Natural Sweeteners Market Report by Type (Stevia, Sorbitol, Xylitol, Mannitol, Erythritol, Sweet Proteins, and Others), Form (Liquid, Powder, Solid and Crystals), Distribution Channel (Business-To-Customer (B2C), Business To Business (B2B)), Application (Bakery Products, Confectioneries and Gums, Spreads, Beverages, Dairy Products, Frozen Desserts, Tabletop Sweeteners, Pharmaceutical Products and Others), and Region 2025-2033

Natural Sweeteners Market Size:

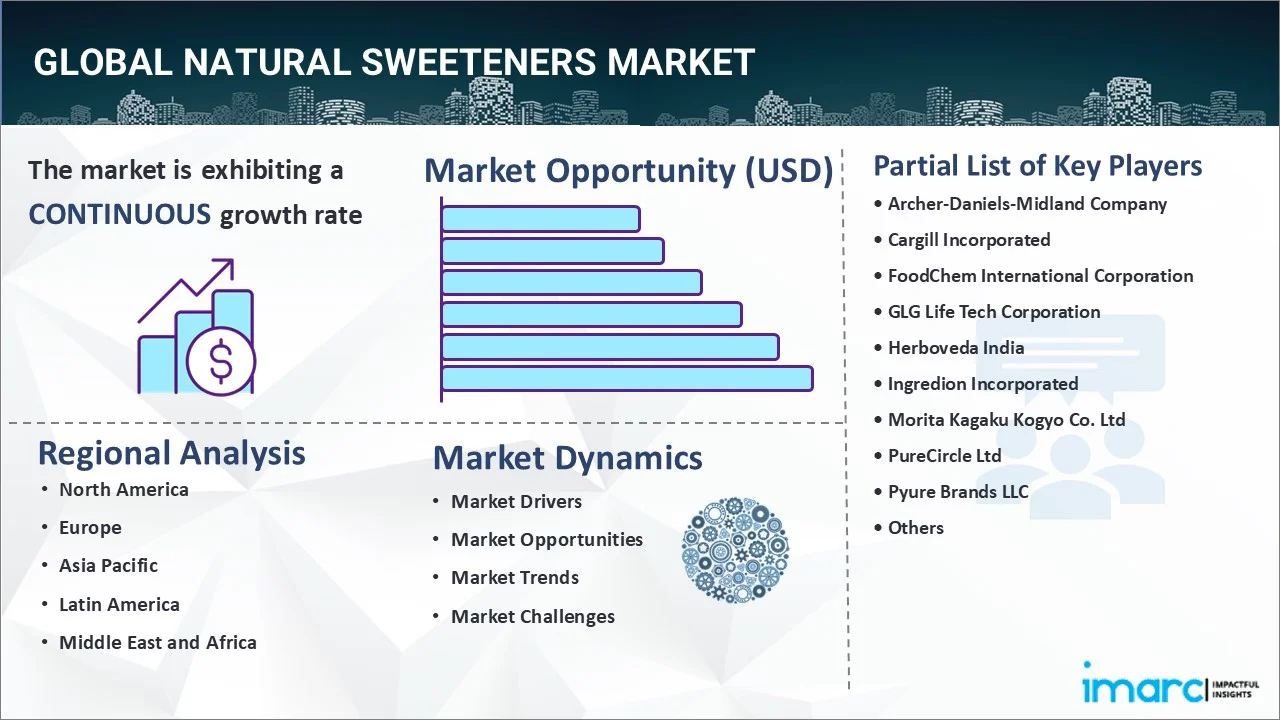

The global natural sweeteners market size reached USD 3.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.2 Billion by 2033, exhibiting a growth rate (CAGR) of 5.95% during 2025-2033. The rising health consciousness among consumers, increasing prevalence of obesity and diabetes, growing demand for clean label products, imposition of regulatory policies and initiatives, and recent innovation in the food and beverage (F&B) industry are some of the major propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.7 Billion |

|

Market Forecast in 2033

|

USD 6.2 Billion |

| Market Growth Rate 2025-2033 | 5.95% |

Natural Sweeteners Market Analysis:

- Major Market Drivers: The increasing awareness of health issues related to sugar consumption, such as obesity and diabetes, and the growing preference for clean label products are the major drivers of the market. Wrigley tree support for sugar reduction and the rising demand for natural ingredients in food and beverage (F&B) Is contributing to the market growth.

