Night Vision Devices Market Size, Share, Trends and Forecast by Device, Technology, End User, and Region, 2025-2033

Night Vision Devices Market Size and Share:

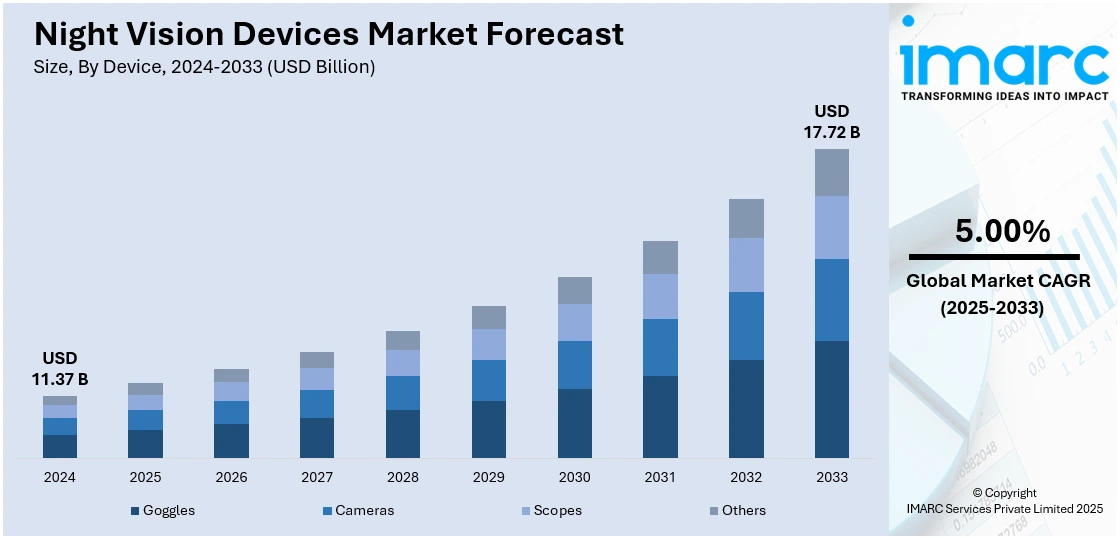

The global night vision devices market size was valued at USD 11.37 Billion in 2024. The market is projected to reach USD 17.72 Billion by 2033, exhibiting a CAGR of 5.00% from 2025-2033. The market growth is attributed to rising investments in defense, modernization of armed forces due to terrorism, cross-border conflicts, and increasing outdoor recreational activities.

Market Insights:

- North America currently dominates the market, holding a market share of 39.7% in 2024.

- On the basis of the device, goggles held 29.8% of the market share in 2024.

- Based on technology, image intensifiers leads the market in 2024.

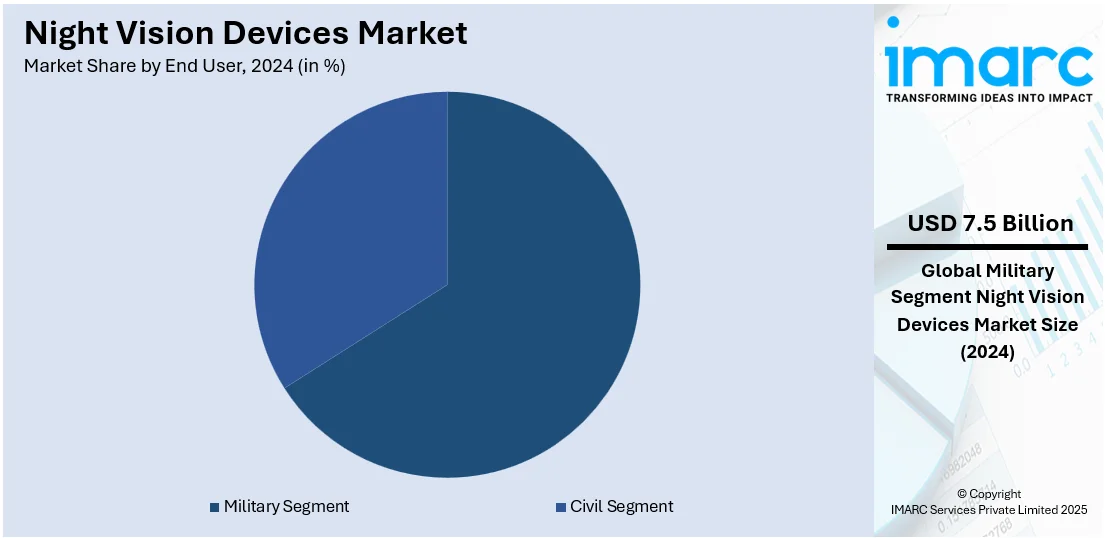

- On the basis of end user, the military segment accounts for 65.8% of the market share.

