Neodymium-Iron-Boron Magnet Market Size, Share, Trends and Forecast by Application and Region, 2025-2033

Neodymium-Iron-Boron Magnet Market Size and Share:

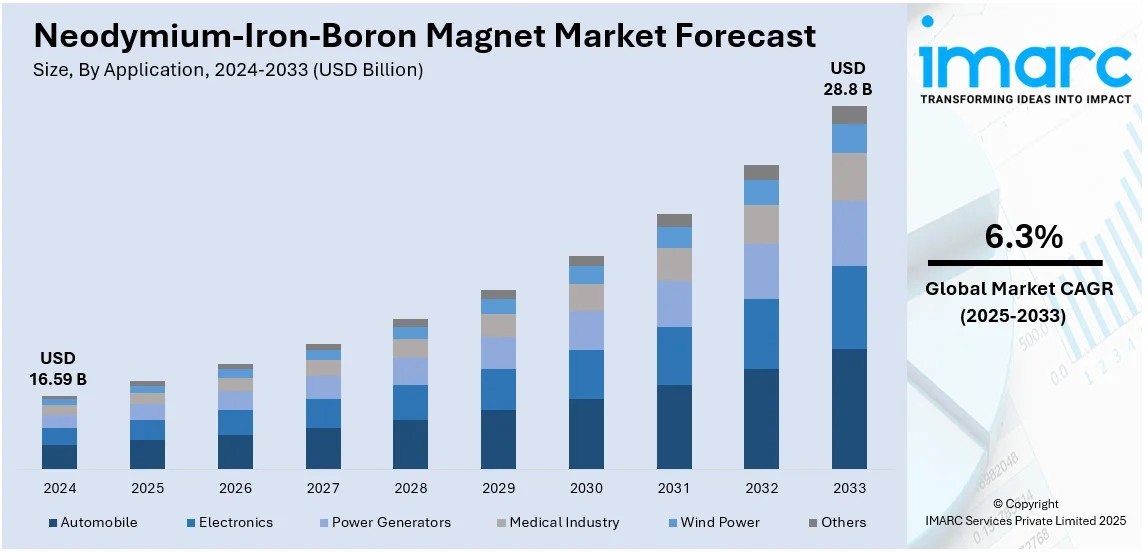

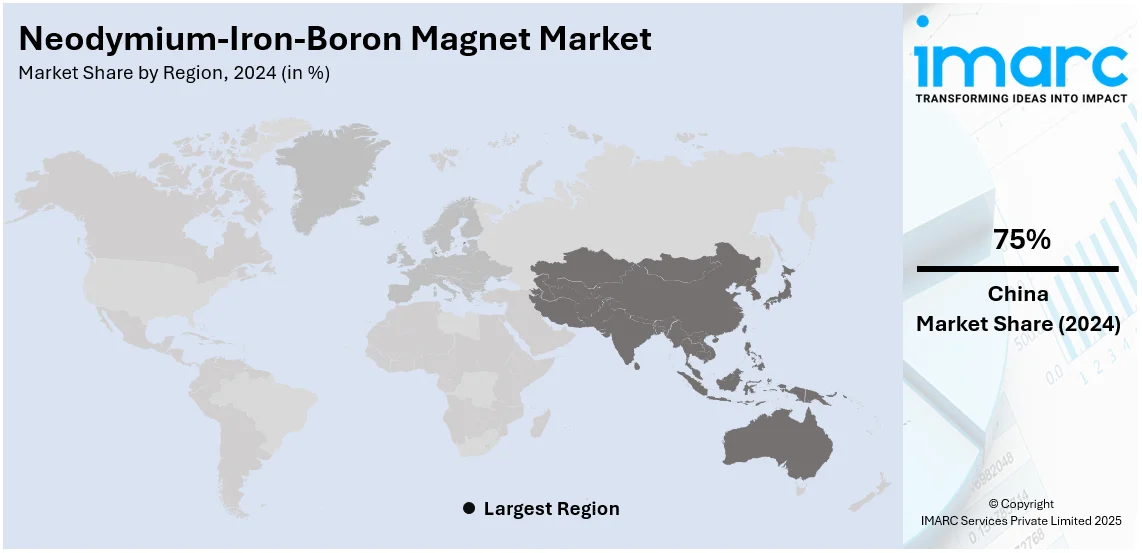

The global neodymium-iron-boron magnet market size was valued at USD 16.59 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 28.8 Billion by 2033, exhibiting a CAGR of 6.3% during 2025-2033. China currently dominates the market, holding a significant market share of over 75% in 2024, due to its control over most of the global rare earth processing and magnet production. Its integrated supply chain and government-backed investments ensure cost efficiency and market leadership.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 16.59 Billion |

