Motor Control Centers Market Size, Share, Trends, and Forecast by Type, Voltage, Component, End-Use Sector, and Region, 2025-2033

Motor Control Centers Market Size and Trends:

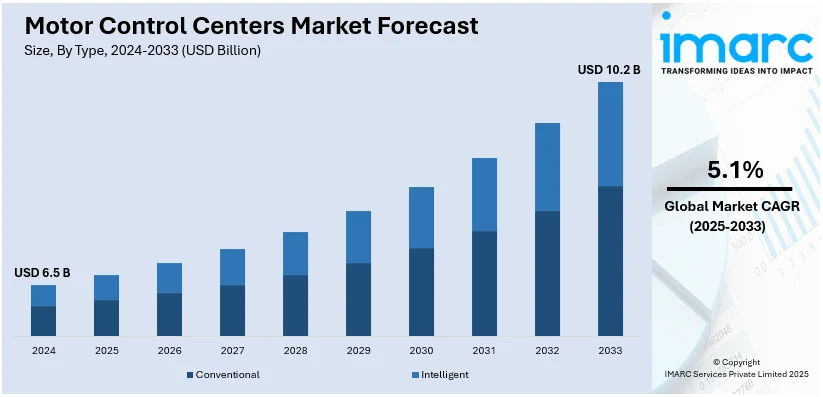

The global motor control centers market size was valued at USD 6.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 10.2 Billion by 2033, exhibiting a CAGR of 5.1% during 2025-2033. Asia Pacific currently dominates the market, holding a significant motor control centers market share of over 35.3% in 2024. The market is driven by the increasing demand for energy-efficient and automated systems across industries, such as manufacturing, oil & gas, and utilities. Advancements in smart technologies, rising industrial automation, and the need for centralized control systems is contributing positively to the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6.5 Billion |

|

Market Forecast in 2033

|

USD 10.2 Billion |

| Market Growth Rate (2025-2033) | 5.1% |

The key drivers in the motor control centers (MCC) market include the growing demand for industrial automation across sectors like manufacturing, oil & gas, and utilities. MCCs are crucial for efficient motor control and protection enabling enhanced productivity and reduced downtime. The increasing focus on energy efficiency, safety standards, and predictive maintenance is fueling the market growth. For instance, in October 2024, Siemens announced the launch of the SIMOCODE M-CP a next-generation motor management system for motor control centers. Featuring a compact design Single Pair Ethernet communication and scalable functionalities through licensable features, it optimizes space and reduces installation costs while enhancing operational efficiency and sustainability with improved diagnostic capabilities. Technological advancements, such as integrated smart sensors, IoT, and automation, further advance MCC adoption to better monitor and control processes.

The key drivers in the United States motor control centers market include the rapid growth of industrial automation across manufacturing, energy, and utility sectors. The demand for more efficient motor management and energy savings is pushing the adoption of advanced MCC solutions. Strict safety regulations and the need for system reliability and reduced downtime also contribute to market growth. The increasing trend toward digitalization and smart technologies such as IoT integration and predictive maintenance further boosts the motor control centers market demand.

Motor Control Centers Market Trends:

Infrastructure Development and Urbanization

The growing demand for infrastructure development, mainly in emerging economies, is an important driver of the MCCs market. For instance, sectors such as construction, transportation, and utilities increasingly use MCCs for efficient motor control and electrical distribution for crucial operations. Rising urbanization needs reliable solutions to back the development of new facilities, water treatment plants, and power grids. The world's infrastructure investment requirements are projected to reach USD 94 Trillion by 2040. The United Nations' Sustainable Development Goals for electricity and water will require an additional USD 3.5 Trillion. Such ambitious targets emphasize the rising demand for sophisticated MCCs in enabling energy efficiency and operational reliability across a wide range of infrastructure projects. With increasing urbanization, MCCs are widely being used for smart grids, transportation systems, and the management of sustainable water to ensure orderly expansion and growth.

