Non-GMO Food Market Size, Share, Trends and Forecast by Product Type, Application, Distribution Channel, and Region, 2025-2033

Non-GMO Food Market Size and Share

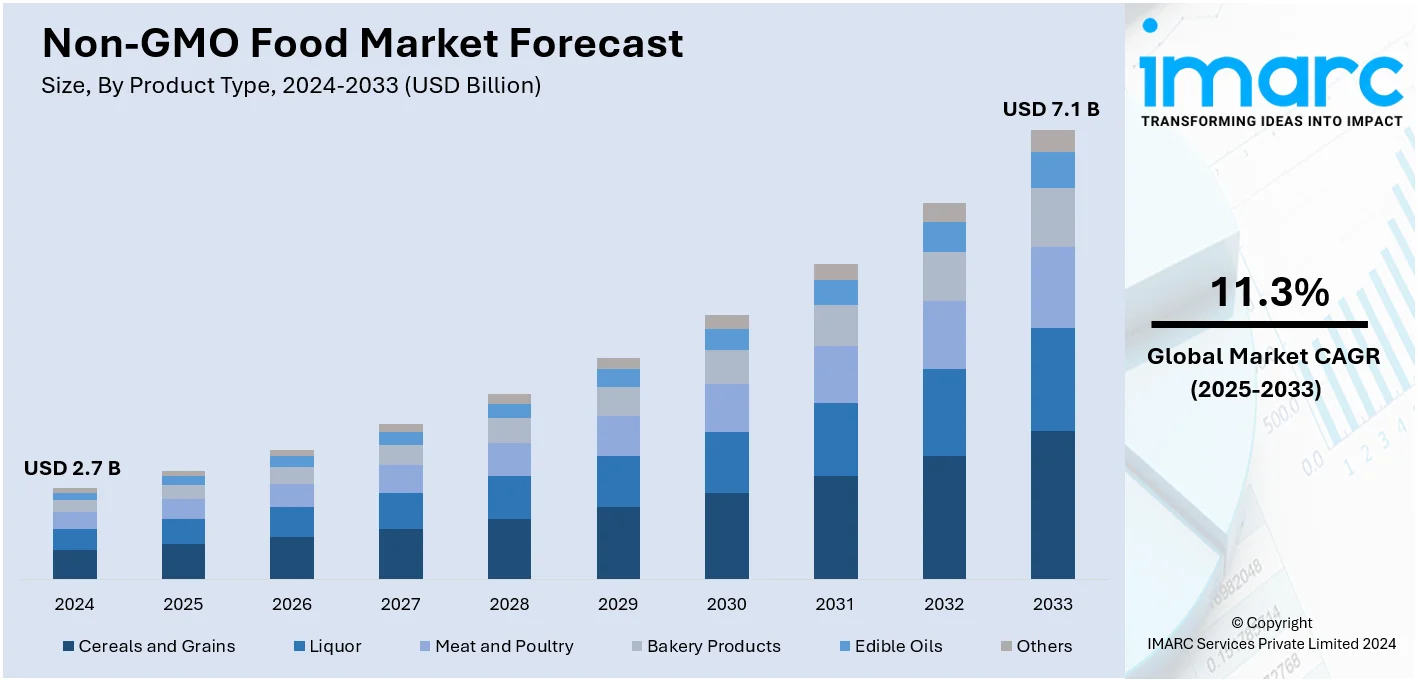

The global non-GMO food market size was valued at USD 2.7 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 7.1 Billion by 2033, exhibiting a CAGR of 11.3% from 2025-2033. North America currently dominates the market, holding a market share of over 37.9% in 2024. The increasing health consciousness, rising promotion of sustainable farming practices, and the growing demand for food products produced using non-GMO seeds are some of the factors driving the market across North America.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.7 Billion |

|

Market Forecast in 2033

|

USD 7.1 Billion |

| Market Growth Rate (2025-2033) | 11.3% |

A key factor driving the growth of the non-GMO food market is the increasing trend of health and wellness among consumers nowadays. The awareness about the dreaded genetically modified organism (GMO) risks has become much more encouraging among consumers to prefer natural and organic food products. Hence, non-GMO is considered safe and healthy as people associate it with environmental friendliness, transparency in food production, and access to online information that can make people more informed while purchasing products. Some dietary concerns, such as allergies and dietary sensitivities, have also influenced people to search for non-genetically modified organisms in production, which will serve in increasing the growth of this market. Moreover, food manufacturers are providing a wide range of non-GMO-certified products from fresh produce to processed goods for this consumer demand.

