Mycelium Market Size, Share, Trends and Forecast by Product Type, Nature, Application, and Region, 2025-2033

Mycelium Market Size and Share:

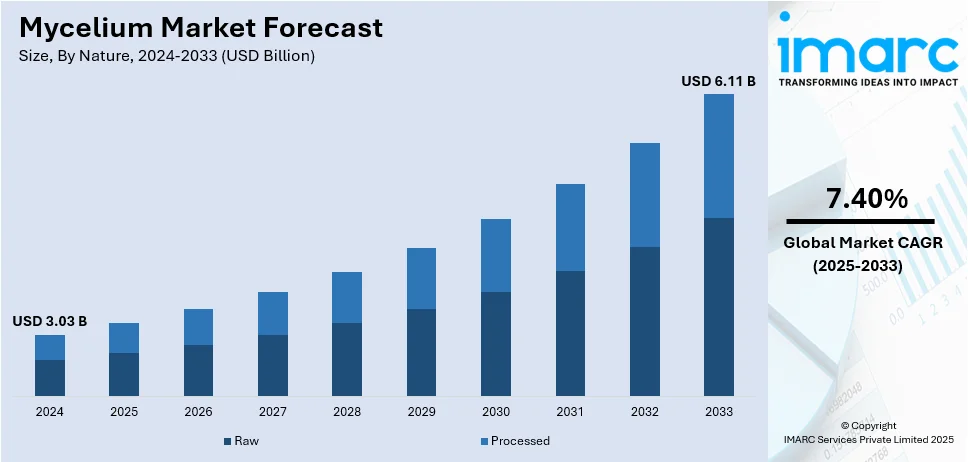

The global mycelium market size was valued at USD 3.03 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 6.11 Billion by 2033, exhibiting a CAGR of 7.40% from 2025-2033. North America currently dominates the market. The growth of the North American region is driven by strong research capabilities, government support, corporate sustainability initiatives, and the escalating demand for eco-friendly alternatives. Expanding commercial applications in food and beverage (F&B), packaging, and textiles sector are further increasing the region’s mycelium market share, strengthening its position as a leader in sustainable biomaterials.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.03 Billion |

| Market Forecast in 2033 | USD 6.11 Billion |

| Market Growth Rate (2025-2033) | 7.40% |

The shift toward eco-friendly materials is driving the adoption of mycelium in industries such as packaging, textiles, and construction. Mycelium-based composites are biodegradable, lightweight, and durable, making them viable alternatives to plastics, synthetic foams, and leather. Companies are actively integrating mycelium into supply chains to meet sustainability goals and regulatory requirements for reduced carbon footprints. In addition, the rising demand for plant-based and cell-based proteins is positioning mycelium as a key ingredient in alternative meat and dairy products. Its natural fibrous structure mimics animal muscle tissue, providing an appealing texture. Fermentation enhances its digestibility and nutritional value, making it a preferred choice for food manufacturers seeking clean-label, high-protein, and functional ingredients.

The United States is a crucial segment in the market, driven by the growing demand for sustainable protein, which is driving the adoption of mycelium-based blends. These products reduce meat consumption while preserving taste, texture, and nutritional value, appealing to both consumers and foodservice operators. Companies are leveraging fermentation technologies and strategic partnerships to scale production efficiently, ensuring affordability and accessibility. The asset-light approach, which involves collaborations with local growers, enhances sustainability by minimizing resource use and optimizing supply chains. For instance, in 2024, Mush Foods launched its 50CUT mycelium blends in the US foodservice market after a successful rollout in Israel. The firm employs solid-state fermentation and a light-asset strategy, collaborating with indoor cultivators to produce mycelium for mixing with meat. Mush Foods seeks to decrease meat intake while preserving flavor, nutrition, and cost-effectiveness.

