Non-Lethal Weapons Market Size, Share, Trends and Forecast by Product Type, Technology, End User, and Region, 2025-2033

Non-Lethal Weapons Market Size and Share:

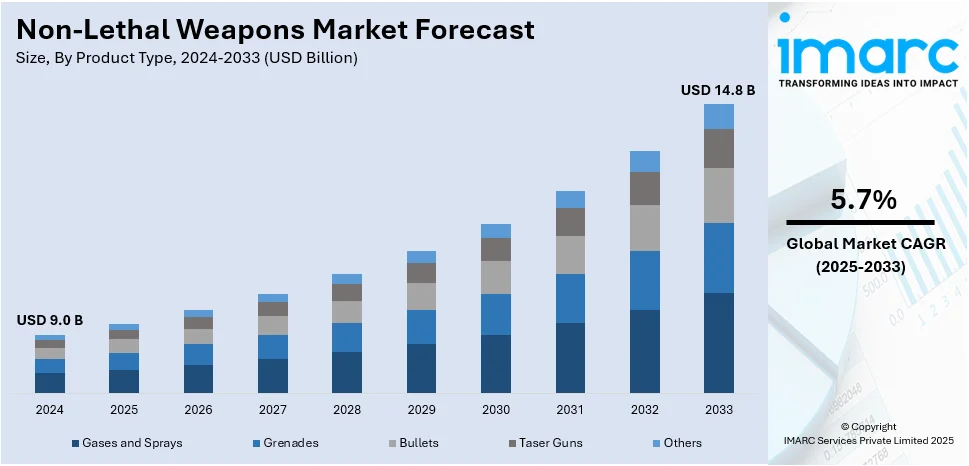

The global non-lethal weapons market size was valued at USD 9.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 14.8 Billion by 2033, exhibiting a CAGR of 5.7% during 2025-2033. North America currently dominates the market, holding a significant market share of over 37.6% in 2024, driven by strong defense investments, technological advancements, and the rising demand from military and law enforcement agencies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 9.0 Billion |

| Market Forecast in 2033 | USD 14.8 Billion |

| Market Growth Rate (2025-2033) | 5.7% |

A primary factor propelling the non-lethal weapons market growth is the urgent demand for a crowd control and riot management system due to the escalating ambience of civil unrest along with increasing geopolitical tensions. To this end, governments and law enforcement agencies worldwide are investing in advanced non-lethal weapons such as rubber bullets, tear gas, and directed-energy devices used in handling illegal protests and disturbances by safely managing human fatalities. Besides, military fighting forces employ the same technologies to add operational effectiveness in peacekeeping missions or in urban warfare scenarios. For instance, in April 2024, the Air Force Security Forces Center announced partnership with sister services to equip Defenders with non-lethal technologies like Tasers, directed energy vehicle-stopping devices, and diversionary grenades for enhanced protection. As concerns over human rights and excessive force grow, the emphasis on non-lethal alternatives continues to rise, driving technological innovation and market expansion in this sector.

The United States plays a pivotal role in the non-lethal weapons market through extensive research, development, and deployment of advanced crowd control and defense technologies. The U.S. Department of Defense (DoD) and law enforcement agencies invest heavily in non-lethal solutions, including acoustic devices, directed-energy weapons, and chemical agents, to enhance operational capabilities while minimizing casualties. Leading defense contractors such as Raytheon Technologies, General Dynamics, and Axon Enterprise drive innovation through continuous technological advancements. For instance, in November 2024, Byrna Technologies announced selling over 500,000 units of its Byrna SD personal security device, a handheld CO2-powered launcher offering less-lethal alternatives for personal defense and security markets. Additionally, U.S. exports of non-lethal weapons support allied nations in riot control, border security, and peacekeeping missions, reinforcing the country’s influence in global defense strategies.