Compliance with Stringent Safety and Performance Regulations

Stringent regulations will be a prime growth driver in the low-voltage MCCs market as they are aimed at guaranteeing the reliability, safety, and efficiency of such systems within any industry. MCCs must follow numerous national and international standards set to meet benchmark levels of performance and safety. For example, the National Electrical Code in the United States sets rigorous electrical safety codes for MCC installation. International Electrotechnical Commission 60439 provides global standard guidelines on low-voltage switchgear and control gear assemblies regarding design, construction, and testing. It also creates end-users' confidence, as they get assurance regarding quality and performance from the MCC in critical applications. The MCC's demand keeps rising as more industries are moving forward with operations with a concern for operational safety and regulatory compliance, further encouraging the need for MCC designed accordingly, resulting in advancements in innovation in the market.

Rising Product Innovation

Global companies have been the catalyst for motor control centers market growth as they now introduce new innovative features in low-voltage motors. For example, ABB, one of the major players, launched its IEC (LV) flameproof motors in 2019, which are provided in frame sizes 80-132. These motor products offer a level of safety and efficiency more commonly associated with the company's larger products. Designed specifically for hazardous and explosive environments, including offshore oil rigs in the oil and gas industry, these motors address key operational challenges. With robust performance and compliance with stringent safety regulations, these motors underscore the focus of the market on technological advancement tailored to specific industry needs. Such innovations enhance the versatility and reliability of motor control solutions, driving adoption across industries like oil and gas, chemicals, and manufacturing, and contributing to the sustained growth of the low-voltage Motor Control Centers (MCCs) market globally. These motor control centers market trends are contributing positively to the market growth.

Motor Control Centers Industry Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the global motor control centers market report, along with forecasts at the global, regional and country level from 2025-2033. Our report has categorized the market based on type, voltage, component, and end-use sector.

Analysis by Type:

- Conventional

- Intelligent

Conventional leads the market with around 66.0% of market share in 2024. The MCC market is dominated by conventional MCCs which are applied in most industries because of their simplicity, reliability and cost-effectiveness. The systems consist of centralized enclosures housing various motor control units including starters, contactors and overload relays which makes them appropriate for controlling and protecting multiple motors. The conventional MCCs are preferred in manufacturing, oil and gas and water treatment industries where standard motor control solutions are sufficient without the need for advanced automation. Their ability to accommodate various motor types, ease of maintenance and proven operational efficiency drive their adoption ensuring their leading position in the MCC market.

Analysis by Voltage:

- Low Voltage

- Medium Voltage

Low voltage leads the market with around 72.6% of motor control centers market share in 2024. Low-voltage motor control centers (LV MCCs) lead the market as they are highly used in industries that require motor control for applications operating at voltages below 1,000 volts. Such systems are usually applied in manufacturing, commercial buildings, water treatment plants and food processing where smaller motors are predominant. LV MCCs are preferred due to their affordability, safety features and ease of installation and maintenance. They offer scalability and compatibility with energy-efficient technologies such as variable frequency drives and smart components making them a versatile choice. Their widespread applicability ensures they maintain a leading position by voltage segment.

Analysis by Component:

- Overload Relays

- Circuit Breakers & Fuses

- Soft Starter

- Busbars

- Variable Speed Drives

- Others

Based on motor control centers market forecast, busbars lead the market with around 23.8% of market share in 2024. Busbars dominate the MCC market by component due to their critical role in efficiently distributing electrical power within MCC systems. These conductive bars typically made of copper or aluminum offer high conductivity, durability and minimal energy loss making them essential for managing power distribution across multiple motor control units. Busbars are preferred by manufacturing, oil and gas and utilities industries due to their compact design, ease of installation and superior heat dissipation compared to traditional wiring. Their compatibility with modern MCC designs including intelligent and low-voltage systems drives their demand cementing their leadership in the market by component.

