North America Cheese Market Size, Share, Trends and Forecast by Source, Type, Product, Distribution Channel, Format, and Country 2025-2033

North America Cheese Market Size and Share:

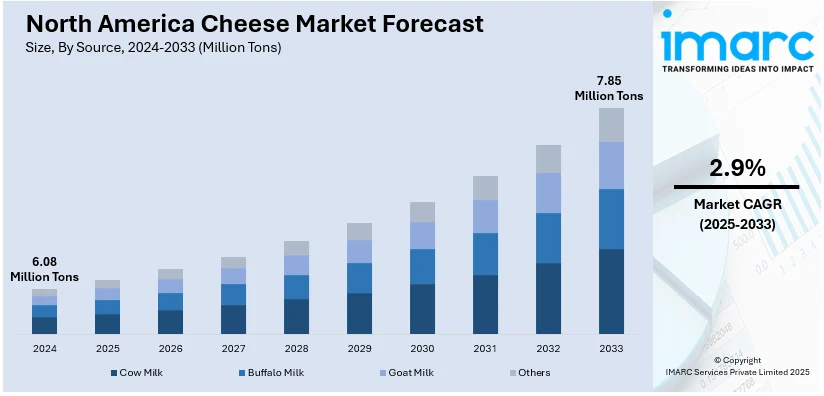

The North America cheese market size was valued at 6.08 Million Metric Tons in 2024. Looking forward, IMARC Group estimates the market to reach 7.85 Million Metric Tons by 2033, exhibiting a CAGR of 2.9% from 2025-2033. The North America cheese market share is expanding, driven by the rising food service establishments like restaurants and cafes, which require cheese to incorporate into different flavorful recipes, along with the expansion of retail channels and e-commerce sites that offer more cheese-infused items, making them easily accessible.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

6.08 Million Metric Tons |

|

Market Forecast in 2033

|

7.85 Million Metric Tons |

| Market Growth Rate (2025-2033) | 2.9% |

At present, technological advancements are improving cheese production efficiency, quality, and sustainability. Modern processing techniques enhance cheese texture, flavor, and shelf life, ensuring consistent quality across different varieties. Automation in cheese manufacturing helps to increase output while reducing labor costs, making cheese more affordable for people. Sophisticated packaging techniques, such as modified-atmosphere packaging and vacuum sealing prolong freshness and refine distribution. Additionally, innovations in dairy farming, including better feed and milking technologies, ensure a steady and high-quality dairy supply for cheese manufacturing. Moreover, food science advancements support the development of new cheese alternatives, catering to changing preferences.

The expansion of e-commerce and retail channels is impelling the North American cheese market growth. These platforms are making cheese more accessible and convenient for individuals. Online grocery platforms, supermarket websites, and specialty food stores offer a wide variety of cheese options, allowing people to shop from home. Subscription-based cheese delivery services and direct-to-consumer (D2C) models have also become popular, providing unique and artisanal cheese items to a broader audience. Apart from this, large retailers and grocery chains continue to broaden their cheese selections, including artisanal and specialty varieties. Discounts, promotions, and bulk purchasing options in supermarkets and hypermarkets further increase sales.

North America Cheese Market Trends:

Increasing dairy production

The growing dairy production is ensuring a steady and abundant milk supply for cheese manufacturing. The US and Canada have large dairy farms, particularly in states like Wisconsin and California, which produce high-quality milk needed for different cheese types. With advanced dairy farming techniques, farmers can maintain consistent production levels, keeping cheese affordable and widely available. A reliable milk supply allows manufacturers to experiment with new cheese varieties and meet the high consumer demand. Additionally, government support and investments in dairy farming help to sustain production efficiency. As per the information provided on the official website of the USDA, the overall cheese production (not including cottage cheese) was 1.20 Billion Pounds, with a rise of 1.7 percent from August 2023 and 0.5 percent higher than July 2024. This further allows the adoption of cheese across retail and foodservice sectors.

