Neurovascular Devices Market Size, Share, Trends and Forecast by Product, Application, End User, and Region, 2025-2033

Neurovascular Devices Market Size and Share:

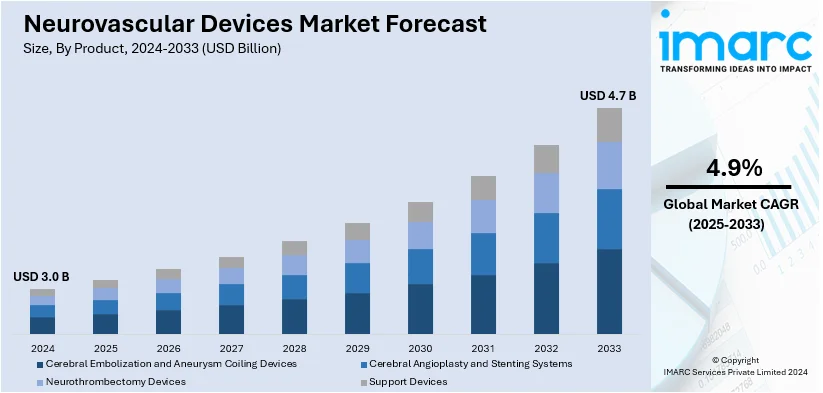

The global neurovascular devices market size was valued at USD 3.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 4.7 Billion by 2033, exhibiting a CAGR of 4.9% from 2025-2033. North America currently dominates the market, holding a market share of 27.8% in 2024. The growth of the North American region is driven by advanced healthcare infrastructure, widespread adoption of innovative neurovascular devices, increasing cases of neurovascular disorders, and strong support for research initiatives.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.0 Billion |

| Market Forecast in 2033 | USD 4.7 Billion |

| Market Growth Rate (2025-2033) | 4.9% |

At present, the rising incidence of conditions, such as strokes, aneurysms, and arteriovenous malformations, among the masses represent one of the major factors impelling the market growth. These conditions necessitate exact treatment, which contemporary neurovascular instruments are tailored to tackle, enhancing patient survival rates and overall quality of life. Moreover, the increasing elderly population, which is more prone to neurovascular issues, is driving the demand for enhanced treatment solutions tailored to their unique healthcare requirements. Additionally, advancements in less invasive technologies, like flow diverters, thrombectomy devices, and embolization coils, are enhancing procedural results. These devices lower risks, shorten recovery durations, and provide customized solutions, promoting extensive use in healthcare settings globally. Furthermore, enhanced reimbursement systems in numerous countries allow patients to obtain expensive neurovascular therapies, rendering neurovascular devices more affordable and accessible.

The United States represents a major market, supported by the introduction of innovative neurovascular devices specifically designed to enhance treatment precision and safety. The presence of cutting-edge technologies, such as coil-assist stents, which enhance visibility and placement precision, indicates an increasing emphasis on effectively treating intricate neurovascular issues. These advancements emphasize the dedication of top manufacturers to providing innovative solutions customized for clinical requirements. For instance, in 2024, MicroVention declared the commercial release of the LVIS EVO Intraluminal Support Device in the United States, intended for the treatment of wide-neck intracranial aneurysms. It is the initial entirely visible coil-assist intracranial stent in the US, providing improved visualization and accurate positioning. This launch underscores MicroVention's commitment to advancing neurovascular treatment technologies. Furthermore, the growing number of awareness programs about stroke prevention, rapid diagnosis, and treatment choices is leading to quicker medical intervention. Professional development programs are also enhancing the abilities of healthcare workers, encouraging the use of sophisticated technology.

