North America Acetic Acid Market Size, Share, Trends and Forecast by Application, End-Use Industry, and Country, 2025-2033

North America Acetic Acid Market Size and Share:

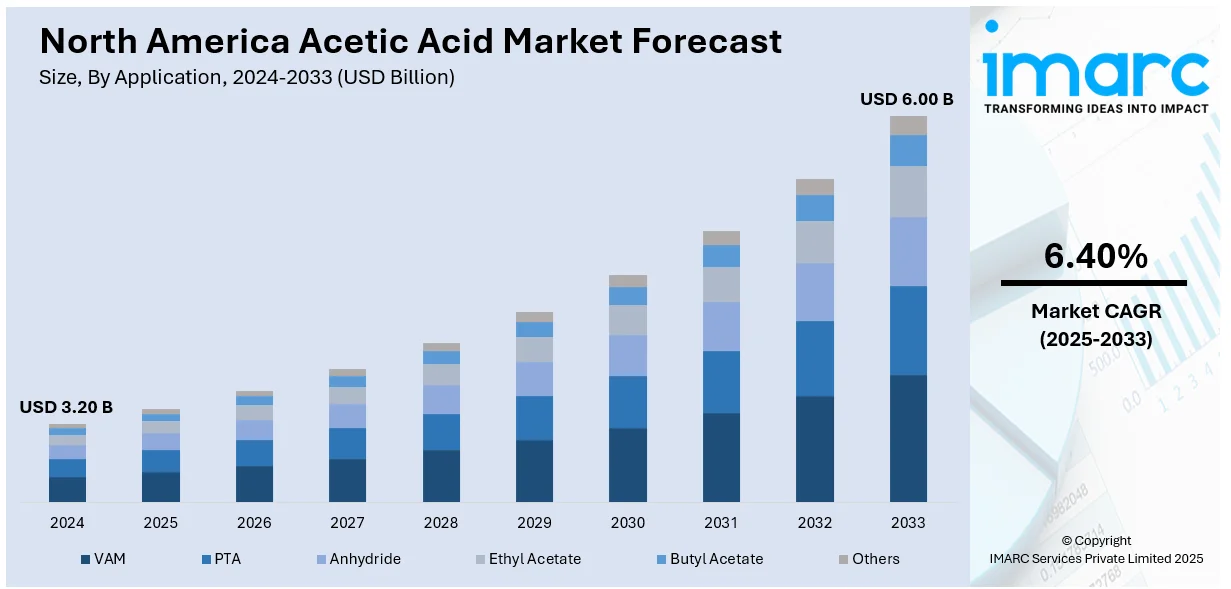

The North America acetic acid market size was valued at USD 3.20 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 6.00 Billion by 2033, exhibiting a CAGR of 6.40% from 2025-2033. The market is experiencing steady growth driven by the demand from vinyl acetate monomer, purified terephthalic acid and food preservation industries. Growing focus on capacity expansion, process optimization and strategic partnerships to enhance competitiveness and meet evolving industrial and environmental requirements is also contributing positively to the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.20 Billion |

| Market Forecast in 2033 | USD 6.00 Billion |

| Market Growth Rate 2025-2033 | 6.40% |

The North America acetic acid market is growing steadily with the increasing demand for vinyl acetate monomer (VAM) in adhesives, paints and coatings. Construction and automotive sectors are expanding and thus supporting this demand as VAM is essential in emulsions and resins. According to industry reports, in December 2024, U.S. car production increased to 10.40 million units up from 10.32 million in November. Historically, production has averaged 10.65 million units from 1967 to 2024, peaking at 13.89 million in November 1978 and hitting a low of 0.09 million in April 2020. Food and beverage industries are also a major contributor as acetic acid is widely used in preservatives and flavor enhancers.

Ethanol-based acetic acid production is picking up pace due to sustainability concerns and regulatory support for bio-based chemicals. The increasing trend toward biodegradable polymers and green solvents is expanding the scope of acetic acid in packaging and industrial processes. Trade policies, volatility in raw material prices and supply chain constraints are affecting market dynamics. Investments in capacity expansion by key manufacturers and technological advancements in production processes are further shaping the competitive landscape in North America.

North America Acetic Acid Market Trends:

Growing Demand in Vinyl Acetate Monomer

The largest consumer of acetic acid is the production of Vinyl Acetate Monomer (VAM) which has a significant share of demand in North America. VAM is an important intermediate in the manufacture of polyvinyl acetate (PVA) and polyvinyl alcohol (PVOH) which are important components in adhesives, paints, coatings and textiles. The construction and packaging industries drive this demand with increasing applications in water-based adhesives and environmentally friendly coatings. As industries shift towards sustainable and high-performance materials VAM demand continues to rise. To strengthen sustainability initiatives major VAM producers are focusing on certified production and ecofriendly sourcing. For instance, in November 2024, Kuraray Co., Ltd. announced ISCC PLUS certification for six vinyl acetate-related products at four production sites in the U.S. and Europe with the U.S. La Porte Plant producing the initial VAM. This certification enables Kuraray to sell sustainably sourced products and aims for broader global certification in the future. Acetic acid producers are expanding capacity and optimizing production processes to meet the growing needs of the adhesive and coating sectors.