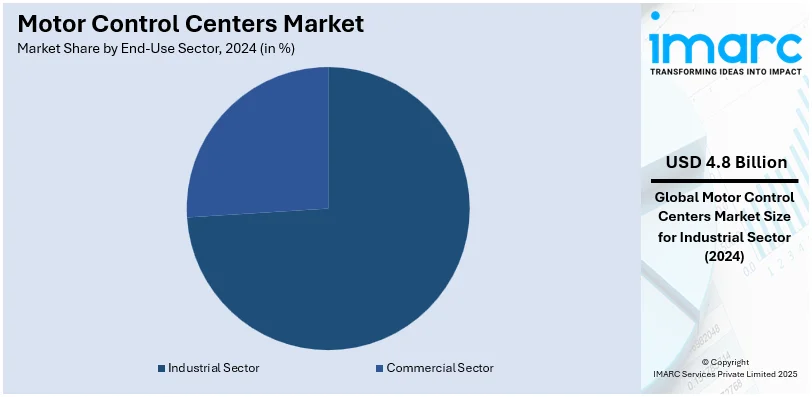

Analysis by End-Use Sector:

- Industrial Sector

- Commercial Sector

Industrial sector leads the market with around 73.7% of market share in 2024. The industrial sector leads the Motor Control Centers (MCC) market by end-use sector because of its significant dependency on motor-driven systems for many applications. Industries such as manufacturing, oil and gas, chemicals, mining and water treatment widely utilize MCCs for the control and protection of motors critical to their operations. Such sectors require efficient power distribution, motor control and fault management to ensure continuous operation and productivity. With increased adoption of automation and the need for energy-efficient solutions the MCCs have become more relevant in industrial applications. The robustness, scalability and reliability of MCCs make them an indispensable part of the industrial sector thereby solidifying its leading position.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

- Middle East and Africa

- Turkey

- Saudi Arabia

- Iran

- United Arab Emirates

- Others

In 2024, Asia Pacific accounted for the largest market share of over 35.3%. The Asia Pacific region accounted for the largest share of the Motor Control Centers (MCC) market driven by rapid industrialization, urbanization and infrastructure development. Countries like China, India and Japan are major contributors with robust growth in industries such as manufacturing, construction, energy and utilities. The region's increasing focus on renewable energy projects and smart grid implementation further boosts demand for MCCs. The expanding oil and gas sector, along with rising investments in industrial automation supports market growth. Competitive manufacturing costs and the presence of numerous MCC manufacturers in the region further solidify Asia Pacific's dominant market position.

Key Regional Takeaways:

North America Motor Control Centers Market Analysis

The North America Motor Control Centers (MCCs) market is witnessing significant growth driven by a robust industrial base and increasing focus on energy efficiency. The region's manufacturing sector is adopting advanced motor control technologies to optimize operations and reduce energy consumption. Government initiatives promoting clean energy and infrastructure modernization are further propelling the demand for MCCs in renewable energy projects and smart grid systems. The growing adoption of industrial automation and digitalization across various industries is enhancing the need for advanced MCC solutions. With an emphasis on sustainability and operational efficiency the North America MCC market is set to expand steadily supported by technological advancements and industry innovations. These factors are creating positive motor control centers market outlook further across the region.

United States Motor Control Centers Market Analysis

United States Motor Control Centers (MCCs) is a highly emerging market with robust growth potential as the manufacturing sector has performed extremely well, while infrastructure investment is ongoing. Manufacturing contributed USD 2.3 Trillion to the U.S. GDP in 2023, making up 10.2%, thus proving a growing need for motor control solutions within all sectors, as per reports. Further to that, the Bipartisan Infrastructure Law by the U.S. government boosts the growth even more as it allocated USD 62 Billion to the Department of Energy. The funding of 60 new programs with existing ones aims to modernize the energy infrastructure in terms of the power grid and renewable energy facilities to boost a clean energy economy. As energy efficiency and sustainability become the focal point, the demand for advanced MCCs to optimize energy usage and reduce operational costs becomes a necessity. These developments, along with the country's industrial and energy sector demands, create a strong foundation for the continued expansion of the MCC market in the United States.

