North America Automotive Market Size, Share, Trends, and Forecast by Type, Application, and Country, 2026-2034

North America Automotive Market Overview:

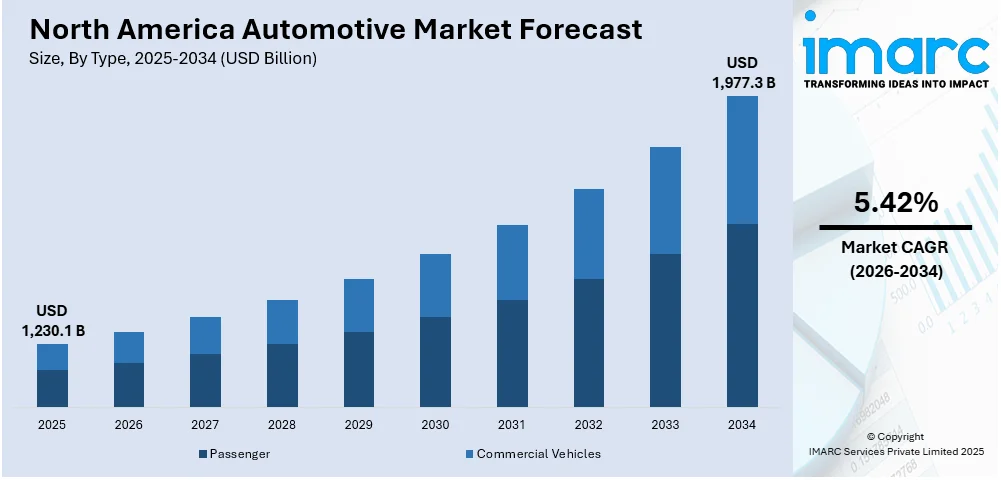

The North America automotive market size reached USD 1,230.1 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 1,977.3 Billion by 2034, exhibiting a growth rate (CAGR) of 5.42% during 2026-2034. The market is experiencing steady growth driven by continual advancements in automotive technology, the increasing adoption of electric vehicles, stringent emission regulations, rising consumer demands for enhanced vehicle performance, and the rising economic growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,230.1 Billion |

| Market Forecast in 2034 | USD 1,977.3 Billion |

| Market Growth Rate 2026-2034 | 5.42% |

Access the full market insights report Request Sample

North America Automotive Market Trends:

Advancements in Automotive Testing and Safety

The automotive sector is focusing on better testing procedures to increase vehicle safety, efficiency, and sustainability. Engineers and academicians are developing novel testing methods, powerful modeling tools, and data-driven methodologies to satisfy changing regulatory and customer expectations. Next-generation vehicle validation discussions highlight the integration of automation, artificial intelligence, and cybersecurity measures. As electric and self-driving vehicles gain popularity, there is a greater emphasis on developing testing frameworks to analyze battery performance, software dependability, and real-world driving scenarios. Manufacturers, suppliers, and regulatory agencies are increasingly working together to develop standardized standards for future mobility solutions. This decision underscores a larger commitment to innovation, ensuring that future cars fulfill high safety and environmental standards while speeding up technological adoption. For example, in October 2024, the Future of Automotive Testing Conference premiered at the Automotive Testing Expo North America 2024 in Novi, Michigan. The event included technical workshops, keynotes, and panel discussions, bringing together OEMs, suppliers, and industry experts to discuss advances in automotive testing, safety, and sustainability.

To get more information on this market Request Sample

Expansion of Electric Truck Manufacturing

The transition to large-scale electric vehicle production is gathering traction, with manufacturers concentrating on expanding output capacity and optimizing operations. Strategic alliances with recognized industry players improve production efficiency, lower costs, and ensure high-quality standards. Logistics and supply chain management are critical to increasing production output while preserving dependability. As fleet managers seek long-term solutions, the availability of dedicated production slots is becoming an important element in driving adoption. Companies are preparing to fulfill increased demand for commercial electrification through breakthroughs in battery technology and vehicle design. This trend is part of a broader push toward sustainable transportation, with collaboration and innovation driving the shift from prototype research to full-scale manufacturing. For instance, in September 2024, REE Automotive began US production of its P7 electric trucks in late 2024, collaborating with Roush Industries at a Detroit plant with a yearly capacity of 5,000 units. Motherson oversaw logistics and quality control. This approach improved production efficiency, reduced expenses, and enabled clients to obtain manufacturing slots for fleet electrification.

