Nanoemulsion Market Size, Share, Trends and Forecast by Type, Route of Administration, Application, and Region, 2025-2033

Nanoemulsion Market Size and Share:

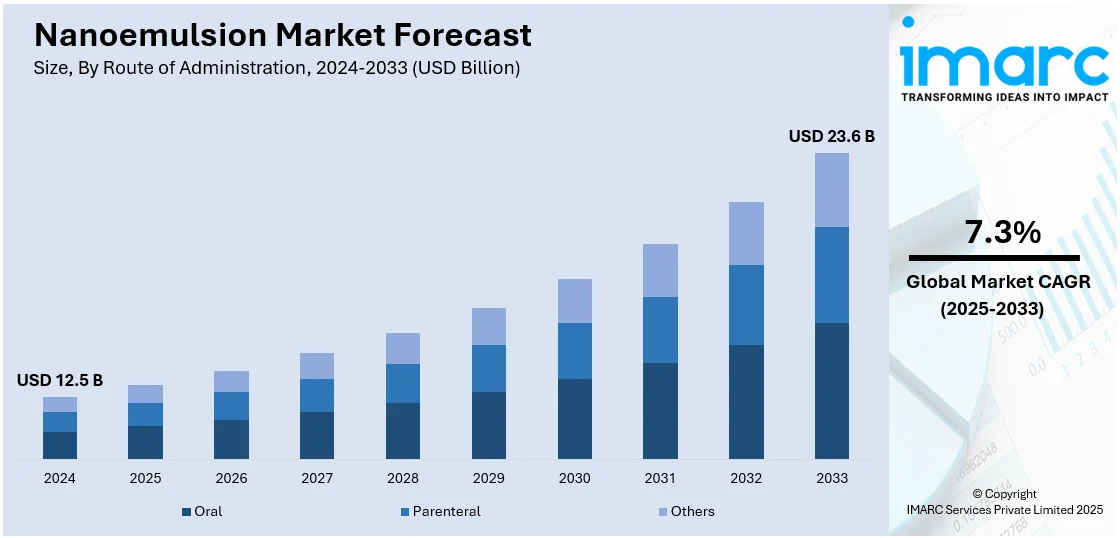

The global nanoemulsion market size was valued at USD 12.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 23.6 Billion by 2033, exhibiting a CAGR of 7.3% during 2025-2033. North America currently dominates the market, holding a significant market share of around 36.8% in 2024. The market is driven by pharmaceutical advancements, where nanoemulsions improve drug solubility and bioavailability, particularly for challenging compounds, alongside growing demand for precision drug delivery and personalized medicine. Regulatory support for efficient delivery systems and increased R&D investments also stimulate growth, further augmenting the nanoemulsion market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 12.5 Billion |

|

Market Forecast in 2033

|

USD 23.6 Billion |

| Market Growth Rate 2025-2033 | 7.3% |

The market is driven by advancements in pharmaceutical formulations, where nanoemulsions enhance drug solubility and bioavailability, particularly for poorly water-soluble compounds. Rising demand for targeted drug delivery systems and personalized medicine further propels growth. In the cosmetics industry, the shift toward nano-based skincare products, offering better active ingredient penetration, fuels adoption. The nutraceutical industry drives growth through omega-3 and vitamin nanoemulsions that overcome bioavailability challenges in functional foods. As per a research report published by the IMARC Group, the global nutraceuticals market was valued at USD 500.0 Billion in 2024 and is projected to reach USD 877.8 Billion by 2033, reflecting a compound annual growth rate (CAGR) of 6.5% from 2025 to 2033. Within this expanding market, nanoemulsion technology is emerging as a key innovation, enhancing the bioavailability and efficacy of nutraceutical formulations. Its adoption is expected to accelerate, driven by demand for advanced delivery systems that improve nutrient absorption and consumer outcomes. Food and beverage applications are expanding due to the need for stable, nutrient-fortified products with improved shelf-life. Additionally, the shift toward natural preservatives in food products, replacing synthetic additives, creates opportunities. The rise of minimally invasive dermatological treatments utilizing nanoemulsions for topical applications also fuels growth. In agriculture, nanoemulsion-based pesticides gain traction due to their improved efficacy and reduced environmental impact. Furthermore, stringent regulatory standards favoring safe, efficient delivery systems and investments in nanotechnology R&D contribute to the nanoemulsion market growth.

