North America Aluminium Powder Market Size, Share, Trends and Forecast by Technology, Raw Material, End-Use, and Country, 2025-2033

North America Aluminium Powder Market Size and Share:

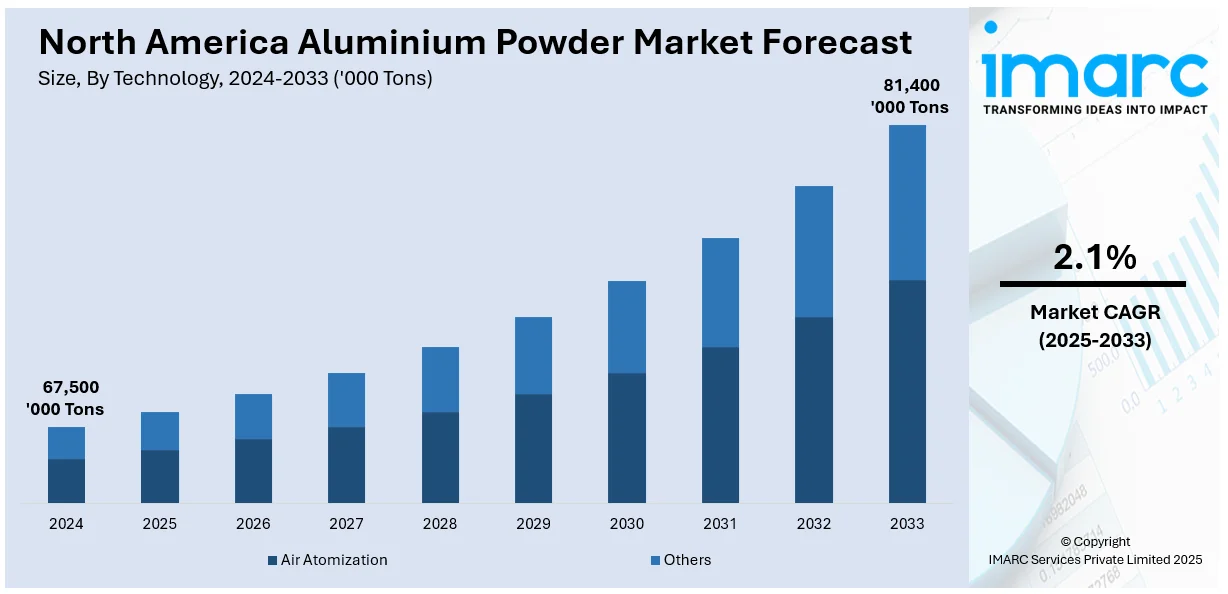

The North America aluminium powder market size was valued at 67,500 Tons in 2024. Looking forward, IMARC Group estimates the market to reach 81,400 Tons by 2033, exhibiting a CAGR of 2.1% from 2025-2033. The North America aluminium powder market share is expanding due to rising demand in additive manufacturing, aerospace, defense, automotive lightweighting, coatings, pyrotechnics, metallurgy, and construction, with increasing applications in energy-efficient and high-performance materials.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

67,500 Tons |

|

Market Forecast in 2033

|

81,400 Tons |

| Market Growth Rate (2025-2033) | 2.1% |

Aluminium powder is at the heart of metal additive manufacturing, and this technology is booming across North America. Industries like aerospace, automotive, healthcare, and defense are using 3D printing to produce complex, lightweight, and highly durable metal parts. Aluminium powder’s combination of high strength, low weight, and corrosion resistance makes it a top choice for these applications. Major aircraft manufacturers like Boeing and Airbus are investing heavily in metal 3D printing to create fuel-efficient, lightweight aircraft components. According to an industry report, the U.S. Department of Defense (DoD) allocated approximately $300 million to additive manufacturing (AM) in 2023, with spending projected to rise to $1.8 billion by 2032.

As per the North America aluminium powder market outlook, the aerospace and defense industry is a powerhouse for aluminium powder consumption. Aluminium’s lightweight properties make it indispensable for reducing the weight of aircraft and spacecraft, leading to better fuel efficiency and lower emissions. Defence contractors rely on aluminium powder for applications ranging from missile casings to armor coatings. The U.S. military is also experimenting with aluminium-based energetic materials to improve explosives, propellants, and pyrotechnics. With ongoing geopolitical tensions, there is a consistent push for military modernization, further driving aluminium powder demand. NASA and private space companies like SpaceX and Blue Origin are also fueling growth, as aluminium powder plays a crucial role in solid rocket propellants and lightweight satellite components. As the aerospace industry shifts towards sustainable aviation fuel (SAF) and next-generation electric aircraft, demand for aluminium powder in advanced lightweight materials is projected to rise significantly.