Market Size & Forecast:

- 2024 Market Size: USD 11.37 Billion

- 2033 Projected Market Size: USD 17.72 Billion

- CAGR (2025-2033): 5.00%

- North America: Largest market in 2024

At present, the market is growing due to the rising demand from defense, law enforcement, and security agencies. Night vision devices aid in surveillance, patrolling, and night-time operations, especially in low-light and dark environments. Military forces are using night vision tools to enhance accuracy and safety during combat missions. Law enforcement is benefiting from better visibility during border control and emergency response. Besides this, increasing outdoor activities like hunting, wildlife tracking, and camping are catalyzing the demand for night vision devices. Technological advancements are making night vision equipment more affordable, lightweight, and user-friendly. High-end vehicles include night vision systems for safer night driving. The need for better security owing to rising threats and crime is also supporting the market growth. As urban safety and national defense are being prioritized, the demand for night vision devices continues to increase across various sectors.

To get more information on this market, Request Sample

The United States has emerged as a major region in the night vision devices market owing to many factors. The growing investments in advanced surveillance to ensure national safety are offering a favorable night vision devices market outlook. Night vision devices support tactical missions, border security, and emergency response during low-light conditions. Law enforcement agencies continue to rely on these tools for patrolling and crime prevention. Rising concerns about public safety and increasing criminal activities are promoting the adoption of such technology. In addition, civilian uses, such as hunting, wildlife observation, and outdoor adventures, are contributing to the market growth. As per industry reports, 55% of the US population aged 6 and older were engaged in outdoor leisure activities in 2024. Technological innovations make these devices more compact, efficient, and accessible. The presence of key manufacturers and strong defense funding is supporting product development.

The market is significantly influenced by the increased need for sophisticated surveillance and security solutions in defense, law enforcement, and civilian applications. The emerging integration of night vision technologies into unmanned platforms like drones and autonomous vehicles is a stand-out market driver, facilitating greater nighttime reconnaissance and situational awareness. Notably, in 2024, Senop Oy announced intentions to develop high-tech night vision equipment for the Finnish Defence Forces, which was set to feature goggles, thermal binoculars, and a multifunctional fire control system. The devices would integrate advanced technologies like M20 lenses and regional thermal cameras, enhancing operational effectiveness across various weapon systems. However, the market is hindered by high prices of advanced devices and export bans based on defense regulations. Furthermore, usability limitations when used in harsh weather conditions can limit use. In spite of these impediments, the market offers robust opportunities through expansion in the use of night vision devices in wildlife studies, search and rescue missions, and outdoor leisure. Technological advancements are centered on enhanced resolution, lighter-weight devices, and increased digital capabilities. These advancements are targeted to broaden applications while enhancing operational effectiveness in different end-user segments.

Night Vision Devices Market Trends:

Growing Defense and Security Needs

Military and law enforcement groups heavily depend on night vision technology for important duties, such as surveillance, reconnaissance, and maintaining operational efficiency in low-light conditions. An increase in defense spending and modernization of armed forces due to terrorism, cross-border conflicts, and internal security threats is catalyzing the demand for advanced night vision devices. For instance, global expenditure on military hit USD 2,718 Billion in 2024, exhibiting a growth of 37% between 2015 and 2024, according to the Stockholm International Peace Research Institute (SIPRI). Advanced technologies improve the understanding of situations and offer strategic benefits, making night vision devices crucial for national security. Moreover, the growing use of night vision devices for border security and surveillance operations is positively influencing the market. Government efforts to provide military members with modern night vision gear highlight the crucial role of such technologies in ensuring security and peace.

Enhanced Training and Simulation Programs

Improved training and simulation initiatives in the defense and security sectors are propelling the night vision devices market growth. Night vision devices play a significant role in these programs, providing participants with practical experience and enhancing their skills in utilizing the technology. Night vision technology aids in evaluating and improving tactical strategies during simulation exercises, leading to enhanced mission readiness. As training and simulation programs are advancing, the integration of advanced night vision devices is becoming more crucial. In July 2024, Force Ordnance from Lightforce Group, in alliance with Theon Sensors, successfully secured a contract to supply 120 advanced binocular night-vision devices to the Australian Defence Force (ADF) for the Dismounted Combat Program.

