North America Baby Food and Infant Formula Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Country, 2025-2033

North America Baby Food and Infant Formula Market Size and Share:

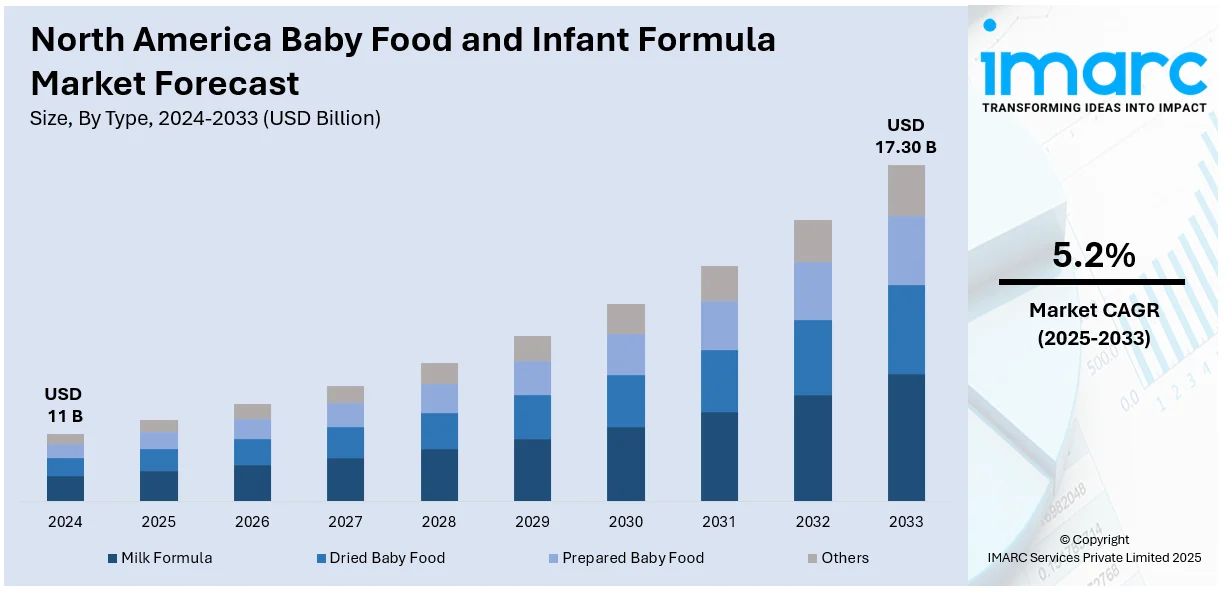

The North America baby food and infant formula market size was valued at USD 11 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 17.30 Billion by 2033, exhibiting a CAGR of 5.2% from 2025-2033. The North America baby food and infant formula market is growing due to increasing parental awareness of infant nutrition, rising demand for organic and clean-label products, a growing workforce of women driving formula adoption, and the expansion of retail distribution channels. Innovations in ingredients and government support for infant health further stimulate the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 11 Billion |

|

Market Forecast in 2033

|

USD 17.30 Billion |

| Market Growth Rate (2025-2033) | 5.2% |

As parents focus more on the health of their children, the need for proper nutrition in infants has become a priority. In this regard, the demand for premium baby food and infant formula with enhanced nutritional benefits is growing. Parents want to give their babies formulas that have the same composition as breast milk and do not contain additives, preservatives, or artificial ingredients. This trend is shifting the preference of the markets toward organic, non-GMO, and clean-label products. Moreover, this increased awareness is forcing companies to give more information about nutritional benefits with their products, which is also the driving force of the market.

The rising number of women in the workforce has driven demand for convenient, nutritionally balanced baby food and infant formula. Many working mothers rely on formula feeding because their infants will definitely get the required nutrition while achieving work-life balance. Formula provides flexibility and convenience, making it an essential option, especially for mothers who cannot breastfeed because of work. This shift to formula feeding has significantly impacted the North American baby food and infant formula market and has driven growth in the sector. A significant indicator of this trend is that, during a recent formula shortage, 81% of parents switched formulas due to availability issues, highlighting the reliance on formula feeding for maintaining infant health and nutrition in today's busy world.