|

Market Forecast in 2033

|

USD 28.8 Billion |

| Market Growth Rate (2025-2033) | 6.3% |

The global neodymium-iron-boron (NdFeB) magnet market is experiencing growth due to increasing demand for high-performance magnets in electric vehicles (EVs), wind energy, and consumer electronics. Expanding adoption of EVs and hybrid vehicles is driving the need for NdFeB magnets in traction motors. Rising renewable energy investments, particularly in wind turbines, are further fueling market expansion. Additionally, advancements in automation, robotics, and medical imaging technologies are boosting demand. Supply chain developments, including recycling initiatives and strategic rare earth sourcing, are enhancing market stability. Government policies supporting clean energy and domestic rare earth production are also key drivers impacting the neodymium-iron-boron magnet market growth.

The United States exhibits a critical role in the global NdFeB magnet market, driven by its advanced manufacturing sector, elevating need for electric vehicles (EVs), and augmenting renewable energy projects. For instance, as per the U.S. Energy Information Administration, the United States electric and hybrid vehicle sales rose to 18.7% of new vehicle sales (light-duty) during the second quarter of 2024, up from 17.8% in Q1 2024, following a slight decline. Furthermore, the country relies on imports for rare earth elements, particularly from China, impacting supply chain security. Government initiatives, including the Inflation Reduction Act and funding for domestic rare earth processing, aim to enhance self-sufficiency. Key industries, such as defense, automotive, and electronics, are increasing adoption of high-performance NdFeB magnets, supporting market growth. Strategic partnerships and investments in local production are expected to reduce dependency on foreign sources.

Neodymium-Iron-Boron Magnet Market Trends:

Rising Demand for NdFeB Magnets in Renewable Energy and Robotics

The increasing shift towards renewable energy sources, such as wind and solar, is one of the key neodymium-iron-boron magnet market trends impacting the growth. As per the International Energy Association, energy investment is anticipated to surpass USD 3 Trillion globally for the first time in the year 2024, with USD 2 Trillion being reserved for clean energy infrastructure as well as technologies. NdFeB magnets play a crucial role in enhancing wind turbine efficiency, supporting this transition. Additionally, their expanding use in robotics, particularly in powering wheels, sensors, and motion, is further fueling market growth as automation and AI-driven technologies gain traction. The rapid advancements in industrial robotics and autonomous systems are further amplifying demand, solidifying the role of NdFeB magnets in next-generation robotic applications.

Expanding Applications in Aerospace, Healthcare, and Consumer Electronics

NdFeB magnets are witnessing increasing demand in aerospace applications, particularly for maintaining astronaut muscular tonus during space missions. In healthcare, they are being integrated into orthodontic treatments for molar distillation and palatal expansion. The consumer electronics sector is also driving growth, with NdFeB magnets used in manufacturing speakers to create opposing magnetic fields for sound production. For instance, as per industry reports, the global venture capital investment in the consumer electronics industry reached USD 26.5 Billion in 2021, underscoring the sector's expansion. Additionally, their role in electrical appliances, including air conditioners, washing machines, and cooling fan motors in computers, is further boosting the neodymium-iron-boron magnet demand.

Growing Demand for NdFeB Magnets in Household and Industrial Appliances

The increasing adoption of neodymium-iron-boron (NdFeB) magnets in household and industrial appliances is driving market growth. Such magnets are widely utilized in air conditioners, microwave, washing machines, cooling fan motors in computers, dryers, and other electrical devices, enhancing efficiency and performance. The rising trend of smart home technologies and energy-efficient appliances is further fueling demand. For instance, industry reports indicate that, as of 2024, 69.91 Million U.S. household actively utilize smart home devices, exhibiting a 10.2% elevation from 2023, which recorded 63.43 Million devices use. Additionally, NdFeB magnets play a crucial role in industrial automation, powering motors and actuators in manufacturing equipment. With industries focusing on sustainability and energy savings, the demand for high-performance magnets in electric motors and compressors is growing, strengthening their presence in both residential and industrial applications, thereby shaping as positive neodymium-iron-boron magnet outlook.

Neodymium-Iron-Boron Magnet Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global neodymium-iron-boron magnet market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on application.