The United States has emerged as a regional market for non-GMO food. It is growing very strong, as more consumers demand products that are all-natural and healthy. Awareness about possible negative effects of GMOs on health has driven many people to switching to non-GMO foods as part of their diet. The switch has also greatly been facilitated as customers are now opting for cleaner label products. Consumers are becoming increasingly direct about food sourcing and processing. Besides, there are the initiatives and certification schemes which beget consumer confidence via non-GMO project verified label and other establishments driving customer purchases. Expansion includes further organic farming exercises directly aligned with non-GMO food production, which enhances the retail channels. The emergence of e-commerce and health-oriented grocery stores enhances the pygmy accessibility to non-GMO foods. Manufacturers here are meeting this demand by increasing their product portfolios to include non-GMO snacks, beverages, and packaged goods to provide the gradual increase in the market.

Non-GMO Food Market Trends:

Increasing health consciousness

The major factor boosting market is the increasing health consciousness and rising awareness among individuals regarding the nutritional value of consuming non-GMO food products. According to research conducted by the International Food Information Council in 2018, Millennials have a higher tendency to practice health and fitness in food choices than among other generations. In line with the increasing environmental issues, government agencies in various countries are undertaking measures to promote sustainable farming practices. Furthermore, the increased demand for food items produced with non-GMO seeds such as grains, vegetables, and fruits, as considered environment-friendly and natural, is also favoring the growth of the market. Moreover, the use of non-GMO food in manufacturing baby food and infant formula is increasing to improve digestion, thereby stimulating the non-GMO food market growth. Apart from this, the consumers who prefer ready to eat (RTE) food products are increasing due to urbanization, fast lifestyles, and increasing purchasing power, creating a favorable sea of prospects for market growth. According to the UN Habitat, in the year 2018, the average urbanization rate of China had reached about 59.6% with Zhejiang Province exceeding more than 68% and Guizhou Province up to almost 46%.

Stringent regulations

Another driving factor for the non-GMO food market is the establishment of stringent regulatory and certification standards. Certifications such as the non-GMO Project Verified label boost consumers' confidence in the genuineness of these products, thus increasing their attractivity. Governments and organizations have made stricter controls to ensure that labeling is more transparent for informed choices of consumers. All these provisions make the food manufacturers tend to modify their product formulations toward a non-GMO certificate to remain competitive in the market. Also, such standards appeal mostly to health freaks, environmental lovers, and even those with dietary restrictions. It, therefore, leaves the non-GMO segment as one of the prime focuses for the businesses, keeping pace with changing consumer trends and regulatory expectations to further develop this market.

Increasing demand for ethical food production

Consumers are showing heightened interest in sustainable and ethical food production practices, which is driving the non-GMO food market. Non-GMO crops are often cultivated using fewer chemical inputs, aligning with eco-conscious consumer preferences for products that have a reduced environmental impact. Ethical considerations, such as support for biodiversity and local farming communities, also play a critical role in this demand. Advocacy groups and certification programs like the non-GMO Project Verified label have bolstered consumer trust in these products. Additionally, as environmental concerns become central to purchasing decisions, businesses and retailers are adopting sustainable sourcing strategies and offering non-GMO product lines to stay competitive. This convergence of sustainability, ethics, and consumer demand is creating a robust foundation for growth in the non-GMO food market.

Non-GMO Food Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global non-GMO food market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, application, and distribution channel.

Analysis by Product Type:

- Cereals and Grains

- Liquor

- Meat and Poultry

- Bakery Products

- Edible Oils

- Others

In 2024, cereals and xrains hold the leading position with 32.7% share in the market. Cereals and grains are staple foods consumed globally, making them a primary focus in the non-GMO market. Their versatility in food production ranging from bread, pasta, and breakfast cereals to snacks and beverages ensures consistent demand. non-GMO cereals and grains are favored by health-conscious consumers due to their natural appeal and nutritional benefits. Additionally, their integration into gluten-free and organic product lines has amplified their market share, catering to evolving dietary preferences and specialized health needs. Moreover, consumers perceive non-GMO cereals and grains as healthier and more sustainable compared to their genetically modified counterparts. This preference is driven by concerns over potential health risks associated with GMOs, such as allergies and digestive issues. Products like non-GMO oats, quinoa, and rice are increasingly popular among individuals following clean eating, vegan, or plant-based diets.