Rising demand for cheese-based items

The growing demand for cheese-based products, with people seeking flavorful and convenient food options, is offering a favorable North America cheese market outlook. Packaged food item companies and cafes employ cheese in pizzas, macaroni, burgers, pasta, and snacks, increasing overall consumption. In September 2024, STOUFFER’S®, a brand of frozen prepared food products, released the boxed mac and cheese STOUFFER’S® Supreme Shells & Cheese. It is available in two incredibly creamy and cheesy varieties. The item will be sold at specific national retailers starting this month for a suggested retail price of USD 3.99 per 12 oz. box, with further expansion planned for 2025. Besides this, the rising snacking trend is encouraging the utilization of cheese sticks, dips, and spreads. With individuals prioritizing taste, cheese remains a key ingredient in many meals.

Growing food service establishments

The rising food service establishments are fueling the market growth. With more restaurants, cafes, and fast-food chains opening up, the need for cheese is high, as it is a key ingredient in many menu items. Food recipes often feature cheese, and as more food businesses emerge, they contribute to a higher consumption rate. Additionally, the foodservice industry is broadening its offerings of cheese-based dishes, providing variety and attracting customers who are looking for quality and savory meals. With the increase in quick-service restaurants and casual dining spots, cheese becomes even more of a staple in the food service sector. This growing number of food establishments ensures a consistent demand for cheese. According to the IMARC group, the United States food service market is set to reach USD 2,508 Billion by 2032.

North America Cheese Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the North America cheese market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on source, type, product, distribution channel, and format.

Analysis by Source:

- Cow Milk

- Buffalo Milk

- Goat Milk

- Others

Cow milk represents the largest segment. It is the most widely available and versatile option for cheese manufacturing. The US and Canada have large dairy farms primarily focused on cow milk, ensuring a steady and high-volume supply. Compared to milk from goats, sheep, or other animals, cow milk is easier to produce on a large scale, making it the preferred choice for commercial cheese manufacturers. It has an ideal composition of fats and proteins, allowing the creation of various cheese types, ranging from cheddar and mozzarella to specialty and processed cheeses. Moreover, the large scale employment of cow milk makes cheese more affordable for consumers, increasing demand in households, restaurants, and the fast-food industry. Additionally, well-established dairy farming practices, government support, and technological advancements in processing enhance cow milk cheese production. As a result, cow milk remains the dominant source of cheese in the region.

Analysis by Type:

- Natural

- Processed

Natural holds the biggest market share. People prefer fresh and high-quality dairy products with fewer additives. With more awareness about the clean-label and minimally processed food items, people choose natural cheese over processed alternatives. It is made using traditional methods with simple ingredients like milk, salt, enzymes, and cultures, making it a healthier option. Popular varieties, such as cheddar, mozzarella, and parmesan, dominate grocery shelves and restaurant menus, further promoting their adoption. The rise of organic and artisanal cheese products also fuels the market growth, as individuals look for premium and specialty options. Additionally, natural cheese is widely utilized in cooking, snacking, and foodservice. Many manufacturers wager on expanding natural cheese production to meet changing preferences. As health-conscious eating trends continue to rise, natural cheese remains the top choice in the area.

Analysis by Product:

- Mozzarella

- Cheddar

- Feta

- Parmesan

- Roquefort

- Others

Cheddar exhibits a clear dominance in the market. It is one of the most popular, versatile, and widely consumed cheese products. Its rich flavor, smooth texture, and ability to age well make it a favorite for households, restaurants, and food manufacturers. Cheddar is used in a variety of dishes, including burgers, sandwiches, macaroni and cheese, and snack foods, driving consistent demand. It is also available in different forms, such as blocks, slices, shredded, and spreadable, making it convenient for people. The cheese’s ability to range from mild to sharp savors appeals to a wide audience, further enhancing its market share. Additionally, major dairy companies produce cheddar on a large scale, ensuring affordability and availability across grocery stores and foodservice channels. As consumer preference for flavorful and high-quality cheese continues to grow, cheddar remains the leading item in the market.

