North America Aluminium Cans Market Size, Share, Trends and Forecast by Application, and Country, 2025-2033

North America Aluminium Cans Market Size and Share:

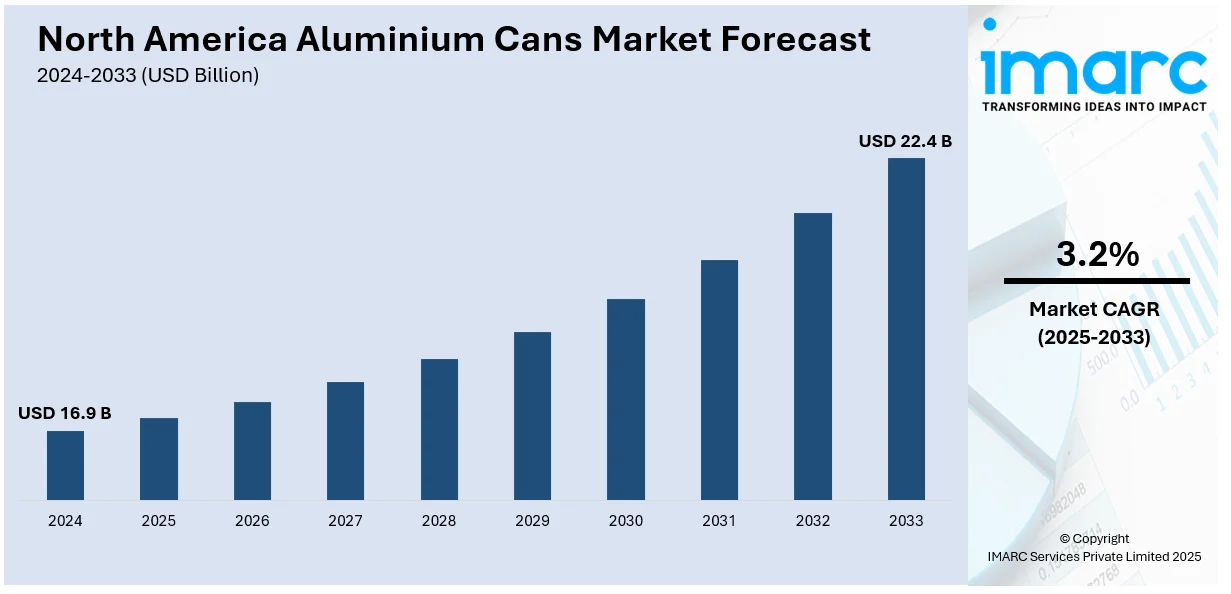

The North America aluminium cans market size was valued at USD 16.9 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 22.4 Billion by 2033, exhibiting a CAGR of 3.2% from 2025-2033. The North America aluminium cans market share is expanding, driven by the rising popularity of energy drinks, soft drinks, and alcoholic beverages, which require effective packaging solutions for better preservation, along with the expansion of supermarkets and online portals that offer a wide range of canned drinks, making them more convenient for individuals.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 16.9 Billion |

|

Market Forecast in 2033

|

USD 22.4 Billion |

| Market Growth Rate (2025-2033) | 3.2% |

Innovations in designs are impelling the market growth in North America. They help to attract people with visually appealing packaging. Manufacturers focus on creating unique can shapes, colors, and artwork to stand out on shelves and appeal to different user segments. Customization options like special edition designs also increase sales and build brand loyalty. These new designs aid in improving product visibility and make cans more marketable, especially in crowded beverage categories. Additionally, different can sizes and features, such as resealable tops, enhance the functionality of the packaging. The ability to print high-quality graphics on aluminium cans offers brands the opportunity to communicate their values like sustainability or premium quality. As packaging design becomes an essential advertising tool, more beverage companies are investing in aluminium cans.

Advancements in can manufacturing are offering a favorable North America aluminium cans market outlook. They aid in improving production efficiency, reducing costs, and enhancing item quality. New technologies in can shaping, coating, and printing allow manufacturers to create lighter, stronger, and more durable cans. These innovations lower the environmental impact by minimizing material utilization and energy usage during production. Additionally, automated manufacturing processes streamline operations, leading to faster turnaround times and lower labor costs. As producers wager on more advanced equipment, they can meet the growing demand for aluminium cans in various beverage categories. These advancements also support sustainable practices by increasing the employment of recycled aluminium.

