North America Diaper Market Size, Share, Trends and Forecast by Product Type, Distribution Channel and Country, 2025-2033

North America Diaper Market Size and Share:

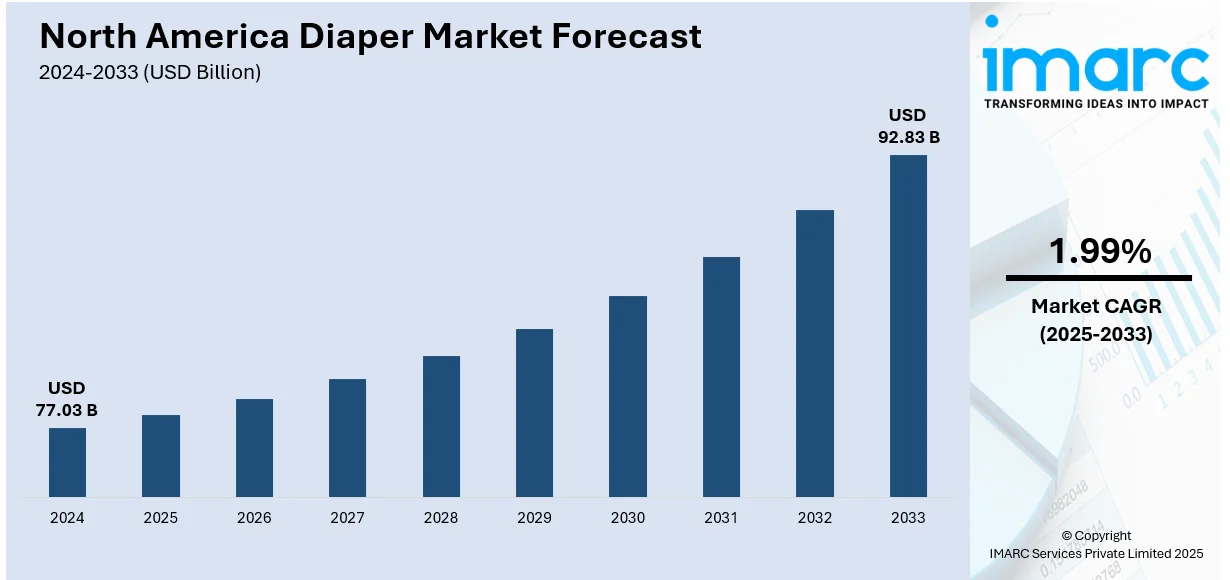

The North America diaper market size was valued at USD 77.03 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 92.83 Billion by 2033, exhibiting a CAGR of 1.99% from 2025-2033. The market share is propelled by the increasing demand for eco-friendly and sustainable products, along with advancements in diaper technology, offering better absorbency and comfort. Additionally, the market is influenced by the rise of premium diaper options and the growing popularity of online and subscription-based shopping, providing convenience and personalized services for consumers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 77.03 Billion |

|

Market Forecast in 2033

|

USD 92.83 Billion |

| Market Growth Rate (2025-2033) | 1.99% |

The growing environmental awareness among consumers drives the demand for eco-friendly diapers in North America. Sustainability being a new imperative, several parents want biodegradable, compostable, and organic diapers. Responding to these demands, diaper manufacturers have integrated natural materials, such as bamboo, cotton, and plant-based polymers, into diaper products. They present these diapers as an environmentally responsible alternative to conventional disposable diapers that take hundreds of years to decompose. However, increasing consumers ready to pay an added premium to seek environmentally friendly diapers contribute to continued changes in this trend. This is representative of a trend toward sustainable consumption patterns in the region.

Technological advancement is the major driving force of the North American diaper market. Manufacturers are trying to improve on the features that make diapers the most comfortable and performative item of convenience to wear. Features such as long-lasting absorbency, better leakage protection, breathable fabrics, or wetness indicators are some developments that keep a baby or an adult dry for a longer time. Innovations such as a hypoallergenic material would appeal to a health-conscious individual who would desire safety and comfort. The manufacturing process now involves the integration of technology, which leads to efficient production and cost savings, which are often trickled down to consumers. These advancements also fuel growth and encourage consumer loyalty in the market.

