Nitrogenous Fertilizers Market Size, Share, Trends and Forecast by Type, Crop Type, Form, Mode of Application, and Region, 2025-2033

Nitrogenous Fertilizers Market Size and Share:

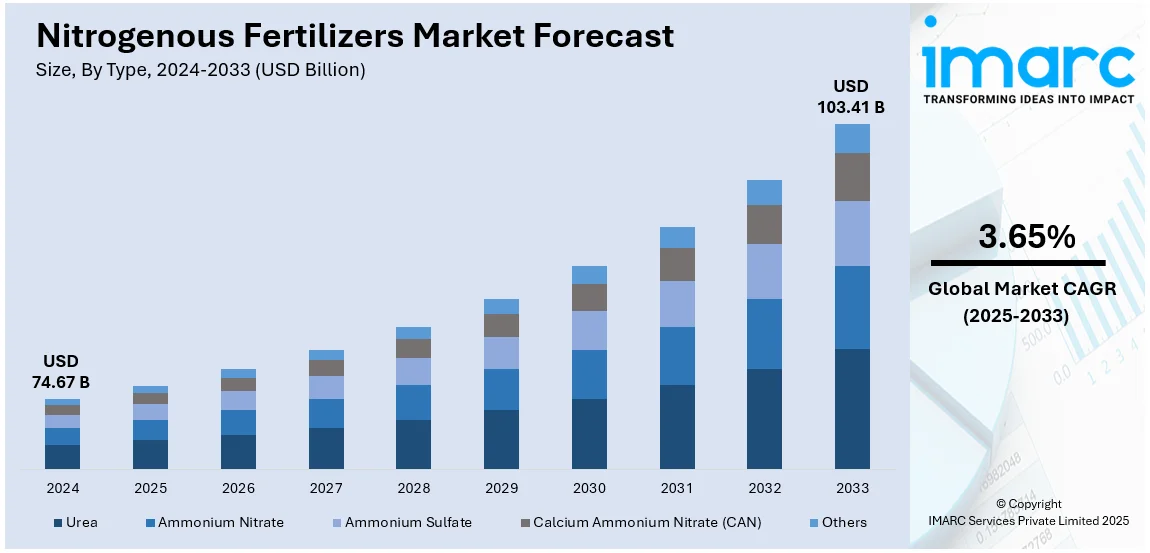

The global nitrogenous fertilizers market size was valued at USD 74.67 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 103.41 Billion by 2033, exhibiting a CAGR of 3.65% from 2025-2033. Asia Pacific currently dominates the nitrogenous fertilizers market share by holding over 45.0% in 2024. The market in the region is driven by high agricultural activity, increasing food demand, rising government subsidies, and the widespread adoption of urea and ammonia-based fertilizers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 74.67 Billion |

| Market Forecast in 2033 | USD 103.41 Billion |

| Market Growth Rate (2025-2033) |

3.65%

|

The global nitrogenous fertilizers market growth is primarily driven by the rising global food demand due to population growth necessitating higher agricultural productivity, boosting fertilizer use. In addition, soil nutrient depletion from continuous farming increases the need for nitrogen-based fertilizers to restore fertility, aiding the market growth. Moreover, rising government subsidies and support in major agricultural economies encourage farmers to use fertilizers for improved yields, driving the market demand. A notable example of this growth is CF Industries, which reported a 68% increase in third-quarter profit in 2024, driven by higher nitrogen fertilizer prices and increased ammonia production. Besides this, ongoing technological advancements in enhanced-efficiency fertilizers improve nitrogen uptake, reducing waste and driving adoption, which is impelling the market growth. Also, the expansion of cereal and grain cultivation fuels the market demand, as these crops require high nitrogen input. Furthermore, expanding industrial applications in textiles and explosives are thus catalyzing the market growth.

