Next Generation Memory Market Size, Share, Trends and Forecast by Technology, Wafer Size, Storage Type, Application, and Region, 2025-2033

Next Generation Memory Market Size and Share:

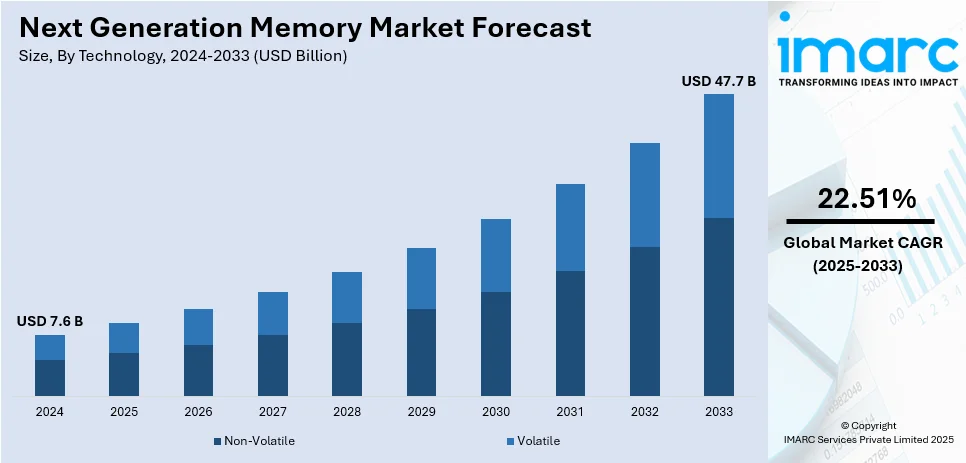

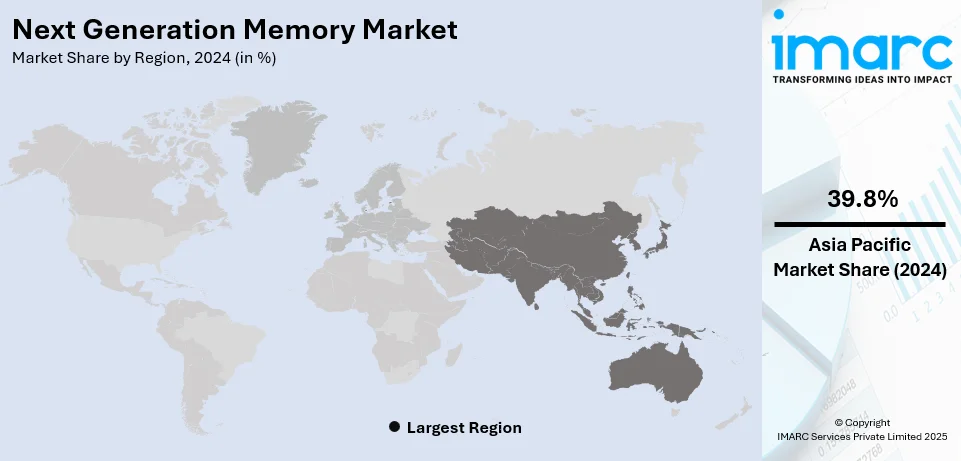

The global next generation memory market size reached USD 7.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 47.7 Billion by 2033, exhibiting a growth rate CAGR of 22.51% during 2025-2033. Asia Pacific currently dominates the market, holding a significant share of 39.8% in 2024, driven by strong semiconductor manufacturing, rising demand for advanced memory solutions, and increasing adoption of AI, IoT, and cloud technologies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7.6 Billion |

|

Market Forecast in 2033

|

USD 47.7 Billion |

| Market Growth Rate (2025-2033) | 22.51% |

A key catalyst for the growth of the next-generation memory market is the rising demand for advanced computing and data storage systems. With the expansion of artificial intelligence, machine learning, and big data analytics, the need for quicker and more dependable memory solutions is growing. Traditional memory technologies are reaching their performance limits, prompting the development of advanced memory solutions such as MRAM (Magnetoresistive Random Access Memory) and 3D NAND. For instance, in 2024, Rambus Inc. unveiled industry-first memory interface chipsets for Gen5 DDR5 RDIMMs and MRDIMMs, offering enhanced bandwidth, memory capacity, and 8000 MT/s support for AI and data center workloads. These technologies offer higher speeds, lower power consumption, and enhanced reliability, making them crucial for meeting the evolving demands of data-intensive applications, thereby driving the growth of the next-generation memory market.

