North America Adult Diaper Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2025-2033

North America Adult Diaper Market Size and Share:

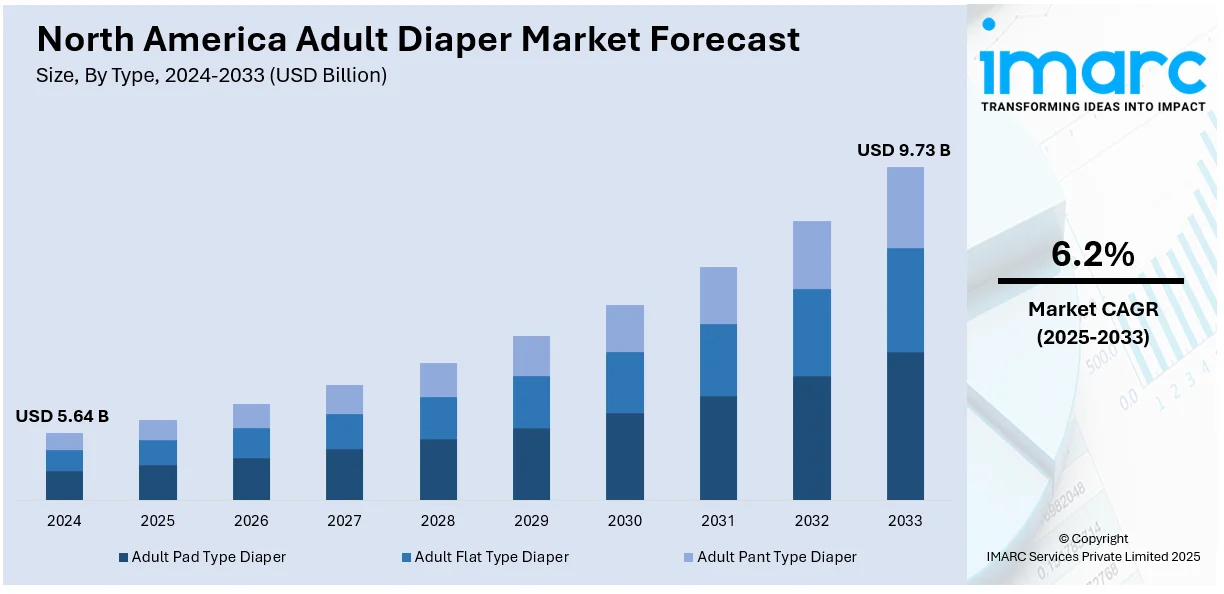

The North America adult diaper market size was valued at USD 5.64 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 9.73 Billion by 2033, exhibiting a CAGR of 6.2% from 2025-2033. The market share is propelled by the increasing geriatric population and their care needs, rising awareness about incontinence products and their benefits, growing preference for convenient and discreet personal care solutions, advancements in product innovation and comfort features, and higher disposable income and improved healthcare accessibility.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 5.64 Billion |

|

Market Forecast in 2033

|

USD 9.73 Billion |

| Market Growth Rate 2025-2033 | 6.2% |

The North America adult diaper market growth is primarily driven by its increasing geriatric population. According to industry reports, 23% of the total population in the United States will be aged 65 years and older by 2050. Similarly, in Canada, 18.9% of the total population was of the ages of 65 years and above in 2024. This demographic is more prone to incontinence problems, including urinary and fecal incontinence, which call for the continuous use of adult diapers. Chronic medical conditions such as diabetes, neurological disorders, and mobility limitations among adults are also increasing demand for these products. Growing awareness about available incontinence solutions and improved quality and comfort of modern adult diapers are encouraging more individuals to seek these products for better health and hygiene management.

Other than this, the easy availability of adult diapers across several distribution channels, such as pharmacies, convenience stores, and online platforms, is making the product more easily accessible to larger numbers, creating a positive North America adult diaper market outlook. Urbanization also expands access to health care and convenience stores, making adult diapers demand higher in the metropolitan areas. As per industry reports, 82.2% of the total population in North America lives in urban areas in 2024. Besides this, there have been advancements in diaper technology, particularly regarding absorbency, skin-friendly materials, and odor control. This leads to higher-quality products that are more appealing to consumers.

