North America Flavoured Milk Market Size, Share, Trends and Forecast by Flavour, Packaging, Distribution Channel, and Country, 2025-2033

North America Flavoured Milk Market Size and Share:

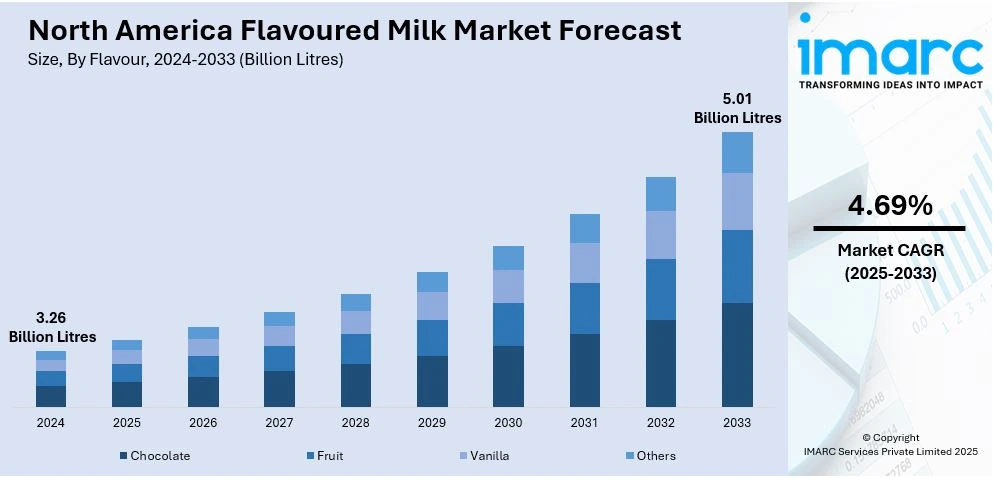

The North America flavoured milk market size was valued at 3.26 Billion Litres in 2024. Looking forward, IMARC Group estimates the market to reach 5.01 Billion Litres by 2033, exhibiting a CAGR of 4.69% from 2025-2033. The United States leads the North America flavoured milk market share due to its large population, diverse consumer preferences, and strong dairy consumption culture. With a growing demand for health-focused and convenient beverages and an extensive retail network, the US continues to drive innovations and market expansion in flavoured milk.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

3.26 Billion Litres |

|

Market Forecast in 2033

|

5.01 Billion Litres |

| Market Growth Rate (2025-2033) | 4.69% |

Increasing demand from consumers for indulgent flavors drives the flavored milk market in North America. The best-selling varieties continue to be chocolate, vanilla, and strawberry; however, consumers are beginning to explore unique or exotic flavors such as caramel and coffee, and even seasonal options like pumpkin spice. The selection is appealing to both children and adults, thus expanding the customer base. As people look for comfort and enjoyment in their beverages, brands are bringing innovation into richer, creamier flavor profiles that intensify the indulgence factor. This has created continuous product innovations in the flavored milk market, therefore rendering it dynamic and competitive.

The major factor that has sustained the growth of the flavored milk market of North America is effective marketing strategies. Brands that have opted for mass television advertising, social media, and digital platforms alike are striving to create visibility for their brands and to raise consumer consciousness about the nutritional benefits, versatility, and flavor aspects of flavored milk. High-profile partnerships with influencers and celebrities, an increasingly focused approach toward flavor innovation or health benefits, and concentrated efforts to penetrate particular consumer segments have all been gaining the attention of marketers. Thus, more consumers are aware of their flavored milk alternatives through advertisements and promotions, which has led to a heightened interest and growth, giving flavored milk a greater share of the overall market.

North America Flavoured Milk Market Trends:

Growing demand for plant-based flavored milk

Demand for plant-based flavored milk has risen in North America, which is experiencing a heightened shift in vegan and dairy-free lifestyles. Consumers have slowly begun to become health-conscious, and therefore are looking for alternatives that are lower in cholesterol, lactose, and fat. Almond milk, oat milk, and coconut milk are popular options, flavored with vanilla, chocolate, or fruit infusions. Brands are therefore innovating to create dairy-free versions that still deliver the same rich, creamy taste and nutritional value of traditional flavored milk. This trend is also being fueled by growing environmental concerns regarding animal farming.