The United States plays a key role in serving the next-generation memory market through its advanced technological innovations and leading semiconductor companies. US-based firms, such as Micron Technology, Intel, and Western Digital, are at the forefront of developing and manufacturing next-generation memory solutions, including DRAM, 3D NAND, and emerging technologies like MRAM and PCM (Phase Change Memory). For instance, in 2024, Avalanche Technology announced full Linux driver support for AMD adaptive SoC platforms, enabling Firmware Over-The-Air updates and mission adaptability using its Gen 3 Space Grade P-SRAM™ up to 8Gb. These organizations are making substantial investments in research and development to advance memory capabilities, meeting the increasing requirements of sectors such as artificial intelligence, data centers, and autonomous technologies. Through strategic partnerships and technological advancements, the US continues to drive market growth and innovation.

Next Generation Memory Market Trends:

Rising Demand for High-performance Computing and Storage Solutions

Rapid memory solutions are now becoming an increasingly pressing need due to the exponential growth of data generated by many applications, which need to be processed and stored on the memory. Many of the conventional memory technologies used today in computers such as dynamic random-access memory, NOT-AND flash, face challenges associated with limited speeds, scalability, and endurance. To address these limitations, next-generation memory technologies such as Magnetoresistive RAM (MRAM), Resistive RAM (RRAM), and three-dimensional (3D) XPoint are under development. These innovations are suited for use in data centers, cloud computing, and enterprise storage systems because they offer higher storage densities, faster read/write speeds, and greater durability. That aspect of handling very large-scale data processing with the latency reduced further becomes critical in meeting modern-day computing needs that are, by turn, gaining impetus towards next-generation memory demand. Next generation memory or High Performance Computing is gaining tremendous seriousness across geographies. In 2019, Hewlett Packard reported data indicating a private sector, close to about 49 percent of the sales amounting to USD 13.7 billion of global server systems for HPC.

Increasing Adoption of AI and IoT Technologies

Memory solutions that can provide fast performance, low power consumption, and real-time data processing capabilities are needed for AI and IoT applications. AI algorithms in machine learning (ML) and neural networks, for example, demand fast processing of large data sets, which calls for sophisticated memory technologies capable of handling such demanding workloads. Similarly, IoT devices, which are often deployed in remote and power-constrained environments, benefit from memory solutions that offer low power consumption and high reliability. As of the close of 2023, there were 16.6 billion connected IoT devices, a 15% increase from the previous year, and this figure is forecasted to grow by 13% to reach 18.8 billion by the end of 2024, as stated in IoT Analytics' State of IoT Summer 2024 report. This rising number of IoT devices is expected to bolster the market growth. Moreover, MRAM and RRAM provide non-volatility and can retain data even when power is lost, which enhances the reliability and efficiency of AI and IoT devices, thereby positively impacting the next generation memory market outlook.

Advancements in Memory Technologies in Terms of Energy Efficiency and Data Integrity

With the increasing demand for computing power, there is a parallel rise in the necessity for energy-efficient solutions to minimize both operational expenses and environmental footprint. Next generation memory technologies are being designed to consume less power while delivering superior performance compared to traditional memory solutions. For instance, MRAM and RRAM technologies are appropriate for energy-efficient computing environments due to lower power consumption and faster data access speeds. Additionally, data integrity and security are becoming increasingly important as the volume of sensitive information processed by memory systems grows. This has led to the integration of features like error correction and improved data retention capabilities in-memory technologies. Additionally, a novel computer memory design created by researchers has the potential to significantly boost speed while lowering the energy requirements of communications and internet technologies, which are expected to use around 33% of the world's electricity in the next ten years. The University of Cambridge lead the team of researchers who created a device that processes information similarly to how synapses do in the human brain. These improvements in energy efficiency and data integrity are supporting the evolving demands of modern computing applications, thus strengthening the next generation memory market growth.

Next Generation Memory Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global next generation memory market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on technology, wafer size, storage type, and application.

Analysis by Technology:

- Non-Volatile

- Magneto-Resistive Random-Access Memory (MRAM)

- Ferroelectric RAM (FRAM)

- Resistive Random-Access Memory (ReRAM)

- 3D Xpoint

- Nano RAM

- Other Non-Volatile Technologies (Phase change RAM, STT-RAM, and SRAM)

- Volatile

- Hybrid Memory Cube (HMC)

- High-Bandwidth Memory (HBM)

Volatile leads the market with around 62.7% of the market share in 2024. This can be attributed to its speed, cost-efficiency, and ability to handle high-performance tasks in real-time applications. As demand for faster data processing increases in sectors like AI, 5G, and cloud computing, volatile memory's ability to provide rapid read and write speeds makes it ideal for high-speed computing environments. Additionally, its continuous development in miniaturization and energy efficiency supports its pivotal role in advancing next-generation devices and systems.