Analysis by Application:

- Automobile

- Electronics

- Power Generators

- Medical Industry

- Wind Power

- Others

Automobile leads the market with around 16.1% of market share in 2024, driven by the increasing adoption of electric vehicles (EVs) and advancements in automotive technologies. NdFeB magnets are essential for high-performance traction motors in EVs, as they offer superior magnetic strength, energy efficiency, and compact design compared to alternatives. Automakers are prioritizing these magnets to enhance vehicle performance, extend driving range, and improve overall efficiency. Additionally, conventional internal combustion engine (ICE) vehicles continue to rely on NdFeB magnets in various components, including power steering, fuel pumps, and starter motors. The growing demand for lightweight and energy-efficient vehicles further strengthens the reliance on these magnets. Governments worldwide are implementing stringent emissions regulations and incentivizing EV adoption, accelerating the demand for high-performance NdFeB magnets. As automotive electrification advances, the segment is expected to maintain its dominance, reinforcing its role as a key driver of market growth.

Regional Analysis:

- China

- Japan

- Europe

- Others

In 2024, China accounted for the largest neodymium-iron-boron magnet market share of over 75%. Growing neodymium-iron-boron magnet adoption is driven by increasing investments in manufacturing, electric vehicles, hybrid vehicles, and automotive components. For instance, China has above 600,000 existing NEV-related (new energy vehicle (NEV)) enterprises. The year 2022 witnessed 239,400 newly launched enterprises, a year-on-year elevation of 40.34%. Expanding production capabilities for advanced automotive technologies is accelerating demand for high-performance magnets in motor applications. Rising investments in next-generation electric vehicles are pushing manufacturers to integrate energy-efficient and lightweight components, enhancing overall efficiency. Hybrid vehicle advancements are contributing to the need for durable and high-strength magnets in powertrains and auxiliary systems. Increased automation in manufacturing is further driving the utilization of high-coercivity magnets for precision control in robotic systems. Automotive components, including power steering, braking, and infotainment systems, are incorporating high-performance magnets for enhanced functionality. Continuous development in permanent magnet-based propulsion systems is reinforcing market demand. Strengthened supply chains are ensuring steady availability of essential raw materials.

Key Regional Takeaways:

United States Neodymium-Iron-Boron Magnet Market Analysis

In 2024, the United States accounted for 82.60% of the market share in North America. The United States holds a significant position in the global NdFeB magnet market, driven by increasing demand from industries such as automotive, consumer electronics, and defense. The transition to electric vehicles (EVs) is a major growth factor, as NdFeB magnets are critical for high-performance traction motors. For instance, as per industry reports, Hyundai achieved its 5th consecutive record sales month across the United States, influenced by strong demand for new EVs, mainly 2025 IONIQ 5. February 2025 marked its highest U.S. sales for the month, with over 62,000 vehicles sold, exhibiting a 3% elevation from February 2024. This growth surpassed the industry’s projected average of approximately 1%. The defense sector also relies on these magnets for advanced weaponry, communication systems, and aerospace applications. However, the U.S. faces challenges due to heavy reliance on Chinese imports for rare earth materials. Efforts to strengthen domestic supply chains include government-backed initiatives to boost rare earth mining and magnet production. Companies are investing in recycling technologies to recover neodymium from end-of-life products, aiming to reduce supply risks. With ongoing policy support and technological advancements, the U.S. is working to secure a more self-sufficient and competitive position in the NdFeB magnet market.

Japan Neodymium-Iron-Boron Magnet Market Analysis

Growing neodymium-iron-boron magnet adoption is propelled by increasing investment in healthcare and the medical industry and facilities. For instance, as of October 1, 2021, the number of hospitals across Japan (excluding dental as well as medical clinics) totalled 8,205. The number of hospital beds were found to be 1,500,057 (1,195.2 per 100,000 population). Expanding medical imaging applications are driving the demand for high-strength magnets in MRI machines, ensuring enhanced diagnostic capabilities. Increasing advancements in medical device miniaturization are fostering the use of compact and powerful magnets in implantable and wearable devices. Growing technological innovations in prosthetics and orthopedic solutions are integrating high-performance magnetic components for improved mobility and precision. Rising adoption of magnetically controlled drug delivery systems is enhancing treatment efficiency, optimizing therapeutic outcomes. Strengthened investments in next-generation rehabilitation technologies are supporting the utilization of specialized magnets for motion assistance devices. Increasing demand for robotic-assisted surgery is fuelling the integration of high-coercivity magnets in precision-guided surgical tools. Advancements in bioelectronics are pushing research into innovative magnetic applications for neuromodulation and patient monitoring.

