Non-Volatile Memory Market Size, Share, Trends and Forecast by Type, Industry Vertical, and Region, 2025-2033

Non-Volatile Memory Market Size and Share:

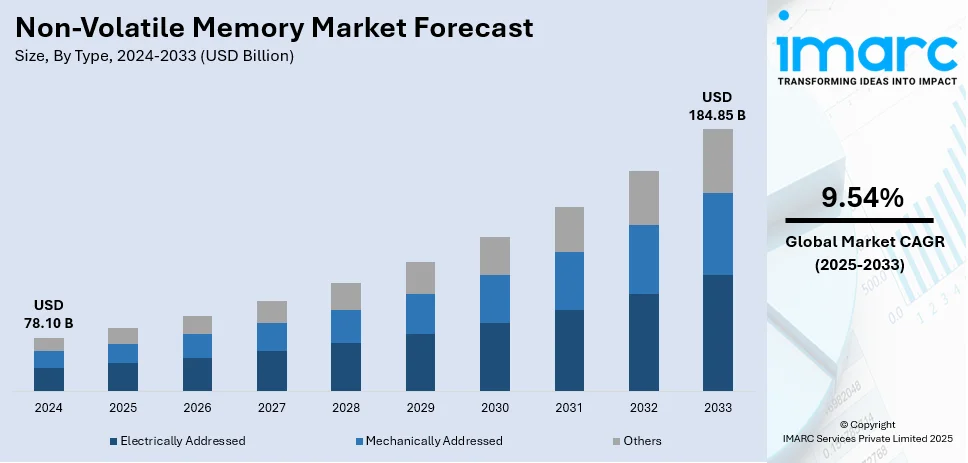

The global non-volatile memory market size was valued at USD 78.10 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 184.85 Billion by 2033, exhibiting a CAGR of 9.54% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 51.5% in 2024. The rising usage of flash memory in laptops, global positioning systems (GPS), gaming gadgets, and electronic musical instruments due to its decreased cost and power usage is stimulating the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 78.10 Billion |

|

Market Forecast in 2033

|

USD 184.85 Billion |

| Market Growth Rate (2025-2033) | 9.54% |

The growing need for dependable, fast data storage across a range of industries is driving the non-volatile memory market's expansion. Growth in automation, AI, healthcare, and networking is pushing the need for memory solutions that deliver both speed and data retention. In addition, the growing use of MRAM technology is supporting market expansion more as companies search for alternatives to conventional flash storage.In April 2024, EverspinAdditionally, as industries prioritize energy-efficient and durable memory solutions, the demand for non-volatile memory continues to rise. The market is witnessing strong investment in next-generation memory solutions with technological advancements ensuring faster processing speeds and improved durability.

The U.S. non-volatile memory market is expanding due to increasing demand for secure, high-performance storage solutions across industries. In addition, growing concerns over cybersecurity threats and data protection are driving the adoption of advanced embedded memory technologies. The need for reliable firmware security is also rising as industries integrate more connected devices. In June 2024, Lattice Semiconductor launched the MachXO5D-NX FPGA family, featuring integrated flash-based root of trust and crypto-agile security. This innovation strengthens secure firmware updates and system resilience, accelerating the demand for non-volatile memory in cybersecurity, industrial automation, and critical infrastructure applications across the U.S.

Non-Volatile Memory Market Trends:

Rising Advancements in 3D NAND Technology

Advancements in non-volatile memory are driving higher efficiency and affordability across various applications. 3D NAND technology continues to enhance memory density, performance, and cost-effectiveness, making storage solutions more accessible for smartphones, laptops, and enterprise systems. Moreover, manufacturers are focusing on improving speed, endurance, and energy efficiency in memory solutions with growing data storage demands. For instance, in June 2024, CEA-Leti introduced the FAMES Pilot Line, a key initiative to accelerate semiconductor advancements in Europe. This development supports innovation in next-generation memory technologies, ensuring higher capacity, improved durability, and lower costs, thereby strengthening the global non-volatile memory industry.