Neurovascular Devices Market Trends:

Technological advancements driving innovation

In the field of global neurovascular devices, a vital factor is the ongoing rise in technological innovations. Advancements in medical devices have transformed neurovascular procedures, offering novel treatment options for a range of neurovascular problems. The Institute for Health Metrics and Evaluation reports that neurological disorders accounted for 443 million years of healthy life lost from illness, disability, and early death in 2021. Cutting-edge technologies such as 3D printing, advanced imaging techniques, and minimally invasive approaches are revolutionizing patient care. These developments enable more precise diagnosis and treatment, enhancing patient outcomes and reducing risks. Moreover, the integration of robotics and artificial intelligence (AI) in neurovascular interventions is greatly improving procedures and offering personalized therapies. With ongoing research and development (R&D), the relentless pursuit of technological progress drives the neurovascular devices market.

Rising prevalence of neurovascular disorders

The upward trajectory of the global neurovascular devices market is intrinsically linked to the rising prevalence of neurovascular disorders. Reports indicate that in 2021, over 3 billion individuals around the globe were affected by a neurological disorder. Health challenges on a global scale are significantly posed by conditions like strokes, aneurysms, and arteriovenous malformations. The elderly population, along with shifting lifestyles and risk elements, has led to an increased occurrence of these conditions. This increase in cases requires the creation of efficient and modern neurovascular instruments for precise diagnosis, therapy, and monitoring after treatment. The demand for minimally invasive procedures has notably increased because of their lowered patient discomfort and faster recovery periods. As a result, the market addresses this increasing demand with creative products and solutions, reinforcing its role as a crucial factor in enhancing patient results and overall quality of life.

Geriatric population and accessibility to minimally invasive treatments

The geriatric demographic stands as a significant driver in the expansion of the global neurovascular devices market. According to the Census Bureau, in 2020, the senior population reached 55.8 million, representing 16.8% of the overall US populace. With the growing susceptibility of the elderly population to neurovascular diseases, the demand for comprehensive and minimally invasive treatment options increases. Older individuals usually prefer minimally invasive procedures that lessen physical stress and recovery time. As a result, producers focus on developing devices tailored for this patient group, ensuring their safety and efficiency. The availability of minimally invasive treatments improves patient compliance and addresses the ongoing emphasis in the healthcare industry on effective and economical options. The link between the needs of the aging population and the market's available products highlights the crucial role of the neurovascular devices sector in meeting evolving healthcare demands.

Neurovascular Devices Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global neurovascular devices market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, application, and end user.

Analysis by Product:

- Cerebral Embolization and Aneurysm Coiling Devices

- Embolic Coils

- Flow Diverters

- Liquid Embolic Agents

- Cerebral Angioplasty and Stenting Systems

- Carotid Artery Stents

- Embolic Protection Devices

- Neurothrombectomy Devices

- Clot Retrieval Devices

- Suction Devices

- Vascular Snares

- Support Devices

- Micro Catheters

- Micro Guidewires

Cerebral and aneurysm coiling devices (embolic coils, flow diverters, and liquid embolic agents) lead the market with 37.8% of market share in 2024. Cerebral embolization and aneurysm coiling devices dominate the market due to their demonstrated efficacy in treating critical conditions like aneurysms and arteriovenous malformations. Such devices, like embolic coils, flow diverters, and liquid embolic agents, provide less invasive treatment alternatives that greatly decrease recovery durations and procedural hazards. Their accuracy in detecting aneurysms and averting rupture has rendered them essential in neurovascular procedures. Ongoing technological progress has improved their effectiveness, allowing customized solutions for various patient requirements. These devices are commonly used in modern healthcare centers, bolstered by the increasing recognition of their advantages among healthcare practitioners. Cerebral embolization and aneurysm coiling devices have become essential in this market segment due to their vital role in tackling the rising incidence of neurovascular disorders, fostering innovation and enhancing patient outcomes.

Analysis by Application:

- Ischemic Stroke

- Aneurysm

- Arteriovenous Malformation and Fistulas (AVM)

- Stenosis

- Others

Ischemic stroke is a significant segment in the market, driven by the rising global incidence of strokes. These instruments, such as thrombectomy devices and stents, are essential in restoring blood circulation and reducing brain injury during crises. The rise in their adoption is driven by progress in less invasive techniques and a heightened focus on early intervention, leading to better patient results.