Non-Lethal Weapons Market Trends:

Increasing Need to Control Crowd and Civil Unrest

The increasing incidence of protests, riots, and civil disturbances globally has heightened the demand for effective crowd control measures. This further represents one of the key non-lethal weapons market trends. Studies have identified significant risks associated with police use of crowd-control weapons such as rubber bullets and pellet guns. According to an analysis published in the British Medical Journal, out of 1,984 individuals struck by these weapons, 53 succumbed to their injuries, and 300 suffered permanent disabilities. The severity of injuries was notably higher when individuals were struck in critical areas. Law enforcement agencies require non-lethal options to manage large gatherings without causing permanent harm, maintaining order while minimizing casualties. The ability to de-escalate potentially volatile situations using tools like rubber bullets, tear gas, and stun grenades is crucial for public safety and civil order. For instance, in April 2023, the Springfield Police Department purchased several Bolawrap restrain devices, a new technology designed to restrain individuals using tethering mechanism. According to the department, this non-lethal weapon is particularly useful in situations involving suspects with mental health issues or addiction during enforcement calls.

Ongoing Technological Advancements

The requirement for non-lethal weapons has increased significantly due to advanced features and the capability to control riots without inflicting damage on human life. Consequently, this has compelled defense organizations and major manufacturers into further enhancement of state-of-the-art products in their portfolios. Some of the modern products being developed in the defense sector include laser interdiction systems, long-range acoustic devices, flash-bang grenades, and TASERs. For instance, the TASER X26P uses trilogy logs alongside charge metering that makes up a dissection component of electric charges. Similarly, LRAD Corporation's acoustic hailing devices can employ electromagnetic sound waves for purposes of riot control. In April 2023, China introduced the CS/LW21 handheld electromagnetic launcher for riot control, capable of firing coin-shaped bullets using electromagnetic force. Additionally, Wrap Technologies’ BolaWrap device offers remote restraint without force, highlighting the trend towards innovative and cost-effective non-lethal solutions to enhance market growth.

Growing Terrorism and Security Concerns

The growing threat of terrorism and the need for enhanced security have spurred the adoption of non-lethal weapons. Governments and security agencies are investing in these tools to safeguard critical infrastructure, manage borders, and respond to terrorist threats without using lethal force. According to the 2023 Global Terrorism Index report produced by the Institute for Economics and Peace (IEP), more than 90% of terrorist attacks and 98% of related deaths occurred in conflict zones, with ten countries accounting for 87% of the deaths. In 2023, terrorism-related fatalities increased by 22% to 8,352, the highest since 2017. In May 2024, the Air Force Security Forces Center (AFSFC) explored new non-lethal weapon options, partnering with the Joint Intermediate Force Capabilities Office to deploy advanced technologies. Additionally, in May 2023, the Republic of Singapore Navy equipped its Sentinel-class vessels with Sitep Italia's multirole acoustic stabilized system. Moreover, in October 2021, Apastron Private Limited in India developed non-lethal weapons inspired by traditional Indian combat tools for security forces.

Non-Lethal Weapons Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global non-lethal weapons market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, technology, and end user.

Analysis by Product Type:

- Gases and Sprays

- Grenades

- Bullets

- Taser Guns

- Others

Gases and sprays lead the market with around 28.7% of the non-lethal weapons market share in 2024. Gases and sprays dominate the non-lethal weapon market for their versatility, effectiveness, and ease of effectiveness. Aerosols or sprays, including devices like tear gas, pepper spray, and chemical agents, can disperse crowds and incapacitate individuals without permanent injury. Law enforcement and military personnel use these tools for riot control, self-defense, and scenarios where rapid de-escalation is required. The remarkably cheap pricing and ease of use have made it notable in a wide variety of security applications, allowing it to retain dominance in the non-lethal weapons market share.

Analysis by Technology:

- Chemical

- Electroshock

- Mechanical and Kinetic

- Acoustic/Light

- Others

Chemical leads the market in 2024, due to their versatility, efficiency, and effectiveness in various law enforcement and military applications. These technologies, including tear gas, pepper spray, and other chemical agents, are widely used for crowd control, riot management, and personal protection. Chemical agents quickly incapacitate individuals or disperse crowds with minimal long-term harm, making them ideal for situations where lethal force is unnecessary. The ability to quickly neutralize a threat while minimizing fatalities and injuries is a key advantage of chemical technologies. Additionally, chemical non-lethal weapons comply with international ethical and legal standards, ensuring their acceptance in law enforcement and military operations. This market growth is driven by the increasing demand for safer, more humane methods of managing potential threats.

