Multi-Mode Receiver Market Size, Share, Trends and Forecast by Fit, Sub-System, Platform, Application, and Region, 2025-2033

Multi-Mode Receiver Market Size and Share:

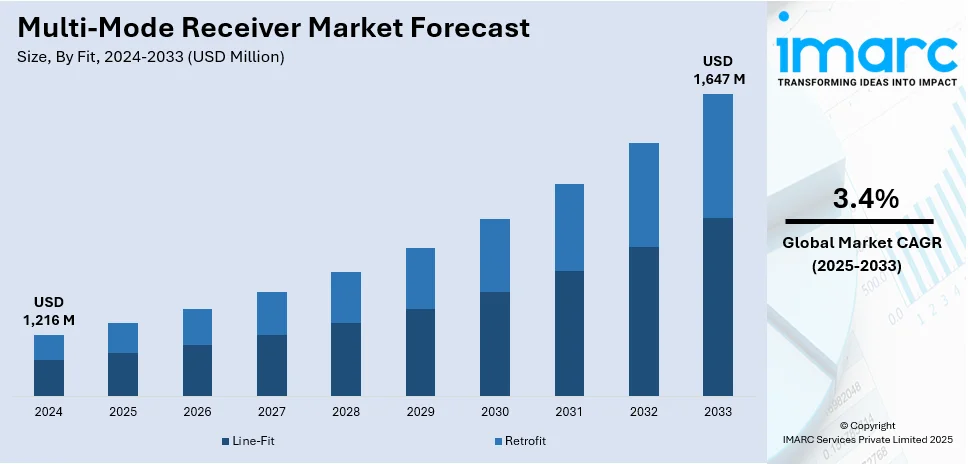

The global multi-mode receiver market size was valued at USD 1,216 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,647 Million by 2033, exhibiting a CAGR of 3.4% from 2025-2033. North America currently dominates the market, holding 34.4% of the market share in 2024. The market is primarily driven by increasing aviation advancements, defense modernization, regulatory compliance demands, cutting-edge satellite integration, enhanced navigation precision, fleet upgrades, increasing autonomous systems adoption, expanding telecommunication networks, rapid 5G deployment, and rising demand for compact, energy-efficient systems across aerospace, automotive, consumer electronics, and industrial sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1,216 Million |

|

Market Forecast in 2033

|

USD 1,647 Million |

| Market Growth Rate (2025-2033) | 3.4% |

The multi-mode receiver market is expanding due to increasing investments by airlines and defense sectors in modern avionics to ensure precision landing capabilities. Besides aviation, advancements in satellite navigation systems such as GPS modernization and compatibility with other constellations like Galileo and GLONASS are enhancing receiver performance, which is fueling broader adoption. For example, on November 29, 2024, the EU agency for the space program (EUSPA) outlined the MUGG project, which focuses on developing a multi-mode global positioning system receiver incorporating Galileo and GPS signals. This system enhances precision navigation, ensuring advanced reliability for aviation and related industries. Moreover, the increasing focus on retrofitting older aircraft with advanced systems to comply with international mandates is stimulating market growth. Additionally, continual technological advancements, such as miniaturization and improved signal processing, are enhancing performance while reducing costs, thereby making them more accessible to a wider range of applications.

The United States multi-mode receiver market is witnessing significant growth due to the increasing adoption of advanced avionics systems across commercial and military aircraft. With the rise in air traffic, airlines are upgrading their navigation systems to comply with evolving federal aviation administration (FAA) regulations, which emphasize precision and safety in air travel. Moreover, the country’s robust defense sector is driving demand for reliable and high-performance multi-mode receivers to support mission-critical operations and crewless aerial vehicles (UAVs). Furthermore, the growing integration of satellite-based augmentation systems (SBAS) and ground-based augmentation systems (GBAS) is enhancing the accuracy and reliability of multi-mode receivers, which is driving the adoption across the region. For example, American Airlines signed an agreement on April 10, 2024, with Airbus to upgrade 150 A320ceo aircraft with modern avionics systems and airframe enhancements. The upgrades include advanced weather radar for better weather prediction, a satellite-based augmentation system multi-mode receiver (SBAS MMR) for precision GPS-based navigation, and the latest air traffic services units (ATSU) for improved air-ground communication.

