Newborn Screening Market Size, Share, Trends and Forecast by Product, Technology, Test Type, and Region, 2025-2033

Newborn Screening Market Size and Share:

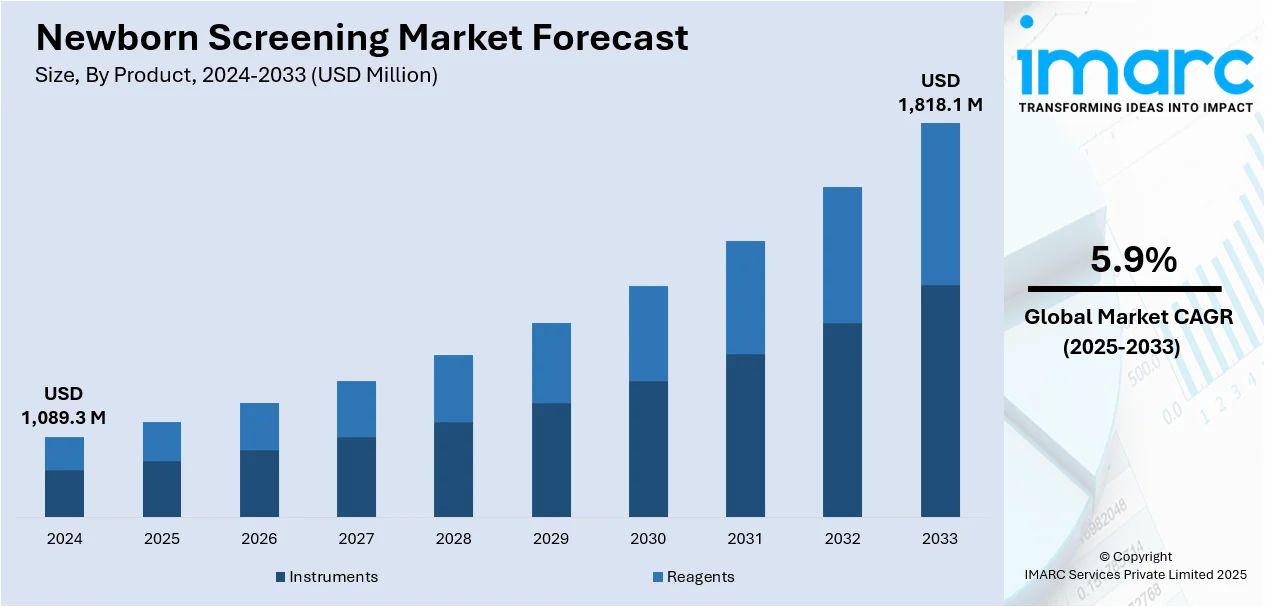

The global newborn screening market size was valued at USD 1,089.3 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,818.1 Million by 2033, exhibiting a CAGR of 5.9% from 2025-2033. North America currently dominates the market, holding a market share of over 33.2% in 2024. This is due to the increasing awareness among individuals toward early detection of severe diseases in newborns, improvements in medical technology for more accurate outcomes, and favorable government initiatives.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1,089.3 Million |

|

Market Forecast in 2033

|

USD 1,818.1 Million |

| Market Growth Rate 2025-2033 | 5.9% |

The newborn screening market is escalating due to the advent of technological advances in diagnostics and awareness regarding early identification of neonatal diseases. Governments around the world have undertaken programs for comprehensive screening at birth - metabolic, genetic, and endocrine disorders - which further increases the demand for advanced screening kits and systems for these disorders. Further extensions in the field of tandem mass spectrometry and enzyme-linked immunoassays have increased the sensitivity and specificity required by the tests and thus improved their overall adoption. The rising incidence of congenital anomalies and inherited metabolic disorders makes early diagnosis highly imperative, making this system a top priority in public health policy.

The United States has emerged as a key regional market for newborn screening. This is due to growing awareness about early disease detection and its role in preventing lifelong complications. Government initiatives mandating comprehensive newborn screening programs have been pivotal in driving adoption. Advances in technology, such as tandem mass spectrometry and next-generation sequencing, enhance the accuracy and speed of detecting genetic, metabolic, and infectious conditions, encouraging widespread use. The rising prevalence of genetic disorders and metabolic conditions further fuels demand. Increased public and private funding supports research and the implementation of advanced screening methods. Additionally, the development of non-invasive screening techniques offers safer and more efficient testing options. Moreover, healthcare providers and policymakers emphasize the long-term cost savings of early diagnosis and treatment, creating further momentum.