Increasing Shift to Data-Centric Infrastructure

Organizations are increasingly adopting data-centric infrastructure, leading to higher investments in non-volatile memory (NVM) technologies that enhance storage capacity, data retrieval speed, and overall system efficiency. The rising demand for faster, more reliable memory solutions is fueling market expansion across industries, including cloud computing, AI, and enterprise storage. Aligned with this trend, in August 2024, NVM Express released three new specifications and updated eight existing ones, further improving NVMe technology. These updates enhance performance, scalability, and compatibility, strengthening NVMe’s role in high-speed data storage applications. As businesses continue integrating advanced storage solutions, innovations in NVMe technology contribute significantly to the growth and adoption of non-volatile memory in modern computing environments.

Growing Demand for Flash Memory

The non-volatile memory market is expanding due to the increasing demand for high-speed, durable storage across industries. Consumer electronics, automotive applications, and data centers require efficient memory solutions that offer faster processing speeds and enhanced reliability. As businesses generate vast amounts of data, the need for advanced storage technologies continues to grow. For example, in October 2024, Numemory, a Wuhan-based firm, introduced the 64-gigabyte NM101 storage-class memory chip, addressing the demand for high-performance data storage. This innovation supports faster read/write speeds and greater endurance, strengthening flash memory’s role in modern computing. Furthermore, non-volatile memory adoption is rising, ensuring better data security, efficiency, and scalability for next-generation applications in AI, cloud computing, and edge devices with continuous advancements in storage technology.

Non-Volatile Memory Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with the market forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type and industry vertical.

Analysis by Type:

- Electrically Addressed

- Mechanically Addressed

- Others

Electrically addressed memory led the non-volatile memory market in 2024, driven by its high-speed performance, reliability, and widespread adoption in data centers. According to the report, electrically addressed represented the largest market segmentation. Electrically addressed types, such as flash memory and EEPROM, have benefits such as high read/write rates and data preservation without power, making them critical for applications in consumer electronics, automotive, and industrial markets.

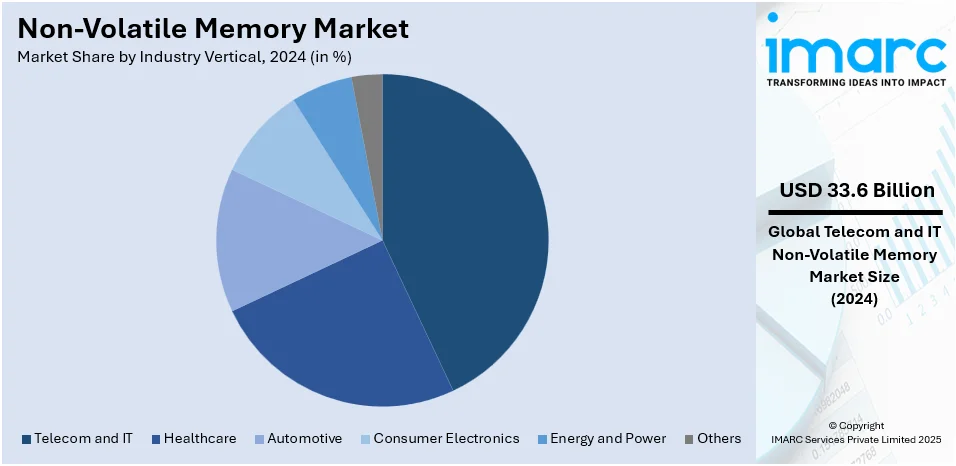

Analysis by Industry Vertical:

- Telecom and IT

- Healthcare

- Automotive

- Consumer Electronics

- Energy and Power

- Others

Telecom and IT leds the market with around 43.0% of market share in 2024. The non-volatile memory industry has a considerable influence on the telecom and IT segments, as it provides critical storage solutions for efficient data transfer and processing. This industry fuels the demand for high-speed and dependable memory technologies that power cloud computing, data centers, and modern telecommunications networks.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 51.5%. Asia-Pacific exhibits a clear dominance in the market driven by significant expenditures in data centers and cloud computing infrastructure, which are increasing the demand for dependable and high-performance memory solutions. Moreover, companies like Samsung Electronics and SK Hynix are leading players, producing large volumes of NAND flash memory.

