North America Ferrite Magnet Market Size, Share, Trends and Forecast by End-Use, and Country, 2025-2033

North America Ferrite Magnet Market Size and Share:

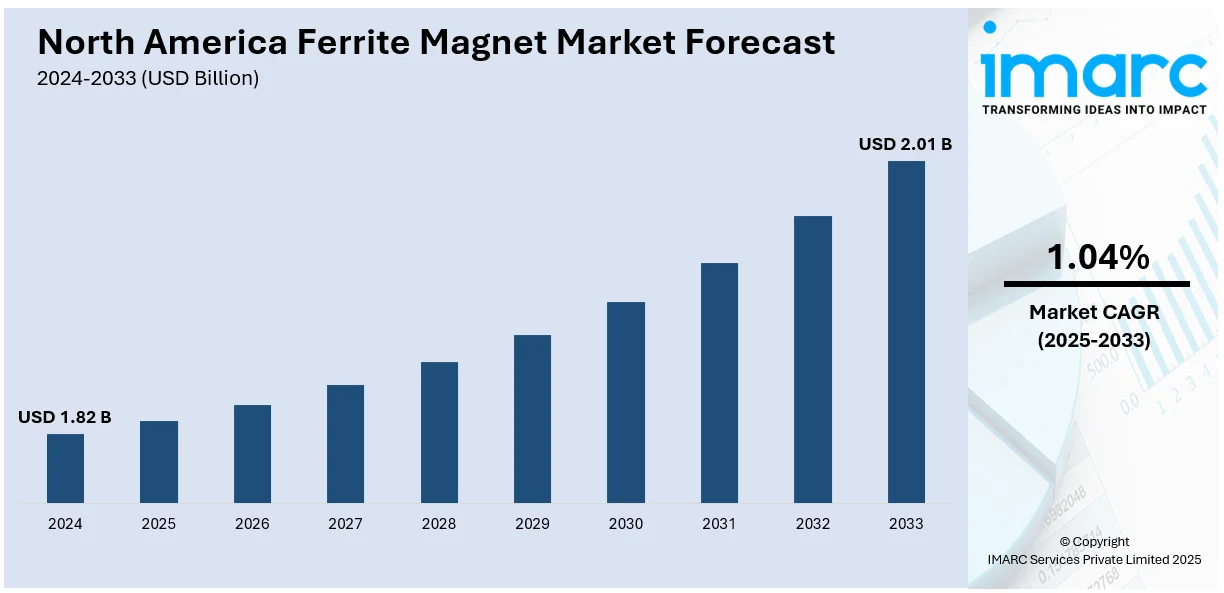

The North America ferrite magnet market size was valued at USD 1.82 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2.01 Billion by 2033, exhibiting a CAGR of 1.04% from 2025-2033. The United States dominates the market due to the rising demand from the automotive, electronics, and renewable energy (RE) sectors, the increasing electric vehicle (EV) production, ongoing advancements in industrial automation, and the growing investments in wind energy.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.82 Billion |

| Market Forecast in 2033 | USD 2.01 Billion |

| Market Growth Rate (2025-2033) | 1.04% |

The North America ferrite magnet market growth is driven by the increasing demand from the automotive and electronics industries. The rise in electric vehicle (EV) production is significantly boosting the need for ferrite magnets, which are used in electric motors, sensors, and charging infrastructure, which is supporting the market growth. Additionally, the expanding consumer electronics sector, particularly in the United States, is fueling demand for ferrite magnets in devices such as speakers, transformers, and microwave ovens, providing an impetus to the market. Besides this, ferrite magnets are an essential element in actuators, sensors, and motor-driven systems, with the rising adoption of industrial automation and robotics, thus contributing to the market expansion. Notably, reports indicate that Niron’s first magnet offering in 2024 will be followed by a high-performance magnet in 2025, with an energy product exceeding 30 MGOe. This development is expected to boost ferrite magnet performance, driving growth in North America's EV and industrial automation sectors.

Concurrently, the renewable energy (RE) sector plays a crucial role in driving demand for ferrite magnets, particularly in wind turbine generators. The increasing investments in wind energy projects across North America are boosting the adoption of ferrite magnets due to their cost-effectiveness and durability, aiding the market growth. Furthermore, government initiatives to strengthen domestic magnet production and reduce dependence on imports are strengthening the North America ferrite magnet market share. For instance, the F-35 fighter jet uses 900 pounds of rare earth elements, while the Arleigh Burke DDG-51 destroyer and Virginia-class submarine require 5,200 and 9,200 pounds, respectively. This significant demand for rare earth materials, particularly magnets, underscores the increasing reliance on advanced magnetic technologies in vital industries, driving the growth of the ferrite magnet market. Besides this, the rising research and development (R&D) activities aimed at enhancing ferrite magnet performance and expanding their applications in medical devices and telecommunications are driving the market demand. Apart from this, strong industrial demand and technological advancements are thereby propelling the market forward.