Analysis by Wafer Size:

- 200 mm

- 300 mm

- 450 mm

300 mm leads the market with around 32% of the market share in 2024. The increasing demand for 300 mm size wafers due to their efficiency and cost-effectiveness in semiconductor manufacturing is bolstering the next-generation memory market size. In line with this, this large wafer size allows for more memory chips to be produced per wafer, reducing production costs and increasing yield. This scalability is crucial for meeting the high demand for advanced memory technologies in data centers, consumer electronics, and emerging applications such as AI and IoT. Additionally, the semiconductor industry's existing infrastructure and equipment are optimized for 300 mm wafer processing, enabling seamless integration of next-generation memory technologies. The combination of increased production capacity, cost efficiency, and industry-standard infrastructure is impelling the demand for 300 mm wafers in the market.

Analysis by Storage Type:

- Mass Storage

- Embedded Storage

- Others

Mass storage leads the market with around 81.3% of the market share in 2024. The next generation memory market forecast shows that the demand for mass storage is driven by the ever-growing need for high-capacity, high-performance storage solutions. As data generation surges across industries from cloud computing and big data analytics to consumer electronics and enterprise applications, there is a surging demand for memory technologies that offer faster access speeds, greater storage densities, and improved reliability. Next-generation memory technologies, such as 3D XPoint, MRAM, and RRAM, meet these requirements by providing superior performance and durability compared to traditional storage solutions. In addition to this, their ability to handle vast amounts of data efficiently makes them ideal for mass storage applications, bolstering the next generation memory market revenue as businesses and consumers alike seek to optimize data management and retrieval processes.

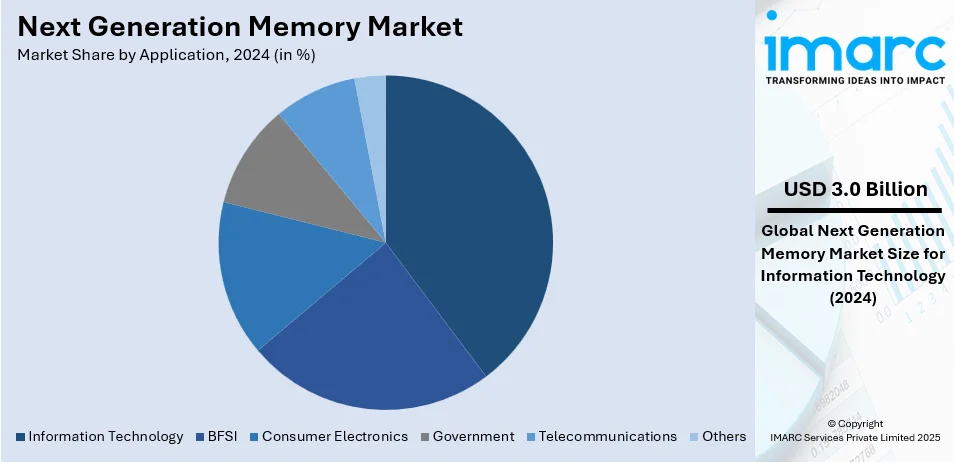

Analysis by Application:

- BFSI

- Consumer Electronics

- Government

- Telecommunications

- Information Technology

- Others

Information technology leads the market with around 39.6% of the market share in 2024. This leadership is fueled by the growing need for advanced computing capabilities, artificial intelligence, and cloud-centric solutions. As businesses and consumers require faster and more efficient memory solutions, IT companies continue to invest in cutting-edge technologies to enhance storage capacity, speed, and energy efficiency. The growing adoption of advanced memory solutions in data centers, edge computing, and mobile devices further strengthens the sector’s market position. Additionally, continuous innovation in non-volatile memory technologies, such as MRAM, PCM, and RRAM, has propelled the IT industry's growth. With ongoing advancements, the sector is expected to maintain its leadership in shaping the future of memory technology.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 39.8%. This leadership is driven by the region’s rapid technological advancements, strong semiconductor manufacturing base, and increasing demand for high-performance memory solutions. Countries like China, Japan, South Korea, and Taiwan play a crucial role, housing major semiconductor manufacturers and research facilities that drive innovation. The growing adoption of AI, IoT, and cloud computing across industries has further fueled the need for advanced memory solutions. Additionally, government initiatives and investments in semiconductor production have strengthened the region’s position. With a thriving consumer electronics market and continuous technological advancements, Asia-Pacific is expected to maintain its dominance in the foreseeable future.

