Neobanking Market Size, Share, Trends and Forecast by Account Type, Application, and Region, 2025-2033

Neobanking Market Size, Share And Trends

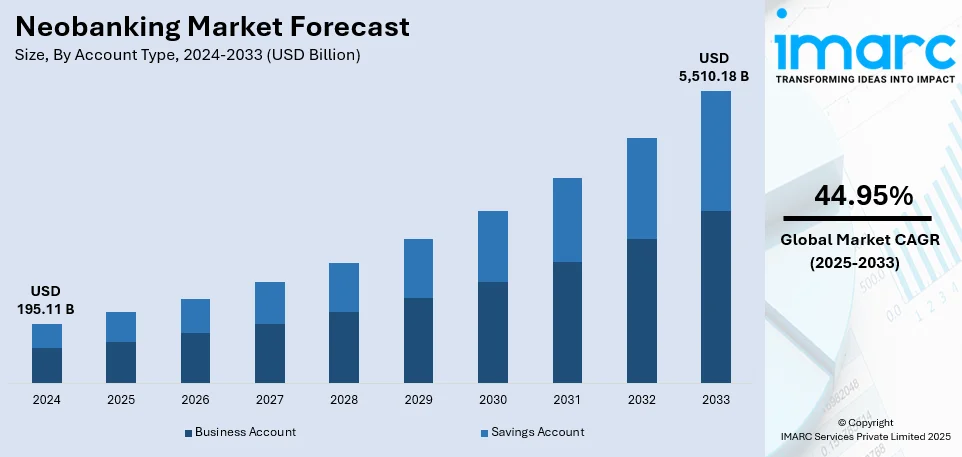

The global neobanking market size was valued at USD 195.11 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 5,510.18 Billion by 2033, exhibiting a CAGR of 44.95% from 2025-2033. Europe currently dominates the market, holding a market share of over 31.5% in 2024. The neobanking market share is expanding, driven by the increasing consumer preference for digital and mobile-first banking solutions, favorable regulatory changes facilitating the growth of neobanks, and continuous technological advancements, particularly in artificial intelligence (AI), blockchain, and machine learning (ML).

Neobanking Market Insights:

- Technological innovations are central to neobanks’ operational and service efficiency.

- Consumer shift favors mobile-first, digital banking experiences across demographics.

- Regulatory reforms globally are accelerating digital banking ecosystem development.

- Business-focused neobanks offer tailored solutions for SMEs and enterprises.

- Artificial intelligence (AI), machine leaning (ML), and blockchain enhance personalization, security, and transaction speed.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 195.11 Billion |

|

Market Forecast in 2033

|

USD 5,510.18 Billion |

| Market Growth Rate (2025-2033) | 44.95% |

One of the most prominent factors contributing to the rise of neobanking is the rapid advancement of technology. The widespread adoption of smartphones, the increase of high-speed internet, and the development of secure digital payment solutions have all played pivotal roles in the expansion of digital banking services. Neobanks employ cutting-edge technologies such as artificial intelligence (AI), machine learning, and blockchain to streamline operations, enhance customer experiences, and provide more personalized services. For example, AI-powered chatbots and virtual assistants are increasingly being used by neobanks to offer day-and-night customer support, while blockchain technology is enabling faster, more secure cross-border transactions. Moreover, the use of cloud computing allows neobanks to scale their operations efficiently without the overhead costs associated with maintaining physical branches.

The United States has emerged as a major region in the neobanking market owing to several reasons. The neobanking market demand is rising in the US, which is largely attributed to rapid advancements in technology. The increasing availability of smartphones, combined with high-speed internet, has created an environment in which consumers expect instant, digital-first access to financial services. Neobanks capitalize on this trend by offering banking services entirely through mobile apps and websites, which simplifies the user experience and removes the need for physical branches. Cloud computing has emerged as a pivotal technology for neobanks, enabling them to scale quickly and affordably. By using cloud-based infrastructure, digital banks can bypass the significant costs associated with maintaining physical branches, which allows them to offer low or even zero-fee accounts. According to the predictions of the IMARC Group, US cloud managed services market is expected to hit USD 32.3 Billion by 2032.

