North America Advertising Market Size, Share, Trends and Forecast by Segment, and Region, 2025-2033

North America Advertising Market Size and Share:

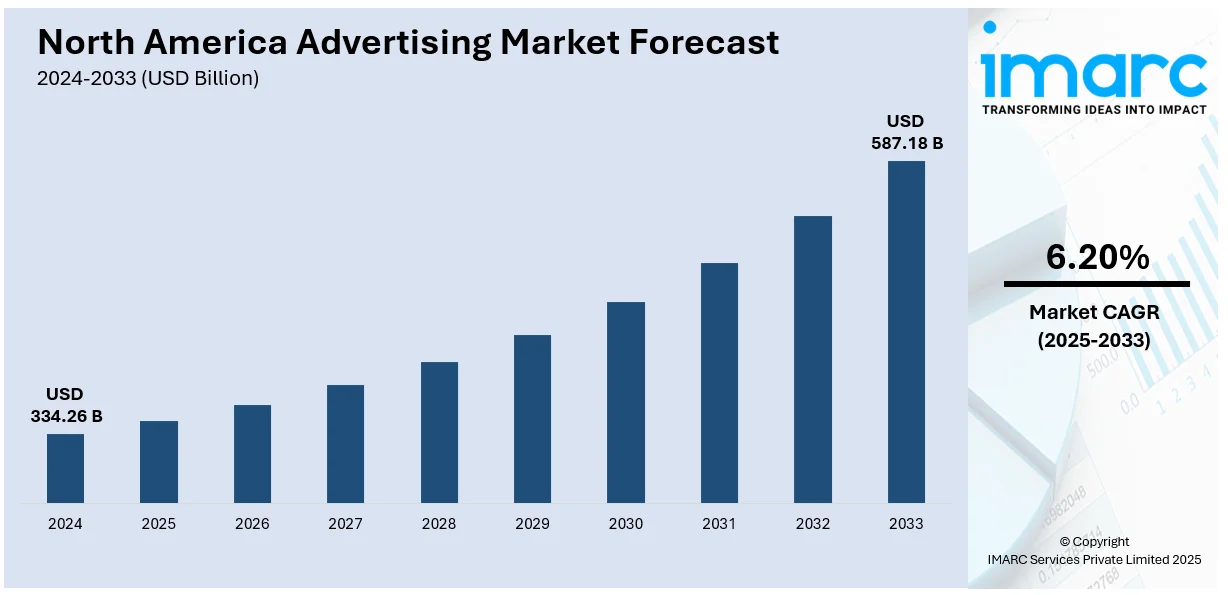

The North America advertising market size was valued at USD 334.26 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 587.18 Billion by 2033, exhibiting a CAGR of 6.20% from 2025-2033. The North America advertising market share is expanding, driven by the growing adoption of digital skills that help to improve content development, user involvement, and general advertisement efficiency, along with the increasing adoption of OTT channels and streaming services, which allows flexibility to enhance ad-formats to target a wider audience.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 334.26 Billion |

|

Market Forecast in 2033

|

USD 587.18 Billion |

| Market Growth Rate (2025-2033) | 6.20% |

The rise of influencer marketing is impelling the market growth in North America. It assists in linking brands with highly engaged niche audiences. Brands team up with influencers across social media platforms to promote products in more authentic and relatable ways. These people, whether they are celebrities or micro-influencers, generate content that connects with their audience, resulting in increased interaction and reliance. Because individuals tend to trust influencer recommendations over traditional ads, this type of marketing has become more effective. With influencers’ ability to target specific demographics and build personal associations, brands can reach their ideal customers in a manner that feels less like advertising and more like genuine content.

The growing demand for personalization and hyper-targeting is offering a favorable North America advertising market outlook. As people expect more relevant and tailored experiences, advertisers employ data analytics, machine learning (ML), and artificial intelligence (AI) to develop ads that are specific to individual preferences and behaviors. With tools that track browsing history, past purchases, and social media activity, brands can deliver highly personalized ads that resonate with users on a deeper level. This level of targeting improves ad performance and increases return on investment (ROI) because ads are shown to people who are most likely to engage. Social media platforms allow advertisers to customize their campaigns to reach precise demographics, locations, and interests.

North America Advertising Market Trends:

Growing adoption of digital skills

The increasing adoption of digital skills across the region is enabling businesses to create more efficient and engaging campaigns. As more professionals gain digital marketing expertise, companies can leverage instruments, such as social media analysis, search engine optimization (SEO), programmatic advertising, and data analytics to reach specific audiences. This allows advertisers to optimize their campaigns in real time, improving ROI. Additionally, digital skills help to enhance content creation, user engagement, and overall ad effectiveness. Moreover, government agencies wager on the incorporation of digital skills, thereby driving the demand for advertising in the area. In January 2025, the National Telecommunications and Information Administration (NTIA) of the Department of Commerce proposed awarding over USD 369 Million to 41 entities to aid digital skills and inclusion initiatives in communities nationwide.

