Non-ferrous Scrap Recycling Market Report by Metal (Aluminum, Copper, Lead, and Others), Sector (Construction, Automotive, Consumer Goods, Industrial Goods), and Region 2026-2034

Non-ferrous Scrap Recycling Market Size:

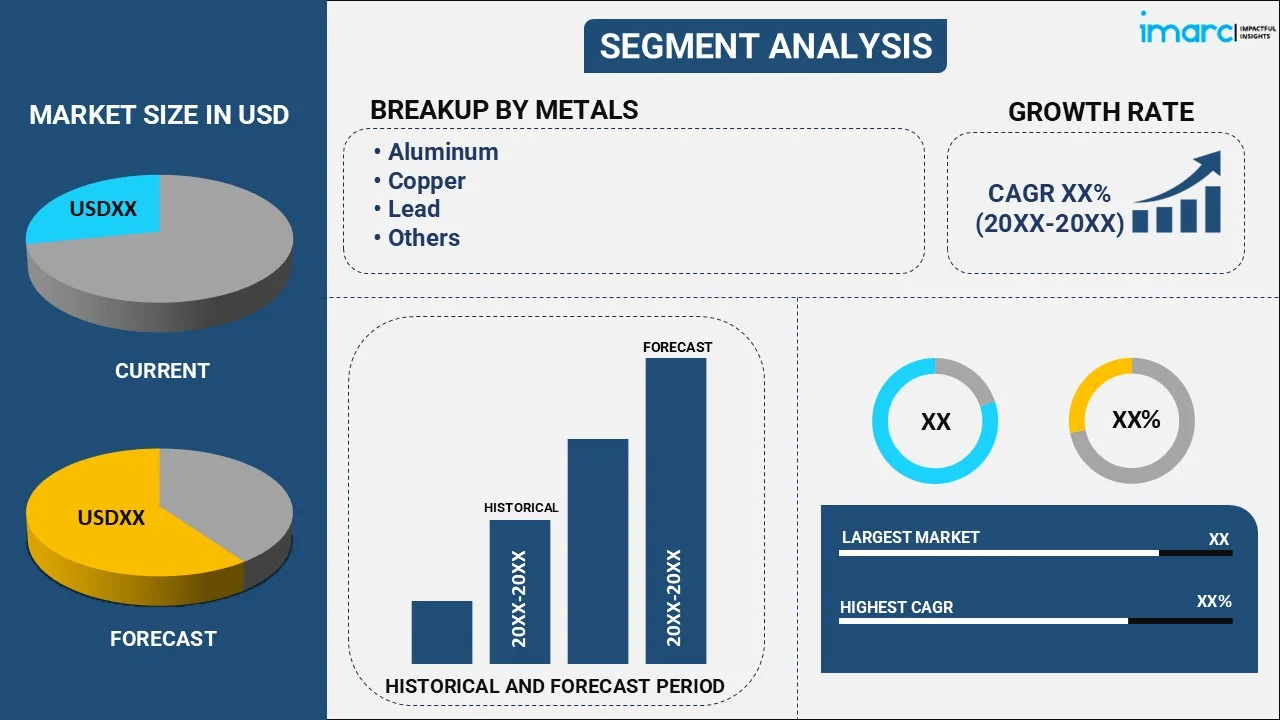

The global non-ferrous scrap recycling market size reached USD 282.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 349.5 Million by 2034, exhibiting a growth rate (CAGR) of 2.31% during 2026-2034. The market is experiencing significant growth mainly driven by the rising environmental awareness, the growing product demand from automotive and electronics industries and technological advancements in recycling technologies, along with rising inclination toward sustainable development.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 282.7 Million |

| Market Forecast in 2034 | USD 349.5 Million |

| Market Growth Rate (2026-2034) | 2.31% |

Non-ferrous Scrap Recycling Market Analysis:

- Major Market Drivers: The key market drivers include the rising environmental awareness and sustainability initiatives which promotes recycling in order to reduce the carbon footprints. Various technological advancements in non-ferrous scrap recycling processes such as advanced sorting and processing equipment further enhances the efficiency and recovery rates. The rising demand from automotive and electronics industries mainly for materials like aluminum and copper also fuels the market growth. Furthermore, various government policies and incentives aimed at encouraging recycling and circular economy practices significantly boosts the non-ferrous scrap recycling market growth.

