Nicotine Pouches Market Size, Share, Trends and Forecast by Product, Flavor Type, Strength, Distribution Channel, and Region, 2025-2033

Nicotine Pouches Market Size and Trends:

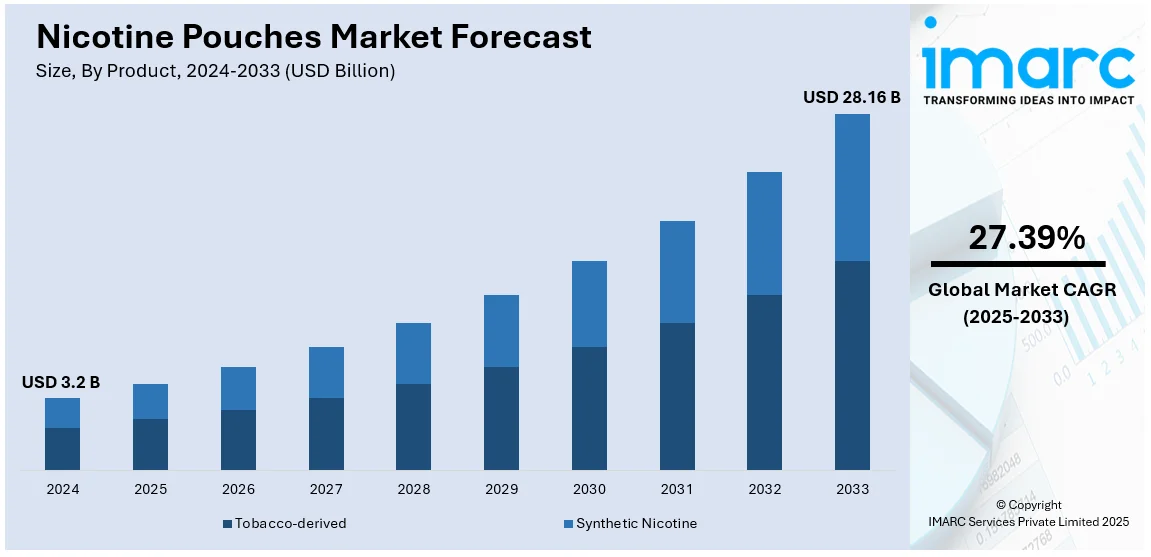

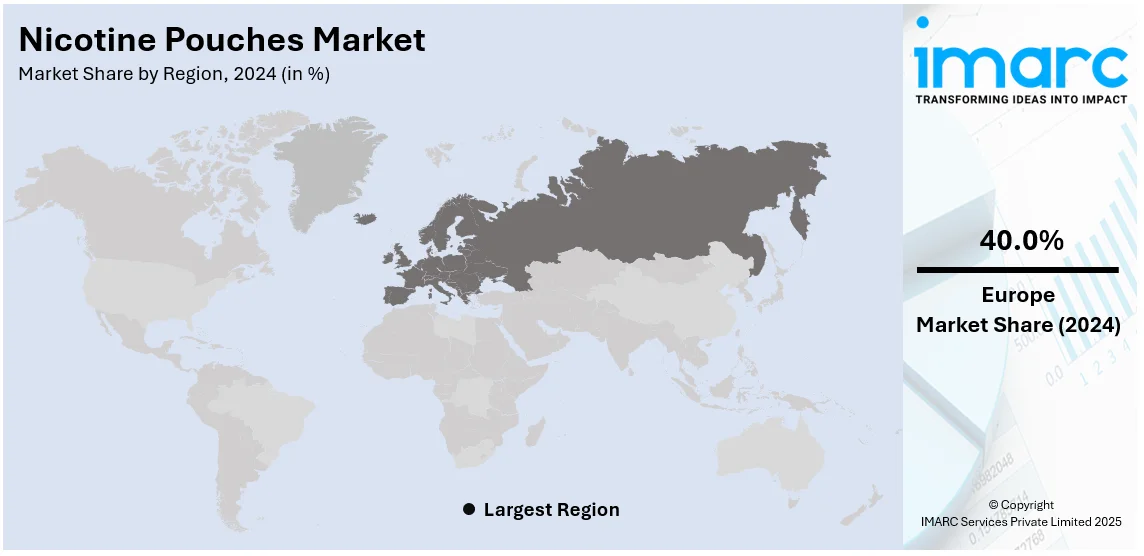

The global nicotine pouches market size was valued at USD 3.2 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 28.16 Billion by 2033, exhibiting a CAGR of 27.39% during 2025-2033. Europe currently dominates the market, holding a significant nicotine pouches market share of over 40.0% in 2024. The rising product adoption as an alternative to smoking, the growing awareness among consumers regarding tobacco consumption, and the increasing product availability on online platforms represent some of the key factors driving the nicotine pouches market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.2 Billion |