North America Diaper Market Trends:

Shift toward eco-friendly and sustainable diapers

There is an increasing trend for environmental considerations into the diaper selection in North America, as consumers are becoming more environmentally conscious. According to Kinder Cloth Diaper Co., about 20 billion disposable diapers are sent to waste in a year in the United States alone. In response, manufacturers now produce biodegradable, compostable, or recyclable diapers. This means that such diapers are probably made from natural products, such as cotton, bamboo, or even plant-based polymers, so they have less carbon footprint than a traditional disposable diapers. However, North America diaper market price analysis indicates that these sustainable options typically come at a premium due to higher production costs associated with organic materials and eco-friendly manufacturing processes. Besides this, the integration of sustainable production processes is also helping brands reduce packaging waste. This trend is primarily driven by growing awareness about environmental issues and consumer demand for products that resonate with eco-conscious values, thus becoming a critical driver of the North American diaper market.

Rising popularity of premium diaper products

Premium diapers are gaining substantial growth in the North America diaper market, and consumers are getting more inclined toward investing in superior quality for their babies. Advanced features of such diapers are mostly enhanced absorbency, fit, and skin-friendly materials for enhanced comfort and protection. The premium brands also adding features such as wetness indicators, hypoallergenic, and dermatologically tested material, which helps satisfy the increased need for safety and convenience. According to the US Bureau of Labor Statistics, wages and salaries of civilian workers increased 0.9% and benefit costs increased 0.8% from September 2024. As disposable income increases and parents seek the best possible products for their children, the demand for premium diaper options is expected to continue rising.

Growth of online and subscription-based diaper services

There has been a shift toward online purchasing and subscription-based services in the North American diaper market. Due to convenient options such as home delivery and customized offers, the sales of diapers increasingly take place via e-commerce. According to reports, the United States e-commerce sales increased by 14.6% online. Subscription services, including diaper delivery subscriptions, have gained popularity because they provide convenience, cost savings, and customization based on baby age and size. The trend is attractive to busy parents who want to simplify their buying decisions and have a constant supply of diapers. As digital platforms continue to expand, the online and subscription-based segment will be an increasingly significant force, thereby fueling North America diaper market demand.

North America Diaper Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the North America diaper market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type and distribution channel.

Analysis By Product Type:

- Baby Diaper by Product Type

- Disposable Diapers

- Training Diapers

- Cloth Diapers

- Swim Diapers

- Biodegradable Diapers

Disposable diapers hold the leading market share as they are more convenient, absorbent, and easier to use. These are used once, hence convenient for parents to maintain the hygiene needs of their babies. They are made to be comfortable, providing long-lasting dryness and excellent leakage protection. As a result, most families have opted for disposable diapers. Apart from this, innovative technologies in the disposable diaper space, such as better fit, breathability, and eco-friendly materials, further strengthen their position in the market. Disposable diapers are expected to continue to dominate the North American market as technology continues to improve.

- Adult Diaper by Product Type

- Pad Type

- Flat Type

- Pant Type

Pad-type diapers are the most dominant product line in North American adult diaper market on account of their comfort, discretion, and use. These products have been designed to provide a good deal of absorbency while easy to wear and change. Mainly pad-type adult diapers attract the attention of those who have mild incontinence as these diapers are comparatively lighter in size and flexible and less bulky than full diaper products. They come in different sizes and absorbency levels to meet the needs of different users. Increased awareness about incontinence care and the aging population are expected to continue driving demand for pad-type adult diapers in North America.

