Nickel Market Size, Share, Trends and Forecast by Product Type, Application, End Use Industry, and Region, 2025-2033

Nickel Market 2024, Size and Outlook:

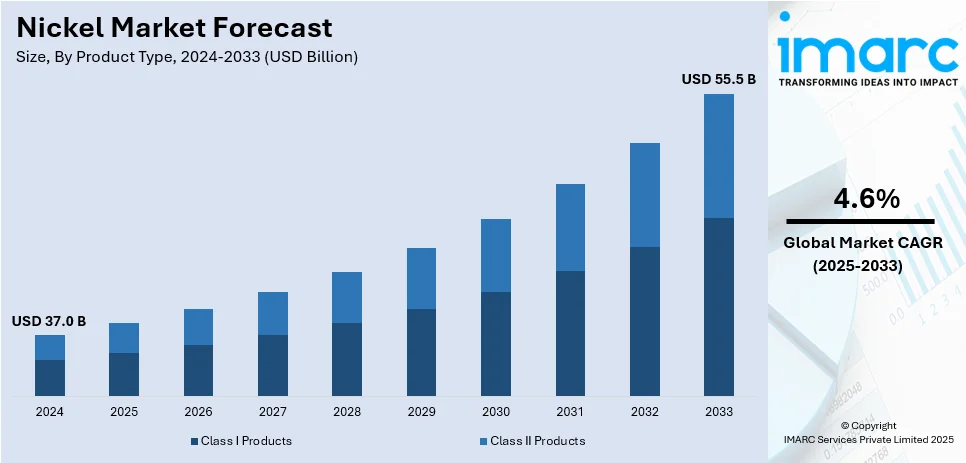

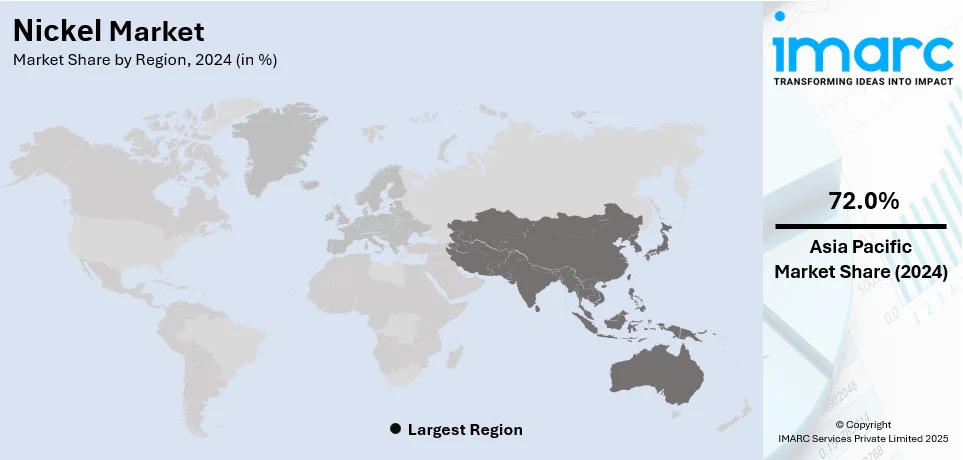

The global nickel market size was valued at USD 37.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 55.5 Billion by 2033, exhibiting a CAGR of 4.6% during 2025-2033. Asia Pacific currently dominates the nickel market share, holding a significant market share of over 72.0% in 2024. Rapid technological advancements and innovation, favorable government policies and regulations, burgeoning investments in infrastructure and development projects, and the rising demand for stainless steel products are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 37.0 Billion |

|

Market Forecast in 2033

|

USD 55.5 Billion |

| Market Growth Rate (2025-2033) | 4.6% |

The market is primarily driven by the growing focus on renewable energy storage systems and grid-scale battery installations, which is augmenting the demand for nickel. Moreover, robust research and development (R&D) initiatives are fostering innovation in nickel extraction, aiming to improve efficiency, reduce environmental impacts, and develop sustainable alternatives to traditional mining practices. For instance, on September 23, 2024, Nornickel opened a research and development (R&D) hub in St. Petersburg to investigate applications of nickel-containing cathode active materials for electric vehicle (EV) batteries, signifying its first step into battery manufacturing. This initiative aims to establish a foundation for future projects and production facilities in the battery materials sector. Additionally, supply constraints and the geopolitical risks surrounding major nickel-producing regions contribute to market volatility and influence pricing trends. Besides these factors, continual technological advancements in mining technologies and recycling processes are helping optimize nickel production to meet growing global needs sustainably, thereby ensuring long-term nickel market growth.

