North America Data Center Server Market Size, Share, Trends and Forecast by Product, Application, and Country, 2025-2033

North America Data Center Server Market Size and Share:

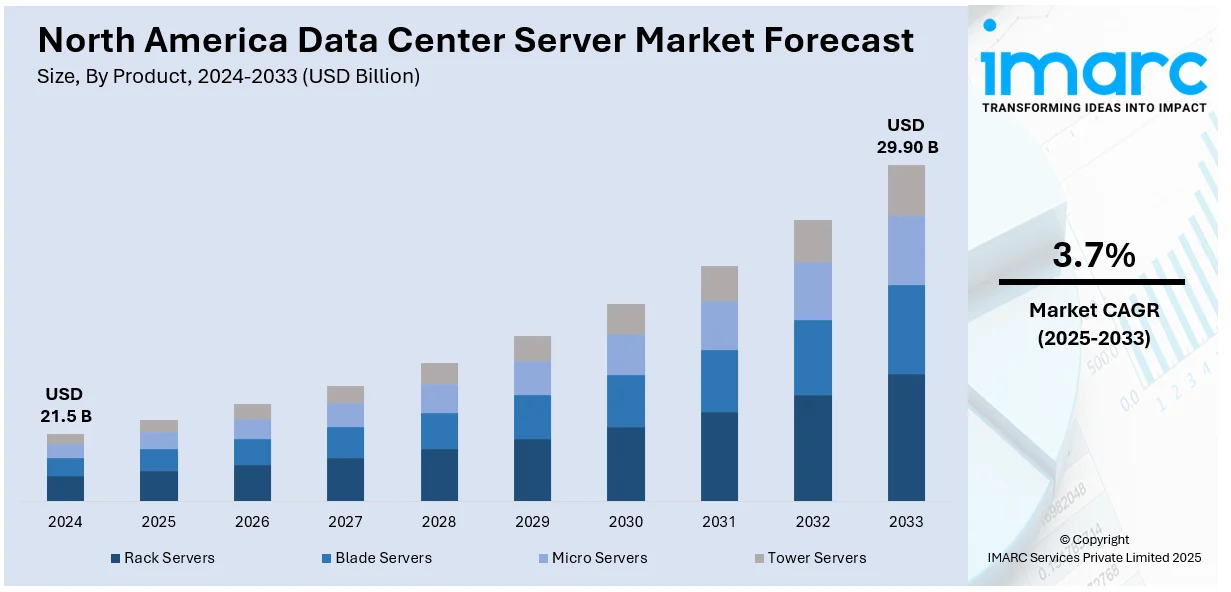

The North America data center server market size was valued at USD 21.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 29.90 Billion by 2033, exhibiting a CAGR of 3.7% from 2025-2033. The North America data center server market share is growing rapidly, with the US leading the region, driven by rising cloud adoption, artificial intelligence (AI) and machine learning (ML) demands, energy-efficient technologies, and the need for scalable, secure infrastructure across various sectors including commercial, industrial, and telecom, as businesses seek high-performance, cost-effective server solutions for modern workloads.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 21.5 Billion |

|

Market Forecast in 2033

|

USD 29.90 Billion |

| Market Growth Rate 2025-2033 | 3.7% |

The North America data center server market growth is driven by accelerating demand for high-performance computing, cloud adoption, and the expansion of AI and ML applications. Organizations across industries are migrating workloads to cloud-based infrastructures, requiring scalable, energy-efficient, and high-speed servers to handle complex data processing needs. The hyperscale cloud providers, led by the technology giants and large enterprise-level service providers, are heavily investing in advanced server architecture to support their growing cloud ecosystems. Hybrid and multi-cloud strategies continue to heighten preference for software-defined infrastructure (SDI), edge computing, and colocation facilities-further fueling server deployments. Businesses looking for more agility, automation, and workload efficiency in their systems deploy high-density computing solutions, such as graphics processing units (GPUs) and custom-built processors specifically designed for workloads in AI, among others. The advent of 5G networks, Internet of Things (IoT) applications, and real-time data analytics also heighten the need for low-latency, high-performance servers to process volumes of information in minimal latency. For instance, in March 2024, NVIDIA launched the Blackwell platform, enabling real-time generative AI on trillion-parameter models with up to 25x lower cost and energy consumption, driving breakthroughs across multiple industries.

