North America Flexible Packaging Market Size, Share, Trends and Forecast by Product Type, Raw Material, Printing Technology, Application, and Country, 2025-2033

North America Flexible Packaging Market Size and Share:

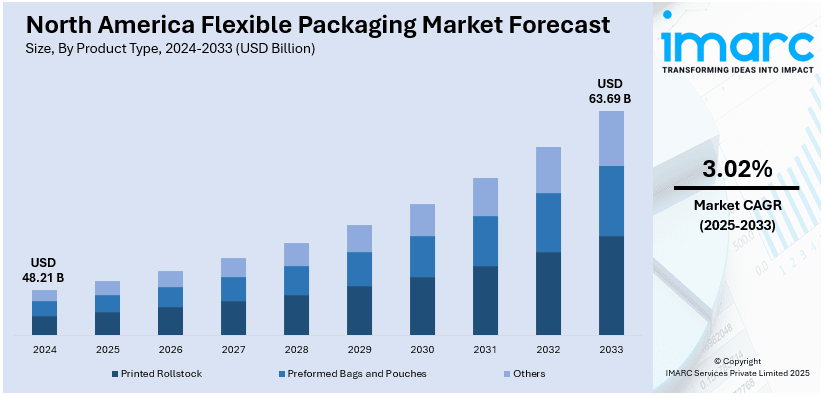

The North America flexible packaging market size was valued at USD 48.21 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 63.69 Billion by 2033, exhibiting a CAGR of 3.02% from 2025-2033. The North America flexible packaging market is experiencing robust growth driven by rising consumer demand for convenience, sustainability, technological advancements in packaging materials, and the expansion of e-commerce, with a shift towards eco-friendly solutions and innovative packaging designs across industries like food, beverages, pharmaceuticals, and personal care.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 48.21 Billion |

|

Market Forecast in 2033

|

USD 63.69 Billion |

| Market Growth Rate (2025-2033) | 3.02% |

The North America flexible packaging market is propelled by the confluence of changing consumer behaviors, technological advances, and their resounding focus on sustainability. Convenience for the consumer, particularly with respect to food, beverage, and personal care products, acts as a key driving factor. The lightweight, portable, and easy-to-use flexible packaging meets these demands appropriately and thereby provides consumers with an ideal packaging solution. For instance, in September 2024, Berry Global highlighted its sustainability initiatives at Fachpack, showcasing circular solutions in packaging made from recycled plastics, renewable materials, and designs that enhanced recyclability and offered reuse or refill options. Moreover, the main driver of interest in flexible packaging is also because e-commerce is fast becoming highly profitable industry, and flexible packaging offers shipping cost-effectiveness compared to rigid packaging. Its capability to reduce the weight of packaging without sacrificing integrity boosts the benefit, as online retailers look to ensure optimal transportation costs. Another reason that drives the adoption of more environmentally friendly flexible packaging is shifting consumer consciousness on the importance of environmental friendliness. Heightening environmental concerns drive companies to invest in recyclable, compostable, and biodegradable packaging, making sustainability a major market driver.

Technological advancement in material science and packaging technology is a major driver for the North America flexible packaging market growth. New multi-layer films, high-barrier coatings, and advanced sealing technologies have all contributed to a more comprehensive flexible packaging product range with enhanced overall performance and flexibility. Such products provide improved environmental protection from moisture, oxygen, and UV light, contributing to extended shelf life and the quality of products. For example, in July 2024, Mondi launched FlexiBag Reinforced, an innovative, recyclable mono-PE-based packaging solution with enhanced mechanical properties, tailored for the pet food industry, contributing to a circular economy. Moreover, high-quality printing technologies boost the attractiveness and efficiency of branding, which in turn has brought more appeal to the market. Moreover, the flexibility in the designs with the option to change the size, shape, and functionality of packaging has been one of the main reasons that had attracted diverse industries such as food, pharmaceutical, and cosmetics. As brands focus more on packaging that reflects consumer preference and helps preserve products, flexible packaging is going to gain more and more grounds in various sectors.