Key Regional Takeaways:

United States Non-Volatile Memory Market Analysis

As of March 2024, there were a total of 5,381 data centers in the United States, based on industry reports. This increased number of data centers has largely driven the growth of the non-volatile memory (NVM) market in the United States. The growing use of data storage, cloud computing, and big data analytics is fueling the need for NVM solutions that offer quicker, more secure, and efficient data storage alternatives. NVM technologies like flash memory and next-generation storage-class memory are key to improving the performance and scalability of data centers, and hence are a key part of the contemporary data infrastructure. The growth of IoT devices, artificial intelligence, and machine learning applications that demand large amounts of data storage are also driving the need for non-volatile memory solutions. With the pace of digital transformation intensifying in various industries, the US market for NVM will witness tremendous growth in the next few years.

Europe Non-Volatile Memory Market Analysis

As part of the EU's "Europe 2020" strategy, the region sought to offer 100 Mbps internet to 50% of homes by 2020. Based on statistics from the Organization for Economic Cooperation and Development (OECD), as of 2019, only around 2% of broadband connections were founded on pure fiber-optic systems, and this had risen to 5.4% by 2022. This trend towards faster, more stable networks is fueling the need for non-volatile memory (NVM) technologies in Europe. The growing demand for cloud computing, data centers, and high-speed broadband calls for sophisticated storage technologies such as flash memory. With industries embracing IoT, AI, and 5G, the demand for high-performance and high-capacity NVM grows. Moreover, with the acceleration of data generation, the application of NVM across different industries, such as telecommunications and consumer electronics, is instrumental in solving data storage and processing needs. These trends are likely to drive high growth of the European non-volatile memory market over the next few years.

Asia Pacific Non-Volatile Memory Market Analysis

The Asia Pacific non-volatile memory market is experiencing significant growth as a result of growing demand for high-performance memory solutions. GlobalFoundries has invested USD 4 Billion in increasing its Singaporean manufacturing base, with an emphasis on creating next-generation semiconductor manufacturing facilities. This investment reflects the region's concentration on advancing the dynamics of memory technology to address the growing demand for advanced memory storage solutions. Moreover, based on GSMA projections, India will account for close to 24% of the globe's new mobile subscribers by 2025, marking the rise in potential for long-term memory technology adoption in developing economies. The ever-growing momentum for 5G, Internet of Things (IoT), and artificial intelligence (AI) adoption is also driving the need for non-volatile memory. With remarkable growth in data centers, cloud computing, and mobiles, the Asia Pacific region is on the cusp of emerging as a key location for non-volatile memory innovation, aided by growing investments from industry titans.

Latin America Non-Volatile Memory Market Analysis

As of January 2024, Brazil had 187.9 Million internet users, surpassing Mexico and Argentina together, reported industry news. This mass use of the Internet is fueling the need for next-generation memory solutions, including non-volatile memory (NVM), to address the increasing data storage needs of mobile devices, cloud computing, and upcoming technologies in the region. In 2023, Latin America's GDP was generated by 8% of mobile services and technologies, adding economic value worth USD 520 Billion, as per GSMA. Such a huge economic contribution is proof of the growth in the reliance of the region on digital storage and infrastructure that drives the consumption of NVM technologies. In addition, Latin America's expanding mobile subscribers, with Brazil as a digital penetration leader, offer huge prospects for NVM adoption in smartphones, tablets, and connected devices. With growth in industries such as e-commerce, fintech, and online entertainment, Latin America's demand for effective, reliable, and high-capacity memory solutions is likely to accelerate non-volatile memory market growth.

Middle East and Africa Non-Volatile Memory Market Analysis

The Middle East and Africa (MEA) market is experiencing high mobile connectivity growth, with 477 Million subscribers in Sub-Saharan Africa on the mobile network at the close of 2019, accounting for 45% of the population, as stated by GSMA. Growth in the mobile network is instrumental in increasing demand for non-volatile memory (NVM) solutions. With the proliferation of mobile devices and connected technologies, there is a growing demand for effective and trustworthy memory storage to enable mobile applications, e-commerce, digital banking, and other data-driven services. Further, investments in cloud computing and data centers in the MEA region are driving the expansion of NVM technologies. With the increasing uptake of smart devices, IoT solutions, and next-generation digital infrastructure, demand for NVM is likely to skyrocket, leading to further growth in the market. MEA's digital transformation both in emerging and mature markets is likely to drive demand for innovative non-volatile memory technology.