The United States stands out as a key regional market, primarily driven by escalating demand for advanced drug delivery systems, particularly in treating chronic diseases such as diabetes and cardiovascular disorders, where controlled release and enhanced bioavailability are critical. As per 2025 industry reports, cardiovascular diseases (CVD) had caused 941,652 deaths in the United States in 2022, surpassing the number of deaths from cancer and accidents combined. The increasing risk factors, such as high blood pressure, affecting close to 47% of US adults, unhealthy weight (more than 72%), and diabetes/prediabetes (57%), highlight the imperative need for new prevention and treatment strategies, similar to the breakthroughs in targeted delivery seen in the nanoemulsion area for a range of medical applications. This current scenario requires urgent and comprehensive measures to respond to the increasing incidences of CVD in the United States. Apart from this, strategic collaborations between academic institutions and biotech firms accelerate commercialization, while military and defense applications in vaccine development further expand the market’s potential.

Nanoemulsion Market Trends:

Increasing Need for Enhanced Drug Delivery Systems

Nanoemulsions enhance the bioavailability and targeted delivery of therapeutic agents, making them effective for poorly soluble drugs. Their small droplet size ensures better absorption and distribution, driving pharmaceutical companies to invest in nanoemulsion-based formulations. The rising prevalence of chronic diseases and the preference for precision drug delivery systems increase global demand. Moreover, nanoemulsions are used for targeted delivery of anticancer drugs and other therapeutic agents, improving efficacy and minimizing side effects. The aging population's susceptibility to health disorders also increases the market demand, especially for treating reticuloendothelial system infections and liver enzyme replacement therapy. According to WHO, chronic diseases are responsible for 74% of global deaths, while cancer accounted for nearly 10 million deaths in 2020, further underscoring the need for advanced drug delivery systems such as nanoemulsions, particularly in low- and middle-income countries. Additionally, biopharmaceutical companies are leveraging nanoemulsions in vaccine production, exemplified by BlueWillow Biologics' patented NanoVax intranasal anthrax vaccine.

Growing Applications in Food and Beverage Industry

The food and beverage industry utilizes nanoemulsions to enhance the solubility, stability, and bioavailability of hydrophobic ingredients such as vitamins, flavors, and antioxidants. This improves the nutritional value and sensory properties of products, catering to the rising consumer demand for functional foods and beverages. The versatility of nanoemulsions in creating stable, clear, and homogeneous products further increases their adoption in products, including energy drinks, health drinks, dairy products, bakery goods, and salads and dressings. In 2023, the U.S. sales of functional foods and beverages reached USD 92.1 Billion, with projections by Nutrition Business Journal indicating a growth to USD 106.9 Billion by 2026 at a CAGR of 5%. The interest in these products is higher among younger demographics, with two-thirds of millennials and households with children, half of Gen Z and Gen X, and one-third of baby boomers purchasing functional foods. Nearly half (47%) of U.S. adults are proactive health consumers, according to NIQ, and 48% plan to eat healthier in 2024, as reported by FMI. Globally, over half of consumers select foods to enhance performance, mood, and sleep. Currently, over half of the U.S. food companies are reformulating products to add health benefits, with 22% planning to do so within the next two years, focusing on reducing sugars and sodium and adding beneficial ingredients.

Rising Consumer Awareness of Nutraceuticals

Growing awareness of the health benefits associated with nutraceuticals and functional foods drives the demand for nanoemulsion-based products, thereby creating a positive nanoemulsion market outlook. These products offer superior delivery of bioactive compounds, ensuring better absorption and efficacy. This trend is supported by increasing health consciousness among consumers and the desire for products that provide specific health benefits, leading to greater market expansion. According to a research report published on PMC in June 2023, the nutraceutical market in India is rapidly changing and is projected to reach USD 18 Billion by the end of 2025, up from USD 4 Billion at the end of 2020. This represents more than a fourfold increase over five years. The significant growth is partly driven by increased foreign investment, spurred by the introduction of 100% Foreign Direct Investment (FDI) in the nutraceutical and food supplement manufacturing sector. Consequently, FDI in this sector accelerated from USD 131.4 Million in 2012 to USD 584.7 Million in 2019. With this remarkable growth trajectory, India is on track to become a global leader in the nutraceutical industry.

