Nasal Polyps Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035

Market Overview:

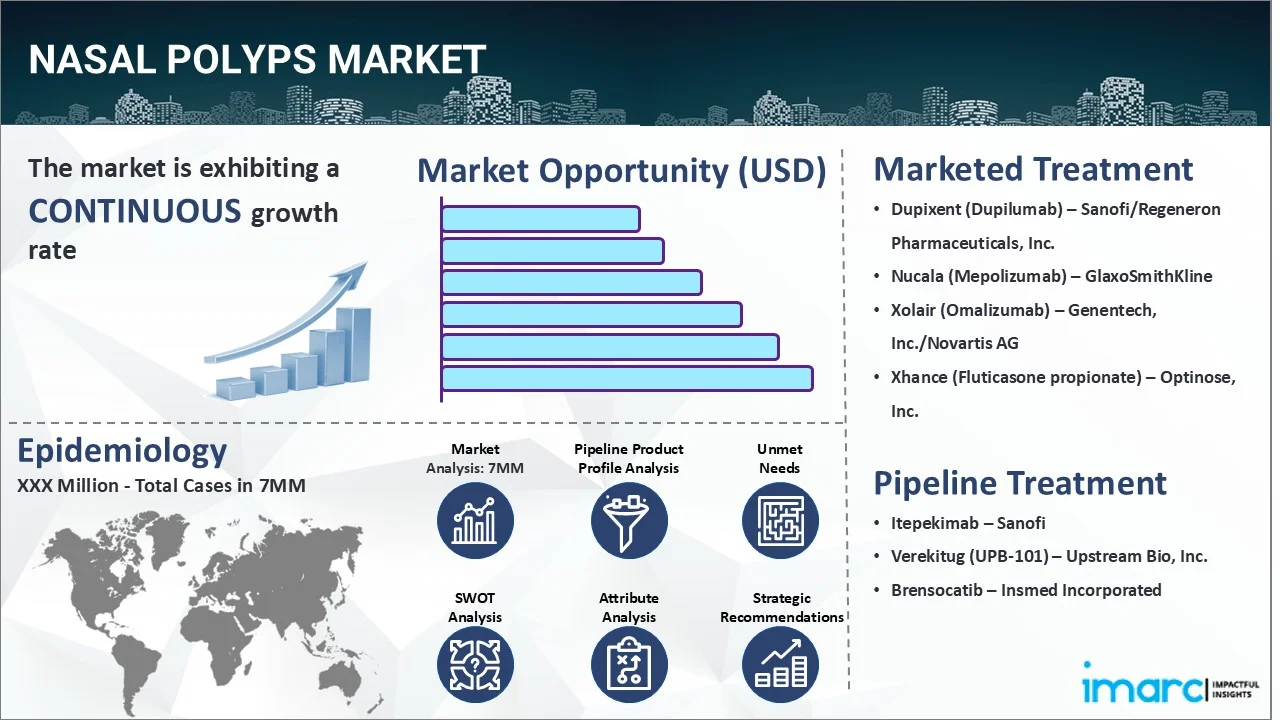

The nasal polyps market reached a value of USD 71.6 Million across the top 7 markets (US, EU4, UK, and Japan) in 2024. Looking forward, IMARC Group expects the top 7 major markets to reach USD 128.7 Million by 2035, exhibiting a growth rate (CAGR) of 5.60% during 2025-2035.

|

Report Attribute

|

Key Statistics

|

|---|---|

| Base Year |

2024

|

| Forecast Years | 2025-2035 |

| Historical Years |

2019-2024

|

|

Market Size in 2024

|

USD 71.6 Million

|

|

Market Forecast in 2035

|

USD 128.7 Million

|

|

Market Growth Rate (2025-2035)

|

5.60% |

The nasal polyps market has been comprehensively analyzed in IMARC's new report titled "Nasal Polyps Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035". Nasal polyps refer to a medical condition in which there are soft, painless growths on the lining of the nasal passage or sinuses. They are noncancerous and often occur in the area where the sinuses open into the nasal cavity. Nasal polyps can be single or multiple and vary in size from small to large. The common symptoms of this ailment include a runny nose, persistent stuffiness, postnasal drip, decreased or absent sense of smell, facial pain, frequent nosebleeds, headache, snoring, pain in the upper teeth, a sense of pressure over the forehead and face, etc. The diagnosis of the illness is typically based on the patient’s medical history, clinical features, and a general physical test. Nasal endoscopy is further recommended in patients for a detailed examination of the nose and sinuses. The healthcare professional may also perform imaging studies, such as a computerized tomography (CT) scan, to evaluate the location and size of polyps in deeper areas of the sinuses and rule out other possible blockages in the nasal cavity.

To get more information on this market, Request Sample

The rising cases of allergies or infections, which trigger long-term inflammation and irritation in the nasal passage, are primarily driving the nasal polyps market. Moreover, the increasing incidence of genetic mutations associated with immune system functioning that result in the formation of abnormally thick, sticky mucus from the nasal and sinus linings is also bolstering the market growth. In addition to this, the widespread adoption of intranasal corticosteroid injections, like fluticasone, over conventional oral drugs on account of their improved efficacy profiles and lower risk of systemic side effects, is acting as another significant growth-inducing factor. Furthermore, the escalating demand for image guided endoscopic sinus surgery, which helps to improve precision, reduce complications, and enhance surgical outcomes in patients, is also creating a positive outlook for the market. Additionally, the rising popularity of biological drugs for treating the ailment, as they work by targeting specific proteins or cells to reduce swelling and irritation in the nasal passage, is expected to drive the nasal polyps’ market in the coming years.