Europe Neodymium-Iron-Boron Magnet Market Analysis

The rising deployment of neodymium-iron-boron in the wind power sector is driven by the increasing transition toward renewable energy sources and sustainable power generation. The rapid expansion of wind power installations and the shift from conventional turbines to high-efficiency direct-drive systems are amplifying the demand for neodymium-iron-boron magnets. For instance, Europe deployed 18.3 GW of new wind capacity during 2023. With an emphasis on lowering carbon emissions and achieving energy security, the adoption of permanent magnet generators in wind power projects is growing. The strong magnetic properties and high coercivity of neodymium-iron-boron enable efficient energy conversion, enhancing the reliability and longevity of wind turbines. Technological advancements in offshore wind power projects, particularly in large-scale turbines, are increasing the need for durable and high-strength neodymium-iron-boron components. Investments in grid infrastructure and energy storage solutions are supporting the integration of wind power, further driving demand for advanced magnet technologies. The push for localized production and supply chain resilience is fostering research into sustainable extraction and recycling of neodymium-iron-boron, ensuring long-term availability for the growing wind power sector.

Competitive Landscape:

The magnet market features intense competition among key players. Market participants focus on technological advancements, supply chain optimization, and sustainability initiatives to secure a competitive edge. The sector witnesses increasing R&D investments to enhance magnet performance and reduce dependence on critical raw materials like dysprosium and terbium. Vertical integration strategies and collaborations with end-user industries strengthen market positions. China is prominent in global production, influencing pricing and supply dynamics. For instance, IMARC Group states that NdFeB magnet market size across China is anticipated to grow to 1,55,380 Tons by the year 2033. Furthermore, regulatory policies, particularly regarding rare earth mining and environmental sustainability, significantly impact market strategies. Emerging players from Asia-Pacific further intensify competition through cost-efficient manufacturing capabilities.

The report provides a comprehensive analysis of the competitive landscape in the neodymium-iron-boron magnet market with detailed profiles of all major companies.

Latest News and Developments:

- January 2025: MP Materials has begun manufacturing rare-earth neodymium magnets in the U.S., challenging China's dominance. The Fort Worth, Texas, facility is producing on a trial basis, aiming for full-scale production by year-end. Initial capacity is 1,000 tonnes annually, with potential expansion to 3,000 tonnes. General Motors and other U.S. manufacturers are expected customers.

- January 2025: E-Vac Magnetics, a US subsidiary of Germany's VAC Group, will build a rare earth magnet plant in Sumter, South Carolina, set to open in late 2025. The facility will manufacture high-performance NdFeB magnets for utilization ion defense and electric vehicles. The US Department of Defense is providing USD 94.1 Million for equipment and infrastructure. VAC confirmed a long-term supply agreement with GM for the plant’s output.

- December 2024: HyProMag USA plans a rare earth magnet facility in the U.S., utilizing hydrogen processing to recycle neodymium iron boron (NdFeB) magnets. A feasibility study confirms its viability, supported by CoTec Holdings and Mkango Resources. The process, developed at the University of Birmingham, recovers NdFeB alloy powder from magnet scrap. This technology offers a lower-carbon alternative to traditional recycling methods.

- July 2024: Mkango Resources' UK rare earth magnet plant at Tyseley Energy Park is set to begin operations in early 2025. The facility will focus on short-loop recycling and manufacturing of neodymium iron boron (NdFeB) magnets with a low carbon footprint. Final equipment delivery, infrastructure installation, and permitting are key to the timeline. Strong interest from potential partners highlights the growing demand for sustainable NdFeB solutions.

- August 2023: ZHAOBAO MAGNET is set to boost its Neodymium Iron Boron magnet production capacity to 8,000 tons by 2024 with a new factory. The expansion aims to meet rising demand in the Sintered Neodymium magnet market. The facility will enhance global supply and strengthen ZHAOBAO MAGNET’s industry presence. The company expects increased customer engagement and market influence post-completion.

Neodymium-Iron-Boron Magnet Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD, Metric Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Automobile, Electronics, Power Generators, Medical Industry, Wind Power, Others |

| Regions Covered | China, Japan, Europe, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the neodymium-iron-boron magnet market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global neodymium-iron-boron magnet market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the neodymium-iron-boron magnet industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The neodymium-iron-boron magnet market was valued at USD 16.59 Billion in 2024.

IMARC estimates the neodymium-iron-boron magnet market to reach USD 28.8 Billion by 2033, exhibiting a CAGR of 6.3% during 2025-2033.

The market is driven by rising demand in electric vehicles, wind energy, and industrial automation. Technological advancements enhancing magnetic performance, increasing miniaturization in electronics, and government policies supporting renewable energy further propel growth. Supply chain developments and recycling initiatives also influence market expansion.

China currently dominates the neodymium-iron-boron magnet market, accounting for a share exceeding 75%. This dominance is fueled by its control over rare earth mining, refining, and magnet production, supported by strong government policies and supply chain integration.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)