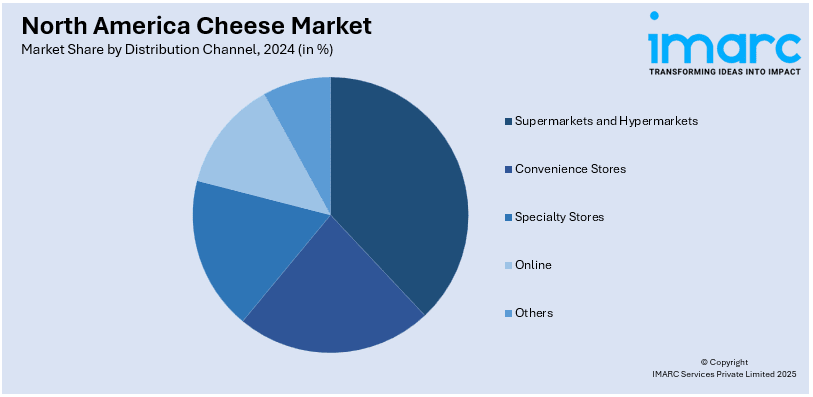

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online

- Others

Supermarkets and hypermarkets lead the market. They offer a wide variety of cheese options at competitive prices. These large retail stores provide convenient access to different types of cheese, including natural, processed, organic, and specialty varieties, catering to all consumer preferences. Shoppers prefer buying cheese from supermarkets and hypermarkets because they can compare brands, find discounts, and purchase in bulk. These stores also have dedicated dairy sections with proper refrigeration, ensuring cheese stays fresh. Many retailers team up with leading cheese brands to introduce new products and promotions, further increasing sales. Private-label cheese options have also become popular, providing affordable alternatives to branded products. The strong presence of supermarkets and hypermarkets across urban and suburban areas makes them the primary choice for cheese purchases.

Analysis by Format:

- Slices

- Diced/Cubes

- Shredded

- Blocks

- Spreads

- Liquid

- Others

Slices represent the largest segment. They offer convenience, versatility, and easy portion control. Consumers prefer sliced cheese for sandwiches, burgers, and quick meals, making it a staple in households and foodservice establishments. Pre-sliced cheese saves time in meal preparation, which is especially important for busy lifestyles. Fast-food chains and restaurants also depend on cheese slices for consistency and efficiency in their menu offerings. Supermarkets and hypermarkets stock a wide variety of sliced cheese options, including cheddar, American, Swiss, and provolone, catering to different tastes. Many brands offer resealable packaging to keep slices fresh, further increasing their appeal. The rising need for ready-to-eat (RTE) and on-the-go food items also promotes the usage of sliced cheese. As people continue to prioritize convenience without compromising on taste and quality, sliced cheese remains the leading format across the area.

Country Analysis:

- United States

- Canada

United States enjoys the leading position in the market. It has a well-established massive dairy industry. Being the leading cheese producer in the area, the US enjoys a plentiful supply of milk, particularly in states, such as Wisconsin, California, and Idaho, where extensive dairy farms facilitate consistent cheese manufacturing. Brands and restaurants employ cheese in various food items, ranging from everyday meals to fast food products like burgers, pizzas, and sandwiches, driving continuous demand. In March 2024, Hidden Valley Ranch, the prominent developer of cheese products, teamed up with Cheez-It, a well-known cheese crackers brand, to launch the new item ‘Cheezy Ranch’ in the Hidden Valley Ranch innovation range for National Ranch Day. It is created with 100% authentic cheese and offers the tangy taste of ranch. It was sold at Walmart and Kroger grocery locations across the country for USD 5.99. Besides this, major food chains, supermarkets, and convenience stores offer a wide variety of cheeses, making them easily accessible. Innovations in cheese types, including artisanal and specialty cheeses, also help to expand the market. Additionally, strong export activities, particularly to Mexico, increase overall sales.

Competitive Landscape:

Key players work on introducing new varieties to meet the high North American cheese market demand. Big companies wager on advanced processing technologies to enhance quality and efficiency. They develop innovative cheese products, including artisanal and specialty cheeses, to cater to changing consumer choices. They also spend resources on strong branding and marketing strategies to help them to increase awareness and demand, particularly for premium and artisanal cheese options. These firms also strengthen their supply chains, ensuring consistent availability in supermarkets, restaurants, and foodservice channels. Additionally, investments in sustainable dairy farming and packaging appeal to eco-conscious people. Partnerships with fast-food chains and retailers further boost sales by making cheese more accessible. For instance, in August 2024, Bergader, a prominent producer of cheese specialties, teamed up with Abbey Specialty Foods, a well-known importer and distributor of specialty cheese, to unveil the new edelblu Blue Cheese range, designed to attract a younger audience. The edelblu range presents two new products: edelblu Cubes, offered in two distinct 50-gram packs, and edelblu Cream, a smooth and spreadable Blue cheese. They were accessible in the United States beginning in September.