North America Ferrite Magnet Market Trends:

Rising Demand from the Electric Vehicle (EV) Sector

The North America ferrite magnet market is experiencing significant growth, driven by the rising demand for EVs. In line with this, ferrite magnets serve essential roles in EV motors, power steering systems, and battery management systems because of their low price and their ability to not lose their magnetic properties. For instance, the GM HUMMER EV from GMC, equipped with Ultium Platform technology, demonstrates the importance of motor system design by distributing its maximum 11,500 lb-ft (15,590 N·m) torque output through an on-demand system. As a result, the GMC HUMMER EV achieves 0-60 mph in just three seconds, highlighting the critical role of magnet technology in high-performance EV motors. Moreover, automakers producing EVs to fulfill sustainability targets while complying with emission standards create rising demand for ferrite magnets. Furthermore, government incentives alongside infrastructure developments that expand EV charging networks are driving the automotive market toward efficient motor components where ferrite magnets serve as an essential part, thus impelling the North America ferrite magnet market demand.

Expanding Use in Renewable Energy and Wind Power

The expanding use of the wind power segment of RE drives the increased demand for ferrite magnets across North America. Wind turbine generators use ferrite magnets to convert energy efficiently and benefit from their cheaper cost over rare-earth alternatives which makes them the preferred choice for big-scale wind power operations. Besides this, the commitment of United States and Canadian authorities toward wind power development to achieve cleaner energy operations solidifies ferrite magnet adoption in the region. For example, North America is experiencing substantial investments in wind energy infrastructure, with the U.S. Department of Energy (DOE) allocating USD 50 Million for wind energy R&D, boosting the use of cost-effective ferrite magnets in turbine designs. Furthermore, the RE market depends heavily on ferrite magnets because technological improvements in turbine technologies and magnetic efficiency boost their operational capabilities, thereby enhancing the North America ferrite magnet market outlook.

The Expansion of Consumer Electronics and Industrial Automation

The growth of the consumer electronics and industrial automation industries is shaping the North America ferrite magnet market trends. Ferrite magnets enhance performance and durability within smartphone devices as well as speakers, transformers, and home appliances. Additionally, manufacturers continue to use ferrite magnets for powering automated systems including robotics, electric actuators, and conveyor systems. The market experiences growth also because of smart factory development and the increasing implementation of the Internet of Things (IoT) in manufacturing technology. Apart from this, the rising demand for high-quality affordable ferrite magnets, driven by the ongoing advancement of electronic devices and increasing automation speed is propelling the market forward. For instance, Tesla’s new factory in Texas features ferrite magnet-powered robotics, significantly boosting automation efficiency. The move aims to streamline electric vehicle production, reducing costs and improving operational speed, highlighting This development further reinforces the rising demand for ferrite magnets, as their use in automation systems becomes more widespread across industries.

North America Ferrite Magnet Industry Segmentation:

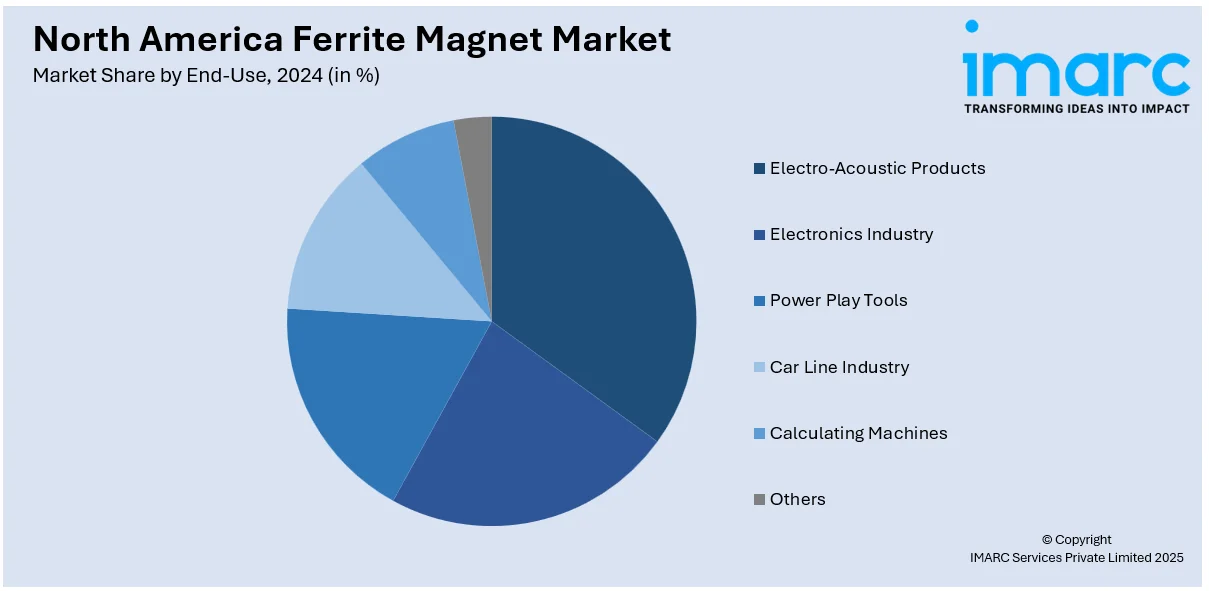

IMARC Group provides an analysis of the key trends in each segment of the North America ferrite magnet market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on end-use.