Rise of Outdoor Recreational Activities

The increasing appeal of outdoor leisure activities, such as camping and wildlife observation, is driving the night vision devices market demand. For instance, government spending on recreational and sporting activities across the European Union reached €67.6 Billion in 2023, equating to 0.8% of total general government expenditure, according to Eurostat. Hobbyists and experts need top-notch night vision gear to participate in nighttime activities safely and efficiently. Night vision device brands are meeting this demand by introducing specialized products designed especially for outdoor enthusiasts and travelers, improving user experience and functionality. Night vision devices are becoming necessary for these activities since they offer clear visibility and ensure safety in low-light situations.

Night Vision Devices Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global night vision devices market, along with forecast at the global and regional levels from 2025-2033. The market has been categorized based on device, technology, and end user.

Analysis by Device:

- Goggles

- Cameras

- Scopes

- Others

Goggles leads the market with around 29.8% of market share in 2024 driven by its functional design, ease of use, and hands-free nature, which render them extremely popular among both military and civilian users. Defense personnel use the devices during nighttime surveillance, navigation, and combat because they enable users to stay aware of their surroundings while keeping their hands free from tools or weapons. The use of night vision goggles (NVGs) is also gaining traction in law enforcement, border patrol, and search and rescue. In the civilian market, their use is on the rise among outdoor recreational users, hunters, and security agencies. The technological developments, including the inclusion of thermal imaging and infrared illumination, have improved the performance and cost-effectiveness of goggles, thereby increasing their application and demand. Their light build and ease of use further increase their popularity, making goggles a central product segment in the night vision device market globally.

Analysis by Technology:

- Image Intensifier

- Thermal Imaging

- Infrared Illumination

Image Intensifier is the central mechanism used in many common night vision systems. The technology functions by amplifying existing ambient light, i.e., moonlight or starlight, to create a discernible image in low-light environments. Image intensifiers are mostly built into night vision goggles, monoculars, and weapon sights and are, therefore, a critical component of military, law enforcement, and surveillance missions. They have the advantage of being lower in power consumption, more portable, and capable of providing real-time imagery with very little latency. The ongoing development of image intensifier tubes, ranging from third-generation to newly developed fourth-generation ones, has improved resolution, sensitivity, and operating life. Even with the advent of competing technologies like thermal imaging, image intensifiers continue to be a preferred option because they are more affordable and perform better in applications involving detailed identification of individuals or objects in near-total blackness.

Analysis by End User:

- Military Segment

- Civil Segment

Military segment accounts for 65.8% of the market share in 2024 driven by the increased demand for greater situational awareness, mobility, and target acquisition during low-light or night-time operations. Military personnel worldwide heavily depend on night vision technology such as goggles, scopes, and binoculars with image intensifiers or thermal imaging to support reconnaissance, surveillance, and combat activities with greater accuracy and safety. The increasing emphasis on defense modernization and arming troops with sophisticated battlefield technologies further drives demand for high-performance night vision equipment. Governments are spending heavily on defense budgets, particularly in countries with active conflict or strategic threats, further driving procurement. Furthermore, the combination of night vision with other technologies, like augmented reality and helmet-mounted displays, facilitates mission efficiency and coordination. Consequently, the military segment continues to be one of the prime drivers of innovation and expansion for the global market.

Regional Analysis:

- Europe

- North America

- Asia-Pacific

- Middle East and Africa

- Latin America

In 2024, North America accounted for the largest market share of over 39.7% due to its superior defense infrastructure, high defense expenditure, and high concentration of established night vision equipment manufacturers. The United States, specifically, plays a major role in driving regional market expansion through ongoing investments in defense modernization initiatives and technological advancements. The military and law enforcement forces of the region make heavy use of night vision devices for observation, combat, and tactical missions, resulting in steady demand. Furthermore, the use of night vision technology is increasing in the civilian world, ranging from outdoor recreational activities to private security and wildlife watching. The presence of such major industry players, strong research and development (R&D) strengths and favorable government contracts and procurement policies reinforce the market environment even more. With continuously improving thermal imaging and digital night vision systems, North America remains the leader in pace-setting innovation and application, continuing to lead the market globally.