Energy efficiency concerns, sustainability initiatives, and regulatory compliance are also key drivers for server advancement in North America's data center market. Governments and enterprises are focusing on ecofriendly infrastructure by embracing liquid cooling, energy-efficient processors, and modular server designs that consume less power without sacrificing performance. As data center operations account for most of the energy consumption, organizations are investing in innovations, such as AI-driven workload management and dynamic resource allocation to optimize power utilization. For example, in February 2024, Microsoft launched the Azure Boost DPU, its first data processing unit, designed for high-efficiency, low-power data-centric workloads, offering four times better performance and three times lower power consumption than existing servers. Moreover, security and compliance requirements further influence server procurement as sensitive data industries require high-security hardware with encryption capabilities, secure boot mechanisms, and real-time threat detection. This boosting advancement of cyber threats, including ransomware and supply chain attacks, is making organizations embrace trusted server architectures with integrated security to maintain data integrity and business continuity. Furthermore, government initiatives and funding for digital infrastructure projects in North America support investments in the expansion of data centers, deployment of high-performance servers, and next-generation networking solutions, further bolstering overall market growth.

North America Data Center Server Market Trends:

Rising Adoption of ARM-Based and Custom-Built Processors

The North America data center server market is witnessing a shift toward Advanced RISC Machine (ARM)-based and custom-built processors as enterprises and cloud service providers seek higher efficiency, lower power consumption, and improved workload optimization. Traditional x86-based architectures, dominated by Intel and AMD, are highly competing with ARM-based alternatives that offer better power efficiency and cost-effectiveness. For instance, in October 2024, AMD introduced the MI325X AI accelerator, featuring 153 billion transistors, 19,456 stream processors, 1,216 matrix cores, 2100 MHz clock speed, and up to 2.61 PFLOPs peak FP8 performance. Moreover, hyperscale cloud providers are investing in proprietary chip designs to achieve greater control over performance, security, and energy consumption, reducing reliance on third-party semiconductor manufacturers. Companies are leveraging ARM architectures for their ability to handle specialized workloads, such as AI, big data analytics, and real-time processing with reduced heat output and increased parallel processing capabilities. The encouragement toward sustainability is further driving demand for these processors, as businesses prioritize lower energy costs and reduced carbon footprints in large-scale data centers. Additionally, ARM-based servers enable enterprises to achieve improved price-performance ratios while enhancing computing capabilities for emerging workloads.

Expansion of Edge Data Centers and Distributed Computing

The boosting demand for low-latency applications, real-time data processing, and 5G infrastructure is accelerating the expansion of edge data centers and distributed computing architectures. Organizations are deploying decentralized server solutions to process data closer to the source, reducing network congestion and improving application response times. Edge computing is critical for industries such as autonomous vehicles, industrial automation, healthcare, and smart cities, where real-time decision-making depends on rapid data transmission. Telecom operators and cloud providers are investing in regional micro data centers and modular server solutions to enhance processing efficiency while minimizing data transmission delays to central cloud facilities. The rollout of private 5G networks and IoT ecosystems is further escalating demand for scalable, high-density edge servers that can handle localized workloads efficiently. Additionally, advancements in containerization, serverless computing, and AI-driven edge analytics are transforming data center architectures, enabling businesses to operate in a more distributed and responsive manner.

Growing Investments in Liquid Cooling and Energy-Efficient Server Technologies

The North America data center server market is experiencing a surge in investments toward liquid cooling and energy-efficient server technologies as organizations seek to optimize thermal management and reduce operational costs. With boosting server densities and higher power consumption in modern data centers, air cooling solutions are becoming less effective, driving the adoption of direct-to-chip liquid cooling and immersion cooling systems. These solutions enhance energy efficiency, extend hardware lifespan, and support high-performance workloads such as AI model training and advanced simulations. Data center operators are also integrating AI-driven cooling management systems that dynamically adjust cooling mechanisms based on workload intensity, reducing unnecessary energy expenditure. The demand for energy-efficient processors, power management units (PMUs), and sustainable server rack designs is growing, as enterprises focus on compliance with environmental regulations and corporate sustainability goals. These trends are reshaping server infrastructure by enabling improved performance, lower operating costs, and reduced environmental impact in large-scale deployments.

