Nigeria Online Food Delivery Market Report by Platform Type (Mobile Applications, Websites), Business Model (Order Focused Food Delivery System, Logistics Based Food Delivery System, Full-Service Food Delivery System), Payment Mode (Online, Cash on Delivery), End User (Individual, Corporate), and Region 2025-2033

Market Overview:

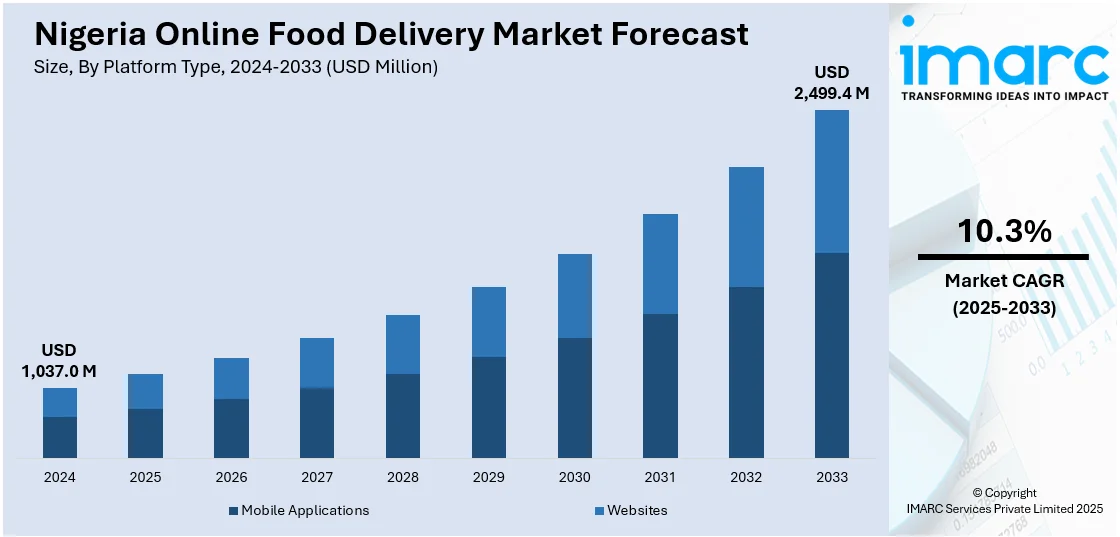

The Nigeria online food delivery market size reached USD 1,037.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,499.4 Million by 2033, exhibiting a growth rate (CAGR) of 10.3% during 2025-2033. The growing consumption of ready-to-eat (RTE) and fast-food products, increasing online food ordering activities of working individuals, and rising integration of advanced technologies in online food ordering and delivering systems represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1,037.0 Million |

|

Market Forecast in 2033

|

USD 2,499.4 Million |

| Market Growth Rate 2025-2033 | 10.3% |

Online food delivery refers to the process of ordering and delivering food through online portals. It comprises an order management system that streamlines the entire ordering process, starting from order placement to final delivery. It relies on mobile-based software, applications, and websites that offer access to numerous food joints based on the preferences of the customers. It enables eateries to take the placed orders, prepare the particular dish on time, and hand it over to the delivery personnel to deliver it to the buyer. It also allows customers to provide valuable reviews about the service and quality of the food offered by the restaurant on the online portal. It helps individuals place an order virtually any time, from anywhere, and avoid the hassle of traveling and standing in long queues at restaurants. Online food delivery also provides various discounts, offers, and exclusive benefits, such as fast and free delivery, to attract buyers. Furthermore, as it allows individuals to track the location of the delivery personnel and check the routes taken by them, the demand for online food delivery is increasing in Nigeria.

Nigeria Online Food Delivery Market Trends:

At present, the increasing demand for online food delivery services due to the rising consumption of various ready-to-eat (RTE) and fast-food products represents one of the significant factors influencing the market positively in Nigeria. Besides this, the growing online food ordering activities of working individuals to save time and avoid the hassle of cooking is offering a favorable market outlook. In addition, the increasing habits of binge eating among the masses are propelling the growth of the market in the country. Apart from this, the rising adoption of online sales channels by several brick-and-mortar food chains in Nigeria to save rent and other operational expenses is strengthening the growth of the market. Additionally, the increasing integration of advanced technologies in online food ordering and delivering systems, such as artificial intelligence (AI), the internet of things (IoT), predictive analytics, and big data, to provide personalized options to customers and enhance their experiences is supporting the growth of the market in the country. Moreover, the rising utilization of various smart devices, such as smartphones, tablets, and laptops, to access the internet, connect with other individuals, and purchase products and services online is impelling the market growth in Nigeria.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the Nigeria online food delivery market report, along with forecasts at the country and regional level from 2025-2033. Our report has categorized the market based on platform type, business model, payment mode and end user.

Platform Type Insights:

- Mobile Applications

- Websites

The report has provided a detailed breakup and analysis of the Nigeria online food delivery market based on the platform type. This includes mobile applications and websites. According to the report, mobile applications represented the largest segment.