The United States holds around 74.50% of the market share, and the nitrogenous fertilizers market demand is driven by precision farming, as its adoption increases the demand for nitrogen fertilizers to optimize crop yields. In confluence with this, the growing biofuel production boosts corn cultivation, a nitrogen-intensive crop, thus strengthening the market share. Concurrently, the fluctuating soil health due to intensive monocropping necessitates higher nitrogen inputs, providing an impetus to the market. Besides this, the rising demand for organic blends encourages innovations in nitrogen-based fertilizers, fostering the market growth. Furthermore, climate change-driven weather variability affects planting cycles, leading to greater reliance on fertilizers for stable yields, and contributing to the market expansion. Apart from this, strong export demand for U.S. agricultural products pushes farmers to maximize productivity, thereby propelling the market demand.

Nitrogenous Fertilizers Market Trends:

Decreasing arable land across the globe

The decreasing availability of arable land worldwide is enhancing the nitrogenous fertilizers market outlook. The United Nations reports that yearly healthy land destruction surpasses 100 million hectares. The agricultural sector battles an urgent issue because urbanization and industrialization and infrastructure development are steadily occupying productive land areas. The fertilizers offer solutions to this issue by producing superior crop outputs while improving land management capabilities. These products enhance agricultural density while optimizing the output from current farmable territories. The global population growth requires increased food production and nitrogenous fertilizers serve as essential tools for achieving this goal. The chemical compounds work as major agents for restoring soil fertility levels. Continuous cultivation of arable land results in nutrient depletion of the agricultural soil. Such fertilizers restore vital nutrients to deficient lands which enables them to sustain agricultural production.

Increasing demand for these fertilizers for improved soil fertility

The increasing demand for these fertilizers to enhance soil fertility is influencing the nitrogenous fertilizers market trends. Farmers depend on nitrogen to preserve and build their soil fertility which constitutes the fundamental base of agricultural success. Moreover, agricultural professionals together with farmers understand nitrogen plays a fundamental role in developing strong plants along with maximizing crop production. The chemical fertilizers supply quick-access nitrogen that builds soil quality thus enabling healthy and abundant crop production. Through their application they restore nitrogen levels which decrease because of continuous farming practices. These fertilizers enjoy increasing demand because farmers need to satisfy global food needs and follow sustainable agriculture practices. The OECD forecasts show that food consumption as the primary agricultural commodity use will increase by 1.3% every year during the upcoming ten years. These fertilizers enhance yield production and help preserve the health of agricultural land for extended periods.

Escalating demand for grain-based biofuels

The escalating demand for grain-based biofuels is fueling the market growth. According to the International Energy Agency (IEA) biofuel consumption will expand by 38 Billion liters until 2023-2028 which represents a 30% increase compared to the previous five-year period. The worldwide shift toward sustainable and clean energy alternatives has made biofuels obtained from corn and wheat grains increasingly significant. The market growth of grain-based biofuels drives an upward trend in crop yield requirements which subsequently increases the demand for these fertilizers. The production of biofuels from grains necessitates extensive agricultural practices because the expanding human population needs more energy. The process of raising grain production requires nitrogenous fertilizers which improve soil nutrient levels while optimizing plant development to yield higher grain output. The biofuel industry builds its growth through government policies together with environmental regulations which seek to minimize greenhouse gas emissions. Robust crop yields demand increased adoption of these fertilizers because they are necessary to reach the required grain production targets.

Nitrogenous Fertilizers Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global nitrogenous fertilizers market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, crop type, form, and mode of application.

Analysis by Type:

- Urea

- Ammonium Nitrate

- Ammonium Sulfate

- Calcium Ammonium Nitrate (CAN)

- Others

Urea stands as the largest type in 2024, holding around 35.8% of the nitrogenous fertilizers market share. It is one of the most widely used nitrogenous fertilizers and is pivotal in modern agriculture. It is highly versatile and applicable to a broad spectrum of crops. Its nitrogen content is released gradually, making it suitable for short-term and long-term crop requirements. This versatility has led to widespread adoption across various agricultural practices, contributing significantly to market expansion. Moreover, its cost-effectiveness is a driving factor. It offers an efficient and economical means of providing essential nitrogen nutrients to plants. This affordability appeals to multiple farmers, from smallholders to large-scale commercial operations.