The market in the United States is experiencing significant growth due to the increasing investments by the aerospace and defense industries, as nickel-based superalloys are essential for manufacturing high-performance components that withstand extreme conditions in aircraft engines and military equipment. For example, on December 18, 2024, Metal Tech News reported that the U.S. Department of Defense's Defense Logistics Agency (DLA) awarded Talon Metals Corp. a USD 2.47 Million research and development contract. The funding aims to support innovative methods for extracting nickel, cobalt, and iron from domestic sulfide ores and tailings, focusing on the Tamarack Nickel Project in Minnesota and North Dakota. This initiative seeks to reduce U.S. reliance on foreign sources, particularly China and Russia, for critical battery metals essential to defense platforms and clean energy systems. Moreover, the energy transition in the United States, with significant investments in clean energy infrastructure, is leading to a higher need for nickel in wind turbines and hydrogen production technologies. Furthermore, the U.S. government's strategic focus on reducing reliance on foreign mineral imports results in the exploration and development of domestic nickel resources, fostering a more resilient supply chain. Apart from this, strategic collaborations between companies often focus on leveraging complementary strengths to drive innovation, improve efficiency, or expand market reach.

Nickel Market Trends:

Growing Demand for Nickel in the Stainless Steel Industry

The stainless-steel industry is a major consumer of nickel, utilizing it as a key alloying element to enhance the strength, corrosion resistance, and durability of stainless-steel products. According to the International Stainless-Steel Forum (ISSF), over 60% of global nickel consumption is attributed to the stainless-steel industry. The increasing usage of stainless steel in various sectors, including construction, automotive, and consumer goods, is raising the nickel market demand. In construction, stainless steel is widely used in infrastructure projects, such as bridges, railways, and buildings, due to its excellent structural properties and resistance to corrosion. In the automotive sector, nickel-containing stainless steel is utilized in components like exhaust systems and catalytic converters. Additionally, the increasing popularity of stainless-steel appliances and utensils in households further boosts the demand for nickel.

Increasing Adoption of EVs

Nickel is a key component in the cathode of rechargeable lithium-ion batteries used in EVs. According to a report from Benchmark Mineral Intelligence and Carbon Credits, the demand for nickel in batteries could increase by 300% over the next decade, largely due to the growing adoption of EVs. As governments and consumers worldwide prioritize reducing greenhouse gas emissions and dependence on fossil fuels, the demand for EVs is experiencing significant growth. This, in turn, drives the demand for nickel in the battery sector, which is also increasing the nickel market share. Nickel-based lithium-ion batteries offer higher energy density, improved longevity, and increased driving range, making them essential for the widespread adoption of EVs. As major automotive manufacturers continue to invest in EV production and governments implement supportive policies and incentives, the demand for nickel in the battery sector is expected to rise exponentially, creating a strong driver for the global nickel market.

Infrastructure Development and Urbanization in Emerging Economies

Nickel is extensively used in producing stainless steel reinforcement bars, which is enhancing the nickel market outlook. Nickel is a crucial component in construction projects, including buildings, bridges, and highways. As developing countries experience population growth, increased urbanization, and rising standards of living, the demand for infrastructure expands. According to a report by the Global Infrastructure Outlook, global infrastructure investment is expected to reach USD 94 trillion by 2040. Stainless steel reinforcement bars offer superior strength, durability, and resistance to corrosion, making them a preferred choice for construction purposes. As a result, the demand for nickel in the construction sector, driven by infrastructure development and urbanization, continues to grow.

Nickel Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global nickel market report, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on product type, application, and end-use industry.

Analysis by Product Type:

- Class I Products

- Class II Products

Class I products lead the market with around 44.8% of market share in 2024 due to their high purity content. These products represent high-purity products applied wherever high-quality metal is critical for specific applications, including in battery production, aerospace, and electronics. Some of the main products in class I nickel include nickel briquettes, cathodes, and powders. The demand is highly driven by the increasing number of electric vehicle sales because class I nickel represents a significant share of the materials used in high-energy-density lithium-ion battery cathodes. As the rate of global EV adoption continues to grow, the usage of nickel is likely to increase. Class I nickel is also crucial to produce high-performance alloys used in jet engines and other advanced applications. Its premium status ensures it is one of the main products for innovativeness and sustainability across industries.

