Non-Alcoholic Beverage Market Size, Share, Trends and Forecast by Product Type, Packaging Type, Distribution Channel, and Region, 2025-2033

Non-Alcoholic Beverage Market Size and Share:

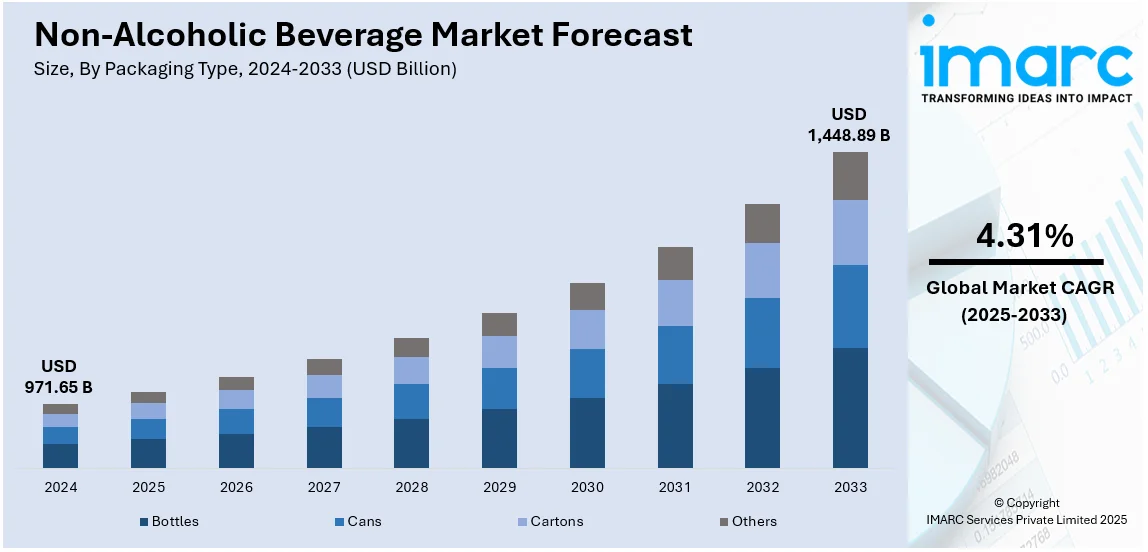

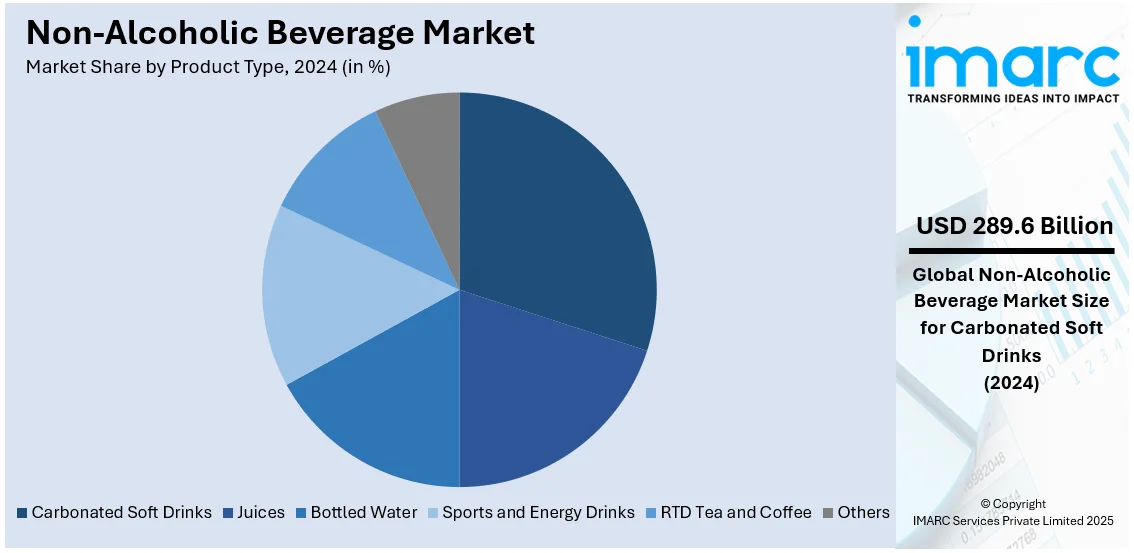

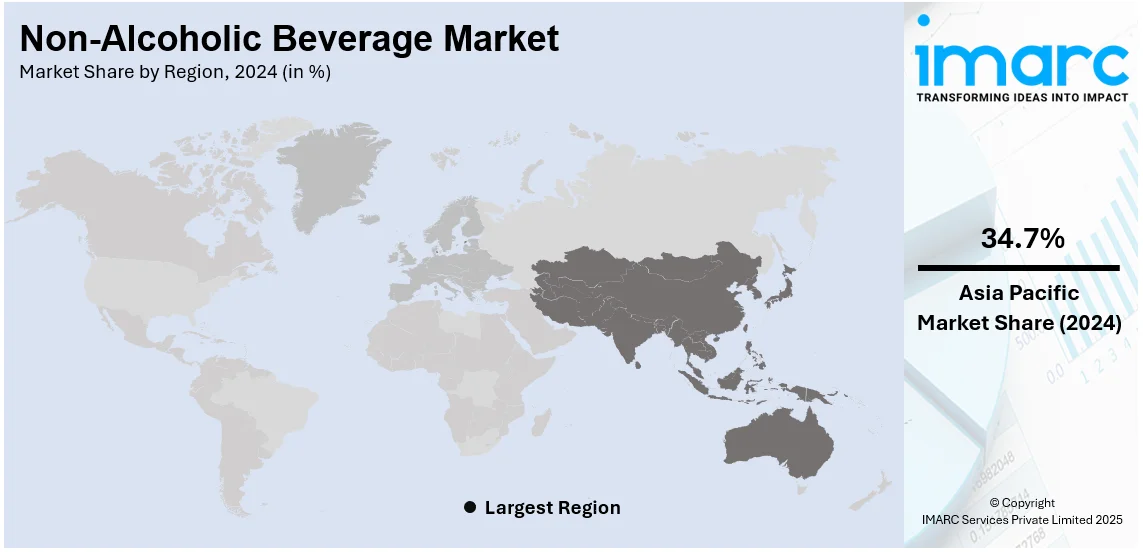

The global non-alcoholic beverage market size was valued at USD 971.65 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,448.89 Billion by 2033, exhibiting a CAGR of 4.31% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 34.7% in 2024. The non-alcoholic beverage market share is primarily driven by the increasing demand for healthier beverage options, the elevating requirement for single-serve, ready-to-drink non-alcoholic variants, and the inflating income levels of consumers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 971.65 Billion |

|

Market Forecast in 2033

|

USD 1,448.89 Billion |

| Market Growth Rate (2025-2033) | 4.31% |

The global non-alcoholic beverage market demand is witnessing remarkable expansion, primarily fueled by growing consumer awareness of health and wellness. Research published in Nature Medicine underscores the serious health implications of consuming sugar-sweetened beverages (SSBs), linking them to nearly 2.2 million new cases of type 2 diabetes and 1.2 million new cases of heart disease each year. In response to such findings, the World Health Organization (WHO) reports that, as of July 2022, 108 countries have implemented national-level excise taxes on at least one type of SSB to curb consumption and promote healthier choices. This shift in consumer behavior is further evidenced by the rising popularity of no- and low-alcohol beverages, particularly among millennials. A study by IWSR reveals that, between 2022 and 2024, the number of consumers opting for no-alcohol products increased by 61 million across ten key countries, including the United States, United Kingdom, and Canada. These trends underscore a growing global preference for healthier beverage options, significantly influencing the expansion of the non-alcoholic beverage market share.

To get more information on this market, Request Sample

The non-alcoholic beverage market growth in the United States is undergoing significant expansion, propelled by a combination of influential factors. Health-conscious consumers are increasingly seeking low- or no-alcohol alternatives, leading to a surge in non-alcoholic beverage options. This shift is especially prominent among millennials and Generation Z, who emphasize wellness and adopt a lifestyle centered on balance and moderation. The market's expansion is also fueled by the introduction of innovative products, such as functional beverages that offer added health benefits, and the rising popularity of plant-based and organic drinks. Moreover, the rising popularity of ready-to-drink options aligns with the fast-paced lifestyles of many Americans, contributing significantly to the market's expansion. This upward trend highlights the industry's adaptability in meeting changing consumer preferences and lifestyle demands.