Health-conscious flavored milk with functional ingredients

According to WHO, the world is already off-track on its achievement targets for the Universal health coverage plan by the year 2025, called the "Triple Billion Targets", which is an initiative by WHO. Keeping the health and wellness trends in view, consumers are moving toward products containing different flavors and functional ingredients in the form of probiotics, protein, or vitamins. This indicates the increasing demand for truly functional foods that go beyond providing bare essential nutrition. Protein-fortified flavored milk is beneficial for the fitness enthusiasts, whereas probiotic-infused products are marketed toward consumers concerned with digestive health. Hence, this is creating an avenue for the companies to capitalize on the trends of health and wellness, by launching products that appeal to health-conscious consumers, such as low-sugar or sugar-free versions made from quality ingredients.

Increased popularity of convenience and ready-to-drink flavored milk

Significant increase in the ready to eat (RTE) food market is strengthening the market further. This demand for convenience has spurred the growth of products such as ready-to-drink (RTD) flavored milk in North America as well. Busy lifestyles and on-the-go consumption drive the need for portable, single-serve packaging in a range of flavors. Brands are bringing flavored milk into convenient bottles, cartons, and cans so that consumers can enjoy a nutritious, flavorful beverage wherever they may be. The trend will likely drive growth further, with increased interest in flavored milk as an on-the-go snack, providing healthy, quick offering options for kids and adults.

North America Flavoured Milk Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the North America flavoured milk market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on flavour, packaging, and distribution channel.

Analysis by Flavour:

- Chocolate

- Fruit

- Vanilla

- Others

Chocolate-flavored milk remains the most popular segment in the North America flavored milk market forecast, led by its universal appeal among consumers. Chocolate has a rich and sweet taste and is hence loved universally by children and adults alike. Chocolate-flavored milk is also marketed as a recovery drink post-workout. The balanced ratio of carbohydrates and protein in it helps in the recovery of muscles. The growing consumption of indulgent yet functional beverages further increases the demand for chocolate flavoured offerings. Moreover, chocolate variants keep evolving, as brands introduce varied intensities- dark chocolate, milk chocolate and the like-so that it satisfies a wide array of tastes.

Analysis by Packaging:

- Paper Based

- Plastic Based

- Glass Based

- Metal Based

Plastic Based continues to lead the North American flavored milk market as it is more cost-effective, convenient, and durable. Plastic bottles and cartons are lightweight, making transportation and storage easier, which also reduces shipping costs. Plastic is also flexible, which allows for various shapes and sizes, catering to different consumer preferences, such as single-serve and family-sized options. Apart from this, plastic packaging provides a longer shelf life, maintaining product freshness. With increased demand for on-the-go products, plastic packaging is preferred due to its portability. Moreover, the innovation in recyclable plastics is addressing environmental concerns and is further increasing adoption in the market.

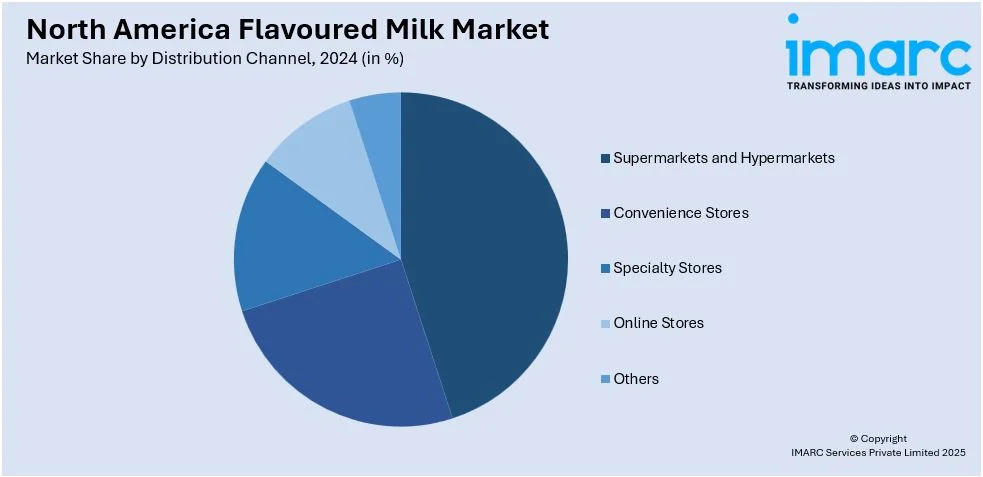

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

With vast reach and convenience, supermarkets and hypermarkets are very prominent distribution channels for flavored milk in North America. The various retail formats showcase a plethora of flavors of milk products from the traditional dairy to plant-based varieties. Their network of stores is high density; hence, their operations allow them to competitively price their products, with appeal to cost-conscious consumers. Several promotions, discounts, and loyalty programs prompt the consumer purchases at supermarkets and hypermarkets as well. The one-stop shopping convenience for groceries and beverages is also popularizing these retail stores among consumers, especially with easy access to both national and regional brands.