Europe Motor Control Centers Market Analysis

The Europe motor control centers (MCCs) market growth is driven majorly by a strong manufacturing industry and ambitious EU climate goals, with the Europe Union adopting, in 2021, the first European Climate Law, stating that it aimed to achieve its climate neutrality at 2050 and reduce emission by 55% by the year 2030 compared with 1990 levels. These goals are pushing industries to adopt energy-efficient solutions, such as advanced MCCs, to optimize energy consumption and reduce their environmental footprint. According to an industry report, the manufacturing sector, which contributed Euros 8.3 Trillion (USD 8.5 Trillion) (a 16% increase from 2020) to the EU's business economy, remains a key driver of MCC demand. This sector's focus on sustainability and automation, coupled with investments in energy-efficient technologies, further supports the growing adoption of MCCs. The EU's dedication to a clean energy transition and emissions reduction, combined with industrial advancements, positions the region for continued growth in MCCs, making Europe a significant market for these technologies.

Latin America Motor Control Centers Market Analysis

The Latin America Motor Control Centers (MCCs) market is growing due to the increasing renewable energy sector in the region, especially in solar power. In 2022, Brazil added nearly 11 GW of solar photovoltaic (PV) capacity, doubling its growth from 2021, according to the International Energy Agency (IEA). This rapid expansion in renewable energy capacity is creating a significant demand for motor control centers to manage and optimize energy generation and distribution in solar facilities. As Brazil and other Latin American countries continue to invest in renewable energy infrastructure, the need for efficient, reliable MCCs to support these operations will increase. It further extends to a myriad of applications where the MCC is becoming an important integration in several industries, especially as Latin American industries embrace sustainability-oriented technologies through efficient energy uses in manufacturing, water treatment, and utilities, marking another trend to MCCs, thus underpinning the increasingly relevant role in shifting to cleaner energy options for the region.

Middle East and Africa Motor Control Centers Market Analysis

The Middle East and Africa (MEA) motor control centers (MCCs) market is growing due to the region's commitment to sustainable energy and industrial modernization. The UAE Energy Strategy 2050, for instance, seeks to triple the proportion of renewable sources by 2030 by investing AED 150 to AED 200 Billion (USD 40.8 Billion to USD 54.4 Billion) during that time as an attempt at coping with exponentially growing demand fuelled by expansion. For solar and wind sources of renewable energy, advanced MCCs will be needed for energy distribution, control, and monitoring to ensure that renewable power plants are reliable and operate at maximum performance. On the other hand, the rising infrastructure projects within the UAE along with industrial automation in manufacturing, oil and gas sectors, and utility sectors will necessitate more use of MCCs. As the region pursues energy diversification and industrial efficiency, the MCC market will continue to grow, supported by innovations in motor control solutions and regulatory incentives.

Competitive Landscape:

The Motor Control Centers (MCCs) market is characterized by intense competition with key players focusing on technological advancements, product innovation and strategic partnerships to strengthen their market position. Companies are prioritizing the development of energy-efficient and intelligent MCC solutions to meet the growing demand for sustainability and automation across industries. Mergers, acquisitions and collaborations are common strategies to expand product portfolios and geographical reach. Market players are investing in research and development to integrate digital technologies such as IoT and AI into MCC systems enabling real-time monitoring and control. Customization and after-sales services are also vital competitive differentiators.

The report provides a comprehensive analysis of the competitive landscape in the motor control centers market with detailed profiles of all major companies, including:

- ABB

- Atmel Corporation

- Eaton Corporation

- Fuji Electric Co.

- General Electric

- Larsen & Toubro

- Mitsubishi Electric

- Rockwell Automation

- Schneider Electric

- Siemens AG

- TESCO Controls Inc.

