North America Avocado Processing Market Size, Share, Trends and Forecast by Product Type, Application, and Country, 2025-2033

North America Avocado Processing Market Size and Share:

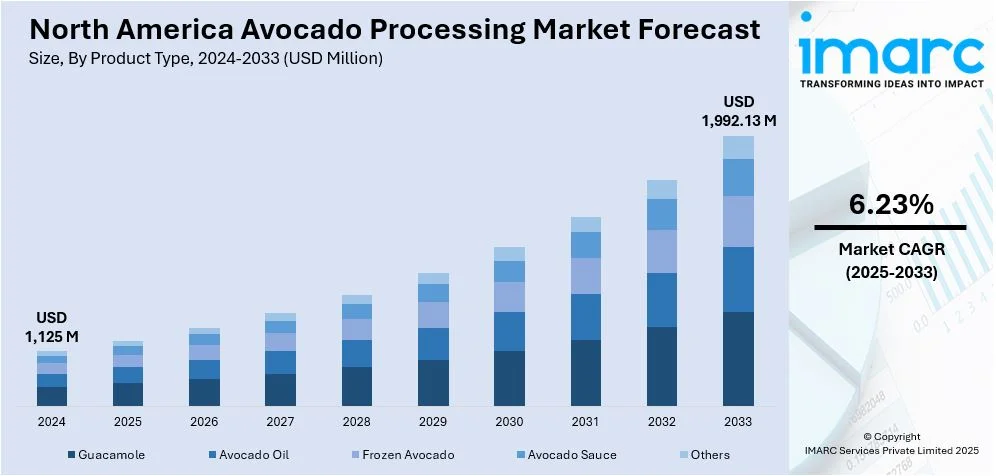

The North America avocado processing market size was valued at USD 1,125 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,992.13 Million by 2033, exhibiting a CAGR of 6.23% from 2025-2033. The market is witnessing significant growth due to the escalating consumer demand for healthy and plant-based foods and advancements in processing technologies. Moreover, increasing emphasis on supply of avocados, the rise of clean-label and organic offerings, and expansion into non-traditional applications are expanding the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,125 Million |

| Market Forecast in 2033 | USD 1,992.13 Million |

| Market Growth Rate (2025-2033) | 6.23% |

As customers are becoming more health-conscious, there is a heightening shift towards plant-based and nutrient-rich foods. Avocados, known for their high content of antioxidants, healthy fats, and vitamins, are being increasingly incorporated into various products such as guacamole, avocado oil, and ready-to-eat meals. The shift towards plant-based diets, alongside a focus on heart health and overall wellness, is boosting the demand for avocado-based products, thereby fueling the growth of the avocado processing market in North America. For instance, as of 2025, Mexico is supplying 95%of avocados to the U.S., supporting the avocado processing market with a consistent, high-volume source for guacamole, oil, and other products.

Technological innovations in avocado processing have improved the efficiency and scalability of production, allowing for greater yield and longer shelf life of processed avocado products. The development of more efficient freezing, dehydration, and packaging technologies has made it easier to maintain the quality and freshness of avocado-based items, even in the off-season. For instance, in September 2024, Cahero MenOro enhanced avocado processing with a cutting-edge facility., The company remains committed to delivering high-quality avocado products through advanced packing and distribution. These advancements enable manufacturers to meet rising consumer demand while reducing waste and lowering costs, further boosting the market's growth potential.

North America Avocado Processing Market Trends:

Increasing Emphasis on Supply of Avocados

A significant trend in the North American avocado processing market is the increasing emphasis on the supply of high-quality avocados to meet growing consumer demand. As demand for premium avocado-based products rises, processors are focusing on sourcing top-tier avocados to ensure consistent quality, taste, and texture. For instance, in 2024, Index Fresh’s GEM season offered high-quality, gold-flecked avocados from California, available from April to mid-July. With over 5 million pounds expected, the peak production is anticipated in May. This trend is driving improvements in cultivation techniques, supply chain logistics, and sorting technologies to identify and deliver only the best fruit for processing. Additionally, the rising popularity of specialty varieties like GEM avocados further fuels this trend, providing retailers and food service providers with high-quality, versatile options for their product offerings.