Analysis by Application:

- Stainless Steel and Alloy Steel

- Non-ferrous Alloys and Superalloys

- Electroplating

- Casting

- Batteries

- Others

Stainless steel and alloy steel leads the market with around 65.0% of market share in 2024. Nickel acts as a significant component in stainless steel production and enhances its corrosion resistance, strength, and durability. Its usage is related to stainless steel manufacturing, as it reflects an essential role in producing high-performance materials for various industries like construction, automotive, and consumer goods. Nickel alloyed steel, a blend of alloy with nickel addition, is fundamental in energy-related and aerospace uses besides heavy machines. The worldwide demand for resistance against corrosion coupled with an extended need from infrastructure development is promoting the nickel addition into steel processing continuously. Other rising trends, such as sustainable construction and lightweight, high-strength alloys for electric vehicles, are strengthening nickel's value in these applications.

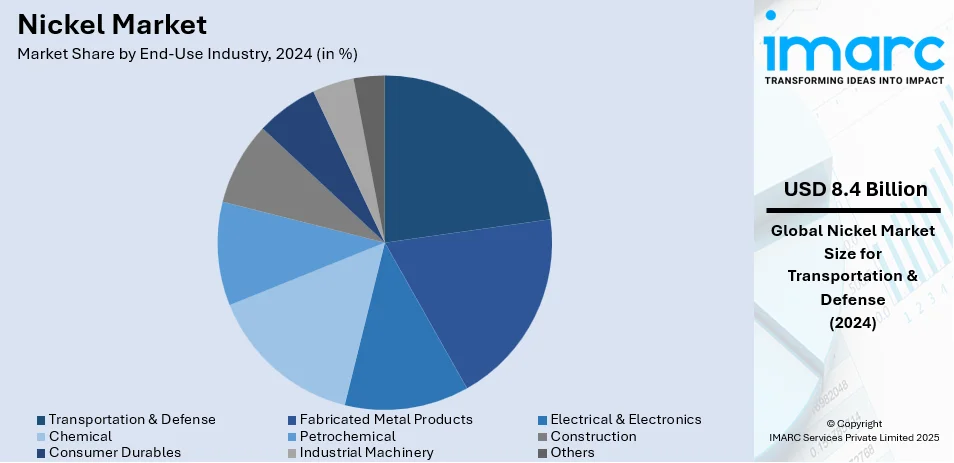

Analysis by End-Use Industry:

- Transportation & Defense

- Fabricated Metal Products

- Electrical & Electronics

- Chemical

- Petrochemical

- Construction

- Consumer Durables

- Industrial Machinery

- Others

Transportation and defense lead the market with around 22.7% of market share in 2024.The transportation industry, particularly electric vehicles (EVs), relies on nickel-rich batteries to enhance energy density and extend vehicle range, aligning with the global push for cleaner mobility solutions. Nickel is a popular choice for automotive, aircraft, and shipbuilding, as well as for manufacturing components for trains that require high strength, can resist corrosion attacks, and undergo extreme temperatures for their operation. The aerospace industry uses nickel-based alloy for jet-engine applications where durability and heating resistance are an absolute necessity in the application area. In defense, nickel is used for armor plating in naval vessels and military-grade batteries. Increased defense spending and modernization efforts further support the nickel market growth.

Regional Analysis:

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- North America

- United States

- Canada

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

- Middle East and Africa

- Turkey

- Saudi Arabia

- Iran

- United Arab Emirates

- Others

In 2024, Asia Pacific accounted for the largest market share of over 72.0% due to its vast population, rapid industrialization, and dynamic economic growth. Countries like China, Japan, South Korea, and India have become manufacturing powerhouses, offering cost-effective production capabilities and a massive consumer base. The region's strong focus on exports, technological advancements, and investments in research and development (R&D) activities propels industries such as electronics, automotive, telecommunications, and e-commerce, driving its market leadership. In line with this, the escalating adoption of electric vehicles (EVs) in the region is driving the need for high-purity nickel in battery production, given nickel's crucial role in enhancing energy density and longevity of lithium-ion batteries. Governments in this region are also implementing favorable policies and providing subsidies for EVs and renewable energy, indirectly influencing the nickel market. Besides this, the region's growing economy increases demand for consumer goods and infrastructure, leading to more nickel use in these products and structures.