Neobanking Market Trends:

Continual Technological Advancements

The global market is significantly influenced by rapid technological advancements. Innovations in financial technology (FinTech) are enabling neobanks to offer user-friendly, efficient, and cost-effective services. Additionally, the addition of technologies like artificial intelligence (AI), machine learning (ML), and blockchain has further enhanced the operational efficiency of neobanks. These technologies facilitate personalized customer experiences, robust security protocols, and efficient data management. In response to this, Monzo launched an investment feature in September 2023, where it allows clients to invest in funds managed by BlackRock. The company website of Monzo says that this feature enables users to start investing with as little as one British pound, making wealth management more accessible to a broader audience. The continuous development in tech allows neobanks to stay ahead in offering innovative financial solutions, attracting a tech-savvy customer base, particularly among millennials and Generation Z. This tech-forward approach is crucial for neobanks as they compete with traditional banking institutions and seek to differentiate their services in the highly competitive financial services sector.

Shifting Consumer Preferences Towards Digital Banking Solutions

Consumer preferences have been shifting towards digital and mobile-first banking solutions, a trend that is significantly supporting the neobanking market growth. Along with this, the modern consumer values convenience, speed, and accessibility in financial transactions, aspects where neobanks excel. With features such as 24/7 access to banking services, real-time updates, and easy-to-use platforms, neobanks cater to the needs of a digital-native clientele. Reflecting the changes, in 2024, Keytom, a digital asset-centered novel neobank got launched in the UAE for assisting customers in managing their digital assets efficiently. Moreover, the inclination towards personalized financial services and the desire for a seamless user experience have led more consumers to opt for services. This consumer-led demand is a fundamental factor fueling the expansion of neobanks worldwide.

Improving Regulatory Environment

The changing regulatory landscape plays a pivotal role in shaping the global market. In many regions, regulatory bodies are increasingly recognizing the importance of digital banking and are updating or introducing new regulations to facilitate the growth of neobanks. These regulatory changes are often aimed at ensuring customer safety, maintaining financial stability, and promoting innovation in the banking sector. As of 2023, the European Banking Authority has taken efforts to refine its regulation for the digital-only banks. It focuses on adjustments in compliance with anti-money laundering and cybersecurity guidelines. These are for consumer protection and also stability of digital banking operations throughout the market in Europe. For instance, the issuance of specialized banking licenses for digital banks and the implementation of supportive policies such as lower capital requirements for startups are key enablers. These regulatory adaptations legitimize the operations of neobanks and help in building consumer trust. The proactive stance of regulatory authorities in adapting to the changing banking ecosystem is thus a critical driver for the expansion and acceptance of globalization.

Neobanking Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global neobanking market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on account type and application.

Analysis by Account Type:

- Business Account

- Savings Account

Business account leads the market with 68.7% of market share in 2024. The business account segment in the market caters specifically to the needs of small and medium enterprises (SMEs), startups, and larger corporations, thereby offering a favorable neobanking market outlook. This segment is characterized by features such as higher transaction limits, advanced cash management tools, integrated accounting software, and sometimes even customized lending solutions. They are increasingly popular among businesses due to their streamlined account opening processes, lower fees compared to traditional banks and enhanced digital experiences. They offer functionalities tailored for business operations such as payroll management, invoicing, and easy integration with other business tools. This segment is poised for growth as more businesses look for agile and cost-effective banking solutions, especially in the burgeoning gig economy and among digitally native startups.