- WEG Industries

Latest News and Developments:

- June 2024: Siemens signed an agreement with Egypt's Electro George, one of the country's major companies, to enter the Egyptian market with high-performance low-voltage power distribution solutions. This alliance is set to improve efficiency and reliability in multiple applications. Electro George will act as a technology partner for the SIVACON Main Distribution Board and Motor Control Center for Siemens, delivering state-of-the-art LV technology to local industries.

- May 2024: Eaton, a power management company, has acquired Exertherm, a UK-based thermal monitoring solutions provider. Exertherm's technology monitors continuous temperature in electrical components like switchgear and transformers and gives early failure warnings. Eaton will incorporate this technology into its Brightlayer software, which will help customers enhance operational efficiency and business outcomes.

- April 2024: Rockwell Automation presented the new generation low voltage MCC, called FLEXLINE 3500, at Hannover Messe. The center has been engineered to increase efficiency in production through the integration with smart devices in real-time monitoring and diagnostics. It is based on a modular structure that provides different industry demands with reduced power consumption when matched with smart variable frequency drives. FLEXLINE 3500 follows global IEC standards; hence, safety has been maximized, as well as downtimes, and reduced costs.

Motor Control Centers Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Conventional, Intelligent |

| Voltages Covered | Low Voltage, Medium Voltage |

| Components Covered | Overload Relays, Circuit Breakers & Fuses, Soft Starter, Busbars, Variable Speed Drives, Others |

| End-Use Sectors Covered | Industrial Sector, Commercial Sector |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico, Argentina, Colombia, Chile, Peru, Turkey, Saudi Arabia, Iran, United Arab Emirates |

| Companies Covered | ABB, Atmel Corporation, Eaton Corporation, Fuji Electric Co., General Electric, Larsen & Toubro, Mitsubishi Electric, Rockwell Automation, Schneider Electric, Siemens AG, TESCO Controls Inc. and WEG Industries |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the motor control centers market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global motor control centers market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the motor control centers industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global motor control centers market reached a value of USD 6.5 Billion in 2024.

According to the estimates by IMARC Group, the global motor control centers market is expected to exhibit a CAGR of 5.1% during 2025-2033.

The market is experiencing growth on account of the increasing trend of automation in industrial processes, along with the escalating demand for reliable electricity supply and maximizing safety in the transmission and distribution (T&D) network.

Several initiatives are currently being undertaken in numerous countries to upgrade the existing power infrastructure to meet energy requirements. Additionally, the leading players are introducing smart motor control centers to expand their consumer base.

The market is experiencing a negative impact on account of lockdowns imposed by governments of numerous countries as a response to the mass spread of COVID-19. The non-essential activities have been halted, which has interrupted the operations of several manufacturing units worldwide.

On the basis of the type, the market has been bifurcated into conventional and intelligent motor control centers. Among these, conventional exhibits a clear dominance in the market.

Based on the voltage, the market has been bifurcated into low and medium voltage motor control centers. Currently, low voltage represents the largest market share.

Based on the component, the market has been classified into overload relays, circuit breakers & fuses, soft starters, busbars, variable speed drives, and others. Among these, busbars accounts for the majority of the total market share.

On the basis of the end-use sector, the market has been divided into the industrial and commercial sectors. Among these, industrial sector exhibits a clear dominance in the market.

On the geographical front, the market has been segmented into North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia and others); Europe (the United Kingdom, Germany, France, Italy, Spain, Russia and others); Latin America (Brazil, Mexico, Argentina, Colombia, Chile, Peru and others); and the Middle East and Africa (the United Arab Emirates Turkey, Saudi Arabia, Iran and others). where Asia Pacific currently dominates the market.

Leading industry players are ABB Group, Atmel Corporation, Eaton Corporation Plc, Fuji Electric Co., Ltd., General Electric Company, Larsen & Toubro Limited, Mitsubishi Electric Corporation, Rockwell Automation, Inc., Schneider Electric SE, Siemens AG, TESCO Controls, Inc. and WEG Industries.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)