Multi-Factor Authentication Market Size, Share, Trends and Forecast by Model, Deployment Type, Application, Vertical, and Region, 2025-2033

Multi-Factor Authentication Market Size and Share:

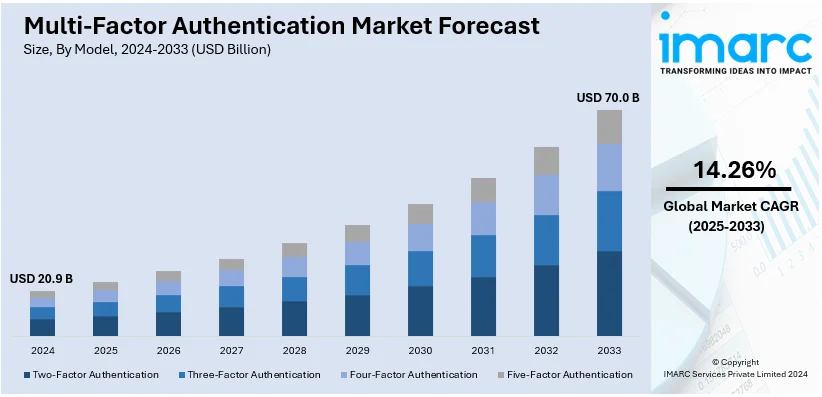

The global multi-factor authentication market size was valued at USD 15.4 Billion in 2022. Looking forward, IMARC Group estimates the market to reach USD 70.0 Billion by 2033, exhibiting a CAGR of 14.26% from 2025-2033. North America currently dominates the market, holding a market share of over 32.7% in 2024. The growing focus on data privacy and security regulations, rising demand for advanced cybersecurity to reduce fraud, and increasing awareness about the importance of securing remote access are some of the major factors propelling the MFA market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 20.9 Billion |

|

Market Forecast in 2033

|

USD 70.0 Billion |

| Market Growth Rate (2025-2033) | 14.26% |

The global market is primarily driven by the increasing nature and intensity of cyberattacks, particularly in developing economies. Cyber Crime Statistics 2024 recently reported that in the year 2022, global economy has suffered a loss of about USD 7 Trillion through cybercrime and expected to reach as high as USD 10.5 Trillion by 2025 with an average cost of a breach being USD 4.35 Million. Among the 900 companies that were surveyed, 66% reported that ransomware and data theft were the most significant threats, followed by supply chain attacks at 60%, and DDoS attacks at 59%. Remote work and cloud services are also creating new risks, and it is forcing organizations to implement MFA as a means of protecting sensitive data and ensuring regulatory compliance. Biometric solutions include facial recognition and fingerprint scanning that enhance security and user experience. AI and machine learning remain an ever-changing area of advancement which continuously makes adaptive authentication more efficient and hence fosters adoption in all industries.

The United States is a key regional market and is majorly expanding due to stringent regulations in healthcare, finance, and government emphasizing data protection. The increasing demand for strong cybersecurity came in with the rising digital transformation and cloud service adoption. The presence of advanced persistent threats and ransomware necessitates multi-layered security. Biometrics such as iris and voice further enhance the security and also the comfort of the user. Significantly, on September 3, 2024, NEC Corporation introduced the biometric authentication system for Japan, the United States, and Singapore, authenticating up to 100 users per minute. The system uses NEC's advanced face recognition and movement analysis technology to swiftly identify individuals, even in crowded areas. Its integration with diverse applications augments efficiency and security. The increasing integration of MFA with Internet of Things (IoT) devices and smart technologies enhances security frameworks, enabling seamless authentication across connected ecosystems, driving adoption in both enterprise and consumer sectors.

Multi-Factor Authentication Market Trends:

Rising demand for advanced cybersecurity

Demand is mounting with growing expectations in advanced cybersecurity to decrease threats and crimes, which supports market growth. Additionally, these new cyber threats pose a grave danger to all organizations, as cybercrime is rising fast. These cyber thieves increasingly apply ways and methods for retrieving valuable information from people. For example, as cybercrime is going to cost the world USD 10.5 Trillion every year by 2025, MFA becomes essential to mitigate such increasing risks as it provides layers of protection against expensive cyber threats. In addition to this, MFA is a vital solution that fights these risks by providing an extra layer of protection against unauthorized access. The growth of the market is due to various companies investing fast in advanced cybersecurity solutions to secure their data, protect their customers, maintain their reputation, and prevent huge financial losses.