North America Adult Diaper Market Trends:

Increasing focus on personal care and hygiene

The increased focus on personal care and hygiene is one of the most significant North America adult diaper market trends. With growing concern over maintaining high levels of hygiene and cleanliness, consumers are purchasing adult diapers that are comfortable and absorbent, besides having odor-controlling capabilities. This is particularly observed among the geriatric demographic, disabled individuals, and patients with chronic health problems. Modern adult diapers are designed to be more discreet, comfortable, and skin-friendly, thus improving the overall well-being and quality of life for users. Moreover, the stigma associated with incontinence is slowly fading away, and individuals are now openly seeking solutions, which is increasing the sales of adult diapers. As more individuals become aware of good hygiene habits, the demand for practical incontinence products that maintain cleanliness and prevent irritation of the skin is growing.

Product innovation and improved comfort

Manufacturers are innovating continuously to drive growth in the North America adult diaper market. They are constantly working to engineer features for adult diapers that make them more comfortable to use discreetly while ensuring efficiency. These innovations include breathable materials, odor control technologies, elastic waistbands for better fit, and enhanced absorbency that ensures users stay dry for longer periods. Since these innovations, adult diapers have been appealing more to consumers due to their higher level of comfort and reliability. Improvements in this direction also target consumers with sensitive skin, guaranteeing that the product is hypoallergenic to avoid irritating the skin. Therefore, according to the North America adult diaper market forecast, these innovations lead to more purchases, driving the market forward.

Increase in healthcare spending and insurance coverage

Increasing healthcare expenditure and broader insurance coverage have increased the North America adult diaper market demand. For instance, according to a report published by the IMARC Group, the U.S. health insurance market size reached USD 453 Billion in 2024 and is forecasted to grow at a CAGR of 3.7% during 2025-2033. Many elderly individuals and those suffering from chronic diseases are now in a position to buy incontinence products due to increased access and affordability of health care. Adult diapers have also become an accepted item covered under insurance policies as part of managing incontinence, and individuals are less worried about having to pay the cash out-of-pocket. This increased accessibility of adult diapers is helping in fulfilling the rising demand across the region, stimulating market growth.

North America Adult Diaper Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the North America adult diaper market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on type and distribution channel.

Analysis by Type:

- Adult Pad Type Diaper

- Adult Flat Type Diaper

- Adult Pant Type Diaper

Adult pad type diaper represents the leading market segment in 2024. Adult pad type diapers hold the largest share in the North America adult diaper market, driven by their usability, comfort, and affordability. These products have gained popularity owing to their simplicity of use and discreet design, which make them highly suitable for use in a range of incontinence conditions. Adult pad diapers provide better absorption and can be used with standard underwear, thereby giving flexibility to users who seek a more natural feel. They are frequently used by individuals with mild to moderate incontinence, as they are equipped to offer excellent protection without the bulk. Moreover, their wide availability in pharmacies and online stores further propels their popularity in the market.

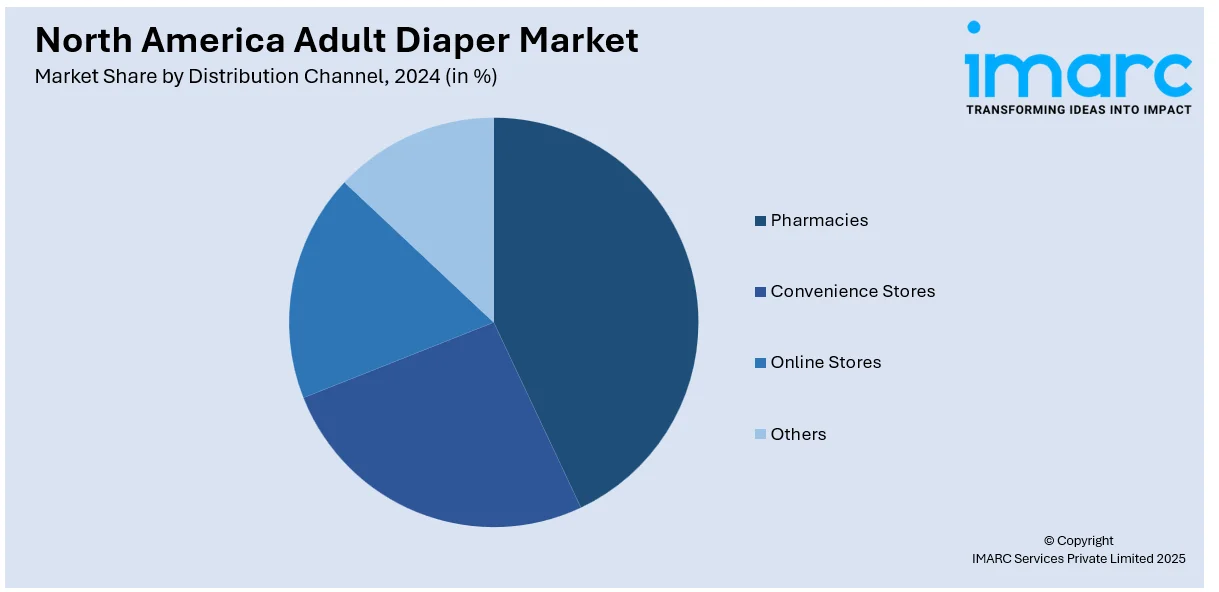

Analysis by Distribution Channel:

- Pharmacies

- Convenience Stores

- Online Stores

- Others

Pharmacies account for the largest market share in 2024. This is due to their easy reach and wide consumer acceptance. Since they are essential retail outlets, pharmacies are convenient and reliable points of purchase for adult diapers, particularly for those handling incontinence issues. Generally, consumers prefer pharmacies for their proximity, extended operating hours, and privacy when purchasing sensitive products. Also, pharmacies have a wide array of adult diaper brands and types that consumers may choose from based on their judgment. Many pharmacies also give personalized consultations, which creates more market dominance as each consumer will leave the pharmacy with the right product for their requirements.

Regional Analysis:

- United States

- Canada

In 2024, the United States accounted for the largest share in the North America adult diaper market. The United States has the most prominent market share in the adult diapers market in North America for various reasons, such as its large geriatric population, more healthcare awareness, and the highly advanced healthcare infrastructure. The increasing prevalence of incontinence among the geriatric demographic and individuals suffering from chronic conditions drives demand for adult diapers. Furthermore, there is an extensive network for distribution in the United States through pharmacies, online stores, and convenience stores. Combined with innovation in comfort, absorbency, and discretion, major manufacturers whose broad ranges of products are widely available enable the United States to extend its leadership in this region's adult diaper market.

Competitive Landscape:

Key players in the North America adult diaper market are driving growth through product innovation, introducing sophisticated features such as enhanced absorbency, skin-friendly materials, and odor-control capabilities for increased consumer comfort. Manufacturers are also launching eco-friendly and biodegradable products so as to attract customers who prefer green products. Companies are also expanding their online distribution channels for easy availability and wider consumer reach. They are forming partnerships with healthcare providers and long-term care providers so as to ensure that products are available to those who need them for medical requirements. Enhanced marketing campaigns about incontinence issues and promoting the benefits of adult diapers further support industry growth.

The report provides a comprehensive analysis of the competitive landscape in the North America adult diaper market with detailed profiles of all major companies.

Latest News and Developments:

- 5 December 2024: American canned water company Liquid Death has launched a novel adult diaper product in collaboration with Depend, a subsidiary of Kimberley Clark that specializes in adult care products. The product provides comfort and dryness while eliminating odors so that individuals can enjoy concerts without taking frequent breaks or worrying about leakage.

- 26 June 2024: AgeComfort, a Canadian retailer providing high-end healthcare goods online, has established an alliance with NorthShore Care Supply to distribute their Forsite Health Maximum Absorbency adult diapers in the United States market. The partnership represents a significant turning point for Forsite Health, expanding its supply network throughout the United States.

- 7 May 2024: NorthShore Care, a leading manufacturer of adult diapers and incontinence products based in the United States, has launched two new innovative adult diaper products, MegaMax and MegaMax Lite. MegaMax provides dry, leak-proof protection for up to 12 hours and has been developed to support individuals with even the most severe control issues.

- 7 June 2023: The ‘Walks by Opposing Pitchers’ on Audacy’s Cubs Radio AM670 The Score is being officially sponsored by NorthShore Care Supply and their NorthShore line of adult diapers. With this collaboration, NorthShore aims to lessen the stigma associated with incontinence, raising awareness about these issues as well as the products used for their management, such as adult diapers.

North America Adult Diaper Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Adult Pad Type Diaper, Adult Flat Type Diaper, Adult Pant Type Diaper |

| Distribution Channels Covered | Pharmacies, Convenience Stores, Online Stores, Others |

| Countries Covered | United States, Canada |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America adult diaper market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America adult diaper market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America adult diaper industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The North America adult diaper market was valued at USD 5.64 Billion in 2024.

The North America adult diaper market is primarily driven by expanding healthcare and long-term care facilities, increased number of individuals with chronic conditions and disabilities, rising demand for premium and eco-friendly adult diaper options, greater focus on personal hygiene and wellness, and growing acceptance and normalization of incontinence products.

IMARC estimates the North America adult diaper market to exhibit a CAGR of 6.2% during 2025-2033.

The United States currently dominates the market due to its large geriatric population and high demand for incontinence products.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)