- Key Market Trends: Key market trends include the rising adoption of advanced sorting technologies such as Eddy current separators and sensor-based systems, which enhances metal recovery rates and purity. The rise in electric vehicle production and electronic device proliferation further boosts demand for recycled metals like aluminum and copper. Additionally, supportive government regulations promoting recycling and sustainability along with the rising environmental awareness and resources scarcity is driving the non- ferrous scrap recycling market growth.

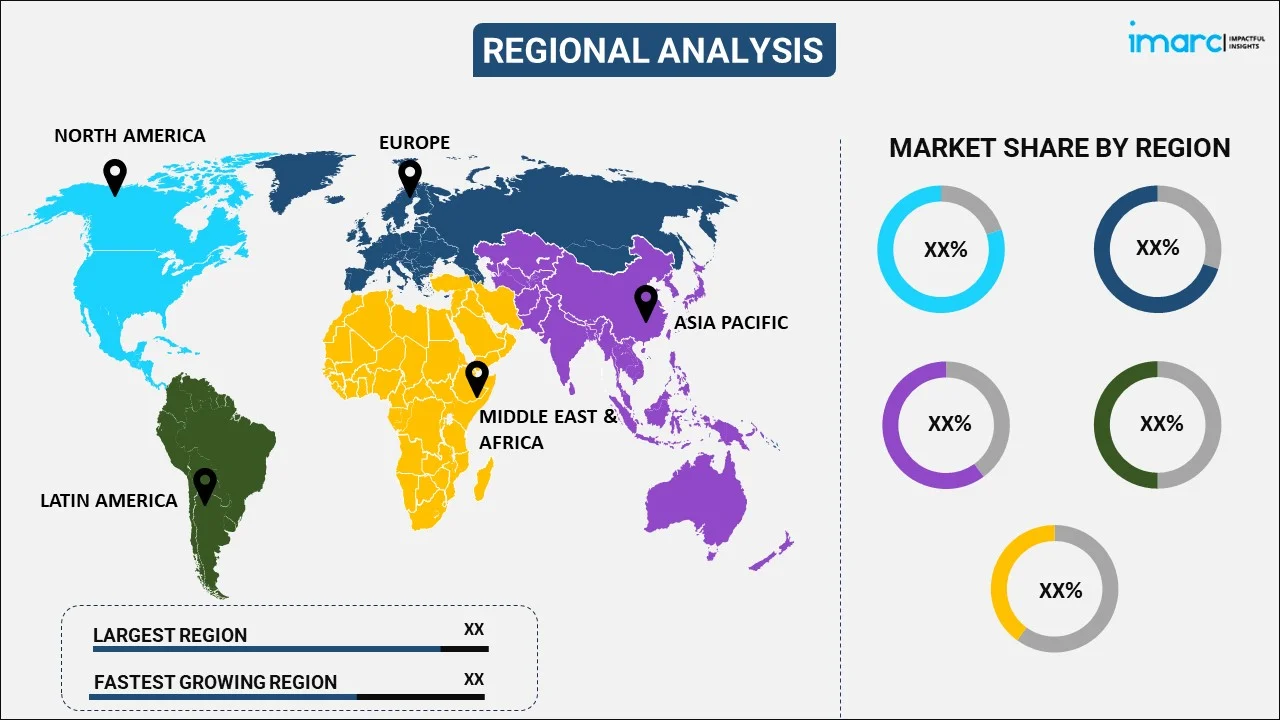

- Geographical Trends: Geographical trends in the market shows significant growth in Asia Pacific region mainly due to the rapid industrialization and rising demand from automotive and electronics sector. North America and Europe also hold significant shares generally driven by strict environmental regulations and advanced recycling infrastructures. Emerging economies in Latin America and Middle East are witnessing a significant growth due to the gradual increase in industrial activities and government initiatives promoting recycling. These regions are investing heavily in modern recycling technologies in order to enhance the overall metal recovery and support sustainable practices.

- Competitive Landscape: Some of the major market players in the non-ferrous scrap recycling industry include ArcelorMittal S.A., Aurubis AG, Commercial Metals Company, Dowa Eco-System Co. Ltd. (Dowa Holdings), European Metal Recycling Limited, Remondis SE & Co. KG (Rethmann Se & Co. Kg), SA Recycling LLC (Sims Ltd.), Sims Limited, among many others.

- Challenges and Opportunities: The market faces various challenges like contamination issues, high processing costs and fluctuation in raw material supply which in turn can impact the quality and efficiency of recycling operations. However, significant opportunities arise from technological advancements in sorting and processing which enhances the overall recovery rates and operational efficiency. Rising demand from the automotive and electronics industries along with the supportive government policies and rising environmental awareness further drives the non- ferrous scrap recycling market growth.

