Network Optimization Services Market Size, Share, Trends and Forecast by Service, Organization Size, Deployment Mode, Application, Industry Vertical, and Region, 2025-2033

Network Optimization Services Market Size and Share:

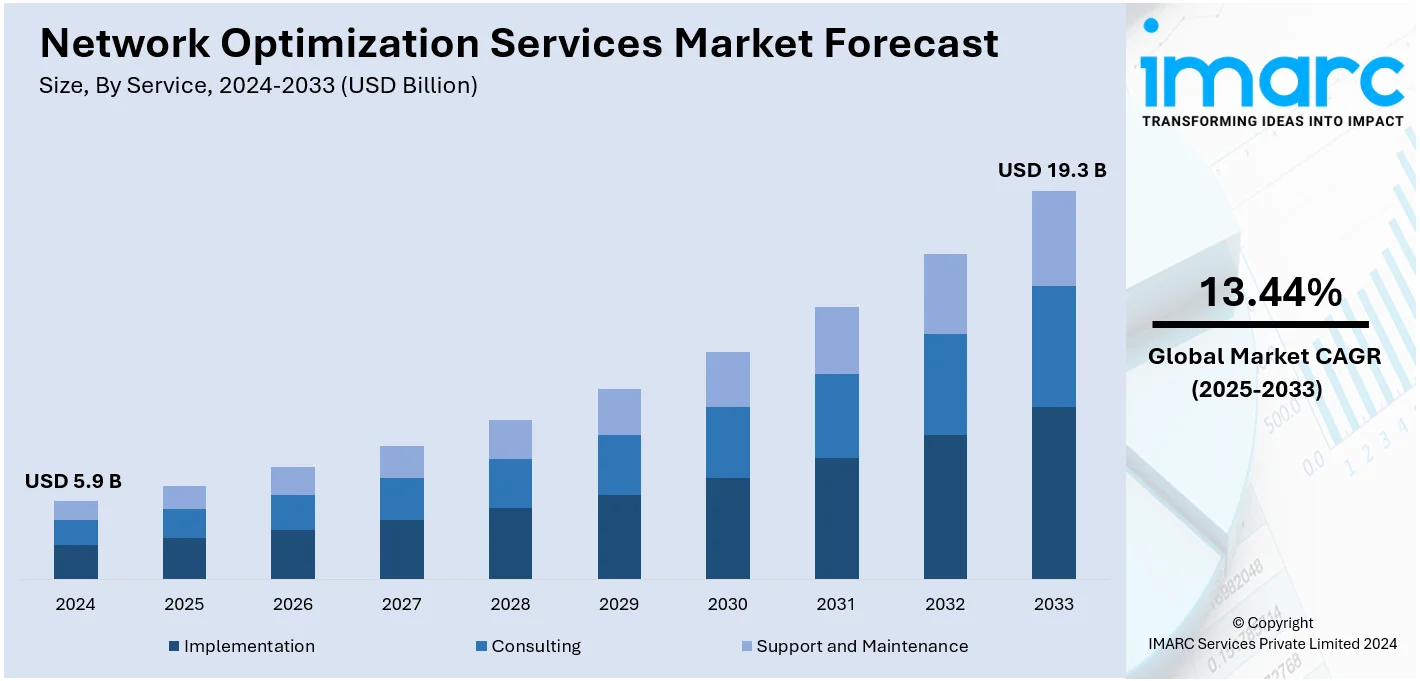

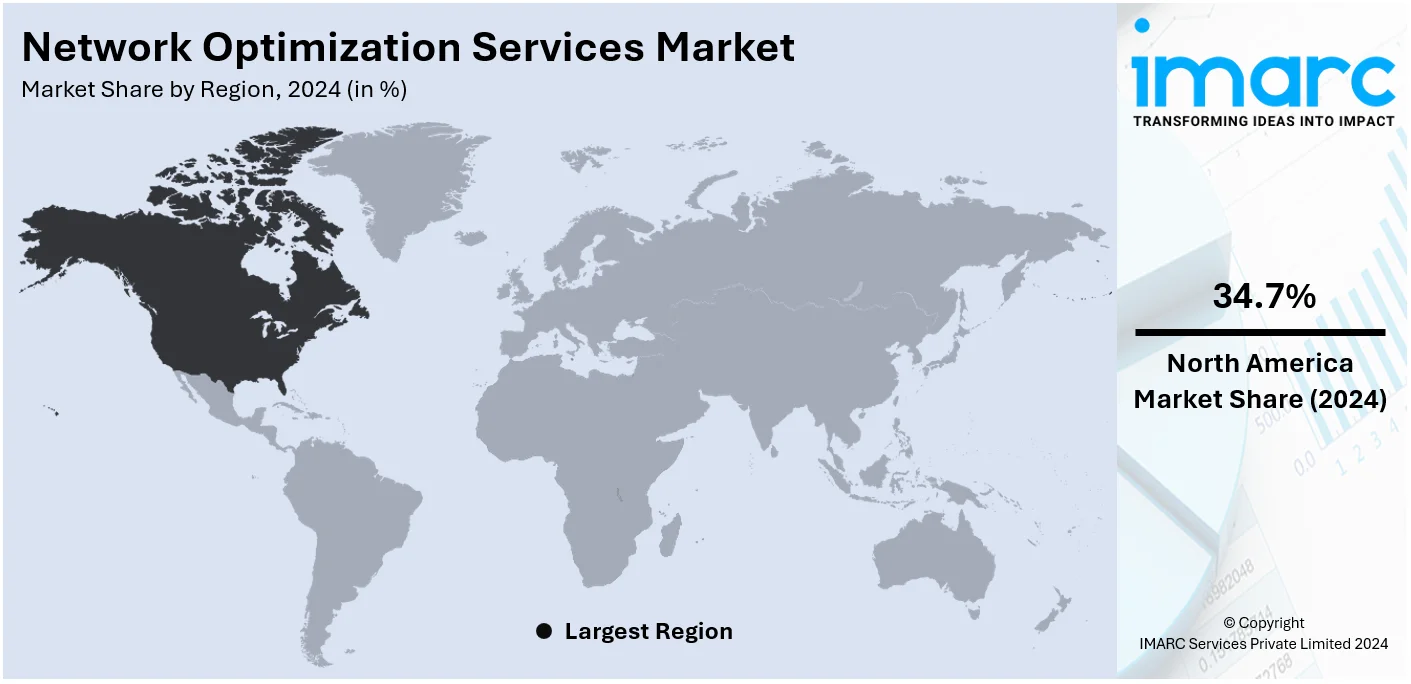

The global network optimization services market size was valued at USD 5.9 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 19.3 Billion by 2033, exhibiting a CAGR of 13.44% during 2025-2033. North America currently dominates the market, holding a significant market share of over 34.7% in 2024, driven by advanced IT infrastructure, widespread 5G adoption, and high investments in digital transformation and cybersecurity initiatives.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 5.9 Billion |

|

Market Forecast in 2033

|

USD 19.3 Billion |

| Market Growth Rate (2025-2033) | 13.44% |

One major driver of the network optimization services market is the increasing adoption of cloud-based applications and services across industries. As businesses shift operations to cloud environments, the demand for optimized network performance has grown significantly. Organizations require robust solutions to enhance bandwidth efficiency, reduce latency, and ensure seamless connectivity for mission-critical operations. For instance, in 2024, ZTE showcased AI-driven 5G solutions at Network X, featuring the G5 Ultra FWA, delivering 20% higher bandwidth efficiency and 30% less congestion for smarter, high-performance connectivity. This trend is further fueled by the rising use of remote work technologies and virtual collaboration tools, which necessitate advanced network management. Service providers are addressing these needs by offering scalable and customizable optimization solutions, driving market growth and catering to the evolving requirements of enterprises.

The United States is a key contributor to the Network Optimization Services Market, driven by its advanced technological infrastructure and widespread adoption of digital transformation initiatives. With a robust ecosystem of leading technology providers, the U.S. delivers cutting-edge solutions tailored to enhance network performance across diverse industries. Enterprises leverage these services to manage high data traffic, optimize bandwidth, and support the growing demand for cloud computing and remote work solutions. Additionally, the U.S. fosters innovation through significant investments in research and development, enabling the deployment of next-generation technologies, such as AI-driven optimization tools, further solidifying its leadership in this market. For instance, in 2024, Cisco acquired Splunk for $28 billion, aiming to enhance its portfolio by integrating Splunk’s AI-driven security and observability features into its existing solutions.

