Naphtha Market Report by Application (Petrochemical Feedstock, Gasoline Blending, and Others), and Region 2026-2034

Market Overview:

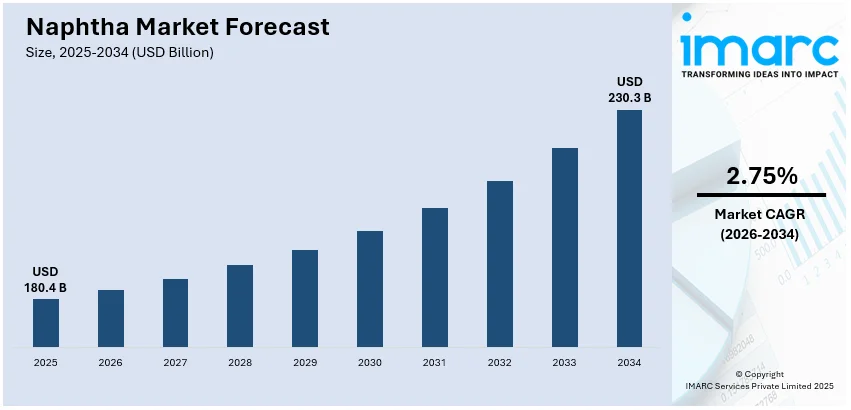

The global naphtha market size reached USD 180.4 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 230.3 Billion by 2034, exhibiting a growth rate (CAGR) of 2.75% during 2026-2034. At present, Asia Pacific represents the largest region owing to the increase in energy and petrochemical consumption. The escalating demand for high-octane fuel using olefin-rich materials, the growing demand for budget-friendly fuel, and continual technological innovations and research and development (R&D) activities are some of the factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 180.4 Billion |

| Market Forecast in 2034 | USD 230.3 Billion |

| Market Growth Rate 2026-2034 | 2.75% |

Naphtha refers to a broad range of volatile and flammable liquid hydrocarbons that are derived from crude oil or coal tar. This liquid fraction, commonly obtained from petroleum refining, displays properties that are intermediate between gasoline and kerosene. It has the ability to dissolve and mix with various organic compounds, facilitating chemical reactions or acting as a carrier for desired materials. Its unique composition ensures its utility as a solvent, diluent, or raw material in various industrial processes, including the production of high-quality gasoline and as a feedstock for the production of chemicals. Furthermore, it finds applications in the cleaning of metals and the extraction of valuable substances.

To get more information on this market Request Sample

The global market is primarily driven by the escalating demand for high-octane fuel using olefin-rich materials. This trend, together with the ongoing expansion in the petrochemical sector and the growing application of this material for the creation of aromatics and olefins is propelling the market. Moreover, the growing demand for budget-friendly fuel has amplified consumption in both developing and industrialized regions, which in turn is creating a positive market outlook. In line with this, the rising construction and infrastructure development activities in both residential and commercial areas are further stimulating the demand for paints and cleaning agents, thereby stimulating the market. Furthermore, the accelerating need to achieve higher fuel efficiency and reduced emissions in alignment with international regulations leading to the formulation of specialized fuel mixtures is fueling the market.

Naphtha Market Trends:

Surging Demand from Petrochemical Sector

The market for naphtha is propelled by the escalating demand of the petrochemical industry, which is constantly dependent on naphtha as a basic feedstock to manufacture ethylene, propylene, butadiene, and aromatics. These chemical blocks are utilized in the production of plastics, synthetic fibers, resins, and other chemical derivatives necessary in packaging, auto, construction, and electronic industries. With the global industrialization process widening its scope, particularly in Asia-Pacific and the Middle East, petrochemical complexes are being established and modernized, thus catalyzing the demand for naphtha. Additionally, the demand for lightweight and tough plastics across a wide range of applications is being supported, keeping naphtha a vital raw material. With increasing investments in downstream petrochemical facilities and integration schemes, the application of naphtha as a versatile feedstock is being enhanced, making it a pillar of the global chemical value chain. In 2024, Indian Oil Corporation Limited. (IOCL) announced its plans to sign a memorandum of understanding with the Odisha government for the establishment of a naphtha cracker project in the port town of Paradip, with a projected investment of ₹61,000 crore.