Non-Alcoholic Beverage Market Trends:

Escalating Demand from Fitness-Conscious Consumers

The growing demand for healthy drinks along with the changing preferences of consumers toward something different and unique flavors is the primary reason behind market demand in the non-alcoholic beverage market. Further, the health-conscious nature of the youth leads to increased demand for beverages that hold fewer or no calories. In addition, athletes, gym-goers, sportspersons, and fitness enthusiasts characteristically take sports and energy drinks while engaging in high-intensity exercise, which replenishes fluids and electrolytes and gives them instant energy. For example, Applied Nutrition just launched its new L-Carnitine sports drink that contains no sugar, no calories, 1,500 mg of L-Carnitine, and vitamins B3, B6, and B12. In addition to this, the growing functional beverage market and rising sport-specific participation are also helping fuel the market around the world. In 2023, approximately 242 million individuals in the United States engaged in sports and fitness activities, according to the 15th Annual State of the Industry Report published by the Sports & Fitness Industry Association in collaboration with Sports Marketing Surveys USA. For instance, GO MATE launched a natural energy drink line. The firm has developed a set of flavors using all-natural ingredients. As an extension to this, Red Bull launched the summer edition dragon fruit flavored beverage. This Summer Edition was derived from the Asian native and exotic fruit called dragonfruit or pitaya and comes in 250 ml and 350 ml cans.

Increasing Need for Ready-to-Drink Beverages

With the growing awareness of overall wellness, consumers seek alternatives to the traditional sugary sodas and prefer non-alcoholic ready-to-drink beverages that usually include natural ingredients and functional benefits, which is driving market growth forward. The percentage of RTD drinkers who consume RTDs more than once a week grew from 39% in 2022 to 43% in 2023, reports indicate. In addition, the growing personal demand for healthier and more innovative drink formulations is also driving the non-alcoholic beverage market outlook. For instance, in February 2024, the Coca-Cola Company released Coca-Cola Spiced in North America. The beverage is available in two flavors: Coca-Cola Spiced and Coca-Cola Spiced Zero Sugar. In addition, PepsiCo, Inc. launched the new and improved Pepsi Zero. This beverage includes new sweeteners and tastes refreshing. This new product launch highlights the company's commitment to stay competitive in this changing beverage landscape, to maintain alignment with consumers, and to satisfy the increasing requirement for innovation. Apart from that, large players are also considering adding natural ingredients, functional benefits, and new flavors to outstrip the competition and boost the market globally.

Innovative Product Launches

Health awareness is one of the most prominent trends driving up revenue in the market for non-alcoholic beverages as consumers seek out healthier alternatives to traditional sweet beverages. Increasingly, they are choosing beverages that provide a functional benefit-such as hydration, vitamins, or antioxidants-while eliminating calories, sugars, and artificial ingredients. Such a trend has boosted the fortunes of several categories, including bottled water, flavored water, herbal teas, and natural fruit juices. Other players, including soft drinks companies, also are finding this trend with their low-calorie formulations, natural sweeteners, and functional ingredients to fit customer preferences. An example would be that based on industry reports, searches for non-alcoholic beverages are on an increase, a 22% rise year by year. It is noted as well that a U.S. tea company Good Earth broadened its distribution in the UK. The company portfolio holds an assortment of fruit & herbal, green, and black teas along with original and flavored kombucha, blended with natural ingredients. Besides this, it is further estimated that according to the Bacardi Cocktail Trends Report, globally about 58% of the consumers are opting for non-alcoholic and low-ABV cocktails and drinks.

Non-Alcoholic Beverage Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global non-alcoholic beverage market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, packaging type, and distribution channel.

Analysis by Product Type:

- Carbonated Soft Drinks

- Juices

- Bottled Water

- Sports and Energy Drinks

- RTD Tea and Coffee

- Others

As per the latest non-alcoholic beverage market outlook, carbonated soft drinks accounted for the largest share of 29.8% in the non-alcoholic beverage market. They are recognized for their effervescence and wide array of flavors, catering to diverse taste and preferences. The convenience and availability of CSDs in various packaging sizes further contribute to their popularity, making them a go-to choice for individuals seeking a quick and satisfying thirst-quencher. For instance, United Kingdom-based start-up PerfectTed launched a range of canned natural energy drinks powered by matcha green tea. The three flavors include pineapple yuzu, apple raspberry, and pear ginger, all made from real fruit juice. The drinks are 100% natural, plant-based, gluten-free, and free from additives, preservatives, and added sugars.