Network Optimization Services Market Trends:

Growth of Remote Work and Distributed Workforce Solutions

The increasing need for optimized network services is being driven by the expansion of remote work and globally distributed teams. Enterprises are focusing on solutions that ensure reliable connectivity, secure data transmission, and reduced latency to support virtual collaboration and productivity. Network optimization services are evolving to address these requirements, incorporating secure access features and advanced traffic management tools. Pew Research Center reports that nearly three years after the COVID-19 pandemic disrupted U.S. workplaces, 35% of workers in remote-capable jobs now work from home full-time. This coupled with increasing network threats like hacking and data breaches is positively contributing to the market growth. And as companies are embracing flexible models and putting infrastructures in place for dispersed workforces, it's expected to continue the same trend.

Optimizing Data Center Infrastructure for High-Performance Computing

Significant advancements in network infrastructure and the increasing number of data centers are other major growth-inducing factors, supporting high-performance computing and advanced workloads. The global data center market size reached USD 194.5 Billion in 2023. Organizations have been adopting network optimization solutions to improve bandwidth utilization and decrease latency while ensuring smooth data flow as data centers grow in complexity to handle cloud computing, edge computing, and AI-driven operations. Advanced tools that provide real-time monitoring, traffic management, and scalability have become more important for data centers in maintaining operational efficiency. This trend represents the rising need for reliable infrastructure that will meet the requirements of dynamic digital ecosystems and increasingly expanding global data traffic. Besides this, the growing use of Voice-over-Internet Protocol (VoIP) services and the growing awareness of network optimization benefits are also driving product demand.

Convergence of AI and Machine Learning

Artificial intelligence and machine learning are transforming the network optimization services industry. These technologies allow for predictive analytics, real-time traffic monitoring, and automated issue resolution, thus significantly enhancing network performance and efficiency. AI-driven solutions enable enterprises to proactively address potential disruptions, optimize resource allocation, and ensure seamless connectivity. For instance, in 2024, ZTE unveiled its AI OpsBot Core Network Intelligent Expert at the 5G Summit, boosting O&M efficiency by 30% through advanced AI models and natural language interaction. This trend is gaining traction as businesses seek intelligent systems to manage increasingly complex network architectures, particularly in the era of cloud computing and IoT.

Network Optimization Services Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global network optimization service market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on service, organization size, deployment mode, application, and industry vertical.

Analysis by Service:

- Implementation

- Consulting

- Support and Maintenance

Implementation stands as the largest service in 2024. This is due to the fact that the demand for efficient deployment of advanced network solutions is growing. This service category includes activities such as system integration, network configuration, and on-site deployment. It ensures seamless integration of new technologies with existing infrastructure. The rapid adoption of 5G, AI-driven solutions, and IoT technologies has heightened the need for tailored implementation services to optimize network performance and scalability. Implementation expertise is also increasingly being used by enterprises to minimize downtime, improve operational efficiency, and achieve faster time-to-market for new services. As the complexity of network environments increases, the role of implementation services continues to grow, becoming an integral part of the overall network optimization strategy.

Analysis by Organization Size:

- Small and Medium-sized Enterprise

- Large Enterprise

Large enterprise leads the market in 2024, reflecting the need for robust, scalable, and efficient network solutions to handle complex infrastructures and high data traffic. These organizations mainly focus on network optimization, which enhances operational efficiency and reduces latency while supporting important applications such as cloud computing, AI-driven analytics, and IoT integrations. The demand for tailored services, including network assessment, implementation, and real-time monitoring, has grown as huge enterprises look to meet the strong performance and security requirements they need. Furthermore, amid 5G and the hybrid work model, fine-tuning networks for constant connectivity and smooth business functionality is a necessity. Large enterprises make the largest contribution to the market segment with their gigantic IT budgets and emphasis on digital transformation.