Key Regional Takeaways:

United States Night Vision Devices Market Analysis

The United States holds 89.60% of the market share in North America. The market is influenced by the growing demand for advanced security and surveillance systems, particularly in military and defense applications. The increasing need for enhanced security solutions, both for government agencies and the private sector, is contributing substantially to industry expansion. The rise in terrorism and border security concerns has also heightened the need for more sophisticated surveillance equipment, boosting the adoption of night vision technologies. For instance, in 2023, 76% of terrorism-related deaths in Western democracies took place in the United States, according to industry reports. Additionally, technological advancements, such as the development of more compact, energy-efficient, and high-resolution night vision devices, are also driving the market forward. The commercial sector, including industries like law enforcement, hunting, and wildlife observation, is witnessing increased utilization of these devices, further expanding the market. Apart from this, defense budgets and investments in modernizing military assets, inculcating equipment for soldiers and surveillance systems, are contributing to the night vision devices market revenue. The incorporation of night vision capabilities into commercial drones for various applications, including infrastructure inspection and search-and-rescue missions, is also positively influencing the market. As night vision technology is becoming more affordable and accessible, its use is expected to continue growing in both military and civilian applications.

Europe Night Vision Devices Market Analysis

The Europe market is experiencing robust growth, fueled by the rise in defense spending across European nations, particularly in response to heightened security concerns stemming from geopolitical tensions. According to the Council of the European Union, from 2021 to 2024, total expenditure on defense by the member nations of the European Union grew by over 30%. Moreover, in 2024, total defense spending hit €326 Billion, equating to approximately 1.9% of the GDP of the European Union. This has resulted in a greater employment of advanced night vision technologies by armed forces, aiming to enhance operational capabilities during nighttime missions. Additionally, law enforcement agencies are adopting these devices to bolster surveillance and public safety efforts in low-light conditions. Technological advancements, including the integration of artificial intelligence (AI), AR, and multispectral imaging, are further propelling industry expansion by improving device performance and expanding application areas. Collaborations between regional businesses and technology firms are also fostering innovations, leading to the development of more sophisticated and user-friendly night vision systems.

Asia-Pacific Night Vision Devices Market Analysis

The Asia-Pacific market is expanding due to increasing defense modernization and rising military expenditures in countries, such as China, India, Japan, and South Korea, which is leading to heightened demand for advanced night vision technologies. For instance, the Union Budget of India allocated INR 6,81,210.27 Crore for FY 2025-26 for the Ministry of Defence (MoD), as per the Press Information Bureau (PIB). This funding was 9.53% more than the Budgetary Estimate of FY 2024-25 and accounted for 13.45% of the Union Budget, which was the highest among the Ministries. Additionally, law enforcement agencies are employing night vision devices to improve surveillance and public safety in low-light conditions. The growing awareness about security needs in critical infrastructure facilities like airports and power plants is positively influencing the market. According to the night vision devices market forecast report, the increasing popularity of outdoor activities and eco-tourism in countries will continue to strengthen the market.

Latin America Night Vision Devices Market Analysis

In Latin America, the market is significantly influenced by the integration of night vision technology into the automotive industry, especially in advanced driver-assistance systems (ADAS). Additionally, the region's emphasis on wildlife conservation and eco-tourism has led to increased adoption of night vision devices for nocturnal wildlife observation. For instance, in 2024, Brazil contained 15-20% of the global biological diversity, hosting more than 120,000 invertebrate species, around 9,000 vertebrate species, and approximatey 4,000 plant species, according to the United Nations Environment Programme (UNEP). This puts the country at a higher risk of poaching and illegal wildlife trafficking, creating the need for advanced security measures like night vision devices for surveillance. Besides this, technological advancements, such as the miniaturization of devices and the incorporation of digital imaging, have made night vision equipment more accessible and user-friendly.

Middle East and Africa Night Vision Devices Market Analysis

In the Middle East and Africa region, the market is being propelled by the rapid expansion of infrastructure projects, particularly in remote and challenging environments, such as deserts and rugged terrains. As the region is investing in the oil, gas, and mining industries, there is a growing demand for night vision devices for operational safety and surveillance. Additionally, increasing tourism activities in the region, especially for desert safaris and wildlife tours, are catalyzing the demand for user-grade night vision devices. For instance, between January and July 2024, Saudi Arabia received 17.5 Million international tourists, registering a growth of 10% in comparison to January-July 2023, according to the Saudi Press Agency. Besides this, the rising integration of night vision technology into unmanned aerial vehicles (UAVs) for applications like aerial surveillance, inspections, and disaster response is also supporting the market growth.

