North America Chitosan Market Size, Share, Trends and Forecast by Grade, Source, Application, and Country, 2025-2033

North America Chitosan Market Size and Share:

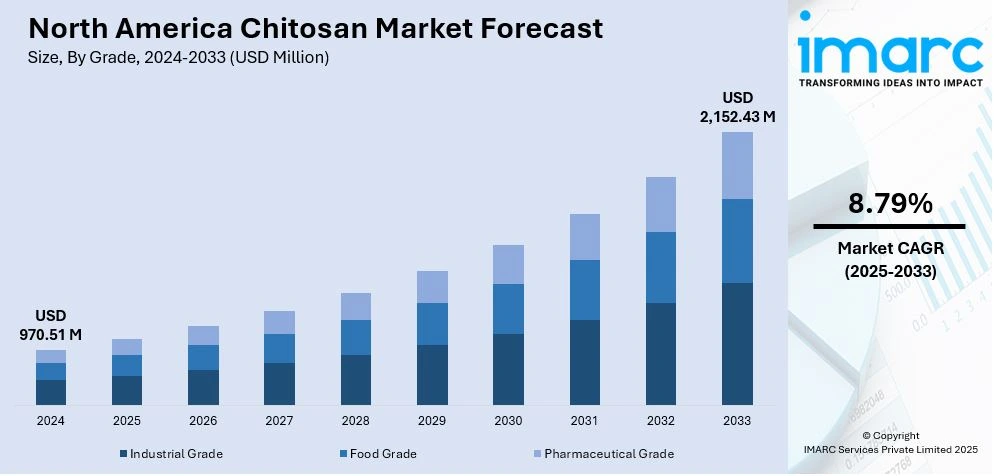

The North America chitosan market size was valued at USD 970.51 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 2,152.43 Million by 2033, exhibiting a CAGR of 8.79% from 2025-2033. The market share is expanding, driven by the growing demand for natural and plant-based components in various consumer products, rising concerns about obesity and the desire for sustainable weight management solutions, and increasing consumption of plant-based food products.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 970.51 Million |

|

Market Forecast in 2033

|

USD 2,152.43 Million |

| Market Growth Rate (2025-2033) | 8.79% |

The North American chitosan market has seen increased growth based on several trends and factors that will be aligned with the interest shown by consumers to health, sustainability, and function in ingredients. Chitosan is a bio-polymer extracted from exoskeleton crustaceans from shrimp and crab shells. At present, chitosan is regarded for its myriad applications in fields such as food and beverage (F&B), pharmaceuticals, agriculture, and cosmetics. In this region, the chitosan market is poised for further expansion due to rising consumer awareness of its potential health benefits like weight management, cholesterol reduction, and its use as a natural preservative.

The growing need for natural and plant-based components in various consumer products is offering a favorable North America chitosan market outlook. Clean-label and organic foods have been gaining popularity as more consumers are focusing on healthy lifestyles. Resultingly, manufacturers are having to introduce natural ingredients, such as chitosan, into their products. It has recently experienced increased use in F&B as a fat blocker or weight management agent. With the increasing health concerns about obesity and the quest for sustainable solutions to weight management, chitosan has been increasingly used as an additive in diet supplements and functional foods. Moreover, growing consumption of plant-based food products further creates a demand for natural food ingredients.

North America Chitosan Market Trends:

Rising Consumer Demand for Natural and Health-Conscious Products

In recent years, North Americans have been growing more concerned about natural, organic, and healthy products. Such a trend is driven by higher awareness of potential health risks of synthetic ingredients and chemicals. Since chitosan is a biopolymer that is naturally derived, it can easily fit within this trend, as it has been associated with natural weight management and cholesterol lowering. The increasing demand for clean-label and functional foods or superfoods has led manufacturers to include chitosan in a wide range of products, from dietary supplements to fortified foods and beverages. As more consumers look for healthier alternatives to manage weight, enhance immune health, and improve digestion, the demand for chitosan as a weight-loss aid, fat blocker, and dietary supplement ingredient is increasing. According to the IMARC Group, the US superfoods market size reached USD 66.6 Billion by 2033. This will further drive the North America chitosan market demand.

Increasing Focus on Sustainability and Eco-Friendly Solutions

Sustainability concerns form a significant base for the drive of the market, especially concerning the F&B, agriculture, and packaging sectors. With plastic waste reduction initiatives and more ecological-friendly practices slowly becoming the rule of the game in the region, biodegradable materials have become popular through chitosan, which, being renewable, is biodegradable. Originating from shells of crustaceans, Chitosan would replace synthetic polymers that increase environmental pollution in their wake. Chitosan, which is produced through the degradation of chitin, is an interesting material, as it also finds application in biodegradable packaging materials with growing popularity to address the negative impact of plastics on the environment. According to an article in 2024 by WWF, the United States generates the highest amount of plastic waste around the world that pollutes its rivers, landscapes, coastlines, and communities. A large percentage of Americans (85%) believe that the pollution caused by plastic waste is a significant and troubling issue that needs urgent political intervention to address. This further increased the demand for biodegradable solutions like chitosan to avoid the usage of plastic in various aspects like packaging.