Analysis by Deployment Mode:

- On-premises

- Cloud-based

On-premises deployment involves hosting network optimization solutions within an organization's infrastructure, offering enhanced data control, security, and customization. It serves the network optimization market by addressing the needs of industries requiring stringent compliance, low-latency operations, and dedicated resources. This mode supports enterprises managing sensitive data, ensuring reliability and performance without relying on third-party cloud providers.

Cloud-based deployment involves hosting network optimization services on remote servers accessible via the internet. It serves the network optimization market by offering scalability, cost efficiency, and flexibility for businesses. This approach supports dynamic network needs, enabling real-time updates, centralized management, and seamless integration with modern technologies like 5G and IoT, making it ideal for enterprises seeking agility and reduced infrastructure costs.

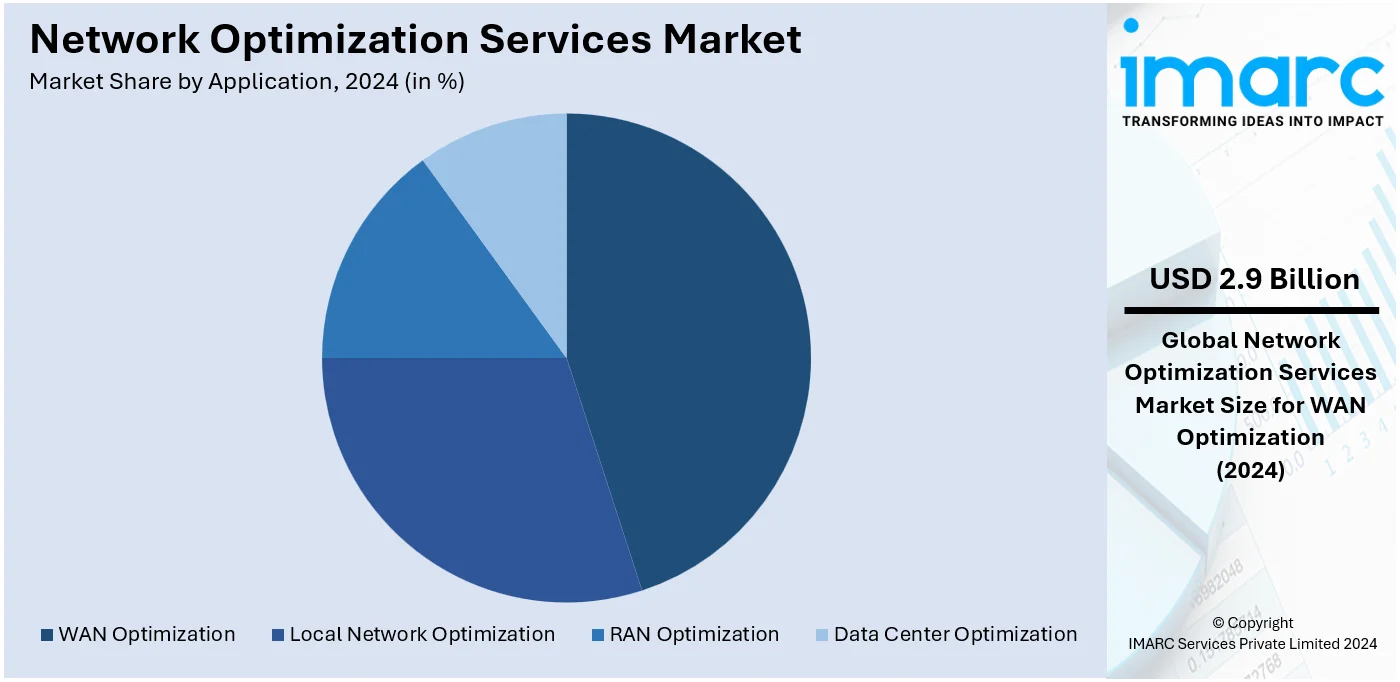

Analysis by Application:

- Local Network Optimization

- WAN Optimization

- RAN Optimization

- Data Center Optimization

WAN optimization leads the market with around 50.2% of the market share in 2024. This is based on its role in helping to improve the performance of distributed enterprises and remote operations in a network. WAN optimization solutions are significant in reducing latency, increasing bandwidth utilization, and expediting data transfer across locations that are separated by considerable distances. Growing cloud-based applications, hybrid work environments, and tools for real-time communication require optimized WAN infrastructure. WAN optimization ensures smooth connectivity and faster application performance through features like data compression, traffic prioritization, and protocol acceleration. Increasing business usage of 5G and edge computing technologies means WAN optimization remains a core in ensuring efficient, reliable, and high-speed network operations in a competitive digital landscape.