Multi-Mode Receiver Market Trends:

Shift Toward Integrated Solutions

The trend of bringing multichannel receivers inside of smaller, more compact units accelerates within all categories of industries. Smartphones and wearables, especially car systems, are highly influenced by the use of a multi-mode receiver for multi-standard communication, GPS/Wi-Fi/Bluetooth. According to industrial reports, the market of compact multi-mode receivers for consumer electronics will grow in the period till 2025 at a CAGR of 8.5%, driven by growing demands of consumers for connectivity and multifunctionality in equipment. Moreover, miniaturizing components has been driving further development of receivers with compact dimensions, low power consumption and cheap price, thus making mass applications possible. In the automotive industry, multi-mode receivers support advanced driver-assistance systems (ADAS) and autonomous vehicles, allowing for smooth navigation and communication between vehicles and infrastructure systems, thus increasing their adoption.

Rise in 5G Network Deployment

Expansion of 5G networks has been the biggest driver of demand for multi-mode receivers, especially in regions like North America and Asia Pacific. GSMA indicates that by September 2024, there were 2,943 announced 5G devices, with at least 2,549 being commercially available. The number of announced phones has increased by 72% since the end of 2022, indicating how fast 5G adoption is. Multi-mode receivers are becoming necessary to support the various frequency bands 5G, 4G, and legacy networks are using. Apart from supporting higher frequencies, multi-mode receivers must handle the complex combination of communication protocols used by different generations of networks. Mobile devices, base stations, and the IoT devices increasingly integrate such gadgets into their core.

Increased Adoption in Aerospace and Defense (A&D)

Adoption of multi-mode receivers in aerospace and defense applications has become more significant in the recent past. The receivers play an important role in supporting the navigation systems that require GPS, GLONASS, Galileo, and Beidou for more accurate and reliable positioning data. Multi-mode receivers enable seamless communication in various satellite and radio frequency bands in military applications. It makes military personnel achieve secure communications in all kinds of environments. According to an industrial report, the use of multi-mode receivers is expected to have a compound annual growth rate of 7.6% in the defense sector over the next five years. Besides position and navigation, these are also being used in some radar and SIGINT applications, where high sensitivity is required for weak signals. The increasing demand for high situational awareness and secure communication in military and defense operations is what drives this upward trend. The growing space industry offers significant prospects for the A&D sector. According to an industry report, this sector is expected to contribute USD 1 Trillion to growth over the next decade and is marked by innovation, startups, as well as mergers and acquisitions, bringing an exciting new dimension to the industry.

Multi-Mode Receiver Industry Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the global multi-mode receiver market report, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on fit, sub-system, platform, and application.

Analysis by Fit:

- Line-Fit

- Retrofit

Line-fit leads the market with 62.8% of the market share in 2024 as this is one of the solutions that enables easy and smooth integration of advanced receivers during the production of the new aircraft. It provides better efficiency in operations and cheaper retrofitting, which is increasing demand among aircraft manufacturers. There is steady growth in line-fit solutions due to air travel increase and modernization of fleets. Airlines and OEMs favor line-fit installation for their reliability and compliance with aviation regulations, as it aids in satellite navigation and precision landing. Growing commercial and military aviation with the technological advancements of next-generation GNSS and ILS receivers further accelerates market growth. Line-fit multi-mode receivers are also important in addressing the need of the industry to optimize performance, reduce downtime, and enhance flight safety.

Analysis by Sub-System:

- ILS Receiver

- MLS Receiver

- GLS Receiver

- VOR and DME Receiver

The ILS receiver is indispensable for precision approach and landing in low-visibility conditions. It remains one of the leading navigation sub-systems in the multi-mode receiver market due to its proven reliability and observance of global aviation standards. With the increase in air traffic and the upgrading of airport infrastructures, there is a higher demand for ILS receivers.

The MLS receivers provide precision landing features along with greater flexibility than a conventional system. It allows the curve as well as segmented approaches to help airports in complex terrains and congested airspace. A growing need for advanced solutions that offer accuracy, and decreased interference is leading to increased MLS receiver adoption.

GLS receivers have a satellite-based navigation system that supports highly precise and cost-effective landings. GLS receivers support modernized airspace operations, particularly in regions adopting performance-based navigation (PBN). Their scalability and efficiency make the GLS important for the multi-mode receiver market, where airlines and their authorities focus more on improving their operational performance, reducing cost, and attaining next-generation requirements in airspace operations.

