North America Extruded Snack Food Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Country, 2025-2033

North America Extruded Snack Food Market Size and Share:

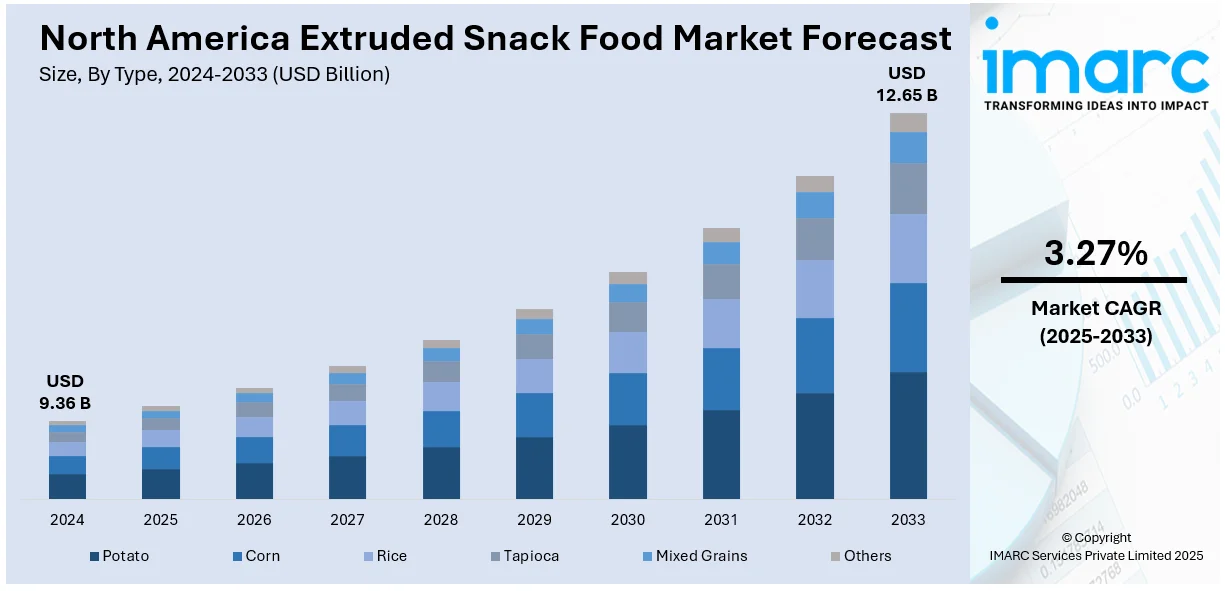

The North America extruded snack food market size was valued at USD 9.36 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 12.65 Billion by 2033, exhibiting a CAGR of 3.27% from 2025-2033. The market is growing because of increasing consumer demand for on-the-go and innovative snacks. Moreover, with increasing demand for healthier options, companies are emphasizing varied product portfolios, richer flavor profiles, and better nutritional content to address changing consumer demands.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 9.36 Billion |

|

Market Forecast in 2033

|

USD 12.65 Billion |

| Market Growth Rate 2025-2033 | 3.27% |

The North America extruded snack food market is expanding due to shifting consumer preferences toward healthier, high-protein, and gluten-free snacks. Additionally, rising awareness of nutrition and functional ingredients is driving demand for fortified snacks made with whole grains, legumes, and plant-based proteins. Moreover, busy lifestyles and on-the-go consumption patterns are fueling the growth of convenient, ready-to-eat snack options. Manufacturers are responding by developing low-fat, high-fiber, and clean-label extruded snacks that cater to health-conscious consumers, while also introducing organic, non-GMO, and allergen-free alternatives to meet evolving dietary needs. For instance, in June 2024, SnackCraft LLC, a subsidiary of Greece-based Unismack SA, invested USD 29.9 Million to expand its Kentwood, Michigan facility. The expansion increases manufacturing, warehousing, and distribution space to 311,000 square feet, supporting baked and extruded snack production with upgraded equipment and infrastructure.

Additionally, technological advancements and retail expansion are further driving market growth. Improved extrusion technology is enhancing texture, flavor, and nutrient retention, making extruded snacks more appealing. The rise of e-commerce and direct-to-consumer sales is increasing accessibility, allowing brands to reach a broader audience through online platforms and subscription-based snack services. For instance, in December 2024, retail sales in Canada increased 2.5% to USD 69.6 Billion with growth in all nine subsectors, including food and beverage retailers. Additionally, sustainable packaging solutions and eco-friendly manufacturing processes are gaining importance as consumers demand environmentally responsible products.