Aneurysm is a significant issue, as untreated cerebral aneurysms can lead to death. Devices like embolic coils and flow diverters play a vital role in isolating aneurysms, preventing rupture, and reducing complications. Continuous improvements in device design and a rising application in advanced medical settings are enhancing this segment's importance in successfully addressing complex neurovascular challenges.

Arteriovenous malformation and fistulas (AVM) benefits from specialized neurovascular devices that safely and efficiently manage abnormal blood vessel connections. Liquid embolics and other embolization devices are widely used to reduce bleeding risks and enhance treatment success rates. Increasing awareness about AVM conditions and advancements in imaging technologies further drive the adoption of these devices.

Stenosis is vital segment in the market driven by the increasing demand for treatments for constricted blood vessels in the brain. Stenting systems and balloon angioplasty tools are essential for restoring adequate blood circulation, lowering the likelihood of stroke, and enhancing long-term vascular wellness. The segment is experiencing expansion because of the rising occurrence of atherosclerosis and associated ailments.

Others encompass various neurovascular conditions requiring specialized interventions. This category includes devices designed for rare or complex disorders, such as dural fistulas or Moyamoya disease. The ongoing development of targeted solutions and the expansion of clinical applications highlight the importance of this segment in addressing diverse patient needs.

Analysis by End User:

- Hospitals

- Ambulatory Surgical Centers

- Clinics

- Others

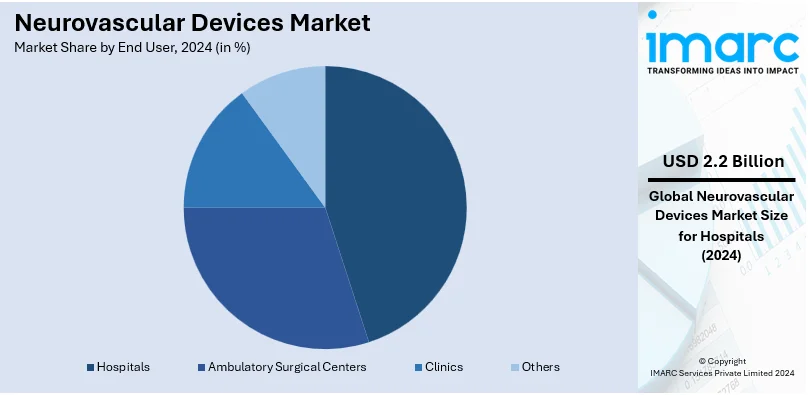

Hospitals lead the market, holding a 70.9% share in 2024. Hospitals hold the largest market share attributed to their advanced infrastructure and ability to handle complex neurovascular procedures. They offer access to multidisciplinary teams of specialists, ensuring comprehensive care for patients with stroke, aneurysms, and other neurovascular disorders. The availability of state-of-the-art equipment and facilities for diagnosis and minimally invasive treatments enhances the success rate of procedures performed in hospitals. High patient inflow, combined with round-the-clock emergency services, positions hospitals as the primary choice for neurovascular treatments. Their emphasis on clinical training and adoption of innovative technologies ensures the integration of the latest devices and techniques into practice. Hospitals’ capability to effectively handle both acute and chronic neurovascular cases makes them crucial in promoting the use of neurovascular devices.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America held the biggest market share at 27.8%. North America leads the market because of its sophisticated healthcare infrastructure and the extensive access to state-of-the-art medical technologies. The area enjoys a significant number of well-equipped medical centers and a vast array of proficient healthcare experts specializing in neurovascular procedures. Continual research and development efforts, backed by strong government and private sector investment, have hastened the launch of innovative devices designed for intricate neurological disorders. The increasing recognition of neurovascular conditions and the significance of prompt treatment further propel the uptake of these devices. Moreover, North America possesses a robust regulatory system that promotes prompt product approvals, guaranteeing the accessibility of safe and efficient treatment alternatives. The presence of key market players in the region enhances accessibility to a wide range of neurovascular devices, fostering continuous advancements. In 2024, Cerenovus, part of Johnson & Johnson MedTech, launched the Cereglide 71 catheter for acute ischemic stroke revascularization in the U.S. Featuring TruCourse technology, it offers improved navigation, trackability, and compatibility for thrombectomy procedures. This innovation enhances Cerenovus’ Stroke Solutions portfolio, addressing critical clinical needs in stroke care.

