Myopia Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035

Market Overview:

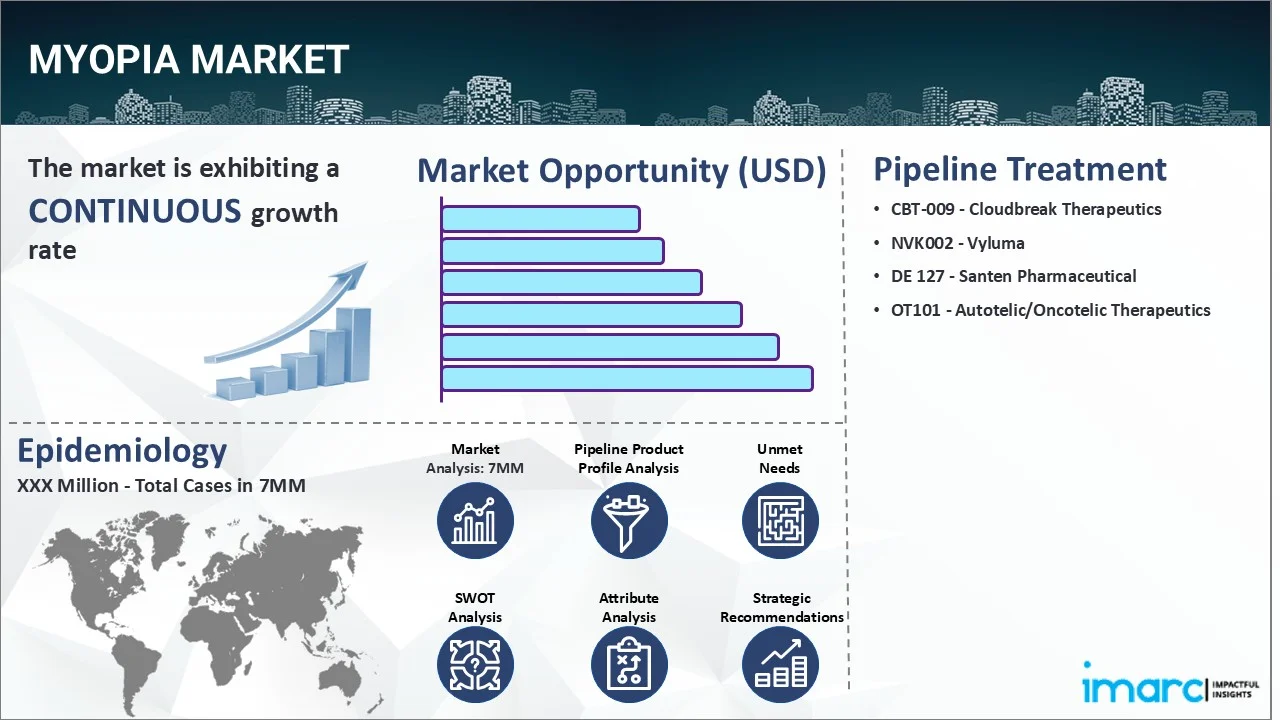

The top 7 (US, EU4, UK, and Japan) myopia markets are expected to exhibit a CAGR of 6.38% during 2025-2035.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2035

|

|

Historical Years

|

2019-2024

|

| Market Growth Rate 2025-2035 | 6.38% |

The myopia market has been comprehensively analyzed in IMARC's new report titled "Myopia Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035". Myopia, also known as nearsightedness, refers to a refractive error of the eye that makes distant objects appear blurry while close objects remain clear. It develops when the eyeball is too long or the cornea or lens is too curved, which causes light rays to be focused in front of the retina instead of directly on it. The main symptom of myopia is blurry vision when looking at things in the distance, such as road signs or chalkboards. Various other symptoms may include eye strain, headaches, and difficulty seeing at night or in dimly lit environment. In some cases, myopia may also cause squinting or the need to frequently adjust the distance between the eyes and the object being viewed. The diagnosis typically involves a comprehensive eye examination conducted by an optometrist or ophthalmologist. During the exam, the eye doctor uses a variety of tools and tests to measure the curvature of the cornea and the length of the eye, as well as assess the clarity of vision at different distances. The healthcare professional may also perform a retinal exam to check for any anomalies or signs of eye disease.

