North America Active Pharmaceutical Ingredients Market Size, Share, Trends and Forecast by Drug Type, Manufacturer Type, Synthesis Type, Therapeutic Application, and Country, 2025-2033

North America Active Pharmaceutical Ingredients Market Size and Share:

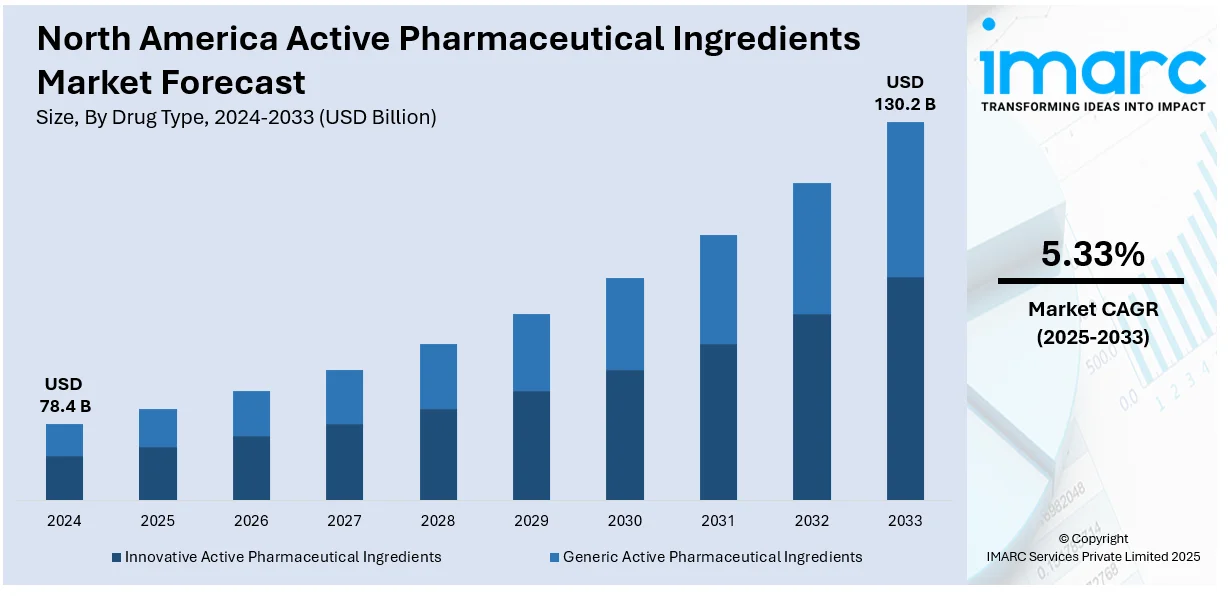

The North America active pharmaceutical ingredients market size was valued at USD 78.4 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 130.2 Billion by 2033, exhibiting a CAGR of 5.33% from 2025-2033. The market in North America is primarily driven by increasing healthcare needs, novel drug formulations, strong research activities, strict compliance standards, the increasing demand for cost-effective treatments, the incorporation of advanced technologies, and synergistic partnerships that have improved efficiency in addressing the continually changing therapeutic problems within the pharmaceutical domain.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 78.4 Billion |

|

Market Forecast in 2033

|

USD 130.2 Billion |

| Market Growth Rate (2025-2033) | 5.33% |

The market in North America is majorly influenced by the increasing number of chronic diseases like diabetes, cardiovascular diseases, and cancer, which require innovative and effective drugs. For instance, on June 12, 2024, the U.S. Centers for Medicare and Medicaid Services announced that national spending on healthcare spending grew 7.5% in 2023, reaching USD4.8 trillion and outpacing the gross domestic product growth rate of 6.1%. Also, innovations in biotechnology and molecular discovery are improving the development of complex APIs, especially among biologics and biosimilars.

High standards regarding APIs and regulatory frameworks that encourage more indigenous production over importation are also providing an impetus to the market. For example, a report by the Active Pharmaceutical Ingredient Innovation Center (APIIC), dated January 24, 2024, addresses the dependence on foreign sources for the APIs. The report recommends the use of advanced manufacturing technologies, along with public incentives, and the formation of a public-private partnership to coordinate efforts in reshoring API production. It also stresses the need to identify critical APIs for initial domestic production to improve national health security. Moreover, government initiatives and private investments are driving pharmaceutical innovation and API production capabilities.

