Nonwoven Industrial Membrane Market Size, Share, Trends and Forecast by Module, Application, and Region, 2025-2033

Nonwoven Industrial Membrane Market Size and Share:

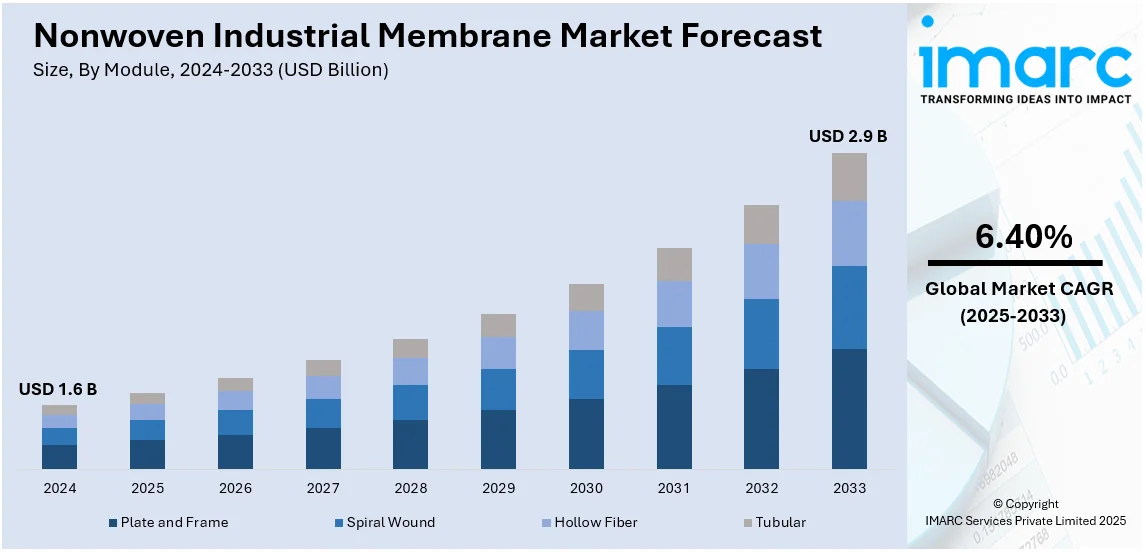

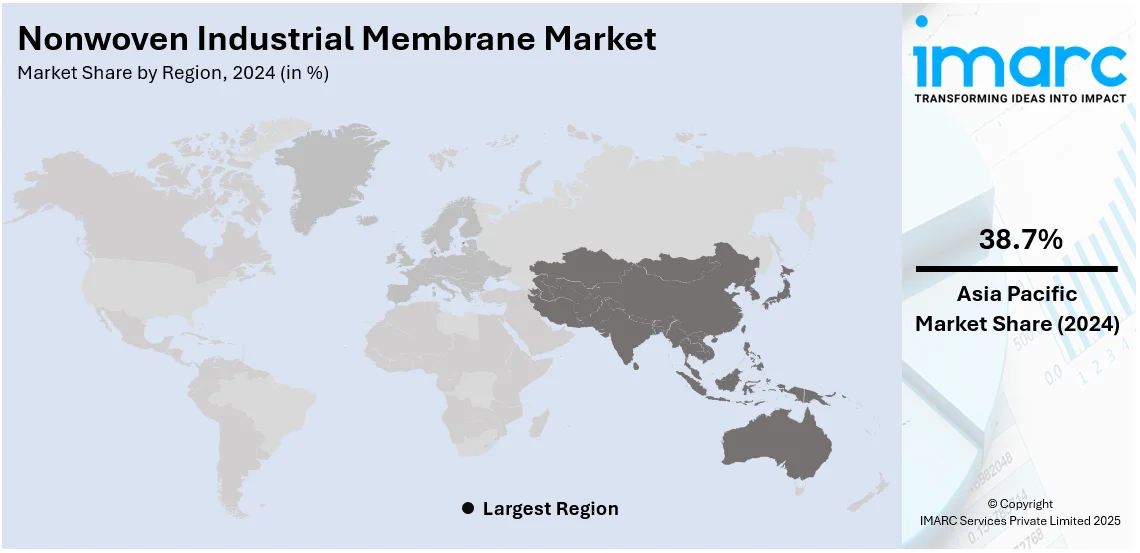

The global nonwoven industrial membrane market size was valued at USD 1.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2.9 Billion by 2033, exhibiting a CAGR of 6.40% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 38.7% in 2024, driven by rapid industrialization, strong demand for filtration solutions, expanding manufacturing sectors, and government initiatives promoting sustainable water and air treatment technologies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.6 Billion |