North America Baby Food and Infant Formula Market Trends:

Demand for Organic and Clean-Label Products

In North America, the demand for organic and clean-label baby food and infant formula is on the rise, driven by growing concerns about food safety and a strong desire for environmentally sustainable options. Parents want ingredients that are naturally organic, with no pesticides, antibiotics, and growth hormones; this ensures they feed their infant the most organic and healthy stuff available. Clean label products, with minimal ingredients and transparency on source, also attract health-conscious consumers who want not to use artificial additives and preservatives. This trend is further amplified due to the growing interest in sustainability, where eco-friendly packaging, sourcing, and other practices can be desired by the consumer for choices in infant nutrition to be both ethical and health-conscious.

Technological Advancements in Product Development

Advancements in nutritional science and technology have paved the way for the introduction of innovative baby food and infant formula products in North America. Manufacturers have been adding prebiotics, probiotics, and docosahexaenoic acid (DHA) to the products, thus making them close to breast milk in their benefit to the infant's immune system and cognitive development. This advanced processing technique not only ensures retention of nutritional values in the product but also guarantees convenience and shelf stability. Some other innovations also involve personalized nutrition solutions, with formulae specifically developed to match particular needs related to the age, health condition, or even genetic makeup of the baby, resulting in further diversified products available in the market.

Expansion of E-Commerce Channels

E-commerce platforms have emerged as a major driver of growth in the North America baby food and infant formula market. Online retail is convenient, allows direct access to consumers, and offers more products, which means parents can easily find the products that suit them best. Moreover, with e-commerce, subscription models allow parents to be replenished at regular periods, ensuring not running out and being able to receive discounts at times. As with the factors that have come above, ease of shopping through personalization together with the provision for comparing products based on the review and cost has been key in shifting purchase preferences from store shopping to ordering on the online baby food products platform.

North America Baby Food and Infant Formula Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the North America baby food and infant formula market, along with forecasts at the country levels from 2025-2033. The market has been categorized based on type and distribution channel.

Analysis by Type:

- Milk Formula

- Dried Baby Food

- Prepared Baby Food

- Others

According to the North America baby food and infant formula market forecast, milk formula is dominating the market due to its role as a nutritionally balanced alternative to breast milk. Available in powder, liquid concentrate, and ready-to-feed forms, milk formula caters to diverse consumer preferences. The rising number of working mothers has significantly contributed to the segment’s growth, as formula feeding offers convenience and flexibility. Additionally, advancements in infant nutrition, coupled with increasing awareness of essential nutrients, have fueled demand. The market also benefits from strong distribution networks, including supermarkets, pharmacies, and online platforms, making formula easily accessible. Regulatory support and ongoing product innovations further reinforce the dominance of this segment in the North American market.

