North America Bancassurance Market Size, Share, Trends and Forecast by Product, Bancassurance Models, and Country 2025-2033

North America Bancassurance Market Size and Share:

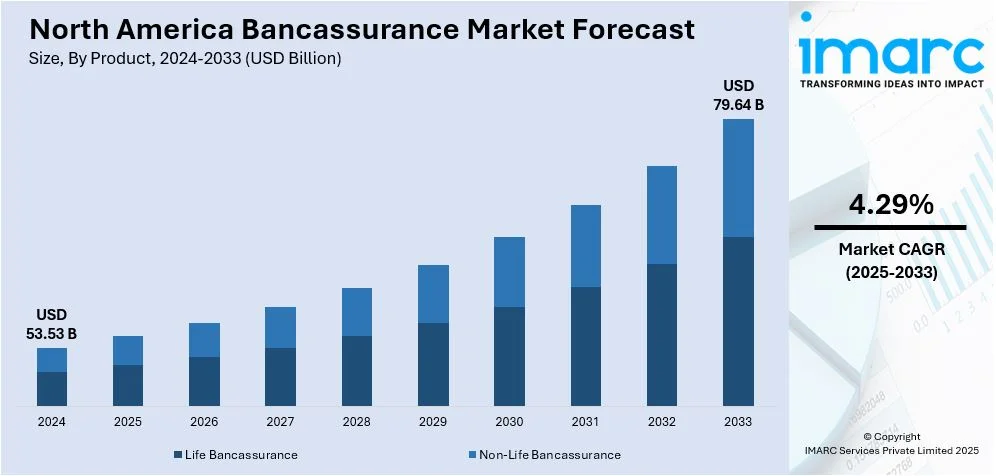

The North America bancassurance market size was valued at USD 53.53 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 79.64 Billion by 2033, exhibiting a CAGR of 4.29% from 2025-2033. Increasing consumer demand for integrated financial solutions, technological advancements in digital banking, strategic partnerships between banks and insurers, economic growth, inflating disposable incomes, and the growing preference for bundled insurance and banking services are some of the factors positively impacting the North America bancassurance market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 53.53 Billion |

|

Market Forecast in 2033

|

USD 79.64 Billion |

| Market Growth Rate (2025-2033) | 4.29% |

The market in North America is primarily driven by the increasing customer demand for bundled financial products, combining banking and insurance services, thereby enhancing convenience and cost-effectiveness. Furthermore, economic growth and increased disposable income among consumers fuel the need for comprehensive financial solutions, including insurance offerings through banks. Moreover, the integration of generative artificial intelligence (AI) and machine learning (ML) is creating a favorable market outlook. According to an IBM survey, which had more than 5,000 executives from 25 industries and 24 countries, 77% of industry leaders believe that to be competitive, organizations must swiftly implement generative artificial intelligence (AI).

In addition to this, the rising adoption of mobile and online banking services accelerates the delivery of insurance products, which provides impetus to the North America bancassurance market growth. Furthermore, strategic collaborations between banks, insurance providers, and companies strengthen market presence, leveraging each other's strengths to create more competitive offerings. For example, on February 5, 2024, One Inc. announced a partnership with U.S. Bank to modernize payment solutions for insurance carriers and policyholders. The collaboration aims to enhance the efficiency, security, and convenience of premium payments through integrated digital solutions. By leveraging U.S. Bank's payment expertise and One Inc.'s technology, the partnership seeks to improve the overall payment experience for insurance customers. Also, enhancements in data analytics allow institutions to assess customer needs better, leading to more targeted and effective marketing strategies.

North America Bancassurance Market Trends:

Digital Transformation and Technological Integration

The integration of advanced digital platforms is transforming the North American bancassurance market outlook. According to recent industry reports, 60% of banking executives in developed economies said their consumers use mobile apps, and 80% of them reported being digitally active. Nearly two-thirds of simple product sales and 80% of basic servicing transactions might be completed digitally, especially in nations with substantial digital infrastructure already in place. Therefore, banks and insurers are increasingly leveraging digital technologies to offer personalized insurance products to their customers. These technologies enable banks to analyze customer profiles and deliver tailored solutions, improving customer satisfaction and retention. Mobile banking apps and online portals also enhance accessibility, allowing customers to purchase insurance products seamlessly. The adoption of automation and digital tools streamlines operations, reducing costs for institutions while enhancing the speed and efficiency of service delivery.