North America Aluminium Cans Market Trends:

Growing beverage consumption

The rising beverage consumption, with people choosing canned drinks for convenience, portability, and freshness, is fueling the market growth. As per the data published on the official website of the United States government, during Q1 2024, beer production in cans and bottles reached 1,291,582.25 Barrels in New York City. A total quantity of 926.35 Barrels was consumed on brewery premises. This growing popularity of soft drinks, energy drinks, and alcoholic beverages creates the need for aluminium cans. Ready-to-drink coffee, sparkling water, and canned cocktails have also become popular, further encouraging the usage of aluminium cans. They offer excellent protection against light and air, preserving beverage quality and carbonation. Their lightweight nature makes transportation easier and cost-effective for manufacturers. As beverage companies expand product offerings and introduce new flavors, the requirement for durable and visually appealing packaging rises.

Rising adoption of sustainability

The increasing adoption of sustainability, with people and businesses prioritizing eco-friendly packaging, is impelling the North America aluminium cans market growth. Aluminium cans are 100% recyclable, reducing waste and supporting circular economy initiatives. Policies restricting plastic use also encourage brands to employ sustainable aluminium alternatives. In July 2024, the Biden administration revealed its plan to remove single-use plastics from all federal activities by 2035, aligning with its larger effort to address plastic pollution. The elimination will commence with an aim to stop federal purchasing of disposable plastics from food service activities, events, and packaging by 2027. The minimized carbon footprint of aluminium cans in contrast to plastic bottles appeals to eco-aware people. Companies also encourage the use of recycled aluminium cans, lowering dependence on raw materials and decreasing production expenses.

Expansion of retail and e-commerce sites

The expansion of retail and e-commerce channels is increasing the availability of canned beverages, thereby boosting sales. According to the information given on the official website of the Statistics Canada, in November 2024, retail trade sales reached USD 4,113,782 in Canada. Supermarkets and convenience stores provide a diverse selection of canned beverages, enhancing convenience for individuals. Online grocery shopping and direct-to-consumer (D2C) sales enable beverage brands to access a wider audience, elevating the demand for aluminium cans. Services that offer subscriptions for beverages and bulk buying alternatives also contribute to the growth of the market. Aluminium cans are both lightweight and sturdy, making them perfect for shipping, lowering transport expenses, and lessening damage. Furthermore, digital marketing and focused advertising on e-commerce platforms improve user awareness and sales of canned drinks.

North America Aluminium Cans Industry Segmentation:

