Monel Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025 Edition

Monel Price Trend, Index and Forecast

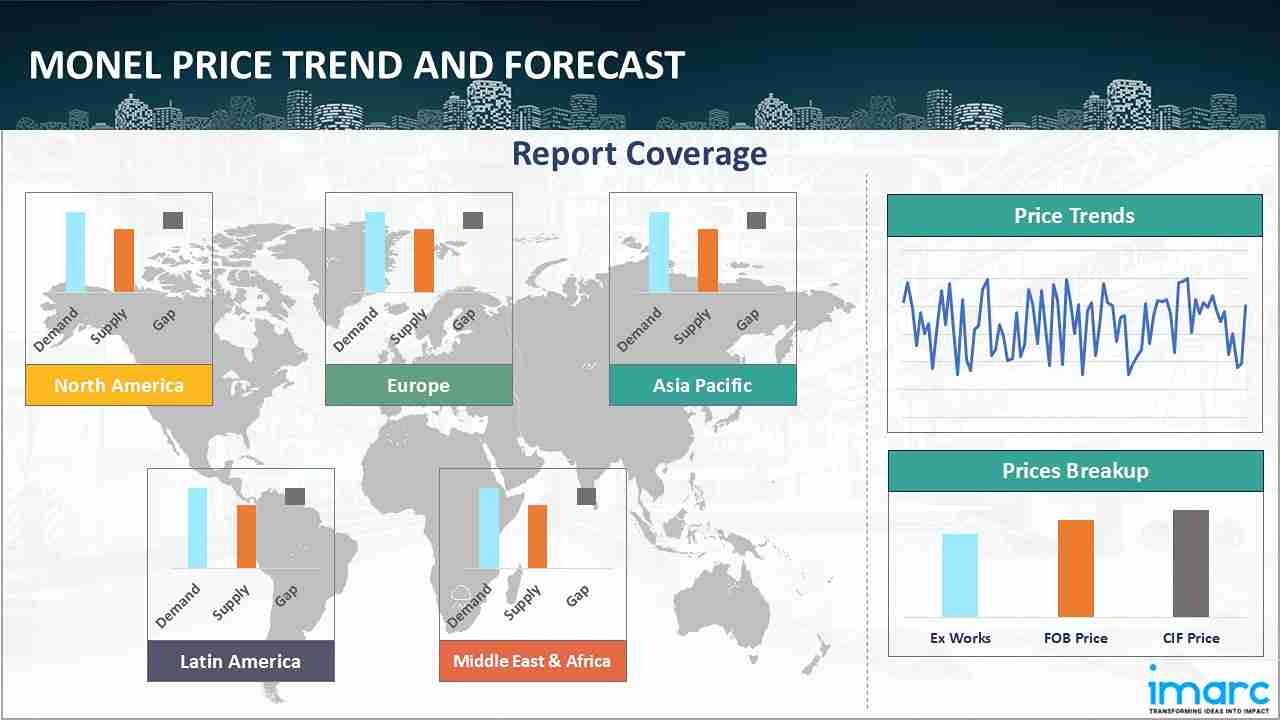

Track the latest insights on monel price trend and forecast with detailed analysis of regional fluctuations and market dynamics across North America, Latin America, Central Europe, Western Europe, Eastern Europe, Middle East, North Africa, West Africa, Central and Southern Africa, Central Asia, Southeast Asia, South Asia, East Asia, and Oceania.

Monel Prices Outlook Q2 2025

- USA: US$ 45772/MT

- Japan: US$ 47767/MT

- Germany: US$ 40980/MT

- UAE: US$ 41618/MT

- India: US$ 44240/MT

Monel Price Chart

Get real-time access to monthly/quaterly/yearly prices, Request Sample

During the second quarter of 2025, the monel prices in the USA reached 45772 USD/MT in June. In the USA, monel pricing was influenced by nickel and copper feedstock cost trends, shaped by global mining output and refined metal supply. Demand from the aerospace, marine engineering, and chemical processing sectors remained a key driver for procurement activity. Domestic production was steady, though maintenance at certain alloy manufacturing facilities affected short-term supply dynamics. Export orders from Europe and Asia increased logistical coordination needs, with freight and port handling costs contributing to delivered prices. Currency movements also impacted the competitiveness of exports, while environmental compliance requirements added to production-related expenses.

During the second quarter of 2025, monel prices in Japan reached 47767 USD/MT in June. In Japan, monel pricing was guided by feedstock cost variations, particularly in nickel sourced from Southeast Asia and copper from global markets. Demand from the shipbuilding, chemical processing, and electronics sectors supported stable procurement, while domestic alloy production was shaped by energy and labor cost changes. Import costs were influenced by exchange rate movements against the US dollar, as well as maritime freight charges. Strategic stockpiling by certain industrial buyers to mitigate supply chain risks contributed to fluctuations in short-term market liquidity, while regional competition for raw materials affected sourcing contracts.