Mycelium Market Trends:

Growing Demand for Alternative Proteins and Meat Substitutes

The rising use of mycelium as a meat substitute and alternative protein due to increasing consumer demand for plant-based and sustainable food options is bolstering the market growth. Mycelium-based proteins offer a meat-like texture, high nutritional value, and efficient production processes with minimal land and water use. Mycelium’s natural ability to mimic meat fibers without the need for extensive processing makes it a compelling alternative to soy and pea protein. Health-conscious consumers are embracing mycelium-based foods due to their high protein, fiber, and micronutrient content. As investments in alternative proteins increase, mycelium is emerging as a key player in the future of sustainable food production, competing directly with plant-based and cultivated meat solutions. In 2024, Israel’s Kinoko-Tech teamed up with Australia’s Metaphor Foods to create and market protein products made from mycelium, such as sausages and muesli bars. The firm employs solid-state fermentation, utilizing byproducts from the food industry to create sustainable, protein-rich alternatives.

Increasing Demand for Mycelium-Based Textiles

The textile industry is shifting towards mycelium-based materials due to increasing environmental concerns and demand for sustainable alternatives to traditional fabrics. These textiles offer a biodegradable and resource-efficient solution without relying on animal-derived leather or synthetic petroleum-based fibers. Mycelium-based materials require significantly less water, energy, and harmful chemicals, making them an attractive option for reducing the environmental footprint of fashion and upholstery production. Their durability, flexibility, and aesthetic appeal allow them to compete with conventional textiles while meeting sustainability targets. Additionally, brands are integrating mycelium textiles into their supply chains to align with stricter regulations on waste reduction and carbon emissions. As user preferences shift toward eco-friendly materials and industries adopt circular economy principles, mycelium-based textiles are emerging as a key component of the next generation of sustainable fashion and industrial fabrics. In 2024, Ecovative secured $28M to grow its mycelium-derived MyBacon and introduce AirLoom alternative leather through its Forager brand. The company is enhancing production capacity, improving mushroom farms, and marketing sustainable mycelium products.

Rising Applications in Construction Industry

Mycelium-based materials are gaining traction in the construction sector due to their strength, lightweight properties, and sustainability. Mycelium composites can be used for insulation panels, bricks, and acoustic materials, offering a biodegradable and fire-resistant alternative to traditional building materials. Companies are developing fungal-based materials that can replace concrete, which is responsible for significant carbon emissions. The ability of mycelium to self-assemble and grow into specific structures makes it an attractive option for modular and prefabricated buildings. Architectural firms and sustainable housing projects are integrating mycelium-based materials to reduce environmental impact and improve energy efficiency. Researchers are also exploring the use of mycelium in self-healing structures and bio-receptive facades that promote urban biodiversity. As regulatory bodies encourage greener building practices and carbon-neutral construction, mycelium-based materials are expected to have a greater influence on the future of sustainable architecture. In 2024, AGI Denim collaborated with Ecovative to produce mycelium bricks from recycled denim waste collected from consumers. The partnership demonstrates eco-friendly building materials and emphasizes mycelium’s possibilities beyond the fashion industry.

Mycelium Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global mycelium market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, nature, and application.

Analysis by Product Type:

- Pre-Formed Product

- Powder

- Tablets & Capsules

- Liquid

- Others

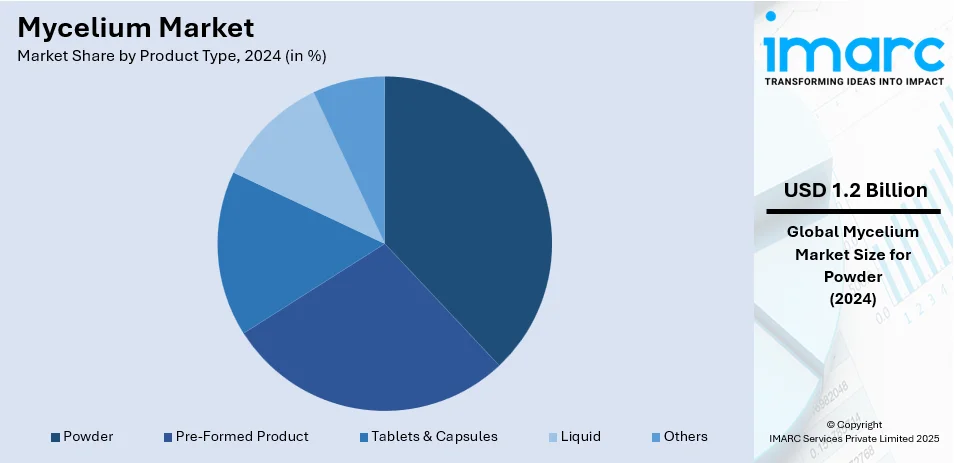

Powder represents the largest segment, accounting 38.5% in 2024. Powder exhibits a clear dominance in the market owing to its versatility, ease of incorporation, and extended shelf life. Companies are refining drying and milling processes to enhance solubility, bioavailability, and functionality across various industries. Mycelium powder is widely used in plant-based protein formulations, meat alternatives, and dairy substitutes, providing improved texture and nutritional value. Functional food and nutraceutical manufacturers are integrating mycelium powder into supplements for its possible health advantages, such as immune improvement and digestive health enhancement. The cosmetics industry is exploring mycelium-derived powders for skincare and personal care formulations due to their antioxidant and antimicrobial properties. Pharmaceutical applications involve the use of mycelium extracts in traditional and modern medicine, leveraging bioactive compounds for therapeutic effects. Companies are focusing on optimizing fermentation conditions and refining processing techniques to improve consistency and scalability. Increasing investments in research, coupled with collaborations between biotech firms and end-user industries, are strengthening market growth for mycelium powder.

Analysis by Nature:

- Raw

- Processed

Processed stands as the biggest component, holding 78.5% in 2024. Processed dominates the market due to its enhanced functionality, improved shelf stability, and expanded application range. Companies are leveraging advanced fermentation techniques, enzymatic treatments, and drying methods to refine mycelium into high-performance biomaterials. In the food and beverage industry, processed mycelium is used for meat substitutes, dairy alternatives, and functional ingredients, offering better texture, taste, and digestibility. Packaging manufacturers are utilizing processed mycelium composites to develop durable, moldable, and biodegradable materials that replace plastic and styrofoam. The fashion and textile sectors are adopting processed mycelium for sustainable leather alternatives, benefiting from its improved strength, flexibility, and water resistance. In construction, processed mycelium serves as an eco-friendly insulation and structural material with fire-resistant properties. Companies are also exploring pharmaceutical applications, incorporating bioactive compounds derived from processed mycelium into nutraceuticals and medicines. Growing corporate interest in sustainable biomaterials, along with investments in scaling production, is further driving the processed mycelium market demand.

Analysis by Application:

- Food and Beverages

- Packaging

- Clothing and Apparel

- Animal Feed

- Others

The food and beverages segment is expanding as mycelium gains traction as a sustainable protein source and texturizing agent. Companies are leveraging fermentation to develop meat substitutes, dairy alternatives, and functional ingredients with enhanced nutrition and mouthfeel. Mycelium’s fibrous structure mimics animal proteins, improving texture and sensory appeal. It also acts as a natural thickener and stabilizer in plant-based formulations.

Mycelium-based packaging is gaining popularity as an eco-friendly alternative to plastic and polystyrene. Companies are developing biodegradable and compostable materials with high durability, thermal insulation, and lightweight properties. The ability to mold mycelium into custom shapes enables applications in protective packaging, food containers, and cushioning materials. Businesses are integrating mycelium into circular economy models, ensuring minimal environmental impact through compostability.