Business Model Insights:

- Order Focused Food Delivery System

- Logistics Based Food Delivery System

- Full-Service Food Delivery System

A detailed breakup and analysis of the Nigeria online food delivery market based on the business model has also been provided in the report. This includes an order focused food delivery system, logistics based food delivery system, and full-service food delivery system. According to the report, order focused food delivery system accounted for the largest market share.

Payment Mode Insights:

- Online

- Cash on Delivery

A detailed breakup and analysis of the Nigeria online food delivery market based on the payment mode has also been provided in the report. This includes online and cash on delivery. According to the report, online accounted for the largest market share.

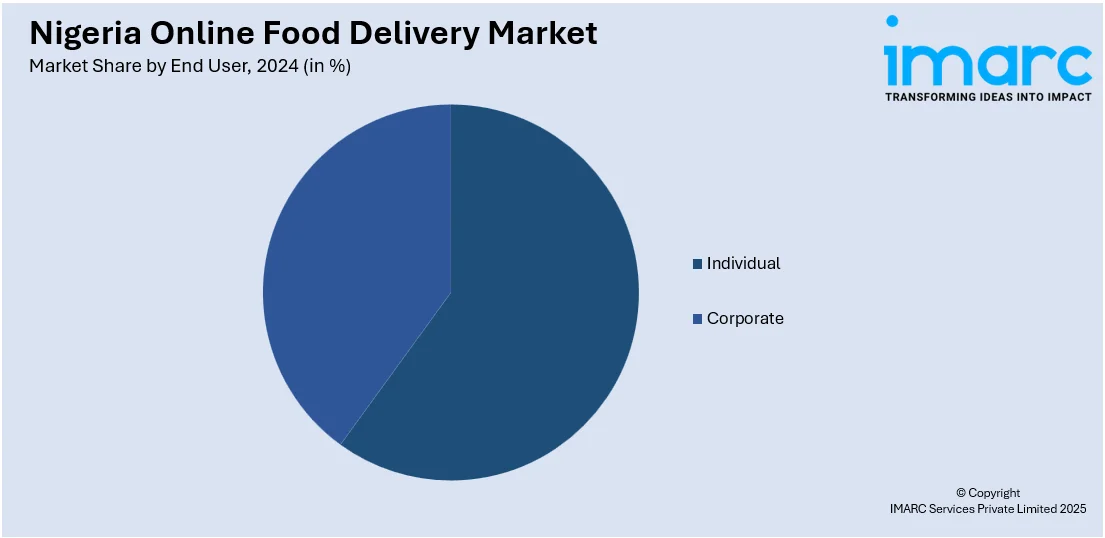

End User Insights:

- Individual

- Corporate

A detailed breakup and analysis of the Nigeria online food delivery market based on the end user has also been provided in the report. This includes individual and corporate. According to the report, individual accounted for the largest market share.

Regional Insights:

- North West

- South West

- North Central

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include North West, South West, North Central, and others. According to the report, North West was the largest market for Nigeria online food delivery. Some of the factors driving the North West Nigeria online food delivery market included the growing popularity of ordering food online, increasing consumption of fast-foods, rising number of quick service restaurants (QSRs) and cafes, etc.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the Nigeria online food delivery market. Competitive analysis such as market structure, market share by key players, player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the companies covered AreaChops, Chopnownow, Foodie Nigeria, Foodstantly, Gingerbox, GoFood (AT&A Retail Limited), Jumia Foods, NaijaEats, Ofood (Opay), etc. Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Segment Coverage | Platform Type, Business Model, Payment Mode, End User, Region |

| Region Covered | North West, South West, North Central, Others |

| Companies Covered | AreaChops, Chopnownow, Foodie Nigeria, Foodstantly, Gingerbox, GoFood (AT&A Retail Limited), Jumia Foods, NaijaEats, and Ofood (Opay) |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Nigeria online food delivery market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Nigeria online food delivery market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Nigeria online food delivery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Nigeria online food delivery market was valued at USD 1,037.0 Million in 2024.

The Nigeria online food delivery market is expected to grow at a CAGR of 10.3% during 2025-2033.

The growing prominence of online food delivery process, as it ensures hassle-free delivery, generates various discount offers, provides convenient payment options, etc., is primarily driving the Nigeria online food delivery market.

The sudden outbreak of the COVID-19 pandemic has led to the increasing demand for online food delivery services across the nation, owing to the temporary closure of dine-in facilities.

Based on the platform type, the Nigeria online food delivery market has been segmented into mobile applications and websites. Currently, mobile applications hold the majority of the total market share.

Based on the business model, the Nigeria online food delivery market can be divided into order focused food delivery system, logistics based food delivery system, and full-service food delivery system. Among these, order focused food delivery system exhibits a clear dominance in the market.

Based on the payment mode, the Nigeria online food delivery market has been categorized into online and cash on delivery, where online payment mode currently accounts for the majority of the total market share.

Based on the end user, the Nigeria online food delivery market can be segregated into individual and corporate. Currently, individual holds the largest market share.

On a regional level, the market has been classified into North West, South West, North Central, and others, where North West currently dominates the Nigeria online food delivery market.

Some of the major players in the Nigeria online food delivery market include AreaChops, Chopnownow, Foodie Nigeria, Foodstantly, Gingerbox, GoFood (AT&A Retail Limited), Jumia Foods, NaijaEats, and Ofood (Opay).

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)