To get more information on this market Request Sample

Non-ferrous Scrap Recycling Market Trends:

Increasing Environmental Awareness and Sustainability Initiatives

There is a rising focus on sustainability and the reduction of carbon footprints across the world. Recycling non-ferrous metals such as aluminum, copper, and zinc is more energy-efficient than producing primary metals, leading to a significant decrease in greenhouse gas (GHG) emissions. This environmental benefit is increasing both regulatory backing and consumer interest in recycled materials. For instance, according to a report published by Recycling International, the global production of recycled non-ferrous metals in 2023 totaled 17.6 million tonnes in China, marking a 6.34% increase. This includes 3.85 million tonnes of recycled copper, 9.5 million tonnes of recycled aluminum, 2.95 million tonnes of recycled lead, and 1.3 million tonnes of recycled zinc.

Technological Advancements

Recent advancements in smart collection bins, mobile scrap processing, AI-driven market analysis, blockchain for transparent supply chain tracking, and 3D printing for creating new products are reshaping the scrap metal sector. These innovations promise streamlined collection, processing, and sales, ultimately boosting profits and promoting environmental sustainability. For instance, international metal recycling leader Sims Metal invested $300,000 in an electric car flattener at its Allens Avenue site. This new equipment is expected to reduce CO2 emissions by 9.6 tons annually and supports Rhode Island's 2021 Act on Climate. Sims Metal's commitment to sustainability and innovation aligns with the state's net-zero carbon emissions goal by 2050. These efforts underscore the industry's shift towards more efficient and eco-friendly practices, driven by technological advancements and regulatory support.

Rising Demand from Automotive Industry

The rising product demand from the automotive industry significantly drives the non-ferrous metals recycling market. The increasing production of electric vehicles (EVs) and the proliferation of electronic devices boost the need for recycled metals. Recycled aluminum is particularly valuable in vehicle manufacturing due to its lightweight and high-strength properties, which enhance fuel efficiency and performance. For instance, in October 2023, SUEZ and Toyota Tsusho expanded their partnership to enhance metal recovery in Türkiye's automotive industry, with a 50% increase in activity. This collaboration aims to develop innovative solutions for waste management and value extraction. The enhanced metal recovery capacity will contribute to the automotive industry's efforts in decarbonization, resource conservation, and circular economy. The partnership signifies a significant step towards a more sustainable and environmentally friendly automotive sector.

Non-ferrous Scrap Recycling Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on metal and sector.

Breakup by Metal:

To get detailed segment analysis of this market Request Sample

- Aluminum

- Copper

- Lead

- Others

Aluminum accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the metal. This includes aluminum, copper, lead, and others. According to the report, aluminum represented the largest segment.

Aluminum represents largest non-ferrous scrap recycling market share, driven by its widespread applications and superior recyclability. Industries such as automotive, aerospace, and construction extensively utilize recycled aluminum due to its favorable strength-to-weight ratio, durability, and resistance to corrosion. The energy efficiency of aluminum recycling, which uses significantly less energy than producing new aluminum from raw materials, enhances its environmental benefits. This makes aluminum a critical material in reducing greenhouse gas (GHG) emissions and promoting sustainable practices. Consequently, the economic and environmental advantages of aluminum recycling reinforce its leading position in the non-ferrous scrap recycling market. For instance, Latasa Reciclagem, a leading aluminum recycling company in Brazil, is pioneering innovation in the industry. With a capacity of over 300,000 tons per year, they utilize state-of-the-art technology for sorting and processing, including a new Taint/Tabor Processing Line inaugurated in 2022. Their commitment to sustainability is evident in their goal to recycle 100% of processed aluminum.

Breakup by Sector:

- Construction

- Automotive

- Consumer Goods

- Industrial Goods

Construction holds the largest share of the industry

A detailed breakup and analysis of the market based on the sector has also been provided in the report. This includes construction, automotive, consumer goods, and industrial goods. According to the report, construction represented the largest segment.

The construction industry holds the largest the non-ferrous scrap recycling market share, driven by its substantial demand for materials like aluminum, copper, and zinc. These metals are integral to construction projects for their durability, lightweight properties, and resistance to corrosion. Recycled non-ferrous metals are used extensively in building frames, wiring, and plumbing, contributing to sustainable building practices. The industry's commitment to reducing environmental impact and costs through recycling further reinforces its dominant position in the market.

