North America Eyewear Market Report by Product (Spectacles, Sunglasses, Contact lenses), Gender (Men, Women, Unisex), Distribution Channel (Optical Stores, Independent Brand Showrooms, Online Stores, Retail Stores), and Country 2025-2033

North America Eyewear Market Size:

The North America eyewear market size reached USD 47.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 73.8 Billion by 2033, exhibiting a growth rate (CAGR) of 4.94% during 2025-2033. The market is propelled by the increasing prevalence of vision disorders, significant technological advancements, increasing demand for fashionable and luxury eyewear, increasing geriatric population, increasing disposable income levels across the region, and increasing preference for renowned brands.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 47.0 Billion |

|

Market Forecast in 2033

|

USD 73.8 Billion |

| Market Growth Rate 2025-2033 | 4.94% |

North America Eyewear Market Analysis:

- Major Market Drivers: Rising prevalence of vision disorders across the North America, growing awareness about eye health, and significant technological advancements are some of the major market drivers.

- Key Market Trends: Some of the key market trends include rising demand for fashionable and luxury eyewear, rising geriatric population, and rising disposable income levels across the North America.

- Competitive Landscape: Some of the major market players in the North America eyewear industry are making investments in technology to develop cutting-edge eyewear solutions, such as smart glasses with augmented reality (AR) capabilities, blue light-blocking lenses, and photochromic lenses to cater to the evolving needs of consumers. They are also launching fashionable and luxury eyewear options to expand product portfolio.

- Challenges and Opportunities: Some of the challenges include rising costs of advanced eyewear products and robust competition from counterfeit and low-quality products. Whereas, increasing adoption of smart eyewear and augmented reality glasses and rapid expansion into emerging markets and untapped North America s are some of the factors driving the North America eyewear market growth and opportunities.

North America Eyewear Market Trends:

Rising Prevalence of Vision Disorders:

The rise in vision disorders significantly fuels the North American eyewear market. Conditions such as myopia, hyperopia, astigmatism, and presbyopia are on the rise, spurred by greater screen time and an aging population. According to the VISION COUNCIL, there are 197.6 million adult vision correction users (75.6%) in the United States. This widespread prevalence accentuates the persistent demand for eyewear products. Moreover, the NATIONAL EYE INSTITUE notes that near sightedness impacts nearly 41.6% of Americans, and this figure is noted to be steadily increasing. This trend is likely to persist, ensuring ongoing demand for corrective eyewear, including glasses and contact lenses. Growing awareness about eye health and the significance of routine eye exams also propel market growth, as early detection and treatment of vision issues gain priority.

Significant Technological Developments in Eyewear Products

Technological advancements are revolutionizing the North American eyewear market, fostering innovation and captivating consumer interest, thereby representing one of the most vital North America eyewear market drivers. Companies are investing resources into research and development (R&D) activities to unveil cutting-edge eyewear solutions, including blue light-blocking lenses, anti-reflective coatings, and photochromic lenses. Smart glasses, possessing augmented reality (AR) and virtual reality (VR) features, are becoming increasingly popular, particularly among tech enthusiasts and professionals in sectors such as engineering, healthcare, and gaming. Breakthroughs in lens materials and designs are significantly improving user comfort and experience. For instance, lightweight and resilient materials such as polycarbonate and Trivex are in high demand. The blend of fashion with functionality, epitomized by prescription sunglasses and customizable frames, is creating a positive eyeglasses market outlook across North America.

Increasing Demand for Fashionable and Luxury Eyewear

The appetite for stylish and luxury eyewear is a major catalyst for market expansion in North America. More consumers now perceive eyewear as a fashion accessory and a vital component of their personal style. This shift is reflected in the growing allure of designer labels and high-end eyewear lines. Prestige brands such as Ray-Ban, Oakley, and Prada have secured a strong foothold in the market, appealing to the tastes of style-savvy buyers. This trend is especially pronounced among millennials and Gen Z, who prioritize brand reputation and visual appeal when making purchases. The rising penetration of social media and celebrity endorsements intensifies this demand, as consumers strive to mirror the looks of their favorite influencers and celebrities. In Canada, the rise in luxury eyewear sales mirrors this trend, with numerous consumers prepared to spend on premium products for both their practical advantages and fashion-forward appeal.