- Key Market Trends: The ongoing shift towards low calorie and low glycemic index sweeteners, coupled with the increasing focus on sustainability and ethical sourcing represents the key trends of the market.

- Geographical Trends: North America is accounted as the largest region in the natural sweeteners market overview. This is primarily due to rapid economic development and changing consumer preferences which is driving the demand for natural sweeteners in the region. Other regions are also showing significant growth, fueled by the rising health consciousness and strict sugar regulations.

- Competitive Landscape: Some of the major market players in the natural sweeteners industry include Archer-Daniels-Midland Company, Cargill Incorporated, FoodChem International Corporation, GLG Life Tech Corporation, Herboveda India, Ingredion Incorporated, Morita Kagaku Kogyo Co. Ltd, PureCircle Ltd, Pyure Brands LLC, Roquette Frères, Sweetly Stevia USA, Tate & Lyle PLC among many others.

- Challenges and Opportunities: The market faces various challenges including balancing taste and health benefits, managing production costs, and navigating varied regulatory environments across regions. However, recent innovations in product development and rapid expansion into new and untapped markets are creating new opportunities for the market growth.

Natural Sweeteners Market Trends:

Rising health consciousness among consumers

The burgeoning health consciousness among consumers across the globe is a pivotal driver for the natural sweetness market. Consumers are becoming aware of the health impacts of excessive sugar consumption concluding the risk of weight gain, heart disease, and dental issues. According to an article by McKinsey & Company, at least 70% of the survey respondents across the market surveyed want to be healthier. Food is essential to achieving that goal and about 50% of consumers across age groups, say healthy eating is a top priority for them. This is influencing the natural sweeteners market statistics.

Increasing prevalence of obesity and diabetes

The market is also driven by the escalating prevalence of obesity and diabetes. These chronic conditions are reaching epidemic proportions, prompting public health campaigns and individual initiatives to reduce sugar intake. Natural sweetness presents a viable solution offering sweetness without the high calorie and carbohydrate content that exacerbates obesity and diabetes. According to the World Health Organization (WHO), in 2022, one in eight people in the world were living with obesity. 2.5 billion adults (18 years and older) we're overweight period of these, 890,000,000 were living with obesity. 43% of adults aged 18 years and over but overweight and 16% were living with obesity. According to the National Institute of Diabetes and Digestive and Kidney Diseases, 38.4 million people of all ages had diabetes (11.6% of the population) in 2021. 38.1 million were adults ages 18 years or older. 29.7 million people of all ages had been diagnosed with diabetes (8.9% of the population). This is likely to fuel the natural sweetness market forecast over the coming years.

Growing demand for clean-label products

The emerging trend of clean-label products, emphasizing simplicity, transparency, and naturalness in food and beverage (F&B) ingredients, is a key driver of the natural sweeteners market. Consumers are increasingly seeking products with labels that are easy to understand, contain fewer additives, and use ingredients that are perceived as natural and wholesome. The growing distrust of artificial ingredients and a preference for products that are deemed safer and healthier is acting as another growth-inducing factor. According to a survey by the Center for Food Integrity found that 75% of respondents identify nutrition and ingredient labels on their food, and 53% believe that “clean label” products are healthier. Notably, 46% of Americans say that the availability of food ingredients directly affects their purchasing decisions and that they are willing to pay more for these foods.

Imposition of regulatory policies and initiatives

The introduction of governmental and regulatory support is playing a vital role in the growth of the natural sweeteners market. Governments and health organizations are increasingly focusing on reducing sugar consumption as part of broader public health initiatives. They are imposing regulatory policies driven by mounting evidence linking excessive sugar intake to a range of health issues, including obesity and diabetes. According to the FSSAI, the WHO guideline can be used to educate consumers and create awareness through Eat right India movement and create awareness among consumers to consume artificially sweetened products in moderation.

Recent innovations in the food and beverage (F&B) industry

Recent innovation within the F&B industry is a crucial factor driving the natural sweeteners market. Food scientists and product developers are continually experimenting with various natural sweeteners, blends, and formulations to achieve the desired taste and texture in products ranging from beverages and confectionery to dairy and baked goods. For instance, in July 2023, MycoTechnology announced the discovery of a sweet protein originating from honey truffles that delivers an intense, natural sweetness without the lingering aftertaste of common sugar replacements. The Colorado-based food tech company believes this newly discovered ingredient has the potential to disrupt the conventional sugar and manufactured sweeteners market.