Furthermore, the growing global population and the need for increased food production amplify the demand for nitrogenous fertilizers like urea. Meeting the rising demand for food necessitates optimizing crop yields, and urea plays a vital role in achieving this objective. Additionally, the sustainable application of urea, when coupled with precision farming practices, mitigates concerns related to environmental impact. The responsible use of urea, guided by modern agricultural techniques, aligns with sustainability goals and reinforces its position as a driving force.

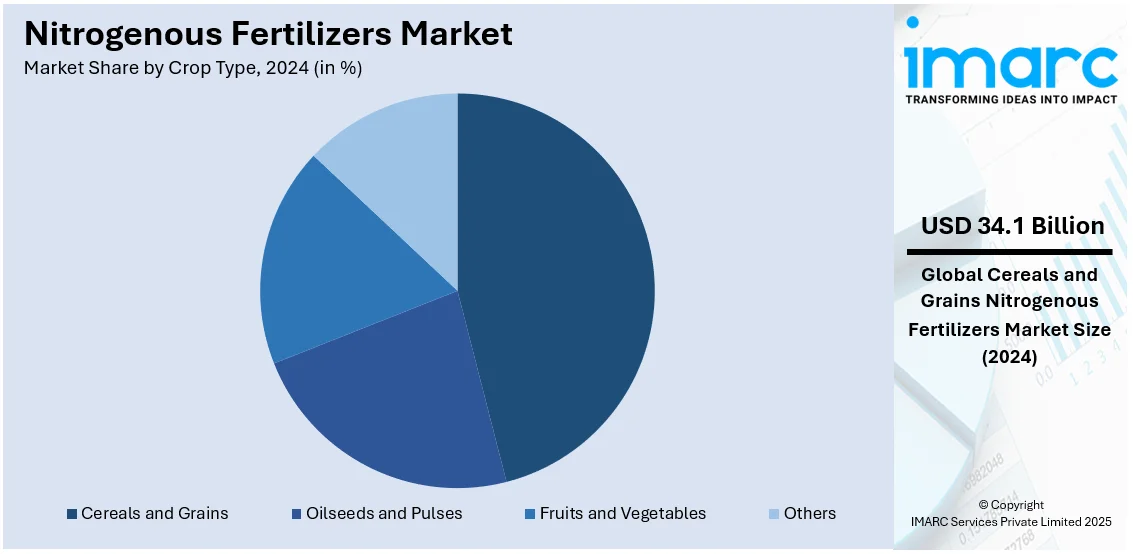

Analysis by Crop Type:

- Cereals and Grains

- Oilseeds and Pulses

- Fruits and Vegetables

- Others

Cereal and grains lead the market with around 45.7% of market share in 2024. They are fundamental staples of global food production, and nitrogenous fertilizers are indispensable in maximizing their yield and quality. As the world's population continues to rise, there is a pressing need to enhance the production of these crops to meet food and feed demands. Nitrogenous fertilizers provide the necessary nitrogen nutrients for the vigorous growth and yield of cereals and grains, making them indispensable for global food security. Moreover, these crops are cultivated on extensive acreages worldwide, making them a significant consumer of nitrogenous fertilizers. Their widespread cultivation amplifies the demand for these fertilizers and drives market growth.

Furthermore, the versatility of these fertilizers in optimizing crop yields aligns perfectly with the agronomic requirements of cereals and grains. These fertilizers directly contribute to increased cereal and grain production by promoting healthy vegetative growth and robust grain development. Additionally, the adoption of precision agriculture practices in cereals and grains cultivation further accentuates the importance of nitrogenous fertilizers. Farmers increasingly rely on data-driven approaches to optimize fertilizer application, ensuring efficient nutrient utilization and reduced environmental impact.