| Market Forecast in 2033 | USD 28.16 Billion |

| Market Growth Rate (2025-2033) | 27.39% |

The global nicotine pouches market is experiencing significant growth, driven by rising awareness regarding the health risks associated with smoking and increasing demand for less harmful tobacco alternatives. The growing adoption of smoke-free lifestyles, coupled with stringent government regulations on traditional tobacco products, is further accelerating the shift toward nicotine pouches. Along with this, innovations in flavors and discreet usage have broadened their appeal among diverse age groups, particularly millennials and Gen Z, which is positively influencing the market. On 12th April 2024, Scandinavian Tobacco Group (STG) launched XQS nicotine pouches in the UK this May. The company offers four different flavors: Tropical, Blueberry Mint, Cool Ice, and Arctic Freeze, all for £5.50 per can of 20 pouches. XQS pouches are famous for a small size and long-lasting flavor. They come in recyclable packaging and receive support from trade shows, national marketing campaigns, as well as an extended sales team. With UK nicotine pouch sales growing rapidly, STG aims to capitalize on the market’s demand for innovative, flavor-driven products. Additionally, inflating disposable income levels and the rapid expansion of e-commerce platforms are enhancing product accessibility and fueling the nicotine pouches market growth across the globe.

The United States stands out as a key regional market, primarily driven by increasing consumer demand for tobacco-free, smoke-free alternatives that align with healthier lifestyles. Apart from this, regulatory pressures, such as higher taxes on cigarettes and restrictions on public smoking, have further shifted consumer preferences across the US. Concurrently, the growing popularity of customizable flavors and nicotine pouches' discreet, portable nature appeal to modern, convenience-focused consumers. On 16th January 2025, the US FDA approved Philip Morris International's Zyn nicotine pouches for sale in the country, based on studies showing that they carry an even lower cancer risk than cigarettes and smokeless tobacco. The regulatory agency approved 10 flavors with strict advertising restrictions to prevent their use by younger people. A recent CDC and FDA survey indicates that Zyn remains the most-used nicotine pouch, with 1.8 percent of U.S. middle and high school students reporting usage as of 2024. Moreover, the widespread adoption of digital sales channels is also enhancing product availability, fueling growth in both urban and rural areas.

Nicotine Pouches Market Trends:

Rising Popularity of Smoke Free Alternatives

Increased awareness of the health risks of smoking has led many individuals to seek safer alternatives. A survey by Tobacco Induced Diseases (TID) revealed that the awareness levels for certain smoking-related diseases were lung cancer (77.1%), heart disease (45.1%), stroke (40.1%), and penile erectile dysfunction (24.2%). Nonetheless, just 22.1% of the participants were aware that smoking could cause all four of the diseases listed. Smoke-free products including nicotine pouches are often perceived as less harmful as they do not involve combustion, which produces harmful toxins and carcinogens. For instance, according to an article published by Nature, chemical research on nicotine pouches revealed that they contain far fewer harmful chemicals than Swedish snus and tobacco smoking. Nicotine pouches are anticipated to be a significantly 'lower-risk product' than tobacco smoking as they do not burn and do not contain tobacco leaves. Moreover, nicotine pouches align with the concept of harm reduction, which aims to minimize the health risks associated with nicotine and tobacco use. For individuals who are unable or unwilling to quit nicotine entirely, switching to smoke-free alternatives including nicotine pouches can significantly reduce their exposure to harmful toxins and carcinogens found in tobacco smoke. For instance, according to an article published by the National Library of Medicine, a human behavioral study suggests that TFNPs can help individuals quit smoking or cut back on how much they smoke. Similarly, according to an article published by the University Hospitals, nicotine packets can help current smokers quit. Because they contain no tobacco, they can have a favorable impact on the health of existing smokers. These factors are further propelling the nicotine pouches market demand.