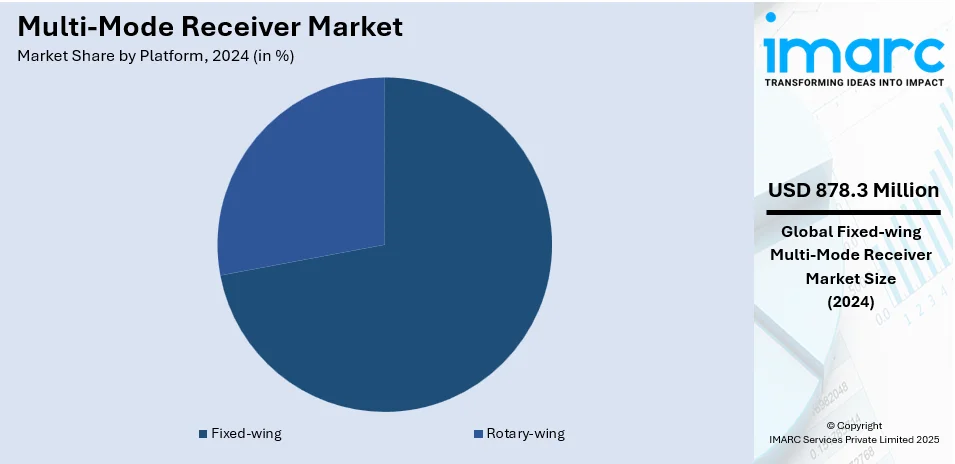

Analysis by Platform:

- Fixed-wing

- Rotary-wing

Fixed-wing platforms leads the market with 72.2% of the market share in 2021. This type of platform is a major driver for the growth of the multi-mode receiver market, especially as global air traffic continues to expand, and airlines modernize their fleets. Advanced navigation systems are necessary for fixed-wing aircraft, including commercial jets, business aviation, and military planes, to ensure operational safety, precision, and efficiency. Multi-mode receivers integrated into these platforms enable seamless access to various navigation technologies such as ILS, MLS, and GLS to ensure exact flight approaches and landings. The increasing adoption of next-generation GNSS and satellite-based navigation systems in fixed-wing aircraft drives market demand as airlines prioritize compliance with evolving airspace regulations and improved flight performance. Also, increased spending in military aerospace and automatic fixed-winging systems contributes to market growth. The increasing demand for robust and flexible avionics systems in fixed-wing platforms further solidifies their role as a major factor in the growth of the multi-mode receiver market.

Analysis by Application:

- Navigation

- Positioning

- Landing

Navigation is a key application in the multi-mode receiver market with accurate flight routing and route guidance. It integrates various systems like GNSS, ILS, and MLS for comprehensive navigation in the complex and diverse airspace environment. There is an increase in air traffic, and the need for optimized flight paths is resulting in a higher demand for advanced navigation solutions to make traveling more fuel efficient, minimize delay, and maintain regulatory compliance.

Positioning plays a major role in providing real-time accurate aircraft location throughout all the phases of flight. Multi-mode receivers use satellite-based and ground-based systems to provide continuous, reliable positioning information. This is important to air traffic management, collision avoidance, and situational awareness. Increased demand for improving safety and efficiency in performance is raising the adoption of multi-mode receivers in providing precise aircraft positions both in commercial and military flying operations.

Landing applications are critical for the multi-mode receiver market, supporting accurate and safe descent in all weather conditions. The ILS, GLS, and MLS systems-equipped receivers support precision landings at less risky conditions, with smooth flying operations even at low visibilities. The increasing need for advanced landing solutions, driven by airspace modernization and growing traffic at busy airports, is significantly expanding the market for multi-mode receivers.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share with 34.4%. The region plays a significant part in the market due to strong aviation infrastructure, high air traffic, and the presence of leading aircraft manufacturers and avionics suppliers. The region's focus on modernizing air navigation systems, along with stringent regulatory mandates from organizations like the FAA, is driving the need for advanced multi-mode receivers. The increasing adoption of next-generation navigation technologies, including GNSS, ILS, and GLS systems, is ensuring smooth and precise flight operations, thereby expanding the market. Also, commercial airlines and defense forces are increasing investments in the expansion and modernization of fleets, which is facilitating the adoption of multi-mode receivers in fixed-wing and rotary-wing aircraft. North America's commitment to optimizing airspaces and rising air travel and cargo transport demands are strengthening the market presence in the region.