North America Eyewear Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2025-2033. Our report has categorized the market based on product, gender, and distribution channel.

Breakup by Product:

- Spectacles

- Sunglasses

- Contact lenses

Spectacles accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the product. This includes spectacles, sunglasses, and contact lenses. According to the report, spectacles represented the largest segment.

Spectacles dominate the North American eyewear market, driven by several compelling factors that make them essential for a wide demographic. Spectacles are highly regarded for their effectiveness in addressing a range of vision disorders, including myopia, hyperopia, astigmatism, and presbyopia. Their capacity to offer precise vision correction tailored to individual needs positions them as a favored choice among consumers. Additionally, the rising prevalence of these vision disorders, fueled by increased screen time and an aging population, has markedly heightened the demand for spectacles.

Breakup by Gender:

- Men

- Women

- Unisex

Men holds the largest share of the industry

A detailed breakup and analysis of the market based on the gender have also been provided in the report. This includes men, women, and unisex. According to the report, men accounted for the largest market share.

Men hold the largest North America eyewear market share by gender for several compelling reasons. Initially, there is a growing awareness among men about the significance of vision health and the need for regular eye examinations, which is driving a higher demand for corrective eyewear such as glasses and contact lenses. Moreover, men are often engaged in professions or activities that require protective eyewear, such as construction, manufacturing, and sports, further fueling the demand in this segment. Fashion trends and the perception of eyewear as a style statement have also played a crucial role.

Breakup by Distribution Channel:

- Optical Stores

- Independent Brand Showrooms

- Online Stores

- Retail Stores

Optical stores represent the leading market segment

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes optical stores, independent brand showrooms, online stores, and retail stores. According to the report, optical stores represented the largest segment.

Optical stores stand as the largest segment in the North American eyewear market by distribution channel due to several pivotal factors. These stores provide a comprehensive, personalized service encompassing eye exams, consultations, and customized eyewear solutions. Consumers highly value this one-stop-shop experience, where professional advice and precision in eyewear choices are readily available. Optometrists and trained staff in these stores offer expert guidance, ensuring that consumers receive accurate prescriptions and appropriate frames and lenses, which significantly boosts consumer satisfaction and loyalty.

