Natural Rubber Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2026 Edition

Natural Rubber Price Trend, Index and Forecast

Track real-time and historical natural rubber prices across global regions. Updated monthly with market insights, drivers, and forecasts.

Natural Rubber Prices January 2026

| Region | Price (USD/Kg) | Latest Movement |

|---|---|---|

| Africa | 1.55 | 6.2% ↑ Up |

| Northeast Asia | 2.38 | 6.2% ↑ Up |

| Europe | 2.09 | 6.6% ↑ Up |

| Indonesia | 1.93 | 7.2% ↑ Up |

| Malaysia | 2.26 | 6.1% ↑ Up |

| Southeast Asia | 1.93 | 7.2% ↑ Up |

| Thailand | 1.93 | 6.0% ↑ Up |

| North America | 1.93 | 4.3% ↑ Up |

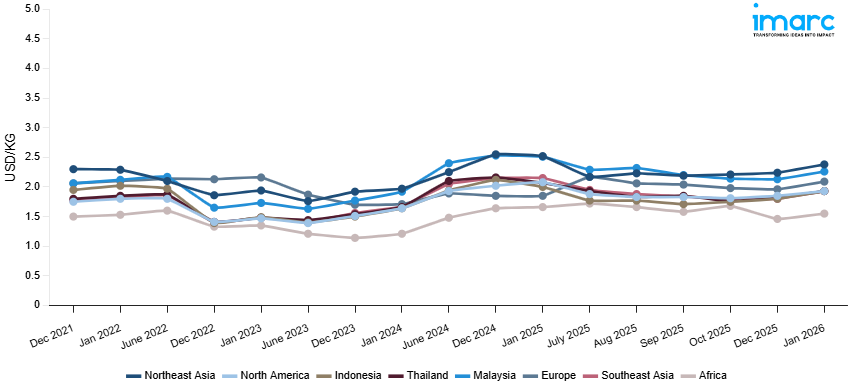

Natural Rubber Price Index (USD/KG):

The chart below highlights monthly natural rubber prices across different regions.

Get Access to Monthly/Quarterly/Yearly Prices, Request Sample

Market Overview Q3 Ending September 2025

Africa: Natural rubber prices in Africa declined notably, as the keyword price index reflected weaker global demand and rising competition from Asian producers. Production remained stable, but subdued procurement from tire manufacturers limited upward momentum. Export shipments slowed, further intensifying bearish sentiment. Adequate inventories weighed on local pricing, leaving market players cautious amid muted demand from international buyers.

Northeast Asia: In Northeast Asia, natural rubber prices edged lower, with the keyword price index showing a marginal decline. Weaker demand from the automotive and industrial goods sectors weighed on values, though steady supply from regional producers kept the market balanced. Export activity remained moderate, while downstream tire manufacturing continued to procure cautiously. Despite stable operations, sentiment leaned bearish due to limited demand-side support.

Europe: Europe recorded a slight dip in natural rubber prices, with the keyword price index showing marginal weakness. Demand from the automotive sector softened, while imports from Asian suppliers increased, intensifying competitive pressure. Regional buyers exercised restraint in procurement as seasonal demand tapered off. Despite stable feedstock supply, subdued end-use activity contributed to a modest decline in prices.

Indonesia: Indonesia saw a moderate price fall, with the keyword price index indicating weaker procurement trends. Strong domestic production ensured supply stability, while export activity faced pressure due to slower international orders. The decline in demand from tire manufacturing limited pricing strength, leaving producers facing margin constraints despite favorable harvesting conditions.

Malaysia: Malaysia experienced one of the steeper declines in natural rubber prices, with the keyword price index reflecting oversupply concerns. Production levels remained high, while slower export momentum kept inventories elevated. Demand from the automotive sector was insufficient to absorb the available supply, leading to pronounced downward adjustments in market values.

Southeast Asia: Southeast Asia as a whole saw a slight decline in natural rubber prices. The keyword price index showed that steady regional production and sufficient feedstock availability outweighed muted consumption trends. Demand from tire and industrial goods sectors was not strong enough to push values higher, while export competitiveness remained constrained by weaker global appetite.