North America Flexible Packaging Market Trends:

Shift Towards Sustainable Packaging Solutions

One of the most important trends in the North America market is flexible packaging is related to mounting demand for sustainable packaging solutions. Increasingly, consumers and brands are becoming more environmentally conscious, as such, a trend has developed forcing greater use of recyclable, biodegradable, or source renewable materials for packaging materials. Both regulatory bodies and environmentally aware consumers are pressurizing companies to come up with alternatives for traditional plastic packaging that has long been known to have harmful effects on the environment. In such an endeavor, light weight and lesser carbon footprint are seen as flexible packaging ideal alternatives for companies. Compostable films, water-based inks, and recyclable multi-layer films are intensely being used, and flexible packaging is becoming a viable, eco-friendly alternative. Moreover, various companies are adopting circular economy models, focusing on reducing waste, reusing materials, and recycling packaging, which further accelerates the demand for sustainable options in the flexible packaging sector.

Integration of Smart Packaging Technologies

Integration of smart packaging technologies is the other big trend influencing the North America flexible packaging market share. Such technologies include features, such as QR codes, RFID tags, and temperature indicators that change the way products are packaged, tracked, and consumed. Smart packaging enables manufacturers to obtain real-time data about the condition of a product-temperature, humidity, or even tampering, especially in perishable goods such as food and pharmaceuticals. The ability to strengthen consumer engagement via digital engagement through the offering of detailed product information or tailored offers is further bolstering the demand for smart packaging. The desire for improved transparency in complex supply chains also serves as an encouragement for brands, which invest in smart packaging so that the goods are traceable and quality oriented. All these innovations would bring added value for consumers as well as a new opportunity to the companies by branding, engaging consumers, and gaining operational efficiency.

Adoption of Lightweight and Cost-Effective Materials

A major trend in the North America flexible packaging market is that people are becoming more interested in lightweight materials. With manufacturer pressure, as well as consumer demand, to maximize cost savings and productivity, lighter flexible packaging materials are produced without sacrificing the necessary strength or protection needed for the safe transport and storage of the product. Lightweight flexible packaging reduces the transportation costs since, in this case, the shipping weights are lighter, thus saving logistics cost for companies. This further save energy at the production level and is also a part of greater sustainability goals. The demand for lightweight materials is particularly strong in the food and beverage (F&B) sector, where the need for cost-effective packaging that ensures product safety and maintains freshness is paramount. For instance, in August 2024, Sealed Air launched BUBBLE WRAP® Brand Ready-To-Roll Embossed Paper, a fiber-based, curbside-recyclable packaging solution offering product protection, light cushioning, and abrasion elimination, aligning with sustainability goals. Additionally, in terms of their weight, advanced films and multi-layered structures are used to make them resistant to moisture and air, protecting the product against environmental influences. Such packaging enhances shelf life while maintaining product quality.

North America Flexible Packaging Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the North America flexible packaging market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type, raw material, printing technology and application.

Analysis by Product Type:

- Printed Rollstock

- Preformed Bags and Pouches

- Others

The North America flexible packaging market is witnessing the accelerating use of preformed bags and pouches due to the rising demand among consumers for convenience and simplicity. Preformed packaging solutions are very much in use within F&B products, with storage versatility for products ranging from snacks to liquids, offering them a compact and easy-to-store design. Pouches and bags have other benefits that relate to ready-to-use products. The main ones are reclosable options with easy pouring, and extended shelf life. Advanced printing technologies like flexography help to make pre-formed bags better-looking than the rigid counterparts with vibrant, high-quality graphics. Additionally, such pouches typically require less material compared to the rigid packaging alternatives, which are cheaper and also contributing less to the environmental burden. As demand for convenient, portable packaging continues to rise, preformed bags and pouches are expected to be an integral part of the flexible packaging market.