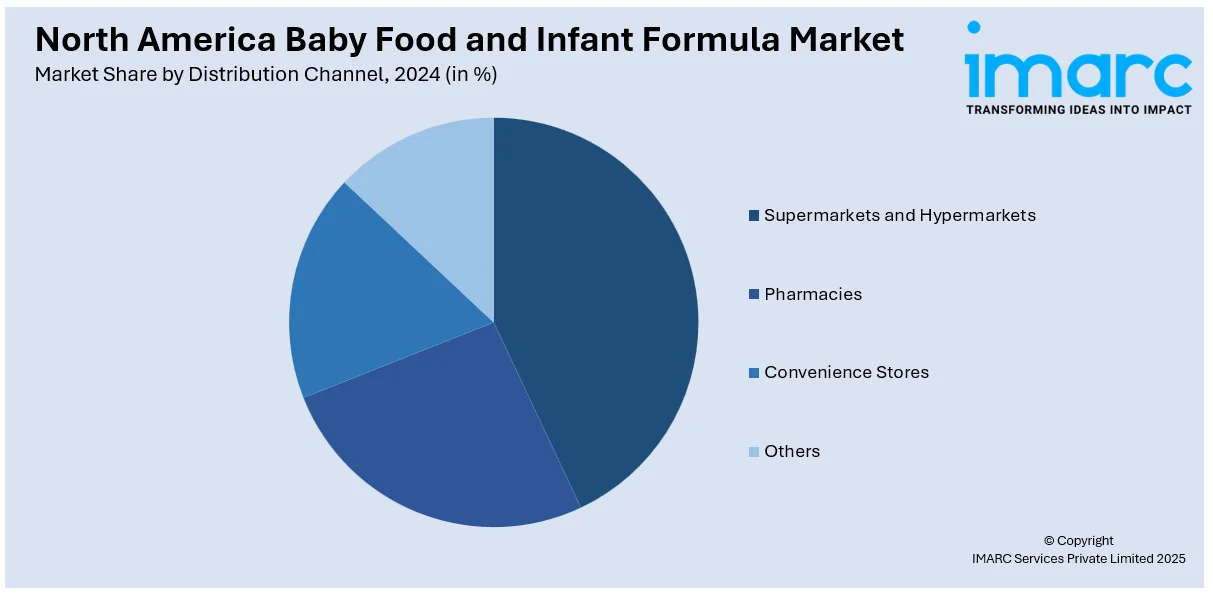

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Pharmacies

- Convenience Stores

- Others

Supermarkets and hypermarkets play a crucial role in the baby food distribution landscape by offering an extensive selection of products in dedicated aisles. Their ability to provide one-stop shopping convenience appeals to busy parents looking for variety and affordability. High foot traffic in these retail outlets enhances product visibility, encouraging impulse purchases and brand loyalty. Competitive pricing strategies, promotional discounts, and bundling options further drive consumer preference. Additionally, the availability of organic, premium, and specialized baby food products in these stores broadens choices for health-conscious parents. Strong supplier relationships and efficient inventory management ensure consistent product availability, reinforcing their market dominance. Their widespread presence across urban and suburban areas continues to fuel the expansion of the baby food market.

Country Insights:

- United States

- Canada

The U.S. baby food market holds a significant North America baby food and infant formula market share, driven by diverse population and evolving consumer preferences. The growing demand for organic and clean-label products highlights a greater focus on ingredient transparency and nutrition. Additionally, the rise of plant-based alternatives is meeting the needs of health-conscious parents who prefer dairy-free and allergen-friendly options. Convenience is a major factor, with innovative packaging solutions such as resealable pouches and single-serve portions gaining popularity. Online shopping platforms, subscription services, and direct-to-consumer models are reshaping distribution, offering parents accessibility and personalized choices. The growing number of working parents further fuels demand for ready-to-eat and nutrient-rich baby food, emphasizing ease of use without compromising quality. These trends collectively drive market expansion and product innovation in the U.S. baby food sector.

Competitive Landscape:

The North American baby food and infant formula market features a competitive landscape with a combination of well-established global brands and emerging regional players. Key factors influencing competition include product innovation, quality, and brand reputation. Leading companies focus on developing organic, clean-label, and nutritionally enriched formulas to cater to the increasing consumer demand for healthier, safer infant nutrition. Price competitiveness is also significant, as brands aim to offer affordable yet high-quality products. E-commerce platforms are becoming an important distribution channel, with companies enhancing their online presence to engage with consumers directly. Strategic partnerships with retailers and investments in marketing further strengthen brands' positions, while smaller players differentiate themselves through niche offerings targeting specific nutritional needs or sustainable production methods.

The report provides a comprehensive analysis of the competitive landscape in the North America baby food and infant formula market with detailed profiles of all major companies.

Latest News and Developments:

- In May 2024, Sure is set to launch its first product a plant-based, ready-to-drink toddler beverage this fall. After researching alternatives and creating a recipe approved by her pediatrician, April recognized the demand within her mom community. Partnering with the North Carolina Food Innovation Lab, she aims to provide a commercially available solution for parents seeking plant-based options for their children’s nutrition.

- In March 2024, Else Nutrition expanded its distribution network by partnering with one of North America's largest supermarket operators, set to launch its kids and toddler product lines by the end of Q2 2024. The retailer, ranked as the fifth largest private U.S. company, will help Else reach millions of new customers. This partnership underscores the increasing demand for nutritious, plant-based dairy alternatives, bolstering Else's presence in the U.S. market.

North America Baby Food and Infant Formula Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Milk Formula, Dried Baby Food, Prepared Baby Food, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Pharmacies, Convenience Stores, Others |

| Countries Covered | United States, Canada |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America baby food and infant formula market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America baby food and infant formula market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America baby food and infant formula industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The North America baby food and infant formula market was valued at USD 11 Billion in 2024.

The North America baby food and infant formula market was valued at USD 17.30 Billion in 2033 exhibiting a CAGR of 5.2% during 2025-2033.

The growth of the North America baby food and infant formula market is driven by factors such as increasing parental awareness of infant nutrition, the rising number of working mothers, demand for organic and clean-label products, technological advancements in product development, and the growing shift toward e-commerce platforms for convenience.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)