Thailand: Thailand bucked the regional trend, with natural rubber prices rising modestly. The keyword price index moved upward as strong procurement from tire manufacturers supported domestic demand. Export interest also improved, particularly from neighboring Asian countries. Despite steady supply, firm downstream consumption created room for slight price gains during the quarter.

North America: North America registered a small increase in natural rubber prices, as the keyword price index reflected improved demand conditions. Tire and automotive manufacturers increased procurement activity, supporting market sentiment. Domestic supply was balanced, while imports remained steady. Buyers accepted marginally higher prices, encouraged by firmer downstream activity and stable logistics.

Natural Rubber Price Trend, Market Analysis, and News

IMARC's latest publication, “Natural Rubber Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2026 Edition,” presents a detailed examination of the natural rubber market, providing insights into both global and regional trends that are shaping prices. This report delves into the spot price of natural rubber at major ports and analyzes the composition of prices, including FOB and CIF terms. It also presents detailed natural rubber prices trend analysis by region, covering North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. The factors affecting natural rubber pricing, such as the dynamics of supply and demand, geopolitical influences, and sector-specific developments, are thoroughly explored. This comprehensive report helps stakeholders stay informed with the latest market news, regulatory updates, and technological progress, facilitating informed strategic decision-making and forecasting.

Natural Rubber Industry Analysis

The global natural rubber industry size reached USD 18.32 Billion in 2025. By 2034, IMARC Group expects the market to reach USD 29.16 Billion, at a projected CAGR of 5.04% during 2026-2034. Growth is driven by rising automotive tire demand, expanding industrial applications, and increasing consumption across emerging economies, with sustainability initiatives and supply chain optimization further shaping long-term market dynamics.

Latest developments in the Natural Rubber Industry:

- May 2025: Kerala Rubber Limited, a public sector enterprise of the state, is planning to create an industrial complex and integrated facility to support industries related to natural rubber and its derivatives. Key goals of the plan involve enhancing price realization for rubber farmers and promoting the value addition of natural rubber.

- March 2025: Olam Agri, a prominent agri-business specializing in food, feed, and fibre, has joined forces with Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH to implement the Sustainable Natural Rubber Initiative in Indonesia's Lampung Province. This initiative seeks to improve the competitiveness, sustainability, and market integration of small-scale rubber farmers while striving for rubber cultivation that is free from deforestation. It is a component of the Sustainable Agriculture for Forest Ecosystems (SAFE) initiative, co-financed by the European Union, the German Federal Ministry for Economic Cooperation and Development (BMZ), and the Dutch Ministry of Foreign Affairs.

- January 2025: More than 1.25 lakh hectares of rubber cultivation have been established in Northeast and West Bengal through a project involving four major tyre producers in the nation. Within the framework of the INROAD project (Indian Natural Rubber Operations for Assisted Development), the Automotive Tyre Manufacturers' Association (ATMA) aimed to establish two lakh hectares of rubber plantations across Assam, Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, Tripura, and West Bengal, with an investment of Rs 1,100 crore over a period of five years.

- April 2024: Sumitomo Rubber Industries, Ltd., was awarded the “Environmental Achievement of the Year-Manufacturing” at the Tire Technology International Awards for Innovation and Excellence in recognition of its use of hydrogen energy and solar power for tire production.

- February 2024: The Indian government increased funding for the sustainable development of the natural rubber sector by 23%, raising the allocation from ₹576.41 crore to ₹708.69 crore for the financial years 2024-26. The rate of assistance for growers has also increased from ₹25,000 to ₹40,000 per hectare to cover rising production costs. In traditional rubber-producing states like Kerala, Karnataka, and Tamil Nadu, 12,000 hectares will be cultivated, while 3,752 hectares in non-traditional areas such as Andhra Pradesh and Odisha will also see rubber cultivation.

Product Description

Natural rubber is an elastomer obtained primarily from the latex of the Hevea brasiliensis tree. Chemically composed of cis-1,4-polyisoprene, it exhibits high elasticity, resilience, and tensile strength. Its unique mechanical properties make it indispensable in the manufacturing of tires, industrial belts, footwear, medical supplies, adhesives, and a range of molded goods. Natural rubber also possesses strong abrasion resistance and flexibility across varying temperatures, enhancing its suitability for dynamic load-bearing applications. It is harvested mainly in tropical regions, with Southeast Asia being the leading producer. Its broad range of industrial uses and renewable nature highlight its importance in global supply chains.