Analysis by Packaging Type:

- Bottles

- Cans

- Cartons

- Others

Based on the recent non-alcoholic beverage market forecast, packaging is also essential in the non-alcoholic beverages market to attract consumers and ensure that the final product stays fresh. Bottles, cans, and cartons are the most common packaging formats for these various beverages. Bottles are versatile and convenient with options including glass and plastic in different sizes and shapes. PepsiCo, for example, opened its largest US bottling plant in Colorado. The new facility could realize 100% renewable electricity, the best class of water efficiency, and less usage of virgin plastic. Packaging formats like cans will support transportability and reusability, widely used with carbonated and energy drinks, whereas cartons are the package of the future for juices, flavored water, and dairy-based beverages with light weight and environmental sustainability. Different packing format will provide different benefits in terms of convenience, shelf-life, and environmental sustainability.

Analysis by Distribution Channel:

- Retail

- Food Service

- Supermarkets and Hypermarkets

- Online Stores

- Others

Owing to the availability of a broad category of brands and goods under one roof, retail stores in this subsection hold the largest market share. In addition to this, several retail stores are increasing their selections in the alcohol-free market, including Whole Foods, Target, Aldi, and Walmart. For instance, Red Bull launched its limited-edition strawberry and apricot-flavored extension. Red Bull Summer Edition Strawberry Apricot was made available on Walmart's shelves in the United States from April 4, 2022, and was sold in single cans in both 8.4oz (25cl) and 12oz (35cl) formats.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

As per the non-alcoholic beverage market report, Asia Pacific accounted for the largest segment of the market, holding 34.7% share. This is attributed to the expanding food and beverage industry and the rising demand for cleaner and more minimalistic drinks. In addition to this, the elevating individual requirement for variants that claim to be ‘free from’ or ‘organic’, on account of the rising awareness towards allergies, hormones, and unethical animal husbandry practices used, is also catalyzing the market growth. Moreover, the widespread adoption of plant-based drinks and the rising popularity of veganism are further affecting non-alcoholic beverage market recent prices across the region. For instance, in July 2022, GO MATE launched a product line of natural energy drinks. The company has made a set of flavors that utilize all-natural ingredients. Furthermore, in developing countries, such as China, India, etc., consumers' inclination and participation in fitness activities and sports have significantly increased to attain a healthy lifestyle. For example, Red Bull released the summer edition dragon fruit flavored drink. This Summer Edition was inspired by the Asian native and exotic fruit called dragonfruit or pitaya, depending on the location, which is available in 250 ml and 350 ml cans.

Key Regional Takeaways:

North America Non-Alcoholic Beverage Market Analysis

The market for non-carbonated, non-alcoholic beverages in North America is being led by health, innovation, and shifting attitudes and preferences of consumers. Consumers are increasingly switching to beverages that promote their health, such as functionals, plant-based, and flavored water-from sugary drinks and carbonated ones. Consumers are opting for beverages that can provide additional nutritional benefits to them, like vitamins-enriched energy drinks and probiotic-rich drinks which benefit their gut. According to the U.S. Department of Agriculture, per capita consumption of bottled water has overtaken that of soft drinks, a clear sign of this movement toward healthier alternatives. Innovation in products is the key driver here, as companies introduce new flavors, low-sugar products, and eco-friendly packaging to grab the consumer's attention. Among these, plant-based milk alternatives, such as oat and almond milk, are especially in demand, given the increasing vegan and flexitarian lifestyle. Reflecting this trend, the United States is the world's largest plant-based beverages market. E-commerce and direct-to-consumer channels are also driving growth, offering convenience, product variety, and allowing for greater opportunities for market outreach by leading regional players. Heavy investment in digital marketing and social media campaigns to target a younger demographic with diversified distribution networks catering to diverse consumer needs is continuing to drive North America's market momentum.

United States Non-Alcoholic Beverage Market Analysis

The United States non-alcoholic beverage market is being driven by the evolution of consumer preferences, increased focus on health and wellness, and new product offerings. There is an increasing health consciousness among consumers that has led to an increase in the demand for functional beverages such as fortified water, energy drinks, and plant-based beverages. People are also opting for beverages that have low sugar content. This is accompanied by innovations in product development, such as the addition of natural ingredients, adaptogens, and probiotics, which is driving market growth. Companies are investing in product transparency and clean labeling to meet consumer demand for healthier alternatives. For example, sparkling water brands and kombucha have experienced significant market penetration due to their perceived health benefits. Besides this, environmental awareness is increasingly shaping purchasing behavior. Most consumers prefer sustainable packaging solutions, including aluminum cans and biodegradable bottles. In addition, the market is further supported by the increasing availability of these beverages across various retail channels, including e-commerce platforms and convenience stores. People in the region are increasingly preferring online channels for product purchases owing to their enhanced convenience. Reports claim that the number of consumers shopping online in the United States is estimated to increase 5.6% in 2024 to 273.49 Million. Last but not least, the marketing strategies of millennials and Gen Z, focusing on experiences and wellness, play a significant role in the market's growth.