Growth of Credit Insurance Applications

The adoption of credit insurance is steadily increasing within the North American bancassurance market and is being promoted by growing awareness of economic uncertainty and financial risks. Credit insurance, which hedges against the risk of non-payment by customers to businesses, forms an integral component of financial risk management strategies. Against fluctuating markets and the disruptive threat of bankruptcy, companies use credit insurance products from banks tailored with bancassurance. Another key factor includes the integration of digital technology, so businesses can quickly obtain, procure, and process their credit policies. For example, Genesis Global introduced, on April 11, 2024, a credit insurance application. This is meant to automate banking processes in order to mitigate credit risk in lending and financing operations. With the CIA, lenders can efficiently handle global portfolios of credit insurance and risk participation agreements across various banking activities, supplanting spreadsheet-based manual workflows with an integrated solution that brings together insurance portfolio data and risk distribution.

Consumer Demand for Customizable Financial Solutions

One of the significant North American bancassurance market trends is the increasing consumer demand for customized and flexible financial solutions. According to an industry report which surveyed 1,000 policyholders in the US between the ages of 18 and 65, 89% of participants are open to sharing more personal information, a 17% rise from the previous two years. The report reveals the customers' increased desire for tailored insurance products that are sensitive to their values and living circumstances. Additionally, it demonstrates consumers' readiness to disclose personal data in exchange for customized offerings, lower premiums, and enhanced claims processing. As consumers seek more personalized experiences, they are propelling the need for banks to offer products that align with their specific financial goals and life stages. Banks, in partnership with insurance providers, are expanding their offerings beyond traditional bundled packages, which allow customers to select and combine services that best fit their individual needs. This trend is highly evident in the life insurance segment, where several consumers seek tailor-made coverage plans that cater to their specific financial situation. With the aging population and the interest in wealth management and protection, demand for tailored bancassurance solutions is bound to increase even further, thus challenging institutions to innovate and keep pace with customer expectations.

North America Bancassurance Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the North America bancassurance market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product and bancassurance models.

Analysis by Product:

- Life Bancassurance

- Non-Life Bancassurance

Life bancassurance dominates the product segment; in this type, the bank distributes insurance products via banking channels and bridges financial services and insurance. The synergy between banks and insurance companies leads to streamlined life insurance policy distribution by offering vast arrays of financial products to a broad customer base within the banking channel. Such an approach provides opportunities for growth and increases customer reach for both parties. Life bancassurance is gaining momentum in North America, as the increasing demand for holistic financial services by growing customers has influenced banks to diversify their revenue streams. Advancement in digital banking provides synergy by integrating insurance offerings with ease. As consumer preferences are changing, life bancassurance is bound to grow even more and expand the North American insurance market.

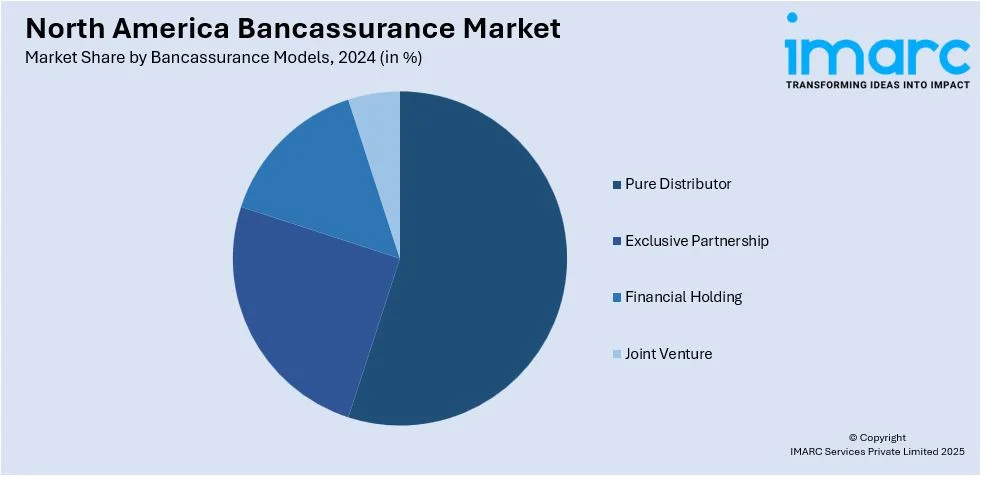

Analysis by Bancassurance Models:

- Pure Distributor

- Exclusive Partnership

- Financial Holding

- Joint Venture

The pure distributor segment leads the market in 2024. In this model, the banks act merely as distributors without any involvement in product development and underwriting. This will enable an insurance company to tap into a bank's established customer base and reduce the associated operational costs. The model, therefore, provides banks with unique advantages by offering value-added services, increasing customer retention rates, and obtaining additional sources of revenue without exposing themselves to the underwriting risks of insurance. The pure distributor model is a cost-effective approach for insurance companies to expand market reach through banks' extensive branch networks and digital platforms. With the increasing preference among North American customers for convenience and integrated financial services, the Pure Distributor model is aligned with consumer preference for one-stop financial solutions.

Country Analysis:

- United States

- Canada

- Mexico

The United States is the dominant region for the North American bancassurance market due to the presence of a large and diversified financial services sector. In the U.S., bancassurance is developing as banks are diversifying their products by adding insurance services, such as life, health, and property insurance, to their product offerings. The model offers the convenience of having both banking and insurance services in one place. U.S. banks benefit from cross-selling opportunities, while insurance companies gain access to a vast customer base through well-established banking channels. Furthermore, the rapid development of digital banking and fintech innovations accelerates the adoption of bancassurance, thereby facilitating more efficient distribution of insurance products. The U.S. maintains its stronghold in the North American market as bancassurance is an integral part of the financial service ecosystem in the region.

Competitive Landscape:

The market in North America is highly competitive, driven by diverse insurance providers and continual technological innovations. The key market players often use digital platforms to enhance service delivery, improve customer experience, and expand market reach. Also, strategic partnerships and collaborations between banks and insurers are popular, as they enable the creation of tailored, comprehensive financial products that appeal to a broader customer base. This trend is further strengthened by the increased need for integrated financial solutions as consumers seek the convenience of dealing with both banking and insurance requirements under one roof. There are reforms in the regulatory policy that support and encourage collaboration with consumer protection and transparency. The competition is becoming intense as firms are looking to integrate technology, product differentiation, and cost-effective distribution models to strengthen their market positions further and increase their customer bases.

The report provides a comprehensive analysis of the competitive landscape in the North America bancassurance market with detailed profiles of all major companies.

Latest News and Developments:

- September 5, 2023: Salem Five Insurance, a subsidiary of Salem Five Bancorp, has acquired Philbin Insurance Group, expanding its presence north of Boston. The merger aims to provide expanded insurance options for Philbin's customers while maintaining a focus on superior customer service.

- May 7, 2024: Truist Financial Corporation has completed the sale of Truist Insurance Holdings (TIH) to an investor group led by private equity firms. The sale resulted in after-tax cash proceeds of USD 10.1 Billion and an after-tax gain of USD 4.7 Billion. This transaction significantly improved Truist's financial profile, increasing its CET1 capital ratio and tangible book value per share.

- June 03, 2024: German American Bancorp, Inc. has sold its insurance subsidiary, German American Insurance (GAI), to Hilb Group for USD 40 Million in cash. The sale results in an after-tax gain of approximately USD 27 Million.

North America Bancassurance Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Life Bancassurance, Non-Life Bancassurance |

| Bancassurance Models Covered | Pure Distributor, Exclusive Partnership, Financial Holding, Joint Venture |

| Countries Covered | United States, Canada, Mexico |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America bancassurance market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America bancassurance market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America bancassurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The bancassurance market in North America was valued at USD 53.53 Billion in 2024.

The key factors driving the market by the increasing consumer preference for convenient, one-stop financial services, technological advancements in digital banking, strategic partnerships between banks and insurance firms, and growing demand for life and health insurance products among the aging population.

The bancassurance market in North America is projected to exhibit a CAGR of 4.29% during 2025-2033, reaching a value of USD 79.64 Billion by 2033.

Life bancassurance dominates the market due to strong demand for life insurance products, the growing need for financial protection, banks' ability to offer tailored life insurance solutions, and increasing awareness about financial security in the region’s aging population.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)