North America Aluminium Powder Market Trends:

Growth in Automotive Lightweighting for EVs

As per the aluminium powder market trends, the electric vehicle (EV) industry is changing the material industry and boosting the use of aluminium powder as a means to help cars be lighter and more energy efficient. The major automakers have aggressively been reducing vehicle weight in an effort to enhance the battery range and performance. Aluminium-based materials form a significant part of that strategy. Manufactures like Tesla, General Motors, and Ford are making more components in aluminium content for structural parts, battery casings, and heat exchangers, further enhancing strength and corrosion resistance of electric drivetrains. In the face of sustainability push and lower emission pressure, adoption of aluminium alloys has been the most rapid adoption for vehicle frames that reduces overall carbon footprint. The U.S. government's incentives for electric mobility and strict fuel efficiency regulations also accelerate this trend even further, with aluminium powder becoming a material of paramount importance in next-generation automotive manufacturing. During the second quarter of 2024, electric and hybrid vehicles sales in the U.S. rose from 17.8% to 18.7% of all new vehicle sales with hybrids witnessing major growth of 30.7%. This growth in sales increased the use of aluminum powder in this sector.

Expanding Applications in the Paints, Coatings, and Pigments Industry

Based on the aluminium powder market forecast, it forms the main material in metallic paints, reflective coatings, and protective finishes for industrial applications. These include automotive paints, industrial coatings, providing the metallic sheen, corrosion resistance, and durability. The major drivers of aluminium powder consumption in the aerospace, marine, and construction sectors, where high-performance coatings are highly demanded. Moreover, reflective coatings made from the use of aluminium powder are largely used in solar panels, helping to increase the efficiency of energy. The construction boom in North America, especially in commercial infrastructure and high-rise buildings, is increasing the demand for aluminium-based paints and coatings. For example, according to industry forecast, it has been observed that the total US construction starts in the beginning of 2025 is 8.5%. Besides this, the U.S. military also employs aluminium powder-based coatings for stealth technology, infrared shielding, and camouflage applications.

Increasing Use in Fireworks, Explosives, and Pyrotechnics

Aluminum powder is used to create firework, explosives, and pyrotechnic spectacular displays with bright sparks and controlled explosions. Thus, for entertainment purposes and military use, it is very essential. Large fireworks industries are found in the United States due to Independence Day celebrations and sporting events. In 2023, USA individuals consumed 246.5 million lbs of firecrackers, while $500 million in revenue was amassed. It has been reported that in defence, aluminium is the main ingredient of thermite mixtures for military-grade explosives and solid rocket propellants. The mining and construction industries use aluminium-based explosives for controlled demolition and excavation. While regulations on explosive materials are strict, demand from the defense sector and mining industry continues to support market growth. Innovations in safer, more efficient pyrotechnic formulations are expected to sustain North America aluminium powder demand in this sector.

North America Aluminium Powder Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the North America aluminium powder market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on technology, raw material, and end-use.

Analysis by Technology:

- Air Atomization

- Others

Air atomization dominates the North America aluminium powder market share due to its cost efficiency, scalability, and ability to produce high-purity, fine-grain powders. This process involves forcing molten aluminium through a high-pressure gas stream, creating uniform and highly spherical particles ideal for applications in additive manufacturing, aerospace coatings, automotive lightweighting, and energetic materials. The superior flowability, oxidation resistance, and controlled particle size distribution of air-atomized aluminium powder make it indispensable in industries requiring precision, such as metal 3D printing, fuel additives, and advanced chemical formulations.

Analysis by Raw Material:

- Aluminium Ingots

- Aluminium Scrap

Aluminium ingots dominate the raw material segment in the North America aluminium powder market due to their high purity, availability, and cost-effectiveness. These ingots undergo atomization to produce fine aluminium powder, widely used in additive manufacturing, automotive coatings, pyrotechnics, and energy storage applications. Their consistent composition ensures superior performance in aerospace and metallurgical processes. With increasing demand from industries requiring lightweight and corrosion-resistant materials, aluminium ingots remain the preferred choice, ensuring stable supply chains and cost efficiency in large-scale production.