During the second quarter of 2025, the monel prices in Germany reached 40980 USD/MT in June. In Germany, monel pricing reflected the interplay between raw material costs for nickel and copper and strong demand from the chemical, aerospace, and marine equipment sectors. Supply availability was shaped by import flows from the USA and Asia, influenced by shipping lead times and European port congestion. Domestic alloy fabrication was affected by energy tariffs and labor input costs, with environmental regulations adding to production expenses. Competitive pressure from alternative corrosion-resistant alloys in specific applications influenced purchasing strategies, while currency parity shifts with the US dollar altered import cost structures.

During the second quarter of 2025, the monel prices in the UAE reached 41618 USD/MT in June. In the UAE, monel pricing was influenced by raw material procurement costs, with nickel largely sourced from international suppliers and copper imports channeled through Asian and African markets. Demand from the offshore oil and gas, desalination, and marine engineering sectors supported steady consumption. Import costs were impacted by shipping freight rates and regional port handling charges. Currency stability against the US dollar moderated exchange-related volatility, while infrastructure investments in the energy sector maintained steady downstream usage. Competition for raw materials with other Gulf Cooperation Council states influenced contractual negotiations with suppliers.

During the second quarter of 2025, the monel prices in India reached 44240 USD/MT in June. In India, monel pricing was shaped by fluctuations in nickel and copper costs, driven by global mining output and trade flows from Indonesia, Australia, and Africa. Demand from the marine, petrochemical, and defense manufacturing sectors underpinned procurement levels. Domestic alloy production faced variations in energy and labor costs, while imports were affected by exchange rate movements and maritime freight charges. Seasonal project activity in coastal infrastructure and shipbuilding increased consumption in certain months, while competition from alternative nickel-based alloys influenced buyer preference in specific industrial applications.

Monel Prices Outlook Q1 2025

- USA: US$ 44960/MT

- Japan: US$ 47060/MT

- Germany: US$ 42075/MT

- UAE: US$ 42295/MT

- India: US$ 43500/MT

During the first quarter of 2025, the monel prices in the USA reached 44960 USD/MT in March. In Q1 2025, monel prices in the USA were influenced by volatile nickel prices, which affected alloy production costs. Domestic demand remained firm across the aerospace and marine sectors, while supply constraints emerged from limited melting capacity and extended lead times at foundries. Import volumes from Asia decreased due to trade bottlenecks, and labor shortages in fabrication units added further cost-side pressures.

During the first quarter of 2025, monel prices in Japan reached 47060 USD/MT in March. Monel pricing in Japan during Q1 2025 reflected high sensitivity to global nickel market trends, especially amid tight supply from key Southeast Asian producers. Local demand from electronics and chemical processing industries remained stable. Yen depreciation against major currencies increased import costs, while rising energy prices affected domestic production margins. Inventory restocking cycles also influenced bulk purchasing behavior among manufacturers.

During the first quarter of 2025, the monel prices in Germany reached 42075 USD/MT in March. In Germany, monel prices in Q1 2025 were driven by increased production costs linked to elevated nickel input prices and energy surcharges. Demand from the defense and chemical processing sectors remained consistent, but fabrication lead times extended due to labor constraints. Environmental regulations raised compliance costs for alloy processing. Import flow disruptions from Asian suppliers added to localized supply tension, especially for precision grades.

During the first quarter of 2025, the monel prices in the UAE reached 42295 USD/MT in March. Monel pricing in the UAE during Q1 2025 was impacted by infrastructure and desalination sector demand. Import dependence on European and Asian suppliers exposed buyers to global nickel volatility and logistical delays. Currency stability helped offset some cost increases, but local fabrication costs rose due to limited machining capacity and higher utility expenses. Construction timelines also drove sporadic bulk procurement activity.

During the first quarter of 2025, the monel prices in India reached 43500 USD/MT in March. In India, monel prices in Q1 2025 were shaped by strong demand from the chemical and marine equipment sectors. Global nickel price fluctuations directly affected raw material sourcing costs. Import duties and logistics constraints added to procurement challenges, especially for high-specification grades. Domestic production remained limited, increasing reliance on imports from East Asia. Exchange rate movements further impacted landed costs for buyers.