Nanoemulsion Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global nanoemulsion market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, route of administration, and application.

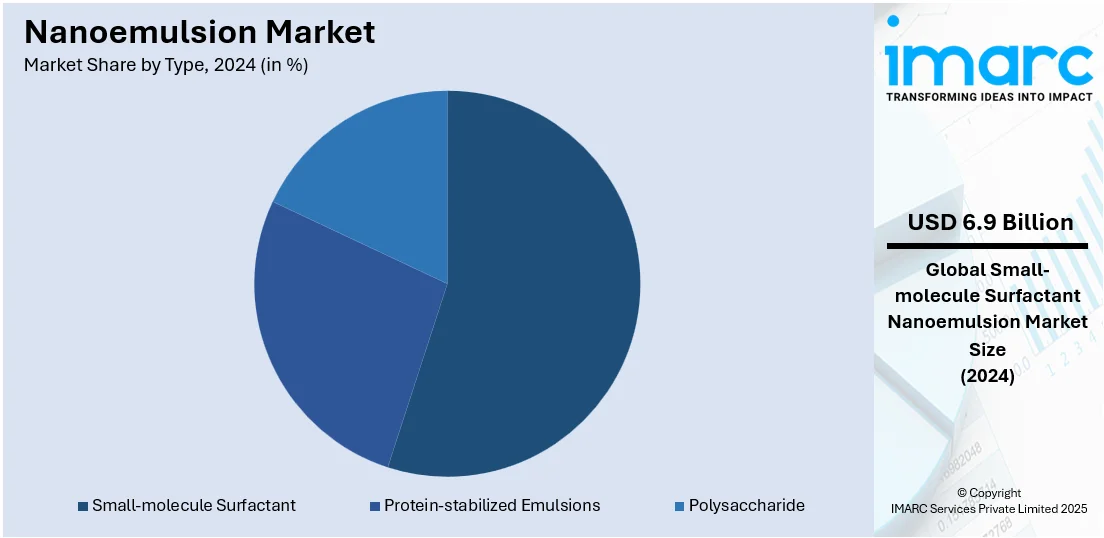

Analysis by Type:

- Small-molecule Surfactant

- Protein-stabilized Emulsions

- Polysaccharide

Small-molecule surfactants stand as the largest component in 2024, holding around 55.3% of the market due to their ability to reduce interfacial tension effectively, resulting in stable and uniform nano-sized droplets. Their amphiphilic nature allows them to enhance the solubility and bioavailability of hydrophobic compounds, making them ideal for applications in pharmaceuticals, cosmetics, and food industries. Moreover, they are cost-effective and versatile, enabling efficient production processes and broad compatibility with various formulation components, thus driving their dominance in the market. Small-molecule surfactants also exhibit excellent stability under varying pH and temperature conditions, further broadening their applicability. Their widespread availability and established regulatory approval in multiple industries contribute to their continued preference. Additionally, ongoing advancements in surfactant technology are expected to further enhance their performance and expand their use in emerging applications.

Analysis by Route of Administration:

- Oral

- Parenteral

- Others

Oral nanoemulsions improve the bioavailability and absorption of poorly soluble drugs, mask unpleasant tastes, and protect sensitive compounds, making them highly demanded in nutraceuticals and functional foods. The growing demand for fast-acting and easy-to-administer supplements further drives the adoption of oral nanoemulsions in the consumer health sector. Their ability to improve the shelf life and stability of active ingredients makes them a preferred choice for innovative formulations. According to the nanoemulsion market forecast, advancements in nanotechnology and increasing consumer preference for liquid dosage forms are expected to fuel further market growth.