Availability of Flavored Nicotine Pouches

Flavored nicotine pouches are often available in a variety of enticing flavors, which can attract younger consumers who may be more inclined to try them compared to traditional tobacco products. Flavors such as fruit, mint, and candy appeal to a broader audience, including those who may not have been interested in smoking before. For instance, according to the 2021 National Tobacco Youth Survey, the majority of users (61.6%) reported utilizing flavored nicotine pouches. The two most popular tastes among current flavored nicotine pouch users were mint (53.5%) and menthol (50.2%), with 45.5% utilizing other flavors such as fruit and candies, desserts, or other sweets. Moreover, the rising launch of flavors by various manufacturers is creating the demand for flavored nicotine pouches. For instance, in April 2024, Scandinavian Tobacco Group UK launched next-generation nicotine pouches, known as XQS. XQS was released in four flavors with varying strengths: Tropical, Blueberry Mint, Cool Ice, and Arctic Freeze. While the Tropical and Blueberry Mint flavors are fruity in nature, the Cool Ice and Arctic Freeze flavors are minty and provide an ice-cooling experience. All four varieties come in entirely recyclable packaging with pouches that are distinctively smaller in size to ensure a precise fit under the lip. These factors are stimulating the nicotine pouches market growth.

Growing Demand for Convenient Options

One of the most significant nicotine pouches market trends is rising adoption of convenient options. Nicotine pouches are pre-portioned and ready to use, thus no preparation and special equipment needed. This ease makes them easy to use while on the move; consumers can quickly and easily satiate their urge for nicotine. For example, in June 2024, Dennis Rodman, a basketball player, presented nicotine pouches. California-designed, these pouches offer smokers a convenient alternative to regular cigarettes. Made with high-quality components, they deliver a consistent and enjoyable nicotine experience. They are easy to use, portable, and made to fit any lifestyle, whether individuals are at work, socializing, or on the run. In addition, nicotine pouches are widely available through a variety of retail channels, including convenience stores, gas stations, and online retailers. This ease-of-access further benefits the convenience since consumers can be able to quickly buy pouches from anywhere and anywhere. In 2024's April, an agreement was executed between Circle K, which runs over 6,000 c-stores around the United States, as its premier convenience chain, and the tobacco-free nicotine pouches provider: 20NE. This strategic relationship propels 20NE to convenience and accessibility, with its products available in every corner of the country. These factors are further contributing to the nicotine pouches market outlook.

Nicotine Pouches Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global nicotine pouches market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, flavor type, strength, and distribution channel.

Analysis by Product:

- Tobacco-derived

- Synthetic Nicotine

Synthetic nicotine leads the market in 2024. With increasing awareness of the health risks associated with smoking traditional tobacco products, many consumers are seeking alternatives that offer nicotine without the harmful effects of combustion and tobacco. Synthetic nicotine pouches provide a smoke-free, discreet way to satisfy nicotine cravings. Moreover, these pouches often come in a variety of flavors, appealing to consumers who enjoy different taste experiences. This variety can attract both new users and those looking for alternatives to traditional tobacco flavors. For instance, in April 2022, Juice Head launched the latest addition of premium fruit-flavored pouches. These pouches are thin and are made with Zero Tobacco Nicotine which is a synthetic nicotine brand.

Analysis by Flavor Type:

- Original/Unflavored

- Flavored

- Mint

- Fruit

- Coffee

- Cinnamon

- Others

Flavored leads the market with around 90.0% of nicotine pouches market share in 2024. Flavored nicotine pouches come in a wide range of flavors, including mint, fruit, and dessert-inspired options. This variety appeals to consumers who enjoy different taste experiences and may help them find flavors they prefer over traditional tobacco flavors. Moreover, flavored nicotine pouches often attract individuals who may not have used traditional tobacco products but are curious to try flavored nicotine options. These consumers may be drawn to the novelty of flavors and the perception that flavored nicotine pouches are less harmful than smoking. For instance, in May 2024, HIIO launched four new flavors in nicotine pouches in order to diversify its product offering.

Analysis by Strength:

- Light

- Normal

- Strong

- Extra Strong

Strong leads the market with around 45.5% of market share in 2024. Strong nicotine pouches are often used as a smoking cessation aid by individuals attempting to quit smoking. Higher nicotine concentrations can help alleviate withdrawal symptoms and cravings, making it easier for smokers to transition away from traditional cigarettes. Moreover, some consumers, particularly long-time smokers or individuals with high nicotine tolerance, seek products with higher nicotine content to satisfy their cravings effectively. Strong nicotine pouches provide a higher concentration of nicotine compared to regular strength options, making them appealing to this demographic.