Key Regional Takeaways:

United States Neurovascular Devices Market Analysis

The United States represented 70.10% of the overall market share in North America. The market for neurovascular devices in the United States is presently propelled by innovations in minimally invasive surgical methods, allowing quicker recovery periods and fewer complications for patients receiving care for neurovascular issues. Firms are proactively putting resources into creating advanced devices, like stent retrievers and flow diverters, which are showing enhanced effectiveness in treating ischemic and hemorrhagic strokes. The market is also experiencing a rise in the use of AI-driven imaging technologies and robotic-assisted treatments, which are improving accuracy and clinical results in neurovascular procedures. Increasing awareness initiatives are informing healthcare professionals and patients about the early detection and management of neurovascular conditions, thus broadening the base of patients pursuing these advanced options. Hospitals and surgical facilities are emphasizing the integration of advanced neurovascular device technologies to enhance procedural efficiency and meet the increasing patient demand. Moreover, insurance companies are increasing coverage for cutting-edge procedures, thus making advanced neurovascular treatments more available to a wider audience. According to the U.S. Department of Agriculture (USDA), the United States population hit 334,914,895 in 2023. The FDA is promoting a competitive environment that stimulates innovation by expediting the authorization and approval of novel neurovascular devices. Medical facilities are also improving their training programs for physicians to improve their proficiency with these complex gadgets, which will expand their market reach.

Europe Neurovascular Devices Market Analysis

The market for neurovascular devices in Europe is presently expanding due to a combination of factors. The area is experiencing a rise in the use of sophisticated minimally invasive techniques for addressing neurovascular conditions like aneurysms, ischemic strokes, and arteriovenous malformations, as medical professionals aim to shorten recovery periods and enhance patient results. Governments and private entities are vigorously financing research and clinical studies for cutting-edge devices such as flow diverters and embolization coils, which is hastening product development and market introduction. At the same time, the increasing elderly population in Europe is leading to a higher incidence of neurovascular diseases, encouraging healthcare systems to enhance their neurointerventional services. As reported by Eurostat, in 2019, there were 90.4 million elderly individuals (aged 65 and above) residing in the EU-27. Hospitals and specialized clinics are consistently enhancing their equipment collections to feature advanced imaging and navigation technologies that support neurovascular devices, improving procedural precision. Moreover, European regulatory authorities are simplifying approval procedures for novel neurovascular devices, promoting quicker market entry of innovative solutions. As emphasis on international collaborations increases, manufacturers are establishing strategic alliances with research institutes and hospitals, promoting innovation that meets local requirements. Additionally, the growing accessibility of training programs for neurointerventional specialists is enhancing procedural skills, facilitating the use of neurovascular devices in everyday clinical practice throughout Europe.