Competitive Landscape:

Key players are introducing advanced technologies that improve image clarity, range, and durability of night vision equipment. These companies focus on miniaturization and integration of features like thermal imaging and augmented reality to meet evolving user demands. Key players are also expanding their worldwide presence through partnerships, acquisitions, and distribution networks. They cater to both defense and commercial sectors, offering customized solutions for military, law enforcement, and civilian applications. Their strong relationships with government agencies help secure large-scale defense contracts. Additionally, key players are investing in marketing, after-sales services, and training programs to enhance user experience. Their continuous innovations and commitment to quality strengthen customer trust and keep the market competitive and growing. For instance, in 2024, Valeo and Teledyne FLIR announced a collaboration to integrate thermal imaging technology into automotive safety systems. Their agreement included a major initiative to enhance night vision capabilities in advanced driver-assistance systems (ADAS), aiming to increase safety for vehicles and roadways, especially when driving at night.

The report provides a comprehensive analysis of the competitive landscape in the night vision devices market with detailed profiles of all major companies, including:

- Teledyne FLIR LLC

- L3Harris Technologies, Inc.

- Elbit Systems of America, LLC

- American Technologies Network Corporation

Latest News and Developments:

- May 2025: Vision Products revealed an effective demonstration of an advanced imaging/display system for soldiers that functioned significantly better than traditional analog night vision goggles, even in very low-light conditions like overcast starlight. This advanced technology sought to equip soldiers with improved situational awareness by integrating a state-of-the-art sensor array with a contemporary, high-resolution screen.

- May 2025: Elbit Systems obtained a USD 112 Million contract to provide the US Marine Corps with Squad Binocular Night Vision Goggles (SBNVGs). These helmet-mounted gadgets combined white phosphor image enhancement with thermal imaging, allowing Marines to identify concealed targets in total darkness. This order for delivery was made under a multi-year Indefinite Delivery/Indefinite Quantity (ID/IQ) contract attained in 2023.

- March 2025: Thales introduced its PANOROMIC quad-tube night vision goggles. PANORAMIC was a compact night vision goggle featuring four light amplification tubes for an expanded field of view. It was particularly appropriate for the needs of specialized units and special operations forces conducting sensitive missions like hostage rescue and counterterrorism.

- March 2025: Exosens declared a EUR 20 Million investment over the next two years to enhance its night vision production capabilities throughout Europe. Through this investment, the firm would establish its first manufacturing plant in the United States for the production of image intensifier tubes.

- January 2025: L3Harris Technologies received a USD 263 Million contract from the US Army to keep manufacturing their Enhanced Night Vision Goggle – Binocular (ENVG-B). The firm's advanced fused night-vision technology sought to deliver US troops an unmatched capability to identify and confront targets in dim conditions before enemy forces could become aware about them.

- January 2025: The Finnish Defence Forces (FDF) made a supplementary order for night vision goggles from Senop. The acquisition was estimated at EUR 19.9 Million.

- May 2024: The Indian Air Force (IAF) achieved a successful nighttime landing of a C-130J Super Hercules aircraft with the aid of night vision goggles at an advanced landing ground in the Eastern Sector. This pioneering accomplishment improved the IAF’s capability for nighttime operations and defense readiness.

Night Vision Devices Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Devices Covered | Goggles, Cameras, Scopes, Others |

| Technologies Covered | Image intensifier, Thermal Imaging, Infrared Illumination |

| End Users Covered | Military Segment, Civil Segment |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Teledyne FLIR LLC, L3Harris Technologies, Inc., Elbit Systems of America, LLC, American Technologies Network Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, night vision devices market forecast, and dynamics of the market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the night vision devices market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the market and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the night vision devices industry.

Key Questions Answered in This Report

The night vision devices market was valued at USD 11.37 Billion in 2024.

The night vision devices market is projected to exhibit a CAGR of 5.00% during 2025-2033, reaching a value of USD 17.72 Billion by 2033.

Law enforcement agencies are employing night vision devices for surveillance, border control, and night patrols, enhancing public safety. Besides this, the increasing appeal of outdoor leisure activities, such as camping and wildlife observation, is supporting the market growth. Moreover, technological advancements are making night vision devices more compact, affordable, and accessible for both professional and personal use.

North America currently dominates the night vision devices market, accounting for a share of 39.7% in 2024, driven by strong defense spending, advanced technology development, and high adoption by law enforcement and the military sector. The region is also supporting R&D activities and innovations through local manufacturers.

Some of the major players in the night vision devices market include Teledyne FLIR LLC, L3Harris Technologies, Inc., Elbit Systems of America, LLC, American Technologies Network Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)