| Market Forecast in 2033 | USD 2.9 Billion |

| Market Growth Rate (2025-2033) | 6.40% |

One major drivers of the nonwoven industrial membrane market growth is the rising demand for advanced filtration solutions across industries such as water treatment, pharmaceuticals, food and beverage, and chemicals. Stricter environmental regulations and increasing concerns over water and air quality are compelling industries to adopt high-performance filtration technologies. Nonwoven membranes offer superior filtration efficiency, durability, and cost-effectiveness, making them essential for critical applications requiring precision separation and contaminant removal. For instance, in February 2025, Schott & Meissner, based in Germany, announced the supply of lamination and consolidation equipment to Unisol Membrane Technology, strengthening their partnership. Unisol’s modular filtration solutions support sustainable water and wastewater treatment for future generations. Additionally, technological advancements in membrane fabrication, including nanofiber-enhanced structures and improved permeability, are further accelerating market growth by enabling higher efficiency and extended operational lifespan in industrial filtration systems.

The United States plays a significant role in the nonwoven industrial membrane market by driving innovation, manufacturing excellence, and regulatory advancements. Leading U.S.-based companies are investing in research and development to enhance membrane performance, durability, and energy efficiency. For instance, in November 2024, University at Buffalo researchers received $3 million from the U.S. Department of Energy to develop energy-efficient industrial membranes, reducing production costs, emissions, and environmental impact in pharmaceuticals, chemicals, food, and other industries. The country’s stringent environmental regulations, particularly from the EPA, are fostering demand for high-performance filtration solutions in water treatment, healthcare, and industrial processing. Additionally, the U.S. boasts a strong industrial infrastructure and advanced manufacturing capabilities, ensuring the production of high-quality nonwoven membranes. Strategic collaborations between industry leaders, research institutions, and government agencies further support technological advancements and market expansion.

Nonwoven Industrial Membrane Market Trends:

Expansion of Applications in Water and Wastewater Treatment

The growing need for efficient water and wastewater treatment solutions is fueling demand for nonwoven industrial membranes. As per the report, from 2006 to 2023, investments in environmental protection within the European Union (EU) rose from about USD 55 Billion to USD 71 Billion, with 44% of these investments allocated to wastewater. With increasing concerns over water scarcity and pollution, industries and municipalities are investing in advanced filtration systems that rely on high-performance membranes for microfiltration and ultrafiltration processes. Membranes with improved chemical resistance and durability are gaining traction in desalination, industrial effluent treatment, and municipal water purification. Rising infrastructure investments and government initiatives to improve water quality are further driving the adoption of nonwoven membranes in critical filtration applications.

Expansion of Applications in Pharmaceuticals

Apart from this, these membranes are extensively being used in the pharmaceutical and biopharmaceutical industry for filtration applications, which improves production while minimizing maintenance costs. As per the India Brand Equity Foundation, the total FDI equity inflow in the drugs and pharmaceuticals sector amounts to USD 22.52 Billion from April 2000 to March 2024, constituting nearly 3.4% of the overall inflow across all sectors. The market is further driven by the escalating demand for these membranes in the production of enzymes. They are also employed for concentrating enzymes prior to their employment in various processes for diverse application requirements. Other factors, including the widespread adoption of nonwoven membranes for ensuring the safety and hygiene of food items, the rising demand for air filters, and the stringent government regulations pertaining to the reduction of carbon footprints in various industries, are expected to contribute to the market growth further.