Monel Prices Outlook Q4 2024

- United States: US$ 44,099/MT

- Germany: US$ 39,963/MT

- Japan: US$ 41,588/MT

During the last quarter of 2024, the monel prices in the United States reached 44,099 USD/MT in December. The market saw price fluctuations influenced by falling nickel costs and economic challenges. The construction sector grew moderately but was constrained by high interest rates while manufacturing contracted. Market participants faced pressures from oversupply, inflation, and cautious consumer sentiment, requiring strategic adjustments.

In the last quarter of 2024, monel prices in Germany reached 39,963 USD/MT in December. The market experienced volatility, driven by fluctuating raw material prices and weak demand. German manufacturing remained in contraction, with the construction sector hindered by labor shortages. Supply challenges and geopolitical concerns added to uncertainty, though year-end stabilization provided a cautious outlook.

During the last quarter of 2024, monel pricing in Japan reached 41,588 USD/MT in December. The market faced downward pressure due to oversupply and weak demand, with prices declining before stabilizing. The manufacturing sector contracted, impacted by surplus nickel supply and geopolitical uncertainties. However, increased construction activity and business transactions in the service sector offered a glimmer of recovery.

Monel Prices Outlook Q3 2024

- United States: US$ 42,000/MT

- Germany: US$ 40,347/MT

- Japan: US$ 37,700/MT

- United Arab Emirates: US$ 40,430/MT

The monel prices in the United States for Q3 2024 reached 42,000 USD/MT in September. Prices of monel were severely affected by a slowdown across multiple sectors. Reduced production volumes and a drop in fresh orders have created a cautious atmosphere amongst market players. The expected rebound in requirements is hindered by continuous geopolitical instability and fluctuating industry sentiment. Q3 largely exhibited a steady downward pricing trend throughout, with a significant drop compared to Q2 and a recorded decrease between the former and latter halves of Q3.

The price trend for monel in Germany for Q3 2024 settled at 40,347 USD/MT in September. The country experienced notable fluctuations in prices, with a pronounced drop compared to Q2. Throughout the period, the industry maintained a pessimistic sentiment, showing a steady to negative landscape. The overall movement pointed to a slow seasonal improvement, hindered by economic disruptions and reduced requirements from major industries, including automotive. Regardless of some changes in prices, the overall landscape was unfavorable, showcasing the difficult industry environment for monel in the third quarter of 2024.

In Japan, the monel prices for Q3 2024 reached 37,700 USD/MT in September. Supply network disruptions, like seaport traffic and limited transportation volumes, strained prices. Prices dropped significantly in the country compared to Q2, with a pronounced decrease between the former and latter halves of Q3. By the end of the period, monel prices reflected a difficult landscape characterized by continuous declines.

The prices for caprolactam for Q3 in the United Arab Emirates settled at 40,430 USD/MT in September. The country experienced an ongoing decline in the price of monel during the period. The overarching pricing trend reflected a pessimistic outlook, with prices consistently decreasing. When compared to Q3 2023, prices showed a significant drop, highlighting the difficult market conditions. In addition to this, prices decreased significantly from Q2 2024, further illustrating the ongoing declining trajectory. By the end of the quarter, monel prices reinforced the prevailing negative pricing landscape across the region.

Monel Prices Outlook Q2 2024

- United States: US$ 46,361/MT

- Japan: US$ 44,823/MT

- Germany: US$ 40,509/MT

- Saudi Arabia: US$ 43,852/MT

The monel prices in the United States for Q2 2024 reached 46,361 USD/MT in June. The country experienced significant fluctuations in prices. Several factors contributed to this, including increasing supply volumes, weaker-than-anticipated requirements from major industries, and ongoing transportation network disruptions. Seasonal patterns and shifting user sentiments in the automotive sector also played a role, further driving down the prices of monel. Overall, the pricing trend continued to decrease, with a notable drop compared to Q1 2024 and a further decline in the latter part of the period.

The price trend for monel in Japan for Q2 2024 settled at 44,823 USD/MT in June. The country experienced notable price fluctuations, displaying a distinctly negative trend. Prices have consistently declined, influenced by high supply volumes and weak requirements, in the automotive industry, in particular. Seasonal trends also contributed to the downward trajectory, with a sharp decrease in purchasing behavior aligned with year-end financial adjustments. When compared to Q2 2023, the industry has significantly weakened, highlighting the persistent economic difficulties.

In Germany, the monel prices for Q2 2024 reached 40,509 USD/MT in June. The country saw the largest price fluctuations in the European market, with an evident declining trajectory. This downturn was driven by a combination of seasonal factors and ongoing challenges in key industries. The slowdown in construction activity, combined with difficulties in the automotive sector, was particularly evident, contributing to the steady fall in prices of monel. Moreover, prices declined from Q1, with a notable decrease observed between the former and latter halves of Q2, underscoring the challenging market conditions.