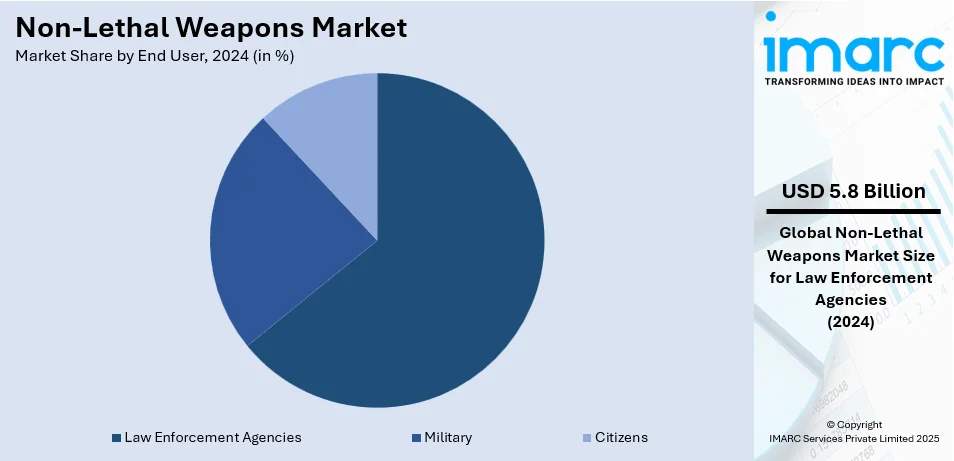

Analysis by End User:

- Law Enforcement Agencies

- Military

- Citizens

Law enforcement agencies the market with around 64.4% of market share in 2024. Law enforcement agencies use fewer lethality weapons in riot control as the need for effective tools to manage a crowd and eruption is very high. They want to maintain the order of things without victimizing individuals. They are making use of de-escalatory tactics in times of flashpoints. For example, it was provided in the Law Enforcement De-escalation Training Act of 2022 (LEDTA), which allocated $34 million for the Department of Justice to develop a de-escalation curriculum. The Act has also earmarked $90 million to provide local police departments with incentives for their participation in de-escalation programs. Also, studies indicated that de-escalation had an association with a 28 percent reduction in uses-of-force, a 26 percent decline in citizen injuries, and a 36 percent lower figure in officer injuries. Thus, these tactics become incomplete without resorting to non-lethal weapons because they provide good solutions for controlling suspects without causing any harm promoting safety to officers and the public.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 37.6%. North America dominates the non-lethal weapons market due to its substantial defense and security budgets, which enable significant investments in advanced technologies. The region is home to several leading manufacturers and research and development centers focused on pioneering non-lethal solutions. A major driver of market growth is the ongoing modernization of law enforcement and military capabilities, where non-lethal weapons offer an effective way to address emerging challenges. The region's focus on addressing civil unrest, terrorism, and other security threats also fuels the adoption of non-lethal weapons by both police and defense forces. These factors, combined with North America's commitment to enhancing public safety and maintaining peace, contribute to the continued expansion of the market in this region.

Key Regional Takeaways:

United States Non-Lethal Weapons Market Analysis

US accounts for 85.80% share of the market in North America. The demand for non-lethal weapons by law enforcement and military forces continues to grow in the U.S. Over 17,000 law enforcement agencies employing riot control and de-escalation tactics were identified by the U.S. Department of Justice as being in active use, non-lethal weapons in 2023. In addition, the U.S. military continues investing in non-lethal technology through its modernization programs, with such efforts influencing the expansion of this market. Acoustic and directed-energy weapons create further dynamics in this market as they advance. Axon Enterprise and Combined Systems are the domestic market leaders, while increased governmental funding for non-lethal methods ensures continued expansion. U.S. companies expand exports to all allied nations as well.