Advancements in Nanofiber Technology

The adoption of nanofiber-enhanced nonwoven membranes is transforming the industrial filtration sector. These membranes offer higher surface area, improved permeability, and enhanced filtration efficiency compared to conventional materials. Manufacturers are integrating electrospinning and other advanced fabrication techniques to produce ultrafine fibers, ensuring superior contaminant removal for water treatment, pharmaceuticals, and chemical processing. For instance, in January 2025, Atmus Filtration Technologies launched NanoNet N3, an advanced gradient mesh filtration media with superior particle retention, extended filter life, optimized size, and enhanced service intervals for OEMs and end users. The demand for high-performance filtration solutions, driven by stringent regulatory requirements and environmental concerns, is accelerating the development of nanofiber-based membranes that provide longer operational life and reduced energy consumption.

Nonwoven Industrial Membrane Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global nonwoven industrial membrane market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on module and application.

Analysis by Module:

- Plate and Frame

- Spiral Wound

- Hollow Fiber

- Tubular

Spiral wound stand as the largest component in 2024, holding around 35.7% of the market, driven by their high filtration efficiency, compact design, and cost-effectiveness. These membranes are widely used in water treatment, pharmaceuticals, food and beverage processing, and chemical industries due to their ability to handle high flow rates and effective separation of contaminants. Their modular structure allows for easy scalability, making them ideal for large-scale industrial applications. Increasing demand for reverse osmosis (RO) and ultrafiltration (UF) systems in wastewater treatment and desalination projects is further boosting adoption. Additionally, advancements in membrane material technology, including nanofiber-enhanced membranes, are enhancing performance, durability, and sustainability, reinforcing the dominance of spiral wound components.

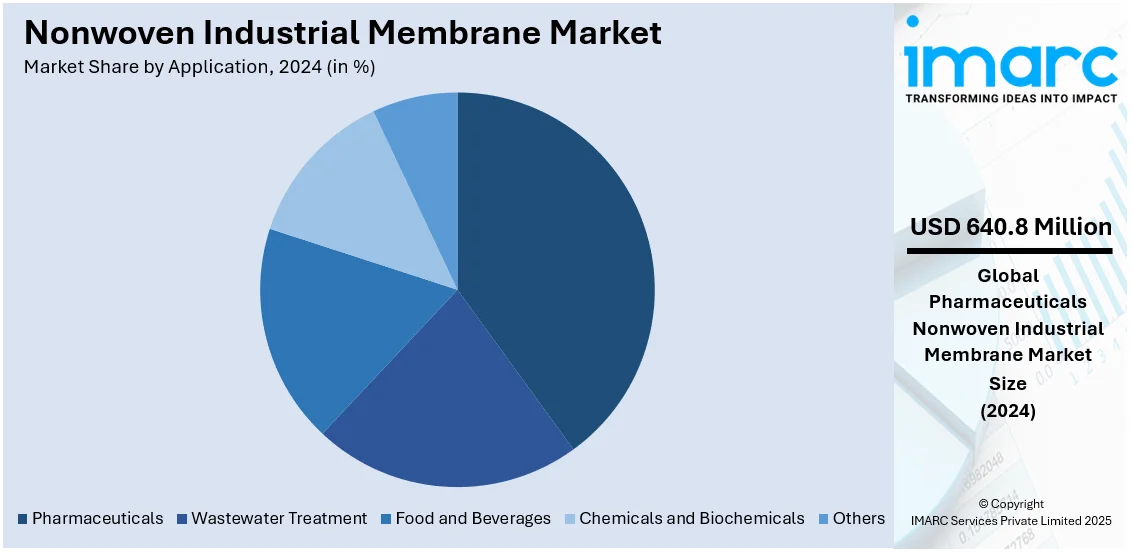

Analysis by Application:

- Wastewater Treatment

- Food and Beverages

- Chemicals and Biochemicals

- Pharmaceuticals

- Others

Pharmaceuticals leads the market with around 39.8% of market share in 2024. This dominance is driven by the increasing demand for high-purity filtration solutions in drug manufacturing, biotechnology, and laboratory applications. Nonwoven membranes play a critical role in sterile filtration, separation, and purification processes, ensuring compliance with stringent regulatory standards set by agencies like the U.S. FDA and EMA. The growing production of biopharmaceuticals, vaccines, and personalized medicine is further accelerating the adoption of advanced membrane technologies. Additionally, rising investments in research and development, coupled with expanding pharmaceutical manufacturing facilities in regions like North America, Europe, and Asia-Pacific, are fueling continued market growth.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 38.7%, driven by rapid industrialization, urbanization, and increasing demand for advanced filtration solutions across key industries such as water treatment, pharmaceuticals, food processing, and chemicals. Countries like China, India, and Japan are investing heavily in water purification infrastructure and air filtration systems due to rising environmental concerns and stringent government regulations. Additionally, the region's strong manufacturing base and increasing adoption of nanofiber-enhanced membranes are fueling market growth. Expanding industrial activities, coupled with government initiatives promoting sustainable water management, are further strengthening Asia-Pacific’s position as a dominant player in the global nonwoven industrial membrane market. Technological advancements and foreign investments continue to drive innovation and market expansion.

Key Regional Takeaways:

United States Nonwoven Industrial Membrane Market Analysis

In the United States, the adoption of nonwoven industrial membranes is experiencing significant growth, primarily fuelled by the expanding chemicals and biochemicals industries. According to International Trade Administration, the U.S. chemical manufacturing industry total FDI in the industry was USD 766.7 Billion in 2023. The increasing demand for high-performance materials that can meet strict environmental and operational standards is pushing for advancements in membrane technologies. Nonwoven industrial membranes offer enhanced filtration and separation capabilities, which are crucial for the processing and production needs of the chemicals and biochemicals industries. This demand is expected to rise as these industries continue to innovate and scale, making nonwoven industrial membranes an essential component in their operations. Furthermore, the ongoing advancements in membrane technology are enhancing the overall efficiency, sustainability, and cost-effectiveness of chemical processing.

North America Nonwoven Industrial Membrane Market Analysis

The North American nonwoven industrial membrane market is expanding due to rising demand for advanced filtration solutions across industries such as water treatment, pharmaceuticals, and food processing. The region’s stringent environmental regulations, particularly from the Environmental Protection Agency (EPA), are driving adoption in wastewater treatment and air filtration applications. Key players are investing in nanofiber technology and sustainable membrane solutions to enhance efficiency and durability. The United States dominates the market, supported by strong industrial infrastructure and increasing research and development investments. For instance, in April 2024, Rowan-Virtua engineers secured a $511,931 NSF grant to enhance manufacturing efficiency and commercialization of their aligned nanofiber fabrication technology, enabling continuous roll production for biomedical and industrial applications. Additionally, growing concerns over water pollution and regulatory compliance are fostering demand for high-performance membranes, positioning North America as a key region for market growth and technological innovation.

Asia Pacific Nonwoven Industrial Membrane Market Analysis

In Asia-Pacific, the adoption of nonwoven industrial membranes is gaining momentum, driven by growing investments in wastewater treatment. According to Ministry of Commerce and Industry India, 565 investment projects in water treatment plants subsector in India worth USD 60.43 Billion. With rising concerns over water scarcity and contamination, there is an increasing push to improve water treatment technologies across the region. Nonwoven industrial membranes are seen as a sustainable solution for filtration and purification, offering enhanced efficiency and lower maintenance costs compared to traditional methods. As industries and governments continue to prioritize clean water initiatives, the demand for advanced filtration solutions, such as nonwoven industrial membranes, is expected to surge. This trend reflects a strong commitment to improving water quality and securing a sustainable water supply in the region.

Europe Nonwoven Industrial Membrane Market Analysis

In Europe, there is a growing adoption of nonwoven industrial membranes due to a heightened focus on reducing carbon footprints. For instance, The EU aims to achieve a 55% net cut in greenhouse gas emissions by 2030. As part of the ongoing shift towards sustainability, industries across the region are increasingly adopting green technologies to minimize their environmental impact. Nonwoven industrial membranes play a vital role in this transition by providing efficient filtration, separation, and processing solutions that contribute to energy savings and reduced emissions. These membranes are particularly valued for their ability to improve industrial processes while meeting stringent environmental regulations. With rising pressure to meet carbon reduction targets, the demand for nonwoven industrial membranes is set to expand, making them an integral part of Europe's green initiatives.

