyond traditional supermarkets.

Increasing Demand for Frozen Food Due to Longer Shelf Life

Unlike fresh potatoes, frozen finger chips last for months without spoiling. This extended shelf life makes them a preferred choice for both consumers and foodservice providers. People no longer have to worry about potatoes sprouting or going bad; frozen fries stay fresh and ready to use whenever needed. Consumers also appreciate the cost savings. Buying frozen fries in bulk means fewer grocery runs and reduced food waste. For restaurants and QSRs, it means better inventory management and lower costs, as they can stock up without worrying about spoilage. Advancements in freezing technology have improved product quality. Modern frozen fries retain their taste, texture, and nutrients better than ever before. With innovations like individually quick frozen (IQF) technology, fries no longer clump together, making them easier to cook and portion out.

Rising Popularity of Air Fryers and Health-Conscious Eating

Consumers are seeking healthier ways to consume their favorite food products, and air fryers has become one of the important innovations that has contributed to this trend. Air fryers enable people to cook frozen finger chips with little oil, thus minimizing fat content and achieving crispy texture. In addition, since more households are now investing in air fryers, demand for frozen fries continues to remain high. Health-conscious consumers are also adopting sweet potato fry variations, organic options with less sodium content and trans-fat, thereby enhancing the North America frozen finger chips market demand. As a result, most major brands have been pushed to adapt through these options considering the shift. Mindful consumption has become crucial leading to ingredient specificity. Consumers research the labels closely for added preservatives and additive content forcing manufacturers to provide cleaner and healthier options in frozen fry production. Some brands introduced gluten-free and non-GMO choices to cater to the needs of healthier-conscious customers. Correspondingly, the percentage of consumers who considered it important that clear product information from manufacturers and brands has grown dramatically over the past five years; from 69% in 2018 to 76% in 2023.

North America Frozen Finger Chips Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the North America frozen finger chips market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on end use.

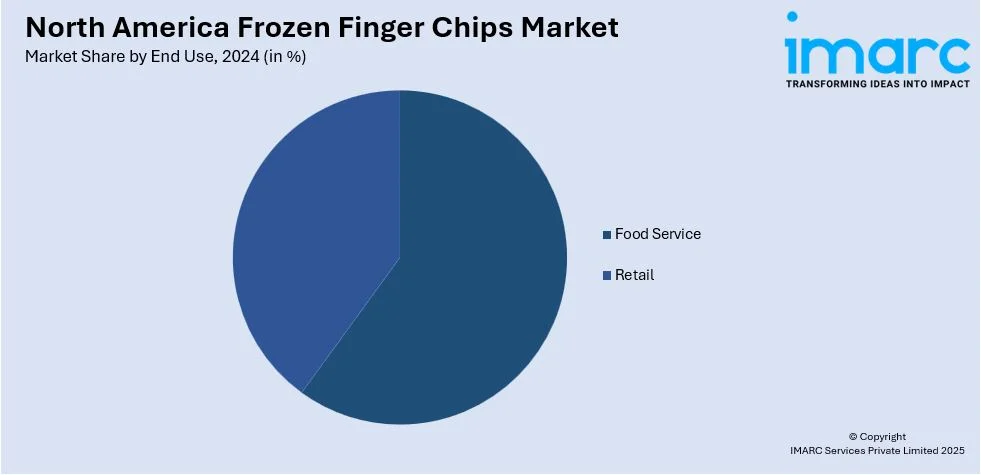

Analysis by End Use:

- Food Service

- Retail

The segment of food services holds the biggest market share, which is driven by QSRs such as Burger King, McDonald's, and Wendy's, as well as casual dining, cloud kitchens, and food trucks. Frozen finger chips offer constant quality, extended shelf life, and quick preparation, making them a commercial kitchen's goldmine in demanding efficiency and scalability. Thereby, the penetration of delivery services such as Uber Eats and DoorDash fueled demand further with restaurants that are looking for fries that are crispy for more extended periods before getting soggy for takeaways and deliveries. Franchise developments, urbanization, and income levels are additionally driving this segment to its continued dominance of North America.

Country Analysis:

- United States

- Canada

- Mexico

North American frozen finger chips market share is dominated by the United States, contributing the most through its high consumption of fast foods, increased preferences of convenience food among consumers and a well-designed network of quick service restaurants of Burger King, McDonald's, and Wendy's. Other drivers of the market in the U.S. are high supermarket penetration and e-commerce grocery platforms that offer a wide array of frozen fries from classic cuts to specialty variants. This is compounded by growing adoption of air fryers and an increasing demand for healthier, organic, and seasoned frozen fries. McCain Foods, Lamb Weston, and Simpot are significant manufacturers whose existence in the market provides steady supplies and innovative products that keep this country ahead in the regional market.

Competitive Landscape:

Key players that lead the North America frozen finger chips market growth are focusing on capacity expansions, product innovation, sustainability, and strategic acquisitions to strengthen their market presence. Many are increasing production capabilities to meet rising demand from food service providers and retail consumers. Innovation is a major priority, with companies launching new flavors, healthier alternatives like low-fat and organic variants, and different cuts such as crinkle, spiral, and waffle fries. Sustainability efforts include eco-friendly packaging, reducing carbon footprints in production, and responsible potato sourcing to align with consumer expectations for ethical food choices. Supply chain enhancements and automation are also gaining traction, allowing manufacturers to improve efficiency, reduce costs, and ensure product consistency. E-commerce and direct-to-consumer sales strategies are expanding, with frozen fries now widely available through online grocery platforms and delivery services. Additionally, investments in research and development are helping to improve product texture, crispiness retention for delivery, and longer shelf-life solutions. These strategies collectively support market growth and help key players maintain competitive advantages.

The report provides a comprehensive analysis of the competitive landscape in the North America frozen finger chips market with detailed profiles of all major companies.

Latest News and Developments:

- In January 2025, Agristo announced that it is set to invest up to $450 million in its first U.S. production facility in Grand Forks, North Dakota, to meet rising demand for frozen potato products like finger chips.

- In December 2024, Post Holdings agreed to acquire Potato Products of Idaho, a manufacturer of refrigerated and frozen potato products, including finger chips, with the deal that is expected to close in the first quarter of 2025. This acquisition strengthens Post's portfolio in the growing market for value-added potato products.

- In September 2024, Lamb Weston invested $415 million to expand its American Falls facility and increase its finger chips production capacity by 40%. The project will cultivate 12,000 additional acres of potatoes and create around 280 new jobs in Idaho.

- In August 2024, Backer’s potato chip company partnered with Vanmark to modernize its operations and address production challenges. The company upgraded to Vanmark’s bulk storage bin system, which improved potato unloading efficiency, reduced downtime, and enhanced flexibility in product processing.

North America Frozen Finger Chips Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| End Uses Covered | Food Service, Retail |

| Countries Covered | United States, Canada, Mexico |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America frozen finger chips market from 2019-2033

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America frozen finger chips market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America frozen finger chips industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The North America frozen finger chips market was valued at USD 7.19 Billion in 2024.

The North America frozen finger chips market is growing due to rising fast-food consumption, expanding quick-service restaurants, increasing retail availability, busy lifestyles driving demand for convenience foods, air fryer adoption, longer shelf life benefits, product innovation, and sustainability trends, with strong support from e-commerce and food delivery platforms.

IMARC Group estimates the market to reach USD 9.05 Billion by 2033, exhibiting a CAGR of 2.6% from 2025-2033.

Food service accounted for the largest end use market share in 2024, driven by high demand from quick-service restaurants (QSRs), cloud kitchens, and fast-casual dining establishments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)