Analysis by Industry Vertical:

- IT and Telecom

- BFSI

- Government and Defense

- Transportation and Logistics

- Manufacturing

- Consumer Goods and Retail

- Media and Entertainment

- Energy and Utility

- Healthcare and Life Sciences

- Education

IT and telecom leads the market in 2024. This dominance is led by its critical reliance on high-performing, secure, and efficient network infrastructures. With the rapid deployment of 5G networks, the surge in data traffic, and the increasing adoption of cloud services, IT and telecom companies prioritize network optimization to deliver uninterrupted services and meet growing customer expectations. To minimize latency, optimize bandwidth utilization, and enable seamless connectivity across devices and regions, these businesses leverage advanced solutions. In addition, the integration of AI and automation in network operations further supports this sector in managing complex infrastructures. With the acceleration of digital transformation, IT and telecom continue to be key drivers in the network optimization market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 34.7%. This is due to the region's advanced IT infrastructure, wide adoption of cutting-edge technologies such as 5G, and the presence of key industry players. Enterprises in North America are focusing more on optimizing networks to support high data traffic, cloud computing, and AI-driven applications. The growth in remote work and hybrid business models has further driven the demand for efficient network solutions. Governments and businesses are also heavily investing in cybersecurity measures, ensuring network reliability and performance. With strong digital transformation initiatives and high technology penetration, North America is a strong leader in the global landscape of network optimization.

Key Regional Takeaways:

United States Network Optimization Services Market Analysis

US accounts for 89.2% share of the market in North America. The network optimization services market in the United States is experiencing significant growth, driven by the increasing demand for faster and more reliable connectivity across various industries. According to CTIA, 40% of all wireless devices ranging from smartphones and smartwatches to IoT devices are now connected to 5G, a 34% increase over 2022. This rapid adoption of 5G technology is a key factor fueling the demand for advanced network optimization solutions, as businesses need to manage higher data volumes, lower latency, and maintain seamless connectivity across their operations. The rise of cloud computing, big data analytics, and the Internet of Things (IoT) has further intensified the need for optimized networks to handle the growing amount of data being processed. Additionally, the shift towards remote work and digital transformation in industries such as healthcare, retail, and finance has highlighted the importance of resilient and high-performing networks. With the increasing complexity of cybersecurity threats, businesses are also focusing on network optimization to ensure the security and reliability of their digital infrastructures. Government regulations, including those related to data privacy and service quality, are also driving companies to invest in network optimization services. As 5G technology continues to expand, the U.S. market for network optimization services is poised for continued growth, positioning the country as a key player in this evolving space.

Asia Pacific Network Optimization Services Market Analysis

The network optimization services market in the Asia-Pacific (APAC) region is growing rapidly, fueled by the region's digital transformation, especially in countries like China, India, Japan, and South Korea. According to reports, India’s IoT market is expected to reach 500 Million connections by 2025, driven by initiatives like Digital India and Smart Cities, and the growing demand across sectors such as healthcare, agriculture, and manufacturing. The increasing adoption of 5G networks and IoT devices is driving the need for optimized network solutions. Additionally, APAC's expanding e-commerce and fintech industries require seamless, reliable network connections to ensure business continuity. With rising concerns about cybersecurity and the demand for data-intensive technologies such as AI and big data, businesses are focusing on network optimization to enhance performance, reduce latency, and improve security. Government investments in digital infrastructure and smart city projects further support the region’s growth in this market.