Europe Non-Lethal Weapons Market Analysis

European non-lethal weapons market is increasing due to strict policies of law enforcement agencies and increasing the budgets for defense. Some sources stated that the European Commission has increased military and defense technology funding by 7.3 billion euros (7.5 billion US dollars) for the period between 2021 and 2027. About 1.1 billion euros (1.13 billion US dollars) are earmarked for 2024. Riot control incidents in France and Germany have thus contributed to the developments in crowd control technologies. In North Rhine-Westphalia, police have employed Tasers 631 times in the first half of 2024. This is a decrease from 736 in 2023 during the same period. Their role in public security is being emphasized. The leading manufacturers Rheinmetall and FN Herstal develop electric shock weapons and rubber bullets that are tailored to NATO standards. EU regulations emphasize ethical weapon usage and compliance with international humanitarian laws. Investments in AI-driven surveillance and autonomous defense systems are other factors driving market growth.

Asia Pacific Non-Lethal Weapons Market Analysis

The Asia Pacific non-lethal weapons market is growing as defense budgets increase and security requirements grow. The total defense budget for India during the fiscal year 2024-25 was about ₹6.21 lakh crore, which is approximately USD 83 billion, with most of it allocated to modernization and self-reliance schemes. Law enforcement agencies in the region are incorporating non-lethal crowd control solutions and public security measures. According to a report by Japan's Ministry of Defense, the budget for non-lethal technologies stands at approximately ¥5.8 billion (around US$42 million), a 15% increase compared to the 2022 figure. China will also invest in non-lethal security equipment to strengthen its internal security. Regional collaborations between local and global defense firms are fostering innovations while governments prioritize research and development in making public safety better and militaries effective.

Latin America Non-Lethal Weapons Market Analysis

Latin American countries' non-lethal weapons market is experiencing growth, mainly because of the increasing public security concerns and rising defense budgets. The Brazilian Federal Police had a budgetary allocation for R$8.7 billion (US$1.49 billion) in 2023. The federal government of Mexico allocated funds to the tune of 726.53 million pesos, roughly 38.6 million US dollars in 2022, for the purchase of 17,442 body protection kits for the National Guard. The kits comprised protective suits, anti-riot helmets, gas masks, shields, and batons. It shows the focus on preparing forces for crowd control. Increased urban crime and protests in the region are demanding non-lethal weapons, as law enforcement is embracing advanced tools for crowd management. Local manufacturers and global defense firms are coming together to accelerate technology, placing Latin America on the emerging list of non-lethal security solutions.

Middle East and Africa Non-Lethal Weapons Market Analysis

The Middle East and Africa non-lethal weapons market is growing because of the increasing security issues and raised defense budgets. In December 2022, the Saudi Ministry of Finance published its budget for 2023, which reveals that the kingdom intended to raise its military expenditure by 50% in 2023 and to spend US$69 billion, which would be around 23% of its total budget. This growth is in alignment with Saudi Arabia's Vision 2030 goals of orienting 50% of its defense spending domestically. In the region, law enforcement agencies are investing in less lethal riot control tools. The demand for tear gas, rubber bullets, electroshocks among others is increasingly high. South Africa remains a key player as police forces and private security firms in the region have been acting very aggressively in using non-lethal weapons to prevent crime. Increased urbanization and civil unrest drive the adoption of advanced security solutions, and in this regard, non-lethal weapons become a must-have tool in the enforcement of law within the region.

Competitive Landscape:

The non-lethal weapons market is highly competitive, driven by increasing demand from military, law enforcement, and private security sectors. Key players focus on technological advancements, product innovation, and strategic partnerships to strengthen market positioning. Companies invest in directed-energy weapons, acoustic devices, and electroshock weapons to enhance operational effectiveness while complying with evolving regulatory standards. Mergers, acquisitions, and defense contracts further intensify competition, with firms expanding their global footprint. For instance, in January 2025, Byrna Technologies announced partnership with the USCCA to promote its less-lethal security solutions to nearly one million members, positioning them as alternatives to firearms and encouraging self-defense training. As security challenges grow, manufacturers prioritize research and development to deliver safer, more effective non-lethal solutions worldwide.