The prices for caprolactam for Q2 in Saudi Arabia settled at 43,852 USD/MT in June. The country witnessed considerable changes in prices, with an overall downward trajectory reflecting the regional pricing trends.

Monel Prices Outlook Q4 2023

- USA: US$ 59,060/MT

- Japan: US$ 45,544/MT

- Germany: US$ 45,940/MT

- UAE: US$ 38,345/MT

The monel prices in the United States for Q4 2023 reached 59,060 USD/MT in December. In the USA, monel prices fell through the fourth quarter of 2023, starting high because of demand from automotive and chemical sectors and limited materials like Nickel. By December, increased inventories and a drop in downstream demand pushed prices lower. Severe winter weather and policy uncertainties also dampened market activity, affecting spot prices.

The price trend for monel in Japan for Q4 2023, reached 45,544 USD/MT in December. The market witnessed a price decrease due to subdued demand in automotive and chemical sectors and oversupply. Increased local production and disrupted global trade routes further strained the market.

The price trend for monel in Germany for Q4 2023, reached 45,940 USD/MT in December. Germany's monel prices in the fourth quarter of 2023 fluctuated, initially rising due to strong demand in chemical and automotive sectors but later declining amid oversupply. Market shifts were influenced by the EU's carbon tax debates, declining EV sales, and a transition towards green steel, contributing to decreased demand for traditional Monel products.

The price trend for monel in UAE for Q4 2023, reached 38,345 USD/MT in December. The market experienced a mild decline in the fourth quarter of 2023, driven by reduced local demand and increased supply from Asia. An extended export ban on scrap materials and disruptions in global trade routes influenced the market.

Regional Coverage

The report provides a detailed analysis of the market across different regions, each with unique pricing dynamics influenced by localized market conditions, supply chain intricacies, and geopolitical factors. This includes price trends, price forecast and supply and demand trends for each region, along with spot prices by major ports. The report also provides coverage of FOB and CIF prices, as well as the key factors influencing the monel prices.

Global Monel Price Trend

The report offers a holistic view of the global monel pricing trends in the form of monel price charts, reflecting the worldwide interplay of supply-demand balances, international trade policies, and overarching economic factors that shape the market on a macro level. This comprehensive analysis not only highlights current price levels but also provides insights into historical price of monel, enabling stakeholders to understand past fluctuations and their underlying causes. The report also delves into price forecast models, projecting future price movements based on a variety of indicators such as expected changes in supply chain dynamics, anticipated policy shifts, and emerging market trends. By examining these factors, the report equips industry participants with the necessary tools to make informed strategic decisions, manage risks, and capitalize on market opportunities. Furthermore, it includes a detailed monel demand analysis, breaking down regional variations and identifying key drivers specific to each geographic market, thus offering a nuanced understanding of the global pricing landscape.

North America Monel Price Trend

Q2 2025:

As per the monel price index, in North America, monel pricing reflected raw material cost dynamics, particularly in nickel and copper sourced from domestic and international suppliers. Demand was supported by the aerospace, defense, and oil and gas sectors, while localized supply constraints emerged due to scheduled maintenance in alloy production facilities. Export activity to Europe and Asia influenced availability for domestic buyers, with logistics costs shaped by freight rates and port handling fees. Currency stability limited exchange-related cost fluctuations, though competitive sourcing from alternative corrosion-resistant alloys affected long-term purchasing commitments in certain industries.

Q1 2025:

As per the monel price index, in Q1 2025, monel pricing in North America during Q1 2025 reflected high raw material costs, particularly for nickel and copper. Strong demand from defense and offshore industries drove steady procurement, while manufacturing faced logistical disruptions and longer lead times. Imports were affected by lower volumes from Asian producers. Labor constraints at fabrication plants and tight domestic inventory also contributed to upward pricing pressure.

Q4 2024:

In the last quarter of 2024, the monel market in North America saw notable fluctuations, driven by volatile raw material costs and shifting demand patterns. A sharp decline in nickel prices led to an initial price drop, followed by brief stabilization. However, economic pressures and an oversupply of materials contributed to a further downturn by year-end. The construction sector saw moderate growth but remained constrained by high interest rates and economic uncertainty, while the manufacturing industry continued contracting, reducing demand. Producers grappled with inflationary pressures, export slowdowns, and cautious consumer behavior, forcing strategic adaptations to navigate the challenging market landscape.

Q3 2024:

In Q3 2024, prices of monel in the North American market witnessed a notable decrease, with the most pronounced changes occurring in the United States. This decline was driven by several factors, including an oversupply of the material, reduced requirements from major sectors such as manufacturing and construction, and volatility in feedstock costs. Q3 ended with the monel market exhibiting unfavorable pricing conditions across the region.