The report provides a comprehensive analysis of the competitive landscape in the North America cheese market with detailed profiles of all major companies.

Latest News and Developments:

- June 2024: Prairie Farms Dairy began June Dairy Month by introducing a collection of classic natural cheeses featuring Natural Cheese Spreads, Classic Cheese Sampler, Mini Moon™ Wheels, and a Classic Cheese Sampler Cheese Curds. Nine out of the ten items showcase the Proudly Wisconsin Cheese® Badge of Honor. The firm announced the manufacturing and distribution of lactose-free Cottage Cheese and Sour Cream and lactose-free Milk Gallons in 16-ounce tubs, across its operational areas that span over 40% of the US. This comes after the release of the lactose-free range in the St. Louis metropolitan region, Illinois, US in April.

- April 2024: KGalbani Cheese launched two daring new flavors of Galbani Marinated Fresh Mozzarella cheese - Spicy Pepper and Garlic, Onion & Chives. They are produced in the United States and are now offered at ShopRite and Albertsons Southwestern Division.

- March 2024: Tillamook, recognized for producing rich and exceptional cheese, introduced the ‘Whole Milk Mozzarella’ in the Aisle. It is crafted using traditional methods and the finest ingredients, guaranteeing that each gooey piece offers rich savor, along with a remarkably long cheese stretch. It is available throughout the United States at grocery stores including Albertsons, Safeway, Target, Kroger, and numerous others.

- March 2024: Kraft Natural Cheese, a prominent dairy brand within Lactalis Heritage Dairy, a division of Lactalis USA, unveiled Kraft Signature Shreds, which will be introduced in three initial varieties- Mozzarella Blend, Cheddar Blend, and Mexican Blend. This innovative product gives consumers a distinctive, restaurant-quality, thick-cut, natural shredded cheese, providing savor for the cheesiest recipes. The item is offered at national retailers like Kroger, Mariano’s, Publix, and Food Lion, with more distribution expected in summer.

- February 2024: KFC, an American fast food restaurant chain, revealed plans to add "Chizza" to its menu options in the United States. The dish consists of two fried chicken filets made with white meat, garnished with marinara sauce, melted mozzarella cheese, and crunchy pepperoni.

North America Cheese Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Metric Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Cow Milk, Buffalo Milk, Goat Milk, Others |

| Types Covered | Natural, Processed |

| Products Covered |

Mozzarella, Cheddar, Feta, Parmesan, Roquefort, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online, Others |

| Formats Covered | Slices, Diced/Cubes, Shredded, Blocks, Spreads, Liquid, Others |

| Countries Covered | United States, Canada |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, the North America cheese market forecast, and dynamics from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America cheese market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America cheese industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The North America cheese market in the region was valued at 6.08 Million Metric Tons in 2024.

The growing preference for cheese in everyday meals and snacking products is impelling the market growth. Besides this, the popularity of fast food items like pizza, burgers, and sandwiches is driving the demand for processed and specialty cheese options. Moreover, the rising health and wellness trends is encouraging the adoption of organic, artisanal, and functional cheese varieties.

The North America cheese market is projected to exhibit a CAGR of 2.9% during 2025-2033, reaching a value of 7.85 Million Metric Tons by 2033.

Cow milk accounted for the largest North America cheese source market share due to its abundant supply, high protein and fat content, versatility in cheese production, cost-effectiveness, and strong consumer preference for cow milk-based cheeses like cheddar and mozzarella.

Natural represented the largest North America cheese type market share owing to its high consumer preference, minimal processing, rich flavor, and nutritional benefits. Its diverse varieties, including cheddar and mozzarella, drive strong demand across retail, foodservice, and industrial sectors.

Cheddar accounted for the largest North America cheese product market share because of its widespread popularity, versatile applications, rich flavor, and long shelf life. Its strong demand in retail, foodservice, and processed foods further solidified its leading market position.

Supermarkets and hypermarkets held the largest North America cheese distribution channel market share due to their broad user reach, convenient locations, diverse product offerings, competitive pricing, and ability to cater to both retail and bulk purchases.

Slices accounted for the largest North America cheese format market share owing to due to their convenience, versatility, and widespread use in sandwiches, burgers, and other quick meals. Their easy-to-use packaging and popularity among the masses for on-the-go consumption contributed to the dominant market share.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)