Natural Sweeteners Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type, form, distribution channel, and application.

Breakup by Type:

- Stevia

- Sorbitol

- Xylitol

- Mannitol

- Erythritol

- Sweet Proteins

- Others

Stevia accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the type. This includes stevia, sorbitol, xylitol, mannitol, erythritol, sweet proteins, and others. According to the report, stevia represented the largest segment.

Stevia is dominating the market due to its zero-calorie content and ability to maintain stability under heat. Furthermore, it is much sweeter than sugar, yet it doesn't raise blood glucose levels, making it a preferred choice for diabetics and those managing their calorie intake. Additionally, the ongoing innovations in extraction and processing techniques leading to improved taste profiles and reduced aftertaste of stevia are positively influencing the market growth. Moreover, the widespread product utilization in beverages, dairy products, and confectionery, coupled with its growing acceptance as a tabletop sweetener, is boosting the market growth.

Breakup by Form:

- Liquid

- Powder

- Solid and Crystals

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes liquid, powder, and solid and crystals.

Liquid form is used in beverage applications, including soft drinks, juices, and health drinks. Liquid natural sweeteners, such as liquid stevia or agave syrup, are favored for their ease of integration into liquid products, ensuring consistent sweetness distribution. Additionally, liquid form is also popular in the culinary world for sweetening sauces, dressings, and marinades, as it blends seamlessly without the need for dissolution.

Powdered natural sweeteners are widely used in baking, confectionery, and as tabletop sweeteners. They are popular due to their similarity in texture and application to traditional granulated sugar. Additionally, powdered sweeteners like stevia, erythritol, and xylitol are especially favored in baking, as they can contribute to the structure and volume of baked goods.

Solid and crystal forms of natural sweeteners, such as crystallized stevia or xylitol, cater to consumers seeking a direct replacement for traditional table sugar. They are particularly appealing for their ease of use in everyday applications like sweetening beverages and for sprinkling on cereals and fruits. Their granulated, crystalline structure closely mimics the physical properties of sugar, making them a popular choice in terms of look and feel.

Breakup by Distribution Channel:

- Business-To-Customer (B2C)

- Business To Business (B2B)

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes business-to-customer (B2C) and business to business (B2B).

The business-to-customer (B2C) segment involves the direct sale of products to end consumers, typically through retail channels, such as supermarkets, health food stores, and online platforms. It caters to individual consumers seeking healthier alternatives to traditional sugar for personal use. Furthermore, the B2C channel is benefiting from the increasing consumer awareness and demand for natural sweeteners, which is driven by rising health consciousness and dietary preferences.

The business-to-business (B2B) segment involves sales from manufacturers and distributors to various businesses, including food and beverage (F&B) manufacturers, pharmaceutical companies, and food service providers. It is driven by the demand for natural sweeteners as ingredients in product formulations, ranging from processed foods and beverages (F&B) to dietary supplements and medicinal products.

Breakup by Application:

- Bakery Products

- Confectioneries and Gums

- Spreads

- Beverages

- Dairy Products

- Frozen Desserts

- Tabletop Sweeteners

- Pharmaceutical Products

- Others

Beverages exhibits a clear dominance in the market

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes bakery products, confectioneries and gums, spreads, beverages, dairy products, frozen desserts, tabletop sweeteners, pharmaceutical products, and others. According to the report, beverages accounted for the largest market share.

Beverages constitute the largest segment due to the rising consumer demand for healthier drink options. It includes soft drinks, juices, health drinks, and tea and coffee products. Beverage manufacturers are increasingly reformulating their products to reduce sugar content and meet the growing preference for natural ingredients. Natural sweeteners like stevia and erythritol are particularly favored for their ability to provide the desired sweetness without adding significant calories or affecting blood sugar levels. Additionally, the recent innovation in flavor and texture, as manufacturers strive to match the taste profiles consumers expect from traditionally sweetened beverages, is boosting the market growth.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest natural sweeteners market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.

North America holds the largest market share due to its high health consciousness, well-established F&B industry, and stringent regulations on sugar intake. Furthermore, the ongoing shift in consumer preferences towards healthier, low-calorie, and natural products is driving the market growth. Additionally, the presence of many key players in the region, contributing to strong research and development (R&D) activities and innovative product offerings, is bolstering the market growth. Besides this, the increasing prevalence of lifestyle-related diseases, such as obesity and diabetes, is further catalyzing the market growth.