North America Automotive Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type and application.

Type Insights:

- Passenger

- Commercial Vehicles

The report has provided a detailed breakup and analysis of the market based on the type. This includes passenger and commercial vehicles.

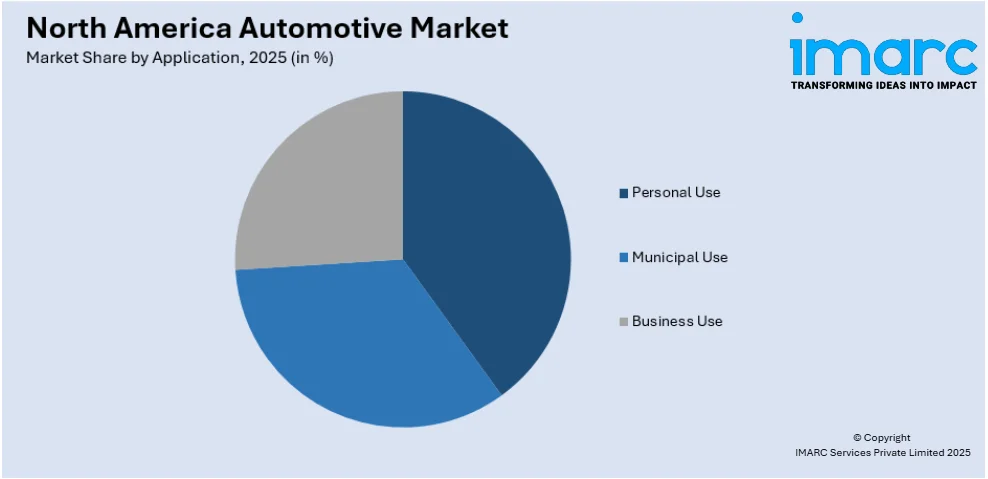

Application Insights:

To get detailed segment analysis of this market Request Sample

- Personal Use

- Municipal Use

- Business Use

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes personal use, municipal use, and business use.

Country Insights:

- United States

- Canada

The report has also provided a comprehensive analysis of all the major country markets, which include the United States and Canada.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

North America Automotive Market News:

- In February 2025, Tesla unveiled the upgraded Model Y Juniper in North America, with prices beginning at USD 46,490 in the US. The Launch Series has four color options and two rim configurations, including new 19-inch 'Crossflow Wheels.' Full self-driving, which is often a USD 8,000 option, comes standard. The long-range model has a range of 320 miles and accelerates from 0 to 60 mph in 4.1 seconds.

- In January 2025, Honda announced its plans to deliver an electric vehicle with a price below USD 30,000 in North America by 2026, aiming to increase its EV market presence. Part of the "Honda 0 Series," production would take place in Ohio with the Honda 0 SUV and Saloon, which was unveiled at CES 2025.

North America Automotive Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Passenger, Commercial Vehicles |

| Applications Covered | Personal Use, Municipal Use, Business Use |

| Countries Covered | United States, Canada |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the North America automotive market performed so far and how will it perform in the coming years?

- What is the breakup of the North America automotive market on the basis of type?

- What is the breakup of the North America automotive market on the basis of application?

- What are the various stages in the value chain of the North America automotive market?

- What are the key driving factors and challenges in the North America automotive?

- What is the structure of the North America automotive market and who are the key players?

- What is the degree of competition in the North America automotive market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America automotive market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the North America automotive market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America automotive industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)