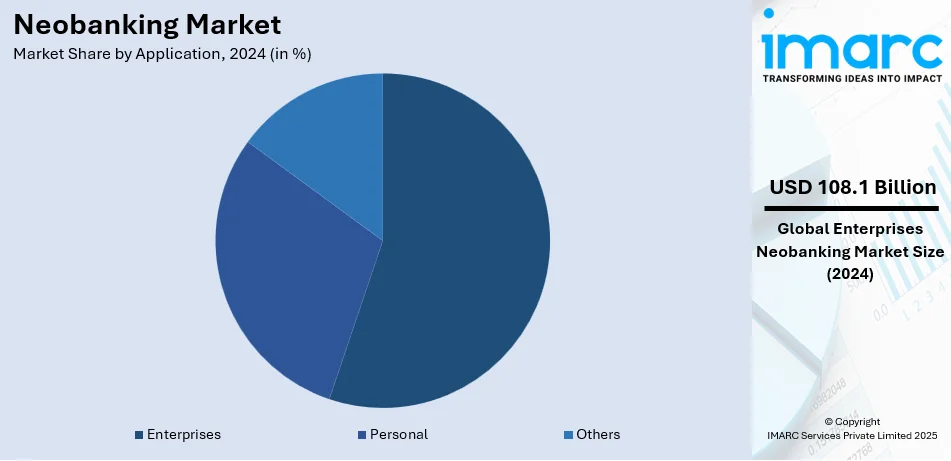

Analysis by Application:

- Enterprises

- Personal

- Others

Enterprises lead the market with 55.4% of market share in 2024. In the market, the enterprise segment targets business entities ranging from small startups to large corporations. This segment's offerings are tailored to address complex business needs, including high-volume transactions, international money transfers, and integrated financial management systems. Enterprises often provide features such as enhanced data analytics, customized credit products, and specialized account management services. The appeal for enterprises lies in the efficient, scalable, and cost-effective banking solutions that neobanks offer, enabling businesses to manage their finances more effectively. This segment is growing as more enterprises seek digital solutions to streamline financial operations, reduce overhead costs, and gain access to innovative banking technologies.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

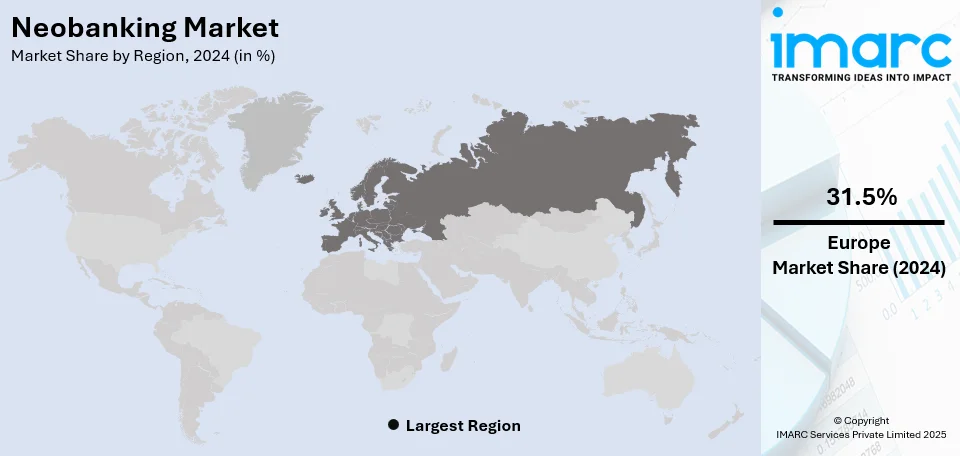

In 2024, Europe accounted for the largest market share of 31.5%. Europe’s market is one of the most advanced, influenced by a strong fintech sector, particularly in the UK, Germany, and the Nordic countries. European neobanks benefit from a supportive regulatory environment, which encourages competition and innovation in the banking sector. The high level of cross-border economic activity in Europe also creates a demand for neobanks offering multi-currency accounts and seamless international transactions. The expectations are evolving rapidly, with many Europeans increasingly seeking convenient, flexible, and low-cost banking solutions. The younger generation, in particular, is driving the demand for digital-first financial services. Millennials and Gen Z, who are accustomed to managing various aspects of their lives through smartphones and digital platforms, are more inclined to use neobanks for their banking needs. They value convenience, user-friendly interfaces, and the ability to manage their finances on the go, all of which neobanks provide. As per IBS Intelligence, in 2024, UK neobanks crossed traditional banks in terms of app installations or downloads. UK marked a major user base of 71.78 Million on Android.