Analysis by End-Use:

- Electro-Acoustic Products

- Electronics Industry

- Power Play Tools

- Car Line Industry

- Calculating Machines

- Others

Electro-acoustic products represent the largest segment in the North American ferrite magnet market, driven by rising consumer demand for high-quality audio devices and advancements in sound technology. The audio equipment market incorporates ferrite magnets because of their effective magnetic capabilities together with their economic value and extended operational lifespan. The market for ferrite magnets is experiencing growth because consumers purchase high-performance speakers for their smart home systems, wireless audio devices, and home entertainment systems. Additionally, an increasing demand for concert sound systems, studio monitors, and public address systems in the professional audio industry is driving the adoption of ferrite magnets in the region. Moreover, the growing market demand for built-in speakers on smartphones and tablets along with portable electronic devices drives additional consumption of ferrite magnets. Furthermore, the ongoing acoustic innovation and rising consumer demand for high-quality audio drive continuous market expansion in the North American ferrite magnet industry.

Country Analysis:

- United States

- Canada

The United States dominates the North America ferrite magnet market due to strong demand from key industries, including automotive, electronics, and RE. The rising utilization of EVs creates an escalating demand for ferrite magnets specifically designed for motors and battery systems. In confluence with this, the market growth receives additional support from the expanding consumer electronics sector which continues to increase its sales of smart devices as well as speakers and home appliances. Moreover, NdFeB magnets, known for being the strongest and most efficient type of permanent magnets, play a crucial role in powering electric motors and generators in hybrid and electric vehicles, robots, wind turbines, drones, electronics, and vital defense systems. Their performance is indispensable in these systems, driving further demand for advanced magnet technologies. The domestic magnet production push by governments together with their efforts to decrease dependence on foreign rare-earth materials also strengthens the industry. Additionally, the rising investments in wind energy infrastructure together with industrial automation development drive the need for ferrite magnets across multiple applications.

Competitive Landscape:

The North America ferrite magnet market is highly competitive, with manufacturers focusing on product innovation, cost reduction, and supply chain optimization. Companies are investing in advanced manufacturing technologies to enhance magnet performance, improve energy efficiency, and expand application scope. Strategic collaborations with automotive, electronics, and renewable energy industries are driving market expansion. The R&D efforts are increasing to develop high-density, lightweight ferrite magnets for next-generation applications. Additionally, government policies supporting domestic production are encouraging new entrants and reducing dependence on imports. With rising demand across multiple sectors, competition remains intense, fostering continuous technological advancements.

The report provides a comprehensive analysis of the competitive landscape in the North America ferrite magnet market with detailed profiles of all major companies.

Latest News and Developments:

- In December 2024, MP Materials is on track to commence commercial magnet production at its Fort Worth, Texas facility by the end of 2025. General Motors has secured a deal with MP Materials for EV magnet supplies, highlighting a significant partnership in the industry.

- In July 2024, The U.S. Consumer Product Safety Commission (CPSC) issued a warning about the dangers of UYPEA Magnetic Ferrite Stones, highlighting the risks associated with ingestion. This reduces demand for unregulated magnets but boosts compliant domestic production, reinforcing North America's supply chain security, consumer trust, and demand for safer ferrite magnet alternatives across industries.

- In April 2024, MP Materials was granted USD 58.5 million to support the development of America's first fully integrated rare earth magnet manufacturing facility. This project aims to bolster domestic production capabilities and reduce dependence on foreign sources for critical materials.

- In March 2024, the U.S. Department of Defense has made progress in its efforts to establish domestic supply chains for rare earth materials critical to producing permanent magnets used in military applications. This initiative aims to reduce reliance on foreign sources and strengthen national security.

- In January 2023, Hitachi Metals rebranded as Proterial following its acquisition. The company positioned its NMF 15 ferrite magnets as a neodymium alternative for EV motors, strengthening North America's magnet supply chain and sustainability.

North America Ferrite Magnet Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| End-Uses Covered | Electro-Acoustic Products, Electronics Industry, Power Play Tools, Car Line Industry, Calculating Machines, Others |

| Countries Covered | United States, Canada |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America ferrite magnet market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America ferrite magnet market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America ferrite magnet industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ferrite magnet market was valued at USD 1.82 Billion in 2024.

Key factors driving the North America ferrite magnet market include the rising demand from the automotive sector, increasing adoption of electric vehicles (EVs), expanding consumer electronics production, growing investments in renewable energy (RE), particularly wind power, continuous advancements in industrial automation, and increasing government support for domestic magnet manufacturing.

IMARC estimates the ferrite magnet market to exhibit a CAGR of 1.04% during 2025-2033, reaching a value of USD 2.01 Billion by 2033.

Electro-acoustic products accounted for the largest North America ferrite magnet end-use segment, driven by the increasing demand for speakers, headphones, and microphones in consumer electronics. The growth of smart home systems, wireless audio devices, and professional sound equipment further boosts ferrite magnet adoption in high-performance acoustic applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)