Analysis by Application:

- Beverages

- Meat Products

- Fruits and Vegetables

- Dairy Alternatives

- Animal Feed

- Others

Beverages hold the leading position with 45.5% share of the market. Beverages such as juices, plant-based milks, and teas are among the most consumed products in the health and wellness category. Non-GMO labeling is often seen as a marker of purity and health, aligning well with consumer preferences in this space. Moreover, beverage manufacturers have been proactive in promoting non-GMO certification as part of their branding strategies. This resonates with health-conscious buyers who prioritize transparency in ingredients. Besides, many retailers and regions emphasize non-GMO certifications in beverages due to their wide consumption and potential impact on health, making it easier for these products to gain traction.

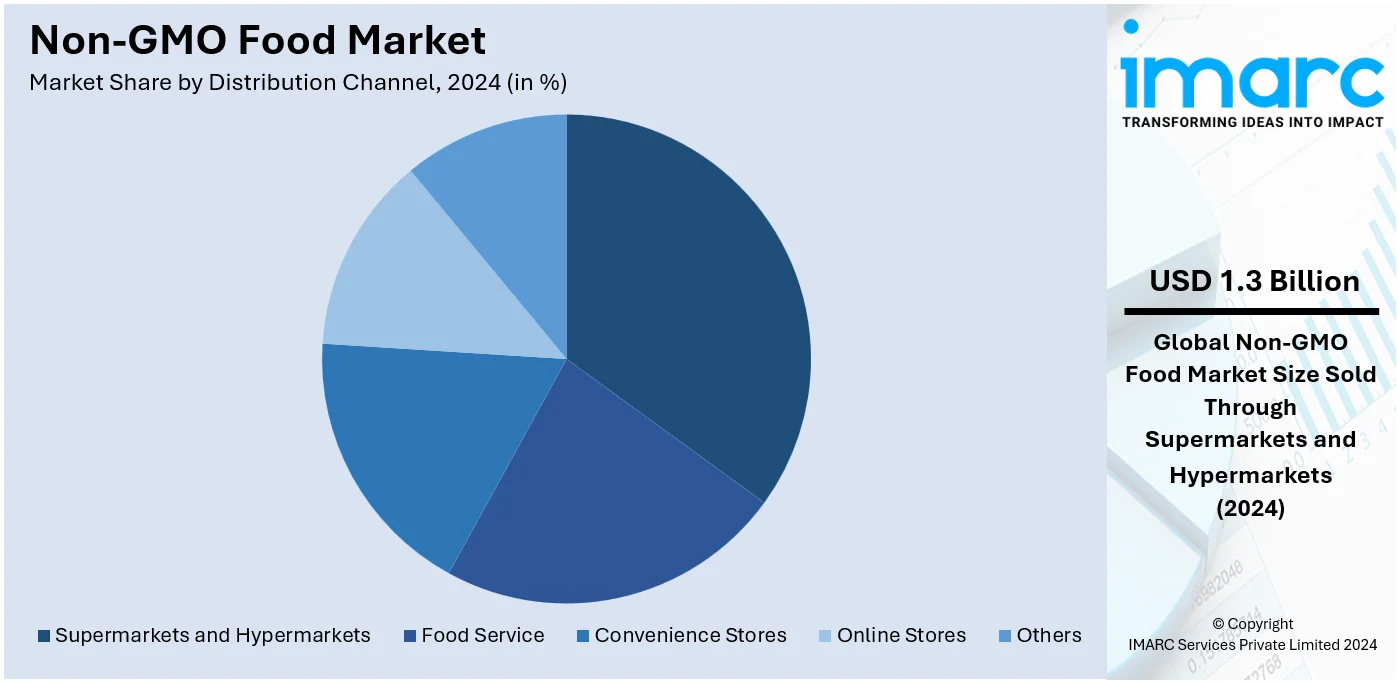

Analysis by Distribution Channel:

- Food Service

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

In 2024, supermarkets and hypermarkets accounted for the largest non-GMO food market share with 48.6%. This is due to their wide-ranging benefits in product availability, accessibility, and consumer trust. These large retail formats offer extensive shelf space, enabling them to stock a diverse selection of non-GMO products across multiple categories, such as fresh produce, packaged foods, and beverages. This variety allows consumers to find all their non-GMO needs in one place, enhancing convenience and shopping efficiency. The significant foot traffic in these retail outlets also gives non-GMO brands greater visibility, enabling them to reach a broader audience. Supermarkets and hypermarkets are often viewed as trusted sources for high-quality goods, and many have established partnerships with certified non-GMO suppliers to meet growing consumer demand. Additionally, these stores frequently feature promotions and discounts, making non-GMO products more affordable and appealing to a wide demographic.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In North America represents the dominant region in the market with 37.9%. The region's well-informed and health-conscious population drives significant demand for natural and non-modified food products. Consumers in North America increasingly prioritize transparency in food labeling, making certifications like "Non-GMO Project Verified" a strong influencer of purchasing decisions. This cultural shift towards clean eating has been further supported by the widespread availability of educational resources on potential health and environmental risks associated with genetically modified foods. Regulatory frameworks in the United States and Canada, such as mandatory GMO labeling laws, have also played a crucial role. These regulations encourage consumers to choose non-GMO alternatives while pushing food manufacturers to diversify their product lines to meet market demand. Additionally, North America’s robust organic farming practices and infrastructure for sustainable agriculture contribute to the easy accessibility of non-GMO ingredients and products.

Key Regional Takeaways:

United States Non-GMO Food Market Analysis

In 2024, the United states accounts for 86.70% of the non-GMO food in North America. The non-GMO food market across the region is growing significantly, driven by rising health awareness, increasing organic food consumption, and consumers preferring transparency in food labeling. According to the U.S. Department of Agriculture (USDA), the certified organic United States land for growing crops or livestock increased from 1.8 Million in 2000 to 4.9 Million in 2021. Moreover, organic sales in 2021 accounted for about 3 percent of United States farm receipts. The expansion of non-GMO certifications, along with stricter labeling regulations, also contributes to the market's growth, as more people seek products that align with their values of health, sustainability, and environmental responsibility.

Asia Pacific Non-GMO Food Market Analysis

Non-GMO food products is preferred across the Asia-Pacific countries due to increasing health consciousness and the growing adoption of Western dietary habits. Additionally, in countries such as India people prefer consuming organic food which is contributing to the growth of the market. According to Invest India, India produced approximately 2.9 Million Metric Tons of certified organic products during 2022-23. Additionally, rising middle class population across the region is also augmenting the market growth. According to the India Brand Equity Foundation (IBEF), wealthy households of India are earning over ₹2 crore (around USD 242,709) per year. This increased from USD 1.06 Million in 2016 to 1.8 Million in 2021, thereby increasing the purchasing power among the people and driving the demand for non-GMO food.

Europe Non-GMO Food Market Analysis

Agricultural practices across European region rely heavily on traditional farming which is contributing to the growth of the non-GMO food market. According to the U.S. Department of Agriculture (USDA), smallholdings ranging from one to five hectares remain the most prevalent in Hungarian agriculture, representing one-third of all farms. Meanwhile, land users managing plots of 200 to 500 hectares account for one-fifth of the total agricultural area. In line with this, the consumption of organic food is rising which is stimulating the market growth. According to the European Parliament, the EU's organic market has experienced consistent growth, reaching an annual valuation of approximately €37.4 Billion (USD 39.27 Billion). Furthermore, in 2018, out of the total 13.4 Million Hectares of agricultural land, 7.5% was allocated to organic farming practices. Additionally, the use of the organic logo on food products in European Union countries, signifying compliance with EU organic production standards, is fueling the market growth.

Latin America Non-GMO Food Market Analysis

The urban population is increasingly showing interest in non-GMO food products, especially as more people are becoming aware of health and environmental issues related to GMOs. Moreover, glyphosate is increasingly used in GMO crops which significantly causes infant mortality, preterm birth rates, and the occurrence of low birth rates, thus the rising awareness among people is favoring the market growth. According to the Central Intelligence Agency (CIA), in 2023, 87.8% of the total population in Brazil were living in urban areas. Moreover, the middle-class population residing across the region is also fuelling the market growth.

Middle East and Africa Non-GMO Food Market Analysis

Healthy eating habits and the growing popularity of organic foods are escalating the non-GMO market across the region. According to the U.S. Department of Agriculture (USDA), the South African organic foods market is experiencing consistent growth, as demonstrated by a significant rise in the number of certified farms, from 35 in 1999 to 250 in 2018. Additionally, there has been an expansion in the variety of organic products available through retailers, food markets, and specialty stores, thus favoring the market. Moreover, traditional agricultural practices across Africa are providing an impetus to the market growth.