Key Regional Takeaways:

United States Multi-Mode Receiver Market Analysis

In 2024, the United States accounts for 85.60% of North America multi-mode receiver market. The U.S. is one of the major regional markets, at the forefront of integrating high-level navigation systems across both military and civilian sectors. BAE Systems says the MLR-2000 and MLR-2050 multimode receivers overcome the challenges of global interoperability as the industry shifts from terrestrial-based navigation aids to satellite-based systems. The adoption of MMRs, like the MLR-2000 by the U.S. military for use in fighter jets like the F-16 and F-15, ensures accuracy in hostile environments and meets the needs of military and civilian operators worldwide. The MLR-2050, operating on the U.S. Air Force's C-17 Globemaster fleet, reflects more than 20,000 hours of reliability, demonstrating the system's capability to support ILS, MLS, and GPS modes. BAE's concentration on the joint precision approach and landing system (JPALS) further enhances U.S. military capabilities. This technological advantage places the U.S. at a leading position in advancing multi-mode receiver solutions worldwide, thus meeting the changing requirements for navigation.

Europe Multi-Mode Receiver Market Analysis

There are several demands in Europe for improvement in navigation accuracy and performance with increased air traffic; MUGG (Multi-constellation Ultra-robust Global GNSS) is such a transition by developing its very advanced DFMC SBAS receiver through the use of signals that can be combined from two constellations, i.e., GPS and Galileo, which enhance better positioning accuracy and resilience under disruptive signal conditions. The project supports the advancement of EUROCAE ED 259 minimum operational performance standards (MOPS), thus guaranteeing compliance with international norms. The innovation lies in the GLU-2100 receiver, which, on its own, combines top ARAIM and DFMC SBAS software for enhanced performance. This technology supports improved flight paths that are also fuel-efficient, reduce fuel consumption, and avoid possible delays, thus having economic as well as environmental advantages. Rigorous flight testing has validated the GLU-2100's reliability and safety, reinforcing Europe's commitment to advancing navigation standards. As global air traffic intensifies, this technology positions Europe as a leader in aviation navigation innovation.

Asia Pacific Multi-Mode Receiver Market Analysis

The multi-mode receiver market in the Asia Pacific is experiencing high growth, following extensive investments in communication infrastructure and technologies in the region. This aspect further drives the demand considering the increased focus towards further expansion of 5G networks and development of higher-performance automotive systems, majorly in ADAS. As the GSMA report Mobile Economy Asia Pacific 2022 indicates, over 400 million 5G connections are forecasted in the region by 2025; this represents just over 14% of total mobile connections. Meanwhile, the GSMA's report Mobile Economy Asia Pacific 2018 projected that by 2025, 62% of Asia's mobile connections will be on 4G networks, and 14% on 5G. Companies like Huawei and Samsung are leading the technological wave in this industry. In addition, the industry is expanding due to growing popularity of consumer electronics. Strategic partnerships and joint ventures are helping accelerate advancements, placing Asia Pacific as a significant player in the multi-mode receiver market.

Latin America Multi-Mode Receiver Market Analysis

In Latin America, the multi-mode receiver market has grown at a high rate based on the increasing demand for advanced infrastructure in telecommunications and further expansion of 4G and 5G networks. It said the GSMA's Mobile Economy Latin America 2024 report foresees 5G adoption covering 14 percent of total mobile connections in Latin America by 2025 and up to 2030, for around nearly 60% of all mobile connections. This revolution in connectivity would stimulate and fuel innovation and the shift towards new economies in automobiles, healthcare, and other consumer electronics segments. This growth is capitalized on by the leaders of telecommunications and technology firms in the marketplace, which also boosts demand for multi-mode receivers in supporting next-generation communication services.