Breakup by Region:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest non-ferrous scrap recycling market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific represents the largest regional market for non-ferrous scrap recycling.

The Asia Pacific region leads the non-ferrous scrap recycling market, accounting for the largest market share. This dominance is driven by rapid industrialization and urbanization in countries such as China, India, and Japan, which generate substantial amounts of scrap metal. The region's extensive manufacturing activities, coupled with government initiatives promoting recycling and sustainable practices, bolster this market leadership. Additionally, the high demand for non-ferrous metals in construction and automotive industries further supports the growth of the non-ferrous scrap recycling market in the Asia Pacific. In June 2024, Mitsui & Co., Ltd. announced its plans to invest in MTC Business Private Ltd., India's prominent metal recycling company. This investment aims to bolster MTC's position as an equity method affiliate of Mitsui. With over 30 recycling locations across India, MTC is poised for significant growth, especially in the steel industry. Mitsui's investment reflects its commitment to a circular economy and its focus on industrial solutions for societal development.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the non-ferrous scrap recycling industry include ArcelorMittal S.A., Aurubis AG, Commercial Metals Company, Dowa Eco-System Co. Ltd. (Dowa Holdings), European Metal Recycling Limited, Remondis SE & Co. KG (Rethmann Se & Co. Kg), SA Recycling LLC (Sims Ltd.), Sims Limited, etc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- The non-ferrous scrap recycling market is highly competitive, with key players such as ArcelorMittal S.A., Aurubis AG, Commercial Metals Company, Dowa Eco-System Co. Ltd. (Dowa Holdings), leading the industry. These companies leverage advanced technologies and extensive global networks to maintain their market positions. Innovations in sorting and processing, along with strategic acquisitions and partnerships, enable them to enhance operational efficiency and expand market reach. Additionally, regional players in Asia Pacific, driven by rapid industrialization and supportive government policies, contribute significantly to the competitive landscape, intensifying market dynamics.

Non-ferrous Scrap Recycling Market News:

- In June 2023, EMR, in collaboration with industry partners, announced that it aims to increase the use of recycled aluminum in UK manufacturing. The initiative seeks to reduce carbon emissions and reliance on virgin materials. By adjusting grade specifications and improving separation techniques, EMR plans to ensure that recycled aluminum meets quality standards for use in domestic products. The endeavor highlights the environmental and financial benefits of utilizing recycled aluminum, particularly in the automotive industry.

- In March 2023, Sims Metal, a global leader in metal recycling, acquired Pennsylvania-based Northeast Metal Traders (NEMT) in mid-April 2023. The acquisition will bring commercial and operating synergies to expand Sims Metal North America's non-ferrous business and strengthen its presence in Philadelphia. This move aligns with Sims Limited's growth strategy and will significantly increase the company's copper volumes, enhancing its position in the energy transition and decarbonisation.

Non-ferrous Scrap Recycling Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Metals Covered | Aluminum, Copper, Lead, Others |

| Sectors Covered | Construction, Automotive, Consumer Goods, Industrial Goods |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ArcelorMittal S.A., Aurubis AG, Commercial Metals Company, Dowa Eco-System Co. Ltd. (Dowa Holdings), European Metal Recycling Limited, Remondis SE & Co. KG (Rethmann Se & Co. Kg), SA Recycling LLC (Sims Ltd.), Sims Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the non-ferrous scrap recycling market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global non-ferrous scrap recycling market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the non-ferrous scrap recycling industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global non-ferrous scrap recycling market size reached USD 282.7 Million in 2025.

The non-ferrous scrap recycling market is projected to reach USD 349.5 Million by 2034, growing at a CAGR of 2.31% during 2026-2034.

Increasing environmental awareness and sustainability initiatives are key drivers of the market. The growing demand for recycled metals like aluminum and copper from automotive and electronics industries also plays a significant role. Technological advancements in recycling processes, such as advanced sorting and processing equipment, are improving efficiency and recovery rates. Additionally, government policies and incentives aimed at promoting recycling and the circular economy are further boosting market growth.

Asia Pacific holds the largest market share, driven by rapid industrialization, high demand for non-ferrous metals in the construction and automotive sectors, and government initiatives promoting sustainable practices.

Major players in the non-ferrous scrap recycling market include ArcelorMittal S.A., Aurubis AG, Commercial Metals Company, Dowa Eco-System Co. Ltd. (Dowa Holdings), European Metal Recycling Limited, Remondis SE & Co. KG (Rethmann Se & Co. Kg), SA Recycling LLC (Sims Ltd.), Sims Limited, and others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)