The clothing and apparel segment is witnessing increased interest in mycelium-based textiles as an alternative to leather and synthetic materials. Companies are refining fermentation techniques to produce durable, flexible, and aesthetically appealing biomaterials that resemble traditional leather. These materials are free from animal-derived components and harsh chemicals, aligning with growing demand for ethical and sustainable fashion. Mycelium-based textiles offer breathability, lightweight properties, and biodegradability, making them suitable for footwear, bags, accessories, and apparel.

Mycelium is emerging as a nutritious and sustainable ingredient in animal feed due to its high protein content, digestibility, and functional benefits. It serves as an alternative to conventional feed protein sources, reducing dependency on soy and fishmeal. Mycelium-based feed enhances gut health, improves feed conversion ratios, and provides essential amino acids.

Others include applications in construction, pharmaceuticals, cosmetics, and biotechnology. Mycelium is gaining attention in the construction industry as an alternative to conventional insulation and composite materials, offering lightweight, fire-resistant, and biodegradable properties. In pharmaceuticals, it serves as a source of bioactive compounds for drug development, including antibiotics and immune-boosting ingredients. The cosmetics sector is incorporating mycelium-derived extracts into skincare and personal care products due to their antioxidant and antimicrobial properties. Additionally, the growing use of mycelium-based biomaterials in biomedical applications like wound healing and tissue engineering is offering a favorable mycelium market outlook.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East

- Africa

North America dominates the market due to strong research and development (R&D) capabilities, advanced biotechnology infrastructure, and increasing investments in sustainable materials. The region has a well-established ecosystem of startups, academic institutions, and investors supporting innovation in mycelium-based products. Companies are leveraging precision fermentation and bioprocess optimization to improve scalability and cost efficiency. Increasing venture capital funding and government grants are further propelling advancements, positioning North America as a leader in global mycelium-based material production and commercialization. Individual demand for eco-friendly alternatives to plastic, leather, and meat substitutes is impelling the market growth. Strategic collaborations between biotechnology firms and major brands are strengthening supply chains and increasing product availability. High awareness about environmental concerns, combined with corporate sustainability goals, is fostering widespread adoption. In 2024, San Francisco-based Gob launched compostable mycelium earplugs as a sustainable alternative to plastic versions. Developed with Ecovative, the earplugs provide balanced sound absorption and decompose within 45 days. Gob aims to expand sustainable wellness products using bio-based materials.

Key Regional Takeaways:

United States Mycelium Market Analysis

In North America, the United States accounted for 81.70% of the overall market share. The United States stands as a prominent market for mycelium-based products, fueled by significant investments in biotechnology, sustainable materials, and alternative proteins. The involvement of major players and research organizations is driving innovation, enhancing scalability, and lowering production expenses, thereby making mycelium materials more available across various sectors. Venture capital investments are driving startups that create solutions based on mycelium. Top brands are partnering with biotechnology companies to incorporate mycelium into everyday consumer goods, improving product efficiency and sustainability features. Additionally, top companies are launching creative products designed for health-minded customers looking for high-protein, fiber-dense options that have low environmental effects. Collaborations with prominent grocery chains are enhancing product availability and speeding up market entry. Sustainability assertions, such as decreased greenhouse gas emissions and lower water consumption, are additionally affecting buying choices. In 2025, Meati Foods launched mycelium-based Breakfast Patties available in Original and Maple flavors at 280 Sprouts Farmers Market locations throughout the US. The patties are made up of 98% mycelium, offering substantial amounts of protein and fiber and having no cholesterol or saturated fat. Meati highlights its focus on sustainability, claiming 89% less GHG emissions and 73% decreased water usage when compared to beef.