Parenteral nanoemulsions enable targeted, controlled drug delivery with superior tissue penetration for intravenous, intramuscular, and subcutaneous administration, enhancing treatment efficacy for chronic diseases and vaccines. Topical and ocular nanoemulsions improve drug penetration and efficacy in dermatology, cosmetics, and eye treatments, driven by the need for advanced drug delivery systems in various medical fields. The rise in biologics and high-potency drugs has further increased demand for parenteral nanoemulsions due to their ability to solubilize and stabilize sensitive compounds. Their customizable droplet size and surface properties allow for precise biodistribution, reducing systemic side effects. In topical applications, nanoemulsions enhance moisturization and active ingredient retention, making them ideal for anti-aging and dermatological therapies. Additionally, the shift toward non-invasive yet highly effective treatments continue to drive innovation in ocular and transdermal nanoemulsion formulations.

Oral and parenteral nanoemulsions are widely used, while other methods, such as ocular delivery, are also significant. Companies in the market collaborate on novel product development. Increasing research into hybrid nanoemulsion systems—combining lipids and polymers further expands their applicability in targeted drug delivery. Regulatory approvals for novel nanoemulsion-based therapeutics, particularly in niche areas such as chronic ocular inflammation, are further augmenting the nanoemulsion market value.

Analysis by Application:

- Anesthetics

- Antibiotics

- Nonsteroidal Anti-inflammatory Drugs

- Immunosuppressants

- Steroids

- Others

Immunosuppressants lead the market in 2024 due to their critical role in enhancing drug delivery systems for these potent medications. Nanoemulsions improve the bioavailability and targeted delivery of immunosuppressants, ensuring more effective management of conditions such as organ transplants and autoimmune diseases. The small droplet size of nanoemulsions facilitates better absorption and distribution of the drugs within the body, reducing side effects and improving therapeutic outcomes. This has led to significant research and development investments, driving market growth in this segment. The growing prevalence of chronic autoimmune disorders and increasing transplant procedures further amplify the demand for optimized immunosuppressant delivery via nanoemulsions. Recent advancements in surface modification techniques allow for even greater precision in targeting specific immune cells, minimizing off-target effects. Additionally, the rise of personalized medicine has spurred innovation in customizable nanoemulsion formulations tailored to individual patient pharmacokinetics.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 36.8% due to its strong pharmaceutical and biotechnology sectors, significant R&D investments, and early adoption of advanced technologies. According to the nanoemulsion market research report, the region's established healthcare infrastructure and the presence of major market players further support market growth. Additionally, increasing consumer demand for functional foods, beverages, and personal care products with enhanced efficacy contributes to the market's dominance. Supportive regulatory frameworks and government initiatives promoting nanotechnology research also play crucial roles in bolstering North America's leadership in this sector. These factors collectively create a conducive environment for innovation and commercialization of nanoemulsion-based products. As a result, North America is expected to maintain its leading position in the global market over the coming years.

Key Regional Takeaways:

United States Nanoemulsion Market Analysis

In 2024, the US accounted for around 88.20% of the total North America nanoemulsion market. The market is primarily driven by advancements in nanotechnology, which have led to the development of nanoemulsions with improved bioavailability, stability, and controlled release of active ingredients, making them highly attractive in pharmaceuticals, nutraceuticals, and cosmetics. The increasing prevalence of chronic diseases and the demand for innovative drug delivery systems are also propelling the adoption of nanoemulsions in medical applications. According to the Centers for Disease Control and Prevention, approximately 129 million individuals in the United States suffer from at least one major chronic disease. Moreover, 42% are suffering from 2 or more, while 12% are suffering from as many as 5. Additionally, in the food and beverage industry, nanoemulsions enhance the solubility and bioavailability of hydrophobic ingredients, catering to the rising consumer demand for functional foods and beverages. The cosmetics and personal care sectors are also contributing substantially to industry expansion as consumers seek products with better skin penetration and efficacy, driving the use of nanoemulsions in skincare formulations. Furthermore, continuous research and technological breakthroughs in emulsification techniques have improved the scalability and cost-effectiveness of nanoemulsion production, facilitating their widespread usage across various industries. As awareness about these technologies increases among both producers and end-users, the market is expected to witness sustained expansion across a broad spectrum of applications.