Analysis by Form:

- Liquid

- Dry

- Others

Liquid nitrogenous fertilizers lead the market with a significant market share in 2024. They are gaining prominence due to their unique advantages and versatility in modern agriculture. They are prized for their ease of application. They can be readily and uniformly applied through various irrigation systems, including drip and foliar applications, enhancing their efficiency. This ease of application is particularly valuable for large-scale and precision farming operations. Moreover, they offer rapid nutrient availability to plants. The liquid form allows quick absorption, promoting vigorous vegetative growth and crop development. This fast nutrient delivery is especially beneficial for crops with high nutrient demands during critical growth stages.

Furthermore, the controlled-release capabilities of some liquid nitrogenous fertilizers are driving their adoption. These formulations release nitrogen gradually over time, ensuring a sustained supply of nutrients to crops, reducing the need for multiple applications, and minimizing nutrient loss through leaching. Additionally, they are valued for their compatibility with other crop protection products. Farmers can conveniently mix liquid fertilizers with pesticides or herbicides, reducing the number of passes through the fields and saving time and resources.

Analysis By Mode of Application:

- Soil

- Foliar

- Fertigation

- Others

Soil accounts for the largest market share, as this application is crucial for delivering essential nitrogen nutrients to crops and enhancing agricultural productivity. It is a traditional and widely adopted method in agriculture. Farmers across the globe rely on these fertilizers applied to the soil to enrich it with vital nutrients, particularly nitrogen. This conventional approach ensures crops receive nutrients from the ground up, promoting healthy root development and overall plant growth. Moreover, this application allows for precise nutrient management. Farmers can tailor the application based on soil nutrient profiles and crop requirements, ensuring optimal nutrient utilization. This precision aligns with modern farming practices and sustainability goals, reducing nutrient wastage and environmental impact.

Furthermore, the versatility of soil application accommodates a wide range of crops, from cereals and grains to fruits and vegetables. This adaptability makes it a preferred mode of application for various agricultural systems and crop types, further driving the demand for nitrogenous fertilizers. Additionally, it is compatible with various agricultural machinery and equipment, facilitating efficient and uniform fertilizer distribution across large agricultural areas. This machinery compatibility enhances the practicality of soil application in modern farming practices.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 45.0%. The Asia Pacific region is a substantial driving force behind the market growth, characterized by a combination of factors fueling its expansion. It hosts some of the world's most populous countries, including China and India. With a growing demand for food to feed their populations, these countries represent significant markets for agricultural production. Nitrogenous fertilizers are essential in achieving higher crop yields, making them indispensable for meeting the increasing food requirements of the region. Moreover, the diverse agricultural landscape, encompassing various crops from rice and wheat to fruits and vegetables, drives the demand for nitrogenous fertilizers. Different crops have varying nutrient requirements, and nitrogenous fertilizers offer a versatile solution to these diverse needs.

Furthermore, the adoption of modern farming practices and the incorporation of technology in agriculture are on the rise in the Asia Pacific. Precision agriculture and data-driven approaches emphasize optimizing nutrient management, making nitrogenous fertilizers crucial in this evolving landscape. Additionally, government initiatives and subsidies to support agricultural development in the region stimulate the demand for fertilizers, including nitrogenous varieties. These policies encourage sustainable farming practices and higher crop productivity. These factors collectively reinforce the region's pivotal role in ensuring food security and contributing to the global market.