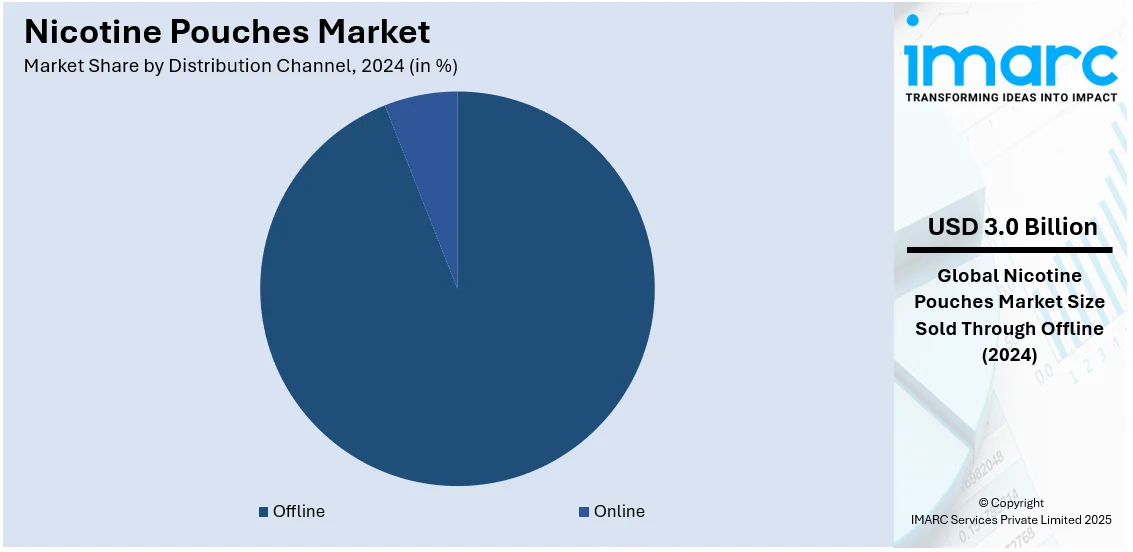

Analysis by Distribution Channel:

- Offline

- Online

Offline leads the market with around 93.7% of market share in 2024. Despite the growth of e-commerce, many consumers still prefer to purchase certain products, especially those related to tobacco or nicotine, in person. They may feel more comfortable buying these products from a physical store where they can see and inspect them before purchase. Moreover, some regions may have stricter regulations on the sale of nicotine products, requiring them to be sold through licensed physical retailers rather than online platforms. For instance, in November 2022, Swedish Match launched ZYN nicotine pouches at Dubai Duty Free (DDF).

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, based on the nicotine pouches market forecast, Europe accounted for the largest market share of over 40.0%. Some of the factors driving the Europe market include rising disposable incomes, the introduction of synthetic product variants, and increasing concerns about the ill effects of tobacco. In addition, growing awareness of the health risks associated with smoking traditional tobacco products has led many consumers in Europe to seek alternatives. Nicotine pouches therefore form a smoke-free avenue for the consumption of nicotine, well-suited for health-conscious customers who seek to minimize or quit smoking. The smoking regulation in public areas has also been extremely strict while the taxes on tobacco products have been on the rise, enticing consumers toward smokeless alternatives which happen to be nicotine pouches. Besides this, increasing product launches by various key players are driving the demand for nicotine pouches in Europe. For instance, in October 2023, TACJA launched nicotine pouches in the United Kingdom, Switzerland, and Sweden. The products offered eight flavors in two taste series Mellow and Frozen.

Key Regional Takeaways:

United States Nicotine Pouches Market Analysis

In 2024, the US accounted for around 96.1% of the total North American nicotine pouches market. The U.S. market is gaining momentum as consumers are increasingly opting for smokeless alternatives to the traditional tobacco product. According to the American Lung Association, around 28.8 million adults in the United States were smoking in 2022, thus creating a consistent demand for healthier alternatives such as nicotine pouches. With more and more attempts of consumers to reduce smoking, nicotine pouches have gained widespread popularity as it is used very discreetly as well and their flavor varieties are quite numerous. The market finds good support from heavy regulations; thus, the FDA of the U.S. allowed several nicotine pouch products to hit the shelves while ensuring their safety and quality. Swedish Match and Altria Group lead the market through innovation in new flavors and wider availability of products. The expansion of the market is further being driven by an increased awareness of smoking-related health risks and a growing preference for smokeless alternatives. The increase in disposable incomes also contributes to increased consumer adoption.