Asia Pacific Nanoemulsion Market Analysis

The Asia Pacific market is expanding due to several key factors. Countries such as China, India, and Japan are investing heavily in nanotechnology research, enhancing the development of nanoemulsion-based products. The region's expanding pharmaceutical and cosmetic industries are also increasingly adopting nanoemulsions to improve drug delivery systems and enhance the efficacy of skincare products. For instance, the pharmaceutical industry in India recorded an 8.8% growth in June 2024, as per the India Brand Equity Foundation (IBEF). Furthermore, rising disposable incomes and a growing middle class are leading to higher consumer demand for advanced healthcare and personal care products, further fueling market expansion. Additionally, the increasing prevalence of chronic diseases in the region is driving the need for innovative drug delivery solutions, positioning nanoemulsions as a promising technology.

Europe Nanoemulsion Market Analysis

The nanoemulsion market in Europe is experiencing robust growth, fueled by the demand for enhanced drug delivery systems, as nanoemulsions improve the bioavailability and stability of active pharmaceutical ingredients, making them effective for poorly soluble drugs. This is particularly important in the treatment of chronic diseases and the health needs of the increasing geriatric population in the region. According to Eurostat, in 2024, 21.6% of the population of the European Union was aged 65 years and above. Furthermore, the increasing demand for personalized medicine, where nanoemulsions enable precise delivery of therapeutic agents, is enhancing treatment efficacy and minimizing side effects, supporting widespread adoption. Moreover, advancements in nanotechnology have facilitated the development of new and superior formulations, propelling industry expansion. Additionally, changing consumer lifestyles and the rise in demand for rapid-acting, non-invasive delivery systems across various sectors are contributing substantially to industry expansion. In particular, the shift toward on-the-go health and wellness products has heightened the need for nanoemulsions in the formulation of compact, fast-acting supplements and beverages. Other than this, the increased focus on sustainability and environmentally friendly production methods in Europe has led manufacturers to explore nanoemulsion techniques that reduce the need for harsh solvents, energy-intensive processing, and synthetic stabilizers.

Latin America Nanoemulsion Market Analysis

The Latin American market is significantly influenced by the expanding urbanization and rising income levels in the region, which are contributing to greater purchasing power among consumers, increasing consumption, and creating opportunities for industry expansion. As per estimates by Worldometers, 88.4% of the population of Latin America lives in urban areas, equating to 387,287,563 individuals. In addition to this, there is a growing demand for advanced drug delivery systems in the pharmaceutical sector, as nanoemulsions provide enhanced bioavailability and tailored drug release. The cosmetics and personal care industries are also contributing substantially to industry expansion as consumers demand more natural, organic, and efficient formulas. The use of nanoemulsions in skincare offers greater absorption and moisturizing advantages, propelling their usage in this industry and supporting overall market growth.

Middle East and Africa Nanoemulsion Market Analysis

The Middle East and Africa market is being increasingly propelled by the growing application of nanoemulsions in the food and beverage industry, where they enhance flavor delivery, shelf life, and nutrient absorption. The growing consumer shift toward functional and fortified food products is encouraging manufacturers to adopt nanoemulsion technologies to improve ingredient solubility and dispersion. In addition to this, rising interest in clean-label and natural formulations has heightened the demand for nanoemulsions that can effectively incorporate plant-based or oil-soluble bioactives without synthetic additives. The expanding agriculture sector is further enhancing market growth through the use of nanoemulsions in pesticide delivery and crop protection. For instance, in 2023, around 1.75 million Tons of grain production were harvested in an area of 323,000 hectares from a total planted area of 331,000 hectares in Saudi Arabia, according to the General Authority for Statistics (GASTAT).

Competitive Landscape:

The competitive landscape of the market is characterized by the presence of several key players actively involved in research, innovation, and product development. Major companies are focusing on leveraging advanced technologies to enhance the bioavailability and stability of nanoemulsion-based products. Collaborations, partnerships, and strategic alliances are common, as companies aim to expand their product portfolios and market reach. The market is also witnessing significant investment in R&D to explore new applications in pharmaceuticals, cosmetics, and the food and beverage industry, driving further competition and innovation. Emerging startups are also entering this space with niche formulations, thus intensifying competition. This dynamic environment is fostering continuous improvements in product performance and application versatility.