North America Active Pharmaceutical Ingredients Market Trends:

Integration of Advanced Technologies like Artificial Intelligence (AI)

The market is increasingly adopting artificial intelligence (AI) to streamline production processes and enhance drug discovery. Algorithms powered by AI are used to optimize routes for chemical synthesis, predict molecular behaviour, and reduce development times for APIs. This technology provides real-time monitoring of manufacturing parameters for consistent quality and minimizes the occurrence of errors during production. Artificial intelligence (AI) also allows predictive maintenance of equipment, reducing downtime and associated operating costs, hence driving efficiency and competitiveness in the API market. For instance, on June 25, 2024, Eli Lilly announced its partnership with OpenAI to make use of artificial intelligence (AI) in discovering treatments targeting drug-resistant diseases. The collaboration is set to accelerate the discovery of novel antimicrobials, addressing a critical global health threat: antimicrobial resistance. Eli Lilly considers this effort to be a transformative step in driving global healthcare innovation. APIs are the active ingredients in antimicrobials that have therapeutic effects, making them a core component in this effort to fight antimicrobial resistance.

Adoption of Sustainable manufacturing practices in API Production

North America's API market is gaining more popularity due to the adoption of sustainable manufacturing practices, especially green chemistry. The use of environmentally friendly methods in manufacturing processes is increasingly becoming popular, reducing waste, and reducing the overall environmental impact of API production. This aligns with the global sustainability goals to lower carbon footprints in industrial processes. Green chemistry practices benefit both the environmental profile of the manufacturer and enhance efficiency and reduce operating costs. For example, on September 26, 2024, the Journal of Chemical and Pharmaceutical Research published a comprehensive overview of green chemistry strategies applied to the production of APIs. According to the research paper, techniques such as solvent-free operations, biocatalysis, and continuous flow chemistry are being implemented for waste minimization, energy consumption, and environmental footprint. The article further underscores sustainable raw material procurement and the role of regulatory bodies in promoting eco-friendly production practices. These efforts are reshaping API production to meet both ecological and economic objectives, attracting environmentally conscious investors and customers.

Rise in Biologics API Production

Biologics, consisting of monoclonal antibodies, therapeutic proteins, and vaccines, are rising in demand, resulting in the growth of specialized API manufacturing in North America. These drugs are helpful in treating cancers, autoimmune diseases, as well as infections. Firms increase their production due to these drugs' effective treatment and exhibit excellent quality and efficacy due to advanced facilities using recombinant DNA technology and cell culture systems. New bioprocessing technologies like single-use bioreactors and continuous bioprocessing are popular due to their efficiency and no contamination due to high regulatory standards. Pharmaceutical companies are making heavy investments in biologic API production capabilities. Recently, in May 2024, Eli Lilly committed an additional USD 5.3 billion to a new manufacturing site in Indiana to increase production of the diabetes and weight loss drugs Mounjaro and Zepbound.

North America Active Pharmaceutical Ingredients Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the North America active pharmaceutical ingredients market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on drug type, manufacturer type, synthesis type and therapeutic application.

Analysis by Drug Type:

- Innovative Active Pharmaceutical Ingredients

- Generic Active Pharmaceutical Ingredients

Innovative active pharmaceutical ingredients significantly drive the market growth. They are important for developing and addressing complex and unmet medical needs across all therapeutic areas, including cardiology, oncology, and rare diseases. The higher attention towards biologics and precision medicine results in increased demand for novel APIs with more specificity to provide more efficient and targeted treatments. This has also increased the speed at which this new API comes into the market in North America with development in pharmaceutical research and development (R&D) activities and an enabling regulatory framework. Other investments in biotechnology, coupled with the embracing of new technologies such as continuous production and green chemistry, ensure growth of the market.