Analysis by Raw Material:

- Plastic

- Paper

- Others

Plastic remains the market leader in North America flexible packaging due to its versatility, cost-effectiveness, and wide range of applications. Being one of the dominant packaging materials used for food, beverages, and consumer goods, plastic benefits involve durability and flexibility, plus preservation over extended periods. In applications where moisture, air, and contamination protection are critical, such as in snacks, beverages, and frozen foods, it matters a lot. Furthermore, the recent developments in plastic film technologies have led to stronger and thinner films possessing improved barrier properties, making them more efficient and using less material. Plastic waste concerns have called for more sustainable options as plastic packaging remains the only option due to its performance combined with affordability. Continued developments of recyclable plastic films along with the effort towards minimizing the negative environmental impacts make plastic the undisputed leader in flexible packaging in the foreseeable future.

Analysis by Printing Technology:

- Flexography

- Rotogravure

- Digital

- Others

Flexography has emerged as a leading printing technology within North America flexible packaging, dominated by the F&B industry. Flexographic printing is held in high regard for efficiency, flexibility, and high-quality graphics printouts; it's comprehensively used for vibrant intricate designs on pre-formed bags, pouches, and other flexible packaging forms. This printing method relies on flexible relief plates and quick-drying inks, thereby allowing for very high-speed production of large quantities of packaging at low cost. As brands move toward enhancing shelf appeal and engaging consumers, flexography enables intricate details and colors that catch attention in retail settings. In addition, the potential to print on a wide range of substrates-from plastic to foil-based films-makes flexography highly versatile. It thus is widely applied in the (F&B) segment because packaging alone attracts customers, and branding plays a key role in success. Advances in ink formulations continue and innovation in printing technologies, and thus flexography is constantly boosting market share.

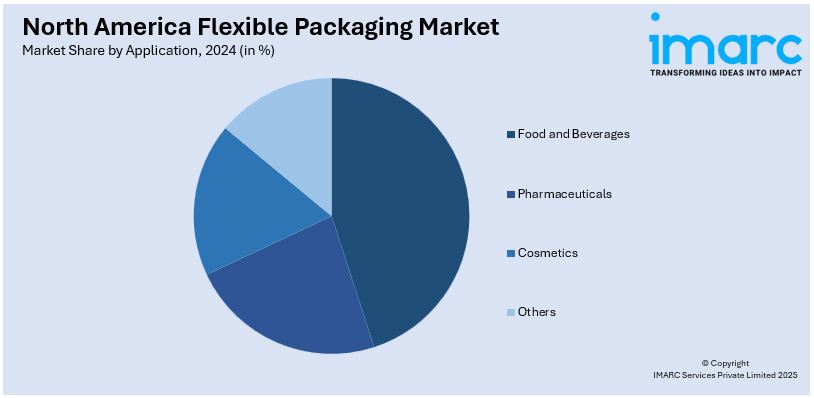

Analysis by Application:

- Food and Beverages

- Pharmaceuticals

- Cosmetics

- Others

The food and beverage (F&B) sector is one of the biggest as well as the rapidly expanding segments in the North America flexible packaging market. This is largely due to such a trend being prominent in the United States. Convenient ready-to-eat (RTE) and portable food options, in particular, drive consumer demand. Flexible packaging solution, such as preformed bag, pouches, and film, is generally used for most food products: it maintains its freshness, makes the shelf-life longer, has a variety of convenient features of resealing closures and even easy pouring spouts, whereas flexible packaging varieties can be highly versatile to correspond to a really wide range of food categories. The adoption of sustainable packaging options such as recyclable films and compostable pouches within the F&B sector has been growing steadily with heightening sustainability concerns, hence becoming a significant market segment for both traditional and sustainable packaging innovations. The continuing evolution in the designs and materials of packaging continues to fuel further growth of flexible packaging in this industry.