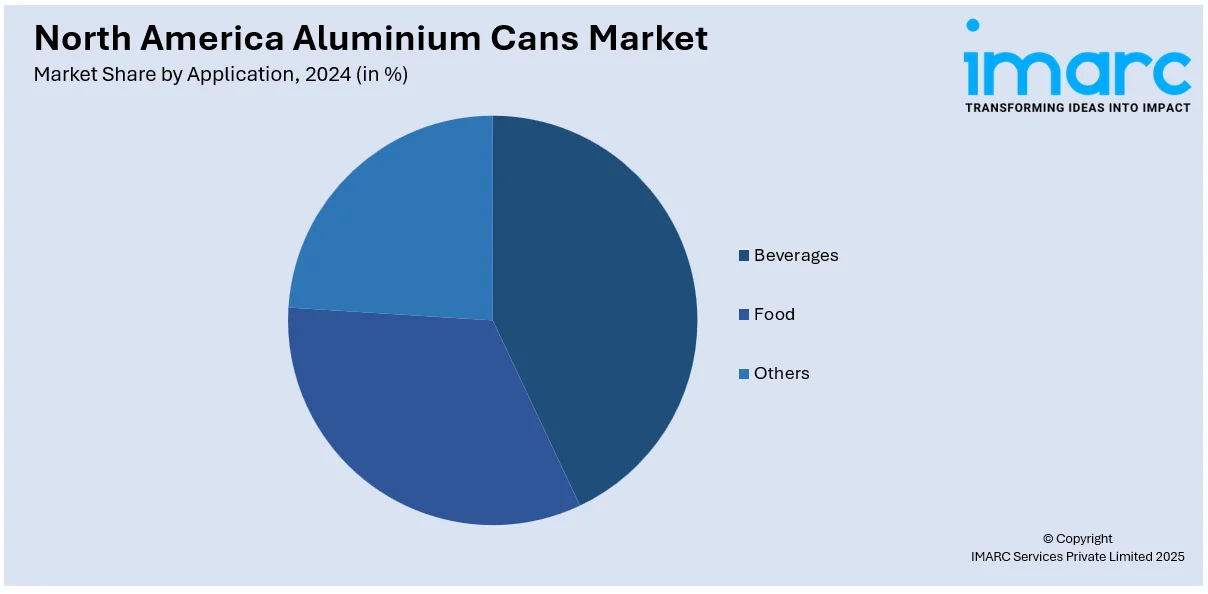

IMARC Group provides an analysis of the key trends in each segment of the North America aluminium cans market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on application.

Analysis by Application:

- Beverages

- Food

- Others

Beverages represented the largest segment. Carbonated beverages and alcoholic drinks rely on aluminium cans because of their light weight, strength, and exceptional freshness retention. Aluminium cans offer a robust shield against light and oxygen, preserving the carbonation of drinks and their flavor. The increasing popularity of ready-to-drink beverages, such as sparkling water, iced coffee, and flavored drinks, further encourages the use of aluminium cans. In addition to this, the ability to recycle aluminium cans makes them a favored option for beverage companies aiming to achieve sustainability objectives and reduce plastic waste. Producers also benefit from the economical nature of aluminium packaging, which facilitates convenient transport and prolongs shelf life. Furthermore, the increasing awareness among the masses regarding environment friendly packaging and the rise in canned beverage choices persist in driving the demand. According to the North America aluminium cans market analysis, with the beverage industry constantly innovating, aluminium cans remain the dominant packaging choice across North America.

Country Analysis:

- United States

- Canada

United States enjoys the leading position in the market. The country is noted for its high beverage consumption, strong recycling infrastructure, and well-established aluminium manufacturing base. As per the data published on the official website of the United States government, in October 2024, the production of primary aluminium reached 57,000 metric tons in the country. The typical daily output in October 2024 was 1,830 Metric Tons. Besides this, the high demand for canned soft drinks, energy drinks, and alcoholic beverages encourages large scale production and distribution. Many beverage companies prefer aluminium cans because they are lightweight, durable, and recyclable, reducing transportation costs and environmental impact. The US has a well-setup aluminium recycling system, ensuring a steady supply of raw materials while promoting sustainability. Moreover, technological advancements in can manufacturing improve efficiency, minimize costs, and enhance packaging designs, attracting more brands to switch to aluminium. The rising preference for sustainable packaging also fuels the market growth. Additionally, a large network of retailers, supermarkets, and convenience stores ensures the widespread availability of canned beverages. With increasing investments in recycling programs and eco-friendly packaging solutions, the US continues to dominate the market.

Competitive Landscape:

Key players work on developing new products to meet the high North America aluminium cans market demand. They develop lightweight, durable, and customizable can designs to meet changing user requirements. Big companies focus on increasing the use of recycled aluminium, reducing environmental impact while lowering production costs. Advanced manufacturing processes improve efficiency, ensuring a steady supply of cans to food and beverage (F&B) industries. They also partner with beverage brands to broaden market reach. They indulge in research activities related to eco-friendly coatings to enhance product safety. Moreover, key players support sustainability initiatives, promoting recycling programs and minimizing carbon emissions. With a high need for canned beverages, these firms continue to wager on capacity expansion and technological advancements. By maintaining strong distribution networks and responding to market trends, they ensure aluminium cans remain the preferred packaging choice in North America. For instance, in April 2024, Can-One USA, a branch of the Malaysia-based can manufacturing firm Can-One, started operations at its newly opened facility in the United States. The facility, covering 180,000 square feet and situated in Nashua, New Hampshire, expects to produce 2 Billion aluminium beverage cans each year.