Key Regional Takeaways:

United States Nickel Market Analysis

In 2024, the United States held a significant share of 89.20% of the North America nickel market forecast. High demand for nickel in various sectors, from battery manufacturers to aerospace users in the production of stainless steel facilitates the growth of the market in the United States. Importantly, nickel supply, with around 130,000 tons, has continued over the year in 2023 from overseas, as per reports. Its reliance indicates that US imports still significantly outweigh home-based consumption due to its application within EVs for increased nickel demand drives growing electric car sales. Rigorous investment in domestic mining projects, and refining, not only aims to decrease the reliance on imports but also to support energy transition. The Inflation Reduction Act will thus stimulate usage of locally sourced materials, considering growth for U.S. nickel producers. Tesla, together with General Motors, has tied up with suppliers to give an assurance of a nickel supply chain that's stable for the following purpose of battery. Innovations in recycling and processing technologies further enhance market sustainability, positioning the U.S. as a strategic player in the global nickel value chain.

Europe Nickel Market Analysis

The European nickel market is supported by strict emissions regulations and the swift adoption of electric vehicles. The European Automobile Manufacturers Association (ACEA) reports that battery electric vehicles (BEVs) have a market share of around 14.6% in 2023, which has generated significant demand for nickel in battery production. Germany and France are investing in advanced processing technologies and forming partnerships with global suppliers to ensure stable supply chains. Europe's commitment to sustainability has accelerated innovation in recycling nickel from end-of-life batteries, which also gets impetus from related regulatory initiatives. The European Raw Materials Alliance continues to promote new local mining and refining initiatives to reduce dependence on imports. Leaders like Norilsk Nickel and Glencore are investing in green nickel production processes. It is through government research and development (R&D) funding that Europe remains ahead in nickel innovation, as the industry is propelled by sustainability.

Asia Pacific Nickel Market Analysis

The Asia Pacific region remains the global market leader in nickel, with booming industrial and electric vehicle growth. Industry reports say that China remains the largest primary nickel consumer worldwide, accounting for about 63.5% of global primary nickel consumption in 2023. Indonesia, on the other hand, is the largest nickel producer worldwide, producing an estimated 1.6 million metric tons in 2023, mainly using its rich resources and friendly policies. India is rapidly expanding stainless steel production and battery manufacturing as part of its "Make in India" initiative, which continues to drive demand for nickel. Regional and global players, like Tesla and its Indonesian partners, are investing in sustainable mining and refining technologies that will be integral to the extraction and processing of nickel. In nickel-laterite processing innovations and the installation of battery precursor facilities, Asia Pacific further solidifies its position at the top in the nickel market.

Latin America Nickel Market Analysis

Latin America continues to grow on account of the nickel market due to rich resources and rising global interest in sustainable mining. According to the industry reports, in 2023, Brazil produced almost 84,800 metric tons of nickel, taking eighth position. The country alongside Colombia is attracting foreign direct investment in its modern nickel mining techniques. Nickel is a very important part of the region's EV battery supply chain. Argentina, for instance, is considering resource development through government-backed initiatives. The strategic location of the region makes exports to North America and Europe more competitive. Vale, one of the key players in Brazil, has increased its production capacity and incorporated sustainable practices that meet global standards. Latin America's expanding mining infrastructure and international partnerships position it as a critical supplier in the global nickel market.

Middle East and Africa Nickel Market Analysis

The Middle East and Africa region is now gaining a substantial share in the nickel market, driven by growing production capacities and strategic trade agreements. According to an industrial report, in 2023, the United Arab Emirates exported 225,860 kilograms of nickel ores and concentrates. The United Arab Emirates is the leading producer and exporter of nickel, which is producing ferronickel as well as thermal refractory grade nickel. Regional mining efforts are increasing, including growing developments in nickel reserves in South Africa and Morocco. The UAE's modern port infrastructure and trading networks make it possible for huge exports to Asia and Europe. Further, the MEA region is seeing investments in refining and environmentally responsible mining, better poised to exploit increasing global demand for nickel, especially in electric vehicles and renewable energy applications.

Competitive Landscape:

The key players in the market vying for market share define the nickel market competitive landscape. These companies operate in all areas of the nickel value chain, such as mining, refining, production, and distribution. Some of the major players have established themselves as major nickel producers, taking advantage of their wide mining operations and technological capabilities. Moreover, there are new market entrants into this business line in countries where large nickel deposits are found, specifically in Indonesia and the Philippines. Growing demand in the nickel commodity market further increases competition as firms form strategic partnerships and research and development (R&D) investments. Also, the expansion of production capacities maintains a competitive edge in the dynamic nickel market.