Key Regional Takeaways:

North America Nitrogenous Fertilizers Market Analysis

The North America nitrogenous fertilizers market is driven by advanced agricultural practices, strong government support, and increasing demand for high-yield crops. The U.S. and Canada are major regions, with large-scale corn, wheat, and soybean production requiring significant nitrogen inputs. Precision agriculture technologies, including global positioning system (GPS)-based fertilizer application and controlled-release fertilizers, are gaining traction to improve efficiency and reduce environmental impact. Additionally, rising investments in sustainable fertilizers, such as green ammonia, are reshaping the industry. For example, investor Carl Icahn, who increased his stake in CVR Partners to approximately 37%, betting on the future of natural gas under the current administration's energy policies, which supports the long-term supply of nitrogen-based fertilizers. Besides this, market players are expanding production capacities and forming strategic partnerships to ensure a stable supply chain. Furthermore, fluctuating natural gas prices, a key raw material, influence fertilizer costs and market dynamics, impacting farmer adoption and overall market growth.

United States Nitrogenous Fertilizers Market Analysis

The United States nitrogenous fertilizers market is experiencing growth because farmers require effective production techniques to satisfy increasing food requirements. This trend occurs because farmers must optimize output on their available land despite restricted arable areas. According to reports, the number of farms in the U.S. decreased to 1.89 million in 2023, down from 2.04 million recorded in the 2017 U.S. Census of Agriculture. The market demand for urea ammonia and multiple nitrogen-based fertilizer products rises because essential crops like corn wheat and soybeans require major nitrogen inputs. The adoption of these fertilizers receives additional support from GPS-guided application systems in precision agriculture because they provide effective nutrient management capabilities. Government initiatives that promote sustainable farming practices along with greenhouse gas emission reduction benefit the market. Programs which offer financial benefits for enhanced-efficiency fertilizers (EEFs) adoption create new possibilities for nitrogenous fertilizer formulation innovation. The substantial manufacturing operations of agrochemical companies in this area provide stable manufacturing and delivery capabilities. Ethanol production from corn for biofuel purposes has accelerated the demand for nitrogenous fertilizers as biofuel popularity increases. The market stability benefits from agricultural practices where farmers rotate their crops to use nitrogen-intensive plants. The implementation of stricter regulations because of environmental concerns about nitrate runoff simultaneously promoted the creation of eco-friendly fertilizer alternatives. The US nitrogenous fertilizers market expands because of these combined market factors.

Europe Nitrogenous Fertilizers Market Analysis

The region's focus on sustainable agriculture and stringent environmental regulations is bolstering the market growth. Countries, such as Germany, France, and the Netherlands, prioritize maintaining high agricultural productivity while reducing the environmental impact of farming practices. According to reports, the EU's agricultural sector generated a gross value added of USD 246.29 billion in 2023. This has led to increased adoption of advanced nitrogenous fertilizers, including slow- and controlled-release variants that enhance efficiency and minimize nitrate leaching. The region's robust livestock industry also contributes to the demand for nitrogen-based fertilizers, as they play a critical role in growing animal feed crops like maize and forage grasses. European Union (EU) policies promoting sustainable farming practices, such as the Common Agricultural Policy (CAP), encourage the use of eco-friendly fertilizers through subsidies and financial support. These policies aim to ensure balanced nutrient application, addressing both yield optimization and environmental conservation. Moreover, technological advancements in precision farming are influencing the market. Farmers in Europe increasingly use smart tools to monitor soil health and optimize fertilizer application, reducing waste and improving crop quality. The demand for nitrogenous fertilizers is also driven by the need for high-value crops, including fruits, vegetables, and cereals, which require efficient nitrogen management for premium quality. Furthermore, export-oriented agricultural production, particularly in France and Spain, is bolstering the adoption of nitrogenous fertilizers to meet stringent quality standards. Efforts to develop biodegradable and eco-friendly fertilizers align with Europe's green goals, ensuring sustained market growth.