Growing Transportation Fuel Market

The utilization of naphtha in gasoline blending and as a fuel component directly is being increased as a result of the expansion of the global transportation market. Accelerated urbanization, increased vehicle ownership, and growing demand for mobility are being witnessed, particularly among emerging economies like India, China, and Southeast Asia. Governments are continually developing road networks and supporting economic growth, which is leading to increased fuel consumption and presenting opportunities for naphtha-based blending. In addition, as refiners are maximizing the operations to meet both petrochemical feedstock as well as transportation fuels, naphtha is emerging as a multi-purpose choice to fulfill the needs of both. Although cleaner energy options and new energy sources are being implemented, use of gasoline in developing markets continues to be maintained, providing continuous utilization of naphtha. IMARC Group predicts that the gasoline market will reach USD 145.7 Billion by 2033.

Ongoing Capacity Additions in Refining and Petrochemicals

The ongoing development of refining and petrochemical capacities in key regions is offering a favorable naphtha market outlook. Integrated refining and petrochemical complexes are being planned to drive maximum feedstock flexibility, best-in-class margins, and respond to growing demand for downstream chemical products. In the Middle East and Asia-Pacific, governments and energy firms are spending a great deal of money building new complexes and upgrading old refineries, thus boosting the output of naphtha. The motive is to make local manufacturing industries more robust and self-reliant on chemical feedstocks import dependency. Furthermore, process improvements in refining technology are being deployed to enhance yield efficiency, thus making naphtha production cost-competitive. While global energy majors are diversifying portfolios by striking a balance between petrochemicals and fuels, naphtha is being placed strategically as an integral intermediary. With the ever-present capacity expansion wave, global supply availability is being fortified, which is elevating the naphtha market price. In 2024, Honeywell revealed an innovative naphtha to ethane and propane (NEP) process that will allow areas globally to enhance light olefin production efficiency and reduce CO2 emissions for each metric ton of olefin created. The NEP technology produces a variable quantity of ethane and propane from naphtha and/or LPG feedstocks.

Naphtha Market Growth Drivers:

Industrialization and Urbanization in Emerging Economies

The industrialization and urbanization trend especially in emerging economies is constantly driving naphtha demand, with industries increasingly being established and city infrastructure projects initiated. Naphtha-based chemicals and plastics are being used in the form of construction materials, packaging materials, textiles, and consumer products, all of which are increasing as urban populations are expanding. In developing economies, increasing population density is being accompanied by increased levels of income, which is catalyzing the need and resulting in heightened dependency on petrochemical-based products. Governments and industrial investors are investing in massive industrial parks, manufacturing complexes, and smart cities, all of which are demanding more quantities of chemical derivatives processed from naphtha.

Emerging Role in Production of Alternative Fuels

The use of naphtha to produce alternative and cleaner fuels is being promoted, with industries and governments looking for ways to minimize carbon emissions and move to cleaner energy sources. Naphtha is being utilized as a feedstock in coal-to-liquid (CTL) and gas-to-liquid (GTL) processes, where it is being processed into cleaner fuels like synthetic diesel and kerosene. In addition, naphtha is also being used to produce hydrogen, which is gaining importance as a low-carbon energy carrier in the process of transition to low-carbon economies. The increasing interest in bio-naphtha, made from renewable feedstock, is also being witnessed with refiners and chemical manufacturers making it part of existing infrastructure to aid green transition plans. With the tightening of environmental laws, naphtha's versatility in traditional and alternative energy streams is being noticed, further solidifying its role in the changing energy mix and maintaining its relevance in forward markets.