To get more information on this market, Request Sample

The growing prevalence of numerous associated risk factors, such as prolonged close-up activities, excessive screen time, lack of outdoor exposure, genetic predisposition, etc., is primarily driving the myopia market. Furthermore, the widespread adoption of atropine eye drops to dilate the pupils and reduce the progression of myopia in children is creating a positive outlook for the market. Apart from this, the escalating utilization of orthokeratology, since it aids in reshaping the cornea temporarily, allowing for clearer vision without the need for glasses or contact lenses during the day, is acting as another significant growth-inducing factor. Additionally, the introduction of objective refraction measurement techniques, such as autorefraction and wavefront aberrometry, which provide more accurate as well as consistent measurements than subjective methods, is also augmenting the market growth. Moreover, the emerging popularity of photorefractive keratectomy over LASIK surgery on account of its several associated benefits, including reduced likelihood of corneal ectasia, comparable long-term visual outcomes, lowered risk of flap-related complications like dislocation or infection, etc., is expected to drive the myopia market in the coming years.

IMARC Group's new report provides an exhaustive analysis of the myopia market in the United States, EU4 (Germany, Spain, Italy, and France), United Kingdom, and Japan. This includes treatment practices, in-market, and pipeline drugs, share of individual therapies, market performance across the seven major markets, market performance of key companies and their drugs, etc. The report also provides the current and future patient pool across the seven major markets. According to the report, the United States has the largest patient pool for myopia and also represents the largest market for its treatment. Furthermore, the current treatment practice/algorithm, market drivers, challenges, opportunities, reimbursement scenario, unmet medical needs, etc., have also been provided in the report. This report is a must-read for manufacturers, investors, business strategists, researchers, consultants, and all those who have any kind of stake or are planning to foray into the myopia market in any manner.

Recent Developments:

- In February 2024, Santen Pharmaceutical Co., Ltd. announced that it had applied to manufacturing and marketing approval in Japan for the product STN1012700 / DE-127 (generic name: atropine sulfate hydrate ophthalmic solution), a product designed to slow the progress of myopia.

- In October 2023, Vyluma, Inc. released positive top-line results from the second stage of its Phase III CHAMP (Childhood Atropine for Myopia Progression) clinical investigation of its lead compound, NVK002 (low-dose atropine 0.01%), a proprietary, investigational, preservative-free eye drop administered nightly to patients aged 3 to 17. After four years of therapy and follow-up, the results of this multicenter, multinational trial suggest that NVK002 continues to be a safe and effective treatment for myopia in children.

- In September 2023, Cloudbreak Therapeutics received positive feedback from the FDA regarding its application for pivotal Phase 3 clinical trials in the United States for CBT-009, a possible best-in-class therapy for the treatment of juvenile myopia.

Key Highlights:

- Myopia is the most common cause of preventable blindness worldwide.

- It is estimated that 1.4 billion individuals worldwide are affected by myopia (22.9% of the population), with crude estimations predicting that 4.7 billion people will be affected by 2050 (almost 50% of the world's population).

- Myopia is more common in East and Southeast Asia, affecting 80-90% of the population.

- In the United States, the prevalence of myopia is 42%

- Myopia is significantly more common in children aged 11-17 compared to those aged 5-10 years.

Drugs:

CBT-009, a non-aqueous atropine eye drop developed by Cloudbreak Therapeutics, is designed to slow the progression of myopia in children. It works by utilizing atropine, an anticholinergic agent, which inhibits the action of acetylcholine, a neurotransmitter, in the eye. This mechanism helps to prevent the eye from elongating, which is a primary cause of myopia.