The report provides a comprehensive analysis of the competitive landscape in the nickel market with detailed profiles of all major companies, including:

- Anglo American Plc

- BHP Group Limited

- Cunico Corporation

- Eramet Group

- Glencore Plc

- IGO Limited

- Jinchuan Group International Resources Co. Ltd.

- Norilsk Nickel

- Pacific Metal Company

- Queensland Nickel Group

- Sherritt International Corporation

- Sumitomo Corporation

- Terraframe Ltd.

- Vale S.A.

- Votorantim SA.

Recent Developments:

- January 2025: Herbert Smith Freehills advised Sumitomo Corporation on restructuring USD 2.3 billion debt for Madagascar's Ambatovy Nickel Project. The plan discharged USD 2 billion debt, injected USD 140 million, and ensured shareholders retained full equity.

- September 2024: IGO highlighted nickel's role in its diversified portfolio strategy. The company plans to enhance exploration and operations in lithium, copper, and nickel, aligning with global energy transition trends, ensuring reduced nickel price volatility due to industry shifts.

- September 2024: Anglo American announced plans to sell two nickel mines in Brazil, located in Barro Alto and Niquelandia, producing approximately 38,000 tons annually. Financial advisers are engaged.

- July 2024: BHP revealed plans to temporarily halt operations at Nickel West and the West Musgrave project in Western Australia starting October 2024, with a decision reevaluation set for February 2027.

- June 2024: Vale SA announced a USD 3.3 billion investment plan to enhance nickel and copper production in Brazil and Canada, aiming to boost nickel capacity and improve operational efficiency over the next four years.

Nickel Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Class I Products, Class II Products |

| Applications Covered | Stainless Steel and Alloy Steel, Non-ferrous Alloys and Superalloys, Electroplating, Casting, Batteries, Others |

| End-use Industries Covered | Transportation & Defense, Fabricated Metal Products, Electrical & Electronics, Chemical, Petrochemical, Construction, Consumer Durables, Industrial Machinery, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico, Argentina, Colombia, Chile, Peru, Turkey, Saudi Arabia, Iran, United Arab Emirates |

| Companies Covered | Anglo American Plc, BHP Group Limited, Cunico Corporation, Eramet Group, Glencore Plc, IGO Limited, Jinchuan Group International Resources Co. Ltd., Norilsk Nickel, Pacific Metal Company, Queensland Nickel Group, Sherritt International Corporation, Sumitomo Corporation, Terraframe Ltd., Vale S.A. and Votorantim SA |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the nickel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global nickel market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the nickel industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

Nickel is a chemical element with the symbol Ni and atomic number 28. It is a silvery-white, corrosion-resistant metal commonly used in alloys, including stainless steel, to enhance strength and resistance to oxidation. Nickel also plays a vital role in the production of batteries, particularly lithium-ion batteries, and is used in coins, electronics, and industrial applications.

The nickel market was valued at USD 37.0 Billion in 2024.

The nickel market is projected to exhibit a CAGR of 4.6% during 2025-2033, reaching a value of USD 55.5 Billion by 2033.

The nickel market is driven by rising demand for stainless steel production on a global scale, rapid expansion of electric vehicle (EV) adoption, continual technological advancements in battery manufacturing, and growing investments in infrastructure development, especially in emerging economies.

Asia Pacific currently dominates the nickel market in 2024, accounting for 72.0% of the market share. The dominance is fueled by robust industrialization, increasing EV battery production, and high stainless-steel demand in countries like China and India.

Some of the major players in the nickel market include Anglo American Plc, BHP Group Limited, Cunico Corporation, Eramet Group, Glencore Plc, IGO Limited, Jinchuan Group International Resources Co. Ltd., Norilsk Nickel, Pacific Metal Company, Queensland Nickel Group, Sherritt International Corporation, Sumitomo Corporation, Terraframe Ltd., Vale S.A. and Votorantim SA, among others.

Nickel is a chemical element with the symbol Ni and atomic number 28. It is a silvery-white, corrosion-resistant metal commonly used in alloys, including stainless steel, to enhance strength and resistance to oxidation. Nickel also plays a vital role in the production of batteries, particularly lithium-ion batteries, and is used in coins, electronics, and industrial applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)