Middle East and Africa Multi-Mode Receiver Market Analysis

The multi-mode receiver market in the Middle East and Africa is growing with investments in defense, telecommunications, and smart city projects. According to GSMA's Mobile Economy Middle East and North Africa 2024 report, the adoption of 5G in the MENA region is expected to take a leap from 2025 and cover half of the region's population by 2030. On 4G availability, GSMA's State of Mobile Internet Connectivity Report 2023 suggests that in the MENA region, high-income countries have higher mobile internet adoption at 75%, compared to 48% in low- and middle-income countries in the region. Inmarsat and ST Electronics are major drivers for change in wireless communication advancement. These companies support rising demands in multi-mode receivers within the region. The region focuses on infrastructure development and digital transformation, thereby driving growth in communication technologies.

Competitive Landscape:

The competitive landscape of the market is characterized by intense competition driven by technological advancements and increasing demand for advanced navigation systems. Market participants are focusing on innovation to enhance reliability, accuracy, and compatibility with multiple navigation systems. Companies are investing in research and development to integrate next-generation features, such as satellite-based augmentation systems and dual-frequency capabilities, to meet evolving aviation standards. Strategic partnerships, product differentiation, and regional expansions are key strategies adopted to gain market share. Price competition and regulatory compliance further shape the market dynamics.

The report provides a comprehensive analysis of the competitive landscape in the global multi-mode receiver market with detailed profiles of all major companies, including:

- BAE Systems

- Collins Aerospace

- Honeywell International Inc.

- Leonardo S.p.A.

- Saab AB

- Thales Group

Recent Developments:

- December 2024: Honeywell revealed that Avianca chose its avionics and mechanical systems for its new Airbus A320neo fleet to optimize operational performance. The list comprises Honeywell's 131-9A APUs, Pegasus II A320 FMS, IntuVue RDR-4000 weather radar, TCAS, and the Integrated Multi-Mode Receiver, enhancing navigation and situational awareness for pilots.

- December 2024: Saab announced that the company has received a USD 48 Million order from BAE Systems to supply multiple Giraffe 4A radar systems for the US Air Forces in Europe. The long-range surveillance and Air Base Air Defense capability will be enhanced by deliveries in 2027 that are to be supplied through the U.S. as well as Sweden.

- November 2024: Quectel presented SC682A multi-mode smart LTE module at Electronica 2024. This has LTE Cat 4, Wi-Fi, Bluetooth 5.1, and dualband GNSS support and a built-in operating system that varies from Android 13-18. They provide for the customers an extended lifetime cycle till 2030 by ensuring a smooth migration.

- November 2024: Raytheon, a business of RTX, has received a contract from the U.S. Army for developing wireless power beaming technology. The innovation promises to extend operational reach and improve logistics in manned and unmanned systems.

- October 2024: BAE Systems announced the award of a five-year contract for USD 460 million in funding from the U.S. Army for the AN/ARC-231/A Multi-mode Aviation Radio Set (MARS).

Multi-Mode Receiver Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fits Covered | Line-Fit, Retrofit |

| Sub-Systems Covered | ILS Receiver, MLS Receiver, GLS Receiver, VOR and DME Receiver |

| Platforms Covered | Fixed-wing, Rotary-wing |

| Applications Covered | Navigation, Positioning, Landing |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | BAE Systems, Collins Aerospace, Honeywell International Inc., Leonardo S.p.A., Saab AB, Thales Group, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the multi-mode receiver market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global multi-mode receiver market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the multi-mode receiver industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

A multi-mode receiver (MMR) is an integrated navigation system that combines multiple technologies, such as ILS, MLS, GLS, and GNSS. It enables seamless communication and navigation, ensuring precision, efficiency, and safety across all flight phases, from takeoff to landing.

The multi-mode receiver market was valued at USD 1,216 Million in 2024.

IMARC estimates the global multi-mode receiver market to exhibit a CAGR of 3.4% during 2025-2033.

The key drivers include rising air traffic, modernization of airspace infrastructure, fleet expansion, and regulatory mandates for advanced navigation systems. Increasing demand for next-generation GNSS, ILS, and GLS technologies is also fueling market growth globally.

According to the report, line-fit represented the largest segment, driven by increasing demand for factory-installed navigation systems, reduced retrofitting costs, and compliance with evolving aviation safety regulations.

Fixed-wing leads the market by platform due to high demand for commercial and military aircraft, ongoing fleet modernization, and the need for advanced navigation systems to enhance safety, efficiency, and operational performance.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global multi-mode receiver market include BAE Systems, Collins Aerospace, Honeywell International Inc., Leonardo S.p.A., Saab AB and Thales Group, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)