Latin America Nonwoven Industrial Membrane Market Analysis

In Latin America, the adoption of nonwoven industrial membranes is driven by the growing pharmaceutical sector. As per the International Trade Organization, Brazil holds the title of the largest healthcare market in Latin America and allocates 9.47% of its GDP to healthcare, amounting to USD 161 Billion. As the demand for high-quality pharmaceuticals rises, so does the need for advanced filtration and purification technologies. Nonwoven industrial membranes provide reliable and efficient filtration solutions, essential for ensuring the purity and safety of pharmaceutical products. The pharmaceutical industry's expansion across Latin America is spurring investments in state-of-the-art filtration technologies, making nonwoven industrial membranes a vital component in meeting industry standards. This growing demand for advanced filtration solutions is expected to drive further growth in the region.

Middle East and Africa Nonwoven Industrial Membrane Market Analysis

In the Middle East and Africa, the growing food and beverage sector, driven by the expanding tourism industry, is fuelling the adoption of nonwoven industrial membranes. For example, from January to October 2024, Dubai received 14.96 million overnight guests, reflecting an 8% rise compared to the corresponding period in 2023, showcasing robust growth in tourism. As tourism increases, so does the demand for high-quality food and beverages, which require efficient production and processing technologies. Nonwoven industrial membranes are increasingly used in the filtration of water and other ingredients, ensuring the highest standards of product quality. The growing focus on enhancing food safety, combined with the region's booming tourism industry, is pushing for the adoption of advanced filtration solutions, including nonwoven industrial membranes, to meet the demands of this dynamic sector.

Competitive Landscape:

The competitive landscape of the nonwoven industrial membrane market is characterized by the presence of key global players focused on innovation, strategic partnerships, and market expansion. Leading companies invest in advanced manufacturing technologies and sustainable solutions to enhance membrane performance and efficiency. Mergers, acquisitions, and collaborations with research institutions drive product development and market penetration. For instance, in March 2025, AGC Chemicals Americas and Dryfiber launch a non-fluorinated oil/water repellent for nonwovens, scaling production in 2025. Based on Cornell-developed polymer chemistry, it forms a protective coating, enabling easy stain removal. Regulatory compliance and adherence to stringent environmental standards influence competitive positioning. Key players differentiate through superior product quality, durability, and cost-effectiveness. Additionally, increasing demand for high-performance filtration solutions across industries, including water treatment and pharmaceuticals, intensifies competition, fostering continuous technological advancements and strategic growth initiatives.

The report provides a comprehensive analysis of the competitive landscape in the nonwoven industrial membrane market with detailed profiles of all major companies, including:

- 3M Company

- Ahlstrom-Munksjo Oyj

- Asahi Kasei Corporation

- Berry Global Group Inc.

- DuPont de Nemours Inc.

- Exxon Mobil Corporation

- Fibertex Nonwovens A/S (Schouw & Co.)

- Fitesa S/A (Petropar SA)

- Freudenberg Filtration Technologies SE & Co. KG

- Glatfelter Corporation

- Johns Manville Corporation (Berkshire Hathaway Inc.)

- Mitsui Chemicals Inc.

- Toray Industries Inc.

Latest News and Developments:

- January 2025: Toray Industries, has devised a new high-efficiency separation membrane module doubling biopharmaceutical manufacturing filtration performance. The innovation leads to reduced clogging and improved yields beyond 90%, making the purification process even better. The new membrane is aimed to deliver prototype supply for gene therapy drug production evaluation. The goal is to bring down the very high cost of biomanufacturing, especially in gene therapies, through this new membrane.