Technological Advancements in Chitosan Production and Applications

Advancements in extraction, processing, and formulation technologies are significantly contributing to the expansion of the chitosan market in North America. Research has focused on improving the yield, purity, and cost-effectiveness of chitosan extraction processes, making it more accessible for widespread use across various industries. The North America Chitosan market price analysis highlights the factors influencing cost fluctuations, including raw material availability, production technologies, and demand shifts in industries. Moreover, innovations in chitosan formulations, such as nano-chitosan, have enhanced its bioactivity and solubility, leading to new and more efficient applications in pharmaceuticals, food processing, and even cosmetics. The pharmaceutical industry, for instance, benefits from these advancements in the form of improved drug delivery systems, wound healing materials, and tissue regeneration techniques. In 2023, ChitogenX Inc. launched a novel development program targeting major unmet medical requirements in the burn and skin repair market in the US and Canada.

North America Chitosan Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the North America chitosan market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on grade, source, and application.

Analysis by Grade:

- Industrial Grade

- Food Grade

- Pharmaceutical Grade

Industrial grade represents the largest segment. Industrial-grade chitosan, derived from the exoskeletons of crustaceans such as shrimp and crabs, offers a wide array of benefits across various sectors due to its unique properties. As environmental concerns over synthetic polymers and plastic waste grow, chitosan offers a sustainable and eco-friendly alternative. Unlike many synthetic chemicals, industrial-grade chitosan breaks down naturally, reducing environmental impact. In applications like biodegradable packaging and agricultural mulch films, chitosan is favored for its ability to decompose without leaving harmful residues, making it an essential material for eco-conscious industries. Furthermore, its use as a natural pesticide and soil conditioner promotes sustainable farming practices, providing an environmentally friendly solution to enhance soil health and crop productivity.

Analysis by Source:

- Shrimp

- Crab

- Squid

- Krill

- Others

Shrimp holds the biggest market share. Shrimp shells are a readily available byproduct of the shrimp processing industry. Every year, millions of tons of shrimp are harvested for human consumption, generating substantial amounts of waste in the form of shells. By utilizing these shells to extract chitosan, the seafood industry can reduce waste and make use of what would otherwise be discarded. This process aligns with sustainable practices, contributing to the circular economy. Since shrimp are one of the most farmed seafoods globally, the continued availability of shrimp shells ensures a steady and renewable source of chitosan. This not only promotes waste reduction but also reduces the need to harvest additional resources, making chitosan derived from shrimp a sustainable and eco-friendly option for various industrial applications.

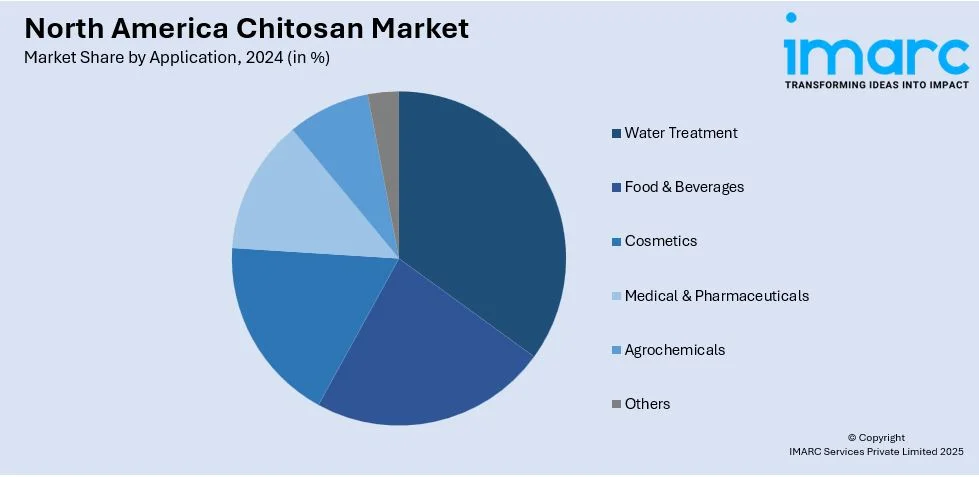

Analysis by Application:

- Water Treatment

- Food & Beverages

- Cosmetics

- Medical & Pharmaceuticals

- Agrochemicals

- Others

Water treatment represents the leading segment. One of the primary applications of chitosan in water treatment is as a coagulant and flocculant. In water treatment, coagulation is the process where fine particles, colloids, or impurities are destabilized by the addition of chemicals, while flocculation refers to the aggregation of these particles into larger clumps, or "flocs," that can then be removed from the water. Chitosan, due to its positively charged amino groups, can unite with negatively charged particles, neutralizing their charge and promoting the formation of larger flocs. These flocs can then be easily removed through sedimentation or filtration. The natural origin of chitosan makes it an attractive alternative to traditional synthetic coagulants, which may pose environmental risks. In addition, chitosan is effective in removing a wide range of contaminants, including suspended solids, organic materials, and even heavy metals like lead and cadmium.