IMARC Group's new report provides an exhaustive analysis of the Nasal Polyps market in the United States, EU4 (Germany, Spain, Italy, and France), United Kingdom, and Japan. This includes treatment practices, in-market, and pipeline drugs, share of individual therapies, market performance across the seven major markets, market performance of key companies and their drugs, etc. The report also provides the current and future patient pool across the seven major markets. According to the report, the United States has the largest patient pool for Nasal Polyps and also represents the largest market for its treatment. Furthermore, the current treatment practice/algorithm, market drivers, challenges, opportunities, reimbursement scenario, unmet medical needs, etc., have also been provided in the report. This report is a must-read for manufacturers, investors, business strategists, researchers, consultants, and all those who have any kind of stake or are planning to foray into the Nasal Polyps market in any manner.

Key Highlights:

- Approximately 4% of people currently have nasal polyps, and up to 40% will develop them at some point in their lives.

- There are two forms of nasal polyps, including ethmoidal and antrochoanal.

- Antrochoanal polyps mainly develop in the maxillary sinus and spread into the nasopharynx, accounting for only 4-6% of total nasal polyps.

- In the United States, chronic rhinosinusitis with nasal polyposis (CRSwNP) typically affects patients aged 40 to 60 years.

- Males are more inclined to have CRSwNP, with one study reporting a 38% incidence in females and a 62% prevalence in males.

- The prevalence of CRSwNP is estimated to be around 1.1% in the United States, whereas estimates in Europe range from 2.1% to 4.4%.

Drugs:

Dupixent is a prescription therapy used with additional medicines to maintain the treatment of CRSwNP in individuals whose condition is not under control. It works by blocking two key sources of type 2 inflammation, shrinking nasal polyps, and minimizing the need for surgery.

Time Period of the Study

- Base Year: 2024

- Historical Period: 2019-2024

- Market Forecast: 2025-2035

Countries Covered

- United States

- Germany

- France

- United Kingdom

- Italy

- Spain

- Japan

Analysis Covered Across Each Country

- Historical, current, and future epidemiology scenario

- Historical, current, and future performance of the nasal polyps market

- Historical, current, and future performance of various therapeutic categories in the market

- Sales of various drugs across the nasal polyps market

- Reimbursement scenario in the market

- In-market and pipeline drugs

Competitive Landscape:

This report also provides a detailed analysis of the current nasal polyps marketed drugs and late-stage pipeline drugs.

In-Market Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

Late-Stage Pipeline Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

| Drugs | Company Name |

|---|---|

| Dupixent (Dupilumab) | Sanofi/Regeneron Pharmaceuticals, Inc. |

| Nucala (Mepolizumab) | GlaxoSmithKline |

| Xolair (Omalizumab) | Genentech, Inc./Novartis AG |

| Xhance (Fluticasone propionate) | Optinose, Inc. |

| Itepekimab | Sanofi |

| Verekitug (UPB-101) | Upstream Bio, Inc. |

| Brensocatib | Insmed Incorporated |

*Kindly note that the drugs in the above table only represent a partial list of marketed/pipeline drugs, and the complete list has been provided in the report.

Key Questions Answered in this Report:

Market Insights

- How has the Nasal Polyps market performed so far and how will it perform in the coming years?

- What are the markets shares of various therapeutic segments in 2024 and how are they expected to perform till 2035?

- What was the country-wise size of the Nasal Polyps across the seven major markets in 2024 and what will it look like in 2035?

- What is the growth rate of the Nasal Polyps across the seven major markets and what will be the expected growth over the next ten years?

- What are the key unmet needs in the market?

Epidemiology Insights

- What is the number of prevalent cases (2019-2035) of Nasal Polyps across the seven major markets?

- What is the number of prevalent cases (2019-2035) of Nasal Polyps by age across the seven major markets?

- What is the number of prevalent cases (2019-2035) of Nasal Polyps by gender across the seven major markets?

- What is the number of prevalent cases (2019-2035) of Nasal Polyps by type across the seven major markets?

- How many patients are diagnosed (2019-2035) with Nasal Polyps across the seven major markets?

- What is the size of the Nasal Polyps’ patient pool (2019-2024) across the seven major markets?

- What would be the forecasted patient pool (2025-2035) across the seven major markets?

- What are the key factors driving the epidemiological trend of Nasal Polyps?

- What will be the growth rate of patients across the seven major markets?

Nasal Polyps: Current Treatment Scenario, Marketed Drugs and Emerging Therapies

- What are the current marketed drugs and what are their market performance?

- What are the key pipeline drugs and how are they expected to perform in the coming years?

- How safe are the current marketed drugs and what are their efficacies?

- How safe are the late-stage pipeline drugs and what are their efficacies?

- What are the current treatment guidelines for Nasal Polyps drugs across the seven major markets?

- Who are the key companies in the market and what are their market shares?

- What are the key mergers and acquisitions, licensing activities, collaborations, etc. related to the Nasal Polyps market?

- What are the key regulatory events related to the Nasal Polyps market?

- What is the structure of clinical trial landscape by status related to the Nasal Polyps market?

- What is the structure of clinical trial landscape by phase related to the Nasal Polyps market?

- What is the structure of clinical trial landscape by route of administration related to the Nasal Polyps market?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Request Customization

Request Customization

.webp)

.webp)