Europe Mycelium Market Analysis

Europe is experiencing significant growth in the market due to strict environmental regulations, strong government support for sustainable materials, and consumer awareness about ecological impact. The F&B sector is adopting mycelium-based meat substitutes, while the packaging and fashion industries are integrating mycelium into biodegradable products. Research initiatives backed by funding programs are driving advancements in fungal biotechnology. Companies are actively collaborating with sustainability-driven brands to expand applications. The region’s commitment to circular economy practices and bio-based solutions positions mycelium-based materials as key contributors to achieving long-term sustainability goals across multiple industries. In line with this, in 2024, Infinite Roots and Hamburg University of Technology were awarded a €2.6M grant by the German Ministry of Food and Agriculture to transform whey into a substrate for mycelium fermentation. The initiative seeks to minimize dairy waste while producing sustainable, high-protein food components. Infinite Roots is optimizing fermentation methods to effectively incorporate whey into mycelium production.

Asia Pacific Mycelium Market Analysis

Asia Pacific is emerging as a fast-growing market for mycelium-based products, supported by increasing focus on biotechnology advancements and the expansion of fermentation-based production is enabling cost-effective scaling of mycelium applications. Additionally, consumers in the region are becoming more environmentally conscious and health-focused, which is resulting in a shift toward plant-based foods. Mycelium, with its ability to be produced efficiently and at a low cost through biomass fermentation, presents an attractive solution for meeting the demand for sustainable, scalable protein production. This trend is further supported by investments and innovations aimed at improving the affordability and accessibility of mycelium-based products across the market. For example, in 2024, 70/30 Food Tech established its Mycelium Research Lab and obtained seed-extension funding to promote affordable mycelium-derived protein for the Asian market. The firm partners with B2B clients, such as Guaka, a Chinese restaurant chain, to provide sustainable options for animal protein. The funding aids biomass fermentation advancements aimed at scalable, economical protein generation.

Latin America Mycelium Market Analysis

Latin America’s mycelium market is expanding as industries seek sustainable alternatives for food, packaging, and agricultural applications. The region's rich biodiversity and a growing interest in fungal biotechnology are driving research and commercial production. Companies are incorporating mycelium-based proteins into plant-based diets, while packaging firms explore biodegradable solutions to reduce plastic waste. Government policies promoting sustainable agriculture and responsible resource use are further supporting the market growth in the region. Companies are investing in fermentation-based production systems to enhance local manufacturing capabilities. With increasing awareness about sustainable materials, mycelium-based products are gradually gaining market presence across multiple industries. In 2024, Furf Design Studio presented the first mycelium facade globally for Crema Lab Café located in Curitiba, Brazil.

Middle East and Africa Mycelium Market Analysis

The Middle East and Africa are witnessing a growing interest in mycelium-based products, particularly in sustainable construction, food innovation, and biodegradable packaging. The growing need for environment-friendly materials, as businesses and policymakers focus on reducing environmental impact, is positively influencing the market. For example, in 2024, ReRoot exhibited an emergency shelter made from mycelium during Dubai Design Week. Created by Dima Al Srouri and her team, the portable, weatherproof shelters are designed to provide enhanced protection. Furthermore, companies are exploring mycelium-based composites for insulation and structural materials, while the F&B sector is evaluating fungal-based proteins as viable alternatives. Research institutions and sustainability initiatives are driving awareness and pilot projects. The adoption of mycelium-based materials remains in the early stages, but with increasing investments and policy support, the market holds significant long-term potential in various industrial applications.

Competitive Landscape:

Key players in the market are focusing on scaling production, optimizing fermentation processes, and enhancing material properties to meet commercial demand. They are investing in bioreactor technology, precision fermentation, and automation to improve yield and consistency. Strategic partnerships with food, packaging, and textile companies are expanding application areas. Intellectual property development and regulatory approvals are strengthening market positions. Research efforts are directed toward improving durability, texture, and cost-efficiency of mycelium-based products. Companies are also emphasizing supply chain sustainability by integrating renewable feedstocks and reducing energy consumption. Marketing strategies highlight biodegradability and carbon footprint reduction to attract environmentally conscious individuals. For example, in 2024, MycoWorks and Paragone showcased the Mycelium Muse collection at Design Miami.Paris, featuring Reishi™-based furniture and objects by seven French women designers. The exhibition showcased mycelium's adaptability in sustainable design, merging beauty with environment-friendly craftsmanship.