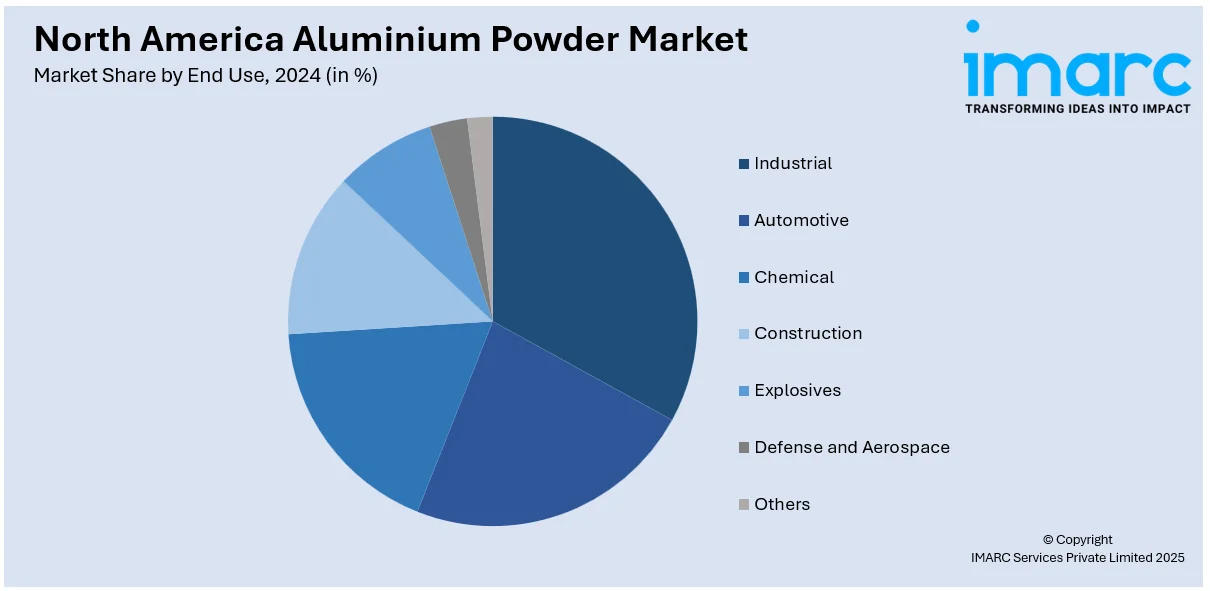

Analysis by End Use:

- Industrial

- Automotive

- Chemical

- Construction

- Explosives

- Defense and Aerospace

- Others

The industrial sector leads the North America aluminium powder market due to its extensive use in metallurgy, chemical processing, coatings, and energy storage. Aluminium powder serves as a critical reducing agent in metal production, an essential component in thermite welding, and a key ingredient in advanced coatings for corrosion resistance. It is also widely utilized in manufacturing lightweight concrete and high-performance refractories. Growing investments in infrastructure, automotive manufacturing, and sustainable energy solutions continue to drive demand, ensuring aluminium powder remains a fundamental material across multiple industrial applications.

Country Analysis:

- United States

- Canada

The United States constitutes the largest portion of the North American aluminium powder market growth, largely due to its strong industrial infrastructure and advanced manufacturing sectors. Major investments in the aerospace, automotive, and additive manufacturing sectors are driving the demand for aluminium powder in the United States. Besides, the growing focus on sustainability and lightweight materials in the construction industry in the United States drives the market forward. Its focus on technological innovation and infrastructure development ensures that the nation remains at the top of the regional consumption list for aluminium powder.

Competitive Landscape:

Following the capacity expansion, technological advancements, and sustainability initiatives, the leading players in the market are majorly focused on new production facilities along with upgrading the existing plants. These are projected to cater to the rapidly growing demands from a few industries like aerospace, automotive, and additive manufacturing. A lot of efforts are being put into the development of high-purity and fine-grain aluminium powders, especially for advanced applications like metal 3D printing and energy storage. Companies are also focusing on cleaner and more energy-efficient production processes that include recycling aluminium into supply chains for reduced environmental impact. Strategic collaborations with research institutions and end-user industries are helping improve product quality and application performance. Additionally, there is a strong push towards regulatory compliance and safety improvements, particularly in handling aluminium powder for pyrotechnics and coatings.

The report provides a comprehensive analysis of the competitive landscape in the North America aluminium powder market with detailed profiles of all major companies.

Latest News and Developments:

- In December 2024, United States Metal Powders, Inc. (USMP) announced that they are launching a new aluminium powder manufacturing line at its Ampal Inc subsidiary in Palmerton, Pennsylvania, which is set to begin full production in summer 2025. The new line will produce both nodular and spherical aluminium powders.

- In November 2024, Equispheres Inc. collaborated with 3D Systems to provide its high-performance aluminum powder for use in 3D Systems' DMP Flex 350 and DMP Factory 350 printers. This partnership enhances printing speeds and boosts productivity by up to 50%, benefiting sectors such as automotive and aerospace.

- In November 2024, Continuum Powders announced the opening of its global headquarters and largest sustainable metal powder production facility in Houston, Texas. The facility incorporates low-carbon production techniques, renewable energy, and advanced recycling, strengthening supply chain resilience and efficiency.

- In May 2024, KBM Advanced Materials and Austria's IMR Metal Powder Technologies partnered to distribute IMR's aluminium metal powders for additive manufacturing in North America. This collaboration will improve accessibility to high-quality aluminium powders through KBM's extensive marketplace and distribution network.

North America Aluminium Powder Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Air Atomization, Others |

| Raw Materials Covered | Technology, Raw Material, End-Use, Country |

| End-Uses Covered | Industrial, Automotive, Chemical, Construction, Explosives, Defense and Aerospace, Others |

| Countries Covered | United States, Canada |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America aluminium powder market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America aluminium powder market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America aluminium powder industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The North America aluminium powder market in the region was valued at 67,500 Tons in 2024.

The North America aluminium powder market is growing due to rising demand in additive manufacturing, aerospace, defense, automotive lightweighting, coatings, pyrotechnics, and construction. Increasing adoption of 3D printing, energy-efficient materials, and sustainable manufacturing practices, along with advancements in metallurgical and chemical applications, are driving market expansion.

The North America aluminium powder market is projected to exhibit a CAGR of 2.1% during 2025-2033, reaching a value of 81,400 Tons by 2033.

Air atomization is leading the market based on technology, driven by its cost efficiency, high purity, and ability to produce fine, spherical particles.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)