Europe Non-Alcoholic Beverage Market Analysis

The European non-alcoholic beverage market is driven by stringent health regulations, shifting consumer preferences, and growing demand for sustainable products. Health-conscious consumers are at the forefront of this trend, with rising awareness about the adverse effects of sugary beverages leading to increased demand for sugar-free and functional drinks. The guidelines on nutritional labeling issued by the European Food Safety Authority are actively empowering consumers to make more informed and healthier choices. It remains a significant growth driver in Europe, where the consumers are pretty eco-conscious. The European Union's Green Deal has focused significantly on reducing plastic waste, encouraging manufacturers to incorporate recyclable packaging solutions. With consumers preferring the products that seem to be earth-friendly, sustainability is strengthening market performance for brands putting it first. Other than that, innovation in product offerings would be another very critical driver. Functional drinks, vitamin, mineral, and probiotic fortified, are becoming popular among beverage consumers today. These health-conscious consumers are consistently seeking beverages that offer additional health benefits. Furthermore, plant-based alternatives, such as oat milk and almond milk, are experiencing rapid growth, driven by the increasing prevalence of veganism and the rising number of individuals with lactose intolerance. There were 6.62 million estimated vegans in the European Union by 2023. The market is projected to grow to 8.25 million by 2033, reports. Besides that, convenience and accessibility are also molding the market. With the emergence of on-the-go beverages and online retail platforms, non-alcoholic beverages are now more accessible.

Asia Pacific Non-Alcoholic Beverage Market Analysis

The non-alcoholic beverage market in the Asia Pacific region is experiencing significant growth, fueled by demographic changes, urbanization, and evolving consumer preferences. According to the Press Information Bureau (PIB), it is projected that more than 40% of India’s population will be living in urban areas by 2030. This is raising concerns over higher demand for convenient and ready-to-drink options. A primary driver is the region's huge and growing middle-class population, which is increasingly spending on premium and functional beverages. The market's expansion is further propelled by the increasing focus on health and wellness, especially in countries like China, Japan, and India, where consumers are prioritizing healthier lifestyle choices. Herbal and traditional beverages, such as green tea, infused water, and functional drinks, are highly in vogue. With this, government moves towards healthier consumption patterns, like India's sugary drink taxation under the GST, are driving demand for low-sugar versions. Additionally, advancements in technology and innovations in flavor profiles are playing a significant role in driving the market's growth. Region-specific flavors from local and international brands, like matcha in Japan and lychee-infused drinks in Southeast Asia, are being used to cater to different consumer preferences. Besides, e-commerce platforms is making non-alcoholic drinks more accessible across the country and particularly in the rural areas which further boosts up the market.

Latin America Non-Alcoholic Beverage Market Analysis

Latin America's non-alcoholic beverage market is being driven by rapid urbanization and the increasing middle class. According to the CIA, in 2023, the urban population of Brazil accounted for 87.8% of total population. Urbanization is also boosting the demand for ready-to-drink convenient products because people have busier lifestyles. Additionally, health trends are pushing consumers towards natural and low-sugar beverages such as coconut water, herbal teas, and fortified drinks. New-age, local, and traditional beverages such as aguas frescas in Mexico are gaining renewed enthusiasm, aided by innovations in flavors and packaging. Sustainability efforts are also gaining momentum; consumers are eager to see eco-friendly packaging solutions for them. Along these lines, social media campaigns, influencer collaborations, and targeted online advertising are amplifying brand engagement and maintaining consistent consumer interest in this area.

Middle East and Africa Non-Alcoholic Beverage Market Analysis

The Middle Eastern and African markets for non-alcoholic drinks benefit from an increase in their population, which is predominantly younger, besides spinning off to a more consciencious consumer upon healthy drinking habits. Demand of non-alcoholic beverages in the region is stimulated by the combination of the high percentage of cultural and religious conformance that disfavor other beverages that grow demand for such popular soft drink brands-like juices, teas, and carbonated soft drinks-out in the market. The young demographic is an encouraging factor in the growth of the market. They are interested in novelty products that cater to needs for energy drinks or flavored water. The figure on Arab youth aged 15 to 24 has gone up from 51 Million in 1995 to about 82 Million in 2023 as stated in the report. The rise in health and wellness consciousness results in increased demand for functional and sugar-free beverages. Excise tax on sugar-rich drinks in the effort to curb obesity, as exemplified by Saudi Arabia, is another instrument that will encourage this in the Middle Eastern market. Provisions are also maturing through e-commerce channels for the internet access of the markets and underserved areas, ushering in relative market stability.