Q2 2024:

Throughout the second quarter of 2024, monel prices in North America saw a considerable drop, largely due to significant changes in supply-demand factors. The industry witnessed a downturn driven by high supply volumes and fluctuations in feedstock prices, worsened by international pressures and issues in major feedstock-manufacturing areas. Transportation expenses also rose due to longer shipment times and higher costs for sea freightage, contributing to overall instability. Although production remained steady, the industry grappled with excess supplies, resulting in a negative market outlook.

Q4 2023:

During Q4 2023, monel prices in North America fell notably. Initially, in October, high demand from the automotive and chemical sectors and limited availability of materials like steel scraps and nickel kept prices elevated. By November, increase in production and decreased consumption led to a downturn. Further declines in December were influenced by heightened inventory levels and subdued demand. Severe weather, winter holidays, and policy uncertainties around electric vehicles also affected market activity in the U.S. spot market.

Specific monel historical data within the United States and Canada can also be provided.

| Region | Countries Covered |

|---|---|

| North America | United States and Canada |

Asia Pacific Monel Price Trend

Q2 2025:

In the Asia Pacific, monel pricing was guided by regional nickel and copper market conditions, with key sourcing from Indonesia, the Philippines, and Australia. Consumption was sustained by the shipbuilding, petrochemical, and electronics sectors, while domestic production costs were impacted by energy pricing and labor trends. Import costs were influenced by maritime freight rates and currency exchange movements against the US dollar. Strategic stockpiling by industrial buyers in some countries increased short-term demand, while competition from stainless steel and alternative nickel alloys affected material selection for certain projects.

Q1 2025:

In Asia Pacific, monel prices in Q1 2025 were shaped by mixed demand trends across industrial and marine applications. China’s export restrictions on nickel alloys and Southeast Asia’s limited output impacted regional availability. Rising energy and feedstock costs strained manufacturing margins, especially in India and South Korea. Currency volatility and freight delays added further complexity to cross-border procurement in the region.

Q4 2024:

The APAC region in the monel market experienced a turbulent Q4 2024, shaped by fluctuating prices and economic pressures. Oversupply and weak consumer demand led to consecutive declines before stabilizing in December. The Japanese manufacturing sector continued to contract, weighed down by a surplus in nickel supply and geopolitical uncertainties affecting the steel industry. Despite this, a slight rise in construction activity and increased business transactions in the service sector provided some optimism. Producers faced ongoing supply and demand imbalances, necessitating adaptive strategies to navigate inflationary pressures and operational challenges in an evolving market environment.

Q3 2024:

Throughout Q3 2024, monel prices in Asia Pacific experienced a significant decrease due to numerous contributing conditions. Shifts in feedstock rates had a major impact on pricing. The industry also faced challenges from increased imports, oversupply, and reduced requirements from numerous sectors. Furthermore, international economic variability, subdued industrial activity, and diminished exports all played a role in the continued decline in prices of monel.

Q2 2024:

During the second quarter of 2024, prices of monel in Asia Pacific witnessed a downward trajectory, primarily driven by disruptions in international supply networks and shifting requirement patterns. Several circumstances impacted monel prices during the quarter, such as international pressures, fluctuations in nickel mining activities, and unstable transportation rates. Reduced production of nickel in major regions, along with operational suspensions at significant facilities, played a substantial role in tightening supply, further intensifying the challenging market conditions.

Q4 2023:

The monel market in the Asia-Pacific region faced challenges throughout the last quarter of 2023 due to fluctuating supply and demand dynamics. October saw a decline in prices in Japan, driven by reduced demand in automotive and chemical sectors, despite steady material supplies. The automotive manufacturing sector continued to see growth, especially in electric vehicles. November's prices further dipped due to increased output from Japanese manufacturers and oversupply issues.

This monel price analysis can be expanded to include a comprehensive list of countries within the region.

| Region | Countries Covered |

|---|---|

| Asia Pacific | China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand, among other Asian countries. |

Europe Monel Price Trend

Q2 2025:

As per the monel price index, European monel pricing was driven by fluctuations in nickel and copper feedstock costs, shaped by mining output trends and global trade flows. Demand from the aerospace, marine engineering, and chemical processing sectors remained steady, while supply was influenced by import volumes from the USA and Asia. Energy tariffs and environmental compliance costs affected domestic alloy production economics. Port congestion in major hubs increased shipping lead times, impacting supply chain fluidity. Currency variations against the US dollar adjusted the landed cost of imports, while competition from other high-performance alloys influenced procurement strategies in certain industrial applications.