Expansion of retail and e-commerce platforms

The expansion of retail and e-commerce platforms is fueling the North America advertising market growth. This helps in giving brands more ways to reach users. According to the data published on the official website of the Statistics Canada, the retail trade e-commerce sales reached USD 4,113,782 in November 2024. As more people shop online, retailers are turning to digital ads to get their products in front of the right audience. Social media platforms have become key advertising channels, allowing brands to run targeted ads and sell directly through the channels. E-commerce sites employ consumer data to create relevant ads, which increases the chances of conversion. Additionally, the rise of omnichannel retail, where businesses integrate both physical and online shopping, also means brands need to advertise across multiple forms, ranging from websites to in-store promotions. This broadening creates the requirement for innovations in ad formats, encouraging brands to find creative ways to engage with people.

Rise of streaming services and over-the-top (OTT) platforms

The increasing number of streaming services and OTT platforms is impelling the market growth. As more people shift to OTT portals, advertisers are tapping into these spaces to run targeted ads. OTT platforms provide detailed viewer data, which allows brands to target specific audiences based on interests, demographics, and viewing habits. Besides this, ad-supported streaming services provide brands a chance to reach viewers with fewer distractions, unlike traditional TV. With video content being more engaging, advertisers can create immersive and high-quality ads that feel less intrusive. The flexibility of these OTT platforms, along with their high popularity, is enabling improvements in ad formats, making streaming a major player in the regional market. This shift reflects how users’ usage habits of OTT channels are influencing ad strategies. According to the IMARC report, the United States OTT market is set to attain USD 371.9 Billion by 2032.

North America Advertising Industry Segmentation:

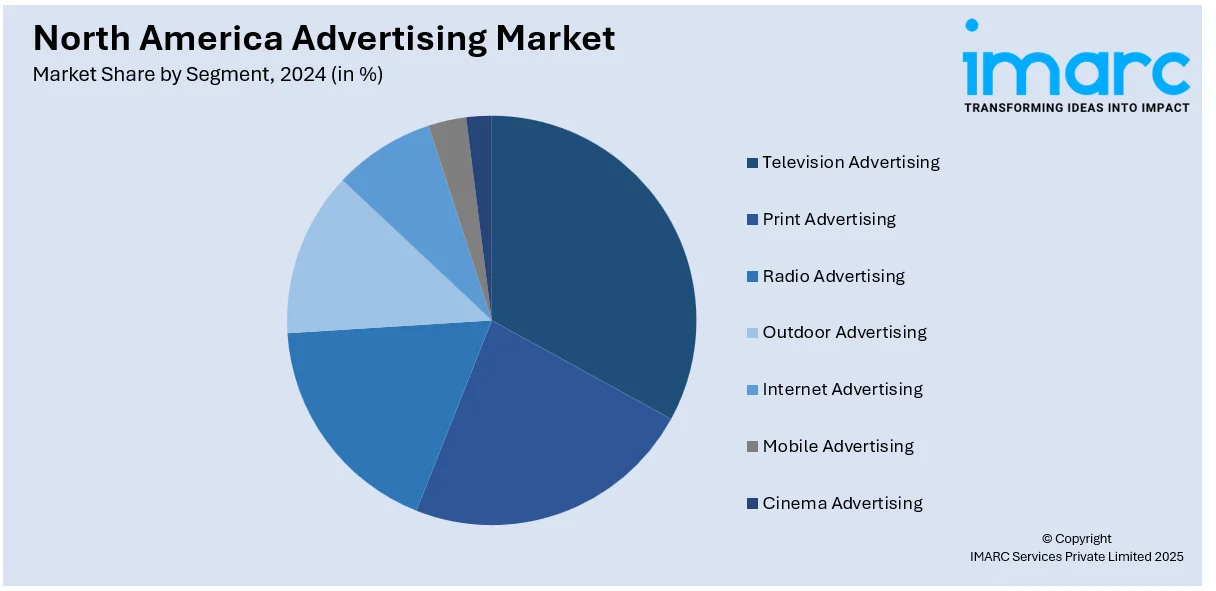

IMARC Group provides an analysis of the key trends in each segment of the North America advertising market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on segment.

