Narcotics Scanner Market Report by Product Type (Handheld Scanner, Tabletop Scanner, Walkthrough Scanner), Technology (Ion Mobility Spectrum Technology, Contraband Detection Equipment, Videoscope Inspection System, Infrared Spectroscopy), End User (Airport, Public Transportation, Defense and Military, Law Enforcement, and Others), and Region 2025-2033

Market Overview:

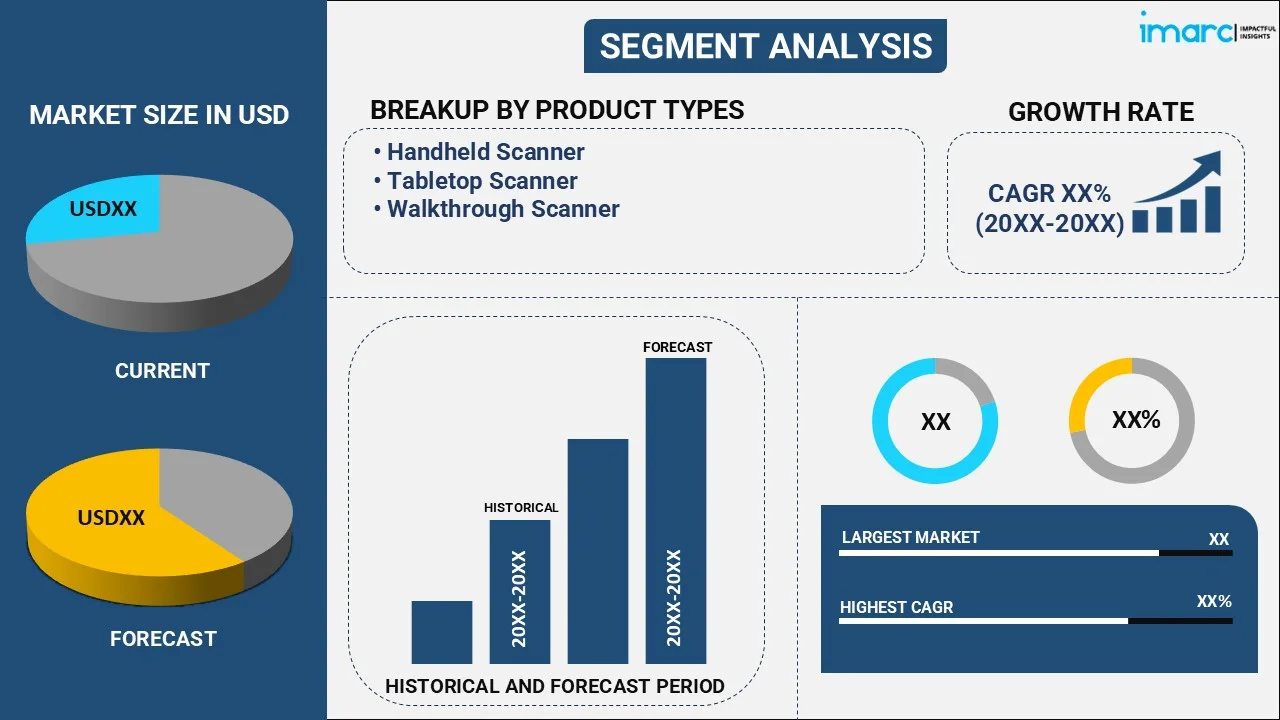

The global narcotics scanner market size reached USD 7.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 12.5 Billion by 2033, exhibiting a growth rate (CAGR) of 5.39% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7.6 Billion |

|

Market Forecast in 2033

|

USD 12.5 Billion |

| Market Growth Rate 2025-2033 | 5.39% |

Narcotics scanners are used by law enforcement authorities for detecting the illicit use of cocaine, amphetamine, opiates, and other drugs. They assist in combating the drug trade and other threats and protecting the prosperity of a nation. Nowadays, several manufacturers are introducing non-destructive scanners with automated data storage and report generation capabilities. These scanners can scan directly through plastic and glass, thereby minimizing contamination, reducing exposure, and preserving evidence.

Narcotics Scanner Market Trends:

Due to the growing instances of drug trafficking across the globe, law enforcement officials are relying on different measures to identify suspected narcotics and drug dealers quickly. This represents one of the key factors influencing the market positively. Apart from this, governments of numerous countries are adopting preventive measures to improve physical security and stop drug smuggling into prisons. For instance, the Government of the United Kingdom (UK) launched the 10 Prisons Project that aims to reduce drug consumption and violence while improving standards in jails. This is positively influencing the sales of narcotics scanners to detect invisible traces of drugs, such as psychoactive substances, on clothes, paper, and mail. Moreover, narcotic scanners are gaining traction at airports to intercept and detain people who have illicit substances. This, in confluence with the increasing air traffic, is contributing to market growth. Furthermore, international organizations are also focusing on tightening the security of airports. For instance, the United Nations Office on Drugs and Crime (UNODC) and International Civil Aviation Organization (ICAO) signed a partnership to prevent criminal and terrorist threats at airports. Additionally, several manufacturers are introducing handheld narcotics analyzers that enable officers, customs, border control, and other personnel to scan suspected controlled substances in a single, definitive test.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the global narcotics scanner market report, along with forecasts at the global, regional and country level from 2025-2033. Our report has categorized the market based on product type, technology and end user.