Key Regional Takeaways:

United States Neobanking Market Analysis

The United States hold 93.90% of the market share. The adoption of digital payments is one of the key drivers of the neobanking market in the United States. According to industry reports, as of 2024, 60% of in-app purchases in the country are made using digital payment methods, an 8-percentage-point increase since 2019. This rise underlines the increasing consumer preference for seamless, cashless transactions, particularly among tech-savvy users. The rise of neobanks with their digital-first approach is very much poised to exploit this trend. They are likely to provide payment solutions integrated, real-time transactions, and frictionless user experiences. Some other features such as instant fund transfers, automated bill payments, and AI-driven financial insights enhance the appeal. Additionally, the emergence of mobile wallets and contactless payment options has strengthened the digital ecosystem and reduced reliance on traditional banking. Because daily transactions are ever more being cashless, digitally, neobanks are becoming ever more acceptable; the trend represents a greater milestone toward an exclusively digital financial economy, where banks will play even more pivotal roles in the continuing transformation of banking in the U.S.

Europe Neobanking Market Analysis

The rapid boom of FinTech as a sector is key to the development of the European neo-banking market. The UK remains a prominent FinTech hub with more than 1,600 firms, and the ITA projects that this figure will double by 2030. This growth depicts a focus that the region has on the financial innovation area, support from regulation, and greater consumer uptake of digital banking solutions.

With the FinTech ecosystem thriving and becoming more successful, neobanks can take pleasure in improved infrastructures, as well as various partnerships and new funding opportunities in order to gain a better customer-centric financial facility. In particular, open banking regulations across the European continent allow for greater openness and faster-digitization of financial institutions. Of course, with the expansion of FinTech firms, neobanks are said to scale their offerings, integrate cutting-edge technologies, including AI and blockchain, attract a broader customer base, and so on. This momentum cements Europe's stronghold as a leader globally in digital banking, thereby making neobanks a prime part of the financial landscape in this region.

Asia Pacific Neobanking Market Analysis

Such factors as rapid digital transformation and FinTech investment fuel the Asia-Pacific neobanking market. As reported by the MEDICI India FinTech Report 2020, India's neobank startups raised more than USD 200 million in 2020- a clear indicator that there's a reasonable amount of investor interest in this space. Funding influx has helped neobanks scale their operations, improve technological capacity, and serve a rapidly growing digital-first customer base.

Mobile phone penetration in India still stood at 54% in 2020 but was expected to reach 96% by 2040, according to industrial reports. Mobile connectivity has become the most rapid enabler for the adoption of digital banking due to its surge among the masses, especially in underserved and rural economies where neo-banks can reach more people. Similarly, neobanks' growth prospects can be huge going forward, primarily due to homogeneous digital adoption in the Asia-Pacific region, encouraging regulatory policies and increased financial inclusion initiatives. Overall, this revolution is changing banking in the Asia-Pacific region: making digital-first financial solutions even more accessible and mainstream.

Latin America Neobanking Market Analysis

Another key factor driving the Latin America neobanking market is increased dependence on mobile technologies. GSMA estimates that the mobile technologies and services generated 8% of the region's GDP in 2023, with an associated economic value of USD 520 billion. Such a contribution significantly underlines the increasing role of digital connectivity in financial services, providing an excellent foundation for expansion to neobanks.

With high mobile penetration and rising demand for digital financial solutions, neobanks in Latin America are using mobile platforms to offer accessible, cost-effective, and user-friendly banking services. The large unbanked and underbanked population in the region further fuels the adoption of digital banking, as neobanks provide streamlined financial access without the constraints of traditional banking infrastructure. With the mobile-driven expansion of financial inclusion, neobanks will be pivotal in changing the region's banking landscape, bringing innovation to cater for the needs of both the tech-savvy and the underserved consumers.

Middle East and Africa Neobanking Market Analysis

The growing preference for digital and cashless payments is a key driver of the neobanking market in the Middle East and Africa (MEA). As per the Digital Banking in the Middle East, 2022 report, 58% of people in the MEA region favor digital and cashless payment methods, while only 10% still choose cash. This shift highlights the increasing adoption of digital financial solutions and the region's accelerating transition away from cash-based transactions.