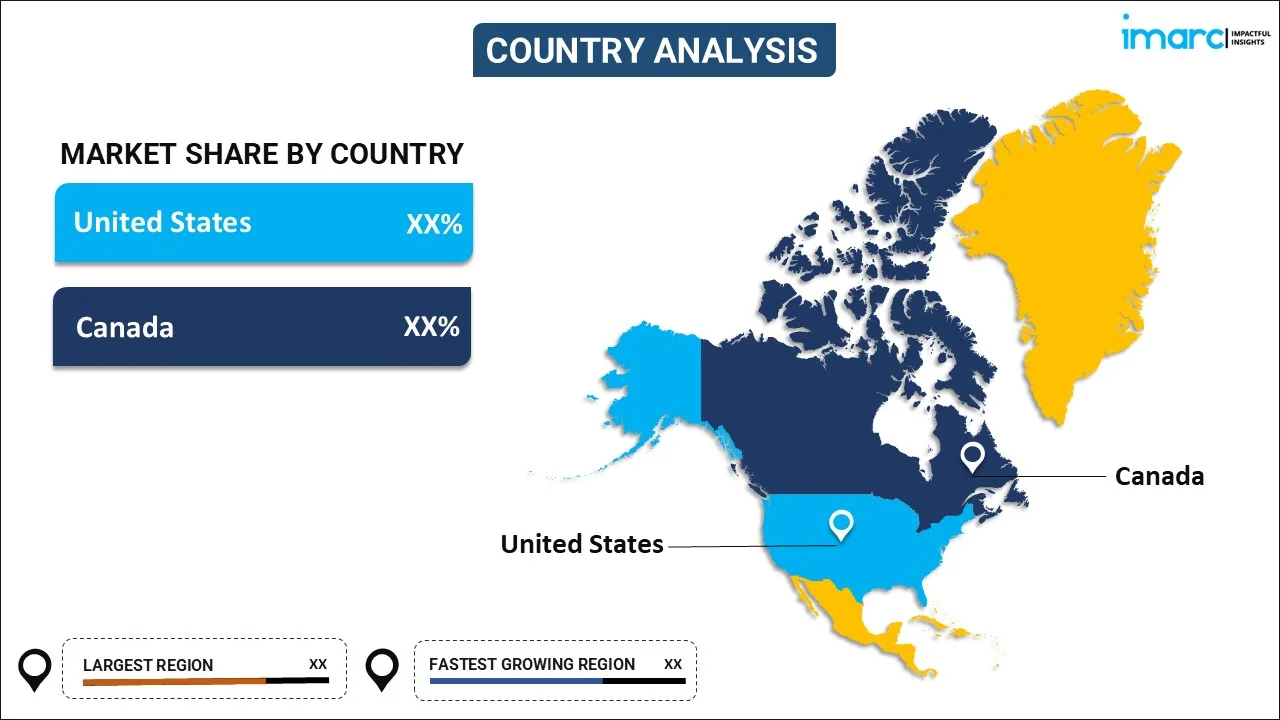

Breakup by Country:

- United States

- Canada

United States leads the market, accounting for the largest market share

The report has also provided a comprehensive analysis of all the major markets in the North America, which include United States and Canada. According to the report, United States was the largest market for eyewear in the North America.

The United States leads the North American eyewear market due to its high disposable income, significant aging population, and widespread vision issues exacerbated by increased screen time. Apart from this, technological advancements in eyewear, such as anti-reflective coatings and digital eye strain solutions, attract consumers seeking high-quality products. Additionally, fashion and brand consciousness drive demand for designer eyewear, supported by a robust retail infrastructure. Health insurance coverage for prescription eyewear also enhances affordability, further boosting market growth.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market.

- Key players in the North American eyewear industry are implementing several strategic initiatives to propel market growth. A notable effort is the continuous investment in innovation and technology. Companies are developing cutting-edge eyewear solutions, such as smart glasses with augmented reality (AR) capabilities, blue light-blocking lenses, and photochromic lenses that adapt to varying light conditions. These advancements cater to the evolving needs of consumers, enhancing both functionality and user experience. Additionally, the expansion of product lines to include fashionable and luxury eyewear options is a critical strategy. Leading brands are partnering with designers and celebrities to create exclusive collections that appeal to style-conscious consumers.

North America Eyewear Market News:

- On October 10, 2023, Alcon launched TOTAL30 multifocal contact lenses for patients with presbyopia. The lenses have begun to roll out in the United States and in select international markets.

North America Eyewear Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Spectacles, Sunglasses, Contact Lenses |

| Genders Covered | Men, Women, Unisex |

| Distribution Channels Covered | Optical Stores, Independent Brand Showrooms, Online Stores, Retail Stores |

| Countries Covered | United States, Canada |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America eyewear market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the North America eyewear market.

- The study maps the leading, as well as the fastest-growing, markets. It further enables stakeholders to identify the key country-level markets within the region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America eyewear industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The North America eyewear market was valued at USD 47.0 Billion in 2024.

We expect the North America eyewear market to exhibit a CAGR of 4.94% during 2025-2033.

The high prevalence of ocular diseases, along with the growing demand for advanced glare-free prescription eyewear with enhanced durability, is currently driving the North America eyewear market.

The sudden outbreak of the COVID-19 pandemic has led to the increasing consumer inclination towards online retail platforms for the purchase of eyewear, as online players are integrating their services with product virtualization and facial analysis to remotely recommend appropriate eyewear designs for individuals.

Based on the product, the North America eyewear market can be segmented into spectacles, sunglasses, and contact lenses. Currently, spectacles hold the majority of the total market share.

Based on the gender, the North America eyewear market has been divided into men, women, and unisex. Among these, unisex currently exhibit a clear dominance in the market.

Based on the distribution channel, the North America eyewear market can be categorized into optical stores, independent brand showrooms, online stores, and retail stores. Currently, retail stores account for the largest market share.

On a regional level, the market has been classified into United States and Canada, where the United States currently dominates the North American market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)