Newborn Screening Market Trends:

Increasing awareness about early disease detection

The growing awareness among parents toward the critical importance of early disease detection, as it helps in enhancing treatment outcomes, improving quality of life for the child, offering timely intervention represents one of the primary drivers bolstering the newborn screening market. Besides this, the rising occurrence of congenital diseases is also acting as another significant growth-inducing factor. Moreover, according to reports, about two to three children out of every 1000 children have cerebral palsy in the United States.

Favorable government initiatives

The launch of policies by regulatory authorities that often cover a comprehensive panel of disorders and ensure that potential health issues are addressed efficiently is bolstering the global newborn screening market. For example, in June 2022, government bodies in Manitoba, Canada, announced the expansion of their newborn screening program with an aim to extend screening for spinal muscular atrophy, along with other diseases. Moreover, various government authorities have also made newborn screening compulsory before getting discharged from the hospital, thereby positively impacting the overall newborn screening market growth.

Improvements in medical technology

Key players are advancing their medical technologies to improve newborn screening methods, which is acting as another significant growth-inducing factor. Moreover, emerging screening technologies encourage healthcare providers to offer and adopt these services, thereby fueling the global market. For example, in June 2021, the Texas Department of State Health Services introduced newborn screening for Spinal Muscular Atrophy (SMA). In line with this, in 2022, Trivitron Healthcare developed a Centre of Excellence (CoE) with state-of-the-art R&D and manufacturing facilities at AMTZ Campus in India for genomics, newborn screening, metabolomics, and molecular diagnostics. Furthermore, in January 2023, Masimo announced the launch of its new state-of-the-art baby monitoring system that allows caretakers to monitor the data of babies in real-time.

Newborn Screening Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global newborn screening market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, technology, and test type.

Analysis by Product:

- Instruments

- Reagents

Instrument stand as the largest component in 2024, holding around 77.6% of the market. Instruments play a crucial role in the screening process for sample collection, analysis, result interpretation, etc. In addition to this, they comprise a wide array of technologies, such as deoxyribonucleic acid (DNA) analyzers, automated screening platforms, mass spectrometry systems, etc. Moreover, the rising investments by key healthcare companies in diagnostics tests that require instruments are expected to bolster the market growth in this segmentation. For instance, in March 2023, GC Labs announced the launch of its new test for the diagnosis of Inborn Errors of Metabolism (IEM) among newborns with the integration of novel disease detection methods.

Analysis by Technology:

- Tandem Mass Spectrometry

- Pulse Oximetry

- Enzyme Based Assay

- DNA Assay

- Electrophoresis

- Others

Tandem mass spectrometry leads the market with around 23.8% of the newborn screening market share in 2024. Tandem mass spectrometry refers to an analytical technique that is employed in newborn screening to identify several metabolic disorders. In line with this, it provides improved accuracy and speed. Numerous technological advancements in the medical field enhance tandem mass spectrometry, which will continue to drive the market growth in this segmentation. For example, in April 2023, Waters Corporation announced the development of its new Xevo TQ Absolute IVD Mass Spectrometer for clinical applications.