The report provides a comprehensive analysis of the competitive landscape in the mycelium market with detailed profiles of all major companies, including:

- MyForest Foods Co.

- Biomyc Ltd.

- Bolt Threads

- Ecovative LLC

- Four Sigma Foods, Inc.

- Fungi Perfecti, LLC

- GROWN bio

- Meati Inc.

- MOGU S.r.l.

- MycoBee Mushrooms C.I.C.

- Mycotech Lab

- Mycoworks Inc.

Latest News and Developments:

- October 2024: Fungi Perfecti, LLC launched BrainPower Stack™, a mycelium-based brain health supplement combining Lion’s Mane mushroom with Niacin (B3) and Vitamin B12. Developed by mycologist Paul Stamets, the powder supports memory, cognition, and nerve regeneration. It is now available online and in health food stores across the US.

- July 2024: MycoWorks announced its collaboration with Cadillac to incorporate Fine Mycelium™ materials into the SOLLEI concept vehicle. This marks the first automotive application of MycoWorks' bio-based material, developed in partnership with General Motors. The innovation aligns with Cadillac’s sustainability efforts and MycoWorks' expansion into scalable, luxury-grade biomaterials.

- June 2024: MyForest Foods Co. introduced its mycelium-derived MyBacon strips on the US West Coast via online retailer Good Eggs. The item, created from organic oyster mushroom mycelium, seeks to offer a sustainable replacement for bacon.

- January 2024: The Italian biotech company Mogu secured €11 million in Series A funding to expand its business focused on mycelium-derived materials and to establish a new manufacturing facility. Soon rebranding as SQIM, the company develops sustainable alternatives for textiles, leather, interiors, and automotive applications. Investors include CDP Venture Capital, ECBF VC, and Kering Ventures.

- January 2024: German biotech company Infinite Roots raised $58M in a Series B round to scale mycelium-based products and expand production. Investors include Dr. Hans Riegel Holding, REWE Group, and Betagro Ventures.

- July 2023: MycoWorks Inc. launched three new Reishi finishes, including Doux, Natural, and Pebble, made from Fine Mycelium as a leather alternative. The company plans commercial-scale production at its new factory in Union, South Carolina.

Mycelium Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | USD Billion |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Pre-Formed Product, Powder, Tablets & Capsules, Liquid, Others |

| Natures Covered | Raw, Processed |

| Applications Covered | Food and Beverages, Packaging, Clothing and Apparel, Animal Feed, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | MyForest Foods Co., Biomyc Ltd., Bolt Threads, Ecovative LLC, Four Sigma Foods, Inc., Fungi Perfecti, LLC, GROWN bio, Meati Inc., MOGU S.r.l., MycoBee Mushrooms C.I.C., Mycotech Lab, Mycoworks Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the mycelium market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global mycelium market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the mycelium industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The mycelium market was valued at USD 3.03 Billion in 2024.

IMARC estimates the mycelium market to exhibit a CAGR of 7.40% during 2025-2033, reaching a value of USD 6.11 Billion by2033.

The mycelium market is expanding due to rising demand for sustainable materials in packaging, textiles, and alternative proteins. Advancements in fermentation technology, cost reductions, and regulatory support for biodegradable products are accelerating adoption. Increased investments in biomaterials and user preference for eco-friendly solutions are further fueling growth across F&B, construction, and healthcare industries.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the market.

Some of the major players in the mycelium market include MyForest Foods Co., Biomyc Ltd., Bolt Threads, Ecovative LLC, Four Sigma Foods, Inc., Fungi Perfecti, LLC, GROWN bio, Meati Inc., MOGU S.r.l., MycoBee Mushrooms C.I.C., Mycotech Lab, Mycoworks Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)