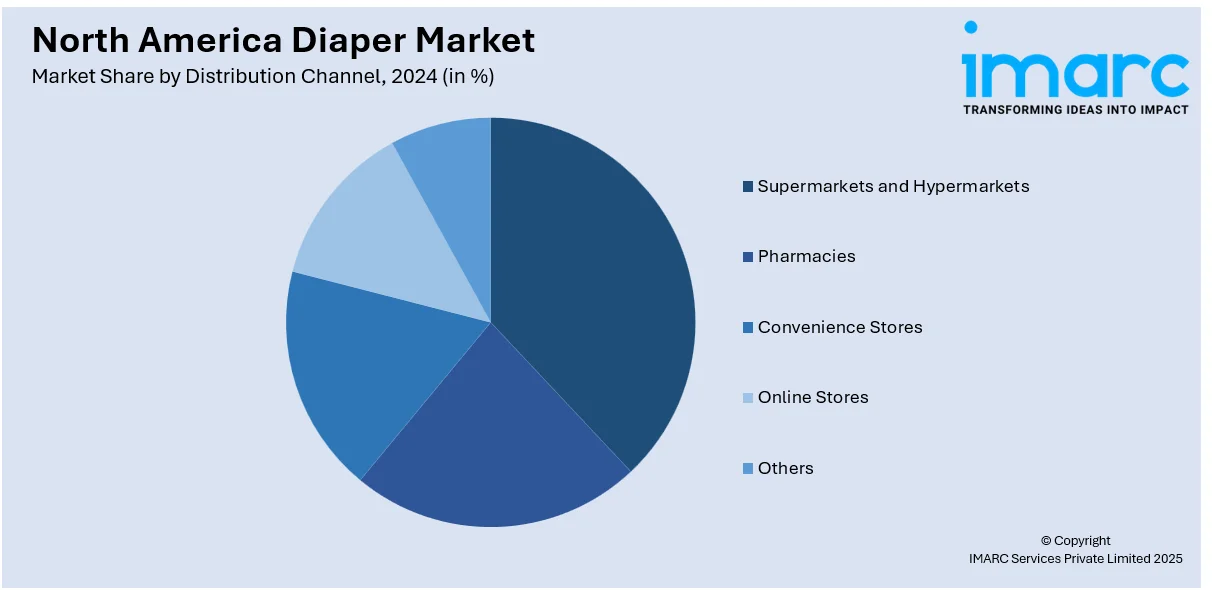

Analysis By Distribution Channel:

- Supermarkets and Hypermarkets

- Pharmacies

- Convenience Stores

- Online Stores

- Others

The most prominent distribution channels in the North America diaper market are supermarkets and hypermarkets. These channels are easily accessible, offer a wide range of products, and are convenient for consumers. These large retail outlets provide a broad range of diaper brands and types, allowing consumers to compare options and make informed purchasing decisions. In addition, the in-store shopping experience offers immediate availability, making it convenient for parents to purchase diapers on a regular basis. The urban and rural distribution channels for baby and adult diapers continues to be dominated by supermarkets and hypermarkets in North America which is expected to keep the sales very high for the market.

Country Analysis:

- United States

- Canada

The United States remains the biggest portion of the North American diaper market, generating the most regional demand. It has the highest population in the region and also houses the biggest economy, where a large proportion of the population pays much attention to health and hygiene, especially in the parenting population and elder caregivers. The country's well-established retail infrastructure, which includes supermarkets, hypermarkets, and e-commerce platforms, allows for easy access to a wide variety of diaper products. Furthermore, innovations in diaper technology, such as eco-friendly options and premium features, have further added to the demand. The US is expected to continue dominating the North American diaper market in the coming years.

Latest News and Developments:

- March 2024: First Quality declared a 50% boost in the production capacity for baby diapers and training pants. This expansion, which encompasses an investment in a new production facility, additional diaper production lines, new training pant lines, and a cutting-edge automated warehouse, will be carried out in phases, anticipated to be finalized by June 2025.

- 10 May 2024: Huggies, headquartered in the United States, has launched Skin Essentials diapers with SkinProtect liner technology to reduce diaper rash. The new diapers claim to leave up to five times less mess and better absorb moisture compared to regular diapers. The Skin Essentials line includes wipes and training underpants, accompanied by a "Be Free, Baby" marketing campaign.

- August 2024: Kudos, founded by Amrita Saigal, is launching a sustainable diaper that uses cotton lining and other degradable materials, aiming to disrupt the plastic-dominated diaper industry. The company's innovative "DoubleDry" technology allows its diapers to absorb more fluid than competitors while maintaining dryness for the baby.

North America Diaper Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Product Types Covered |

|

| Distribution Channels Covered | Supermarkets and Hypermarkets, Pharmacies, Convenience Stores, Online Stores, Others |

| Countries Covered | United States, Canada |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America diaper market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America diaper market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America diaper industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The North America diaper market was valued at USD 77.03 Billion in 2024.

The North America diaper market is driven by the increasing awareness about infant hygiene, rising demand for premium and eco-friendly products, advancements in diaper technology, and a growing aging population requiring adult incontinence products. Additionally, the rise of online shopping and subscription-based services further fuels market growth.

The North America diaper market is projected to exhibit a CAGR of 1.99% during 2025-2033, reaching a value of USD 92.83 Billion by 2033.

Disposable diapers lead the baby diaper by product type market segment owing to their convenience, absorbency, and ease of use, while pad type diaper is the leading product segment in the adult diaper market due to its comfort, discreetness, and practicality.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)