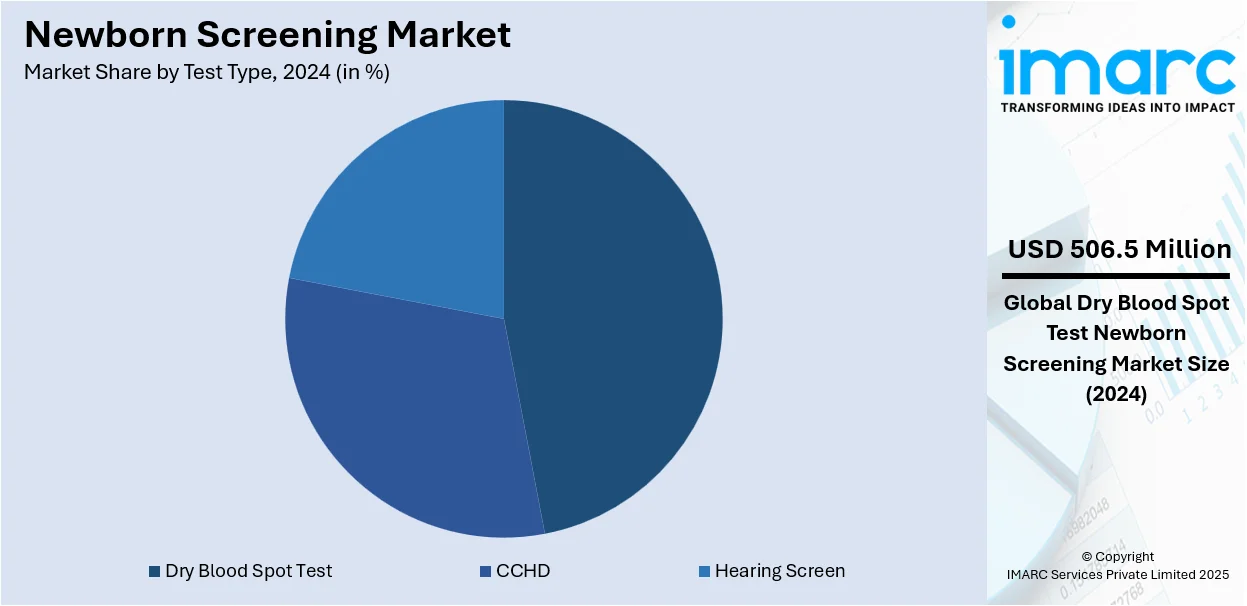

Analysis by Test Type:

- Dry Blood Spot Test

- CCHD

- Hearing Screen

Dry blood spot test leads the market with around 46.5% of market share in 2024. A dry blood spot test refers to a non-invasive screening technique that generally involves collecting a small amount of blood from the heel of a newborn onto a special filter paper. The dried blood sample is then analyzed for the presence of specific markers associated with several disorders. The test is widely preferred among newborn screening programs, as it provides ease of transportation, convenience of sample collection, and the ability to simultaneously screen for various conditions. Besides this, the elevating number of initiatives by government bodies is acting as another significant growth-inducing factor in this segmentation.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 33.2%. The increasing prevalence of congenital disabilities in North America is augmenting the need for newborn screening. Moreover, the implementation of stringent regulations by government bodies across the region is also acting as another significant growth-inducing factor. For example, according to the March of Dimes (MoD) report of 2021, before leaving the hospital, every baby in the United States went through the screening process. Apart from this, the elevating focus of key players on preventive healthcare is inflating the popularity of advanced technologies, which is expected to bolster the North America newborn screening market over the foreseeable future.

Key Regional Takeaways:

United States Newborn Screening Market Analysis

In 2024, the United States accounts for 86.80% of the newborn screening market in North America. Most insurance plans across the United States are covering newborn screening tests, which is contributing to its accessibility. This is providing an impetus to the market growth. In line with this, awareness campaigns and healthcare initiatives across the United States are continuously growing to improve early diagnosis, particularly among parents and healthcare providers. This is further fueling the market growth. According to reports, each year, approximately 8,000 to 10,000 newborns across the United States are diagnosed with cerebral palsy. Moreover, 764,000 number of children are diagnosed with cerebral palsy in the United States of America. In addition to this, the adoption of advanced diagnostic tools such as tandem mass spectrometry across the region is fueling the newborn screening market. Furthermore, newborn screening is being mandated by law in all the states situated across the United States of America for several diseases thereby leading to high screening coverage. This, in turn, is impelling the market growth.

Asia Pacific Newborn Screening Market Analysis

Several countries located across the Asia-Pacific region have established their nationwide newborn screening programs while others are in the process of expanding their programs. This is providing an impetus to the market growth. In line with this, healthcare systems particularly in urban areas across this region are propelling the reach of newborn screening programs. According to the National Bureau of Statistics of China, by the end of 2023, the national population totaled 1,409.67 Million, with urban permanent residents accounting for 932.67 Million. Additionally, the rising incidences of genetic disorders across this region are escalating the growing demand for early detection methods. This, in turn, is impelling the market growth. Furthermore, there is an increasing awareness among healthcare providers and the general public regarding the importance of newborn screening, proliferating its adoption and implementation.

Europe Newborn Screening Market Analysis

Many European countries are implementing national screening programs, ensuring that almost all newborns are being tested. This, in turn, is impelling the market growth. According to the British Medical Association, one in every 1000 children residing across the United Kingdom are diagnosed with autism spectrum disorder. Moreover, according to reports, in England and Wales, with an annual birth rate of approximately 700,000, there could be up to 1,700 new cases of cerebral palsy diagnosed in children each year. In line with this, European Union regulations and directives are supporting newborn screening, ensuring its adoption and standardization. This is providing an impetus to the market growth. Additionally, the use of high-throughput technologies across the European region, such as dry blood spot screening and tandem mass spectrometry, is continuously increasing. Owing to this, the market growth is augmenting. Furthermore, NGOs and healthcare agencies in Europe are actively advocating for the expansion of the scope of newborn screening.

Latin America Newborn Screening Market Analysis

Latin American countries are following newborn screening programs thereby ensuring that the newborns are being tested. This is providing an impetus to the market growth. According to the National Institutes of Health (NIH), in Brazil, there are approximately 4 Million pediatric pneumonia cases reported annually. In line with this, there is a growing awareness about the importance of early detection of diseases among infants which is being driven by healthcare NGOs and international organizations. This, in turn, is impelling the market growth.