Asia Pacific Neurovascular Devices Market Analysis

The neurovascular devices market in the Asia-Pacific region is presently experiencing growth fueled by various localized factors. Improvements in healthcare systems in developing nations such as India and Indonesia are facilitating improved access to neurovascular treatments, bolstered by government efforts to increase the accessibility of sophisticated medical equipment. The area is experiencing a rise in neurovascular disorders like strokes and aneurysms, linked to lifestyle changes, an aging population, and a higher occurrence of hypertension and diabetes. As per the IDF Diabetes Atlas, the number of individuals impacted by diabetes (in thousands) in China in 2021 is 140,869.6. Healthcare providers are progressively embracing minimally invasive techniques because of their reduced risk factors and quicker recovery periods, driving the need for sophisticated neurovascular tools such as embolic coils and flow diverters. Top manufacturers are partnering with local distributors and establishing strategic alliances to broaden their presence, particularly in markets such as China and Japan, where rapid adoption of advanced devices is driven by an increasing emphasis on state-of-the-art medical technologies. At the same time, the growth of medical tourism in nations like Thailand and Malaysia is enhancing access to cost-effective and high-quality neurovascular treatments, drawing in patients from around the world. Regulatory authorities in the area are simplifying approval procedures, enabling quicker market access for advanced neurovascular products, thus fostering innovation and rivalry in the Asia-Pacific market.

Latin America Neurovascular Devices Market Analysis

The neurovascular devices market in Latin America is supported by the growing acceptance of minimally invasive surgical methods and increased awareness among patients and healthcare providers about their benefits, including quicker recovery times and lower complication risks. Hospitals and specialized clinics are upgrading their infrastructure and resources, focusing on equipping facilities with advanced neurovascular equipment to meet the increasing demand for stroke care and other neurovascular disorders. The region is seeing a rise in healthcare investment, especially in countries like Brazil and Mexico, where officials are concentrating on enhancing neurology services through collaborations between public and private sectors. Additionally, companies are actively launching creative products tailored to the specific needs of Latin American communities, addressing issues such as affordability and accessibility. The growing prevalence of lifestyle-associated risk factors, such as hypertension and diabetes, is contributing to a greater number of strokes, consequently increasing reliance on advanced technologies for clot removal and aneurysm management. As per the IDF Diabetes Atlas, the diabetes prevalence in Mexico was approximately 17% in 2021. At the same time, healthcare professionals regularly participate in specialized training sessions provided by device manufacturers to guarantee the effective use of these technologies. Community programs that encourage early detection and treatment offer extra assistance to the market, leading to improved patient results.

Middle East and Africa Neurovascular Devices Market Analysis

The neurovascular device market in the Middle East and Africa is growing due to multiple region-specific factors. To address the growing prevalence of neurovascular diseases including aneurysms and strokes, governments and commercial healthcare organizations are now investing more in healthcare infrastructure, especially in institutions devoted to neurology. Medical tourism is expanding in countries like the UAE and South Africa, supported by advanced neurological treatment facilities that are encouraging the utilization of minimally invasive neurovascular devices. According to the Ministry of Economy, the medical tourism industry in the UAE generated AED 12.1 Billion (USD 3.29 Billion) in 2018. Concurrently, regional healthcare entities are strengthening partnerships with international producers to launch advanced technological devices in the market, addressing the unmet needs in stroke management and interventional neurology. Furthermore, the rising prevalence of hypertension, diabetes, and sedentary habits is elevating the demand for new approaches to tackle associated neurovascular problems. Training sessions and workshops are being conducted more frequently to improve the abilities of healthcare professionals in using advanced equipment, thereby guaranteeing improved patient results. Governments are swiftly accelerating regulatory clearances and endorsing clinical trials in this field, enhancing access to groundbreaking neurovascular products. These elements are jointly establishing a conducive atmosphere for the continuous expansion of the neurovascular devices market in the region.

Competitive Landscape:

Key players in the market are focusing on expanding their product portfolios through innovative solutions and advanced technologies to address complex neurovascular conditions. They are heavily investing in research operations to enhance device efficiency, safety, and minimally invasive capabilities. Strategic collaborations, mergers, and acquisitions are being pursued to strengthen market presence and gain access to emerging regions. These companies are also prioritizing regulatory approvals to ensure global availability and compliance with healthcare standards. Additionally, they are leveraging advanced manufacturing techniques to reduce production costs while maintaining quality. In 2024, Philips and Medtronic Neurovascular announced a joint advocacy initiative designed to enhance global access to essential stroke therapies. The collaboration seeks to raise awareness, improve access to treatments, and implement advanced technologies for effective stroke care management. The two firms joined the World Stroke Organization Advocacy Coalition to advocate for global stroke care policies.