Country Analysis:

- United States

- Canada

Large consumers, improved manufacturing capabilities, and a solid focus on the packaging innovation business give the United States a leadership position in North America's development of flexible packaging. The key players in flexible packaging are dispersed across the entire United States-both large-scale and small scale-with both local and international backgrounds. Consumer goods sectors are dominated by various product categories which are in massive demand for consumer food, beverage, personal care, and pharmaceutical applications. Second, e-commerce drives the shift to more use of flexible packaging as it tends to be much lighter and cost-effective than traditional packaging products when shipping large quantities. Escalating regulatory pressures to more sustainable packages also make headway in America. This is reflected in the rising trend of recyclable, biodegradable, and compostable materials in flexible packaging, especially for F&B products. As consumer preferences evolve and sustainability becomes a key priority, the United States will continue to lead the market in driving the growth of the flexible packaging industry.

Competitive Landscape:

Competition in the North America flexible packaging market is characterized by a mix of well-established and new companies that are emerging on innovation and sustainability. Major manufacturers continue to dominate the market with more extensive product portfolios, stronger distribution networks, and advanced manufacturing capabilities. These companies employ cutting-edge technologies like high-definition printing, smart packaging solutions, and sustainable materials to fulfill the escalted demand for eco-friendly, cost-effective, and customised packaging. Small innovative companies are finding niches in terms of specialization, such as biodegradable films or specific industry packaging that would encompass temperature-sensitive shipping for food and pharmaceutical products. Shifting consumer preferences, regulatory pressures for sustainability, and the continued evolution of e-commerce create competitive rivalry where packaging needs to be optimized both for protection and efficiency. Competitive rivalry is thus intensified by all these factors, and companies have started focusing more on sustainability initiatives, operational efficiency, and technological advancements to remain ahead of the market trend.

The report provides a comprehensive analysis of the competitive landscape in the North America flexible packaging market with detailed profiles of all major companies.

Latest News and Developments:

- In November 2024, ProAmpac launched its latest sustainable packaging innovations. The new products included ProActive Recyclable® RP-1050, ProActive Recyclable® R-2050 EU Film, and RAP Packaging, all designed to provide high-performance, eco-friendly solutions that met both regulatory standards and consumer expectations.

- In November 2024, Graphic Packaging International unveiled sustainable paperboard innovations, including Boardio™ paperboard canisters, reduced-plastic ProducePack™ punnet trays, and multipack solutions like EnviroClip™. These products focused on eco-friendly, functional packaging to meet consumer and regulatory demands, enhancing branding and operational efficiency.

- In November 2024, Winpak Ltd. announced a long-term agreement with NOVA Circular Solutions LLC to source post-consumer recycled polyethylene (rPE) under the SYNDIGO™ brand. This partnership aims to advance sustainable, flexible packaging solutions for food, beverages, and personal care products, supporting Winpak’s commitment to sustainability and innovation.

- In September 2024, Flint Group showcased its latest innovations. Key products included the Evolution De-inking Primer and OPV, which enhanced recycling efficiency, the EkoCure® dual-curing inks for a sustainable shift to UV LED, and Ultra Clear Dual Cure Coatings, supporting narrow web printing with minimal environmental impact.

North America Flexible Packaging Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Printed Rollstock, Preformed Bags and Pouches, Others |

| Raw Materials Covered | Plastic, Paper, Others |

| Printing Technologies Covered | Flexography, Rotogravure, Digital, Others |

| Applications Covered | Food and Beverages, Pharmaceuticals, Cosmetics, Others |

| Countries Covered | United States, Canada |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America flexible packaging market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America flexible packaging market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America flexible packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The flexible packaging market in the North America was valued at USD 48.21 Billion in 2024.

Key drivers of growth in the North America flexible packaging market include increasing consumer demand for convenience, sustainability initiatives encouraging for eco-friendly materials, advancements in packaging technologies like smart packaging, and the rise of e-commerce, which requires lightweight and cost-effective packaging solutions for shipping.

The North America flexible packaging market is projected to exhibit a CAGR of 3.02% during 2025-2033, reaching a value of USD 63.69 Billion by 2033.

The preformed bags and pouches segment accounted for the largest market share in the North America flexible packaging market. This segment is driven by consumer demand for convenience, portability, and product preservation, particularly in food and beverage packaging, where pouches offer lightweight, space-efficient, and customizable solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)