Report Coverage

| Key Attributes | Details |

|---|---|

| Product Name | Natural Rubber |

| Report Features | Exploration of Historical Trends and Market Outlook, Industry Demand, Industry Supply, Gap Analysis, Challenges, Natural rubber Price Analysis, and Segment-Wise Assessment. |

| Currency/Units | US$ (Data can also be provided in local currency) or Metric Tons |

| Region/Countries Covered | The current coverage includes analysis at the global and regional levels only. Based on your requirements, we can also customize the report and provide specific information for the following countries: Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, New Zealand* Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal, Greece* North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, Peru* Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, Morocco* *The list of countries presented is not exhaustive. Information on additional countries can be provided if required by the client. |

| Information Covered for Key Suppliers |

|

| Customization Scope | The report can be customized as per the requirements of the customer |

| Report Price and Purchase Option |

Plan A: Monthly Updates - Annual Subscription

Plan B: Quarterly Updates - Annual Subscription

Plan C: Biannually Updates - Annual Subscription

|

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report presents a detailed analysis of natural rubber pricing, covering global and regional trends, spot prices at key ports, and a breakdown of FOB and CIF prices.

- The study examines factors affecting natural rubber price trend, including input costs, supply-demand shifts, and geopolitical impacts, offering insights for informed decision-making.

- The competitive landscape review equips stakeholders with crucial insights into the latest market news, regulatory changes, and technological advancements, ensuring a well-rounded, strategic overview for forecasting and planning.

- IMARC offers various subscription options, including monthly, quarterly, and biannual updates, allowing clients to stay informed with the latest market trends, ongoing developments, and comprehensive market insights. The natural rubber price charts ensure our clients remain at the forefront of the industry.

Key Questions Answered in This Report

The natural rubber prices in January 2026 were 1.55 USD/KG in Africa, 2.38 USD/KG in Northeast Asia, 2.09 USD/KG in Europe, 1.93 USD/KG in Indonesia, 2.26 USD/KG in Malaysia, 1.93 USD/KG in Southeast Asia, 1.93 USD/KG in Thailand, and 1.93 USD/KG in North America.

The natural rubber pricing data is updated on a monthly basis.

We provide the pricing data primarily in the form of an Excel sheet and a PDF.

Yes, our report includes a forecast for natural rubber prices.

The regions covered include North America, Europe, Asia Pacific, Middle East, and Latin America. Countries can be customized based on the request (additional charges may be applicable).

Yes, we provide both FOB and CIF prices in our report.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Why Choose Us

IMARC offers trustworthy, data-centric insights into commodity pricing and evolving market trends, enabling businesses to make well-informed decisions in areas such as procurement, strategic planning, and investments. With in-depth knowledge spanning more than 1000 commodities and a vast global presence in over 150 countries, we provide tailored, actionable intelligence designed to meet the specific needs of diverse industries and markets.

1000

+Commodities

150

+Countries Covered

3000

+Clients

20

+Industry

Robust Methodologies & Extensive Resources

IMARC delivers precise commodity pricing insights using proven methodologies and a wealth of data to support strategic decision-making.

Subscription-Based Databases

Our extensive databases provide detailed commodity pricing, import-export trade statistics, and shipment-level tracking for comprehensive market analysis.

Primary Research-Driven Insights

Through direct supplier surveys and expert interviews, we gather real-time market data to enhance pricing accuracy and trend forecasting.

Extensive Secondary Research

We analyze industry reports, trade publications, and market studies to offer tailored intelligence and actionable commodity market insights.

Trusted by 3000+ industry leaders worldwide to drive data-backed decisions. From global manufacturers to government agencies, our clients rely on us for accurate pricing, deep market intelligence, and forward-looking insights.

.webp)

Request Customization

Request Customization

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst Request Brochure

Request Brochure

.webp)

.webp)