Changing Trade Flows and Regional Supply Patterns

As per the naphtha market analysis, global trade patterns are constantly influencing the market, as changes in regional supply and demand balances are being witnessed. Asia-Pacific, the biggest consumer of petrochemicals, is continually importing massive amounts of naphtha from Europe, the Middle East, and the US. This dependence is being underpinned by the region's industrialization boom and low domestic production capacity versus demand. Meanwhile, Middle Eastern producers are using their refining increases to gain increased market share in Asia by shipping excess naphtha. Price swings in crude oil are also being passed on to naphtha trade values, impacting arbitrage benefits and realigning supply chains. Developments in global shipping and logistics are being incorporated, facilitating producers to respond more easily to cross-regional demand.

Naphtha Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global naphtha market report, along with forecasts at the global and regional levels from 2026-2034. Our report has categorized the market based on application.

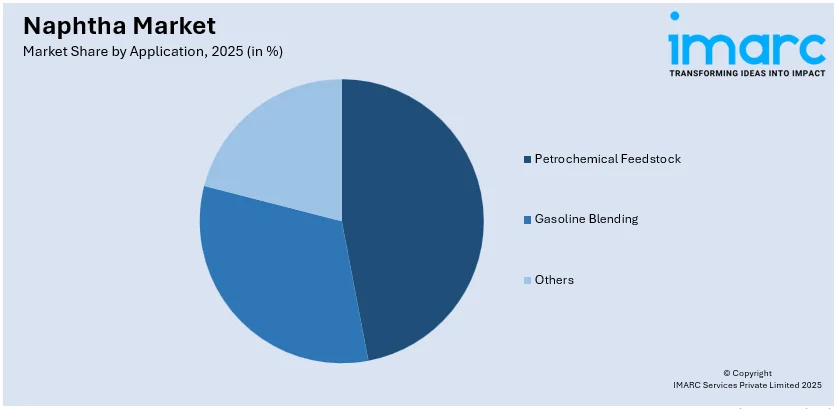

Breakup by Application:

Access the comprehensive market breakdown Request Sample

- Petrochemical Feedstock

- Gasoline Blending

- Others

Petrochemical feedstock represents the largest market segment

The report has provided a detailed breakup and analysis of the market based on the application. This includes petrochemical feedstock, gasoline blending, and others. According to the report, petrochemical feedstock represented the largest segment.

The growing demand for plastics and synthetic materials, which require petrochemical feedstock in their production process, fuels this market segment. Also, technological advancements in refining processes enable more efficient extraction and processing of petrochemical feedstock, supporting the market growth. Moreover, the shift towards cleaner and more sustainable chemicals is pushing manufacturers to utilize specific feedstock that aligns with environmental standards.

On the other hand, the increasing vehicle usage and a growing automotive industry worldwide contribute to higher demand for gasoline, thus driving the gasoline blending market. Also, regulatory mandates to ensure cleaner combustion and reduced emissions necessitate specific gasoline blending techniques, thereby supporting this market segment. Volatile crude oil prices influence gasoline blending strategies, as refiners aim to achieve cost-effective production without sacrificing quality.

Breakup by Region:

- Asia Pacific

- North America

- Europe

- Middle East and Africa

- Latin America

Asia Pacific exhibits a clear dominance, accounting for the largest naphtha market share

The report has also provided a comprehensive analysis of all the major regional markets, which include Asia Pacific; North America; Europe; Middle East and Africa; and Latin America.

Rapid industrialization and urbanization in the Asia Pacific region lead to an increase in energy and petrochemical consumption, propelling market growth. The emergence of Asia Pacific as a manufacturing hub for various industries including automotive, electronics, and textiles requires extensive energy and raw materials, driving market segments.

In addition to this, strategic policies and investments by governments in this region to promote energy security and sustainable development further fuel market growth. Also, an increasing focus on environmental conservation, adherence to international emissions standards, and the development of eco-friendly technologies are influencing market trends in the Asia Pacific region.

Furthermore, the presence of several key market players and the region's strategic location, facilitating export and import activities, make the Asia Pacific a vital segment in the global market landscape.