North America Extruded Snack Food Market Trends:

Growing Demand for Healthier and Functional Snack Options

The North America extruded snack food market is experiencing a shift toward healthier alternatives, driven by increasing consumer awareness of nutrition and wellness. Consumers seek protein-rich, fiber-enhanced, and low-fat snacks made from whole grains, legumes, and plant-based ingredients. Brands are incorporating fortified nutrients, probiotics, and clean-label ingredients to appeal to health-conscious buyers. The rise of gluten-free, organic, and non-GMO snacks is further fueling innovation. For instance, in November 2024, Stellar Snacks, a U.S. based company, unveiled a USD 137 Million production facility in Louisville, Kentucky to expand its non-GMO pretzel production and distribution. Manufacturers are reformulating traditional extruded snacks to offer better taste and texture while maintaining nutritional benefits, responding to the demand for guilt-free snacking without compromising on flavor and convenience.

Expansion of E-Commerce and Direct-to-Consumer Snack Sales

Digitalization is reshaping the North America extruded snack food market, with brands expanding their e-commerce presence and direct-to-consumer sales. For instance, according to industry reports, U.S. retail e-commerce sales for third quarter of 2024 are estimated at USD 288.8 Billion, reflecting a 2.2% (±0.4) increase from second quarter of 2024. Additionally, consumers prefer online platforms for convenience, wider product variety, and subscription-based snack deliveries. Companies leverage DTC websites, online marketplaces, and social media marketing to engage with consumers and promote personalized snack experiences. The rise of bundled offerings, limited-edition flavors, and exclusive online discounts is enhancing brand loyalty. As home snacking habits continue, manufacturers are optimizing packaging and supply chains to cater to the growing digital demand, ensuring efficient distribution and market reach across diverse consumer segments.

Innovation in Flavor Profiles and Sustainable Packaging

The extruded snack food market in North America is witnessing a surge in innovative flavors and sustainable packaging solutions. Brands are introducing bold, international-inspired flavors to appeal to diverse consumer palates, including spicy, umami, and plant-based seasonings. For instance, in October 2024, Pringles introduced Pringles Mingles, its first bagged snack in over 15 years. These air-puffed, bow-tie-shaped chips offer a light, crispy texture and blend two flavors per bite, including cheddar-sour cream, white cheddar-ranch, and dill pickle-ranch combinations. Additionally, sustainability concerns are driving companies to adopt biodegradable, compostable, and recyclable packaging materials to reduce environmental impact. Moreover, consumers increasingly prioritize eco-friendly products, pushing manufacturers to balance sustainability with product freshness. These trends are fostering product differentiation, encouraging brands to experiment with unique ingredients, seasoning blends, and environmentally responsible packaging innovations to strengthen their market position.

North America Extruded Snack Food Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the keyword market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type and distribution channel.

Analysis by Type:

- Potato

- Corn

- Rice

- Tapioca

- Mixed Grains

- Others

Potato-extruded snacks lead the North America extruded snack food market due to strong consumer demand, flexibility, and mass availability. Potatoes have high starch content, which makes it possible to achieve better texture, crispness, and expansion characteristics in extrusion processing. They are easily formulated as puffed, baked, and air-fried snacks, which appeals to health-conscious customers looking for low-fat and gluten-free products. Wide retail visibility across supermarkets, hypermarkets, and e-commerce sites further promotes growth in the market. Moreover, improvements in seasoning, clean-label, and eco-friendly packaging improve product attractiveness. Cost-efficiency, extended shelf life, and consumer acceptability of potato-based extruded snacks support their market leadership.