Q1 2025:

As per the monel price index, monel prices in Europe were influenced by persistently high nickel costs and elevated energy prices affecting alloy manufacturing. Demand from the aerospace, marine, and chemical sectors stayed consistent, while fabrication lead times were extended due to skilled labor shortages. Environmental compliance costs and tighter emissions regulations increased production expenses. Import delays from Asian suppliers added supply-side pressure across key industrial markets.

Q4 2024:

In the last quarter of 2024, monel prices were marked by instability in Europe, with fluctuating prices reflecting uneven demand across industries. Despite growing nickel and copper values, supply chain difficulties and weak construction activity drove an initial decline. Manufacturers restocked inventories after the holiday season, briefly pushing prices upward, though overall business activity remained sluggish. The sector faced ongoing challenges from geopolitical uncertainties, reduced manufacturing output, and regulatory concerns. The German manufacturing industry struggled with contraction, while construction activity was hindered by labor shortages. By quarter-end, prices stabilized, though the broader market outlook remained cautious amid persistent economic headwinds.

Q3 2024:

During the third quarter of 2024, prices of monel in the European market experienced a substantial decline. Several circumstances contributed to this downward trend. A continuous drop in requirements from major industries such as construction, automotive, and aerospace was a key driver in lowering prices. Additionally, global economic unpredictability worsened the market conditions, causing buyers to delay sizeable purchases and disrupting the balance of demand and supply for monel. Geopolitical instability added to the subdued conditions, prompting manufacturers to adopt a more cautious strategy.

Q2 2024:

Throughout the second quarter of 2024, prices of monel in the European market saw a significant decline due to various contributing circumstances. Demand remained weak in numerous sectors, intensified by persistent international pressures and disruptions in supply chains. The construction industry, a major consumer of monel, experienced a sharp decrease in fresh orders, influenced by increased rates and economic unpredictability. Similarly, the automotive sector experienced a drop in new vehicle purchases, further reducing the need for monel. These challenges within key industries were worsened by increasing supply volumes and an oversupply of nickel, resulting in an overarching negative pricing landscape.

Q4 2023:

In Europe, the monel market experienced an unsteady fourth quarter of 2023, owing to oversupply and shifting demand. Prices in Germany rose in October due to rising demand from the chemical and automotive sectors, but market stability was hampered by a lack of raw material supply. By November, monel prices had dropped due to low demand in an oversupplied market. This trend persisted in December, with economic factors such as lower EV sales and a shift towards more environmentally friendly materials influencing traditional monel demand.

This analysis can be extended to include detailed monel price information for a comprehensive list of countries.

| Region | Countries Covered |

|---|---|

| Europe | Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal, and Greece, among other European countries. |

Middle East and Africa Monel Price Trend

Q2 2025:

As per the monel price chart, in the Middle East and Africa, especially the UAE, monel pricing was shaped by feedstock procurement costs, largely dependent on imports of nickel and copper from global suppliers. Demand was concentrated in the offshore oil and gas, desalination, and marine infrastructure sectors. Shipping freight rates and port handling charges influenced delivered prices, while regional competition for raw materials among Gulf states affected supplier contract terms. The UAE’s currency stability against the US dollar reduced exchange-related volatility, and ongoing investments in industrial and energy infrastructure sustained consistent downstream consumption across the region.

Q1 2025:

Monel pricing in the Middle East and Africa, particularly the UAE, was driven by strong demand from desalination and oil and gas infrastructure projects. Limited local production capacity led to heavy reliance on imports from Europe and Asia. Shipping delays and increased global nickel prices raised procurement costs. Regional fabrication costs rose as utilities and machining inputs became more expensive.

Q4 2024:

The monel market in MEA remained relatively stable throughout Q4 2024 despite fluctuations in demand and economic conditions. Prices saw an initial decline due to high inventory levels and lower consumption but later steadied as the quarter progressed. Competitive pressures and reduced input cost inflation shaped the pricing landscape, with some companies still managing rising material expenses. The UAE’s non-oil sector displayed resilience, supported by an uptick in new orders and business activity. However, concerns over weakening demand persisted, requiring firms to adjust pricing strategies and remain responsive to both domestic and global market shifts.

Q3 2024:

During the third quarter of 2024, prices of monel in Middle East and Africa witnessed a significant decrease. This downward trend was due to numerous factors, including excess supplies, weak requirements, and continuous volatility in feedstock prices, particularly nickel. These factors created a declining pricing trend, highlighting a tough landscape for industry players.

Q2 2024:

Throughout the second quarter of 2024, prices of monel in Middle East and Africa witnessed a substantial drop, driven largely by international instability and disruptions in supply chains. Key factors contributing to this decline included tariffs on feedstocks from Russia, escalating rates of nickel caused by shortages in major producing areas, and rising transportation costs following the Red Sea conflict. These issues created a difficult market landscape for monel producers, further strained by logistical challenges at nickel manufacturing plants.