Europe Nicotine Pouches Market Analysis

Robust growth is experienced in the market for nicotine pouches in Europe, as there is an increased consumer preference for nicotine alternatives, and smoking rates are gradually decreasing. According to the European Commission, in 2019, daily smokers accounted for about 19.7% of individuals aged 15 years and above in the European Union (EU). By 2022, this figure had declined to about 18.4%, meaning that smoking prevalence was on the decline in all EU countries. In Sweden and the UK, where tobacco control policies are relatively strong, nicotine pouches have become popular. According to the Swedish Health Authority, Sweden's tobacco-free nicotine pouch market is growing at 10% per annum over the next five years. Strong and stable regulatory regimes also continue to propel this industry. In its continuous effort to offer consumers new tobacco products, for example, companies such as British American Tobacco and Imperial Brands have expanded on their lines by producing more nicotine pouches that cater to higher demand levels by consumers.

Asia Pacific Nicotine Pouches Market Analysis

The Asia Pacific market for nicotine pouches is on a high-growth trajectory with a rise in the demand for smokeless tobacco substitutes. It has been recorded by the World Health Organization that, with over 300 million smokers, China leads with nearly a third of global numbers, meaning its demand contributes substantially to smokeless alternatives, such as nicotine pouches. Therefore, with rising health concerns from Chinese smokers, the changeover to smokeless nicotine-based products is rapid. In India, the increasing middle-class and disposable income is a strong demand for nicotine pouches and is likely to rise in the coming years. Smokeless products are gradually replacing combustible tobacco products in the region. Markets of countries such as Japan and South Korea have witnessed increasing interest among consumers, which has increased availability and product innovation. With favorable regulatory environments coupled with increasing awareness of health hazards, Asia Pacific would continue to play a key role in the global nicotine pouches market.

Latin America Nicotine Pouches Market Analysis

The demand for nicotine pouches is booming rapidly in Latin America as more consumers move away from conventional tobacco products to smokeless counterparts. As a matter of fact, in 2021 data available, roughly 9.1% of adults in Brazil smoked, or just about 21.1 million individuals. With the smoking rates reducing gradually, consumers seek an alternative, that is nicotine pouches. The nicotine pouch market in Brazil is growing since companies including Nicoventures and British American Tobacco (BAT) are targeting the region for more expansion. Rising discretionary spending among Brazil's middle class, increased income levels, and attempts to introduce stronger tobacco control measures create an environment in Brazil that readily embraces smokeless products. More than that, however, awareness of health hazards that are caused by smoking has increased consumer's tendency towards alternative sources of nicotine.

Middle East and Africa Nicotine Pouches Market Analysis

The demand for nicotine pouches in the Middle East and Africa is gradually increasing since more smokers opt for alternatives that do not conform to traditional tobacco products. Reports from the industry reveal that, in 2022, an estimated 952,400 users of tobacco, aged 15 years or older, lived in the UAE. This corresponds to around 11.9% of the total population in the country. The prevalence of smoking in the UAE was much higher among men than women, at 15.5% for men and 2.5% for women, using tobacco. Deaths in the UAE due to all causes were contributed to by tobacco use in 18.9%. These included deaths from stroke, lung cancer, and ischemic heart disease. As individuals are becoming increasingly aware of the health risks posed by smoking, more smokers are seeking alternative nicotine delivery systems, such as nicotine pouches. As public health awareness rises and the adoption of smokeless products increases, the nicotine pouches demand is expected to rise. The regional market also holds the interest of various international brands that are keen to benefit from this emerging segment.

Competitive Landscape:

The market is characterized by severe competition due to increased demand for smoke-free alternatives for traditional tobacco products. Market players focus on innovation in flavors, nicotine strengths, and product formulations that reflect the changed consumer preferences. Companies are employing high-tech marketing and geographical reach expansion through partnerships and digital channels of distribution. Growing concerns for sustainability and environmentally friendly packaging also now create competitive differences as firms need to meet consumers who care for the environment. Additionally, strict regulatory frameworks and the need for compliance have spurred manufacturers to invest in research and development to maintain market relevance, fueling the race for innovation and differentiation across the global market.