North America Data Center Server Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the North America data center server market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product and application.

Analysis by Product:

- Rack Servers

- Blade Servers

- Micro Servers

- Tower Servers

The data center server market is dominated by rack servers, with high density, scalability, and efficiency. Such rack servers are suitable for big IT infrastructures that large enterprises need. The design of the rack server accommodates mounting on standard 19-inch server racks to optimize space and simplify management. Rack servers offer a cost-effective solution to businesses seeking high performance in a compact footprint. Their modular design allows for easy expansion as workloads increase, and organizations can add additional units without significant changes to the infrastructure. This flexibility is a key driver in industries such as telecommunications, cloud computing, and e-commerce, where rapid scalability and resource allocation are crucial. Rack servers also provide enhanced cooling solutions, which are critical for maintaining energy efficiency in high-performance environments. Continuous growth in virtualization, cloud computing, and the consolidation of the data center itself is further helping rack servers due to their suitability for complex, modern IT system requirements.

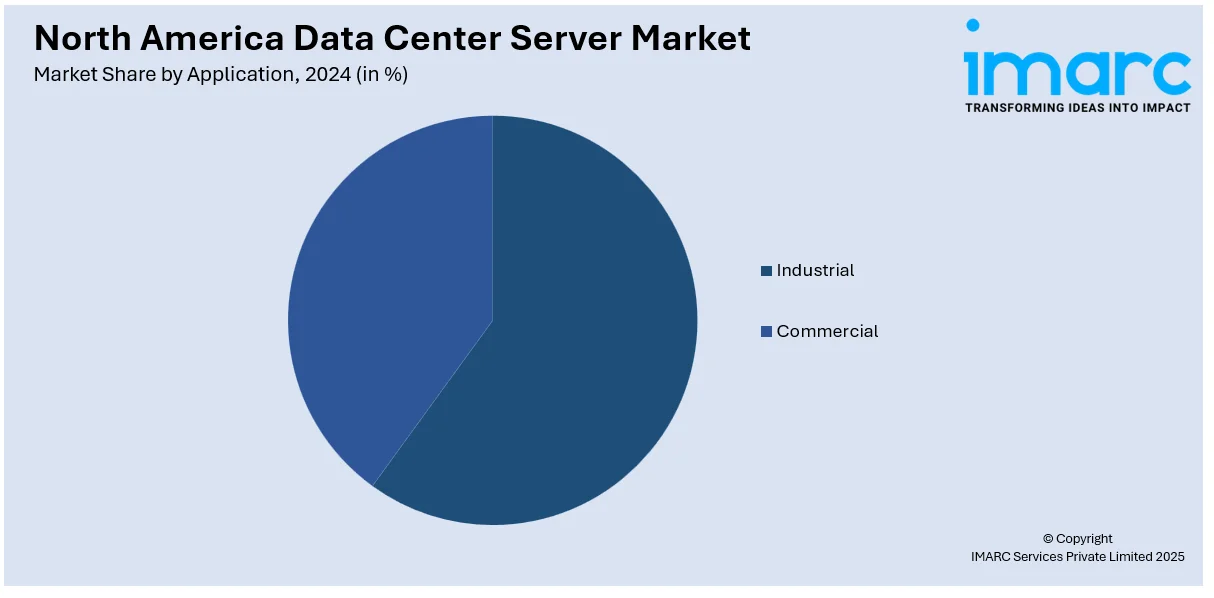

Analysis by Application:

- Industrial

- Commercial

The commercial sector leads the charge of the growth in the data center server market since businesses, both small and big, within these sectors require a high-performance server solution for increasing data and computing demands. This is in accordance with how rapidly digital transformation accelerates in its pace as most commercial enterprises continue to invest in advanced technologies, such as cloud computing, big data analytics, and artificial intelligence (AI). Extensive data processing needs at the various sectors in retail, finance, healthcare, among others, motivate the deployment of rack servers, blade servers, and other forms of servering. In general, an increasing number of SMEs and large enterprises are requiring efficient and scalable IT solutions for better operational efficiency, better customer experience, and a reduction of higher operational costs. With the mushrooming of e-commerce, online services, and digital platforms, commercial businesses require servers with more traffic-handling capabilities, high uptimes, and rapid data processing. The growing dependence of the commercial sector on cloud-based solutions and IT infrastructure is one of the main drivers for more demand for data center servers.