Middle East and Africa Newborn Screening Market Analysis

Newborn screening is increasingly becoming mandatory across the region so that the list of disorders screened can be expanded. According to a survey, a total of 613 children diagnosed with cerebral palsy were identified, with a higher prevalence among males. Moreover, the median age at which children at risk for cerebral palsy were identified was 9 weeks. In addition to this, governments across the region are investing in healthcare infrastructure, which includes expanding newborn programs. This, in turn, is impelling the market growth.

Competitive Landscape:

Companies are investing in cutting-edge technologies, such as next-generation sequencing (NGS) and mass spectrometry, to enhance the accuracy and efficiency of screening processes. These advancements enable early detection of a broader range of disorders, meeting growing healthcare demands. Moreover, key players are introducing comprehensive screening panels and user-friendly devices tailored to healthcare providers’ needs. These expanded offerings increase market appeal and address diverse customer requirements. Besides, strategic partnerships with healthcare institutions, research organizations, and government agencies allow companies to drive innovation and expand their market presence. Collaborations also facilitate better adoption of screening programs globally.

The report provides a comprehensive analysis of the competitive landscape in the newborn screening market with detailed profiles of all major companies, including:

- Agilent Technologies Inc.

- Baebies Inc.

- Bio-RAD Laboratories Inc.

- Chromsystems Instruments & Chemicals GmbH

- Danaher Corporation

- Masimo Corporation

- Medtronic plc

- Natus Medical Incorporated

- Perkinelmer Inc.

- RECIPE Chemicals + Instruments GmbH

- Thermo Fisher Scientific Inc.

- Trivitron Healthcare

- Waters Corporation

Latest News and Developments:

- March 2024: A newborn screening program aimed at identifying rare and severe genetic conditions in infants was launched at the state-operated Niloufer Hospital in Hyderabad. The screening was implemented to detect conditions such as congenital hypothyroidism, congenital adrenal hyperplasia, glucose-6-phosphate dehydrogenase (G6PD) deficiency, galactosemia, and biotinidase deficiency.

- March 2024: The World Health Organization had launched implementation guidance in the South-East Asia Region for the universal screening of newborns for hearing impairment, eye abnormalities, and neonatal jaundice. This initiative aimed to mitigate the risk of disabilities caused by these conditions, ensuring early detection and appropriate management.

Newborn Screening Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered | Instruments, Reagents |

| Technologies Covered | Tandem Mass Spectrometry, Pulse Oximetry, Enzyme Based Assay, DNA Assay, Electrophoresis, Others |

| Test Types Covered | Dry Blood Spot Test, CCHD, Hearing Screen |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Agilent Technologies Inc., Baebies Inc., Bio-RAD Laboratories Inc., Chromsystems Instruments & Chemicals GmbH, Danaher Corporation, Masimo Corporation, Medtronic plc, Natus Medical Incorporated, Perkinelmer Inc., RECIPE Chemicals + Instruments GmbH, Thermo Fisher Scientific Inc., Trivitron Healthcare, Waters Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the newborn screening market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global newborn screening market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the newborn screening industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Newborn screening is a public health program designed to identify specific genetic, metabolic, hormonal, or functional conditions in newborns shortly after birth. It involves a series of tests performed within the first few days of life to detect potentially serious disorders that may not be immediately apparent but could lead to severe health complications, developmental delays, or death if left untreated.

The global newborn screening market was valued at USD 1,089.3 Million in 2024.

IMARC estimates the global newborn screening market to exhibit a CAGR of 5.9% during 2025-2033.

The market is primarily driven by the increasing awareness among individuals toward early detection of severe diseases in newborns, improvements in medical technology for more accurate outcomes, and favorable government initiatives.

In 2024, instruments represented the largest segment as they play a crucial role in the screening process for sample collection, analysis, result interpretation.

Tandem mass spectrometry leads the market as it is used to identify several metabolic disorders and provides improved accuracy and speed.

Dry blood spot test is the leading segment as it provides ease of transportation, the ability to simultaneously screen for various conditions, and convenience of sample collection.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global newborn screening market include Agilent Technologies Inc., Baebies Inc., Bio-RAD Laboratories Inc., Chromsystems Instruments & Chemicals GmbH, Danaher Corporation, Masimo Corporation, Medtronic plc, Natus Medical Incorporated, Perkinelmer Inc., RECIPE Chemicals + Instruments GmbH, Thermo Fisher Scientific Inc., Trivitron Healthcare, Waters Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)