Analysis by Country:

- United States

- Canada

The United States leads the North American flavored milk market due to its large, diverse population and strong dairy consumption culture. The demand for flavored milk is supported by the country’s penchant for indulgent and convenient beverages. Furthermore, increasing health-consciousness along with the demand for functional and plant-based offerings fuels the market. The retail infrastructure in the US is also strong, with well-established supermarkets, hypermarkets, and online retailers providing easy access to flavored milk products. Moreover, the strong advertisement and marketing activities of the country helps in spreading awareness among consumers and ensure continued growth within the flavored milk segment.

Competitive Landscape:

North America flavoured milk market is driven due to strategic initiatives by key market players. Companies are spending highly on research and development for launching new flavours and improving product quality to suit a wide variety of consumer tastes. For instance, Fairlife ultra-filtered milk is available in chocolate, strawberry, and vanilla flavors for a healthy-conscious consumer who seeks more protein and lesser sugar. To cater to the growing demand for healthy and convenient beverages, these companies are now diversifying their product lines to include lactose-free and plant-based products. Mooala, for instance, has developed organic, plant-based creamers and non-dairy milks, including its newly launched USDA-certified organic barista oatmilk, targeting the fast-growing vegan and lactose-intolerant consumer segments. Strategic partnerships and acquisitions are also undertaken to enhance market presence and distribution networks. An example of strategic moves is the collaboration between Select Milk Producers and The Coca-Cola Company for the launch of Fairlife, leveraging Coca-Cola's extensive distribution channels to reach a wider consumer base.

The report provides a comprehensive analysis of the competitive landscape in the keyword market with detailed profiles of all major companies.

Latest News and Developments:

- On January 2025, TruMoo, a farmer-owned brand from Dairy Farmers of America (DFA), launched the limited-edition Disney Moana themed strawberry banana lowfat milk.

- On January 2024, FC Development Corp. (FCDC), announced the formalization of its partnership with the clean energy leader, Agricultural Green Energy Systems (Ag-GES), of Columbia, Connecticut.

- On August 2024, Arla Foods announced the expansion of its product portfolio, by entering the chocolate milk market, through a partnership with Mondelēz International. This has led to the intoduction of a new range of Milka-branded chocolate milk products, marking a noteworthy extension of the iconic brand, Milka.

- On April 2024, fairlife and The Coca‑Cola Company ceremonially broke ground on the new state-of-the-art fairlife production facility in Webster, New York.

- On December 2024, the Dutch dairy cooperative Friesland Campina announced its intention to merge with Belgian peer Milcobel, as the two parties have signed a framework agreement and aim to finalise a detailed merger proposal in the first half of the year 2025.

North America Flavored Milk Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion Litres |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Flavour Covered |

Chocolate, Fruit, Vanilla, Others |

| Packaging Covered |

Paper Based, Plastic Based, Glass Based, Metal Based |

| Distribution Channel Covered |

Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others |

| Countries Covered | United States, Canada |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America flavoured milk market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America flavoured milk market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America flavoured milk industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The North America flavoured milk market in the region was valued at USD 3.26 Billion Litres in 2024.

The growth of the North American flavored milk market is driven by rising consumer demand for convenient, nutritious beverages, increased interest in plant-based alternatives, and innovations in functional ingredients like protein and probiotics. Additionally, strong retail channels, effective marketing, and a preference for indulgent flavors further fuel market expansion.

The North America flavoured milk market is projected to exhibit a CAGR of 4.69% during 2025-2033, reaching a value of USD 5.01 Billion Litres by 2033.

Chocolate-flavored milk remains one of the most popular segments in the North America flavored milk market, driven by its widespread consumer appeal along with the rich, sweet taste of chocolate which is universally loved.

Plastic Based continues to dominate the North America flavored milk market packaging segment, due to its cost-effectiveness, convenience, and durability.

Supermarkets and hypermarkets are key distribution channels driving the North America flavored milk market, largely due to their widespread reach and convenience.

The United States leads the North American flavored milk market due to its large, diverse population and strong dairy consumption culture.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)