The report provides a comprehensive analysis of the competitive landscape in the nanoemulsion market with detailed profiles of all major companies, including:

- Ascendia Pharmaceuticals

- B. Braun Melsungen AG

- BlueWillow Biologics Inc.

- Covaris Inc.

- Fresenius Kabi AG

- IDEX Corporation

- Kaken Pharmaceutical Co., Ltd.

- Latitude Pharmaceuticals Inc.

- Owen Biosciences Inc.

- Santen Pharmaceutical Co., Ltd.

- Taiwan Liposome Co., Ltd.

Latest News and Developments:

- April 2025: Creative Biolabs introduced advanced emulsion formulation technologies, emphasizing nanoemulsions, to enhance drug stability and bioavailability. These nanoemulsions, characterized by nanometer-sized droplets, improve solubility and absorption of poorly soluble drugs, offering controlled release and protection against degradation. The company also offers customized solutions, including microemulsions and self-emulsifying drug delivery systems, tailored to specific pharmaceutical needs.

- February 2025: University of Leicester scientists designed a nanoemulsion technology employing water and oil for the sustainable recovery of valuable metals from the waste of discarded batteries. The patent-pending technique enables the direct purification of lithium-ion battery black mass, a low-value mixture of cathode and anode and other components, within minutes of room temperature operation.

- November 2024: Organigram Holdings Inc., an authorized provider of cannabis, introduced its first product, the Edison Sonics gummies. This first-to-market breakthrough was made possible by FAST, the company's nanoemulsion technology, which facilitates the faster and more effective absorption of cannabis by breaking it down into little particles after ingestion.

- July 2024: Lupin and Huons Co. Ltd. entered into a license and supply agreement in order to register and commercialize Cyclosporine Ophthalmic Nanoemulsion in Mexico. The Cyclosporine Ophthalmic Nanoemulsion does not include any preservatives. Its special nanoparticle technology increases tear production, hence relieving symptoms more quickly in individuals suffering from inhibited tear formation from keratoconjunctivitis sicca-related ocular inflammatory illness.

Nanoemulsion Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Small-molecule Surfactant, Protein-stabilized Emulsions, Polysaccharide |

| Routes of Administration Covered | Oral, Parenteral, Others |

| Applications Covered | Anesthetics, Antibiotics, Nonsteroidal Anti-inflammatory, Immunosuppressants, Steroids, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Ascendia Pharmaceuticals, B. Braun Melsungen AG, BlueWillow Biologics Inc., Covaris Inc., Fresenius Kabi AG, IDEX Corporation, Kaken Pharmaceutical Co. Ltd., Latitude Pharmaceuticals Inc., Owen Biosciences Inc., Santen Pharmaceutical Co. Ltd., Taiwan Liposome Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the nanoemulsion market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global nanoemulsion market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the nanoemulsion industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The nanoemulsion market was valued at USD 12.5 Billion in 2024.

IMARC estimates the nanoemulsion market to exhibit a CAGR of 7.3% during 2025-2033, reaching a value of USD 23.6 Billion by 2033.

The market is driven by advancements in pharmaceuticals that are enhancing drug solubility and bioavailability, rising demand for functional foods and nutraceuticals, superior cosmetic formulations with better absorption, and regulatory support for efficient delivery systems. Increased R&D investments and applications in agriculture and vaccines further propel growth.

North America currently dominates the nanoemulsion market, accounting for a share exceeding 36.8%. This dominance is fueled by strong pharmaceutical and biotech sectors, high R&D investments, advanced healthcare infrastructure, and growing demand for functional foods and personal care products.

Some of the major players in the nanoemulsion market include Ascendia Pharmaceuticals, B. Braun Melsungen AG, BlueWillow Biologics Inc., Covaris Inc., Fresenius Kabi AG, IDEX Corporation, Kaken Pharmaceutical Co. Ltd., Latitude Pharmaceuticals Inc., Owen Biosciences Inc., Santen Pharmaceutical Co. Ltd., and Taiwan Liposome Co. Ltd., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)