Increasing focus on data privacy and security regulations

The increasing focus on data privacy among various business organizations across the globe is propelling the growth of the market. In line with this, governing agencies and various private organizations of several countries are implementing stringent measures to protect sensitive information. In addition, compliance with these regulations is not optional but it is legally required. Apart from this, MFA is a fundamental component of compliance efforts, as it significantly enhances data security. According to report by IBM and Ponemon Institute study reveals that the global average cost of a data breach in 2024 is USD 4.88 Million, with breaches involving shadow data accounting for one in three incidents. Multi-Factor Authentication, along with security AI and automation, can help reduce breach costs by up to USD 2.22 Million, enhancing data security. Organizations are implementing MFA to mitigate the risk of data breaches and ensure the privacy of personal and sensitive data as it can result in severe financial penalties and lower the reputation of an organization.

Growing awareness about the importance of securing remote access

The rising awareness about the importance of securing remote access is impelling the growth of the market. In addition, there is an increase in the popularity of remote working in various organizations across the globe. According to U.S. Bureau of Labor Statistics, the rise in remote work, with a 14.9% increase in remote workers from 2019 to 2021, is positively correlated with a 1.2 percentage-point boost in industry-level TFP, highlighting the role of Multi-Factor Authentication (MFA) in securing productivity growth. Over 2019-22, the 11.8% rise in remote workers led to a 1.1 percentage-point increase in TFP, highlighting the value of robust security measures in supporting remote work efficiency. Besides this, MFA is an essential tool that ensures only authorized individuals can access critical systems and data. Moreover, there is a rise in chances of expanded cybercriminals as employees access corporate networks and sensitive data from various locations. The increasing demand for MFA solutions as organizations adapt to remote work arrangements is contributing to the growth of the market. Employers recognize that securing remote access is essential in maintaining the operational continuity of a business.

Multi-Factor Authentication Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global multi-factor authentication market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on model, deployment type, application and vertical.

Analysis by Model:

- Two-Factor Authentication

- Three-Factor Authentication

- Four-Factor Authentication

- Five-Factor Authentication

Two-factor authentication stands as the largest component in 2024, holding around 76.9% of the market. It refers to a security process which requires two separate factors that authenticate users to gain access into any system, account, or application. These two factors may fall into three categories including a password, smartphone, or hardware token, and biometric data like fingerprint. Any two of the factors combined render 2FA significantly more secure compared to a password. This approach eliminates the weaknesses typical of password-based authentication, including weak passwords or password reuse.

Analysis by Deployment Type:

- On-Premises

- On-Cloud

On-premises deployment dominate the market share in 2024. It refers to the installation and management of authentication systems within the physical infrastructure of an organization rather than relying on cloud-based or off-site solutions. It provides organizations with complete control over their authentication systems and allows them to tailor security measures to their specific needs and compliance requirements. This level of control is especially crucial for industries with stringent data security regulations, such as finance and healthcare. Furthermore, on-premises deployment often offers enhanced security as sensitive authentication data remains within the own secure network of organization, which reduces exposure to external threats.

Analysis by Application:

- Smart Card Authentication

- Phone-Based Authentication

- Hardware OTP Token Authentication

Phone-based authentication leads the market share in 2024, as it offers a convenient and secure means of verifying user identities. It leverages mobile devices, such as smartphones, as a key component in the authentication process. It typically involves the generation of one-time passwords (OTP) or the use of mobile apps to validate the identity of users. OTPs are sent via short message service (SMS), voice calls, or generated by mobile apps. This authentication method is highly versatile and widely adopted across industries. It is commonly used to secure online accounts, mobile banking, and two-factor authentication (2FA) for various applications.

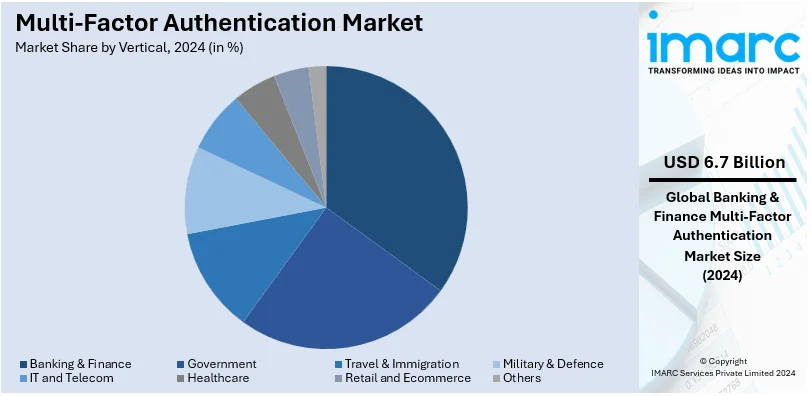

Analysis by Vertical:

- Banking & Finance

- Government

- Travel & Immigration

- Military & Defence

- IT and Telecom

- Healthcare

- Retail and Ecommerce

- Others

Banking and finance lead the market with around 32.3% of market share in 2024. The banking and finance sector is one of the most security-conscious industries due to its responsibility for managing and protecting vast amounts of monetary assets and personal information. Authentication methods like MFA and biometrics are extensively deployed to secure online banking, mobile banking apps, and transactions. MFA adds an extra layer of protection that assists in preventing losses. Moreover, biometric authentication, such as fingerprint recognition and facial recognition, is increasingly used in this sector due to its high level of security and convenience. It ensures that only authorized individuals can access accounts and conduct financial transactions.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

- Middle East and Africa

- Turkey

- Saudi Arabia

- Iran

- United Arab Emirates

- Others

In 2024, North America accounted for the largest market share of over 32.7%. North America is increasing the adoption of advanced authentication methods. In addition, the rising focus on security to protect the vast amounts of financial data is strengthening the growth of the market in the region. Apart from this, the growing demand for MFA due to stringent data protection regulations is positively influencing the market. In line with this, the increasing number of data breaches is supporting the growth of the market in the North America region.

Key Regional Takeaways:

United States Multi-Factor Authentication Market Analysis

In 2024, the United States holds 89.50% of the North America multi-factor authentication market. The driving factors behind the growth of multi-factor authentication (MFA) in the United States are primarily rooted in the increasing need for enhanced cybersecurity measures across various sectors. According to reports, around 1 in 10 US organizations lacks insurance against cyberattacks and 53.35 Million citizen were impacted by cybercrime in the first half of 2022, this rising threat highlights the importance of robust security measures. Multi-factor authentication (MFA) offers a critical defense, significantly reducing the risk of unauthorized access and potential data breaches. With cyberattacks becoming more sophisticated, including phishing, ransomware, and data breaches, organizations are prioritizing MFA as a critical security tool to safeguard sensitive data. Regulatory compliance, such as with GDPR and CCPA, further propels the demand for robust authentication methods to protect consumer information. The rise in remote work also escalated the necessity of MFA to secure access to organizational systems from different locations. Moreover, the growing adoption of cloud-based services and digital banking has heightened concerns over unauthorized access, creating a significant push for MFA solutions. The widespread use of mobile devices and IoT also amplifies vulnerabilities, driving the need for stronger authentication methods. As the digital transformation of businesses accelerates, the integration of MFA is becoming a standard part of the security framework, reinforcing the importance of user verification in an increasingly interconnected world. Thus, the combination of evolving cyber threats, legal requirements, and technological advancements are key drivers in the adoption of MFA solutions in the United States.

Europe Multi-Factor Authentication Market Analysis

In Europe, the driving factors behind the widespread adoption of multi-factor authentication (MFA) are heavily influenced by stringent data protection regulations, such as the General Data Protection Regulation (GDPR). Organizations across Europe are required to ensure that they implement the highest standards of security to protect personal data, making MFA an essential tool for compliance. The growing reliance on digital services, especially in sectors like banking, finance, and healthcare, amplifies the need for strong authentication practices to prevent fraud and unauthorized access. Europe’s sophisticated digital infrastructure and high internet penetration further fuel MFA adoption, as businesses and consumers seek to ensure the security of their online transactions. According to reports, as of early 2024, Germany had 77.7 Million internet users and 121.0 Million mobile connections, highlighting a strong mobile adoption rate. This growing mobile app usage presents significant opportunities for enhancing multi-factor authentication, offering more secure and accessible methods for user verification across platforms. Additionally, the increasing number of data breaches and identity theft incidents in the region escalated the demand for more robust security mechanisms. As companies adopt cloud-based solutions and migrate to digital platforms, MFA acts as a crucial line of defense against evolving security threats. Furthermore, a high level of consumer awareness about privacy and data security encourages businesses to prioritize MFA to safeguard customer information and maintain trust. With a strong regulatory environment and a focus on data protection, Europe’s commitment to cybersecurity is a significant driver for the continued rise of MFA implementation across various industries.