Competitive Landscape:

As per the emerging non-alcoholic beverage market trends, major players are seeking innovation, sustainability, and consumer-centric strategies to create competitive advantages for themselves. A portfolio expansion plan by the companies involved in launching a range of new functional beverages: probiotic drinks, energy boosters, and plant-based alternatives meet growing health-conscious demand. Major brands are using technological developments and ingredient innovations to develop low sugar, or less sugar, and nutritionally improved consumer foods and beverages featuring more exciting flavors. Sustainability has captured the focus, with investments in eco-friendly packaging solutions, such as recyclable bottles and aluminum cans, in keeping with the conscientious, environmentally aware consumer trend. The players are increasingly moving toward operation and supply chain carbon neutrality, partly a reflection of increased emphasis on corporate social responsibility.

The report provides a comprehensive analysis of the competitive landscape in the non-alcoholic beverage market with detailed profiles of all major companies, including:

- AriZona Beverages USA

- Asahi Group Holdings Ltd.

- Danone S.A.

- Keurig Dr Pepper Inc.

- Nestlé S.A.

- Parle Agro Pvt. Ltd.

- PepsiCo Inc.

- Primo Brands

- Red Bull GmbH

- Suntory Holdings Limited

- The Coca‑Cola Company

Latest News and Developments:

- January 2025: Mash Gang, a UK-based brewery renowned for its creativity and innovation in the non-alcoholic beverage sector, is making a notable entrance into the American market. Coinciding with Dry January, the brewery has introduced four new non-alcoholic beers in Wisconsin, made possible through its collaboration with Pilot Project Brewing.

- September 2024: Diageo North America recently announced its acquisition of Ritual Zero Proof Non-Alcoholic Spirits (Ritual). Since its debut in Chicago, Illinois, in 2019, Ritual has experienced rapid growth and has become the leading non-alcoholic spirit brand in the United States.

- September 2024: DioniLife, a company established by pioneers in the spirits industry, has announced its debut in the U.S. and U.K., with plans for further global expansion in the near future. The company is dedicated to non-alcoholic adult beverages and aims to create a diverse portfolio of premium, flavorful products across various beverage categories through both in-house innovation and strategic acquisitions.

- April 2024: The Boston Beer Company, known for brands like Samuel Adams, Twisted Tea, Truly Hard Seltzer, Angry Orchard, and Dogfish Head, has introduced a non-alcoholic beverage under the General Admission brand (<0.5% ABV). General Admission blends the taste profile of non-alcoholic beer with the refreshing qualities of fruited seltzer water, offering a sober-friendly beverage option.

Non-Alcoholic Beverage Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Carbonated Soft Drinks, Juices, Bottled Water, Sports and Energy Drinks, RTD Tea and Coffee, Others |

| Packaging Types Covered | Bottles, Cans, Cartons, Others |

| Distribution Channels Covered | Retail, Food Service, Supermarkets and Hypermarkets, Online Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AriZona Beverages USA, Asahi Group Holdings Ltd., Danone S.A., Keurig Dr Pepper Inc., Nestlé S.A., Parle Agro Pvt. Ltd., PepsiCo Inc., Primo Brands, Red Bull GmbH, Suntory Holdings Limited, The Coca‑Cola Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the non-alcoholic beverage market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global non-alcoholic beverage market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the non-alcoholic beverage industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The non-alcoholic beverage market was valued at USD 971.65 Billion in 2024.

IMARC estimates the non-alcoholic beverage market to exhibit a CAGR of 4.31% during 2025-2033, reaching USD 1,448.89 Billion by 2033.

The market growth is primarily driven by the increasing demand for healthier beverage options, the elevating requirement for single-serve, ready-to-drink non-alcoholic variants, and the inflating income levels of consumers.

Asia Pacific currently dominates the market, driven by the significant growth in the food and beverage industry, widespread adoption of plant-based drinks, and the heightened demand for minimalistic drinks.

Some of the major players in the non-alcoholic beverage market include AriZona Beverages USA, Asahi Group Holdings Ltd., Danone S.A., Keurig Dr Pepper Inc., Nestlé S.A., Parle Agro Pvt. Ltd., PepsiCo Inc., Primo Brands, Red Bull GmbH, Suntory Holdings Limited, The Coca-Cola Company, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)