Analysis by Segment:

- Television Advertising

- Print Advertising

- Radio Advertising

- Outdoor Advertising

- Internet Advertising

- Mobile Advertising

- Cinema Advertising

Television advertising represents the largest segment. It remains the most effective way to reach a wide and diverse audience. Despite the rise of digital platforms, television (TV) has an unmatched extent, especially among older demographics who are less likely to spend time on social media. Major events and shows attract millions of viewers, making TV an ideal platform for advertisers to create high-impact campaigns. It also offers a level of credibility and trust, as many people still associate TV ads with established brands. In terms of segments, sectors like automotive, retail, food and beverage (F&B), and entertainment heavily depend on TV for their advertising, as the medium allows them to showcase their items on a large scale. Consequently, TV remains the go-to choice for big-ticket campaigns that aim for mass exposure and long-term brand recognition.

Regional Analysis:

- United States

- Canada

United States enjoys the leading position in the market. It is noted for its large and diverse economy, advanced technology, and established media infrastructure. With a high population, the US offers advertisers a vast and varied user base, which is ideal for targeted campaigns across different sectors. Besides this, the country's strong digital ecosystem, including major streaming platforms, also plays an important role, as businesses employ these channels to reach specific demographics. Additionally, the US has a highly competitive advertising industry, with numerous agencies and media companies coming up with innovative ideas and products in marketing strategies. In September 2024, Life360, Inc., the premier company for family connectivity and safety, unveiled its advertising platform in the United States. It utilizes the firm's distinct family insights and location information to give privacy-focused advertising targeting, linking millions of active families with brands, items, and services. Moreover, the area consistently sets trends in advertising with creative and high-budget campaigns. Apart from this, major brands and a growing startup culture drive the demand for advertising, making the US dominant in North America.

Competitive Landscape:

Key players in the market work on developing services and products to meet the high North America advertising market demand. Big companies wager on highly targeted ads based on user data. Traditional media outlets, such as TV networks and print publications, play an important role, especially in reaching mass audiences. Advertising agencies work with brands to come up with engaging, new, and creative campaigns across platforms, encouraging innovations in Internet, social, and television advertising. In addition, influencers and celebrities help brands to connect with younger audiences on social media platforms. Apart from this, the competition among these key players enables them to continuously improve, making advertising more personalized, interactive, and effective. As they adapt to changing user behaviors and new technologies, they are essential in keeping the market dynamic and evolving. For instance, in May 2024, Netflix, a prominent media company, developed a new advertising technology platform, as it almost doubled its user base for ad-supported services. The firm will start its testing in Canada later in 2024 and aims to introduce its service in the US by the conclusion of the second quarter of 2025. By teaming up with top advertising technology organizations, it seeks to provide advertisers with enhanced features and more accurate targeting alternatives.

The report provides a comprehensive analysis of the competitive landscape in the North America advertising market with detailed profiles of all major companies.

Latest News and Developments:

- January 2025: Amazon Prime, a streaming service company, revealed its plan about starting to feature ads in the US. Prime members wishing to maintain an ad-free experience for their movies and TV shows will need to pay an extra USD 2.99. Amazon stated in its email that it intends to have significantly fewer ads compared to traditional television and other streaming services.

- January 2025: Meta Platforms will start test-launching advertisements on its Threads social media platform with select brands in the US and Japan. Beginning with initial testing, image advertisements will be featured in the Threads home feed and positioned between content posts for a limited number of users.

- January 2025: WHSmith, a well-known British retailer, aims to introduce a retail media advertising network. The advertising network will enable advertisers to reach consumers at the company’s 347 sites throughout the US and Canada, such as airports, train stations, and holiday destinations.

- October 2024: DirecTV, a streaming services provider, intended to launch a free ad-supported streaming service named MyFree DirecTV on November 15 in the US. This FAST service aims to feature both linear and on-demand content, with more channels anticipated to be added to its platform during 2025. The service will be available across the country online, through mobile devices, and on certain smart TVs and streaming platforms.

North America Advertising Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Segments Covered | Television Advertising, Print Advertising, Radio Advertising, Outdoor Advertising, Internet Advertising, Mobile Advertising, Cinema Advertising |

| Regions Covered | United States, Canada |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America advertising market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America advertising market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America advertising industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The advertising market in North America was valued at USD 334.26 Billion in 2024.

With the rise in smartphone usage, advertising allows companies to reach users with geo-targeted and on-the-go ads. Besides this, the growing influence of social media personalities is helping brands to connect with younger and engaged audiences who trust their recommendations. Moreover, the expansion of streaming services and OTT platforms is driving the demand for targeted ads through subscription-based and free ad-supported models in North America.

The North America advertising market is projected to exhibit a CAGR of 6.20% during 2025-2033, reaching a value of USD 587.18 Billion by 2033.

Television advertising accounted for the largest North America advertising segment market share.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)