The report provides a comprehensive analysis of the competitive landscape in the neurovascular devices market with detailed profiles of all major companies, including:

- Acandis GmbH

- Asahi Intecc Co. Ltd.

- Imperative Care Inc.

- Integer Holdings Corporation

- Johnson & Johnson

- Medtronic plc

- MicroPort Scientific Corporation

- Penumbra Inc.

- Perflow Medical Ltd.

- Rapid Medical

- Stryker Corporation

- Terumo Corporation

Latest News and Developments:

- August 2024: Gravity Medical Technology introduced the Supernova stent retriever and Neutron aspiration catheter for worldwide stroke therapy. These devices, leveraging AI-assisted design, improve clot removal and revascularization outcomes, addressing diverse patient needs. Early adoption and clinical trials demonstrate successful treatments and global accessibility.

- July 2024: MicroVention revealed the one-year outcomes of the CLEVER study, highlighting the safety and efficacy of its WEB™ 17 device in treating intracranial aneurysms. Marking five years of its WEB™ Aneurysm Embolization System in the US, the company emphasized its groundbreaking single-device approach for wide-neck bifurcation aneurysms.

- June 2024: Penumbra introduced its cutting-edge BMX81 and BMX96 neuro access catheters in Europe after receiving CE mark certification. These devices, which are made for neurovascular management of ischemic and hemorrhagic stroke, have innovative laser-cut stainless steel hypotube technology for enhanced stability and trackability.

Neurovascular Devices Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Applications Covered | Ischemic Stroke, Aneurysm, Arteriovenous Malformation and Fistulas (AVM), Stenosis, Others |

| End Users Covered | Hospitals, Ambulatory Surgical Centers, Clinics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Acandis GmbH, Asahi Intecc Co. Ltd., Imperative Care Inc., Integer Holdings Corporation, Johnson & Johnson, Medtronic plc, MicroPort Scientific Corporation, Penumbra Inc., Perflow Medical Ltd., Rapid Medical, Stryker Corporation, Terumo Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the neurovascular devices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global neurovascular devices market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the neurovascular devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Neurovascular devices assist in diagnosing and treating conditions affecting brain blood vessels, including aneurysms, strokes, and arteriovenous malformations. They include embolization coils, stents, flow diverters, and thrombectomy systems. These less invasive tools improve outcomes by restoring blood flow, sealing abnormal vessels, or supporting weakened arteries, offering critical solutions for life-threatening neurovascular disorders.

The neurovascular devices market was valued at USD 3.0 Billion in 2024.

IMARC estimates the global neurovascular devices market to exhibit a CAGR of 4.9% during 2025-2033.

The global neurovascular devices market is driven by rising cases of neurovascular disorders like strokes and aneurysms, advancements in minimally invasive technologies, and growing demand for effective, quicker recovery treatments. Increased healthcare spending, supportive government initiatives, and expanding access to advanced medical facilities in emerging regions.

In 2024, cerebral embolization and aneurysm coiling devices represented the largest segment by product, driven by advancements in less invasive techniques and the growing prevalence of aneurysms and stroke-related conditions.

Hospitals lead the market by end user owing to their advanced infrastructure, availability of skilled professionals, and high patient inflow for neurovascular procedures requiring specialized equipment and comprehensive post-treatment care.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global neurovascular devices market include Acandis GmbH, Asahi Intecc Co. Ltd., Imperative Care Inc., Integer Holdings Corporation, Johnson & Johnson, Medtronic plc, MicroPort Scientific Corporation, Penumbra Inc., Perflow Medical Ltd., Rapid Medical, Stryker Corporation, Terumo Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)