Country Analysis:

- United States

- Canada

The US is leading the data center server market in North America, with its robust IT infrastructure, technological advancements, and massive investments in cloud computing and data center facilities. The country houses various hyperscale cloud providers, tech giants, and large enterprises, which are some of the major consumers of high-performance servers. Indicative of this trend is the adoption by U.S. businesses of data center solutions with a base in big data analytics, AI, and ML applications while integrating retail, finance, healthcare, and manufacturing industries into an actual digital transformation drive. Further, the U.S. government's emphasis on strengthening its digital infrastructure and ensuring data security has fueled demand for the services of secure, scalable servers. The growth of 5G networks and IoT applications amplifies server adoption even more, as companies need faster, more reliable processing capabilities. The U.S. also leads in the development of next-generation technologies, such as edge computing, contributing to the growth of data center server deployments across the country.

Competitive Landscape:

The competitive landscape of the data center server market in North America is characterized by a wide variety of players that focus on product innovation, performance optimization, and energy efficiency. The main competitors are heavily investing in research and development (R&D) in order to meet growing demand for high-density computing solutions capable of carrying out modern workloads like AI, ML, and big data analytics. Companies are also focusing on energy-efficient technologies. Many companies have already started using advanced cooling techniques such as liquid cooling and AI-driven power management systems to cut down operational costs and environmental impact. Server vendors are also coming up with customizable solutions based on the needs of the industries, like high-performance computing for research or low-latency solutions for financial services. As the market expands, so do strategic collaborations and acquisitions due to the nature of companies requiring expansion of portfolios and strengthening the market position with more products in the pipeline. Additionally, trends toward cloud and edge computing force competitors to compete with the needs of the marketplace in terms of technological advancement of products.

The report provides a comprehensive analysis of the competitive landscape in the North America data center server market with detailed profiles of all major companies.

Latest News and Developments:

- In October 2024, AMD launched its 5th Gen EPYC processors, featuring the “Zen 5” core architecture. The new processors offer up to 2.7X better performance, supporting AI, cloud, and enterprise workloads. With up to 192 cores and boost frequencies of 5GHz, they provide significant energy efficiency and performance gains for data centers.

- In September 2024, NVIDIA (NVDA) experienced a stock surge as it prepared to introduce its next-generation AI chip, Blackwell, in the fourth quarter. Designed for data centers, Blackwell delivers significant performance improvements in AI training and inference, reinforcing strong revenue projections and investor confidence in NVIDIA’s market leadership.

- In September 2024, Microsoft, in collaboration with BlackRock, Global Infrastructure Partners, and MGX, launched the Global AI Infrastructure Investment Partnership. This initiative aims to invest up to $100 billion in data centers and supporting power infrastructure across the U.S., enhancing American competitiveness in AI.

- In June 2024, Intel launched its Sierra Forest Xeon processors with up to 288 E-cores, delivering 2.7x performance-per-rack gains, optimized for AI, infrastructure, and 5G workloads. The launch aligns with Intel’s 'AI Everywhere' vision. Moreover, Granite Rapids-D, aimed at edge computing, is expected in 2025 with enhanced vRAN Boost features.

North America Data Center Server Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Rack Servers, Blade Servers, Micro Servers, Tower Servers |

| Applications Covered | Industrial, Commercial |

| Countries Covered | United States, Canada |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America data center server market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America data center server market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America data center server industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The data center server market in the North America was valued at USD 21.5 Billion in 2024.

Key drivers of the North America data center server market include the growing demand for cloud computing, big data analytics, AI applications, the shift toward edge computing, heightened adoption of energy-efficient technologies, and the need for scalable, high-performance infrastructure to support digital transformation across various industries.

The North America data center server market is projected to exhibit a CAGR of 3.7% during 2025-2033, reaching a value of USD 29.90 Billion by 2033.

The Rack Servers segment accounted for the largest share of the North America data center server market, driven by their high-density, scalable, and cost-effective nature, making them ideal for enterprise-level data centers and cloud service providers requiring efficient performance and space optimization.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)