NVK002 is an experimental, preservative-free, low-dose atropine eye drop that employs Vyluma's patented technology to improve stability, tolerance, and safety. Atropine for myopia addresses the anatomic alterations (i.e., longer ocular axial length) associated with myopia development, which are difficult to achieve using spectacles or contact lenses.

DE-127 is an eyedrop medication developed by Santen in collaboration with the Singapore Eye Research Institute (SERI), a national ophthalmic and visual research facility in Singapore. The product contains 0.025% atropine sulfate hydrate and is intended to reduce the progression of myopia. Atropine is a reversible antagonist of muscarine receptors that inhibits muscarine receptor activity, functioning directly or indirectly on the retina or sclera to prevent the thinning or stretching of the sclera, reducing the elongation of the axial length of the eye.

Time Period of the Study

- Base Year: 2024

- Historical Period: 2019-2024

- Market Forecast: 2025-2035

Countries Covered

- United States

- Germany

- France

- United Kingdom

- Italy

- Spain

- Japan

Analysis Covered Across Each Country

- Historical, current, and future epidemiology scenario

- Historical, current, and future performance of the myopia market

- Historical, current, and future performance of various therapeutic categories in the market

- Sales of various drugs across the myopia market

- Reimbursement scenario in the market

- In-market and pipeline drugs

Competitive Landscape:

This report also provides a detailed analysis of the current myopia marketed drugs and late-stage pipeline drugs.

In-Market Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

Late-Stage Pipeline Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

| Drugs | Company Name |

|---|---|

| CBT-009 | Cloudbreak Therapeutics |

| NVK002 | Vyluma |

| DE-127 | Santen Pharmaceutical |

| OT101 | Autotelic/Oncotelic Therapeutics |

*Kindly note that the drugs in the above table only represent a partial list of marketed/pipeline drugs, and the complete list has been provided in the report.

Key Questions Answered in this Report:

Market Insights

- How has the myopia market performed so far and how will it perform in the coming years?

- What are the markets shares of various therapeutic segments in 2024 and how are they expected to perform till 2035?

- What was the country-wise size of the myopia across the seven major markets in 2024 and what will it look like in 2035?

- What is the growth rate of the myopia across the seven major markets and what will be the expected growth over the next ten years?

- What are the key unmet needs in the market?

Epidemiology Insights

- What is the number of prevalent cases (2019-2035) of myopia across the seven major markets?

- What is the number of prevalent cases (2019-2035) of myopia by age across the seven major markets?

- What is the number of prevalent cases (2019-2035) of myopia by gender across the seven major markets?

- What is the number of prevalent cases (2019-2035) of myopia by type across the seven major markets?

- How many patients are diagnosed (2019-2035) with myopia across the seven major markets?

- What is the size of the myopia patient pool (2019-2024) across the seven major markets?

- What would be the forecasted patient pool (2025-2035) across the seven major markets?

- What are the key factors driving the epidemiological trend myopia of?

- What will be the growth rate of patients across the seven major markets?

Myopia: Current Treatment Scenario, Marketed Drugs and Emerging Therapies

- What are the current marketed drugs and what are their market performance?

- What are the key pipeline drugs and how are they expected to perform in the coming years?

- How safe are the current marketed drugs and what are their efficacies?

- How safe are the late-stage pipeline drugs and what are their efficacies?

- What are the current treatment guidelines for myopia drugs across the seven major markets?

- Who are the key companies in the market and what are their market shares?

- What are the key mergers and acquisitions, licensing activities, collaborations, etc. related to the myopia market?

- What are the key regulatory events related to the myopia market?

- What is the structure of clinical trial landscape by status related to the myopia market?

- What is the structure of clinical trial landscape by phase related to the myopia market?

- What is the structure of clinical trial landscape by route of administration related to the myopia market?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Request Customization

Request Customization

.webp)

.webp)