Europe Network Optimization Services Market Analysis

The network optimization services market in Europe is growing due to several key factors, including the rapid adoption of 5G technology, the increasing reliance on cloud computing, and the rise of artificial intelligence (AI) applications. According to the European Commission, 8% of EU enterprises utilized artificial intelligence technologies in 2023, a trend that is driving the demand for optimized networks capable of supporting data-intensive applications like AI, machine learning, and big data analytics. As businesses across sectors such as healthcare, finance, and manufacturing digitize operations, they require high-performance networks that can efficiently handle the increasing volumes of data and ensure low latency for real-time processing. Europe's emphasis on sustainability and energy-efficient technology is also influencing the network optimization market, with companies seeking solutions that improve performance while reducing energy consumption. Furthermore, the region’s stringent regulatory framework, including the General Data Protection Regulation (GDPR), has led to increased demand for optimized networks that can ensure data privacy and security. The expansion of 5G networks, coupled with the rise in cybersecurity concerns, is prompting enterprises to invest in network optimization services to maintain high performance and secure their infrastructures. Continued government funding in digital infrastructure and smart city endeavors is likely to drive sustained demand for network optimization solutions in Europe.

Latin America Network Optimization Services Market Analysis

The network optimization services market in Latin America is expanding due to the region's growing digitalization and the increasing adoption of mobile networks. According to GSMA, by 2030, 5G will account for nearly 60% of total mobile connections in Latin America, driving the need for advanced network optimization solutions. This shift to 5G, alongside the rising demand for IoT devices and cloud-based services, is pushing businesses to enhance network performance and reduce latency. Additionally, sectors such as e-commerce, fintech, and manufacturing are contributing to the demand for seamless, high-quality connectivity to ensure business continuity. As concerns over cybersecurity grow and more industries adopt data-intensive technologies, companies are increasingly investing in network optimization services to improve performance, security, and resilience. This transition to more advanced networks, coupled with government investments in digital infrastructure, further supports the region's growth in the network optimization services market.

Middle East and Africa Network Optimization Services Market Analysis

The network optimization services market in the Middle East and Africa is expanding, driven by the rapid adoption of 5G technology and increasing investments in digital infrastructure. According to Ericsson, the GCC countries are set to reach 47% 5G subscription penetration by the end of 2024, fueling the demand for optimized networks capable of handling the higher data volumes and lower latency required by 5G applications. To ensure seamless connectivity and reliable performance, critical industries such as oil and gas, telecommunications, and finance are making significant investments in advanced network solutions. Government initiatives focused on smart cities and digital transformation further accelerate the demand for network optimization services in the region.

Competitive Landscape:

The competitive landscape of the Network Optimization Services Market is marked by the presence of key global and regional players focusing on innovation and service differentiation. Leading companies are investing in advanced technologies like artificial intelligence, machine learning, and automation to enhance network performance and reliability. Strategic partnerships, mergers, and acquisitions are prevalent, enabling firms to expand their service portfolios and geographic reach. Emerging players are introducing cost-effective solutions to address the needs of small and medium-sized enterprises. With increasing demand for scalable and customizable network services, competition remains dynamic, driving continuous advancements and fostering market growth. Additionally, the rise of cloud-native solutions and 5G deployments further intensifies competition, prompting continuous innovation and differentiation. For instance, in 2024, Huawei introduced seven F5.5G innovations, including 1.6T OTN, Hybrid ASON, 50G PON, and FTTR+X, enhancing AI-centric networks with ultra-low latency, 99.9999% availability, 10G coverage, smart home hubs, and efficient optical network O&M. These advancements are crucial for optimizing networks to meet the growing demands of AI-centric applications and smart home ecosystems.

The report provides a comprehensive analysis of the competitive landscape in the network optimization services market with detailed profiles of all major companies, including:

- Array Networks Inc.

- Cisco Systems, Inc.

- Cloudflare, Inc

- F5, Inc

- FatPipe Inc.

- Infovista

- NetScout Systems, Inc.

- Nokia Corporation

- Riverbed Technology

- Telefonaktiebolaget LM Ericsson

- ZTE Corporation

Latest News and Developments:

- November 2024: Aira Technologies launched Naavik, a GenAI-powered platform for optimizing Telco RAN operations. It streamlines KPI analysis, anomaly detection, energy management, and zero-touch provisioning, reducing network setup times and enhancing efficiency.