Competitive Landscape:

The report has provided a comprehensive analysis of the competitive landscape. Also, the market is driven by competition among key players like Samsung, Micron, and Western Digital, focusing on advancements in NAND, MRAM, and ReRAM, with increasing R&D, strategic partnerships, and cost-efficient scaling to enhance performance. Detailed profiles of all major market companies have also been provided. Some of the key players in the market include:

- Avalanche Technology

- CrossBar Inc.

- Dialog Semiconductor PLC (Renesas Electronics Corporation)

- Fujitsu Limited

- Honeywell International Inc.

- Infineon Technologies AG

- Intel Corporation

- Microchip Technology Inc.

- Micron Technology Inc.

- Samsung Electronics Co. Ltd.

- STMicroelectronics

- Texas Instruments Incorporated

- Toshiba Corporation

- Western Digital Corporation

Recent Developments:

- February 2025: Everspin Technologies validated its PERSYST MRAM for configuration across all Lattice Semiconductor FPGA families. This advancement enhances non-volatile memory adoption by replacing NOR flash with high-speed, reliable MRAM, driving demand in aerospace, automotive, and industrial applications requiring mission-critical and real-time processing.

- January 2025: Solidigm extended its partnership with Broadcom to advance high-capacity SSD controllers for AI workloads. This includes Solidigm’s new 122TB D5-P5336 SSD, enhancing storage efficiency in AI data centers and driving innovation in non-volatile memory solutions for data-intensive applications.

- January 2025: Weebit Nano licensed its ReRAM technology to onsemi, integrating it into the Treo platform for embedded non-volatile memory. This development strengthens ReRAM’s position as a flash alternative, driving adoption in IoT, AI, and automotive applications with enhanced speed, efficiency, and durability.

- October 2024: A Wuhan-based firm, Numemory, introduced to the domestic market its 64-gigabyte NM101, a type of storage-class memory chip.

- August 2024: NVM Express, Inc. announced the release of three new specifications and eight updated specifications. This update of new technology builds on the strengths of previous NVMe specifications.

- June 2024: CEA-Leti announced the launch of the FAMES Pilot Line, a major project aimed at advancing semiconductor technologies in Europe.

Non-Volatile Memory Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Electrically Addressed, Mechanically Addressed, Others |

| Industry Verticals Covered | Telecom and IT, Healthcare, Automotive, Consumer Electronics, Energy and Power, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Avalanche Technology, CrossBar Inc., Dialog Semiconductor PLC (Renesas Electronics Corporation), Fujitsu Limited, Honeywell International Inc., Infineon Technologies AG, Intel Corporation, Microchip Technology Inc., Micron Technology Inc., Samsung Electronics Co. Ltd., STMicroelectronics, Texas Instruments Incorporated, Toshiba Corporation, Western Digital Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the non-volatile memory market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global non-volatile memory market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the non-volatile memory industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The non-volatile memory market was valued at USD 78.10 Billion in 2024.

The non-volatile memory market is projected to exhibit a CAGR of 9.54% during 2025-2033, reaching a value of USD 184.85 Billion by 2033.

Rising demand for high-speed storage, increasing adoption of IoT and AI, growth in consumer electronics, advancements in 3D NAND and MRAM, and expanding data centers are driving the non-volatile memory market.

Asia Pacific currently dominates the market with a 51.5% share, driven by rapid technological advancements, expanding semiconductor manufacturing, rising consumer electronics demand, and increasing investments in data centers and 5G infrastructure.

Some of the major players in the non-volatile memory market include Avalanche Technology, CrossBar Inc., Dialog Semiconductor PLC (Renesas Electronics Corporation), Fujitsu Limited, Honeywell International Inc., Infineon Technologies AG, Intel Corporation, Microchip Technology Inc., Micron Technology Inc., Samsung Electronics Co. Ltd., STMicroelectronics, Texas Instruments Incorporated, Toshiba Corporation, Western Digital Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)