- January 2025: Gessner, a Germany-based provider of water filtration solutions, threw into the market the Naltex™ diamond nettings to enhance membrane filters toward healthier water. These feed spacers optimize hydraulic conditions by inducing turbulence on the membrane surface, thus minimizing fouling and pressure losses. Using FDA-approved materials, Naltex™ products meet extensive criteria for water contaminants. Their special design contributes towards improving membrane flux and providing even-water dispersion, thus offering more efficient and durable water filtration systems.

- January 2025: Pure Lithium and Saint-Gobain Ceramics have entered into a partnership to work on developing lithium-selective, water-blocking membranes towards lithium metal anodes from brine, in addition to scaling a flexible lithium-conducting membrane for next-gen batteries. Thus, speeding up lithium extraction as well as battery innovation is the focus of this collaboration.

- June 2024: New technology recently introduced by Asahi Kasei in April 2024, which will use Microza™ hollow-fiber membrane technology, is meant to make Water for Injection (WFI). Compared to traditional distillation methods of production, this new system is an energy-efficient one, which will therefore help reduce CO2 emissions and costs of production. The innovative design improves water quality and filtration while reducing environmental impact.

- February 2024: Freudenberg Performance Materials has brought on the market yet another product line 100% synthetic wetlaid nonwoven and manufactured in Germany. They are meant for liquid and air filtration; reverse osmosis membranes and oil filtration. Polymer-based fibers are the raw materials for these nonwovens, and they are meant for industrial purposes, like building & construction as well as the composites industry. The Filtura brand markets them.

- December 2023: Asahi Kasei achieved the invention of a novel membrane system that can dehydrate organic solvents without heat or pressure and enable pharmaceutical manufacturers to optimize their processes. The new system is now entering its practical verification stage in cooperation with Ono Pharmaceutical Co., Ltd. This breakthrough is anticipated to increase overall process efficiency in pharmaceutical applications.

Nonwoven Industrial Membrane Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Modules Covered | Plate and Frame, Spiral Wound, Hollow Fiber, Tubular |

| Applications Covered | Wastewater Treatment, Food and Beverages, Chemicals and Biochemicals, Pharmaceuticals, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M Company, Ahlstrom-Munksjo Oyj, Asahi Kasei Corporation, Berry Global Group Inc., DuPont de Nemours Inc., Exxon Mobil Corporation, Fibertex Nonwovens A/S (Schouw & Co.), Fitesa S/A (Petropar SA), Freudenberg Filtration Technologies SE & Co. KG, Glatfelter Corporation, Johns Manville Corporation (Berkshire Hathaway Inc.), Mitsui Chemicals Inc., Toray Industries Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the nonwoven industrial membrane market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global nonwoven industrial membrane market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the nonwoven industrial membrane industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The nonwoven industrial membrane market was valued at USD 1.6 Billion in 2024.

IMARC estimates the nonwoven industrial membrane market to reach USD 2.9 Billion by 2033, exhibiting a CAGR of 6.40% during 2025-2033.

The nonwoven industrial membrane market is driven by rising water and wastewater treatment demand, stringent environmental regulations, rapid industrialization, advancements in filtration technology, and increasing adoption in pharmaceuticals, food processing, and biotechnology. Growth in desalination projects, energy-efficient membranes, and sustainable filtration solutions further boosts market expansion.

Asia Pacific currently dominates the market with a 38.7% share, driven by rapid industrialization, increasing demand for water and wastewater treatment, expanding pharmaceutical and food processing industries, and stringent environmental regulations. Technological advancements, government investments in sustainable filtration solutions, and a strong manufacturing base further contribute to the region’s market leadership.

Some of the major players in the nonwoven industrial membrane market include 3M Company, Ahlstrom-Munksjo Oyj, Asahi Kasei Corporation, Berry Global Group Inc., DuPont de Nemours Inc., Exxon Mobil Corporation, Fibertex Nonwovens A/S (Schouw & Co.), Fitesa S/A (Petropar SA), Freudenberg Filtration Technologies SE & Co. KG, Glatfelter Corporation, Johns Manville Corporation (Berkshire Hathaway Inc.), Mitsui Chemicals Inc. and Toray Industries Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)