Asia Pacific Multi-Factor Authentication Market Analysis

In the Asia-Pacific region, the rapid digital transformation across industries plays a crucial role in the push for multi-factor authentication (MFA). As businesses move towards digital solutions, ensuring robust security is essential to protect both consumer data and corporate networks. The region's heavy reliance on mobile devices, coupled with increasing internet penetration, makes MFA a vital component in securing mobile-based applications, banking services, and online transactions. According to reports, the total number of app users in India surpassed 148 Million in 2021, with 116.6 Million non-paying and 31.4 Million paying users. This growing mobile app market, with high growth in 2022, highlights the increasing demand for secure mobile experiences, making Multi-Factor Authentication (MFA) essential for safeguarding user data and enhancing security. Growing concerns over personal data theft and the rise in cyber incidents drive enterprises to adopt MFA to safeguard sensitive information. The diverse regulatory frameworks across countries in Asia-Pacific also contribute to the MFA rise, with several nations implementing data protection and privacy regulations that necessitate stronger authentication measures. Furthermore, industries like finance, healthcare, and government are increasingly required to comply with stricter security protocols, fostering wider MFA adoption. As organizations seek to prevent unauthorized access and identity fraud, MFA has become an essential safeguard, enabling secure user authentication, and building trust with customers in this dynamic region.

Latin America Multi-Factor Authentication Market Analysis

In Latin America, the growing concerns about the rise in fraud and identity theft have significantly driven the adoption of multi-factor authentication (MFA). As the region increasingly adopts mobile banking and e-commerce platforms, the need for robust security measures to protect transactions and user data has become critical. For instance, Brazil, commanding 57% of Latin America's e-commerce sales, is a key player in the region's digital growth. As e-commerce expands, Multi-Factor Authentication (MFA) becomes crucial for securing online transactions, ensuring consumer trust and safety in the digital marketplace. Governments are also implementing stricter data protection regulations, which have further encouraged the adoption of MFA. The rise of online services and the surge in digital payments have created new vulnerabilities, compelling organizations to prioritize authentication solutions. Additionally, local businesses, especially in the financial and retail sectors, are increasingly recognizing MFA as essential for securing customer trust.

Middle East and Africa Multi-Factor Authentication Market Analysis

In the Middle East and Africa, the growth of the mobile economy and the rising trend of mobile banking have driven the adoption of multi-factor authentication (MFA). For instance, mobile banking usage increased 35% over the year to March 2019, with 90% of UAE residents now banking online, highlighting the growing need for robust Multi-Factor Authentication (MFA) to secure mobile transactions. This trend, driven by near-total smartphone penetration, underscores the importance of MFA in ensuring secure access to financial services. With many consumers accessing financial services and government-related services via smartphones, securing mobile transactions has become a priority. Additionally, as digital infrastructures expand, organizations are implementing MFA to prevent unauthorized access to critical systems. Regulatory frameworks in the region are shifting, encouraging businesses to strengthen their security practices, including MFA, to comply with data protection standards. Furthermore, the increasing prevalence of cyber threats is prompting businesses to adopt MFA solutions to safeguard user credentials and maintain trust in digital services.

Competitive Landscape:

Continuous developments in authentication methods, such as mobile-based authentication, behavioral analytics, and biometrics with facial recognition and fingerprint scanning, are made by the key players in order to provide more secure options to customers and be more user-friendly. Moreover, they are ensuring their MFA solutions integrate easily with a variety of applications, systems, and devices. It enables greater user experience and reduces barriers to MFA adoption within enterprise IT environments. In addition to that, many MFA service providers are providing cloud-based services that provide scalability and flexibility for business needs. Further, companies are investing in upgrading the security features in their MFA solutions as an investment in protecting against emergent threats. In addition to this, they are focusing on data protection regulations.

The report provides a comprehensive analysis of the competitive landscape in the multi-factor authentication market with detailed profiles of all major companies, including:

- Deepnet Security

- Duo Security (Cisco Systems, Inc.)

- Fujitsu Limited

- HID Global Corporation (Assa Abloy AB)

- NEC Corporation

- Okta, Inc.

- OneSpan Inc.