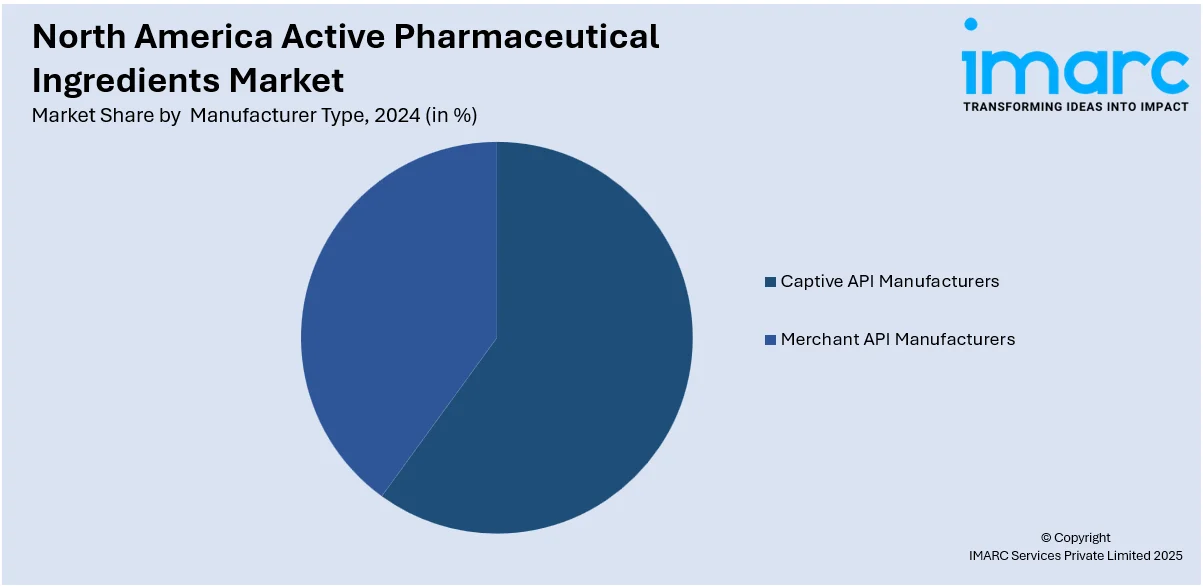

Analysis by Manufacturer Type:

- Captive API Manufacturers

- Merchant API Manufacturers

- Innovative Merchant API Manufacturers

- Generic Merchant API Manufacturers

Captive API manufacturers hold a key place in the market. Captive manufacturers will provide assured and economical supplies to the pharmaceutical companies involved. It is exclusive in producing the APIs, which can control quality and pricing along with production time. Captive API manufacturing within large pharmaceutical companies increases efficiency and reduces dependence on external suppliers, which is a critical factor in overcoming supply chain disruptions. The stringent regulations in North America and growing demands for innovative and higher-quality APIs are propelling pharmaceutical companies to invest in captive manufacturing facilities. Advances in technology, as well as automation, have allowed manufacturers to scale production with complete GMP compliance.

Analysis by Synthesis Type:

- Synthetic Active Pharmaceutical Ingredients

- Innovative Synthetic APIs

- Generic Synthetic APIs

- Biotech Active Pharmaceutical Ingredients

-

-

-

- Market by Drug Type

-

- Innovative Biotech APIs

- Biosimilars

-

- Market by Product Type

-

- Monoclonal Antibodies

- Vaccines

- Cytokines

- Others

-

- Market by Expression System Type

-

- Mammalian Expression System

- Microbial Expression System

- Yeast Expression System

- Others

-

- Market by Drug Type

-

-

-

Synthetic APIs share an important portion of the market due to their broad applicability and cost efficiency. Mostly, synthetic APIs are applied in small-molecule drugs, which represent a cornerstone in pharmaceutical treatments of diseases such as cardiovascular diseases, diabetes, neurological disorders, etc. The use of advanced chemical synthesis techniques in the synthesis process helps the manufacturer reach extremely high purity levels and obtain uniform quality, thereby enabling them to adhere to regulations set in North America strictly. Advancements in chronic diseases and the growing need for affordable medicines heighten the demand for those APIs. Innovations in chemical processes, such as continuous manufacturing and green chemistry, also increase efficiency and sustainability in their production.

Analysis by Therapeutic Application:

- Oncology

- Cardiovascular and Respiratory

- Diabetes

- Central Nervous System Disorders

- Neurological Disorders

- Others

Oncology holds a significant place in the market due to growing cancer prevalence and consequent demands for advanced treatments. Active pharmaceutical ingredients (APIs) in oncology therapy are considered essential for developing drugs that are targeted to specific genetic and molecular profiles of tumors. The rise in investment in cancer research and technological advancements in biologics and small-molecule APIs is driving the growth of this segment. Innovations in immunotherapy and combination therapies have also accelerated the need for high-quality APIs tailored for oncology. Government initiatives and approvals for expedited drug development contribute to the growth of this segment. With the increased focus on effective cancer treatments and the need for precision medicine, oncology APIs are driving market growth and innovation in North America.