Key Regional Takeaways:

United States Next Generation Memory Market Analysis

US accounts for 82.7% share of the market in North America. The US leads the world for next-generation memory due to its strong technological ecosystem, sophisticated semiconductor production, and increasing demand for high-performance computing. The popularity of technologies like MRAM (Magnetoresistive RAM) and RRAM (Resistive RAM) is driven by memory-intensive applications like artificial intelligence (AI), machine learning (ML), and big data analytics. The demand for non-volatile memory, or NVM, is enhanced because more than 70% of US businesses are actively investing in cloud computing, as per reports. Another critical factor is the automobile industry's shift to autonomous vehicles, which require effective memory to process data in real-time. Government initiatives like the CHIPS Act also support the development of local memory technology. It has set aside USD 53 Billion for semiconductor research and manufacture, as per reports.

In addition, the consumer electronics industry that ships millions of smartphones annually relies on innovative memory solutions to improve device performance. Companies such as Intel and Micron drive innovation through their focus on fast and energy-efficient memory solutions.

North America Next Generation Memory Market Analysis

North America is a key hub for the next-generation memory market, driven by strong technological advancements, significant R&D investments, and a well-established semiconductor industry. Leading companies such as Intel, Micron Technology, and Honeywell are pioneering innovations in DRAM, NAND, MRAM, and RRAM to support high-performance computing, AI, and data center applications. The region benefits from a robust infrastructure, government support, and strategic partnerships among technology firms and research institutions. For instance, in 2024, Honeywell launched AI-powered handheld computers (CT37, CK67, CK62) with 5G, Wi-Fi 6E, and Android compatibility. These devices demand high-performance memory solutions like low-latency DRAM and flash storage to handle real-time data processing. This accelerates the need for next-generation memory technologies to support mobile and IoT devices' growing data processing requirements. Additionally, the growing demand for faster, more energy-efficient memory solutions in cloud computing, autonomous systems, and aerospace further fuels market expansion. With continuous advancements, North America remains at the forefront of next-generation memory development and commercialization.

Europe Next Generation Memory Market Analysis

Developing in the fields of data centre, industrial automation, and automotive is driving the next generation of memory industry in Europe. As the world-leading automobile innovators, Germany and France, raised the ambitions of electric and driverless cars, the demand for high-performance memory solutions dramatically increased in the region. In 2023, over 22% of cars sold in Europe were hybrid or electric, which utilizes memory technologies such as MRAM to meet efficiency energy requirements, as per reports. The demand for long-lasting and low-latency memory systems is increased by the widespread adoption of Industry 4.0 technologies in Europe, such as robotics and the Internet of Things. The development of memory technology is further accelerated by the Euro 216 Million (USD 224 Million) funding made by the European Union in semiconductor research. With data centers in the region, including Sweden and the Netherlands, on the rise, scalable and energy-efficient storage solutions are increasingly needed. Major companies such as Infineon Technologies are sure to keep driving innovation in the industry.

Asia Pacific Next Generation Memory Market Analysis

The Asia-Pacific is the largest market for next-generation memory due to its robust electronics manufacturing sector and rising demand for high-end consumer devices. China, Japan, and South Korea are among the top producers of semiconductors and memory chips; together, Samsung and SK Hynix produce more than 70% of the world's DRAM, as per reports. The need for low-power, high-speed memory technologies like 3D NAND and MRAM is being driven by the expansion of 5G networks throughout the region. With investments of over USD 150 Billion, China's focus on independence in semiconductor production is boosting innovation at home, according to data from Semiconductors Industry Association. Additionally, the South Korean and Japanese markets for gaming and AR/VR demand advanced memory solutions to enhance user experience, as more than 1.5 billion active gamers exist in those markets, according to data from Think With Google. The Indian government programs, including the PLI electronics plan, promote investments in the development and production of memory technologies.

Latin America Next Generation Memory Market Analysis

The increasing usage of cloud computing, the development of smart cities, and the digitization of industries are driving the next-generation memory market in Latin America. More than 50% of the IT expenditures in the region come from Brazil and Mexico, making them major contributors. A combination of growth of data centers and the requirement for scalable memory technology is a factor that supports the growth in the region, especially with regard to Google and AWS in Brazil. According to an industrial report, Latin America's mobile penetration of over 400 million smartphone users forces manufacturers to deploy high-speed and energy-efficient memory solutions. Next-generation memory is being used in infotainment systems and energy management in electric vehicles, especially within the automotive sector of Mexico.