- Ping Identity Corporation (Thoma Bravo)

- RSA Security LLC

- SecurEnvoy Limited (Shearwater Group plc)

- Symantec Corporation (Broadcom Limited)

- Thales Group

Latest News and Developments:

- March 2024: Identiv Inc. introduced ScrambleFactor, a new high-security physical access control system designed for the federal market. The ScrambleFactor reader integrates fingerprint biometrics with an LCD touchscreen keypad, offering multiple authentication methods. This product is built to enhance security, speed, and convenience, focusing on the specific needs of federal agencies. It is part of Identiv's broader efforts to improve digital security on the Internet of Things (IoT) domain.

- March 2024: Intercede launched MyID MFA (multi-factor authentication) 5.0, the latest version of their digital identity management solution. The upgrade enhances security by offering a range of phishing-resistant MFA options, including OTPs, mobile apps, syncable FIDO passkeys, and biometric-secured hardware devices. This version supports both on-premise and cloud applications, along with Windows desktop logins, ensuring robust protection across various platforms. The solution aims to raise the bar for digital identity management and security for organizations.

- November 2021: SecureAuth acquired Acceptto, a leader in passwordless authentication, to advance its AI-driven continuous authentication solutions. This acquisition bolstered SecureAuth's mission to provide more user-friendly, password-free login options. By integrating Acceptto’s technology, SecureAuth aimed to enhance its identity and access management offerings. The acquisition positioned SecureAuth as a key player in simplifying secure user authentication for businesses.

- May 2021: Microsoft Corp. introduced new initiatives to combat rising cyber threats, focusing on providing advanced multifactor authentication (MFA) and enhanced security for customers. These measures aim to protect users against large-scale cyberattacks. The company emphasized its commitment to reinforcing the security of businesses, especially amid the growing sophistication of cyber threats. The announcement underscored the importance of proactive cybersecurity strategies in the digital age.

- March 2020: Ping Identity Corporation (Thoma Bravo) launched its PingID multi-factor authentication (MFA) solution on the AWS marketplace, offering enterprises an easy way to secure remote work. This cloud-based solution was designed to enhance security while also increasing employee productivity. It became a valuable tool for organizations adjusting to the remote work paradigm, enabling secure access for users. The move demonstrated Ping Identity's focus on supporting businesses with seamless security measures.

Multi-Factor Authentication Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Models Covered | Two-Factor Authentication, Three-Factor Authentication, Four-Factor Authentication, Five-Factor Authentication |

| Deployment Types Covered | On-Premises, On-Cloud |

| Applications Covered | Smart Card Authentication, Phone-Based Authentication, Hardware OTP Token Authentication |

| Verticals Covered | Banking and Finance, Government, Travel and Immigration, Military and Defence, IT and Telecom, Healthcare, Retail and Ecommerce, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico, Argentina, Colombia, Chile, Peru, Turkey, Saudi Arabia, Iran, United Arab Emirates |

| Companies Covered | Deepnet Security, Duo Security (Cisco Systems, Inc.), Fujitsu Limited, HID Global Corporation (Assa Abloy AB), NEC Corporation, Okta, Inc., OneSpan Inc., Ping Identity Corporation (Thoma Bravo), RSA Security LLC, SecurEnvoy Limited (Shearwater Group plc), Symantec Corporation (Broadcom Limited), Thales Group, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the multi-factor authentication market from 2019-2033.

- The research report study provides the latest information on the market drivers, challenges, and opportunities in the global multi-factor authentication market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the multi-factor authentication industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The multi-factor authentication market was valued at USD 20.9 Billion in 2024.

The multi-factor authentication market is projected to exhibit a CAGR of 14.26% during 2025-2033, reaching a value of USD 70.0 Billion by 2033.

The market is driven by the increasing frequency of cyberattacks, stringent data protection regulations, adoption of remote work, cloud services, and the growing need for biometric authentication solutions. Rising investments in artificial intelligence (AI) based adaptive authentication and integration with IoT devices further enhance security and efficiency, thereby supporting market growth.

North America currently dominates the multi-factor authentication market, accounting for a share of 32.7% in 2024. The dominance is fueled by stringent data security regulations, widespread digital transformation, increasing cyber threats, and robust adoption of advanced authentication technologies across industries.

Some of the major players in the multi-factor authentication market include Deepnet Security, Duo Security (Cisco Systems, Inc.), Fujitsu Limited, HID Global Corporation (Assa Abloy AB), NEC Corporation, Okta, Inc., OneSpan Inc., Ping Identity Corporation (Thoma Bravo), RSA Security LLC, SecurEnvoy Limited (Shearwater Group plc), Symantec Corporation (Broadcom Limited), and Thales Group, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)