Rise of Clean-Label and Organic Offerings

Consumers are paying increasing attention to the ingredients in the products they consume and are actively seeking clean-label and organic variants that correspond with their health-conscious ideologies; thus, the naturally nutrient-rich avocados fit perfectly into this trend. For instance, in 2024, The Hass Avocado Board report revealed a 2.3% increase in the unit sales and 19% increase in sales in dollars. Combined sales on Independence Day and Labor Day led to quantities of 92.4 million units and $122.5 million. In response, processors are also evolving by providing organic avocado-based products free of additives, preservatives, and artificial ingredients. This ingredient sourcing and production transparency trend is pushing the avocado processing industry towards sustainability and health-oriented practices with the purpose of creating products that meet the fast-growing demand for high-quality organic products.

Expansion into Non-Traditional Applications

While avocados have long been associated with guacamole and other Mexican-inspired dishes, their versatility is being recognized in a wider array of culinary uses. Avocado oil is gaining popularity in cooking and cosmetic products due to its health benefits and natural properties. For instance, in January 2025, Chosen Foods launched Chosen Beauty Avocado Oil Hair Serum, its first beauty product. Made with 100% pure avocado oil, it nourishes, repairs, and moisturizes dry, damaged, or color-treated hair, free from additives. Additionally, avocado is being incorporated into baked goods, smoothies, and even snacks, broadening its appeal to diverse consumer segments. As innovation continues, avocado processing companies are exploring new product formulations to tap into these emerging markets, driving further growth and diversification.

North America Avocado Processing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the North America avocado processing market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type and application.

Analysis by Product Type:

- Guacamole

- Avocado Oil

- Frozen Avocado

- Avocado Sauce

- Others

Guacamole leads among all product types in processed avocado offerings, which has catered to retail and food service demand. Growing consumer demands for greater convenience in ready-to-eat and healthy foods means guacamole continues to dominate food processing because of its varied health benefits. They are fresh, frozen, or packaged to meet all uses - from home to restaurant application. It has also enjoyed considerable market growth due to innovations in its packaging and preservation that have made it last longer. Again, guacamole still leads in processed avocado products in North America, with rising customer demands for fresh consumption and improved distribution networks in avocado consumption market growth.

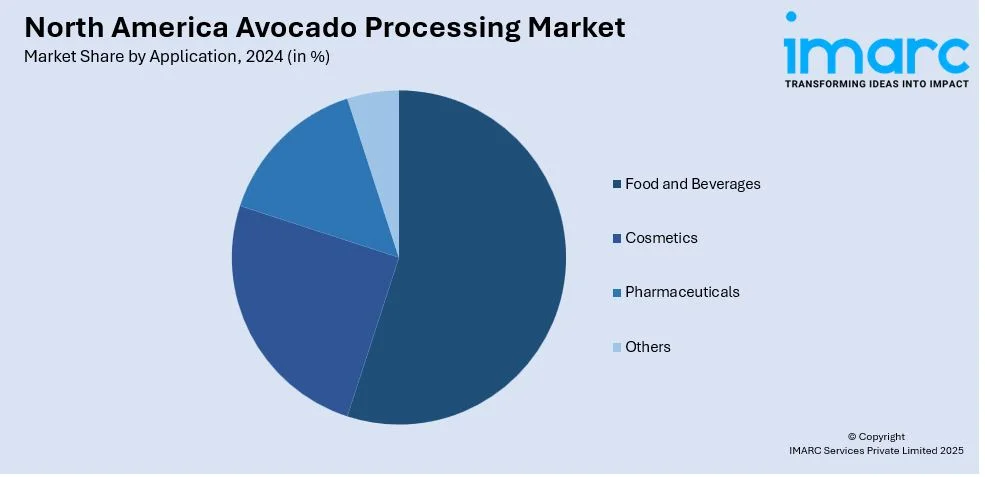

Analysis by Application:

- Food and Beverages

- Cosmetics

- Pharmaceuticals

- Others

Food and Beverages Applications are the largest application segment for avocado processing, as there are more and more consumers demanding nutritious, plant-based ingredients for such uses. Guacamole, avocado oil, and frozen avocado products are consumed in restaurants, packaged foods, and by the end-user at home. Increasing health and wellness diets, such as keto and vegan diets, would additionally increase consumption of avocados in smoothies, salads, dressings, and even baked products. Emerging technologies in processing food are also improving the durability and convenience of avocado products, making them even more prominent as the primary market growth driver in food and beverage categories.

Regional Analysis:

- United States

- Canada

- Mexico

The United States is the largest market in consumption and import of avocados because of an increasing demand for avocado-based products in retail and food service establishments. In addition, good wholesaling and retailing distribution channels, a growing health-conscious population, and an increase in preference for plant nutrient-rich foods make it a dominant player in the market. Major avocado processing firms such as Calavo Growers and Mission Produce operate in the United States, further improving fresh and processed avocado products such as guacamole, avocado oil, and frozen avocado. Improvement in food processing technologies and wider retail channels further consolidate the United States' dominant market position. For instance, as per industry reports, avocado consumption is expected to attain a valuation of USD 26.2 Billion by the year 2028 across the United States.

Competitive Landscape:

The North American avocado processing market is comprised of both old companies and new ones. The big names dominating the avocado-processing market include Index Fresh, Calavo Growers, and Mission Produce, which are large companies that deal with various kinds of processed avocado products such as guacamole, avocado oil, and frozen avocado. For instance, in August 2024, Calavo Growers sold its Fresh Cut business and related real estate to F&S Fresh Foods, which would be pocketing $83 million from the sale. Therefore, Fresh Foods would get great access to processing capabilities from Calavo's strategic move on fresh-cut avocado products because they would now be able to concentrate on their core business. There are also smaller companies developing themselves well into this suggesting clean-label and organic products to appeal to a much wider market that demands healthier, clearer products. The competitive environment is characterized by innovation in processing technology, packaging solutions, and product diversification to reach a larger and more diverse consumer audience.

The report provides a comprehensive analysis of the competitive landscape in the North America avocado processing market with detailed profiles of all major companies.

Latest News and Developments:

- In November 2024, West Pak Avocado launched a new series of bagged avocados featuring three key growing regions, California, Mexico, and Colombia. This initiative, part of their AVO360 Full-Service Experience, aims to improve the avocado shopping experience for retailers by facilitating steady , year-round quality and customer-focused insights.

- In September 2024, Chipotle introduced Autocado, a cobotic prototype developed with Vebu to cut, core, and peel avocados in 26 seconds, streamlining guacamole preparation. The Augmented Makeline is also being tested in restaurants across California.

North America Avocado Processing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Guacamole, Avocado Oil, Frozen Avocado, Avocado Sauce, Others |

| Applications Covered | Food and Beverages, Cosmetics, Pharmaceuticals, Others |

| Regions Covered | United States, Canada, Mexico |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America avocado processing market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America avocado processing market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America avocado processing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The North America avocado processing market in the region was valued at USD 1,125 Million in 2024.

The growth of the North American avocado processing market is driven by rising consumer demand for healthy, plant-based foods, increasing popularity of guacamole and avocado oil, advancements in processing technologies, expanding retail and foodservice sectors, and year-round avocado availability through imports from Mexico, ensuring a consistent supply for processed products.

The North America avocado processing market is projected to exhibit a CAGR of 6.23% during 2025-2033, reaching a value of USD 1,992.13 Million by 2033.

Guacamole accounted for the largest product type market share.

United States accounted for the largest North America avocado processing market share. This dominance is attributed to high consumer demand, advanced processing infrastructure, and the strong presence of key industry players driving innovation and large-scale production.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)