- October 2024: Fujitsu has developed an AI-powered application to improve mobile network performance, reduce energy use, and optimize operations. Part of the NEDO-led post-5G project, it features real-time QoE estimation, proactive traffic management, and dynamic base station adjustments. Tests with commercial data in August 2024 confirmed its effectiveness in enhancing reliability and efficiency for users and operators.

- October 2024: Ericsson has launched seven 5G Advanced software solutions to improve network performance and efficiency for CSPs. The suite includes AI-powered RAN, intent-driven networks, and service-aware RAN, enabling real-time decision-making and adaptive connectivity to meet service goals and optimize performance.

- September 2024: NVIDIA has launched AI Aerial, a suite of software and hardware solutions for AI-powered radio access networks (AI-RAN). The platform supports network optimization at scale, reducing costs while enabling advanced services like teleoperations, computer vision, generative AI applications, and emerging 5G and 6G technologies. Designed to meet the demands of next-generation connectivity, it aims to drive efficiency and new revenue streams for telecom providers.

- September 2024: OpenVault has launched Vantage, an integrated platform combining Proactive Network Maintenance (PNM), Profile Management Application (PMA), and Congestion Management into a unified solution. Enhanced by AI-driven automation and an AI Help Desk, Vantage streamlines network health monitoring and maintenance with RF-to-IP visibility. Deployable on-premises or in the cloud, it aims to optimize broadband performance and efficiency.

Network Optimization Services Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Implementation, Consulting, Support and Maintenance |

| Organization Sizes Covered | Small and Medium-sized enterprise, Large Enterprise |

| Deployment Modes Covered | On-premises, Cloud-based |

| Applications Covered | Local Network Optimization, WAN Optimization, RAN Optimization, Data Center Optimization |

| Industry Verticals Covered | IT and Telecom, BFSI, Government and Defense, Transportation and Logistics, Manufacturing, Consumer Goods and Retail, Media and Entertainment, Energy and Utility, Healthcare and Life Sciences, Education |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Array Networks Inc., Cisco Systems, Inc., Cloudflare, Inc, F5, Inc, FatPipe Inc., Infovista, NetScout Systems, Inc., Nokia Corporation, Riverbed Technology, Telefonaktiebolaget LM Ericsson, ZTE Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the network optimization services market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global network optimization services market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the network optimization services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Network optimization services enhance the performance, reliability, and efficiency of IT networks by improving data flow, reducing latency, and maximizing resource utilization. These services involve assessing, configuring, and maintaining networks to meet evolving demands, ensuring seamless connectivity, better bandwidth management, and support for modern technologies like 5G, cloud computing, and IoT.

The network optimization services market was valued at USD 5.9 Billion in 2024.

IMARC estimates the global network optimization services market to exhibit a CAGR of 13.44% during 2025-2033.

The rapid adoption of 5G networks is a key market driver, as it requires advanced network optimization services to handle higher frequencies, faster data rates, and multi-band operations, ensuring seamless connectivity for smartphones, IoT devices, and telecommunications infrastructure.

According to the report, implementation represented the largest segment by service, driven by the growing need for seamless integration of advanced technologies, efficient deployment processes, and customized solutions to enhance network performance and reliability.

Large enterprise leads the market as these organizations require robust, scalable solutions to manage complex networks, high data traffic, and ensure seamless operations for critical applications like cloud computing and AI-driven technologies.

WAN optimization leads the market by application as it enhances data transfer efficiency, reduces latency, and ensures seamless connectivity across geographically dispersed networks, meeting the growing demand for optimized performance in cloud computing and remote work environments.

IT and telecom lead the market by industry vertical as these sectors rely heavily on high-performance networks to manage massive data traffic, support 5G deployment, enable cloud services, and ensure seamless connectivity for critical applications.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global network optimization services market include Array Networks Inc., Cisco Systems, Inc., Cloudflare, Inc, F5, Inc, FatPipe Inc., Infovista, NetScout Systems, Inc., Nokia Corporation, Riverbed Technology, Telefonaktiebolaget LM Ericsson, ZTE Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)