The report provides a comprehensive analysis of the competitive landscape in the nicotine pouches market with detailed profiles of all major companies, including:

- Altria Group Inc.

- British American Tobacco PLC

- Japan Tobacco Inc.

- Nicopods ehf.

- Philip Morris International

- Skruf Snus AB (Imperial Brands plc)

- Swedish Match AB

- The Art Factory AB

- Triumph Tobacco Alternatives LLC

Latest News and Developments:

- In January 2025, Scandinavian Tobacco Group UK (STG) has expanded its XQS nicotine pouch range with two new flavors: Black Cherry and Citrus Cooling. Available now for £5.50, Black Cherry offers a rich, deep flavor, while Citrus Cooling combines tart citrus with a refreshing mint effect. Launched in May 2024, XQS has rapidly grown, becoming the fastest-growing nicotine pouch brand by the end of the year. STG plans further innovations to drive category growth.

- In January 2025, The U.S. FDA has authorized ZYN nicotine pouches, making it the first and only nicotine pouch approved in the U.S. This approval covers all ZYN pouches marketed by Swedish Match, offering a healthier alternative to cigarettes and traditional tobacco products for adults 21+. Swedish Match President Tom Hayes emphasized that ZYN can help the 30 million smokers in the U.S. switch to a less harmful nicotine consumption method, supporting public health.

- In November 2024, Tucker Carlson launched a new nicotine pouch brand, ALP, marketed as “for adults who unapologetically love nicotine.” The product, available in strengths of 3 mg, 6 mg, and 9 mg, offers flavors like Chilled Mint and Tropical Fruit. Sold through a joint venture between Carlson's network and Turning Point Brands, ALP is presented as an alternative to politically charged brands, with Carlson criticizing competitors like Zyn for being “dry as a teabag.”

- October 2024: British American Tobacco (BAT) announced that they will launch a version of its Velo nicotine pouches using synthetic nicotine in the U.S. The synthetic nicotine, produced in a lab, contrasts with naturally occurring nicotine derived from the tobacco plant, commonly found in smoking alternatives including vapes.

- June 2024: Altria Group submitted Premarket Tobacco Product Applications (PMTAs) to the FDA for its on! PLUS, nicotine pouches. The pouches, available in tobacco, mint, and wintergreen varieties, are designed for adult dual users and come in various nicotine strengths.

- June 2024: Dennis Rodman, a basketball player, introduced nicotine pouches. Designed in California, these pouches provide smokers with an alternative to regular cigarettes.

- May 2024: HIIO launched four new flavors in nicotine pouches in order to diversify its product offering.

- April 2024: 20NE, a tobacco-free nicotine pouches provider signed an agreement with Circle K, the premier convenience store chain with over 6,000 locations in the United States.

Nicotine Pouches Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Tobacco-derived, Synthetic Nicotine |

| Flavor Types Covered |

|

| Strengths Covered | Light, Normal, Strong, Extra Strong |

| Distribution Channels Covered | Offline, Online |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Altria Group Inc., British American Tobacco PLC, Japan Tobacco Inc., Nicopods ehf., Philip Morris International, Skruf Snus AB (Imperial Brands plc), Swedish Match AB, The Art Factory AB, Triumph Tobacco Alternatives LLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the nicotine pouches market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global nicotine pouches market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the nicotine pouches industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The nicotine pouches market was valued at USD 3.2 Billion in 2024.

IMARC estimates the nicotine pouches market to exhibit a CAGR of 27.39% during 2025-2033.

The nicotine pouches market was valued at USD 28.16 Billion by 2033.

The key drivers of the nicotine pouches market include increasing awareness of the health risks associated with smoking, prompting a shift to safer alternatives, and the growing demand for smoke-free, discreet, and portable nicotine options. Additionally, continuous innovations in flavors and product formulations appealing to a diverse consumer base are also significantly supporting the market.

Europe currently dominates the nicotine pouches market, accounting for a share exceeding 40.0% in 2024. This dominance is fueled by increasing awareness of the health risks of smoking, higher disposable incomes, and stringent regulations on traditional tobacco products.

Some of the major players in the nicotine pouches market include Altria Group Inc., British American Tobacco PLC, Japan Tobacco Inc., Nicopods ehf., Philip Morris International, Skruf Snus AB (Imperial Brands plc), Swedish Match AB, The Art Factory AB, and Triumph Tobacco Alternatives LLC, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)