The report provides a comprehensive analysis of the competitive landscape in the non-lethal weapons market with detailed profiles of all major companies, including:

- Byrna Technologies Inc.

- Combined Systems Inc.

- FN Herstal, General Dynamics Corporation

- Intelligent Optical Systems Inc.

- Lamperd Less Lethal Inc.

- Mace Security International Inc.

- Moog Inc., Nonlethal Technologies Inc.

- Raytheon Technologies Corporation

- Rheinmetall AG

- Textron Inc.

- Zarc International Inc.

Latest News and Developments:

- February 2025: Byrna Technologies has now launched a CO2-powered non-lethal pistol in Franklin, Tennessee, meant for personal and self-defense purposes. This weapon incapacitate threats but does not kill, as it is made to prevent hot murder threats. This is supposed to serve as an alternative for personal protection and prevention from any crime without lethal force application.

- June 2024: Rheinmetall and Anduril Industries partnered for the development of advanced Counter-small Unmanned Aerial Systems (C-sUAS) for Europe. With the Skymaster command system from Rheinmetall, Anduril's Lattice software, Sentry Tower, Wisp sensors, and Anvil autonomous interceptor, both lethal and non-lethal means of defense are provided by this merger.

- February 2024: AARDVARK and Combined Systems, Inc. (CSI) entered into an agreement whereby AARDVARK will market and distribute Combined Tactical Systems Less-Lethal Products and Penn Arms Launchers. This is a significant change from AARDVARK's exclusive brand relationship, which continued for 25 years with one other company and further enhances its less-lethal offerings to end-users within law enforcement and corrections.

- May 2023: The Baltimore Board of Estimates approved a five-year, USD 5 million contract with Axon Enterprise Inc., making provision for the Baltimore Police Department to be supplied with 1,200 new tasers. The expenditure is essentially an extension on the existing contract, hence helping the department to make further progress in meeting federal standards in terms of less-lethal options.

- January 2023: Byrna Technologies Inc. announces set up of new subsidiary Byrna LATAM in Montevideo, Uruguay. This subsidiary will take over the manufacturing, marketing, and distribution of Byrna's non-lethal weapons product lines in Latin America.

Non-Lethal Weapons Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Gases and Sprays, Grenades, Bullets, Taser Guns, Others |

| Technologies Covered | Chemical, Electroshock, Mechanical and Kinetic, Acoustic/Light, Others |

| End Users Covered | Law Enforcement Agencies, Military, Citizens |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Byrna Technologies Inc., Combined Systems Inc., FN Herstal, General Dynamics Corporation, Intelligent Optical Systems Inc., Lamperd Less Lethal Inc., Mace Security International Inc., Moog Inc., Nonlethal Technologies Inc., Raytheon Technologies Corporation, Rheinmetall AG, Textron Inc., Zarc International Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the non-lethal weapons market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global non-lethal weapons market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the non-lethal weapons industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The non-lethal weapons market was valued at USD 9.0 Billion in 2024.

IMARC estimates the non-lethal weapons market to reach USD 14.8 Billion by 2033, exhibiting a CAGR of 5.7% during 2025-2033.

Key factors driving the non-lethal weapons market include rising civil unrest, increasing defense and law enforcement budgets, technological advancements, and growing demand for crowd control solutions. Stringent regulations on the use of lethal force, military modernization programs, and expanding applications in riot control, border security, and personal safety also contribute to market growth.

North America currently dominates the market with 37.6% share, driven by increasing defense budgets, advanced law enforcement technologies, and growing demand for crowd control solutions. The presence of major defense contractors, continuous research and development, and stringent security measures further strengthen the region’s leadership in the global non-lethal weapons industry.

Some of the major players in the non-lethal weapons market include Byrna Technologies Inc., Combined Systems Inc., FN Herstal, General Dynamics Corporation, Intelligent Optical Systems Inc., Lamperd Less Lethal Inc., Mace Security International Inc., Moog Inc., Nonlethal Technologies Inc., Raytheon Technologies Corporation, Rheinmetall AG, Textron Inc., Zarc International Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)