Competitive Landscape:

The leading companies are focusing on research and development to create more efficient and environmentally friendly naphtha products. Innovations in refining processes and the development of new applications for naphtha are part of this strategy. The top players are also expanding their presence into emerging markets, where the demand for naphtha in various industries such as petrochemicals and solvents is growing. By forming alliances with other industry players and investing in joint ventures, leading companies can share knowledge, technology, and resources. The key players are integrating modern technologies, such as artificial intelligence and analytics, to optimize inventory management and logistics. Additionally, they are adopting green chemistry practices and investing in cleaner technologies to reduce emissions and waste.

The report has provided a comprehensive analysis of the competitive landscape in the naphtha market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- BP plc

- Chevron Corporation

- Exxon Mobil Corporation

- Lotte Chemical Corporation

- Mangalore Refinery and Petrochemicals Limited

- OAO Novatek

- Saudi Basic Industries Corporation (SABIC)

- Shell International B.V.

- Sinopec Group

- Total S.A.

- Vitol SA

- Mitsubishi Chemical

- Reliance Industries Limited

- Indian Oil Corporation

Recent Developments:

- July 2025: Haldia Petrochemicals Limited. (HPL) is a contemporary Petrochemical Complex that uses naphtha as its main feedstock. HPL ranks as the second biggest producer of polyethylene in India, boasting a total capacity of 700 KTA. The firm has started a Rs. A capex plan of 5,500 crore for an integrated OCU-Phenol project, featuring a total capacity of 560,000 TPA of phenol and acetone.

- June 2025: In a significant action indicating a long-awaited overhaul of South Korea's petrochemical sector, Lotte Chemical Corp. and HD Hyundai Co. are in final discussions to merge their naphtha cracking center (NCC) activities at the Daesan petrochemical facility. This partnership is a direct reaction to severe market pressures, mainly arising from aggressive oversupply by Chinese manufacturers and the resulting financial burden on local companies.

- April 2025: Aramco has recently entered into an agreement with Chinese state-owned Sinopec to construct and incorporate a 1.8mn t/yr mixed-feed ethylene steam cracker and a 1.5mn t/yr aromatics complex into the 400,000 b/d Yasref refinery. This type of integration would generally channel naphtha to the petrochemical facilities and shift it away from the gasoline blending pool, traders noted.

- February 2025: ExxonMobil has acquired multiple deliveries of naphtha for its recently opened petrochemical facility in southern China, according to Reuters. The facility, located in the Dayawan Petrochemical Industrial Park in Huizhou, Guangdong province, is among the rare large petrochemical plants in China that are entirely owned by a foreign investor, aimed at manufacturing premium petrochemical products. The ExxonMobil facility is scheduled to get a naphtha shipment of 55,000 metric tons (489,500 barrels). The chemical facility will manufacture performance polymers utilized in packaging, automotive, agricultural, and hygiene and personal care consumer products.

- October 2024: QatarEnergy has entered into an important long-term naphtha supply contract with Shell International Eastern Trading Company, a unit of Shell based in Singapore. The contract, lasting 20 years, includes the provision of up to 18 million tons of naphtha to Shell, with shipments scheduled to start in April 2025.

Naphtha Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million Tons, Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Applications Covered | Petrochemical Feedstock, Gasoline Blending, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | BP plc, Chevron Corporation, Exxon Mobil Corporation, Lotte Chemical Corporation, Mangalore Refinery and Petrochemicals Limited, OAO Novatek, Saudi Basic Industries Corporation (SABIC), Shell International B.V., Sinopec Group, Total S.A., Vitol SA, Mitsubishi Chemical, Reliance Industries Limited, Indian Oil Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global naphtha market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global naphtha market?

- What is the impact of each driver, restraint, and opportunity on the global naphtha market?

- What are the key regional markets?

- Which countries represent the most attractive naphtha market?

- What is the breakup of the market based on the application?

- Which is the most attractive application in the naphtha market?

- What is the competitive structure of the global naphtha market?

- Who are the key players/companies in the global naphtha market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the naphtha market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global naphtha market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the naphtha industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)