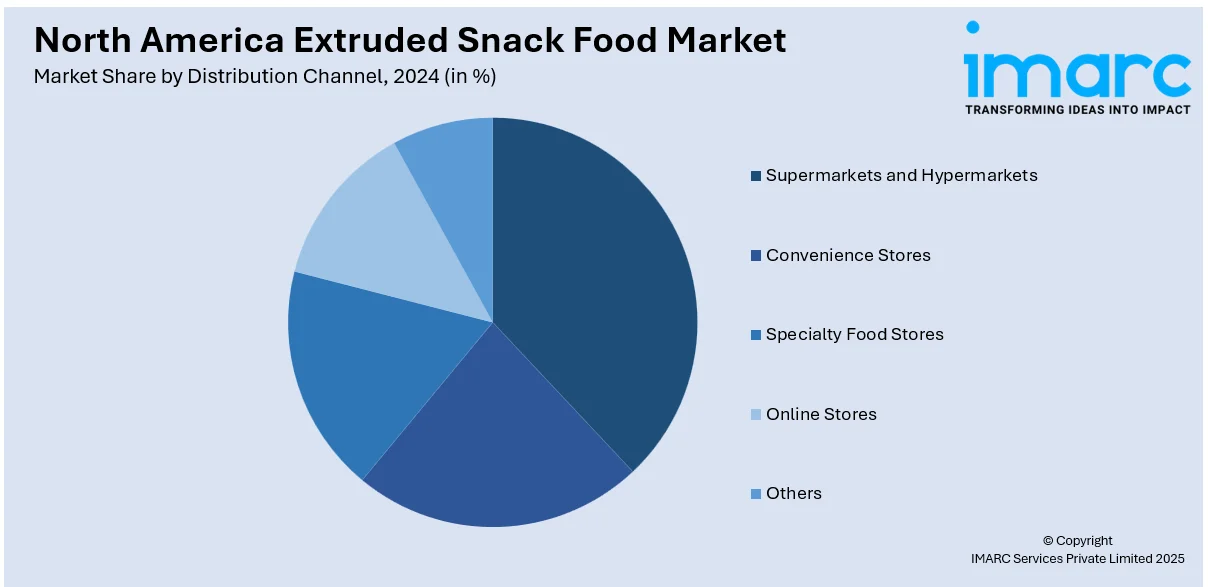

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Food Stores

- Online Stores

- Others

Supermarkets and hypermarkets are the dominant channels of distribution for the North America extruded snack food market due to extensive availability of products, competitive prices, and high shopper traffic. They provide large shelf space, which allows brands to display a variety of extruded snacks such as puffed, baked, and air-fried snacks. They have strong ties with manufacturers to facilitate bulk buying, promotions, and private labels, making products more affordable. In addition, supermarkets and hypermarkets incorporate self-checkout lanes, electronic coupons, and in-store tasting, enhancing the shopping experience. Their supremacy is supported by optimal store locations, serving urban and suburban shoppers alike, ensuring extensive market penetration and steady sales growth.

Country Analysis:

- United States

- Canada

According to the North America extruded snack food market outlook, the United States is the dominant country segment, fueled by strong consumer demand for convenient, ready-to-consume snacks. The country's high-volume production capacity, sophisticated extrusion technologies, and varied retail distribution networks support market expansion. Growing preference for healthy, high-protein, and gluten-free extruded snacks further underpins demand. For instance, in July 2024, Herbalife introduced Protein Chips in the United States and Puerto Rico, adding to its protein snack portfolio. These tasty, high-protein chips offer a healthy, convenient choice to assist consumers in achieving their daily nutrition requirements. Additionally, growth in e-commerce and direct-to-consumer channels increases access, while environmentally friendly packaging solutions keep pace with changing consumer demands. Strong brand equity, ongoing product development, and increasing per capita snack consumption place the United States in a leading position in the worldwide extruded snack market.

Competitive Landscape:

The North America extruded snack food market is highly competitive, driven by changing consumer preferences, health trends, and product innovation. Key players, including multinational corporations and regional brands, compete through flavor diversification, clean-label ingredients, and sustainable packaging, contributing to the North America extruded snack food market share. Additionally, demand for protein-rich, gluten-free, and plant-based snacks is increasing, influencing product development. For instance, in March 2024, Legendary Foods, a Santa Monica-based high-protein snack company, introduced Popped Protein Chips at Expo West. The product line is available in four flavors, containing 20g protein, 4g net carbs, and 150 calories per serving, targeting health-conscious consumers and fitness enthusiasts. Moreover, retail expansion through supermarkets, convenience stores, and e-commerce strengthens market reach. Companies are also investing in advanced extrusion technology to enhance texture, taste, and nutritional value. Besides this, strategic mergers, acquisitions, and marketing initiatives shape the competitive landscape, while regulatory compliance on food labeling and ingredient sourcing impacts market positioning and product formulation.

The report provides a comprehensive analysis of the competitive landscape in the North America extruded snack food market with detailed profiles of all major companies.

Latest News and Developments:

- In April 2024, Our Home, a Boonton, NJ-based snack maker, acquired the ParmCrisps cheese crisp business from Hain Celestial Group. This acquisition expands Our Home’s snacking portfolio, which includes plant-based churro puffs, gluten-free organic crackers, corn chips, veggie chips and other snacks, strengthening its manufacturing, innovation, and distribution capabilities in the U.S. market.

- In December 2024, Little Bellies, an Australian-based organic snack brand for children, is expanding its product range and retail presence in Canada, including organic crackers, puffs, and other wholesome snacks which will be available at Amazon, Walmart, Loblaws, Sobeys, and other major Canadian retailers.

North America Extruded Snack Food Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Potato, Corn, Rice, Tapioca, Mixed Grains, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Food Stores, Online Stores, Others |

| Countries Covered | United States, Canada |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America extruded snack food market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America extruded snack food market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America extruded snack food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The North America extruded snack food market was valued at USD 9.36 Billion in 2024.

The market is driven by a growing preference for convenient, on-the-go snack options and rising health-consciousness among consumers. Product innovation, including healthier alternatives and unique flavors, along with advancements in production technologies and wider distribution networks, are also contributing to market expansion.

IMARC estimates the North America extruded snack food market to reach USD 12.65 Billion in 2033, exhibiting a CAGR of 3.27% during 2025-2033.

Potato segment accounted for the largest type market share.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)