The report provides a comprehensive analysis of the competitive landscape in the North America aluminium cans market with detailed profiles of all major companies.

Latest News and Developments:

- November 2024: Every Can Counts US teamed up with Replenysh, an enterprise circulatory platform, to initiate a new community-focused recycling initiative ‘The Cans for Cash’ aimed at boosting the recovery of aluminium beverage cans. The program, which started in Blytheville, Arkansas, US is set to introduce four additional circularity centers in Florida, Illinois, and Mississippi. The program seeks to increase recycling, minimize litter and landfill waste, and improve local economies through direct cash incentives for individuals who recycle empty aluminium beverage cans. It showcases how aluminium beverage cans support the US recycling infrastructure.

- October 2024: PPG Industries, a prominent supplier of specialty materials, collaborated with Can Manufacturers Institute (CMI) to announce its participation in a US recycling initiative ‘Recycling is like Magic!,’ aimed at gathering millions of aluminium beverage cans through the “2 Million Cans Recycling Contest.” From Oct. 1 to April 30, 2025, elementary students from 12 states of the US will take part in the contest, which seeks to foster environmental consciousness, experiential learning, partnership, and community involvement among young students. Pittsburgh students will also participate in the '2 Million Cans Recycling Contest.'

- April 2024: smartwater, a bottled water brand owned by Energy Brands, introduced a fresh format- stylish 12-oz. aluminium cans for convenient hydration. smartwater original and smartwater alkaline containing antioxidants will be on store shelves throughout the United States in individual cans. A creative campaign set to debut in early May aims to showcase minimalist and detailed images that emphasize the new packaging and important visuals.

- January 2024: Novelis Inc., a prominent provider of sustainable aluminium solutions, entered into a new agreement with Ardagh Metal Packaging USA Corp., a worldwide supplier of sustainable aluminium beverage can sheets. Novelis will provide aluminium beverage packaging material to Ardagh's metal manufacturing plants in North America. This recent contract arrives, as Novelis is currently constructing a new rolling and recycling facility in Bay Minette, Alabama, USA. The facility will be the first completely integrated aluminium plant constructed in the U.S. in almost 40 years and will initially produce 600,000 tonnes of finished products for North America's beverage packaging and automotive sectors.

- August 2023: TricorBraun, a designer and distributor of rigid packaging based in America, disclosed its purchase of aluminium can packaging company CanSourc, which operates four locations in the US, including its main office close to Denver, Colorado, US. The purchase aims to enhance TricorBraun's beverage packaging abilities, reinforcing its stance in the North American beverage packaging industry.

- February 2023: American Canning, a canning service company located in Austin, Texas, declared to produce aTULC beverage cans in the United States for the first time. Manufactured in a dry facility, aTULC employs a pre-coated aluminium sheet featuring a stronger liner to guard against corrosion and enhance item durability. At its aTULC facility, the firm is currently producing 12-ounce standard aluminium beverage cans and intends to begin production of 16-ounce standard cans by spring.

North America Aluminium Cans Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Beverages, Food, Others |

| Countries Covered | United States, Canada |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America aluminium cans market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America aluminium cans market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America aluminium cans industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The North America aluminium cans market in the region was valued at USD 16.9 Billion in 2024.

The rising demand for soft drinks, energy drinks, beer, and ready-to-drink beverages is creating the need for aluminium cans. Besides this, innovations in lightweight and resealable cans and improved printing technology are enhancing product appeal and reducing costs. Moreover, the wider availability of canned products in supermarkets, convenience stores, and online platforms is fueling the market growth.

The North America aluminium cans market is projected to exhibit a CAGR of 3.2% during 2025-2033, reaching a value of USD 22.4 Billion by 2033.

Beverages accounted for the largest North America aluminium cans segment market share due to high demand for canned soft drinks, beer, and energy drinks. Aluminium cans offer convenience, lightweight packaging, recyclability, and efficient preservation, promoting their widespread use.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)