Middle East and Africa Next Generation Memory Market Analysis

The increasingly popular digital transformation and smart city initiatives in the Middle East and Africa (MEA) region are driving the next generation memory market. Saudi Arabia's Vision 2030 and the United Arab Emirates' Dubai 10X are both initiatives that foster technology development, particularly memory-intensive AI and Internet of Things applications. The fast growth of cloud computing business in the region is increasing the demand for reliable fast memory solutions. The use of bleeding-edge memory technology is being accelerated in South Africa by growing data centers and IT infrastructure, which are supported by investments by international IT companies. Other factors that further support market growth are the rising use of smartphones and the healthcare sector embracing cutting-edge medical equipment.

Competitive Landscape:

The competitive landscape is characterized by intense rivalry among leading semiconductor companies, driven by the rapid advancements in next generation memory technology and the growing demand across various applications. In addition to this, collaborations and strategic partnerships with tech firms and research institutions are common, aiming to drive technological breakthroughs and market penetration. Emerging startups also play a crucial role, introducing innovative solutions and adding to the competitive dynamics. As the market evolves, continuous innovation, strategic alliances, and substantial investments remain key factors shaping the competitive landscape of the next generation memory market. For instance, in 2024, Avalanche Technology announced a new product family offering radiation-resilient, high-reliability execution memory for Aerospace and Defense, expanding its Gen 3 Space Grade MRAM to replace DDR4 DRAM.

The report provides a comprehensive analysis of the competitive landscape in the next generation memory market with detailed profiles of all major companies, including:

- Avalanche Technology

- Crossbar Inc.

- Fujitsu Limited

- Honeywell International Inc.

- Infineon Technologies AG

- Intel Corporation

- Micron Technology Inc.

- Nantero Inc.

- Samsung Electronics Co. Ltd.

- SK hynix Inc.

- Spin Memory Inc.

- Taiwan Semiconductor Manufacturing Co. Ltd.

Latest and New Developments:

- December 2024: A fresh consumer brand launched by BIWIN focuses on advanced memory and storage solutions. By employing advanced technologies, the offerings are tailored to address modern digital needs and deliver reliable, high-performance solutions. The firm aims to deliver innovative solutions to address the growing demand in sectors like gaming, content creation, and everyday computing.

- October 2024: Micron has unveiled a remarkably fast clock driver for DDR5 memory, aimed at enhancing AI-powered PCs and boosting their performance. This innovation provides enhanced speeds and greater reliability for next-generation devices, addressing the growing processing requirements of artificial intelligence applications.

- July 2023: Samsung Electronics revealed the successful creation of the innovative Graphics Double Data Rate 7 (GDDR7) DRAM. This noteworthy accomplishment will mainly concentrate on confirming its efficacy in next-generation systems for chosen clients this year.

- May 2023: Micron Technology declared plans to invest as much as JPY 500 billion in Japan in the coming years, aided by the Japanese government to enhance its enterprise in next-generation memory chips. This strategic action demonstrates the Japanese government's commitment to rejuvenating its semiconductor sector and improving the nation's chip supply chain.

Next Generation Memory Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered |

|

| Wafer Sizes Covered | 200 mm, 300 mm, 450 mm |

| Storage Types Covered | Mass Storage, Embedded Storage, Others |

| Applications Covered | BFSI, Consumer Electronics, Government, Telecommunications, Information Technology, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Avalanche Technology, Crossbar Inc., Fujitsu Limited, Honeywell International Inc., Infineon Technologies AG, Intel Corporation, Micron Technology Inc., Nantero Inc., Samsung Electronics Co. Ltd., SK hynix Inc., Spin Memory Inc., Taiwan Semiconductor Manufacturing Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the next generation memory market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global next generation memory market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the next generation memory industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The next generation memory market was valued at USD 7.6 Billion in 2024.

IMARC estimates the next generation memory market to reach USD 47.7 Billion by 2033, exhibiting a CAGR of 22.51% during 2025-2033.

The key factors driving the next-generation memory market include rising demand for high-speed and energy-efficient memory, advancements in AI and IoT, increasing data center expansion, and the growth of consumer electronics. Additionally, innovations in non-volatile memory technologies and government investments in semiconductor manufacturing further boost market growth.

Asia Pacific currently dominates the market with a 39.8% share. This leadership is driven by a strong semiconductor industry, increasing adoption of AI and IoT, and rising demand for high-performance memory in consumer electronics and data centers. Government investments and technological advancements further strengthen the region’s market position.

Some of the major players in the next generation memory market include Avalanche Technology, Crossbar Inc., Fujitsu Limited, Honeywell International Inc., Infineon Technologies AG, Intel Corporation, Micron Technology Inc., Nantero Inc., Samsung Electronics Co. Ltd., SK hynix Inc., Spin Memory Inc., Taiwan Semiconductor Manufacturing Co. Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)