Rising Use in PET Bottle Manufacturing

Acetic acid is an important feedstock in the manufacture of purified terephthalic acid (PTA) a primary raw material for PET bottles. The increasing demand for PET bottles in the beverage, personal care and pharmaceutical industries is driving the demand for PTA, thereby increasing the consumption of acetic acid. The lightweight, durable and recyclable properties of PET make it the preferred packaging material with increasing adoption in sustainable and bio-based PET initiatives. For instance, in March 2024, Coca-Cola North America announced the launch of redesigned lightweight PET bottles for its sparkling beverages in the U.S. and Canada. The new bottles weighing 18.5 grams aim to reduce plastic usage and carbon emissions significantly. This initiative supports the company’s sustainability goals, promoting a circular economy and minimizing environmental impact.

Rising Focus on Sustainability

The shift towards bio-based acetic acid is gaining momentum as industries seek to reduce dependence on fossil fuel-derived chemicals. Companies are investing in research to enhance yield cost-effectiveness and scalability of bio-based production. All these are further driving the transition in the wake of regulatory pressures consumer preference for ecofriendly products and circular economy initiatives. Innovation in fermentation-based production driven by partnerships between chemical manufacturers and biotech firms positions bio-based acetic acid as a viable alternative for applications in packaging, textiles and coatings.

North America Acetic Acid Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the North America acetic acid market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on application and end-use industry.

Analysis by Application:

- VAM

- PTA

- Anhydride

- Ethyl Acetate

- Butyl Acetate

- Others

VAM leads the market with around 42.8% of the North America acetic acid market share. Vinyl acetate monomer (VAM) is the leading application segment in the North America acetic acid market accounting for a significant share due to its widespread use in adhesives, coatings and packaging materials. The demand for VAM is increasing with construction and automotive industries and is supported by rising infrastructure projects and the increasing preference for ecofriendly adhesives. The growth of the paints and coatings industry driven by increased residential and commercial construction activities further enhances VAM's market leadership. The presence of large chemical manufacturers and technological advancements in production processes continue to drive VAM demand.

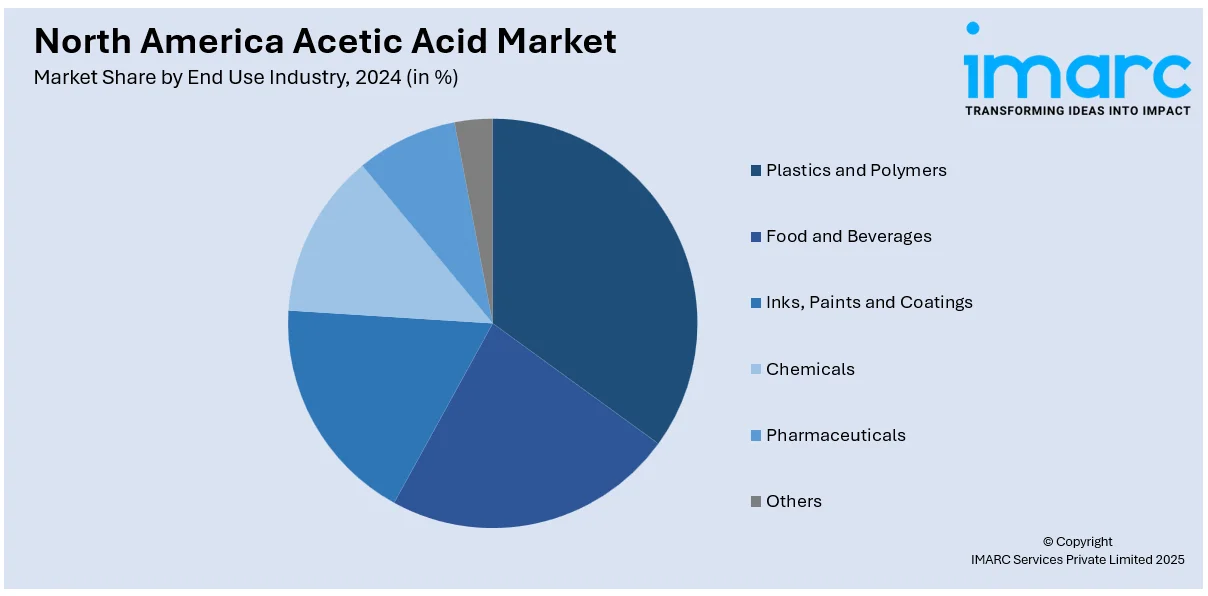

Analysis by End Use Industry:

- Plastics and Polymers

- Food and Beverages

- Inks, Paints and Coatings

- Chemicals

- Pharmaceuticals

- Others

The paints and coatings sector is the largest in the North America acetic acid market primarily due to its role in the production of key derivatives such as vinyl acetate monomer (VAM) and ethyl acetate. These compounds are used in the formulation of high-performance coatings for automotive, construction and industrial applications. Infrastructure development and the increasing demand for protective coatings in harsh environmental conditions are further growth drivers for the market. Also, the rise in consumer preference for low-VOC and environmentally friendly coatings has further increased demand for acetic acid-based formulations. The fact that major coatings manufacturers are based in this sector and technological advances in sustainable coating solutions further boost this sector to dominate the market. Rapid urbanization, expansion of the automotive sector and the need for legal compliance regarding eco-friendly coatings drive sustained demand. The rapidly increasing use of water-based coatings that require acetic acid derivatives propels further growth in the market.

Country Analysis:

- United States

- Canada

In 2024, United States accounted for the largest market share of over 80.5%. The United States holds the majority share of the North America acetic acid market backed by strong demand from major industries such as paints and coatings, adhesives and textiles. It is a principal producer and consumer of acetic acid derivatives mainly vinyl acetate monomer and acetic anhydride needed for producing adhesives, packaging materials and coatings. The presence of leading chemical manufacturers along with advanced production technologies further strengthens the market. Increasing investments in infrastructure and construction projects fuel the demand for acetic acid-based products which further solidifies the United States' dominant position in the regional market. According to the North America acetic acid market forecast, the United States is expected to maintain its leadership due to ongoing industrial expansion, rising demand for sustainable chemical solutions and continuous advancements in acetic acid production.

Competitive Landscape:

The North America acetic acid market is highly competitive with established producers focusing on capacity expansion, process optimization and sustainability initiatives. Companies are investing in advanced production technologies such as methanol carbonylation and bio based acetic acid to improve efficiency and reduce environmental impact. Sustainability certifications are emerging as a competitive advantage supporting the transition toward ecofriendly products. Fluctuating raw material prices and regulatory pressures are driving innovation in alternative feedstocks and energy-efficient manufacturing processes ensuring long term market stability and competitive differentiation.

The report provides a comprehensive analysis of the competitive landscape in the North America acetic acid market with detailed profiles of all major companies, including:

- Celanese Corporation

- Daicel Corporation

- Eastman Chemical Company

- GFS Chemicals Inc.

- Hawkins

- Hydrite Chemical

- INEOS

- Kanto Corporation

- LyondellBasell Industries Holdings B.V.

- SABIC

Latest News and Developments:

- In June 2024, Celanese Corporation announced the force majeure and sales control for acetic acid and vinyl acetate monomer in the Western Hemisphere due to supply disruptions. Production is expected to decline by 15-20% in Q2 2024. The company is working to minimize customer impact and will provide updates during its earnings report.

- In September 2023, INEOS announced the acquisition of the Eastman Texas City site for approximately $500 million which includes a 600kt Acetic Acid plant. A Memorandum of Understanding for a long-term vinyl acetate monomer supply agreement has also been established.

- In March 2023, KBR a US multinational engineering firm announced the acquisition of Acetica a carbonylation technology for acetic acid production enhancing its sustainable solutions portfolio. This acquisition supports CO2 back-integration for high-value chemicals. KBR also introduced ScoreKlean a hydrogen fueled burner aimed at achieving zero emissions in ethylene cracking furnaces targeting major greenhouse gas sources in the petrochemical sector.

North America Acetic Acid Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons, Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | VAM, PTA, Anhydride, Ethyl Acetate, Butyl Acetate, Others |

| End-Use Industries Covered | Plastics and Polymers, Food and Beverages, Inks, Paints and Coatings, Chemicals, Pharmaceuticals, Others |

| Countries Covered | United States, Canada |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America acetic acid market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America acetic acid market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America acetic acid industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The acetic acid market was valued at USD 3.20 Billion in 2024.

The growth of the North America acetic acid market is driven by rising demand for vinyl acetate monomer (VAM) in adhesives, paints, and coatings, along with expanding applications in food, pharmaceuticals, and textiles. Additionally, increasing infrastructure development, sustainable chemical innovations, and strong industrial production further support market expansion.

IMARC estimates the acetic acid market to reach USD 6.00 Billion by 2033, exhibiting a CAGR of 6.40% during 2025-2033.

Vinyl Acetate Monomer (VAM) dominates the North America acetic acid market, accounting for approximately 42.8% of the total market share. VAM is widely used in adhesives, coatings, textiles, and packaging materials, driving its high demand. The growth of construction, automotive, and industrial sectors further fuels its market dominance.

Some of the major key players include Celanese Corporation, Daicel Corporation, Eastman Chemical Company, GFS Chemicals Inc., Hawkins, Hydrite Chemical, INEOS, Kanto Corporation, LyondellBasell Industries Holdings B.V., SABIC, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)