Asia Pacific Nitrogenous Fertilizers Market Analysis

The Asia Pacific nitrogenous fertilizers market is growing, as agriculture remains a fundamental economic sector throughout the region. Soaring population levels in India China and Indonesia create increasing demands to enhance food output which leads countries to adopt nitrogenous fertilizers. The India population exceeded 1,395.0 Million during March 2024 according to data from CEIC. The crop yield enhancement critical for food security challenges depends heavily on urea and ammonium nitrate fertilizers. The implementation of fertilizer subsidy programs together with agricultural production support infrastructure is now being driven by government efforts to promote self-sufficient food agriculture. Indian government support for urea subsidies together with fertilizer factory investments has boosted homegrown production capacity and made fertilizers more affordable across the nation. China increases its need for nitrogen-based fertilizers through its modernization programs aimed at improving agricultural nutrient management systems. Farmers across the world heavily depend on nitrogenous fertilizers to maintain productivity because their soil fertility keeps deteriorating. Farming activities linked to global agricultural product export growth encourage farmers to enhance crop quality and production levels thereby increasing fertilizer demand. The Eastern Black Soil region witnesses rising adoption of emerging irrigation technologies like micro-irrigation systems and drip fertigation that improve nutrient delivery.

Latin America Nitrogenous Fertilizers Market Analysis

In Latin America, the nitrogenous fertilizers market is expanding because of the region's vast agricultural land and reliance on exports of key crops like soybeans, sugarcane, and coffee. According to reports, Brazilian agricultural business exports achieved their highest point in 2023 with a total of USD 166.55 Billion. Brazil together with Argentina provide significant market contributions because they need to increase crop yields to fulfill worldwide market requirements. The achievement of higher yields along with soil fertility maintenance in nitrogen-intensive crops depends on nitrogenous fertilizers that primarily include urea and ammonia. The adoption of precision farming combined with mechanized farming methods supports fertilizer implementation while ensuring nutrient distribution remains efficient. Government support together with beneficial trade policies helps Brazil and other regions to obtain fertilizers because it is their largest consumer market. The expansion of biofuel industries particularly ethanol production creates an indirect need for nitrogenous fertilizers to increase.

Middle East and Africa Nitrogenous Fertilizers Market Analysis

The nitrogenous fertilizers market of the Middle East and Africa functions under conditions which require improved agricultural productivity in dry and semiarid regions. The scarcity of water resources and deficient soil quality compels agricultural producers to use nitrogenous fertilizers as a yield improvement method. A report titled *Economics of Water Scarcity in MENA, Institutional Solutions* projects that by the end of this decade, annual water availability in the region will fall below 500 cubic meters per person per year, reaching the threshold of absolute water scarcity. The growing population of African countries and their ongoing urbanization process leads governments to increase agricultural investments because food demand continues to rise. The combination of subsidies with public-private partnerships is helping small-scale farmers obtain access to fertilizers. Through international aid programs efficient fertilizers are being promoted to enhance food security levels. The focus on food independence in Saudi Arabia together with other nations in the Middle East leads to increased nitrogen-based fertilizer usage within controlled agricultural systems. The market expansion receives additional support from new technologies in both desalination-based irrigation and sustainable agricultural methods.

Competitive Landscape:

Market players in the nitrogenous fertilizers industry are actively expanding production capacities, investing in sustainable solutions, and engaging in strategic mergers and acquisitions. Leading companies are focusing on green ammonia production using renewable energy to reduce carbon footprints. Besides this, ongoing technological innovations in controlled-release and slow-release fertilizers are gaining traction, improving nitrogen efficiency. Major firms are also strengthening distribution networks and forming partnerships with agribusinesses to enhance market reach. Furthermore, increasing investments in research and development (R&D) are fueling advancements in nitrogen stabilizers to reduce environmental impact. Companies are also adapting to regulatory pressures, working on low-emission manufacturing processes to align with global sustainability goals. These activities are shaping the competitive landscape of the market.

The report provides a comprehensive analysis of the competitive landscape in the nitrogenous fertilizers market with detailed profiles of all major companies, including:

- Yara International ASA

- Bunge Limited

- CF Industries Holdings, Inc.