Leading Key Players in the Natural Sweeteners Industry:

Key players are actively engaging in a range of strategic initiatives to capitalize on the growing demand. It includes research and development (R&D) efforts focused on innovation in sweetener blends and formulations to enhance taste profiles and functionality. Additionally, several companies are expanding their product portfolios to include a diverse array of natural sweeteners, catering to various consumer preferences and application requirements in food and beverage (F&B) manufacturing. For instance, in 2022, Cargill launched a new sweetener system, EverSweet + ClearFlo, that brings together the company’s stevia sweetener with a natural flavor, a combination that provides benefits that include flavor modification, improved solubility and stability in formulations, and faster dissolution. The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Archer-Daniels-Midland Company

- Cargill Incorporated

- FoodChem International Corporation

- GLG Life Tech Corporation

- Herboveda India

- Ingredion Incorporated

- Morita Kagaku Kogyo Co. Ltd

- PureCircle Ltd

- Pyure Brands LLC

- Roquette Frères

- Sweetly Stevia USA

- Tate & Lyle PLC

(Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.)

Natural Sweeteners Market News:

- In January 2024, Avansya, the joint venture between Cargill and dsm-firmenich announced that the EverSweet stevia sweetener has received a positive safety opinion from both the European Food Safety Authority and the UK Food Standards Agency, bringing the advanced sweetener one step closer to the commercial availability in the European Union and UK.

- In January 2024, FoodTech start-up Better Juice, limited, announced its collaboration with Ingredion, Inc., a leading global provider of specialty ingredients to the food and beverage industry. Ingredion Ventures, Ingredion’s venture investment arm will lead the Series A funding round for Better Juice which will fast-track penetration of its breakthrough sugar reduction solution into the US juice market.

- In July 2023, Tate & Lyle PLC. launched TASTEVA SOL stevia sweetener which can be utilized in the manufacturing of healthy food and beverages.

- In 2023, Roquette, a global leader in plant-based ingredients and pharmaceutical excipients, announced the completion of the acquisition of Qualicaps from the Mitsubishi Chemical Group.

Natural Sweeteners Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Stevia, Sorbitol, Xylitol, Mannitol, Erythritol, Sweet Proteins, Others |

| Forms Covered | Liquid, Powder, Solid and Crystals |

| Distribution Channels Covered | Business-To-Customer (B2C), Business To Business (B2B) |

| Applications Covered | Bakery Products, Confectioneries and Gums, Spreads, Beverages, Dairy Products, Frozen Desserts, Tabletop Sweeteners, Pharmaceutical Products, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Archer-Daniels-Midland Company, Cargill Incorporated, FoodChem International Corporation, GLG Life Tech Corporation, Herboveda India, Ingredion Incorporated, Morita Kagaku Kogyo Co. Ltd, PureCircle Ltd, Pyure Brands LLC, Roquette Frères, Sweetly Stevia USA, Tate & Lyle PLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the natural sweeteners market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global natural sweeteners market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the natural sweeteners industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

We expect the global natural sweeteners market to exhibit a CAGR of 5.95% during 2025-2033.

The increasing consumer health consciousness, along with the rising adoption of natural sweeteners for preparing jams, chocolates, sweets, ice creams, etc., is primarily driving the global natural sweeteners market.

The sudden outbreak of the COVID-19 pandemic has led to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of natural sweeteners.

Based on the type, the global natural sweeteners market has been segregated into stevia, sorbitol, xylitol, mannitol, erythritol, sweet proteins, and others. Among these, stevia holds the largest market share.

Based on the application, the global natural sweeteners market can be bifurcated into bakery products, confectioneries and gums, spreads, beverages, dairy products, frozen desserts, tabletop sweeteners, pharmaceutical products, and others. Currently, beverages exhibit a clear dominance in the market.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global natural sweeteners market include Archer-Daniels-Midland Company, Cargill Incorporated, FoodChem International Corporation, GLG Life Tech Corporation, Herboveda India, Ingredion Incorporated, Morita Kagaku Kogyo Co. Ltd, PureCircle Ltd, Pyure Brands LLC, Roquette Frères, Sweetly Stevia USA, and Tate & Lyle PLC.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)