Competitive Landscape:

Key players in the market are adopting multifaceted strategies to strengthen their market position and meet evolving consumer demands. One significant approach involves expanding product portfolios to include a diverse range of non-GMO options. Companies are investing in research and development to create innovative products that cater to specific dietary preferences, such as gluten-free, vegan, or organic non-GMO foods. This diversification helps brands reach broader consumer segments and enhance market penetration. Another strategy focuses on certifications and transparency. Leading brands are obtaining non-GMO certifications, such as "Non-GMO Project Verified," to build trust and credibility among consumers. These certifications, prominently displayed on packaging, appeal to health-conscious buyers and serve as a competitive advantage in retail spaces.

The report provides a comprehensive analysis of the competitive landscape in the non-GMO food market with detailed profiles of all major companies, including:

- Amy's Kitchen Inc.

- Blue Diamond Growers

- Clif Bar & Company

- Chiquita Brands International Sarl

- The Hain Celestial Group Inc.

- Nature's Path Foods Inc.

- Now Health Group Inc.

- Organic Valley

- Pernod Ricard SA

- United Natural Foods Inc.

Latest News and Developments:

- March 2024: UK-based biotech firm Clean Food Group (CFG) successfully secured £2.5 Million (USD 3.13 Million) in funding to advance the commercialization of its yeast-derived, non-GMO palm oil alternative, aiming for a market launch by 2025.

- August 2024: Nosh.bio, a prominent B2B food tech startup specializing in ingredients derived from fermented fungi, has forged a pioneering commercial alliance with the zur Mühlen Group (ZMG), one of Europe's leading sausage manufacturers. This partnership represents a significant advancement in the food industry with the debut of Koji Chunks, a novel category of clean-label products. As a subsidiary of the Tönnies Group, a major force in European meat production, ZMG utilized its extensive retail network to introduce Koji Chunks to the German market. These Koji Chunks, created from Nosh.bio’s non-GMO, non-novel fungi, are available in five different flavors and are poised to make a major impact as the first-ever single-ingredient meat substitute.

Non-GMO Food Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Cereals and Grains, Liquor, Meat and Poultry, Bakery Products, Edible Oils, Others |

| Applications Covered | Beverages, Meat Products, Fruits and Vegetables, Dairy Alternatives, Animal Feed, Others |

| Distribution Channels Covered | Food Service, Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amy's Kitchen Inc., Blue Diamond Growers, Chiquita Brands International Sarl, Clif Bar & Company, The Hain Celestial Group Inc., Nature's Path Foods Inc., NOW Health Group Inc., Organic Valley, Pernod Ricard SA, United Natural Foods Inc, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the non-GMO food market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global non-GMO food market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the non-GMO food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Non-GMO food refers to food products made from ingredients that are not genetically modified organisms (GMOs). GMOs are organisms, such as plants, animals, or microorganisms, whose genetic material has been altered in a way that does not occur naturally through mating or natural recombination. This is typically done in laboratories to introduce specific traits, such as resistance to pests, improved nutritional content, or higher yields.

The non-GMO food market was valued at USD 2.7 Billion in 2024.

IMARC estimates the global non-GMO food market to exhibit a CAGR of 11.3% during 2025-2033.

The increasing health consciousness, rising promotion of sustainable farming practices, and the growing demand for food products produced using non-GMO seeds are some of the primary factors driving the market growth.

In 2024, cereals and grains represented the largest segment driven by their versatility in food production ranging from bread, pasta, and breakfast cereals to snacks and beverages that ensures consistent demand.

Beverages lead the market as they are often ready-to-consume and widely available, making it simpler for consumers to choose non-GMO options as part of their daily routines.

Supermarkets and hypermarkets are the leading segment driven by their wide-range in product availability, accessibility, and consumer trust. These large retail formats offer extensive shelf space, enabling them to stock a diverse selection of non-GMO products.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global non-GMO food market include Amy's Kitchen Inc., Blue Diamond Growers, Chiquita Brands International Sarl, Clif Bar & Company, The Hain Celestial Group Inc., Nature's Path Foods Inc., NOW Health Group Inc., Organic Valley, Pernod Ricard SA, United Natural Foods Inc, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)