Q4 2023:

Monel prices in the Middle East and Africa fell in Q4 2023, influenced by various key factors. The UAE market declined in October due to lower domestic demand and increase in supply, as well as cheaper imports from Asia. The UAE's extended ban on stainless steel scrap and steel exports emphasized the need for local production. Disruptions at the Port of Newcastle and changes in global energy production forecasts posed additional challenges to market stability.

In addition to region-wise data, information on monel prices for countries can also be provided.

| Region | Countries Covered |

|---|---|

| Middle East & Africa | Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco, among other Middle Eastern and African countries. |

Latin America Monel Price Trend

Q2 2025:

Latin America's monel market is predominantly influenced by its rich natural reserves, particularly in countries like Chile and Brazil. However, political instability and inconsistent regulatory frameworks can lead to significant volatility in monel prices. Infrastructure challenges and logistical inefficiencies often impact the supply chain, affecting the region's ability to meet international demand consistently. Moreover, the monel price index, economic fluctuations, and currency devaluation are critical factors that need to be considered when analyzing monel pricing trends in this region.

Q1 2025:

Latin America's monel market is predominantly influenced by its rich natural reserves, particularly in countries like Chile and Brazil. However, political instability and inconsistent regulatory frameworks can lead to significant volatility in monel prices. Infrastructure challenges and logistical inefficiencies often impact the supply chain, affecting the region's ability to meet international demand consistently. Moreover, the monel price index, economic fluctuations, and currency devaluation are critical factors that need to be considered when analyzing monel pricing trends in this region.

Q4 2024:

The analysis of monel prices in Latin America provides a detailed overview, reflecting the unique market dynamics in the region influenced by economic policies, industrial growth, and trade frameworks.

This comprehensive review can be extended to include specific countries within the region.

| Region | Countries Covered |

|---|---|

| Latin America | Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru, among other Latin American countries. |

Monel Price Trend, Market Analysis, and News

IMARC's latest publication, “Monel Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025 Edition,” presents a detailed examination of the monel market, providing insights into both global and regional trends that are shaping prices. This report delves into the spot price of monel at major ports and analyzes the composition of prices, including FOB and CIF terms. It also presents detailed monel prices trend analysis by region, covering North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. The factors affecting monel pricing, such as the dynamics of supply and demand, geopolitical influences, and sector-specific developments, are thoroughly explored. This comprehensive report helps stakeholders stay informed with the latest market news, regulatory updates, and technological progress, facilitating informed strategic decision-making and forecasting.

Monel Industry Analysis

The global monel market size reached 22.01 Thousand Tons in 2024. By 2033, IMARC Group expects the market to reach 30.78 Thousand Tons, at a projected CAGR of 3.61% during 2025-2033.

- The intensification of industrial processes as well as the chemical processing, oil and gas, and marine industries develop the field for the application of monel alloys that show high corrosion resistance in aggressive environments. According to the International Stainless Steel Forum (ISSF), stainless steel production saw an annual increase of 10.6%, reaching 56.3 million metric tonnes in 2021.

- Technological breakthroughs and advancements which enhance the quality of products of monel alloys and bring down the processing costs prevailing on the market are encouraging market growth.

- Countries are generally forced to implement tighter environmental standards globally. As a result, industries are using materials of higher quality such as monel to withstand aggressive and corrosive conditions. Consequently, there is increased equipment life span and lower environmental impacts, thereby fueling the market.

- Long-term investments in infrastructure, especially in developing regions where durable materials are needed for construction and engineering, include monel alloys used for critical functioning as environment service, which in turn is propelling the market.

- Considerable rise in oil and gas production as well as the offshore and high-sulfur activities are rapidly growing, thus the materials with extra or extreme corrosion resistance are increasingly preferred which favor the adoption of monel.

- The growing dependence on lighter and more powerful materials in the automotive and aerospace sector drives the demand for monel alloys for improving the performance and fuel efficiency of these heavy duty machines, thereby contributing to the market growth.

- Fast-paced economic growth and industrial renewal in emerging markets as well as the rise of new factories and production facilities, demand more products containing monel alloys.

- Continuous research and development (R&D) activities including search for new applications and improving the capabilities of monel alloys can create extra markets and new applications.

- Monel’s non-reactionary nature allows it to be used in medical devices and implants, a sector that could be demanding due to invention of technologies in the field of medicine and aging population around the world.

- As the electric vehicle segment continues to grow, this consequently creates an increase in the demand for long-lasting and corrosion-resistant materials such as monel.