Breakup by Product Type:

- Handheld Scanner

- Tabletop Scanner

- Walkthrough Scanner

Breakup by Technology:

- Ion Mobility Spectrum Technology

- Contraband Detection Equipment

- Videoscope Inspection System

- Infrared Spectroscopy

Breakup by End User:

- Airport

- Public Transportation

- Defense and Military

- Law Enforcement

- Others

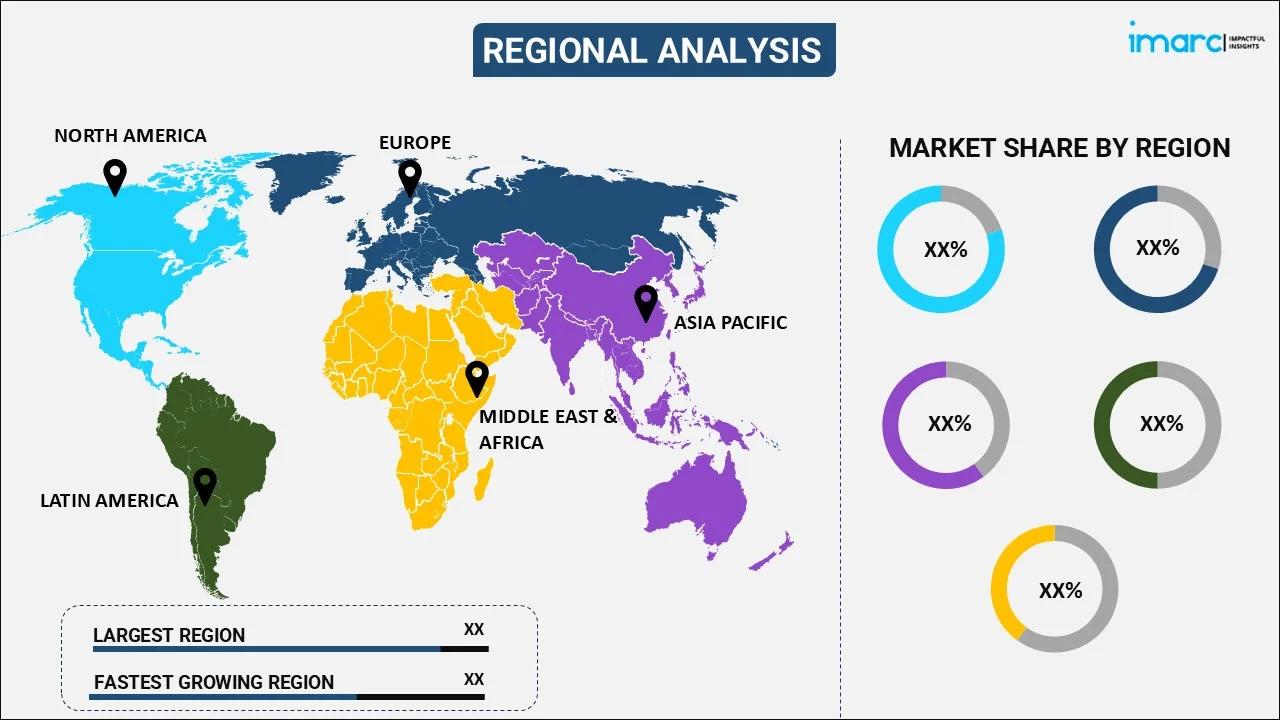

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players being Autoclear, Aventura Technologies Inc., B&W Tek (Metrohm AG), Bruker Corporation, Kapri Corp., Klipper Enterprises, Leidos, Matrix Security & Surveillance Pvt ltd, Rapiscan Systems (OSI Systems Inc), Smiths Group Plc, Teledyne FLIR LLC (Teledyne Technologies Incorporated), Thermo fisher Scientific Inc. and Viken Detection.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Segment Coverage | Product Type, Technology, End User, Region |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Autoclear, Aventura Technologies Inc., B&W Tek (Metrohm AG), Bruker Corporation, Kapri Corp., Klipper Enterprises, Leidos, Matrix Security & Surveillance Pvt ltd, Rapiscan Systems (OSI Systems Inc), Smiths Group Plc, Teledyne FLIR LLC (Teledyne Technologies Incorporated), Thermo fisher Scientific Inc. and Viken Detection |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global narcotics scanner market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the global narcotics scanner market?

- What are the key regional markets?

- What is the breakup of the market based on the product type?

- What is the breakup of the market based on the technology?

- What is the breakup of the market based on the end user?

- What are the various stages in the value chain of the industry?

- What are the key driving factors and challenges in the industry?

- What is the structure of the global narcotics scanner market and who are the key players?

- What is the degree of competition in the industry?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)