- PJSC TogliattiAzot

- Nutrien Limited

- EuroChem Group

- OCI N.V.

- URALCHEM JSC

- ICL Specialty Fertilizers

- SABIC

- Indian Farmers Fertiliser Cooperative Limited

- Coromandel International Limited

- Koch Industries

- Hellagrolip SA

- Sinofert Holdings Limited

- CVR Partners, LP

Latest News and Developments:

- December 2024: Grupa Azoty developed its product line through the introduction of the granular nitrogen fertilizer eNpluS which contains sulfur and calcium. Grupa Azoty implements its product development approach based on market requirements through this strategic move. eNpluS production facilities will operate at both Puławy and Kędzierzyn-Koźle sites after the product launched recently among other new additions to the product lineup.

- November 2024: National Fertilizers (NFL), a government-owned enterprise, announced plans to commence nano urea production at its Nangal plant. The company aims to manufacture 1.5 lakh bottles of 500 ml per day at its nangal plant with the new variant.

- April 2024: Nitricity Inc. conducted its latest field test launch celebration as a California-based company which powers nitrogen fertilizer production through electricity at a Madera County event. The collaboration between Nitricity Inc., Olam Food Ingredients (ofi), Elemental Excelerator, and the Madera/Chowchilla Resource Conservation District facilitated the announcement of their first commercial-scale delivery of locally produced Nitricity liquid calcium nitrate.

- March 2024: The first assessments for low- and zero-carbon calcium ammonium nitrate (CAN) were launched by Argus as a widely used nitrogen-based fertilizer in the European market. The assessments evaluate CAN production costs using blue ammonia derived from natural gas with permanent carbon emission sequestration or reuse and green ammonia manufactured by renewable energy.

Nitrogenous Fertilizers Market Repot Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Urea, Ammonium Nitrate, Ammonium Sulfate, Calcium Ammonium Nitrate (CAN), Others |

| Crop Types Covered | Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables, Others |

| Forms Covered | Liquid, Dry, Others |

| Mode of Applications Covered | Soil, Foliar, Fertigation, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Yara International ASA, Bunge Limited, CF Industries Holdings, Inc., PJSC TogliattiAzot, Nutrien Limited, EuroChem Group, OCI N.V., URALCHEM JSC, ICL Specialty Fertilizers, SABIC, Indian Farmers Fertiliser Cooperative Limited, Coromandel International Limited, Koch Industries, Hellagrolip SA, Sinofert Holdings Limited, CVR Partners LP, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the nitrogenous fertilizers market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global nitrogenous fertilizers market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the nitrogenous fertilizers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The nitrogenous fertilizers market was valued at USD 74.67 Billion in 2024.

IMARC estimates the nitrogenous fertilizers market to exhibit a CAGR of 3.65% during 2025-2033, expecting to reach USD 103.41 Billion by 2033.

Key factors driving the nitrogenous fertilizers include, rising global food demand, surging soil nutrient depletion, increasing government subsidies, ongoing technological advancements, expanding biofuel production, and climate change-driven agricultural challenges.

Asia Pacific currently dominates the nitrogenous fertilizers market, accounting for a share exceeding 45.0% in 2024. This dominance is fueled by the rising demand for the rising demand for high-yield crops, extensive agricultural activities, rapid population growth, increasing fertilizer adoption in emerging economies, and strong industrial usage in chemicals and textiles.

Some of the major players in the nitrogenous fertilizers market include Yara International ASA, Bunge Limited, CF Industries Holdings, Inc., PJSC TogliattiAzot, Nutrien Limited, EuroChem Group, OCI N.V., URALCHEM JSC, ICL Specialty Fertilizers, SABIC, Indian Farmers Fertiliser Cooperative Limited, Coromandel International Limited, Koch Industries, Hellagrolip SA, Sinofert Holdings Limited, CVR Partners LP, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)