Country Analysis:

- United States

- Canada

United States represent the leading country in the market. One of the principal drivers of the chitosan market in the United States is the increasing consumer preference for natural and clean-label products. As health-consciousness grows among individuals, there is a strong shift toward using ingredients that are perceived as healthier and safer. This trend has sparked an increasing demand for dietary supplements, functional foods, and personal care products that feature natural and minimally processed ingredients. The rise of plant-based and organic diets in the United States further drives the demand for chitosan. As more people adopt plant-based lifestyles and seek out organic alternatives, there is an increased need for natural ingredients to replace synthetic additives in processed foods and beverages. Chitosan, as a natural product, fits well within the scope of these diets, serving as an effective substitute for synthetic emulsifiers, preservatives, and fat replacers. As plant-based and organic food requirement continue to expand, chitosan’s role in these sectors is growing, especially in the production of clean-label products that appeal to health-conscious and environmentally aware consumers. According to the 2024 Organic Industry Survey by Organic Trade Association, the sales of certified organic products in the US reached USD 70 Billion in 2023.

Competitive Landscape:

Leading players in the North American market are actively diversifying their product offerings to meet the growing demand for specialized applications across industries such as F&B, pharmaceuticals, cosmetics, and agriculture. To stay competitive, companies are developing new grades of chitosan with enhanced properties such as improved solubility, biocompatibility, and antimicrobial capabilities. Strategic partnerships and collaborations are a key part of the growth strategy for many players in the North American chitosan market. Companies are collaborating with universities, research institutions, and other industry players to develop new applications for chitosan and to explore untapped markets. These partnerships not only facilitate the development of innovative products but also help companies leverage external expertise in areas like biotechnology, material science, and sustainable agriculture.

The report provides a comprehensive analysis of the competitive landscape in the North America chitosan market with detailed profiles of all major companies.

Latest News and Developments:

- February 2025: Tidal Vision declared the ending of an oversubscribed $140M Series B financing round. The funding round surpassed its initial goal due to interest from strategically aligned investors such as Cambridge Companies SPG, Eni Next (the corporate venture branch of Eni S.p.A), Milliken & Company, KIRKBI Climate, Convent Capital, SWEN Capital Partners' Blue Ocean Fund, MBX Capital, Oman Investment Authority's IDO Investments, among others. The firm is constructing new facilities in Europe, Texas, and Ohio, thereby broadening its presence.

- August 2024: Dyson launched the new Chitosan™ styling range - Dyson Chitosan™ Pre-style cream and Dyson Chitosan™ Post-style serum, which is its first hair care products created with chitosan from oyster mushrooms. The product is available in the US and Canada.

- July 2024: Canada’s ‘List of Permitted Additives’ declared the approval of chitosan extracted from white button mushrooms as a natural preservative for consumables.

- June 2024: DPH Biologicals unveiled a licensing agreement with KitoZyme, a Belgium-based producer of pharmaceutical-grade fungal chitosan, to create the first sustainably sourced chitosan seed treatment technology for United States growers.

- November 2024: Milliken & Company declared its investment and collaboration with US based firm Tidal Vision for improving the capability of chitosan to create scalable solutions for critical industries.

North America Chitosan Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Grades Covered | Industrial Grade, Food Grade, Pharmaceutical Grade |

| Sources Covered | Shrimp, Crab, Squid, Krill, Others |

| Applications Covered | Water Treatment, Food & Beverages, Cosmetics, Medical & Pharmaceuticals, Agrochemicals, Others |

| Countries Covered | United States, Canada |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America chitosan market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America chitosan market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America chitosan industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The North America chitosan market in the region was valued at USD 970.51 Million in 2024.

The North America chitosan market growth is driven by increasing consumer demand for natural, plant-based ingredients in food, pharmaceuticals, and cosmetics, rising concerns over obesity and weight management, and the shift towards sustainable and eco-friendly solutions in packaging and agriculture.

The North America chitosan market is projected to exhibit a CAGR of 8.79% during 2025-2033, reaching a value of USD 2,152.43 Million by 2033.

The industrial grade chitosan segment accounted for the largest market share. Its applications in biodegradable packaging, agriculture, and water treatment, due to its sustainability and eco-friendly properties, make it the dominant grade in North America.

Shrimp accounted for the largest share of the chitosan source market in North America. Shrimp shells, a byproduct of the seafood industry, provide a renewable and sustainable source of chitosan, making it the most widely used source in the region.

The water treatment segment held the largest share of the North America chitosan application market. Chitosan’s use as a natural coagulant and flocculant in water treatment processes, offering an eco-friendly alternative to synthetic chemicals, drives its widespread adoption.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)