Monel News

The report covers the latest developments, updates, and trends impacting the global monel industry, providing stakeholders with timely and relevant information. This segment covers a wide array of news items, including the inauguration of new production facilities, advancements in monel production technologies, strategic market expansions by key industry players, and significant mergers and acquisitions that impact the monel price trend.

Latest developments in the monel industry:

- In September 2024, Nuclear Fuel Complex (NFC), under the Department of Atomic Energy (DAE), developed indigenous Monel-400 alloy tubes in various sizes. These specially fabricated tubes, using NFC’s own technology, are expected to play a crucial role in space applications, offering enhanced performance for advanced space programs.

- In February 2023, JSW Steel and Japan's JFE formed JV to produce grain-oriented electrical steel in India. The JV aspires to cater to the rising domestic demand for grain-oriented electrical steel and contribute significantly to the country's energy infrastructure.

- In May 2023, Aramco, Baosteel, and PIF signed an agreement to establish the first integrated steel plate manufacturing complex in Saudi Arabia. The project aims to enhance the domestic manufacturing sector through localizing the production of heavy steel plates, transferring knowledge, and creating export opportunities.

Product Description

Monel is a nickel-copper alloy that is mainly actualized for its strength, toughness, and capacity to resist corrosion and high temperatures. It is widely utilized in various settings with extreme environmental conditions. It is widely preferred in chemical and hydrocarbon processing equipment, marine engineering, valves, pumps, and shafts on account of its high reliability and longevity.

On the other hand, it plays vital roles in the space industry through parts for jets, engine mounts and exhaust systems due to an excellent capacity to endure extreme conditions. Also, monel is used in electronics and medical fields for their high conductivity and non-reactivity.

The alloy stands out in applications such as the development of musical instruments as well as measurement devices where non-erosive and durable materials are preferable.

Report Coverage

| Key Attributes | Details |

|---|---|

| Product Name | Monel |

| Report Features | Exploration of Historical Trends and Market Outlook, Industry Demand, Industry Supply, Gap Analysis, Challenges, Monel Price Analysis, and Segment-Wise Assessment. |

| Currency/Units | US$ (Data can also be provided in local currency) or Metric Tons |

| Region/Countries Covered | The current coverage includes analysis at the global and regional levels only. Based on your requirements, we can also customize the report and provide specific information for the following countries: Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand* Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece* North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru* Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco* *The list of countries presented is not exhaustive. Information on additional countries can be provided if required by the client. |

| Information Covered for Key Suppliers |

|

| Customization Scope | The report can be customized as per the requirements of the customer |

| Report Price and Purchase Option |

Plan A: Monthly Updates - Annual Subscription

Plan B: Quarterly Updates - Annual Subscription

Plan C: Biannually Updates - Annual Subscription

|

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report presents a detailed analysis of monel price index, covering global and regional trends, spot prices at key ports, and a breakdown of ex-works, FOB, and CIF prices.

- The study examines factors affecting monel price trend, including supply-demand shifts and geopolitical impacts, offering insights for informed decision-making.

- The competitive landscape review equips stakeholders with crucial insights into the latest market news, regulatory changes, and technological advancements, ensuring a well-rounded, strategic overview for forecasting and planning.

- IMARC offers various subscription options, including monthly, quarterly, and biannual updates, allowing clients to stay informed with the latest market trends, ongoing developments, and comprehensive market insights. The monel price charts ensure our clients remain at the forefront of the industry.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Why Choose Us

IMARC offers trustworthy, data-centric insights into commodity pricing and evolving market trends, enabling businesses to make well-informed decisions in areas such as procurement, strategic planning, and investments. With in-depth knowledge spanning more than 1000 commodities and a vast global presence in over 150 countries, we provide tailored, actionable intelligence designed to meet the specific needs of diverse industries and markets.

1000

+Commodities

150

+Countries Covered

3000

+Clients

20

+Industry

Robust Methodologies & Extensive Resources

IMARC delivers precise commodity pricing insights using proven methodologies and a wealth of data to support strategic decision-making.

Subscription-Based Databases

Our extensive databases provide detailed commodity pricing, import-export trade statistics, and shipment-level tracking for comprehensive market analysis.

Primary Research-Driven Insights

Through direct supplier surveys and expert interviews, we gather real-time market data to enhance pricing accuracy and trend forecasting.

Extensive Secondary Research

We analyze industry reports, trade publications, and market studies to offer tailored intelligence and actionable commodity market insights.

Trusted by 3000+ industry leaders worldwide to drive data-backed decisions. From global manufacturers to government agencies, our clients rely on us for accurate pricing, deep market intelligence, and forward-looking insights.

Request Customization

Request Customization

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst Request Brochure

Request Brochure

.webp)

.webp)