As consumers demand faster, more convenient, and secure payment options, neobanks are well-positioned to meet these evolving needs with digital-first banking services. The rise of mobile wallets, contactless payments, and government-led financial inclusion initiatives further supports the growth of digital banking. The region of MEA is experiencing fast-paced development in financial technology, with a more tech-savvy population and increasing smartphone penetration. This means that neobanks are gaining more popularity, which provides seamless and cost-effective alternatives to traditional banks and drives the region's digital financial transformation.

Competitive Landscape:

Key players in the global market are actively engaged in a range of strategic activities to strengthen their market position and capitalize on the growing demand for digital banking services. These include forming partnerships with technology companies to enhance their digital platforms, expanding their service offerings, and entering new geographical markets. Additionally, they are investing heavily in marketing and customer acquisition strategies to build brand awareness and trust. For instance, in December 2023, Trigger Software collaborated with Mambu to unveil a neobank engine that aids the development of digital neobanks. Innovation remains a focal point, with many neobanks continuously upgrading their features, integrating advanced technologies such as AI and blockchain for improved security and personalized services, and exploring new business models to cater to niche segments. Moreover, they are actively navigating regulatory landscapes across different regions to ensure compliance and build a sustainable business model in the competitive financial sector.

The report provides a comprehensive analysis of the competitive landscape in the neobanking market with detailed profiles of all major companies, including:

- Agricultural Bank of China Limited

- Atom Bank PLC

- Citigroup Inc.

- Deutsche Bank AG

- Fidor Solutions AG (Groupe BPCE)

- HSBC Holdings Plc

- Malayan Banking Berhad

- Monzo Bank Limited

- Movencorp Inc.

- N26 GmbH

- Simple Finance Technology Corporation (BBVA USA)

- Ubank Limited

- Webank Co. Ltd.

Latest News and Developments:

- July 2024: BranchX became the first neobank which launched India’s first personal loan solution via Open Network for Digital Commerce (ONDC). This is a crucial step towards establishing financial inclusion in the country.

- January 2024: Nu Mexico joined Felix Pago to initiate a new service. It makes money transfer possible from the United States to Mexico. In turn, the combination with Felix Pago improved and made more efficient cross-border remittances across users between two countries.

- November 2023: HSBC Holdings Plc began offering its institutional clients a digital asset safekeeping service. For storage needs, HSBC will collaborate with Metaco, a company owned by Ripple.

- December 2023: Dutch challenger Bunq, the second largest neobank in the European region, unveiled a new generative AI platform called Finn. This platform is created to replace the search option on the app, enabling users to solve queries and seek advices related to their savings, spending patters, bank accounts, and more.

Neobanking Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Account Types Covered | Business Account, Savings Account |

| Applications Covered | Enterprises, Personal, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Agricultural Bank of China Limited, Atom Bank PLC, Citigroup Inc., Deutsche Bank AG, Fidor Solutions AG (Groupe BPCE), HSBC Holdings Plc, Malayan Banking Berhad, Monzo Bank Limited, Movencorp Inc., N26 GmbH, Simple Finance Technology Corporation (BBVA USA), Ubank Limited, Webank Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the neobanking market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global neobanking market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the neobanking industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The neobanking market was valued at USD 195.11 Billion in 2024.

The neobanking market is projected to exhibit a CAGR of 44.95% during 2025-2033, reaching a value of USD 5,510.18 Billion by 2033.

Key drivers of the neobanking market include technological advancements like AI, blockchain, and machine learning, rising consumer demand for mobile-first banking solutions, favorable regulatory frameworks, and increasing adoption of digital payments and financial inclusion initiatives.

Europe currently dominates the neobanking market, accounting for a 31.5% share in 2024, driven by a strong fintech ecosystem, supportive regulations, and high consumer adoption of digital banking services.

Some of the major players in the neobanking market include Agricultural Bank of China Limited, Atom Bank PLC, Citigroup Inc., Deutsche Bank AG, Fidor Solutions AG (Groupe BPCE), HSBC Holdings Plc, Malayan Banking Berhad, Monzo Bank Limited, Movencorp Inc., N26 GmbH, Simple Finance Technology Corporation (BBVA USA), Ubank Limited, Webank Co. Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)