Country Analysis:

- United States

- Canada

- Mexico

The United States dominates the North American active pharmaceutical ingredients (API) market due to the presence of strong pharmaceutical and biotechnology industries in the region. Advanced infrastructure for research and development (R&D) activities and significant investments in drug innovation support API production in the region. The increase in chronic and lifestyle-related diseases and the rising elderly population are increasing the need for quality APIs for both generic and branded drug formulations. Regulatory support by agencies like the FDA that ensure the quality and safety of products is fueling the market growth. Also, the U.S. benefits from a strong presence of captive API manufacturers and contract development organizations, which contribute to a reliable and effective supply chain.

Competitive Landscape:

The market in North America is highly competitive due to advancements in manufacturing technology and a high emphasis on innovation. Manufacturers compete for market share by adopting newer processes, such as continuous manufacturing and green chemistry, to benefit efficiency and more compliance with regulatory requirements. Also, the growing demand for complex APIs, such as biological and high-potency drugs, has been the main investment towards high-tech facilities. The competitive market environment is intensified by continuous efforts to ensure quality, scalability, and cost-effectiveness while addressing supply chain resilience and local demands.

The report provides a comprehensive analysis of the competitive landscape in the North America active pharmaceutical ingredients market with detailed profiles of all major companies.

Latest News and Developments:

- April 9, 2024: The API Innovation Center announced that it had partnered with Apertus Pharmaceuticals to manufacture the API for the critical cancer drug lomustine domestically in the United States. Utilizing advanced continuous manufacturing technologies, the program will ensure a reliable and cost-effective supply of lomustine for the treatment of glioblastoma, reducing dependence on foreign sources. This effort makes Missouri a critical contributor to biomanufacturing and highlights public-private partnerships in addressing the most critical needs of pharmaceutical supply chain infrastructure.

- March 15, 2024: Noramco, an active pharmaceutical ingredients (APIs) manufacturer, launched the Noramco Group, integrating its subsidiaries, Purisys and Halo Pharma. The company plans to address U.S. drug shortages and quality concerns by increasing the reliability of the supply chain, encouraging more domestic production, and reducing logistics costs.

North America Active Pharmaceutical Ingredients Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Drug Types Covered | Innovative Active Pharmaceutical Ingredients, Generic Active Pharmaceutical Ingredients |

| Manufacturer Types Covered |

|

| Synthesis Types Covered |

|

| Therapeutic Applications Covered | Oncology, Cardiovascular and Respiratory, Diabetes, Central Nervous System Disorders, Neurological Disorders, Others |

| Countries Covered | United States, Canada, Mexico |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America active pharmaceutical ingredients market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America active pharmaceutical ingredients market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America active pharmaceutical ingredients industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Active pharmaceutical ingredients (APIs) are the biologically active components in drugs that produce the intended therapeutic effects. They are used in various applications, including pain management, oncology, cardiology, and infectious diseases. APIs can be synthetic, natural, or biological, forming the core of both branded and generic medications.

The North America active pharmaceutical ingredients market was valued at USD 78.4 Billion in 2024.

IMARC estimates the North America active pharmaceutical ingredients market to exhibit a CAGR of 5.33% during 2025-2033.

The key factors driving the North America active pharmaceutical ingredients market are rising chronic diseases, advancements in biologics and biosimilars, strong pharmaceutical research and development (R&D) activities, supportive regulatory frameworks, and increasing demand for generic drugs. Enhanced manufacturing technologies and strategic collaborations further contribute to market growth and competitiveness.

In 2024, innovative active pharmaceutical ingredients represented the largest segment by drug type, driven by advancements in precision medicine, rising chronic disease prevalence, and growing investments in cutting-edge pharmaceutical research and development (R&D) activities.

In 2024, captive API manufacturers represented the largest segment by manufacturer type, driven by pharmaceutical companies ensuring supply chain reliability, cost efficiency, and the ability to maintain strict quality control standards for proprietary drug formulations.

In 2024, synthetic APIs represented the largest segment by synthesis type, driven by cost-effective production, scalability, and widespread use in manufacturing high-demand drugs for chronic and acute conditions.

In 2024, oncology represented the largest segment by therapeutic application, driven by rising cancer prevalence, increased focus on targeted therapies, and substantial investments in innovative treatments and advanced pharmaceutical research.

On a regional level, the market has been classified into United States, Canada, and Mexico, wherein United States currently dominates the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)